By Skanda Amarnath

Friday's Jobs Report for November shows rapid progress in the quest to return to the pre-pandemic labor market. The prime-age 25-54 employment rate gained 0.5% in November alone and now stands just 1.5% below its 2019Q4 level and 1.7% below its peak monthly level. In the next two jobs reports, the momentum we see today together with upcoming seasonal factor revisions will likely narrow the remaining employment gap even further. This adds up to an impressive bottom line: the prime-age 25-54 employment rate may see a full recovery as early as 2022Q2!

Since the FOMC statement in September 2020, the Fed has staked its credibility on ensuring that "labor market conditions have reached levels consistent with the Committee's assessments of maximum employment" before proceeding with interest rate increases. At the time, Employ America applauded the commitment to a rapid recovery embedded in its September 2020 forward guidance ("The Fed’s Forward Guidance: Prioritizing Labor Markets to Ensure a Robust Recovery For All") after calling for very similar guidance earlier that July ("The Fed Still Needs To Do Its Part — Six Ways To Improve The Evans Rule To Recover Jobs And Wages").

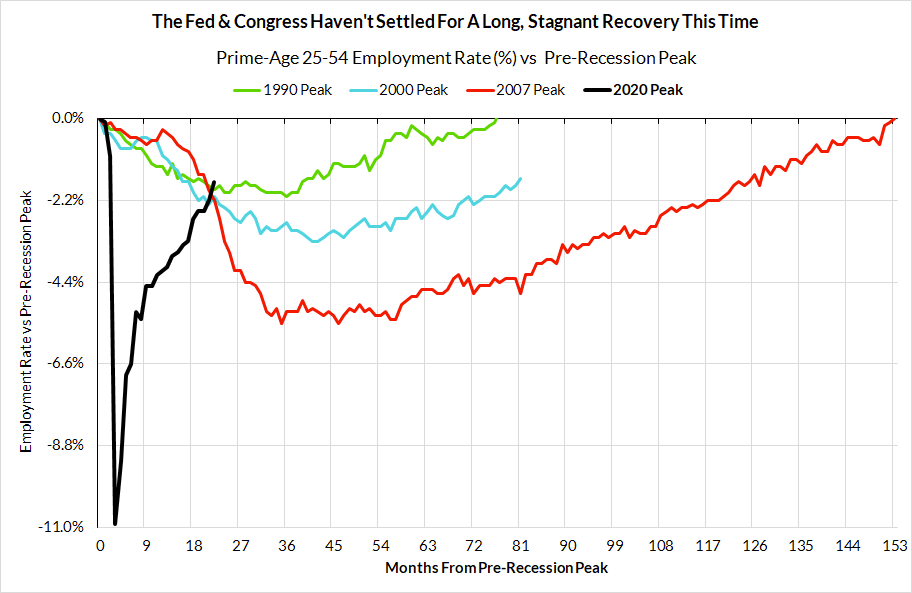

Some commentators have claimed that the Fed's preconditioning of interest rate increases on the achievement of "maximum employment" has been a mistake and, by implication, that lower demand support, a slower recovery and a longer period of depressed employment rates would have been preferable. To American workers, that view might seem jarring. However, it is remarkably consistent with the consensus policymaking view during the previous three recoveries from recessions: a high tolerance for labor market stagnation and a low tolerance for any inflation risk that might stem from a rapid recovery in employment and output.

In those previous recoveries, the prime-age employment rate was still declining 22 months after the previous pre-recession peaks.

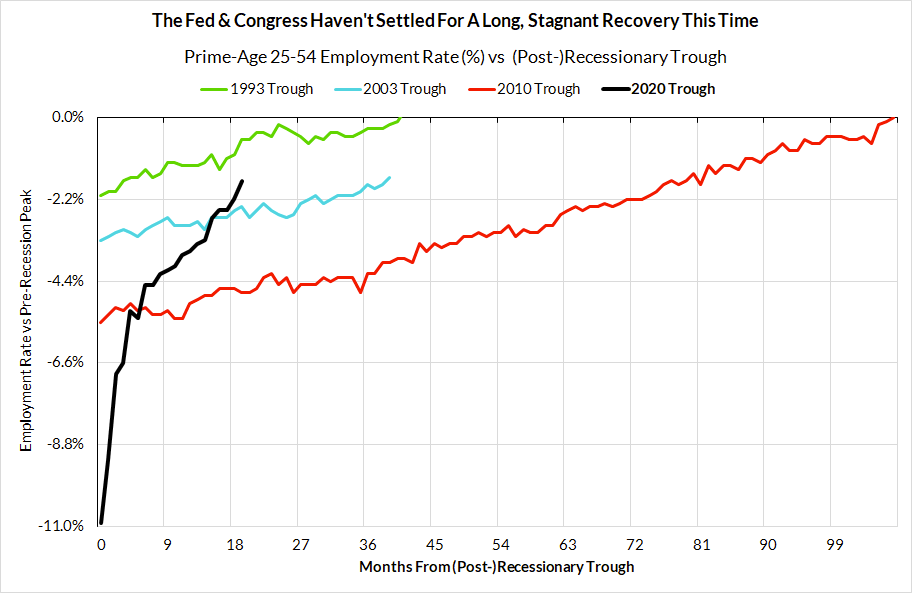

If comparing performance to the pre-recession peak seems unfair, it's worth noting that we see a similar story even if we evaluate the recovery from the trough of the prime-age employment rate. The three previous troughs occurred after the recession officially ended. This recovery is likely to be much faster than the previous three despite starting from a much deeper trough and the additional impediments that the pandemic imposed.

To understand the pandemic recovery, we have to put it into its proper perspective. Current fiscal and monetary policymakers have clearly outdone their predecessors and have shattered past excuses for why Americans should settle for a shallow and sluggish employment recovery. The Fed's commitment to avoiding interest rate policy tightening until maximum employment is achieved has played a pivotal role in creating financial conditions sufficiently supportive to achieve this goal.

In February 2021, Chair Powell noted that maximum employment is "a broad and inclusive goal" that spans more than just the one-dimensional and highly flawed unemployment rate. We agree and hope the Fed will choose multiple indicators to evaluate maximum employment that are robust to the measurement flaws that attend the unemployment rate.

Any committee assessment of maximum employment must include labor utilization measures that are robust to the excessively exclusive definitions of labor force participation in the Current Population Survey.

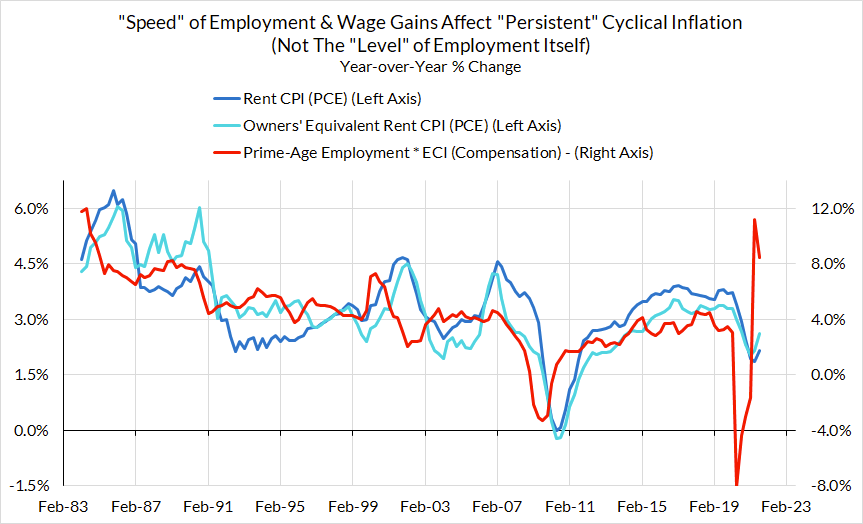

Any committee assessment of maximum employment must include measures of wage growth, and not just labor utilization ("To call something hot, you need to see some heat").

Ideally, the Fed would go beyond these two principles and lay out measures that better identify sources of cyclical inequity and marginalization. However, these two principles should be an unobjectionable starting point for thinking about a broad and inclusive measure of "maximum employment."

Right now we are seeing locally strong wage growth of a kind that we simply did not witness in the previous business cycle expansion, but potentially reaching the pre-pandemic peak in prime-age employment rates will take a few more months. If the Fed wants to stay true to the "maximum employment" component of its forward guidance, and the "broad and inclusive" nature of that goal, it is imperative that their interest rate policy actions reflect a full recovery on both of these measures.

It is equally important for the Fed to express a clear view that their assessments of "maximum employment" today need not serve as a fixed ceiling that cannot evolve over time. Other commentators have understandably staked out an ambitious view of where the levels that characterize "maximum employment" could be over the longer run. We ultimately share this view, insofar as we agree that the level of "maximum employment" consistent with "stable prices" can improve over time.

In the process of pursuing a historically rapid recovery in labor utilization, the economy is seeing evidence of a faster cyclical inflation recovery. As that historic pace subsides over the course of 2022, the inflationary pressure should subside as well. Although price inflation is currently very strong, it is likely that there still exists a pace of positive labor utilization gains consistent with the Fed's longer run inflation goals. The precise pace will, of course, be a function of the kinds of inflationary pressures the economy is experiencing over the course of 2022 and beyond.

But before the Fed seeks to slow the pace of the expansion through possible interest rate increases, the Fed's mandate and its credibility still require that it--at a bare minimum–support a full return to the pre-pandemic labor market, both in terms of wage growth and age-adjusted employment rates.