We systematically track the evolution of financial conditions and their underlying drivers. We intend to share regular updates of these systematic monitors with our donors on a more exclusive basis (so long as it does not compromise our public mission). This monitor is a reflection of how we think macroeconomic and policy dynamics are affecting financial conditions and, by extension, our assessment of the economic growth outlook. If you are interested in becoming an Employ America donor, feel free to reach out to us here.

Takeaways:

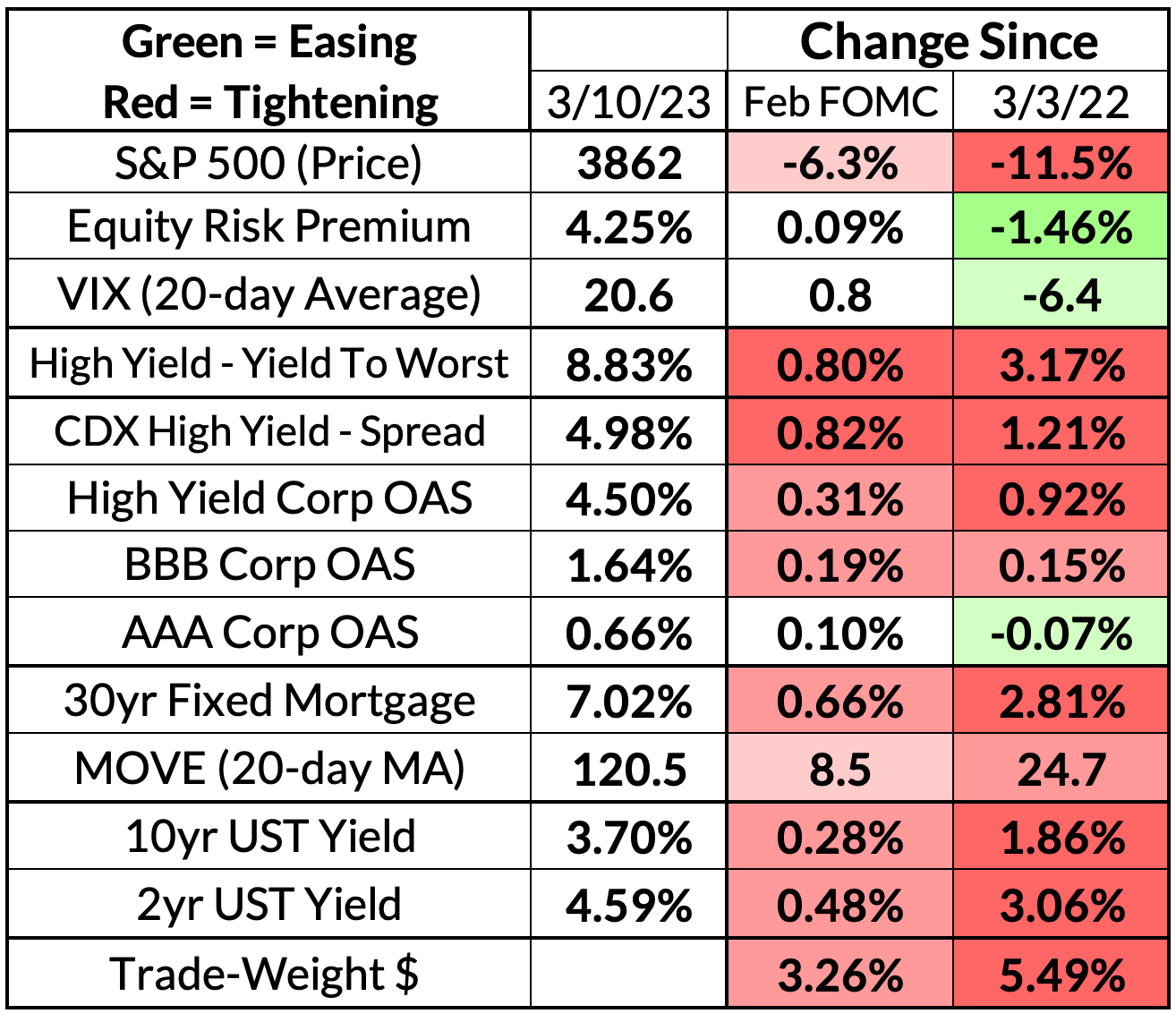

Financial conditions have tightened in the past week, first in response to Chair Powell affirmatively putting a 50 basis point (bp) hike back on the table for the March FOMC meeting, and now more noticeably as a result of Silicon Valley Bank's collapse (recessionary risk-off dynamic). Right now both policy (Fed) and growth expectations (via fears of bank distress) are contributing to tighter financial conditions. Time will tell how these two dynamics stack up. At an asset class level, the tightening has now rapidly shifted towards riskier assets (credit spreads, equity risk premiums); Fed pricing, Treasury yields, and the dollar also contribute to tightening but are of lesser importance.

If fears associated with bank distress quickly dissipate, a hot Consumer Price Index & Producer Price Index print will be enough for 50bps (a risk we flagged last week and looks more likely after Powell's Congressional testimony). If financial conditions tighten further in a "risk-off" manner AND and we get a cool CPI/PPI, a Fed pause should be come into clearer view. A hot CPI likely cements at least 25 basis points. Further risk-off financial conditions index (FCI) tightening likely rules out a 50 basis point hike in March. The prospect of risk contagion could prove to be a game-changer for how the Fed thinks about lagged effects of past tightening. See our Fedspeak Monitor for the dot plot scenarios we have sketched out.

- FCI tightening is no longer just about Fed hikes. We are observing further FCI tightening, after a mini-reversal in December and January. Unlike what we saw last week, this tightening is no longer just related to a hawkish Fed (reacting to strong growth and inflation data). This is also about the de-rating of the growth outlook, seemingly as more risk of bank distress gets factored into market-implied growth expectations

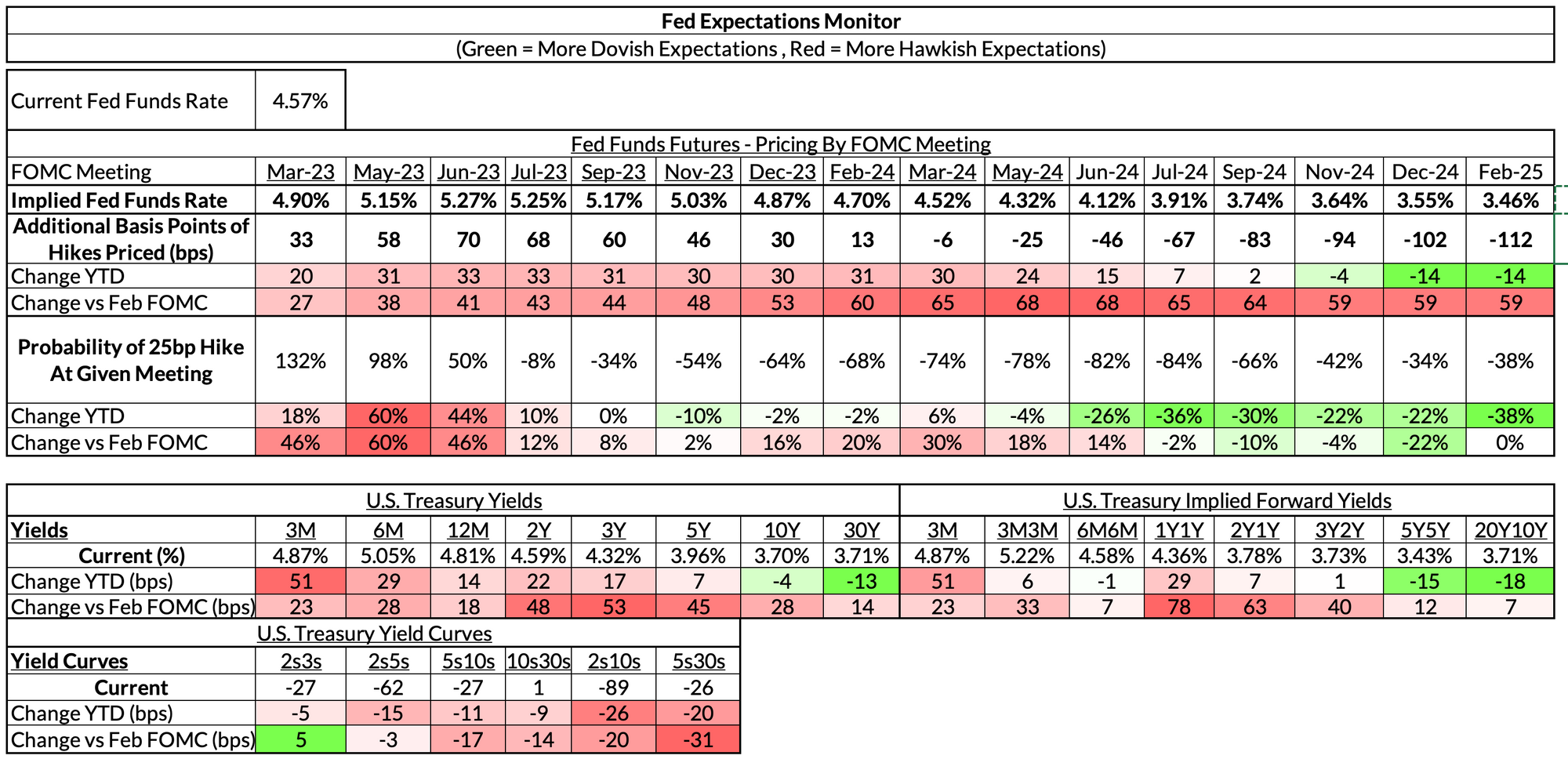

- Since the February FOMC meeting, only 65bps of net hikes are priced in over the next year, in contrast to the 125bps priced just last week. The Fed is caught in a pickle right now. Markets are potentially signaling something more pernicious afoot, while the Fed wants to appear more data-dependent in response to upside inflationary dynamics. If the growth outlook (especially as implied by financial conditions) appears more fragile, then under our framework, that should offset upside risks to the inflation outlook. In that case, Fed should avoid weakening the growth outlook further (through tighter financial conditions).

- The asymmetric risk of "hawkish panic" from the Fed has all but materialized. Residual seasonality is still showing its face in Q1, both in strong labor market data and strong inflation data. If there was no Silicon Valley Bank / financial conditions headwind to grapple with, Chair Powell's testimony signals that a hot CPI would automatically trigger a 50bp hike in March. Financial conditions may ultimately get in the way of these plans, and push the Fed to take a more cautious approach to hiking (25bps/meeting) and a more cautious interest rate outlook displayed in the dot plot.

Financial Conditions Components

The most worrisome aspect to financial conditions right now is that it's driven by risk premium widening, and not merely a higher level of expected risk-free rates. Risk premium widening is an important indicator of aggregate risk aversion and recessionary dynamics.

Fed Pricing

Fed pricing is still more aggressively hawkish than where it stood at the end of the February FOMC meeting, but substantially less so relative to last week. Silicon Valley Bank's collapse is the most obvious catalyst for this substantial decline in interest rates across the yield curve.

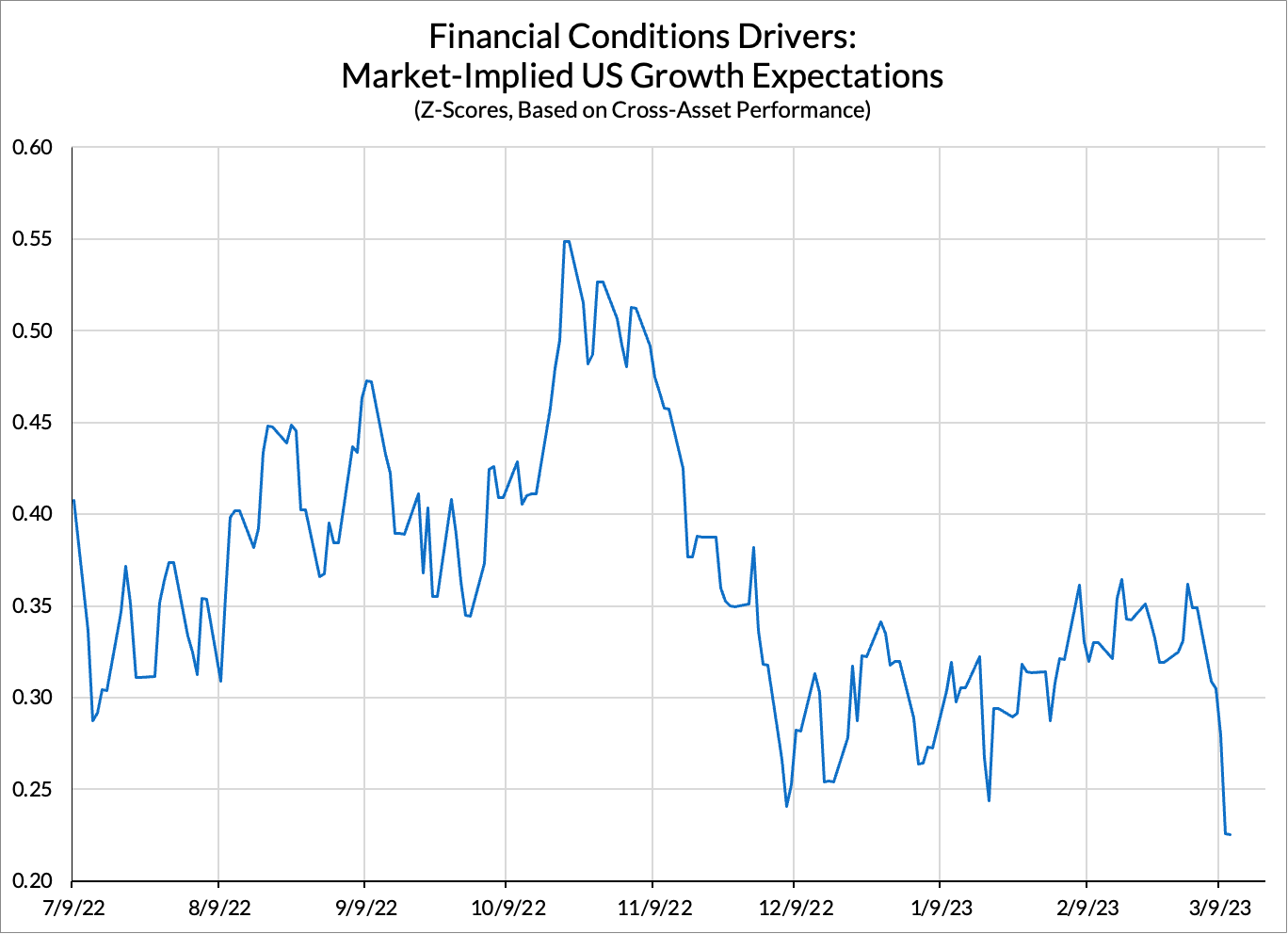

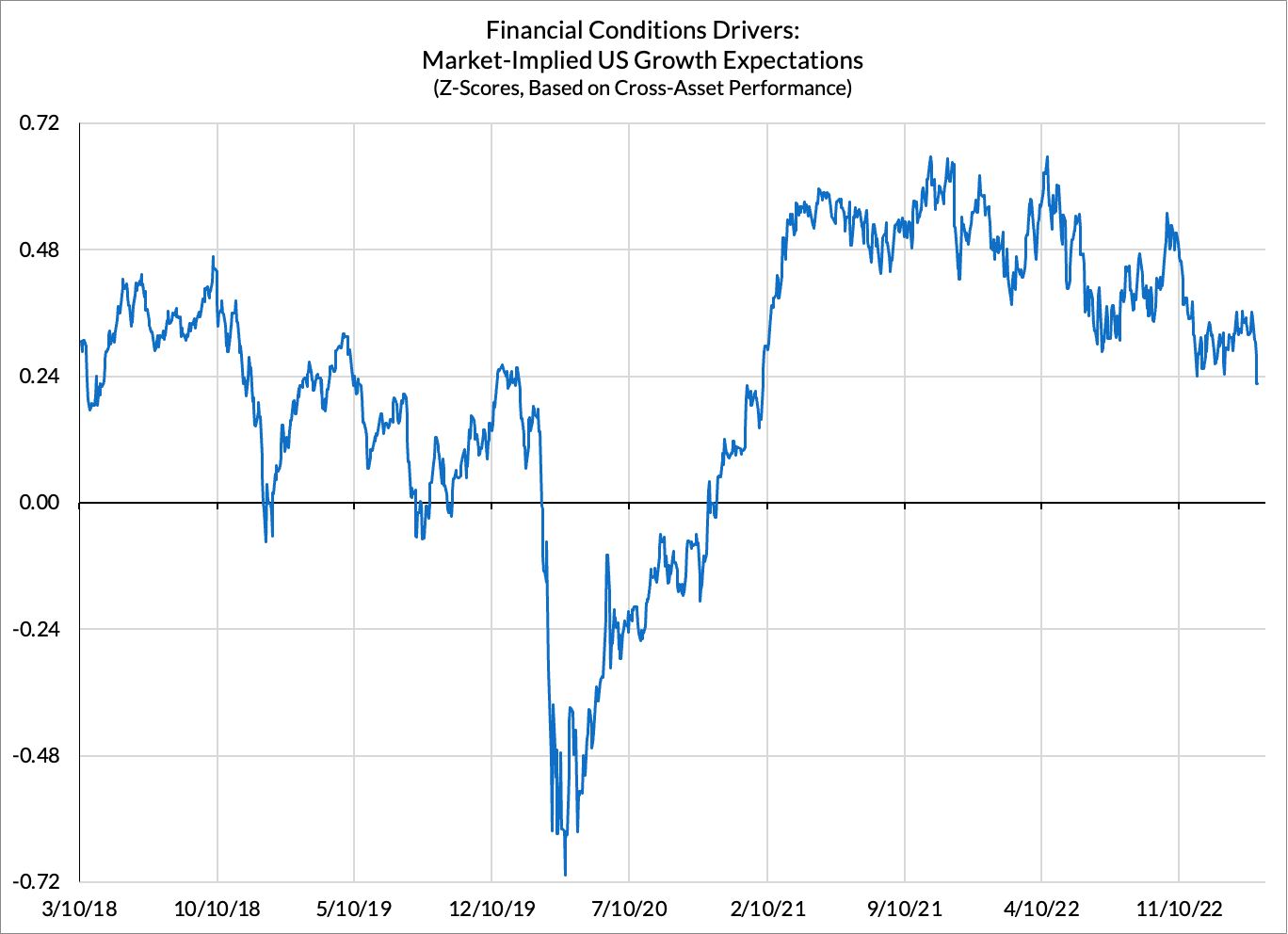

Market-Implied Growth Expectations

The financial conditions tightening this week is meaningfully distinguishable from last week: growth expectations were sharply derated as a result of fears about bank distress. When equity prices are falling and long-term Treasury yields are falling, recession risk is inherently higher. Still, we would not be alarmist about this dynamic and the story could look very different in a matter of weeks, or even days.

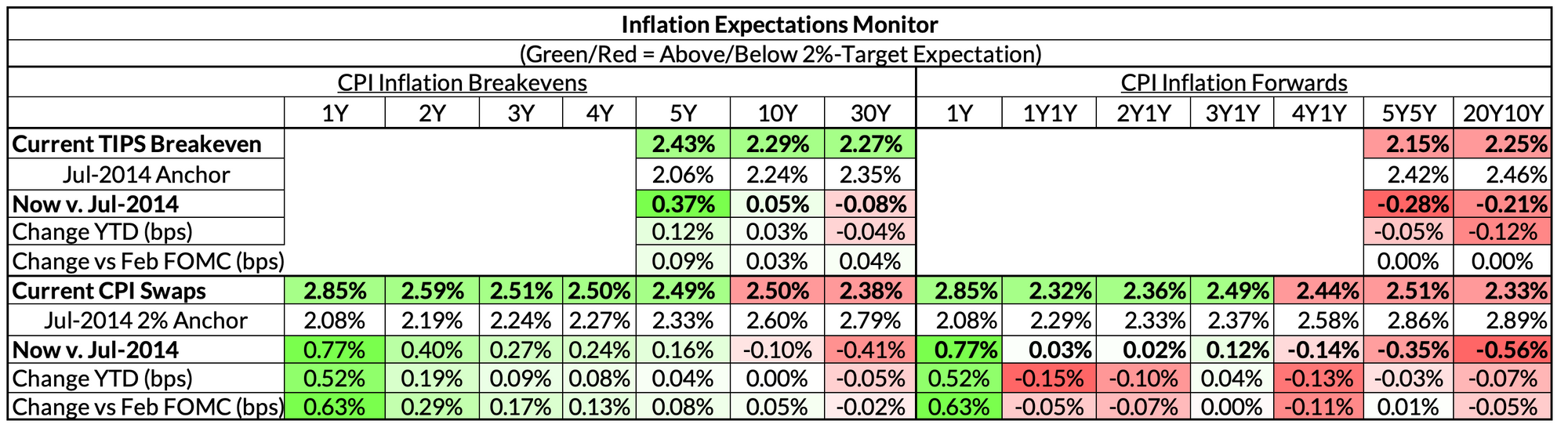

Market-Implied Inflation Expectations

Inflation expectations were moving firmly higher in the past month, but amidst "risk-off" fears about US growth, inflation expectation pricing has also corrected. Outside of 2023, market-implied pricing of CPI-linked swaps are now lower than where they stood at the end of the February FOMC meeting. 1yr inflation swaps are still 77bps above what we see when inflation expectations are assumed to be anchored around 2%; while 2024, 2025, and 2026 swap pricing is just about comparable to the Fed's targeted goals.

While we are skeptical of most inflation expectations measures (there are multiple time-varying risk-premium dynamics and distortions to be aware of), we think market-implied expectations are the most compelling. More importantly, the Fed is surely paying attention.