This is the first of our Fed Research Roundup series. In this series, we’ll check in on academic research (primarily focusing on research coming out of the Federal Reserve Bank research departments) that we think the committee is—or should be—paying attention to.

In this post, we examine the question of whether monetary policy constrains the supply-side, and what that means for inflation. Powell is reluctant to discuss the issue head-on, but recent research suggests that monetary tightening has long-run negative effects on output, capital, and productivity. One explanation for this phenomenon is that tightening has substantial effects on investment in innovation, which can reduce supply in the long-run and work against the Fed on inflation in the medium-term. Fiscal policy can help by supporting innovation investment when monetary policy is tight.

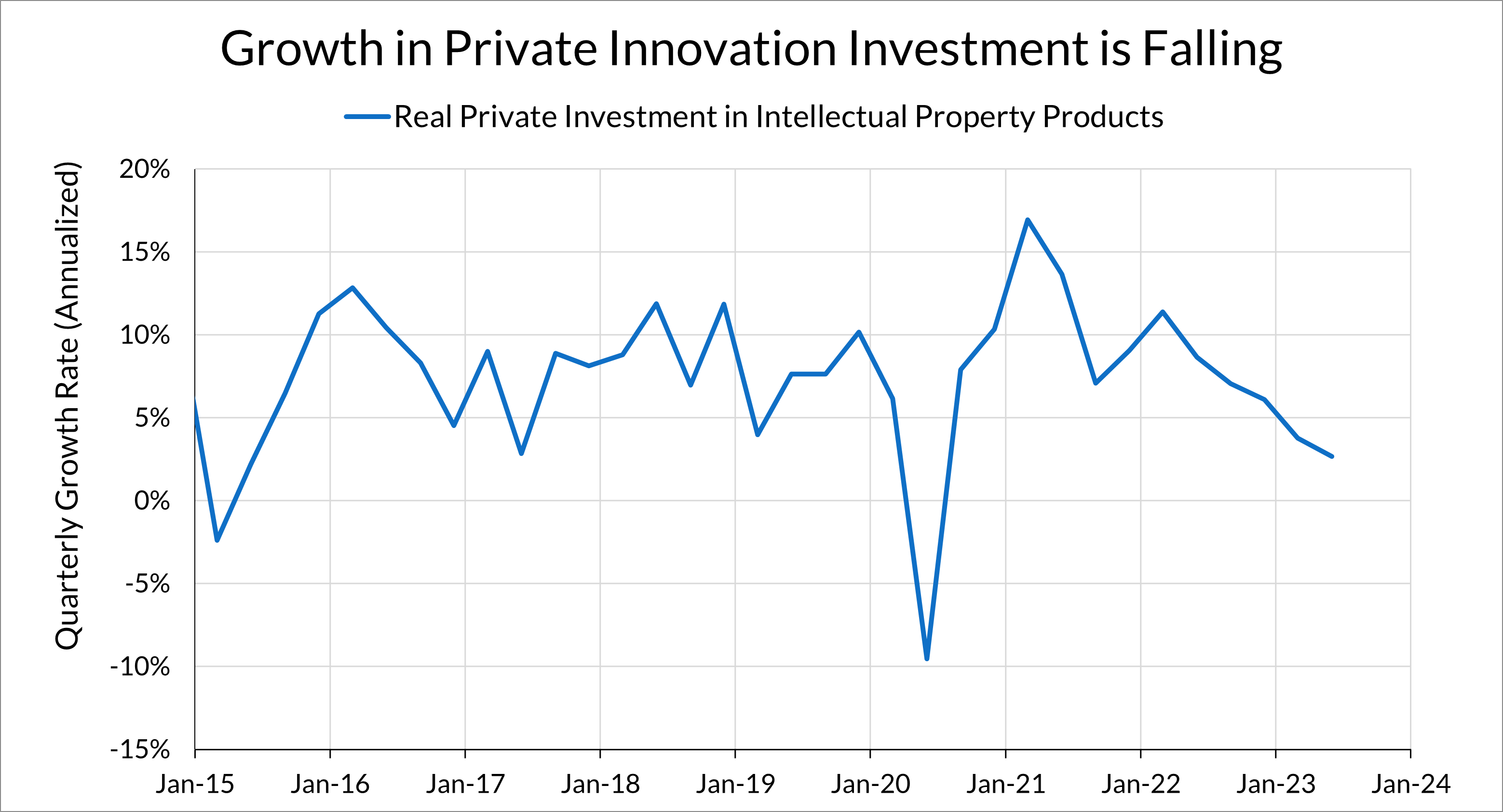

Recent data do indeed show a slowdown in private innovation investment since the Fed started to raise interest rates. This bodes poorly for longer-term prospects for growth and inflation, and weakens the case for higher interest rates. Fiscal policy has an opportunity to alleviate these stresses through the CHIPS Act and the Inflation Reduction Act.

At the September FOMC press conference, Bloomberg reporter Craig Torres asked Chairman Powell about the possibility that overly tight monetary policy could threaten supply-driven growth, which could put pressure on inflation in the longer run:

This economy is seeing added supply in a way that could create long-term inflation stability. We have prime age labor force participation moving up where people can add skills. Workers want to work. We have a boom in manufacturing construction. We've had a decent spate of home building. And since inflation is coming down with strong GDP growth, we may have higher productivity. All of which are good for the Fed's longer run target of low inflation. And if we lose that in a recession, aren't we opting for the awful hysteresis that we had in 2010? So are you taking this into account as you pursue policy?

Craig Torres, September 20th, 2023 FOMC Press Conference

In his response, Powell dodged the question of how monetary policy affects the supply side, instead opting to focus on the importance of reducing inflation:

The worst thing we can do is to fail to restore price stability, because the record is clear on that…. So the best thing we can do for everyone, we believe, is to restore price stability.

Jay Powell, September 20th, 2023 FOMC Press Conference

The notion that monetary policy can constrain supply isn’t at all far-fetched. After all, tighter monetary policy reduces aggregate demand and increases borrowing costs. It’s not hard to find stories of manufacturers making capital investment decisions in response to demand conditions. As Powell himself said in his statement, higher interest rates are currently weighing on business fixed investment (renewable energy projects facing financing issues is one example of this).

Over the past couple of years, there has been renewed interest in monetary policy’s effect on the supply side. Although macroeconomists have traditionally thought of monetary policy as ultimately neutral in its long-run effects on real variables, recent research provides evidence that tight monetary policy can reduce output in the long run by constraining the supply side. Today, we’ll highlight three papers in this stream of research and what they mean for monetary and fiscal policy.

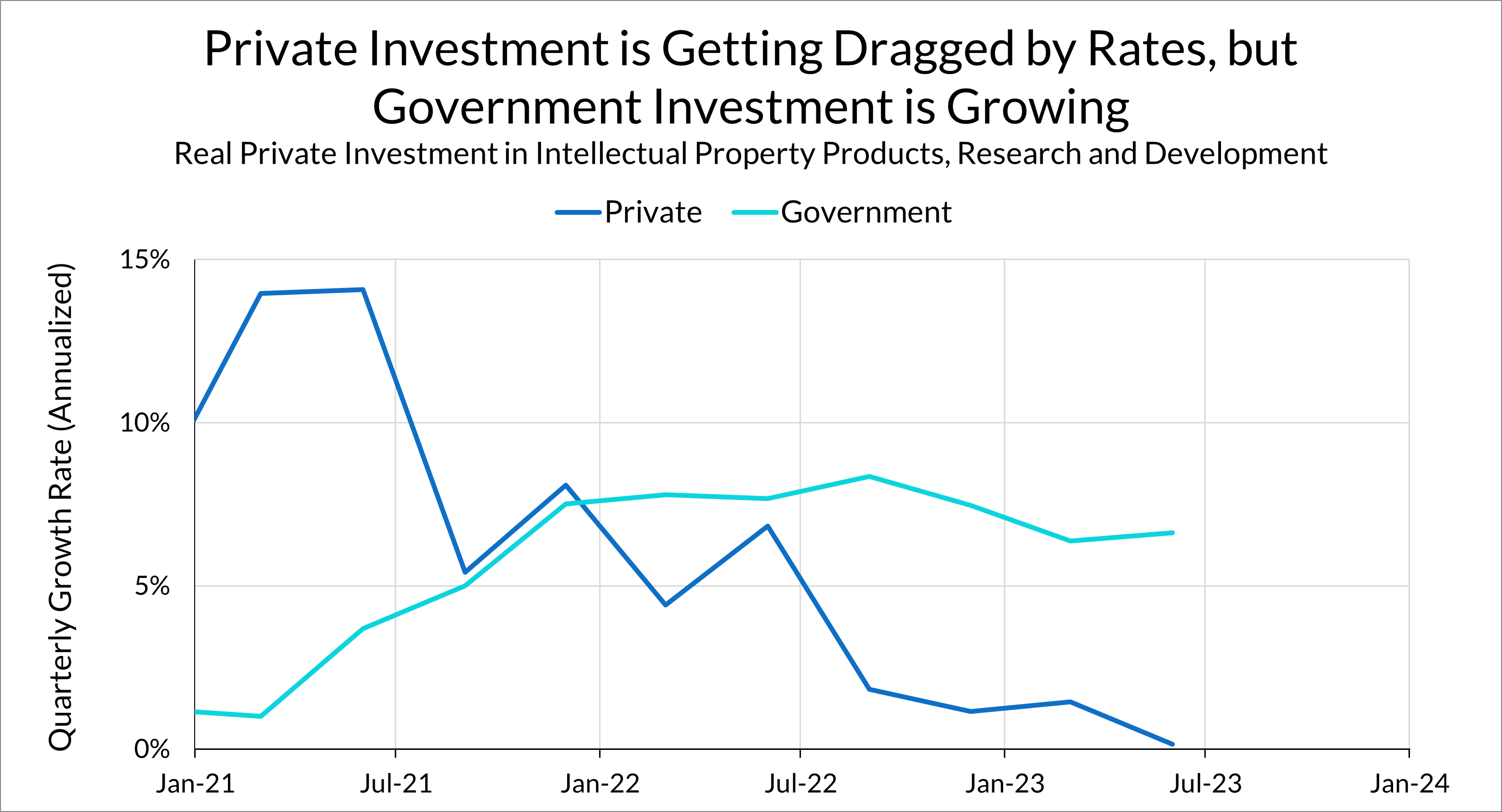

We appear to be witnessing the beginning of these dynamics now. Private investment in innovation, particularly research and development, has slowed to a crawl. On the other hand, government investment remains strong. The outlook for investment in the future productivity of the economy may hinge not only on the path of monetary policy, but whether fiscal policy is sufficient to support innovation investment in both the private and public sector.

Tight Monetary Policy Reduces Investment in Innovation

What’s the mechanism through which tight policy would reduce productivity? That’s the central question tackled by Monetary Policy and Innovation, a paper by Yueran Ma and Kaspar Zimmermann that was presented at the Jackson Hole Symposium this year. This paper studies the effect of monetary policy shocks on a number of measures of investment in innovative activities. The bottom line: tighter monetary policy reduces investment in innovation.

Measuring innovation activity is a tricky endeavor, especially when the digital economy and intangible capital are becoming more important. The authors cover their bases by using several measures of innovation: investment in intellectual property products in the NIPA data, R&D spending in firms covered by Compustat, venture capital investment, and patenting data. To estimate the effects of monetary policy on these innovation measures, the authors use Jordà local projections and the monetary policy shock series from Romer and Romer (2004), an often-used measure of monetary policy shocks that uses Federal Reserve meeting transcripts to find monetary policy movements unrelated to forecasts of economic conditions. This is a very standard way of measuring the effects of monetary policy shocks on other variables.

The effects of monetary policy on innovation spending are substantial; a 100 basis point shock to the federal funds rate results in a decline of investment in intellectual property by 1 percent and a decline in VC investment by 25 percent, (although the latter estimate is imprecise). Patent activity falls by 9%. The peaks of the effects of monetary policy on innovation generally occur 2-3 years after the monetary policy shock. While the authors don’t directly measure the impacts on output and productivity from the innovation channel, they point to other research that shows that these innovation measures are related to changes in output and productivity.

The authors find suggestive evidence that monetary policy affects innovation through both the financial and demand channels. For the first, they point to the strong reaction of early-stage venture capital funding to both monetary policy and changes in the excess bond premium; since these are early-stage startups, changes in funding are likely to reflect financial conditions. For the latter, they show that R&D spending is more impacted at firms that are more cyclical, and R&D spending is impacted at both large and small firms (the idea being that large firms are less impacted by financial conditions, so the likely explanation for decline in R&D spending there is related to demand).

Despite these results—which Powell should be aware of—Powell’s response at the September press conference indicated that he was more concerned with getting inflation down soon than these longer-run effects on output. If inflation doesn’t come down, he argued, the long-run prospects for growth would be worse.

Monetary Tightening Can Rebound on Inflation in a Supply Shock

One recent paper suggests that monetary policy tightening amidst a supply shock may prove counterproductive. In “The Scars of Supply Shocks: Implications for Monetary Policy” (Journal of Monetary Economics, April 2023), authors Luca Fornaro and Martin Wolf present a theoretical model that combines a New Keynesian business cycle model with endogenous growth. The key innovation in this model is that firms invest to improve productivity. In this model, endogenous growth creates a “supply-demand doom loop” in response to supply shocks, where the associated fall in demand discourages investments in productivity, resulting in permanent scarring and prolonged inflation.

Endogenous growth also changes the effects of monetary policy on growth and inflation in this model. Tighter monetary policy reduces inflation in the short-run by decreasing aggregate demand, but that reduction in aggregate demand triggers a reduction in investment in productivity. In the longer-run, the fall in productivity lowers output and actually increases inflation, relative to looser monetary policy.

To be clear, the lesson here isn’t that inflation is currently high because of the Fed’s interest rate policies. Nor should one think that interest rate hikes are always inflationary in the medium-term—this is specifically in the context of a supply shock. The main takeaway for policy is that an excessive focus on monetary tightening to reduce inflation in the near-term may come at the expense of productive feedback loops (hysteresis) in the medium-term, potentially working against growth and the Fed’s inflation goals in the future. This stands in contrast to Powell’s repeated statements that reducing inflation in the near-term is key to ensuring long-term growth.

Tight Monetary Policy May Have Long-run Effects on Output

Is there empirical support for the notion that tight monetary policy may have negative impacts on growth? Some new evidence comes from The Long-run Effects of Monetary Policy, by Òscar Jordà, Sanjay Singh, and Alan Taylor (Jordà is a policy advisor at FRBSF and Sanjay Singh is an Economist at FRBSF). In this paper, the authors study the long-run effects of monetary policy shocks on real GDP, labor, capital, and total factor productivity (TFP) using a macro-historical dataset covering 17 countries between 1900 and 2015. The key takeaway: monetary policy tightening shocks have substantial effects on real variables, reducing output, capital and total factor productivity for over ten years.

The short summary of their identification strategy is that many countries have historically pegged their currencies to the currencies of other countries, so interest rate movements in the base countries will result in domestic interest rate movements because of the trilemma. Using this, they construct an instrument for domestic interest rate changes using shocks to the base rate (obviously there are concerns with identification due to other effects of foreign interest rate changes and exogeneity of the base rate changes; the authors spend considerable time discussing these in the paper). They then use local projections to estimate the responses of other economic variables to these interest rate shocks.

The authors find that interest rate shocks have long-lived effects on output, capital, and productivity. A 1 percentage point shock to the short-term interest rate results in a GDP decline of 4.6% twelve years after the shock. Both capital and productivity decline, but the bulk of the decline in GDP is explained by the decline in productivity. These results are asymmetric, in that they are driven by tightening shocks; loosening shocks have little long-term effects on output.

Does this apply to the US economy? One concern is that this result is unique to small open economies. The authors replicate previous studies that use other identification strategies to measure the effect of monetary policy shocks in the US, and simply extend those previous analyses to longer horizons. They also find effects of interest rate shocks on output in the US, out to eight years.

We are Experiencing a Slowdown in Private Innovation Investment

It does appear that the Fed’s rate hikes are weighing on investment in innovation. First, venture capital funding has fallen dramatically since interest rate hikes started, especially for early-stage startups.

Second, growth investment in intellectual properties, one of the measures of innovation studied by Ma and Zimmermann, has fallen substantially since the beginning of 2022. Growth in real private domestic investment in intellectual property products fell to an annualized rate of 2.7% in Q2 2023 (growth in this component averaged 7.9% from 2015 Q1 to 2020 Q1).

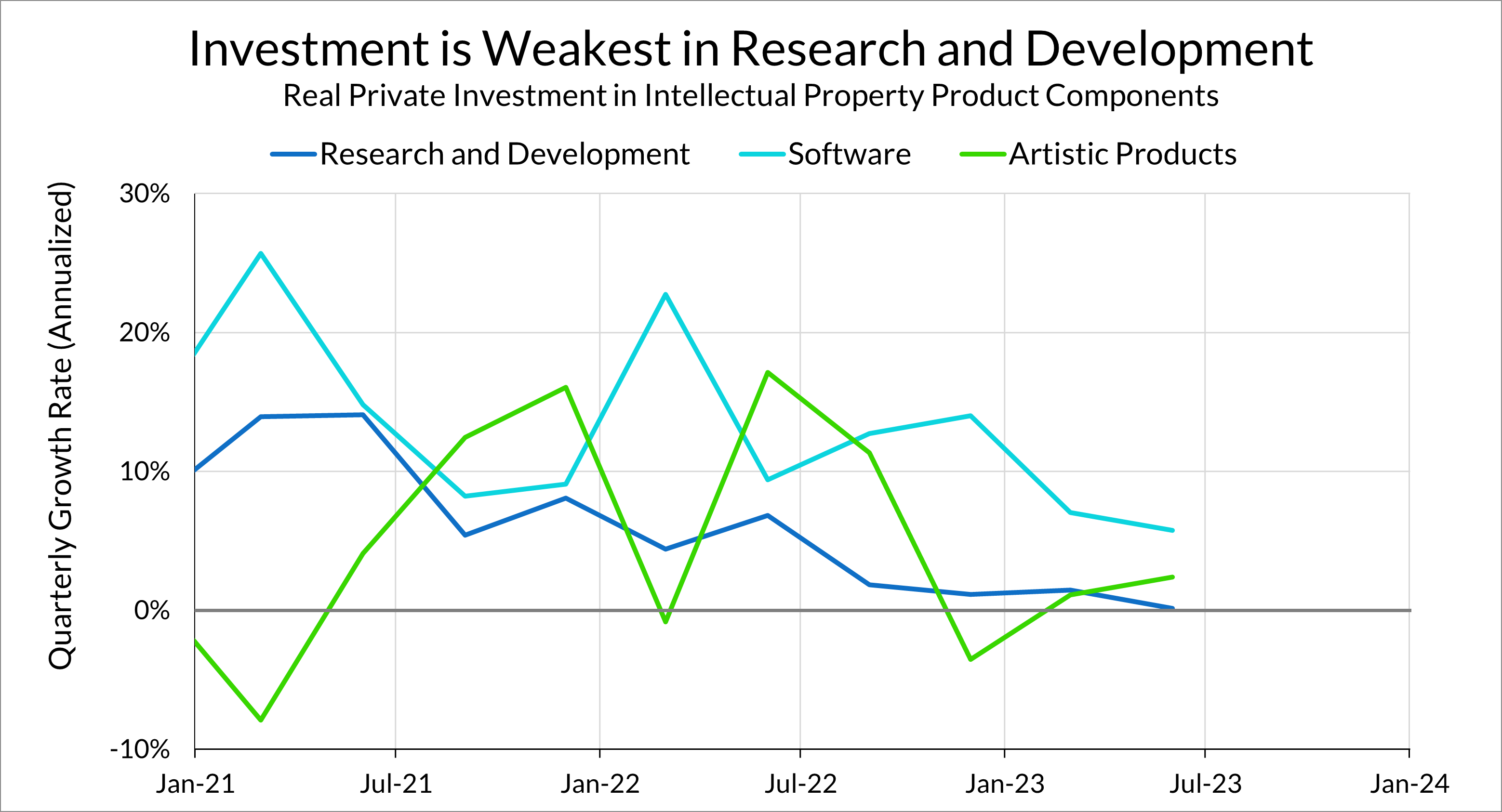

Breaking down this category into its component parts, one sees that investment in the “research and development” component of intellectual property products is the most sluggish, growing at a barely positive annualized rate of 0.15% in Q2 2023.

With the caveat that every monetary tightening episode is different, and things can happen very non-linearly, the evidence suggests that we may have yet to feel the full effects of the Fed’s rate hikes on innovation activity. And the effect of the current innovation slowdown on growth and productivity may not be fully felt until a few years from now.

On the optimistic side, one conclusion of Fornaro and Wolf (2023) is that fiscal policy has an important role to play during supply shocks in that government support for investment in innovation can help counteract the “demand-supply doom loop” triggered by a supply shock and tight monetary policy. While private investment in research and development has leveled off, government investment has been growing at a rapid clip.

So far this appears to be primarily due to increases in R&D spending in the Departments of Health and Human Services and Energy. Much of the former is attributable to COVID-related spending. Meanwhile, the federal government has yet to implement the bulk of spending in the CHIPS Act and the Inflation Reduction Act, which should not only boost research and development directly through public expenditures but also by encouraging private investment. Ensuring that funding for research and development under these laws doesn’t fall through and is well-implemented may be key for sustaining productivity investments during this period of tight monetary policy.