By Skanda Amarnath, Alex Williams, and Arnab Datta

Executive Summary

This piece provides an overview of how the Federal Reserve (“Fed”) decided to require all emergency lending authorized under Section 13(3) of the Federal Reserve Act be conducted at a “penalty rate,” as well as its policy ramifications.

In December 2013, when the Fed sought comment on its notice of proposed rulemaking for 13(3) lending procedures (“Regulation A”) there was no mention of including a penalty rate requirement as part of these procedures. Only in November 2015, when the Fed announced its final rule, was the public informed that there would be such a requirement, and without any opportunity for the public to provide comment. Lending procedures are specifically exempt from the Administrative Procedure Act (APA), but the flawed process by which the Fed adopted this requirement has now proved to be a sticking point in how the Fed designs its crisis facilities. The requirement itself is not essential to the Fed’s lending procedures, and it is within the Fed’s power to rescind.

If the penalty rate requirement no longer existed, the Fed would have greater flexibility in how it priced its lending facilities and could thereby extend and exercise its lending powers to a broader set of institutions. As it currently stands, the Fed’s facilities are only likely to see meaningful take-up if a financial market panic pushes asset prices down to the Fed’s penalty-priced levels. Given the language and intent of the CARES Act, it is questionable whether the Fed should really be taking such a tight-fisted approach to lending. The Fed’s facilities could function not merely as portfolio insurance but also as a direct source of financial capital for those firms and municipalities that lack direct access to the most liquid capital markets.

Introduction

The Fed’s authority to lend, as specified in the CARES Act, is a direct application of the Fed’s general emergency lending authority under Section 13(3) of the Federal Reserve Act.

(B) FEDERAL RESERVE ACT TAXPAYER PROTECTIONS AND OTHER REQUIREMENTS APPLY. — For the avoidance of doubt, any applicable requirements under section 13(3) of the Federal Reserve Act (12 U.S.C. 343(3)), including requirements relating to loan collateralization, taxpayer protection, and borrower solvency, shall apply with respect to any program or facility described in subsection (b)(4). [The $454 billion allocated to the Federal Reserve “for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities”]

Section 13(3) of the Federal Reserve Act was the controversial source of authority that the Fed relied upon during the Bear Stearns and AIG bailouts. As a result, the statute was revised and constrained with the passage of the 2010 Dodd-Frank Act.

The Dodd-Frank Act still left it up to the Fed and the Secretary of the Treasury to specify the full set of procedures it would adhere to when engaging in emergency lending under 13(3) authority, as long as the procedures aligned with the constraints and principles specified in the statute.

The requirement of a penalty interest rate ties the Fed’s hands unnecessarily, prevents them from acting in accordance with the purpose of the CARES Act, and raises questions about the Fed’s compliance with the statutory requirement to make all 13(3) programs “broad-based” in eligibility and purpose.

The Origins of the Penalty Rate

Nearly every theory of how a central bank should operate includes its responsibilities as a lender of last resort in financial markets. When there is sufficient uncertainty or volatility to produce a liquidity trap or a credit crunch, it is the job of the central bank to provide emergency liquidity to market participants.

These theories often build off the work of Walter Bagehot, a nineteenth century journalist who wrote an influential book on London’s money markets, Lombard Street: A Description Of The Money Market. He argued that in a crisis central banks should “lend freely, at a penalty rate, against good collateral” in order to prevent a generalized debt deflation which worsens the initial financial crisis.

The trouble comes from the middle clause, “at a penalty rate.” Bagehot’s justification for the penalty rate had two steps. The first was that penalty rates were necessary to disoblige participants from taking unnecessary loans on a precautionary basis. The second was the worry that the central bank itself could run out of reserves. If the central bank has a fixed level of reserves, and enough participants take out precautionary loans, the central bank may run out of bullion before markets can make it out of the liquidity trap.

Many modern interpreters have kept only the first step of Bagehot’s argument, knowing that central banks are no longer constrained in their ability to produce reserves. This has led to a pathological interpretation, where Bagehot is believed to advocate for penalty rates on a moral hazard basis. Penalty rates are considered necessary to punish institutions that require emergency liquidity in the crisis. If institutions expect to be punished for using the facilities, the theory goes, then they will have more incentive to set up their balance sheets in a way that is robust to downturns.

Just because Bagehot’s original argument was not grounded in moral hazard doesn’t mean that these points are never valid. It is hard to imagine that banks would apply the most stringent of risk controls with a standing bailout from the Fed in their back pockets. It is also easy to understand why everyday Americans would want to see emergency loans made to banks at a penalty rate: they face penalty rates on emergency loans from credit card companies and payday lenders. To be sure, there are times when penalty rates are both sound policy and good politics, but this need not always be the case.

The Penalty Rate Requirement as a Rule

On December 23, 2013, the Fed announced its proposed rule for 13(3) lending procedures, which was officially published in the Federal Register on January 6, 2014. The proposal emphasized the need for all 13(3) lending facilities to have broad-based eligibility, not be used for the purpose of helping individual institutions, not extended towards insolvent firms, and in a manner that was sufficiently collateralized to protect the taxpayer. There was no mention of a penalty rate requirement in this proposed rule.

The Fed received comments from the public until March 7, 2014. Some commenters specifically requested that the Fed include a penalty rate requirement, but the public at large did not know of its presence until November 30, 2015, when the Fed announced its final rule. The Fed’s amended regulation became effective on January 1, 2016.

12 CFR §201.4(d)(7)(ii) The interest rate established for credit extended through a program or facility established under this section will be set at a penalty level that:

(A) Is a premium to the market rate in normal circumstances;

(B) Affords liquidity in unusual and exigent circumstances; and

(C ) Encourages repayment of the credit and discourages use of the program or facility as the unusual and exigent circumstances that motivated the program or facility recede and economic conditions normalize.

12 CFR §201.4(d)(7)(iii) In determining the rate, the Board will consider the condition of affected markets and the financial system generally, the historical rate of interest for loans of comparable terms and maturity during normal times, the purpose of the program or facility, the risk of repayment, the collateral supporting the credit, the duration, terms and amount of the credit, and any other factor that the Board determines to be relevant to ensuring that the taxpayer is appropriately compensated for the risks associated with the credit extended under the program or facility and the purposes of this paragraph (d) are fulfilled.

The penalty rate requirement should not be confused with some of the other requirements that are clearly specified within the statutory text itself. The text already specifies the need for collateral “sufficient to protect taxpayers from losses” and for all forms of lending programs and facilities to come with “broad-based eligibility. Those statutory specifications were already addressed in separate sections of the notice published in the Federal Register for the initially proposed rule and remained in place in the final rule. The penalty rate requirement introduced in the final rule was specified in a separate section.

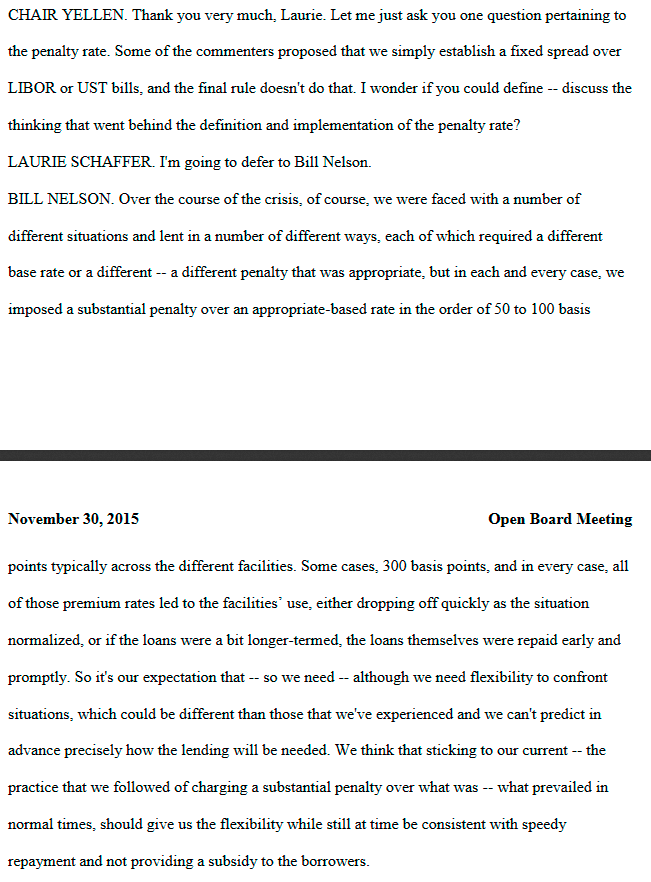

When the Fed provided a press release associated with its announcement, it claimed that the new rule was merely an extrapolation from the Fed’s existing practice of applying penalty rates to 13(3) lending. This claim was present in the Federal Reserve Board’s press release, open meeting, and memo associated with its final rule.

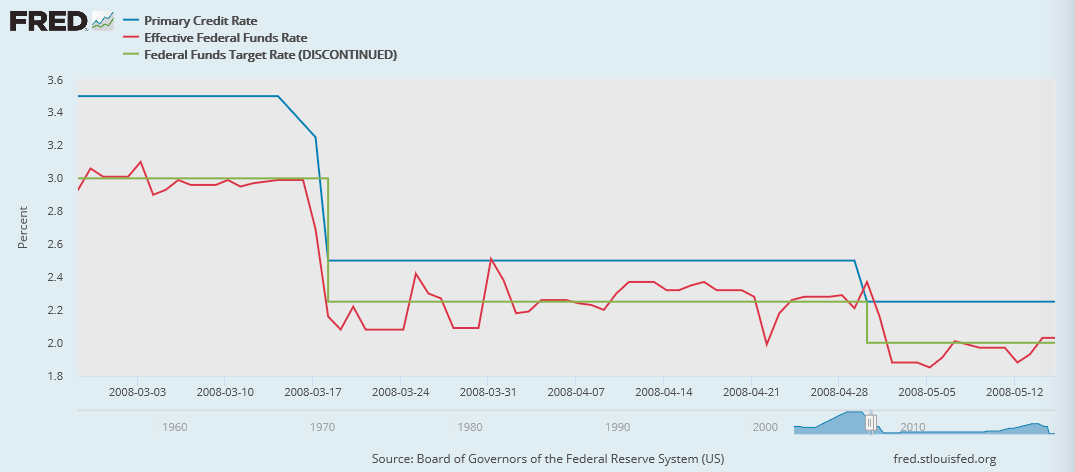

While one can cherry-pick examples from the global financial crisis to prop up such a claim, it becomes impossible when considering the full body of 13(3) actions. The Fed’s non-recourse loan to the LLC that facilitated JP Morgan’s acquisition of Bear Stearns (the “Bear Stearns Bailout”) was a 10-year $29 billion loan indexed to the primary credit rate. At the time of the bailout, the Fed set the primary credit rate (the “discount rate”) no more than 25 basis points from the effective rate of the Fed’s overnight benchmark and on a couple of days around this period, the effective federal funds rate was equivalent to the discount rate.

Clearly, there did not exist an ironclad commitment to the use of penalty rates prior to the adoption of the rule in 2016. The Fed used substantial discretion in deciding the terms of 13(3) loans in the 2008 crisis. While the Dodd-Frank Act is commendable for limiting some of this discretion in the Fed’s dealing with the financial sector, emergency lending to non-financial entities — which are the locus points for production and employment — may require a more flexible approach.

The Municipal Liquidity Facility and Penalty Rates

Even if penalty rates are warranted for some loans to financial institutions, it is hard to understand why they would be desirable for municipalities and other entities covered by the CARES Act.

In March 2020, interest rates on municipal bonds shot up, but credit was still available at those higher rates. This is a different situation from the classic “lender of last resort” scenario in Bagehot, where credit is unavailable at any price. As such, penalty rates simply mimic the action in the rest of the municipal bond market.

Extending lender of last resort protections to banks is meant to prevent a debt deflation – a situation where market participants rush to sell assets and in so doing drive down their price. This decline in price will then force otherwise-solvent banks into insolvency, due to a temporary hiccup in liquidity conditions. Banks in a liquidity crisis are looking for financing to meet liquidity needs to avoid selling assets. Their liabilities are still funded by these assets.

The situation is very different for municipalities. Their core risk in a crisis is not insolvency due to declining asset values, but rather that they will not be able to issue bonds to fund expenditures. If a Fed backstop is provided at penalty rates well above normal market rates, municipalities will have little incentive to use the facility. This implicitly increases the likelihood that they will simply postpone capital expenditures or cut staff immediately, rather than utilize funding facilities that force them to do this at a later date. The testimony of Marion Gee during Thursday’s hearings on the MLF confirms this point.

Municipal bonds are also not subject to moral hazard problems in the same way banks may be, and so should not be subject to the penalty rate requirement. Banks may count on the availability of emergency liquidity, and so structure portfolios that take into account its provision through the Fed. Penalty rates for banks can be a good way to prevent this. However, it seems dubious to claim that municipalities will generally choose to issue more debt than they can handle just because the exigencies of a global pandemic might afford them an opportunity to refinance that debt at more attractive rates.

Lastly, the Fed’s “maximum employment” mandate in Section 2A of the Federal Reserve Act should entail that they use the tools available to them to prevent the unnecessary layoffs of government employees. Failing to provide support for municipalities in the form of non-penalty rates increases the risk of local government job loss while also contributing to an investment slowdown.

The Penalty Rate Requirement and COVID-19

The decision to require a penalty rate in loans provided by 13(3) facilities has interfered with the Fed’s response to COVID and the penalty rate rule should be removed from Regulation A.

The implementation of the penalty rate requirement is directly at odds with the goals of the CARES act to lend in a widespread and affordable manner. The use of penalty interest rates when lending to municipalities means that the Municipal Liquidity Facility will not be a good source of funding under most circumstances. This will raise the required rate of return on projects and bond issues that have already been voted on. Additionally, municipalities are very skeptical of taking on excess debt in the first place. The ideology that there is no bailout coming is very deep. To municipalities, the fact that funding is provided at a penalty rate is arguably more salient than the fact that financing is being provided during a liquidity crunch.

The refusal to lend broadly and affordably also conflicts with the Fed’s obligation under 13(3) to make all programs broad-based in eligibility. Only two entities took up the MLF at penalty rate, both of them for reasons unrelated to COVID. The MTA accessed the MLF because the inclusion of a new bond rating agency in the rate formula at the Fed gave them better-than expected prices, while Illinois took an MLF loan because of a quirk in its legislative calendar.

As it stands, the Fed has substantial space within its penalty rate requirement to make the terms of loans through the MLF more attractive, and thereby create the possibility of broad-based eligibility. So far, the Fed has used its discretion within the penalty rate requirement to offer loans on terms so unattractive that they have only been utilized in edge cases unrelated to the original goals of the facility.

The Fed may argue that its hands are tied by the rule requiring a penalty rate, despite not using the full discretion they already have to provide attractive terms. However, we have shown in the section on legislative process above that the penalty rate rule is self-imposed based on the Fed’s implementation of the Dodd-Frank Act. That the requirement is self-imposed means the Fed can choose to unilaterally rescind the rule and use their own discretion when setting the pricing for the MLF.

Conclusion

If the Fed were forced to strike its penalty rate requirement, it could open the door to a more expansive approach to lending, which seems appropriate given that there are fewer moral hazard dynamics in this recession and asset prices in the most liquid markets have significantly diverged from broader economic performance thus far. The Fed’s Municipal Liquidity Facility (MLF) and Primary Corporate Credit Facility (PMCCF) are most obviously straitjacketed by the penalty rate approach. Even the Main Street Lending Program could be better tailored to ensure that more medium size businesses were able to access affordable sources of financial capital and successfully ride out this pandemic.

The penalty rate approach to emergency lending limits the Fed to being no more than a portfolio insurer. Certain emergencies, including the current one, may warrant more active participation in the lending process, such that the flow of credit is not merely extended to those blessed with easy access to liquid capital markets. To that end, the absence of a penalty rate requirement associated with all 13(3) lending would be a welcome development.