Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%. If you are interested in more timely access to this content following the release of data, feel free to reach out to us here to gain access to our Premium Donor distribution.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant.

Summary

We still have critical data left outstanding for nowcasting the entirety of February PCE (including February PPI tomorrow), but today's CPI reading was quite consistent with what we previewed last Thursday: headline inflation was more neutral while core inflation still surprised to the upside. Lagged price revisions were due to push up Q1 inflation and it has. If there was not a rolling set of bank runs that the Fed had to step in and address, they would want to push for a 50 basis point hike. In light of the broader banking context, the choice is more likely to be between a pause and a 25 basis point hike.

The sectoral composition leans more heavily on reopening-sensitive in-person services and the ongoing "higher for longer" rent CPI dynamic. While there are some silver linings in this release, we still do not see the kind of broad-based goods deflation that would make us more optimistic about goods and services inflation in the near-term. And the coming rise of used cars inflation adds upside risk to March and April inflation releases. The Fed's claim that the labor market is at the root of services inflation is also not aging well; the labor market is cooling on most wage and wage-relevant statistics but it has yet to show up meaningfully in service prices.

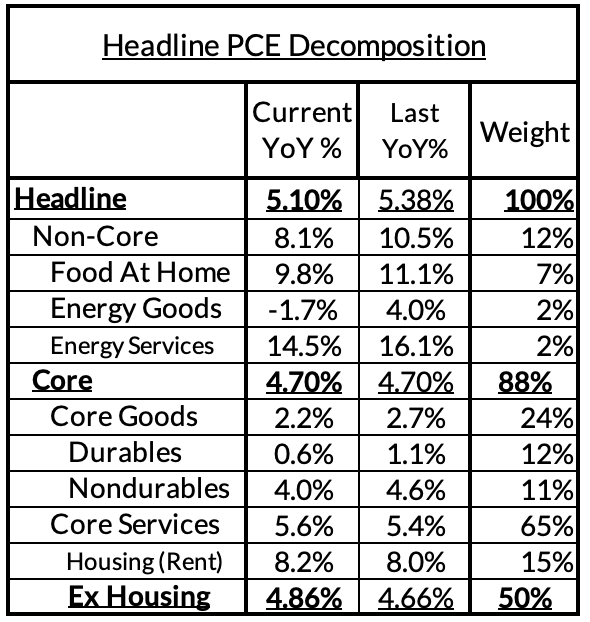

- Headline PCE is currently on track to fall, from 5.38% year-over-year in January to 5.10% in February. (0.33% month-over-month increase)

- Core PCE is currently on track to stay flat, from 4.70% year-over-year in January to 4.70% in February. (0.36% month-over-month increase)

- Core Services Ex Housing PCE is currently on track to increase on year-over-year readings despite decelerating in month-over-month terms. Year-over-year readings are set to rise from 4.66% year-over-year in January to 4.86% in February (0.42% month-over month increase after 0.58% increase in January). We could see this index playing out a few different ways; airfares, financial services, and quirky input cost indices still hold the key.This index is most vulnerable to revision since it involves a much higher share of non-CPI inputs. We'll update this estimate tomorrow, when we should have a clearer picture.

Deeper Discussion

For those interested in a deeper knowledge of the high-stakes dynamics (see the heatmaps below for how their scale to contribute to PCE):

- Lucky break on used cars but upside risk keeps coiling: The best reason to believe in upside in February actually did not pan out: used cars continued to deflate in CPI despite retail prices reportedly flattening out and begining to perk up in the private sector data. Expect a somewhat nasty reversal here in the next couple of months, as upside risk is continuing to coil. It will be interesting to see whether the Fed's emphasis on "Core Services Ex Housing" will soften their sensitivity to this upside development or whether they lose all patience. We worry that motor vehicle services will also inflate further and for longer as a result of this ongoing used car price dynamic.

- The rent lags are longer than the Fed is presuming: Rent and OER continue to run hot and the Fed has not taken a sufficiently generous view of the likely lags. This too will push up the Fed's inflation projections relative to where they stood in December. Here too, it will be interesting to see whether the Fed's emphasis on "Core Services Ex Housing" will soften their sensitivity to this upside development.

- Best news: food inflation is slowing and that should help food services soon. We keep flagging that there is very reliable overlap between grocery store and restaurant inflation dynamics. Grocery store inflation tends to lead at the margin. Thus, even though we did not see progress on food services inflation directly in February, "food at home" (grocery) inflation continued to slow. This bodes especially well for the core services ex housing PCE outlook.

- Don't get headfaked by airline fare CPI; it's the PPI that counts: Last month, the CPI release looked ok to lay observers in part because airline fares fell in the release. But they did not matter at all, because the PPI index for airfares is what flows into PCE (which led us to lean firmly on the upside vs consensus). This month airfares picked up in CPI but could prove more muted in PPI. Other outlets superficially cite "Core Services Ex Housing CPI" as if it is representative of PCE but this is going to leave observers misled on a month-to-month basis. Airfares are the most pronounced driver "Core Services Ex Housing" volatility.

- Reopening-Sensitive In-Person Services Keep Running Hot: Whether you interpret the strength as a product of pandemic/reopening frictions, labor cost, or just a strong consumer willing to pay, we keep seeing lodging and in-person recreation services punch strong. This is going to make the Fed more willing to plow ahead with hikes.

- The dark spaces of PPI and PCE will matter: Methodology details matter when it comes to Core Services Ex Housing PCE. Financial services PPIs and their translation to PCE could pose a bit more downside risk this month (after outperforming in January). Input cost indices were the wild card that pushed up January PCE; it remains to be seen if this is going to be a one-off phenomenon or something more sustained (it seems very questionable for the Fed to put such outsized weight on opaque non-market price indices).

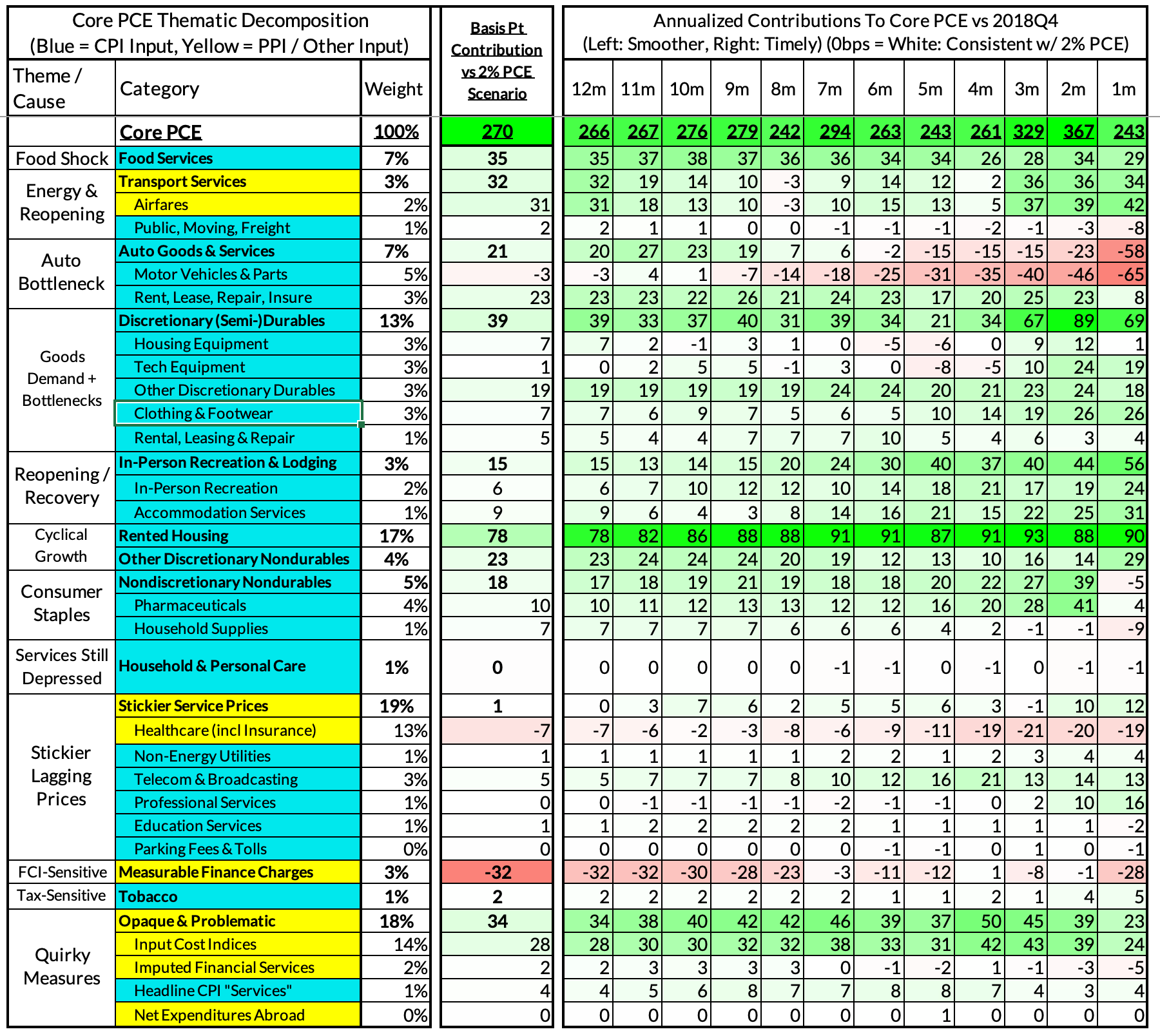

For the Detail-Oriented: Core PCE Heatmaps

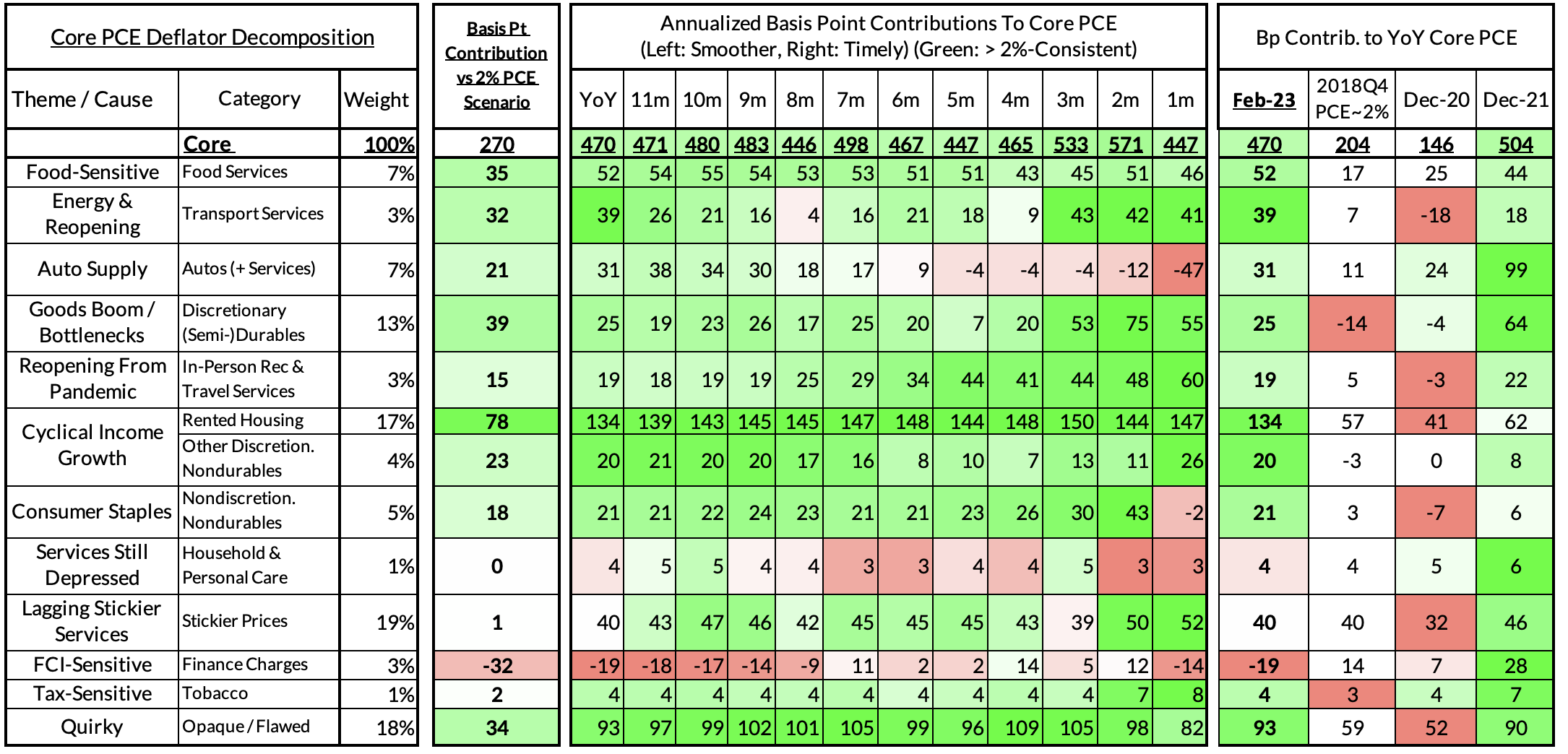

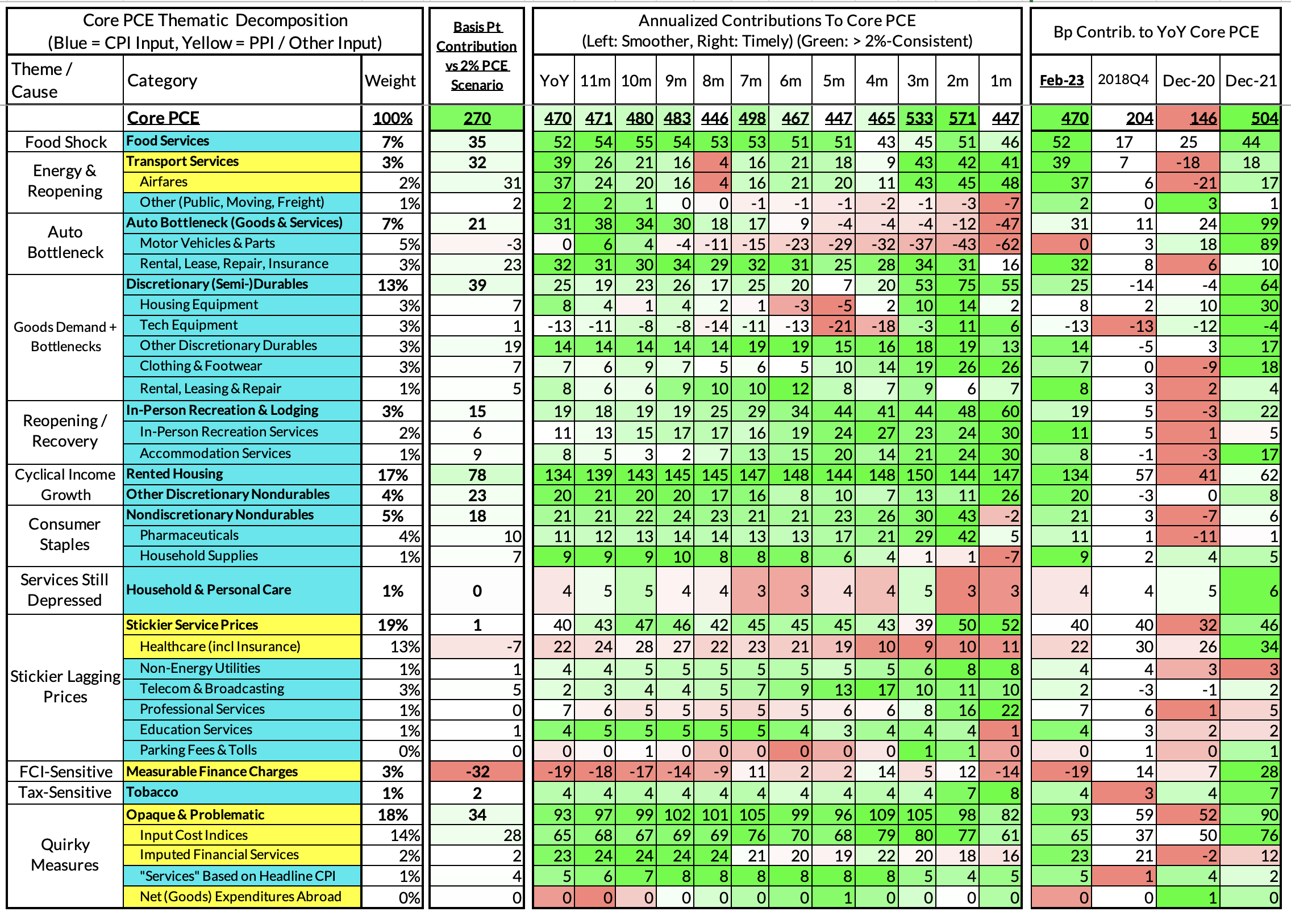

Right now Core PCE (PCE less food products and energy) is running at 4.70%, 270 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation and market rents in 2021-22.

There are other contributors to the overshoot, some more supply-driven (automobile bottlenecks likely explain 21 basis points, while food inputs likely added 35 basis points to the overshoot) and some more demand-driven (in-person recreation and travel services adding 23 basis points to the overshoot) and some both (airfares are both reopening-sensitive and energy-sensitive, adding 32 basis points to the overshoot).

Looking through the detailed version of our heatmaps, you can get a sense for what's still left to play for: airfares, healthcare services, observed financial services, and a lot of opaque and problematic indices the BEA throws in. The first three are going to be determined by tomorrow's release; given the volatility of airfares, this could become a pronounced impact.

The final heatmap gives you a sense of the overshoot on shorter annualized run-rates. Right now we see February's monthly core PCE on track for a 243 basis point overshoot vs 2% (4.43% annualized growth). This estimate will inevitably shift tomorrow.

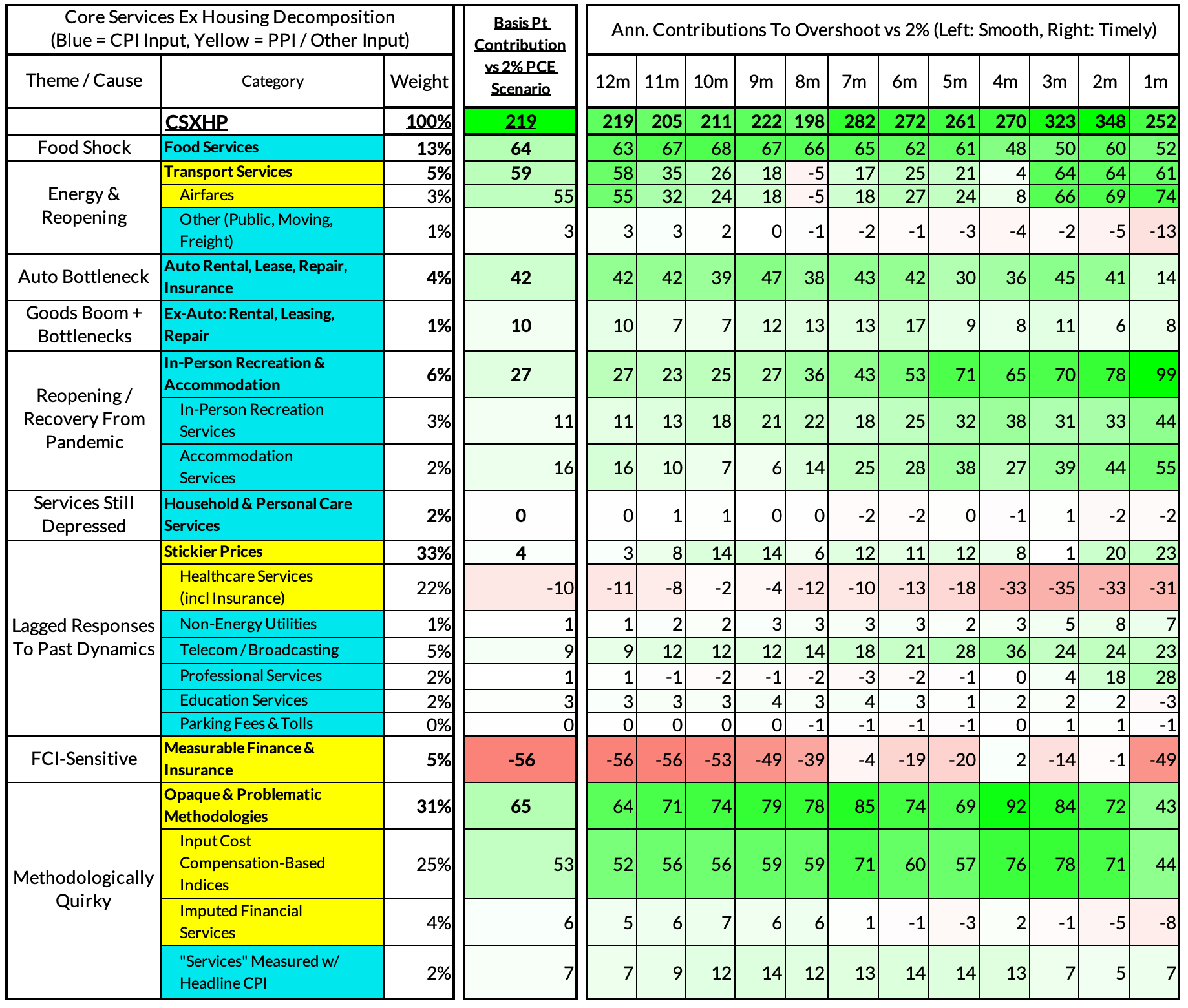

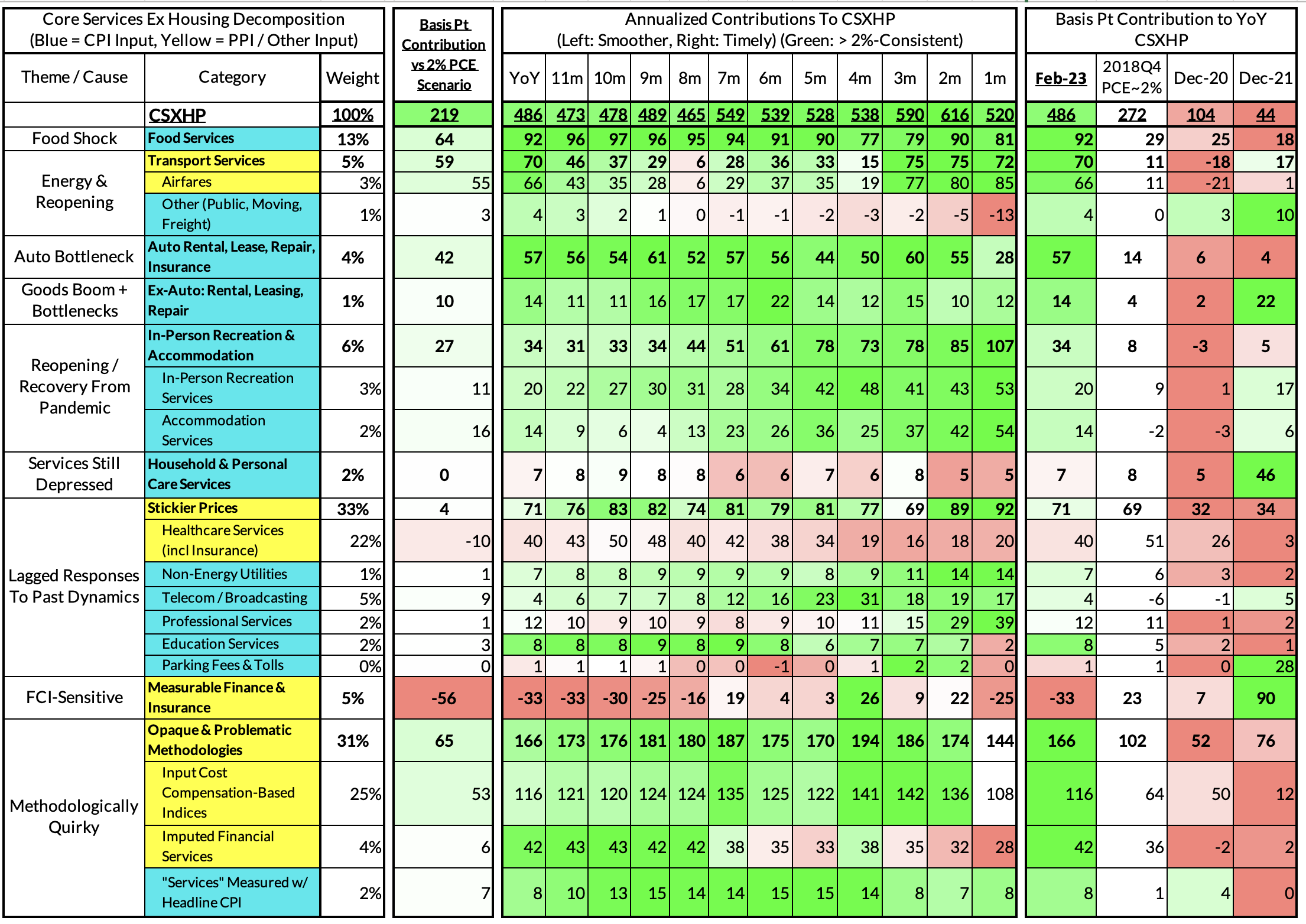

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

February's growth rate in "Core Services Ex Housing PCE" is on track to run at 4.86%, a 219 basis point overshoot versus the 2.72% run rate in this aggregate that coincided with 2% headline and core PCE.

The fundamental drivers of the overshoot are food services, airfares, motor vehicle services, and the ongoing boom in reopened in-person services. Motor vehicle services are starting to show some signs of abating but this may be a false dawn given the likely rise in used car values over the coming months. Airfares estimates will get updated after tomorrow, while food services should disinflate so long as food disinflation continues to sustain.

As for tomorrow, financial services present some upside risk relative to our nowcast model, and the BEA's opaque input cost indices also have scope to outperform our model.

The monthly reading for Core Services Ex Housing is currently on track to still look hot over Q1 though less so in February relative to January (for the same set of reasons we flagged ahead of time). We do not see the Fed backing off their hawkish inflation posturing if financial conditions and banking conditions recover.