This is the first in a recurring series on what the underlying detail tables can tell us about the path of investment across the broader macroeconomy. As industrial policy becomes a more important tool for engaging directly in the US domestic capital stock, keeping track of the impacts only becomes more important.

What Does Today’s GDP Release Tell Us About Where We Are In The Cycle

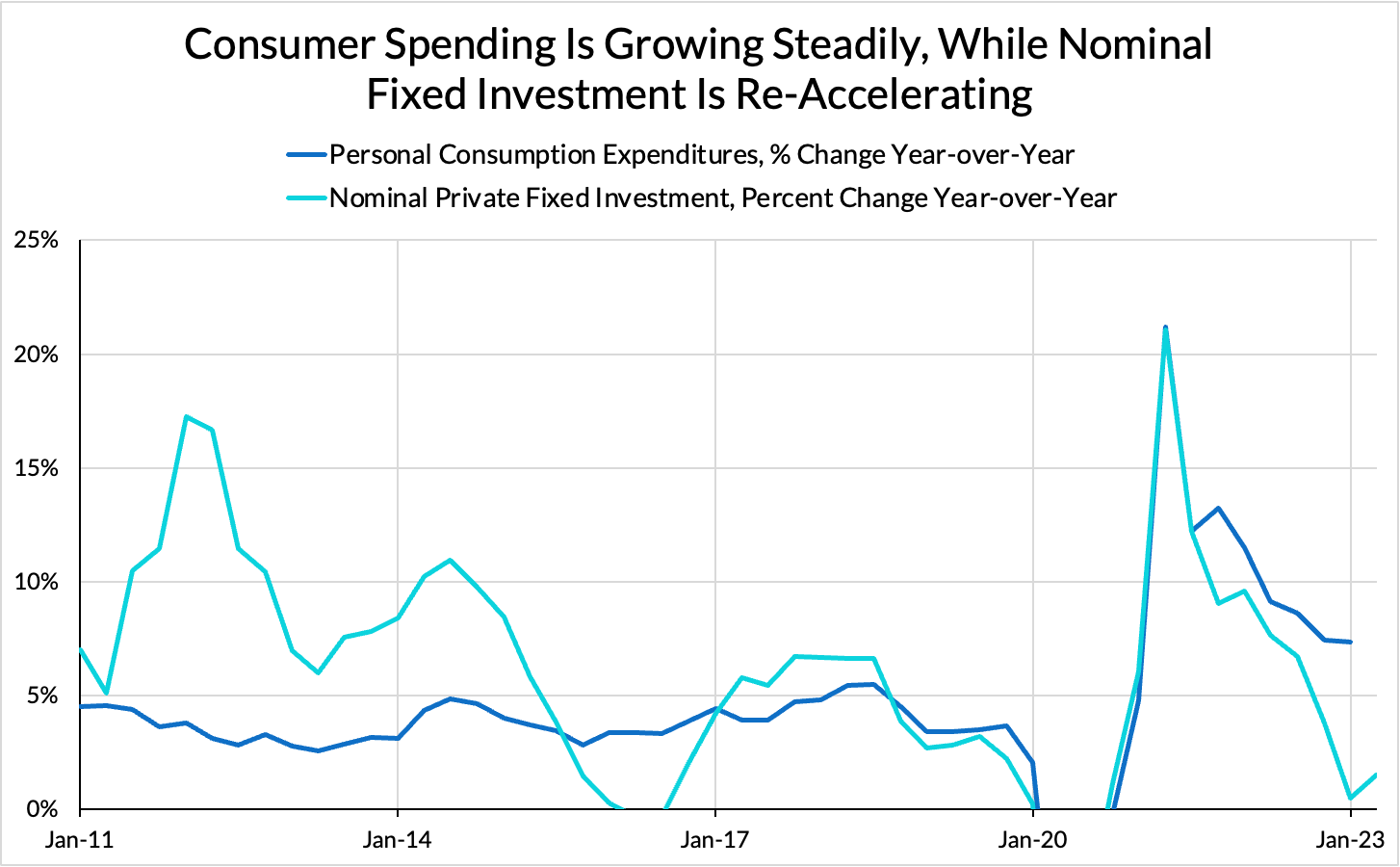

Nominal investment is rising. I’m not sure what kind of recession happens with not only rising labor income, but also rising investment, which leads me to think that there just may not be one in the near term.

If we remember our Keynes, rising investment is key to a strong economy. This is true not only because of the concrete benefits that higher capacity brings, but also because of the fact that the new spending on investment must cycle through the system until it all lands in someone’s savings account, multiplying its contributions to employment and incomes.

Rising investment also has obvious benefits in terms of economic capacity, and a boom in investment will help ensure that continued employment gains remain durable and productive. As I argued, a substantial proportion of inflation over the pandemic can be well-explained by the failure to manage the economy such that sufficient capacity was maintained over past business cycles.

Investment also continues to rise in this report even after adjusting for inflation.

This is key: a lot of PPIs have either stalled out or gone into outright deflation as supply chains have healed, and pandemic bullwhip effects have eased. This leads to a second point: we’re seeing rising aggregate investment on uncharacteristically weak and in places still-weakening PMIs! That’s not supposed to happen!

PMIs and sentiment data are intended to explain how business decision-makers are “feeling.” If they feel good about things, the economy tends to go better, and worse if they feel poorly. The thing is, there are a lot of different dynamics at play in the economy right now! I have a hunch that what PMIs have really captured over the past few months is the steady decline in backlogs as a consequence of the end of pandemic bullwhip dynamics. Since these are constructed as diffusion indices, we can only really know the median of those decision-makers’ “feelings,” and the post-pandemic inventory cycle has been strong.

At base, steady growth in consumer spending and steady growth in investment alongside rising government net expenditure is not the kind of data out of which recessions are made. In fact, a closer look at today’s investment data suggests we might be seeing the first shoots of a secular boom in certain industries combined with the early effects of the Biden administration’s turn towards industrial policy. Let’s dive in.

Secular Boom

Overall, it seems as though the bulk of pandemic-era Uncertainty has passed, and firms are responding to their supply chain needs in an environment of ample earnings, which would mean further investment. But why would this mean a secular boom?

Over the pandemic, the US successfully responded to a recession for the first time in a very, very long time — with overwhelming demand-side fiscal support, followed by steady supply-side fiscal support — and firms are beginning to wake up to this fact. I have been arguing that this result of the overwhelming fiscal firepower of CARES + ARP has been en route since shortly after ARP was passed.

Now that supply chains have begun to untangle, and firms have a clearer vision of the sectoral composition of the coming post-pandemic economy, there is less uncertainty holding back the desire to invest.

At the same time, consumption remains strong and firms have a clearer picture of the weak points in their supply chain than at any point in the recent past. Now that the bullwhip is ending, the next logical step is to start repairing things newly discovered to be broken, or at least easily breakable.

Industrial Policy

This is just beginning to show up in the aggregate data in earnest. This is great, and not just because it shows that the policy approach is really catalyzing new investment. It gives us a place to start the clock on the timeline for industrial policy. Now is the time when we should look to see what the “time-to-build” for industrial policy-driven capital investment is. The impact of CHIPS is easiest to see in the data.

Manufacturing Structures

The boom in investment in manufacturing structures has been literally unprecedented, and is now accelerating at the fastest rate in the history of the BEA’s Underlying Detail tables.

So the US is looking at a manufacturing boom, let’s dig in a little.

We can see above that computer/electric/etc is driving manufacturing structures to new highs. If we look at the data charted, we can see a first trend break at the point US companies began thinking more critically about the global supply chain with a view to reshoring (late 2021), and then a second from October 2022 onward, at which point ongoing investment projects became eligible for CHIPS programs. In the chart, we see how, from that point, investment lurches upwards.

Special Industry Equipment

This category includes the capital goods required to build semiconductors, so exactly the kind of thing investments that CHIPS is meant to catalyze. Beyond that, as as more of the new structures are built out, they will also require further investment in new equipment to fill the new factories with the requisite gear. Although some of the manufacturing structures spending above could very plausibly include IRA-related investment in the battery supply chain, we will likely be talking more about the impact of the IRA in future episodes of The Investment Picture.

Overall, the continued robustness of investment in the face of steadily-tightening interest rates suggests that we may be seeing a real supply-side response to the gaps in domestic physical capacity exposed during the pandemic. The urgent need to decarbonize and electrify, coupled with ample funding from the IRA, CHIPS and IIJA should provide a further runway for investment.