The Fed has chosen to double down on an inflation-oriented framework for setting monetary policy. While there are some advantages in the current environment to an “average inflation targeting” scheme that affirmatively permits inflation to rise at least modestly past 2%, this approach is not particularly robust to a scenario in which inflation temporarily surges. In both the summer of 2008 and in 2011, we saw Federal Open Market Committee (FOMC) members and market participants get sidetracked by rising inflation readings. These readings ultimately proved temporary, all while economic growth and employment outcomes deteriorated. As the Fed rethinks its commitment to a 2% inflation target, these experiences should serve as cautionary tales against such an inflation-centric approach to policymaking.

Whether it’s the existing approach to inflation targeting or the newfound belief in average inflation targeting, the Fed’s fixation with the price level leaves it vulnerable to policy errors, especially in the current context. The summer of 2008 and the first half of 2011 are critical examples for understanding how the prioritization of inflation outcomes can mislead market participants and FOMC members about the optimal path for monetary policy. In both of these episodes, the US economy was decelerating but financial markets and policymakers were distracted by transitory price acceleration. The result was monetary policy and financial conditions that were tighter than would otherwise be optimal.

The Fed’s evaluation of its policy stance in the 2010s — that it was insufficiently accommodative—is correct, but its remedy for this bias is fundamentally flawed. The Fed has signaled a deeper commitment to the symmetric achievement of its 2% inflation target, through a variant of an average inflation targeting strategy that explicitly targets a inflation rate higher than 2% when inflation has run persistently below 2%. As well-intentioned as this strategy might be, it is equally vulnerable to the scenarios of 2008 and 2011, when temporary price level acceleration motivated tighter monetary policy and financial conditions, even though the economy itself was decelerating. Even if the Fed manages to correctly identify such inflationary developments as transitory, it will still face the challenge of convincing market participants to “look through” such noise. This could prove especially challenging if the Fed invests heavily in educating the public about the improvements and innovations associated with its latest iteration of inflation targeting.

The Inflation Distraction of 2008

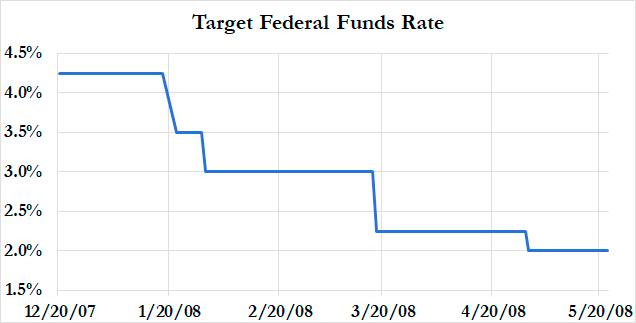

The 2008 experience began with a series of accommodative measures. The Federal Open Market Committee (FOMC) first lowered its target for the federal funds rate from 4.25% to 3.00%. Chair Bernanke also successfully advocated for Congress and the White House to pass the Economic Stimulus Act of 2008. In March, the Fed short-circuited financial panic by questionably subsidizing JP Morgan’s acquisition of the troubled Bear Stearns. By the April FOMC meeting, the federal funds rate target had been lowered to 2% and financial markets were showing signs of stabilization.

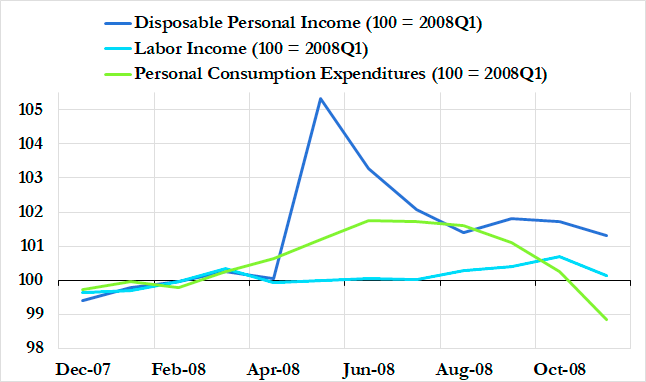

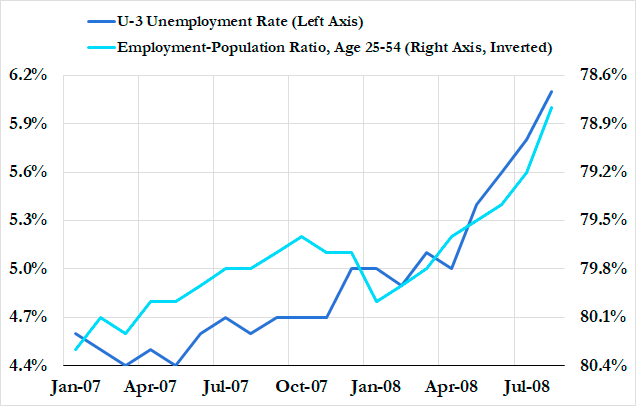

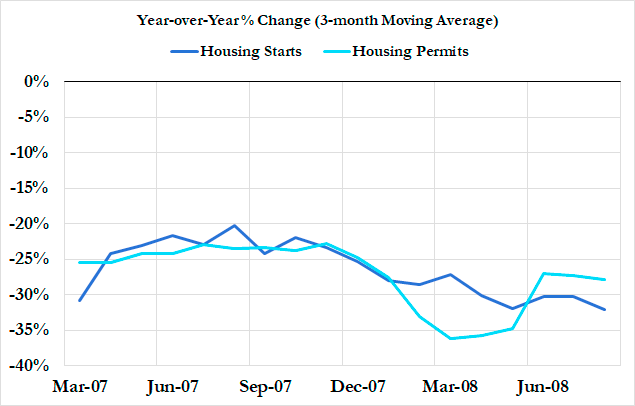

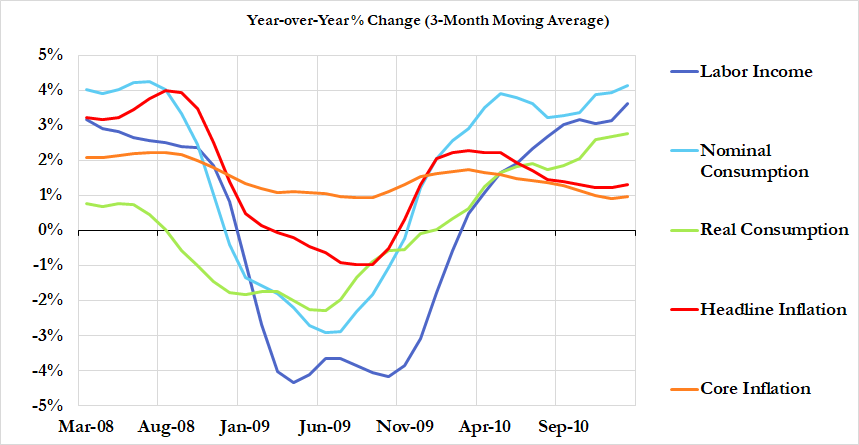

Despite evidence that monetary policy was providing marginal support to financial markets and fiscal stimulus provided a short-term boost to consumption, the underlying economic trends were continuing to deteriorate.

The housing bust was still in full train and the unemployment rate was still moving higher. Nonfarm payrolls were continuing to decline at a worrying rate. Yet if you were simply following the Fed’s own words in the summer of 2008, you would get a very different perspective. On June 10, 2008, the Wall Street Journal ran with the headline “Bernanke Unshaken by Jobless Rise”

“ The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so” — Chair Bernanke

“Containing the risks in what is globally a less benign inflation environment is going to probably require tighter monetary policy on average around the world” — New York Fed President Tim Geithner

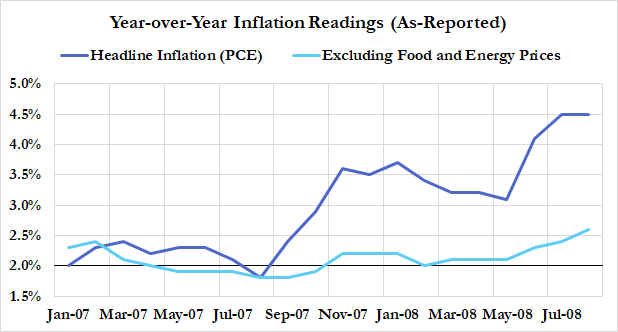

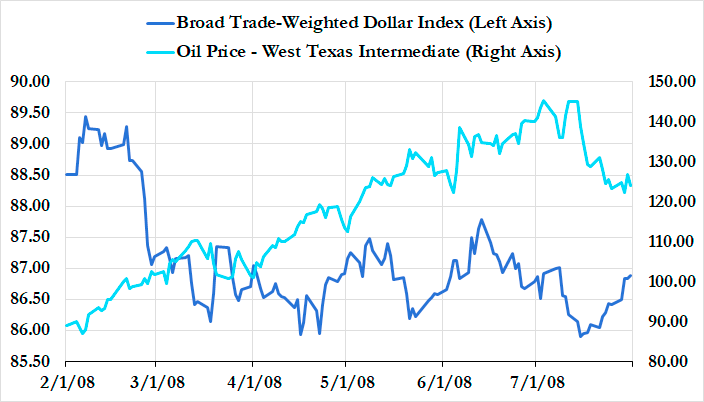

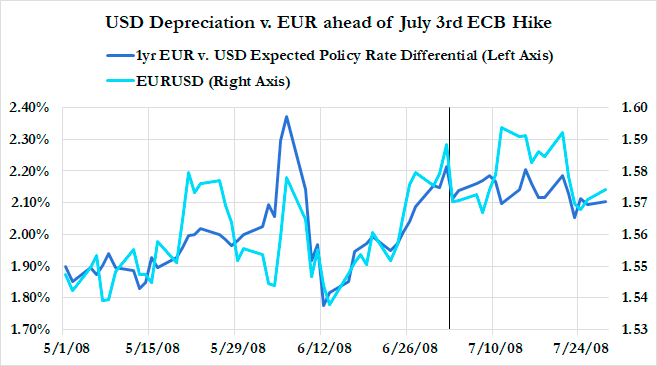

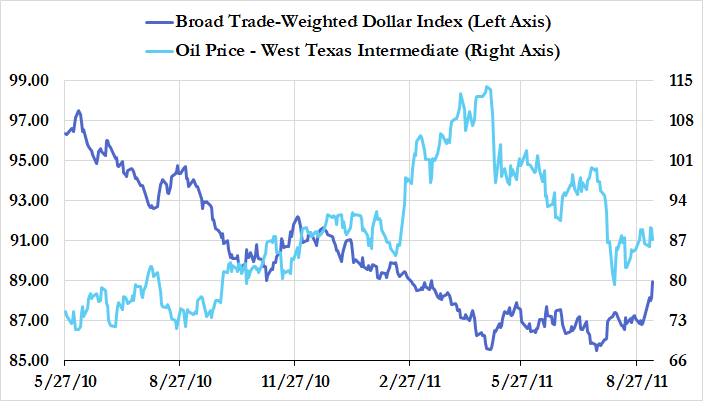

While the economy was still sinking further into recession, financial markets and FOMC members were more concerned that the economy was about to repeat the high inflation of the 1970s, and not the depressed economic activity of the 1930s. Through a narrative fueled by optimism about growth in emerging markets, pessimism about the US dollar, and concerns about resource scarcity, commodity prices boomed and the price of oil reached an all-time high.

The European Central Bank even raised interest rates in June of 2008, which in turn put additional downward pressure on the US dollar in foreign exchange markets.

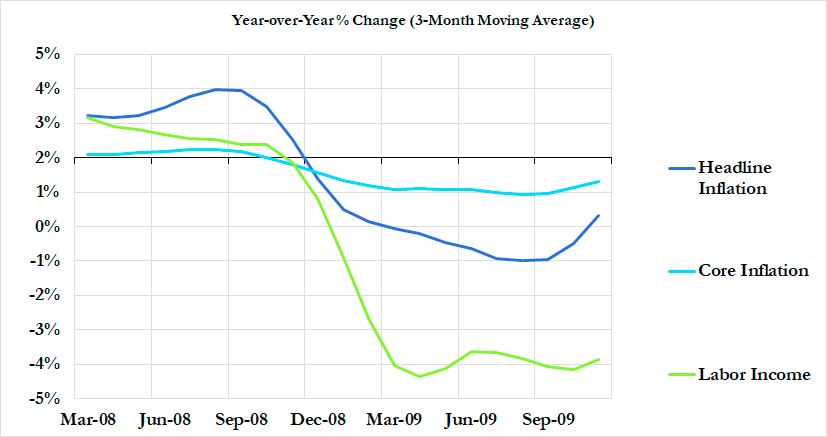

These overshooting dynamics were more obvious in retrospect and their effects on inflation ultimately proved to be closer to a one-off. Trends in nominal income and spending growth reflected the opposite trend throughout this period.

The pivotal question in the summer of 2008 was which trend would prove to be signal and which to be noise. While the Fed ultimately grew more attentive to the risks of deteriorating output, employment, and spending, it took several intervening events to come around to this view.

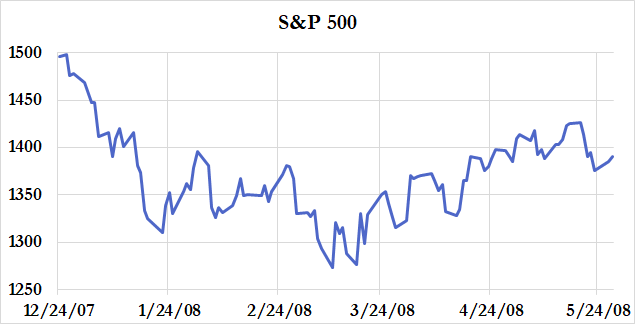

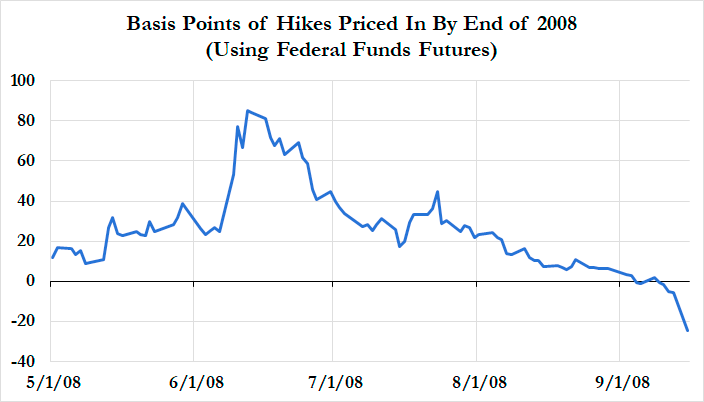

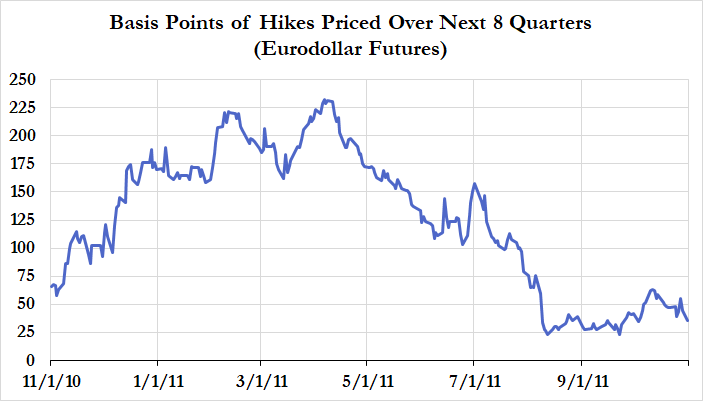

At the time, market expectations reflected a hawkish path for Fed policy, with interest rate futures pricing in more than three 25 basis point hikes before the end of 2008.

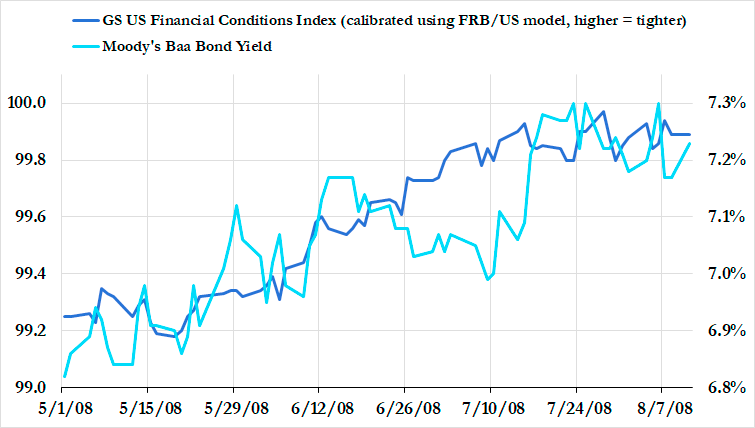

Market predictions weren’t just incorrect, but costly in terms of their effect on financial conditions. At a time when lower long-term interest rates could have supported existing spending and economic activity, the expectation for Fed hikes tightened financial conditions and increased the cost of capital for businesses and households.

In August, commodity prices and exchange rates began to factor in the risk of US economic deceleration spilling over to the rest of the global economy. With every new headline in August about Lehman’s attempt to raise capital, financial markets reflected less concern about mounting inflation and more concern about the risk of a financial crisis. Yet even as financial markets began to shift their attention away from inflation risks and towards the underlying growth risks, the Fed was much slower to pivot. Despite the full-blown collapse of Lehman Brothers, the FOMC chose not to lower interest rates at its September meeting. This reluctance to ease policy was directly tied to concerns about overshooting and self-perpetuating price acceleration.

As the financial crash and crisis spun out of control in the ensuing weeks, the Fed finally shifted its full attention to the deteriorating recession. One wonders how much damage could have been mitigated had the Fed not allowed inflation-centrism get in the way of more decisive action to fight the Great Recession.

The Inflation Distraction of 2011

“Fool me once…shame on you. Fool me — you can’t get fooled again.”

The lessons of 2008 should have been relatively fresh in the minds of FOMC members and financial market participants. For all of the hype about the inflationary implications of rising commodity prices and a depreciating dollar, the underlying trends in nominal and real economic activity proved to be a more reliable guide of central bank policy and even the future path of inflation.

From the end of 2010 through the first half of 2011, we saw the dynamics present in the summer of 2008 make a reappearance. After the Fed’s second round of large scale asset purchases, also known as “QE2”, was announced in October 2010, commodity prices began to see another mini-boom that only concluded in late May of 2011.

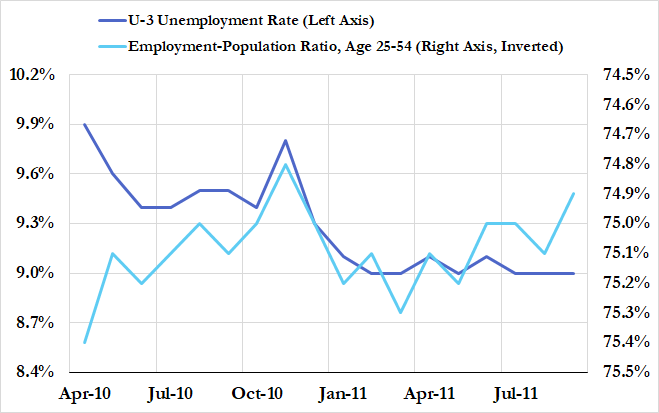

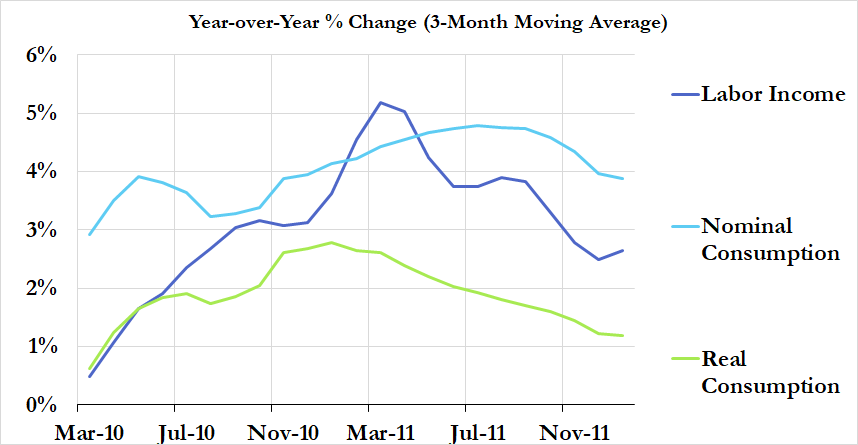

Yet even during this acceleration of inflation, the nascent employment recovery from the Great Recession was faltering. Payroll employment gains were slowing, the unemployment rate was flat-lining and the prime-age 25–54 employment-to-population ratio was continuing to decline.

Despite all of this, financial markets at least temporarily anticipated that the Fed would consider as much as 225 basis points of tightening over the following two years. Some of this pricing reflects the unique asymmetry that the zero lower bound imposes; future hikes are inherently more likely than future cuts. Yet even after accounting for the zero lower bound asymmetry, this was an especially hawkish set of market expectations for Federal Reserve policy. Markets were evidently more inclined to think that the Fed would be more concerned about risks associated with accelerating headline inflation than with the prospect of a double-dip recession.

Chair Bernanke consistently communicated a more dovish outlook throughout this period and advocated for looking through the past the temporary rise in commodity prices.

“On the inflation front, commodity prices have risen significantly recently, reflecting geopolitical developments and robust global demand, among other factors. Increases in commodity prices are in turn boosting overall consumer inflation. However, measures of underlying inflation, though having increased modestly in recent months, remain subdued, and longer-term inflation expectations have remained stable. Consequently, the Committee expects the effects on inflation of higher commodity prices to be transitory; as the increases in commodity prices moderate, inflation should decline toward its underlying level” — Chair Bernanke at press conference following the April 2011 FOMC Meeting

That said, Chair Bernanke’s views did not enjoy a comfortable consensus within the Federal Open Market Committee

Citing the jump in energy prices, [Philadelphia Fed President Charles] Plosser said “the reason oil prices worry me is that there will be more pressure to keep monetary policy easier for longer” as some fear these price gains will hold back growth by reducing households’ spending power. “That response is a response that will in my view” create inflation, and “we need to lean against that,” the policy maker said.

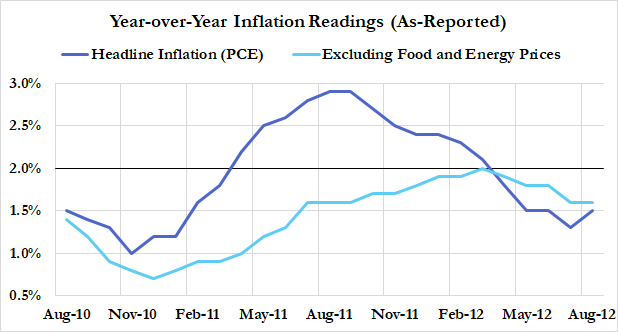

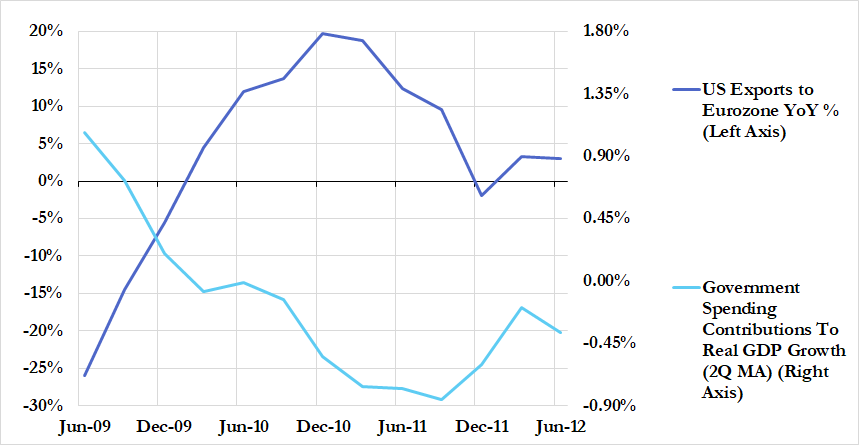

Chair Bernanke was right: rising inflation of this period proved to be temporary, and the growth slowdown of 2011 proved to be the more important risk, especially with the onset of a sovereign debt crisis in the Eurozone and a more austerity-inclined approach to domestic fiscal policy.

The deterioration in the growth outlook, alongside a leveling off of price pressures, ultimately led the Fed to expand its set of accommodative monetary policies.

That financial market participants were sidetracked by temporary price acceleration should be instructive to how the Fed shifts its framework and strategy. Fed communication of the inflation outlook will not always align with how financial markets perceive inflation dynamics. As a result, long-term interest rates may be higher and financial conditions tighter than where the Fed would otherwise prefer them to be.

Average Inflation Targeting Will Not Insulate The Fed From The Policy Errors and Dilemmas of 2008 & 2011

The Fed thinks the problem with its current approach to inflation targeting is that the inflation outcomes have not been symmetric. Headline and core inflation have persistently undershot the 2% target it adopted in January 2012.

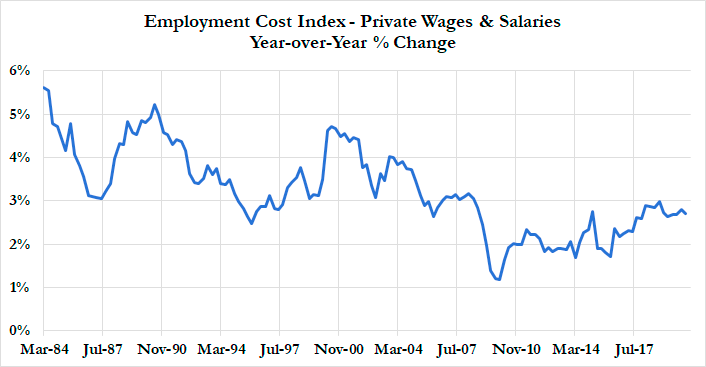

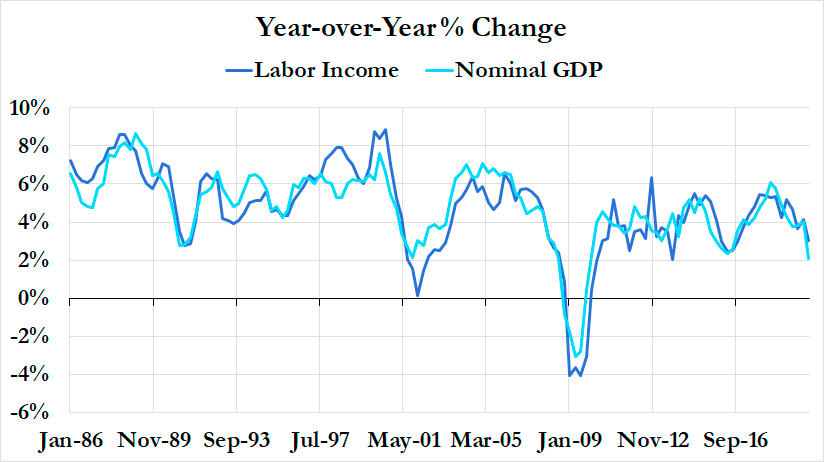

In some ways, this does reflect a broader failure, albeit imperfectly. Whether you look at nominal wages, gross labor income or nominal GDP, growth rates have been systematically lower since 2008 and have failed to return to the pre-crisis trend. Yet the scale of these losses reflect something far more significant and materially tied to the Fed’s “maximum employment” mandate than what the inflation undershoot captures.

While core inflation only barely reached 2% in the 2010s expansion, headline inflation has had its share of circumstances during which it grew materially above the 2% inflation target. In both 2008 and 2011, the Fed’s actual and perceived reaction function were highly distorted by these developments. How would an average inflation targeting strategy, in which the Fed were to pursue a modestly higher inflation rate in the short-run, leave the Fed any less vulnerable to the same problem?

If anything, the Fed’s strategic framework review has reiterated the importance of the inflation target and raises the risk of another inflation distraction if similar economic circumstances arise. At a time of historically low labor utilization, it would be tragic if the Fed or financial markets were sidetracked by inflationary developments that ultimately served to delay or derail economic recovery. Too many jobs, businesses, and incomes are already at risk for the Fed to allow the same error to occur yet again.

In contrast to average inflation targeting, aiming to put a floor under gross labor income growth would provide the Fed and market participants with a more reliable anchor for calibrating the scale and timing of monetary policy accommodation.