Summary

Although neither the magnitude nor composition of last week's inflation print surprised us, especially given the knock-on effects from the 'Ukraine shock', they did surprise the CPI forecasting consensus. In response, Chair Powell and the rest of the committee will likely deliver two innovations:

- Deviating from his previously stated strategy of hiking 50 basis points at every meeting for the foreseeable future with a 75bp 'surprise' hike (that is already priced in). The apparent justification will likely be that surprises to inflation forecasts will be met with corresponding surprises to the hiking path. Given our framework, that could be defensible, provided that if monthly readings for inflation show signs of deceleration, a comparable pivot is also executed (along with equal attentiveness to the likely trajectories of labor income growth).

- Signaling even higher terminal rates through this hiking cycle (likely more than 100 basis points above the projected long-run neutral rate of 2.375%).

Each of these projected outcomes may suggest or imply larger increases in the unemployment rate in 2023 and 2024, which—if taken at face value—are consistent with elevated recession risk. Oil price shocks (and commodity price shocks more generally) have been at least a coincidental ingredient to a number of recessions, and there are at least two relevant sets of identifiable transmission channels (discussed separately below). We have already written elsewhere about what the White House can and should be doing to take on address the root cause of this recession risk source.

The Tortured Exercise Of Seeking Out Disinflation Through Tighter Financial Conditions

With the rapid recovery in employment outcomes and marginally elevated wage growth, the Fed has understandably tightened its focus on the "price stability" component of its Congressionally mandated objectives.

The inflation surprise has rattled commentators into a panicked position, which has led to louder calls for aggressive symbolic action, on the theory that it might enhance 'credibility.' But these strident calls are effectively a wish for monetary policy to work in a fundamentally different way, for which there is little empirical basis. Monetary policy affects employment and inflation through its effects on financial conditions. While homeowners, CFOs and CEOs pay attention to their cost of capital when making major expenditure decisions (for both capital and labor), it is not as clear that consumer-price-setting actors within firms pay attention to the Fed, or even movements in broad financial conditions (independent of the Fed's ability to affect household demand first).

Tighter financial conditions can ultimately hit consumer demand through the labor market, but they also can delay or destroy supply-side responses in the process. Fixed investment, inventory replenishment, and risk intermediation costs are all likely victims of this process.

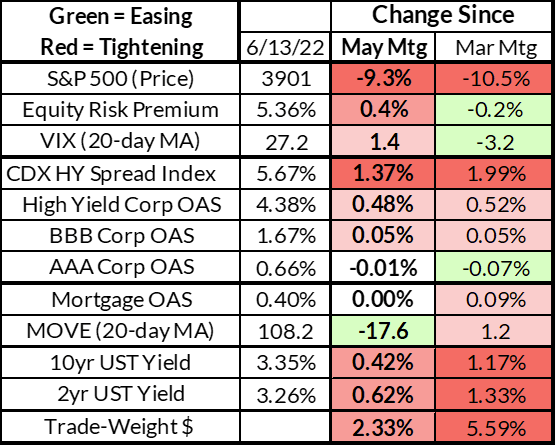

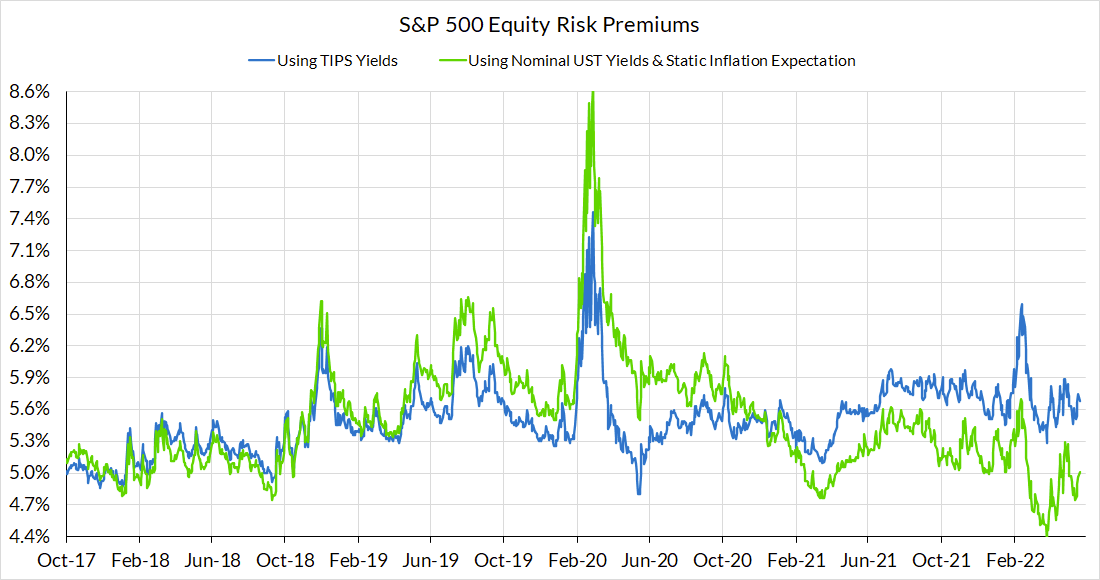

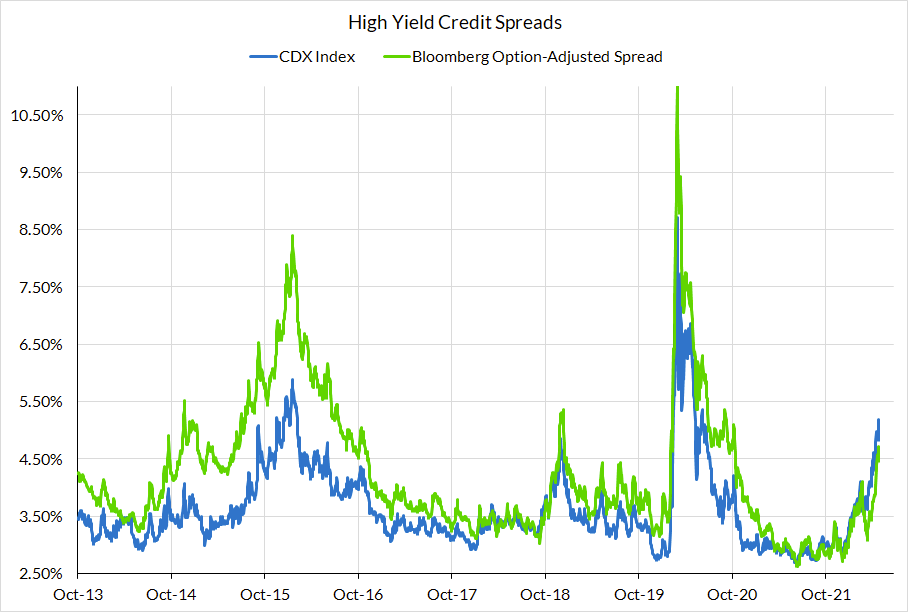

Financial conditions have been tightening across the board. While most of the tightening merely reflects the mechanical effects of higher risk-free rates on the discount rates to which all assets are subject, there are two additional dynamics.

- Credit spreads currently signal outsized left tail risks (higher probability of a default cycle). This would be consistent with "amplified" Fed tightening; borrowing costs are going up nonlinearly relative to a given change in expected Fed hikes.

- The strength of the dollar—despite increasing hawkishness from foreign central banks—is consistent with overseas growth weakening faster than growth within the United States.

The Recessionary Implications of Oil and Commodity Price Shocks: Two Key Channels

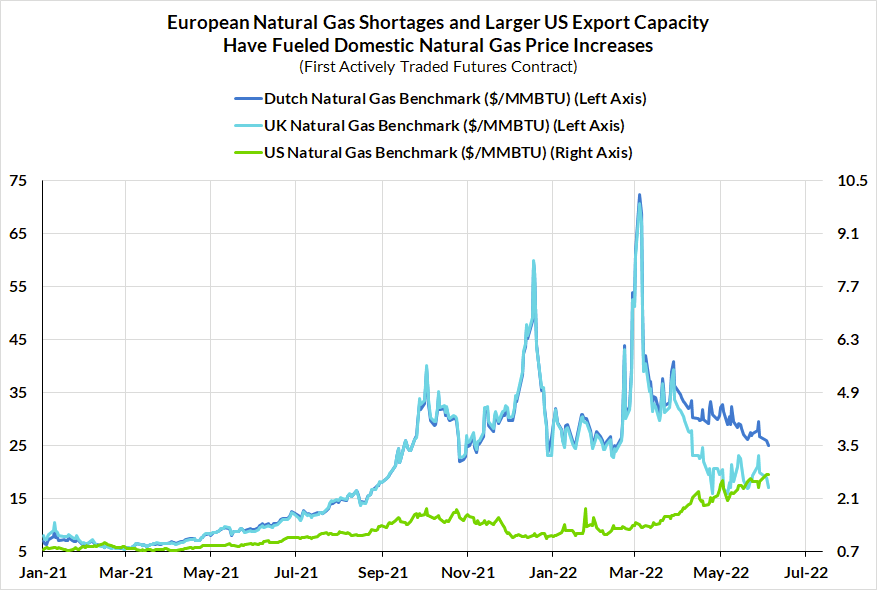

As mentioned, rising energy prices are often coincidental with recessionary impulses. In the few weeks leading up to the Russian attempt to invade Ukraine, global oil prices rose by about 25%, presumably as market actors sought greater compensation amidst the risk of accelerated supply losses. Since that time, oil prices have increased further (almost 40%). The full extent of supply losses will take time to fully realize.

Meanwhile, the invasion has also catalyzed an even bigger global scramble between Asian and European economies for American liquefied natural gas (LNG). Against a backdrop of expanding US export capacity, European benchmark prices have only modestly increased since the invasion while US prices have continued to rise. The Dutch mainland benchmark is up only 14% and prices in the UK have actually fallen since the invasion.

For US businesses and households consuming electricity, utility gas service, or any other input process involving natural gas (e.g. fertilizer), the near 100% run-up in US benchmark prices since the invasion will be a serious hit. To add to the inflationary implications for US consumers, passthrough from spot benchmark natural gas prices is much faster in the US than in Europe, where utilities revise prices less frequently and with a longer lag (and where there is greater usage of price-control and VAT offsetting policies).

Although European prices remain structurally and dramatically higher than US prices, what matters for inflation is marginal changes in price, not outright levels.

Channel #1: Rotation of Household Spending Away From Labor-Intensive Activities And Leads To A Labor Market Downturn

The first key channel through which oil and other commodity prices can become causally relevant to a recession is through their direct effects on household spending patterns.

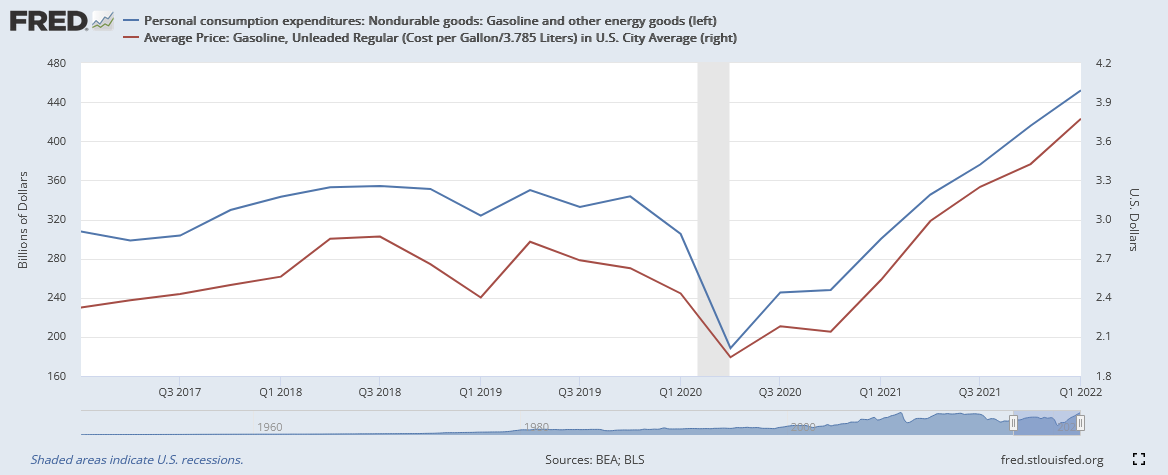

Typically, when goods subject to inelastic demand see an explosion in price, spending on those goods also explodes. It is difficult for most people—especially in automobile-dependent America—to quickly and accurately adjust their vehicle miles traveled in response to higher gasoline prices. Thus consumer expenditures rotate into precisely those inelastic segments, leading to an overall increase in the level of consumer spending on the segments in question.

Although the oil situation is best described as a problem of deficient supply—domestic oil production has yet to recover from the pandemic and Russian supplies are at risk of going offline—the dynamic as a whole manifests in the data as 'above-trend' spending, due to these price effects.

If incomes in the household sector grow at the same pace as prices, then household financial constraints might never bind, and the rotation of spending to inelastic goods may be more limited. In practice, however, the vast majority of workers do not see their wages move up in ways that match the volatility of oil and gasoline prices. Volatile price spikes typically translate into lower per capita real spending power, because individual incomes will fail to fully compensate for changes in price.

As consumer spending rotates into non-discretionary and inelastic categories, the employment attached to discretionary consumer spending categories will become more vulnerable. In layman's terms, if incomes aren't rising fast enough, more spending on energy means less spending on everything else. If employment declines far enough that nominal spending from the household sector begins to fall, we may see pernicious feedback loops in which employers respond to weak household demand with expanded layoffs.

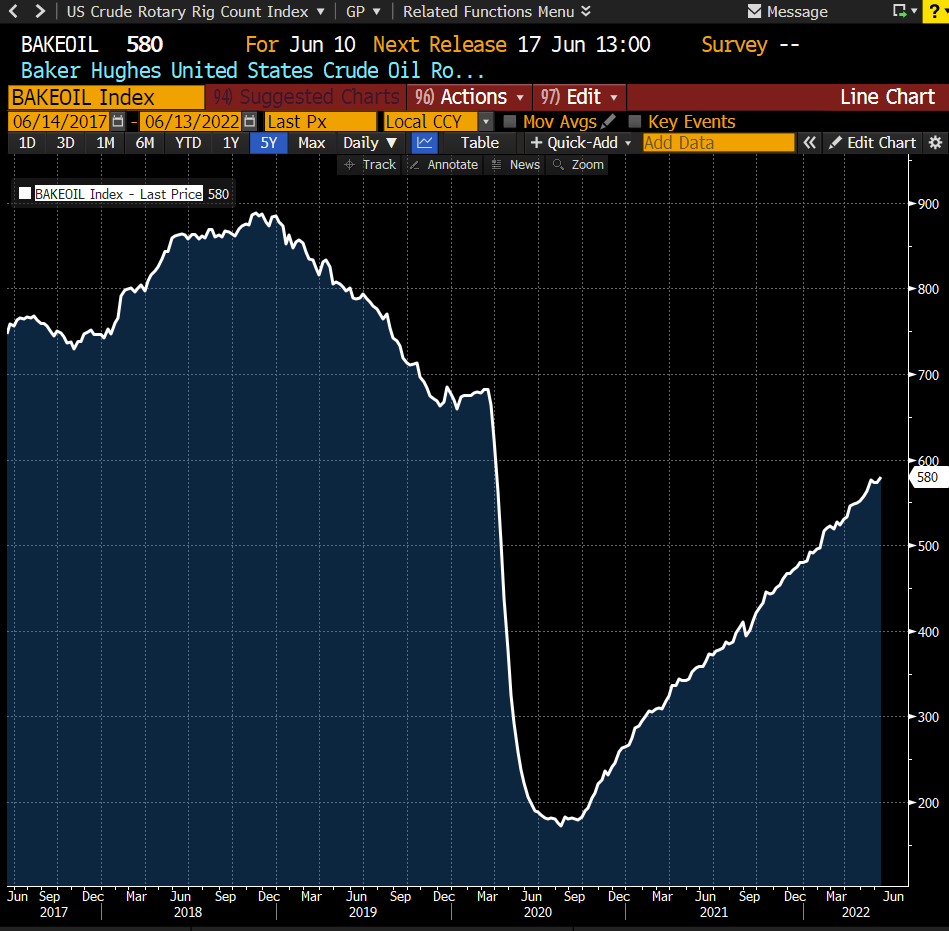

The relevance of this mechanism might seem surprising in light of the growth in the US oil & gas production. As it stands, the US is firmly a net exporter and global supplier. But where oil price increases over the past decade drove increased investment, the industry today is dominated by demands for "capital discipline." In practice, this means each dollar of increased oil prices leads to less investment in oil production than, say, ten years ago. Rig counts are increasing, but it's a slow grind higher. Prices are well-past their pre-pandemic peak, but investment is not.

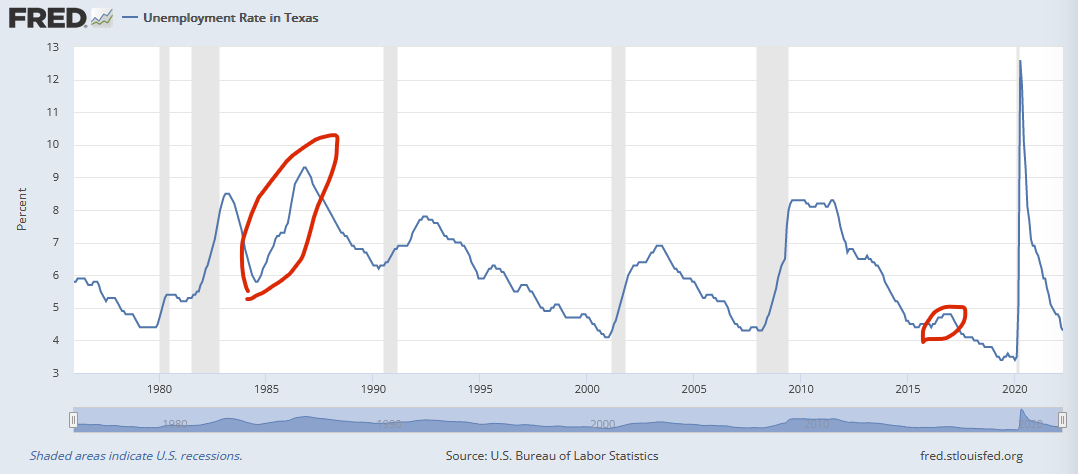

More importantly, even if investment responded more elastically to prices, the investment itself may not prove to be sufficiently labor-intensive to offset the demand destruction of higher energy prices at the macroeconomic level. Texas oil investment has gone through dramatic swings over the past decade, but the Texas labor market has shown none of the wild gyrations witnessed in the 1980s (the previous Texas oil boom-bust). Oil and gas employment will not be a sufficient labor market offset at the macroeconomic level if employment in discretionary consumption sectors takes a serious hit. Higher investment in oil production likely won't produce enough jobs to save us from the employment cost of the demand destruction caused by higher oil prices.

Channel #2: Greater Pass-Through and Corresponding Fed Hawkishness

Owing to their importance to most production processes, oil and commodity price shocks can sometimes spread inflation to a wider array of final goods sectors than anticipated. As inflation spreads to more sectors, the Fed is more likely to view it as the kind of problem that requires more brute-force tightening. This can be especially misleading if price increases appear "broad-based" even as incomes are decelerating: this is precisely what happened in the summer of 2008. Despite conflations on all sides of the debate, "narrow vs broad-based" is not equivalent to "supply vs demand."

In the 1970s, the oil price shocks were truly unprecedented in terms of scale and implications for the US economy. The US was not just dependent on oil for transportation, but for the generation of electricity. It took over a decade for the domestic capital stock to switch away from oil as an electricity generation source (and towards coal). In the meantime, oil prices were a substantial input across domestically produced goods. The 1973 oil price shock was simultaneously an obvious supply-driven recessionary phenomenon and yet also very broad-based in how it affected consumer price inflation.

We live in a different world today. Oil is no longer an electricity generation source and motor fuel is now utilized more efficiently for transportation purposes. As the US economy has continued to advance, so too has the set of non-energy-intensive consumption activities. Still, shocks to oil and other commodities can matter to aggregate inflation numbers if the movement is one of sufficient magnitude and affects a sufficiently high-weight category.

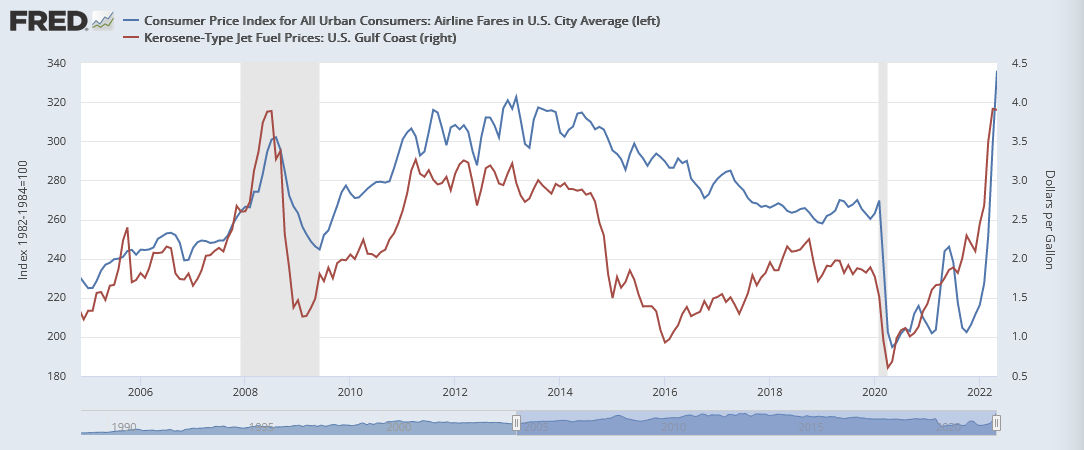

Right now retailers are dealing with elevated costs for diesel to transport and distribute goods, while airlines are having to pay through the nose for jet fuel. Passthrough effects to consumers shouldn't be overstated here, but the point to highlight here is one of asymmetry and nonlinearity. Firms may pass on cost savings slowly, but push through cost increases, once they reach critical mass, more quickly.

The trajectory of airfares is instructive; during a period of historically elevated prices (2006-2014), jet fuel prices appeared to be consistently passed through to airline fares. When oil and jet fuel prices semi-permanently collapsed in 2014-16, airlines were much slower to pass through the benefits of lower costs to consumers (much of this has to do with how the airlines were previously hedging out costs and left them stranded to pass on cost savings in a price crash). Yet now that jet fuel prices have surged, we have seen the timeline for passthrough return to its previous norms.

All of this is to say that if oil and commodity prices surge high enough and fast enough, greater passthrough of costs can materialize and cause the Fed to opt for an even more aggressive hiking path. We could see faster hikes than what income growth would indicate. Of course the solution here is for the Fed to focus more closely on incomes (and not the noise of cost-passthrough debates) but that may prove beyond the Fed's abilities in the midst of the current inflation episode.