This post was originally published two days ago for Employ America donors. If you’re interested in early and extended access to our content, email us at donate@employamerica.org

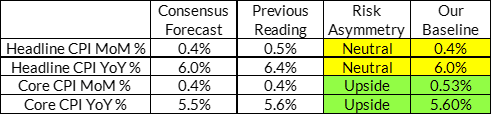

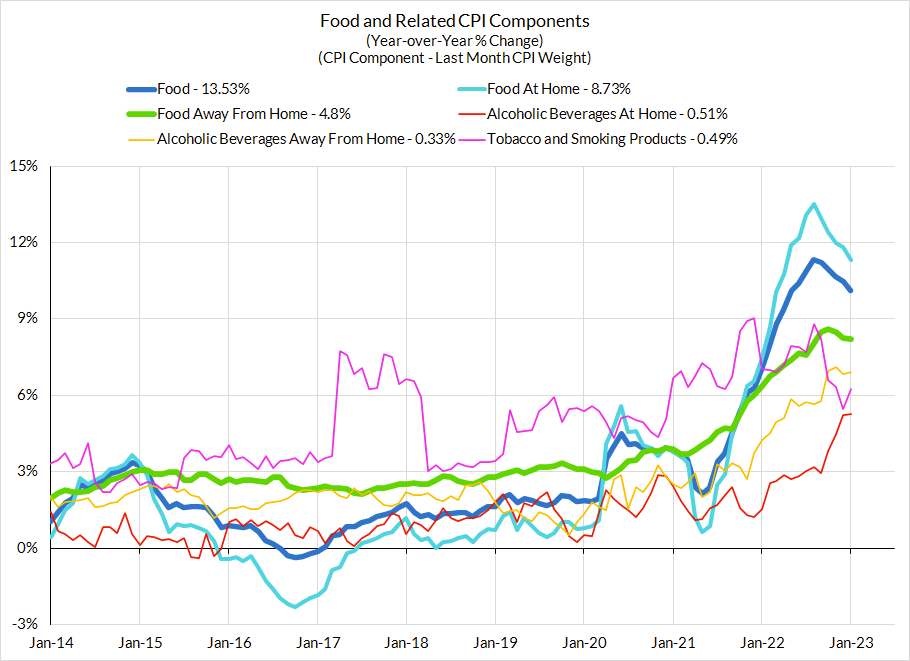

Summary: The risks for February and Q1 core inflation remain asymmetrically tilted to the upside relative to consensus forecasts. We don't think the causes for underlying upside risk (stickier/lagging service prices, used cars) are a sound basis for hawkish panic, but the Fed is now on track to react with panic. A 50bp hike is likely on the cards and such an upside surprise would only further cement the Fed's view here; the only potential out thereafter would be the PPI inputs to PCE (airfare divergence in CPI vs PPI proved pivotal in January). Given that the Fed is in communications blackout for CPI and PPI, you may find our PCE nowcast updates especially helpful. Headline inflation risks remain more balanced because of declining benchmark natural gas prices and the potential for deceleration in food prices.

Key Dynamics:

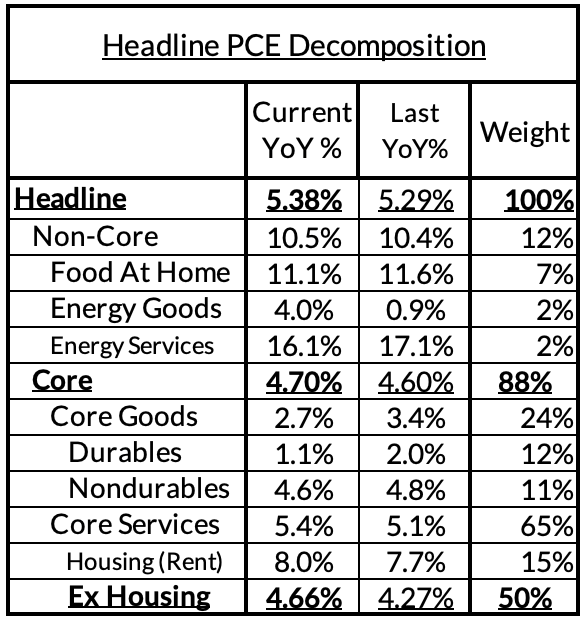

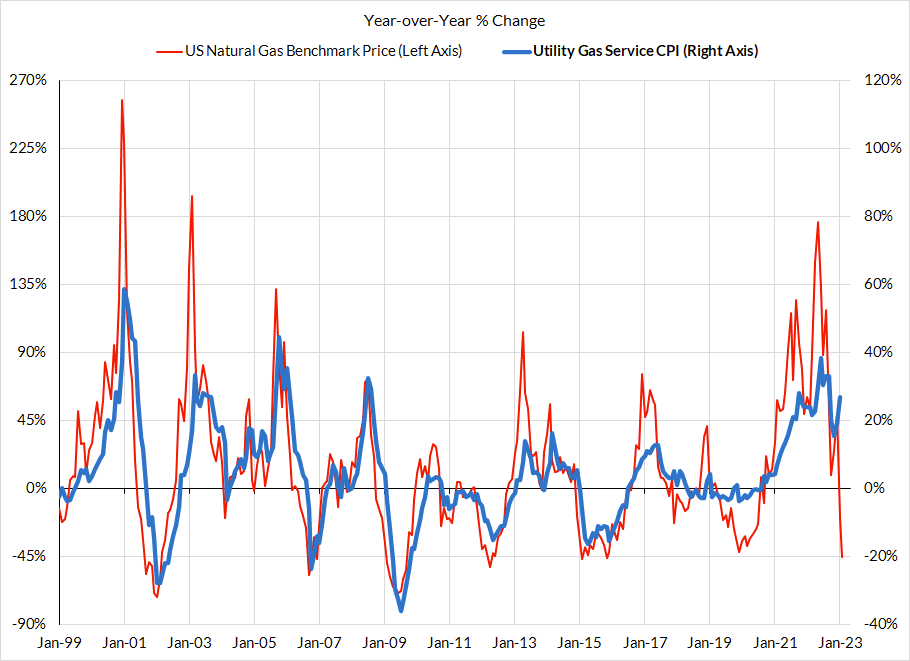

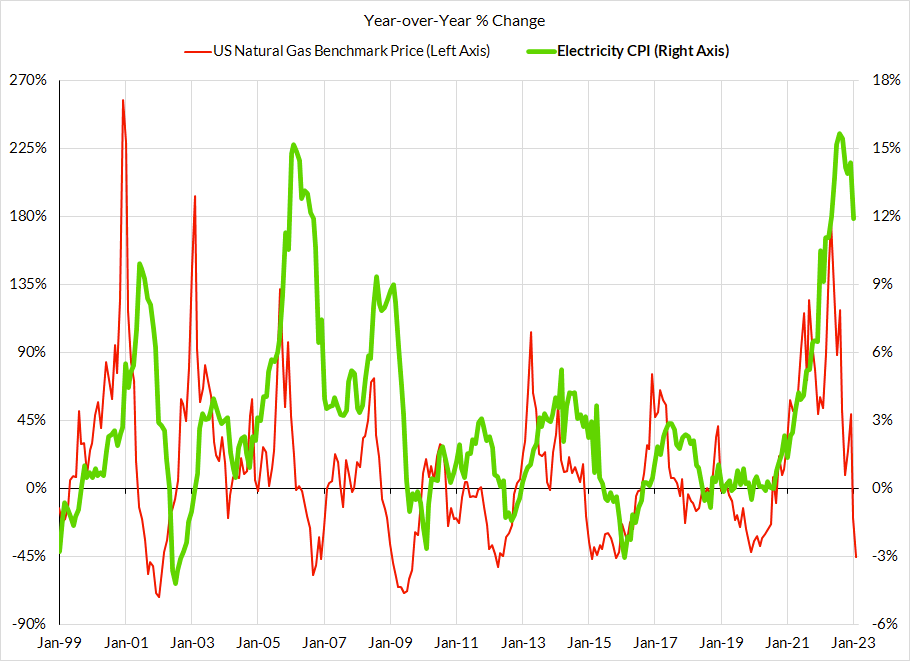

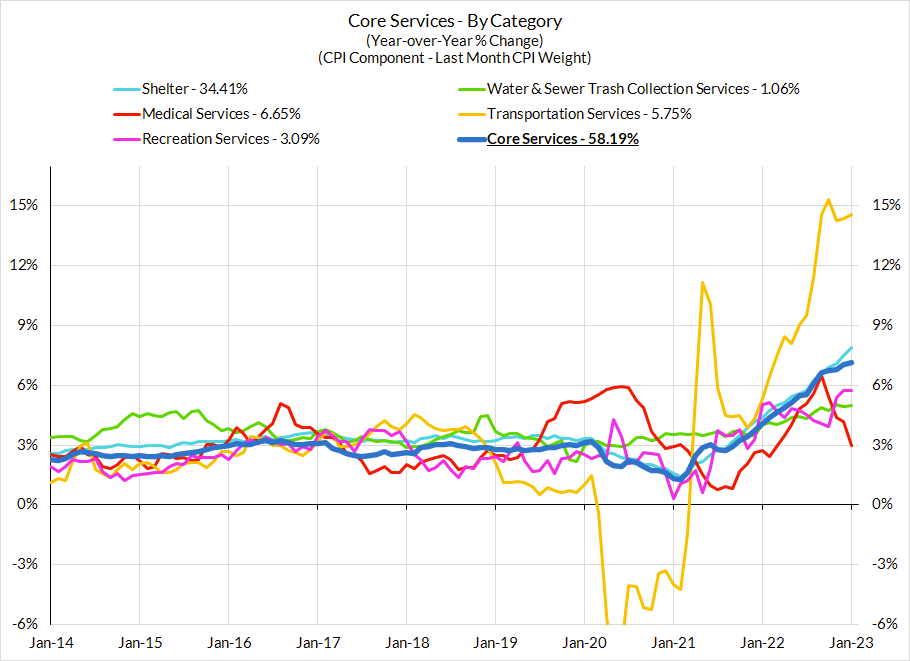

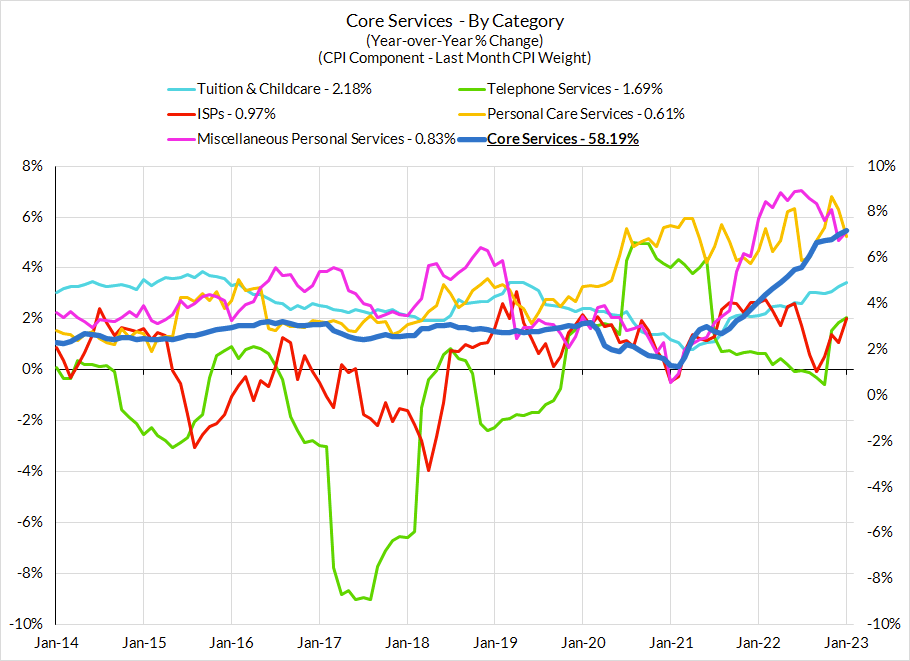

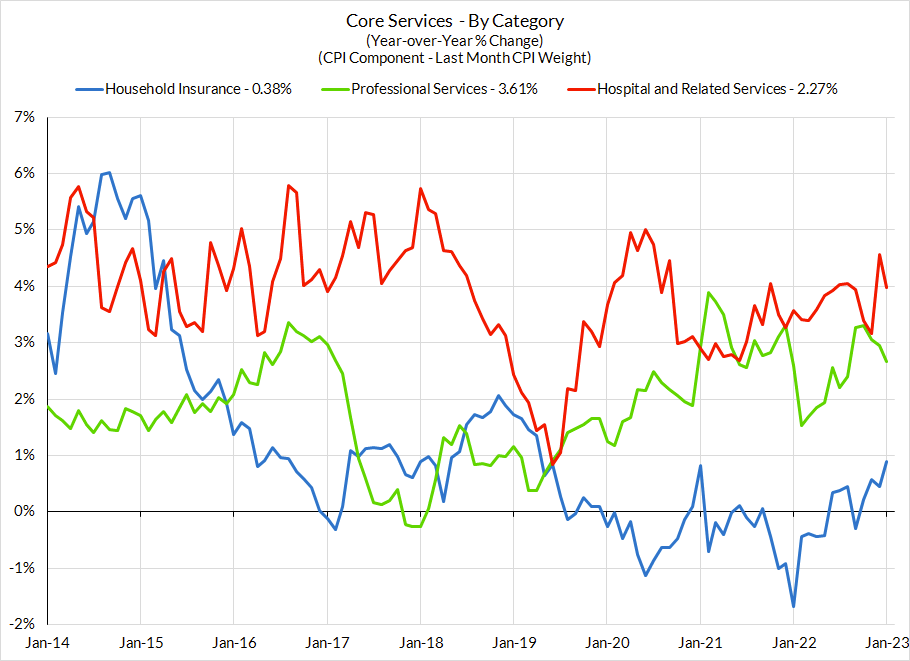

- Sticky service prices revising with a lag: We already discussed in our previous preview that January (Q1 generally) is a time when firms with stickier and lagging service prices are more vulnerable to outsized price increases, especially when inflationary pressures were still elevated over the previous year. We also noted that these upside core inflation risks are more pronounced for PCE than for CPI. We did see a version of this story play out in the January PCE surprise, along with strong airfare PPI. While the effect is lower in February than January, it likely remains underrated. Key categories for tracking this view: healthcare services (PPI), non-energy utilities, telecommunications, broadcasting, and professional services.

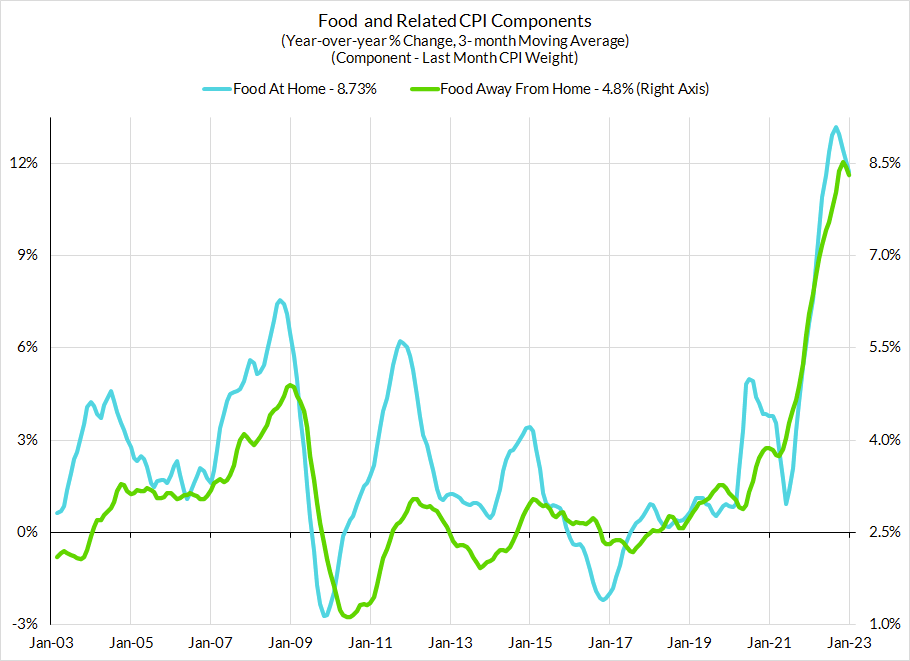

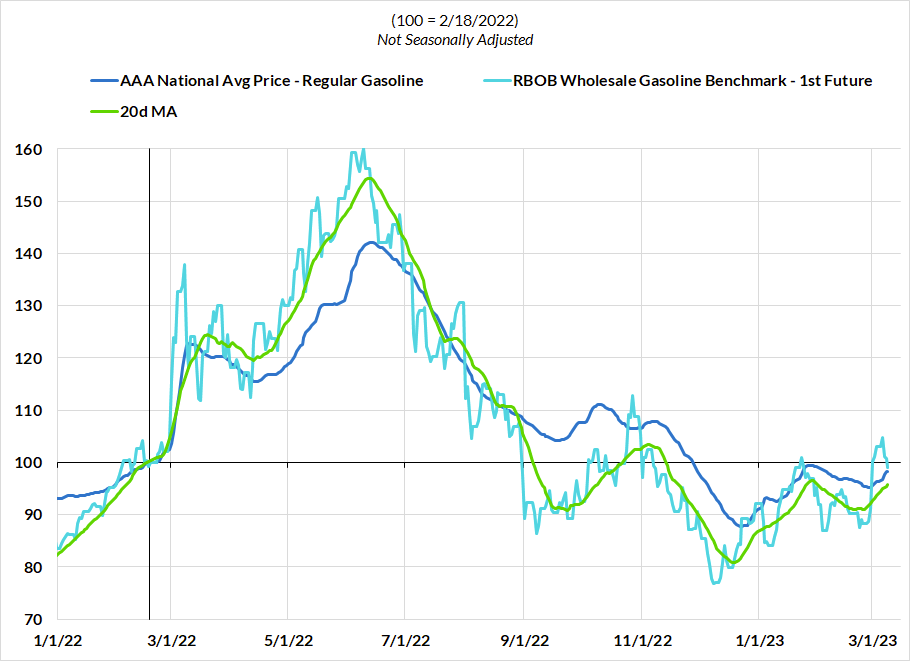

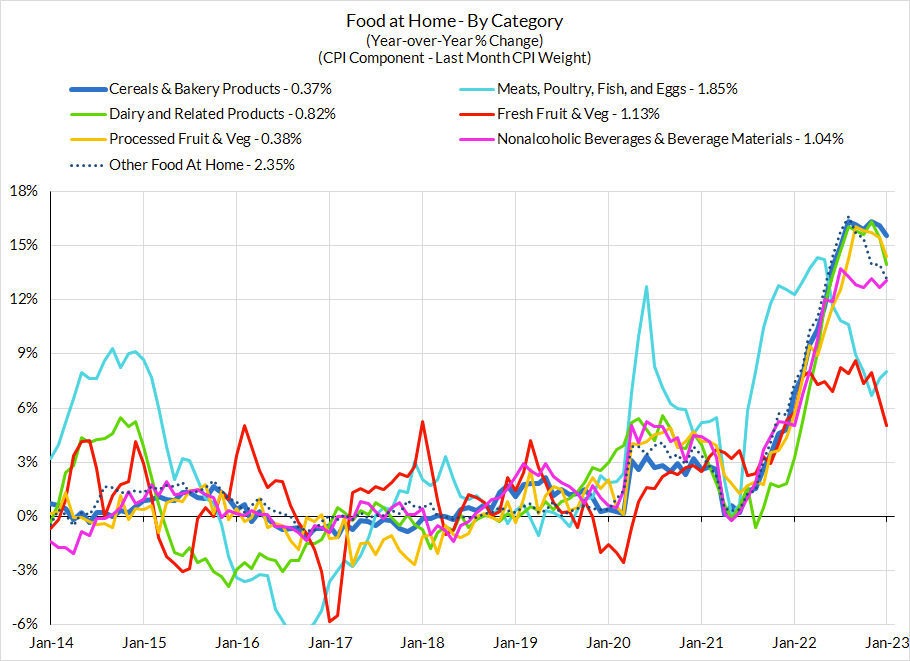

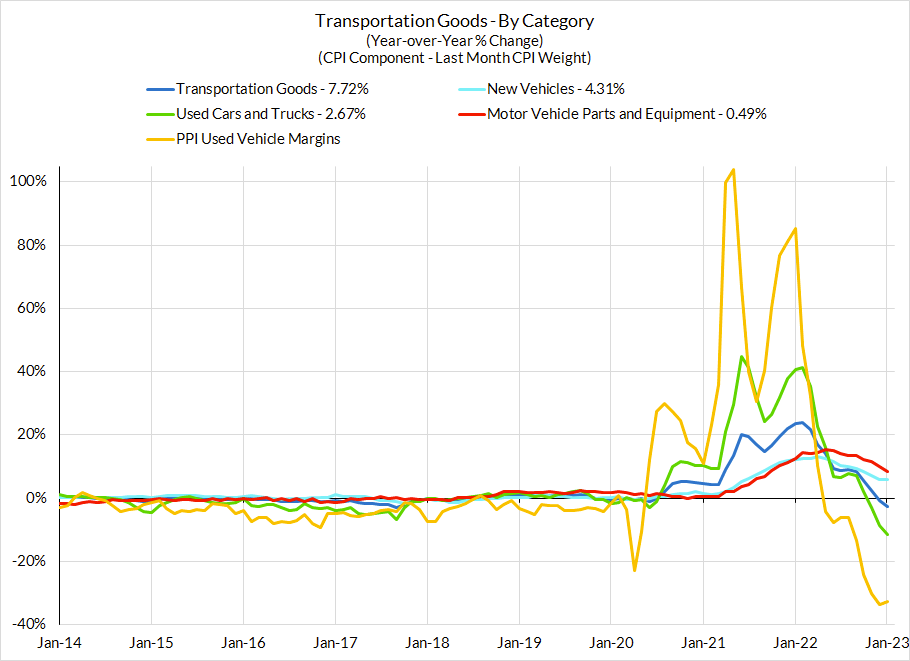

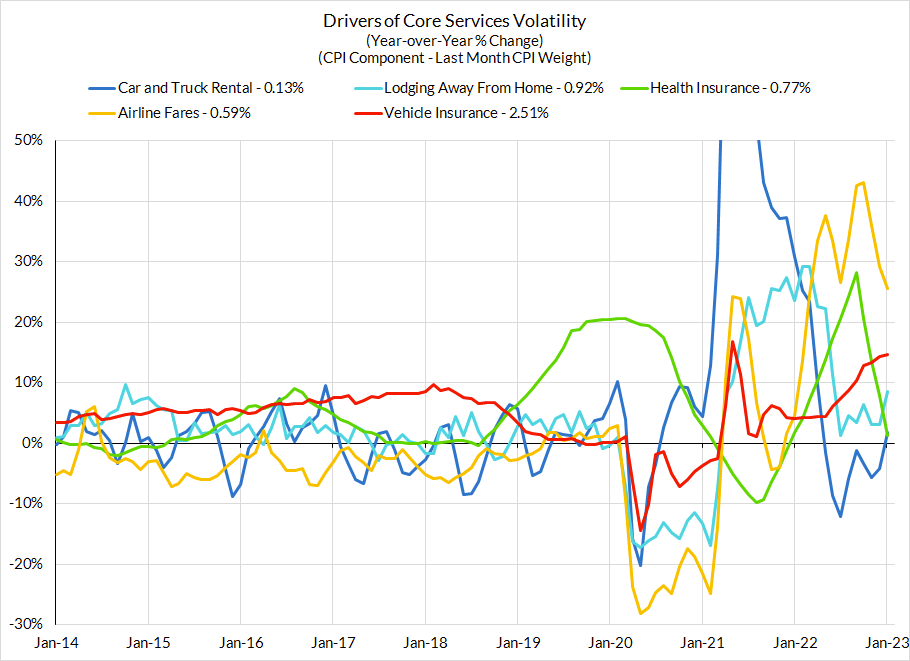

- Goods matter to services: The Fed's story about inflation (that supply chain improvement is bound to drive goods deflation while non-housing services inflation is driven by wages) is liable to be exposed. Supply chains have only just begun to improve and they are still not sufficiently improving where they're most critical to inflation: motor vehicle production. Likewise, even though wages are decelerating, service price deceleration may not follow suit because the major drivers have little to do with wages. Food product deceleration is critical to food service price deceleration. Refined petroleum product prices are a major driver of airfares and other transportation service prices. Used and new car prices are highly relevant to the cost of leasing, rental, repair, and insurance. This last goods dynamic is the most concerning right now.

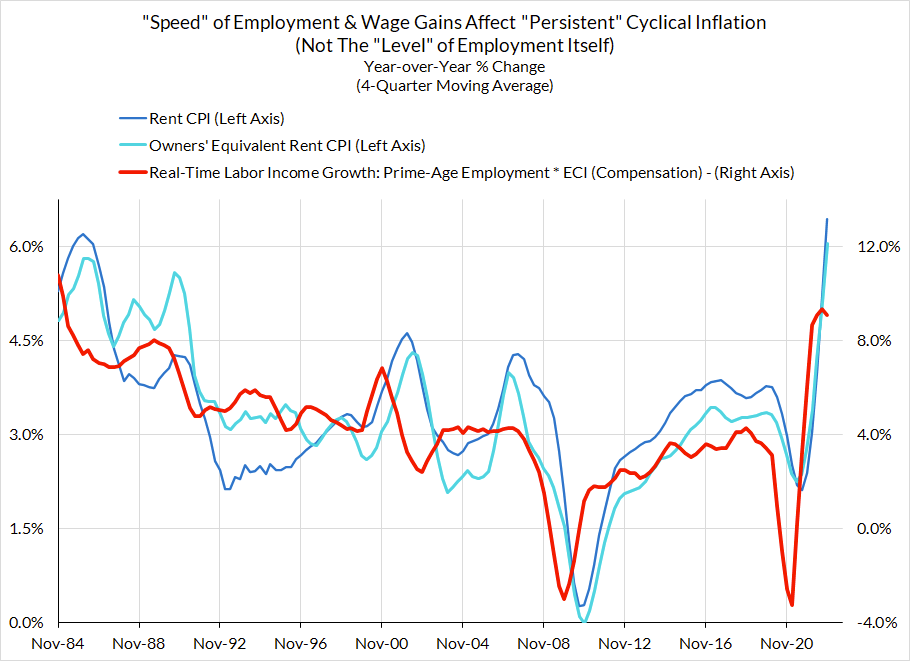

The More Likely Upside Scenario & Its Likely Policy Implications: In addition to stickier service prices, used cars are increasingly likely to drag down core CPI from here. Retail prices only just began to respond to wholesale price upside in February. Used cars are likely to be inflationary in March and April. And while there is still a lot of hype about the implications of falling market rents, the CPI methodology will likely leave rent CPI readings higher for longer than the Fed anticipates. We now expect slower job growth and wage growth to only feed into rental CPI disinflation around Q3.

In the presence of upside inflation surprises in Core Services Ex Housing PCE, the Fed is more likely to hike 50 basis points in March and signal a much higher terminal rate in the dot plot. The biggest concern for us is if this tightening push occurs amidst coincident labor market deterioration; thankfully such deterioration has not transpired as of yet, but we could see more concerning signs as early as Q2

The Less Likely Downside Scenario & Its Implications: Inflation has enough moving parts to surprise to the downside this month. Here are some plausible disinflationary dynamics that could materialize sooner than we now pencil in:

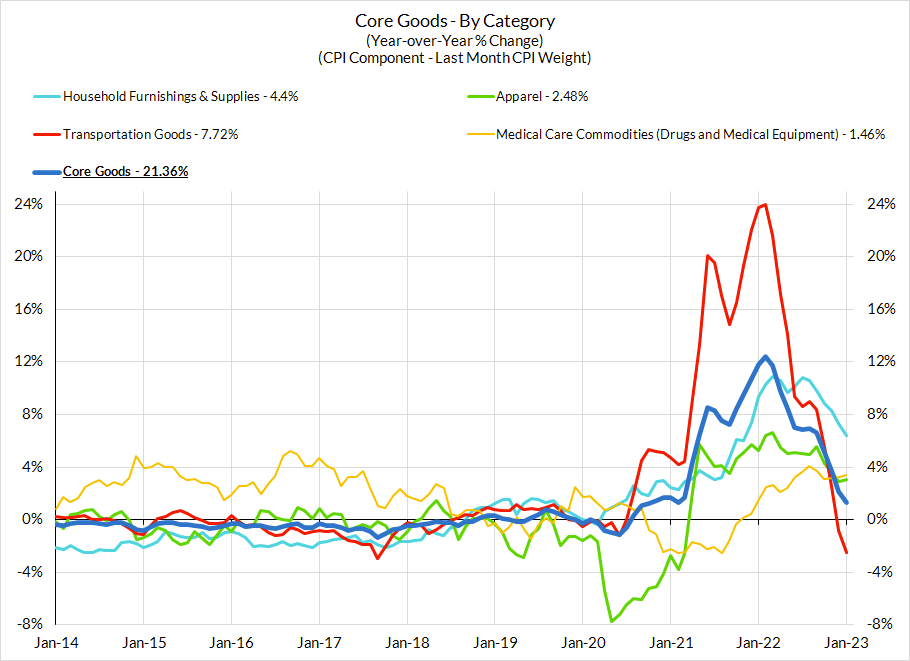

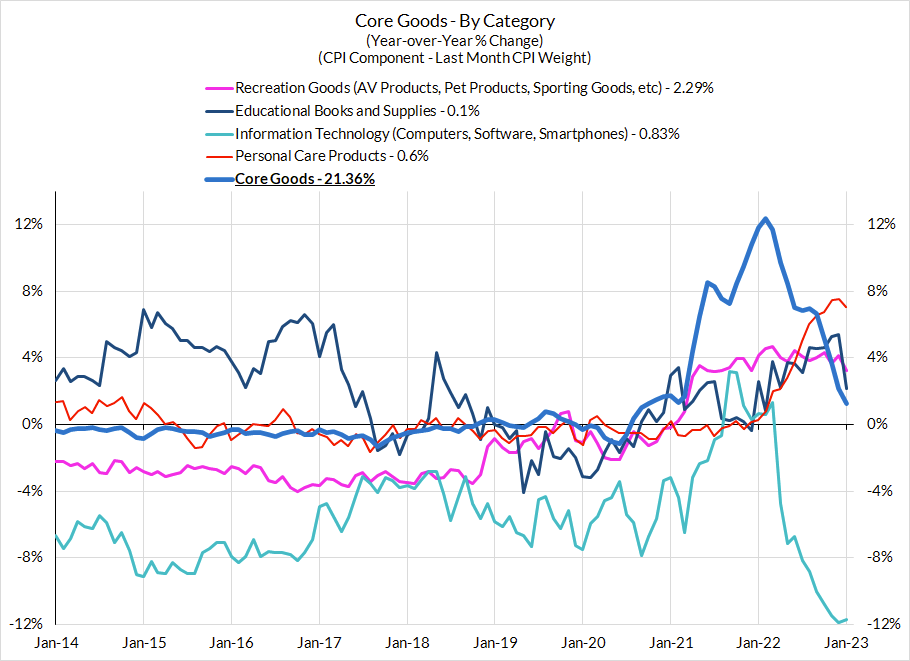

- More Ex-Auto Goods Deflation: There are sticky/lagging/calendar-year price effects in goods, but we do still see signs of underlying improvement in supply chains and producer prices. The most salient categories to watch are housing equipment & apparel.

- Goods-Adjacent Services Sees Disinflation Sooner: The price of food and even energy could be a helpful force for 2023 service price inflation. Specifically on airfares and food services. Motor vehicle services (rental, leasing, repair, insurance) are still playing catch-up to elevated automobile values; it's possible much of this has already happened but the outlook here seems concerning in the short-run. We still don't expect the handoff from goods to good-sensitive service prices to be imminent but if it were to transpire, it would definitely accelerate the path back to 2%.

- Peak Monthly Rent CPI Inflation: We're still not confident that rent CPI readings will trend down so linearly from here, even as we see all the signs of longer term deceleration (slower job growth, slower wage growth, slower household formation, improved supply, slower market rents). It would likely require 2-3 months of disinflation to know that we are past the peak.

Final note: The Fed Has A Communications Mess on Its Hands: Chair Powell and President Daly's most recent comments reveal a desire for optionality headed into the communications blackout period. It seems fair to say that they have a strong inclination not only to raise the terminal rate projection in the dot plot, but also accelerate Fed hikes if inflation comes in strong (otherwise, why even open this issue back up after it seemed closed?). The trouble is there is no direct communication between Fed officials and the public starting next week. We could get a core CPI that causes markets to overreact in one direction, even as food services CPI (included in core PCE but not core CPI) and critical PPI inputs to PCE tell a very different story. This is going to remain a mess.

CPI Charts

Non-Core CPI Components

Core CPI Components

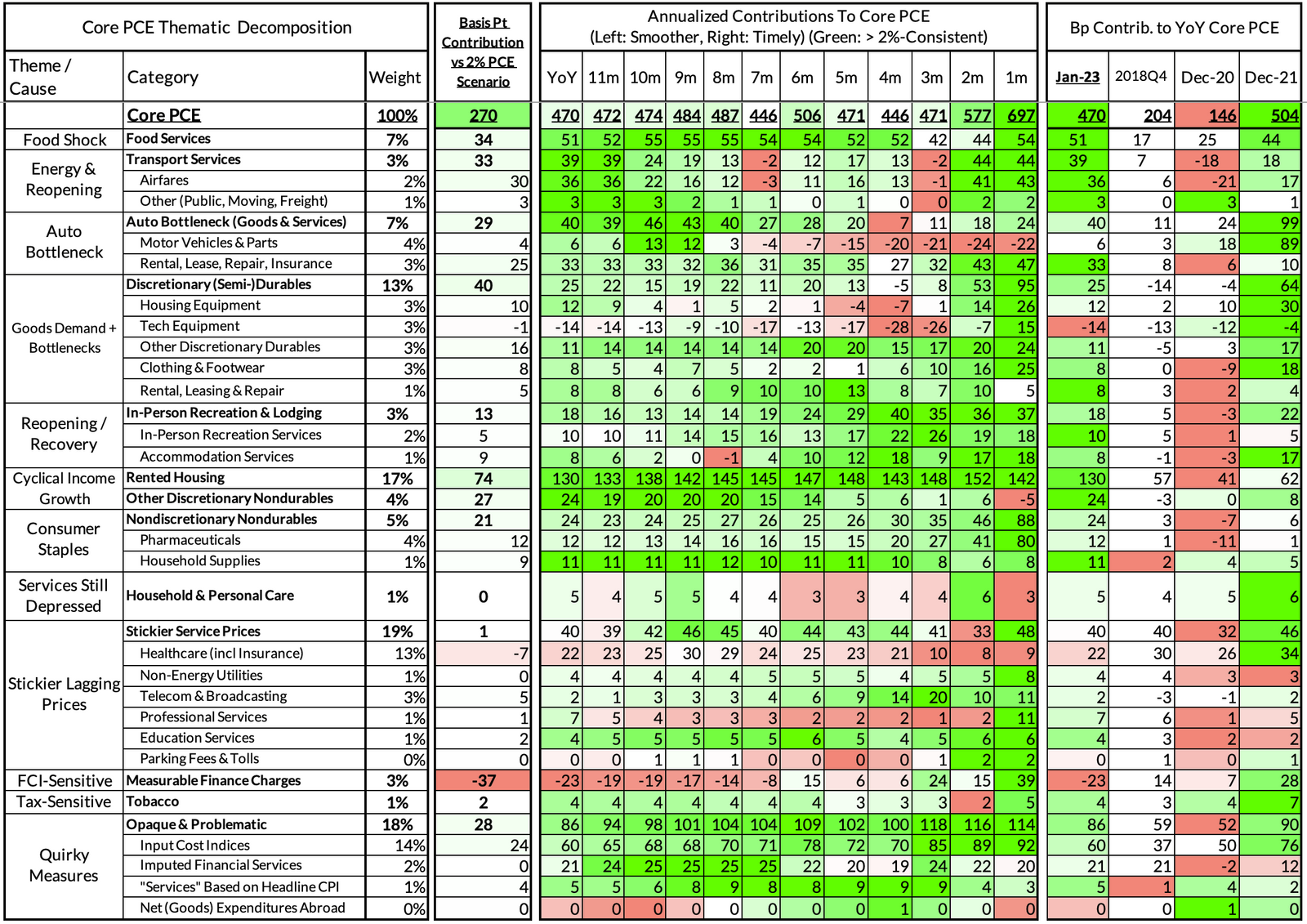

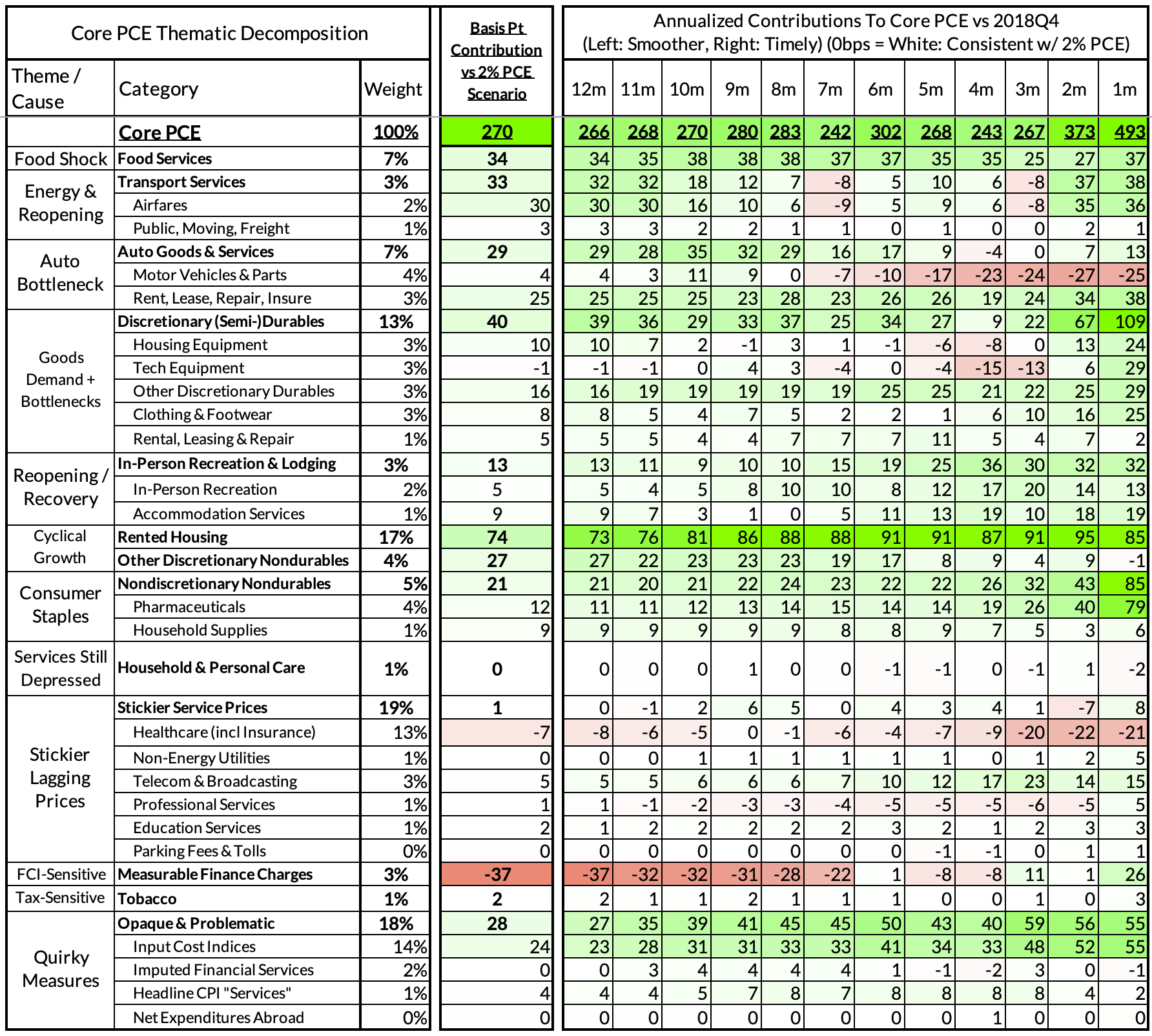

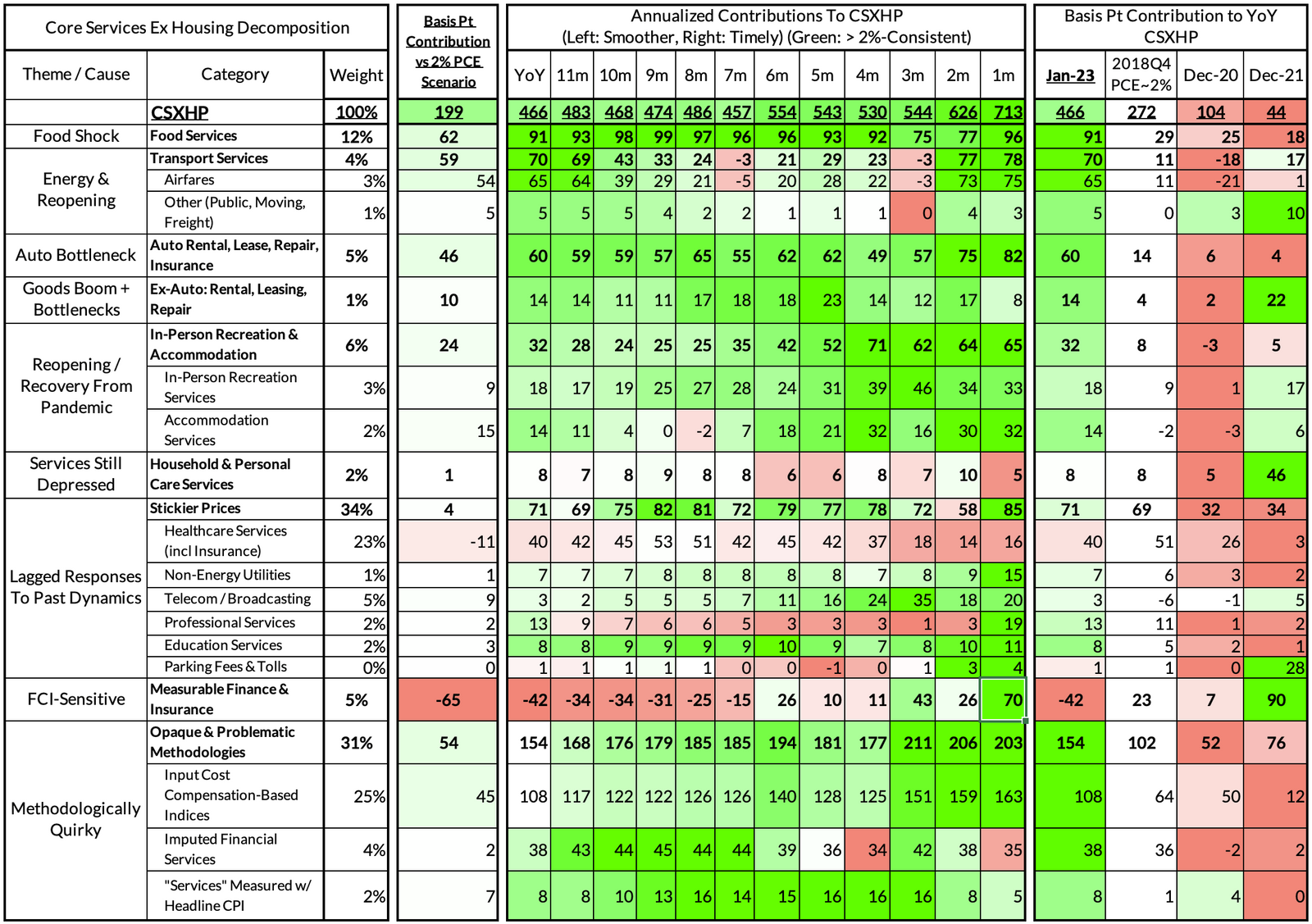

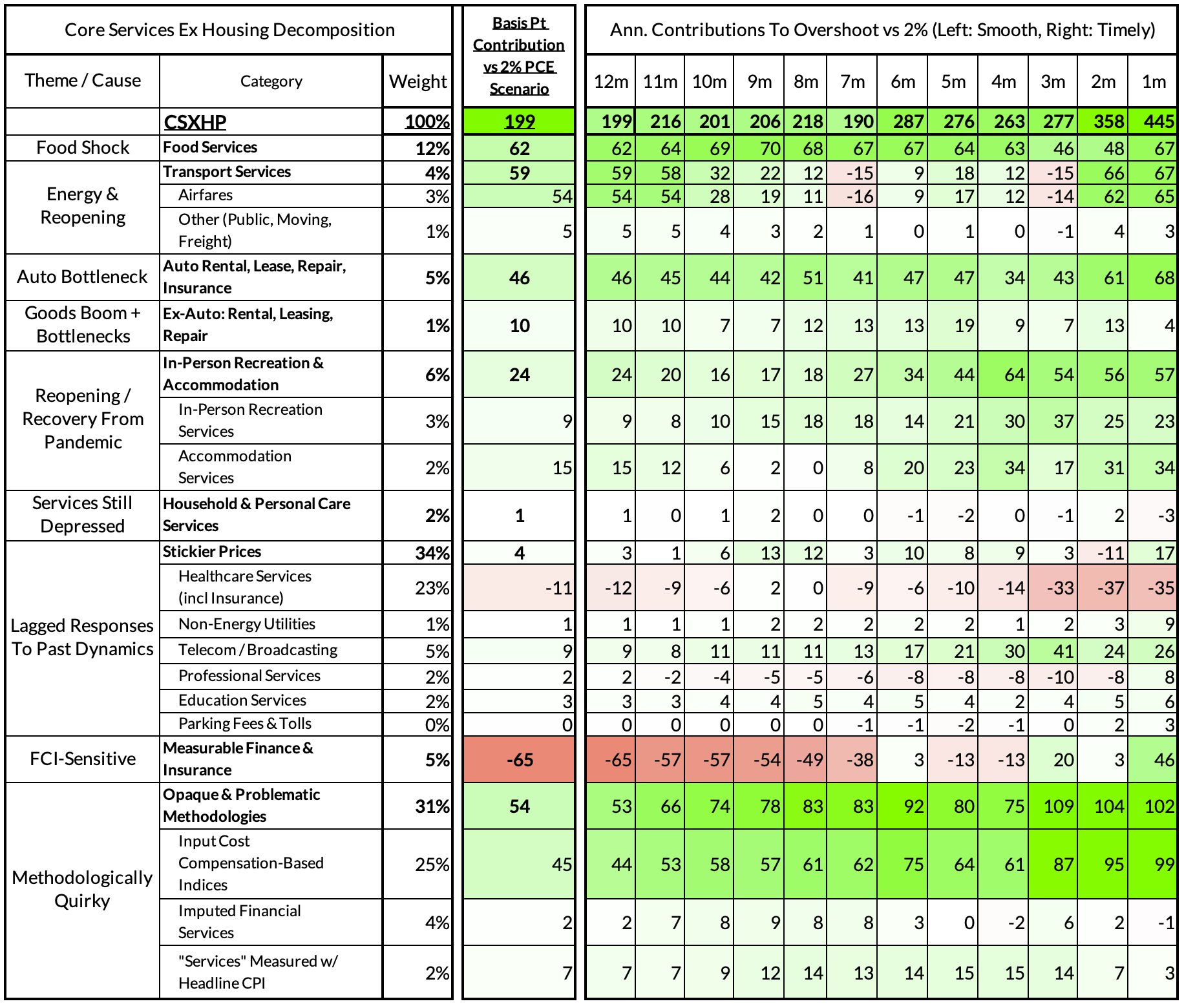

PCE Heatmaps

Past Inflation Previews and Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks