This preview was published for Premium Donors this past weekend. If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

Where We’re At

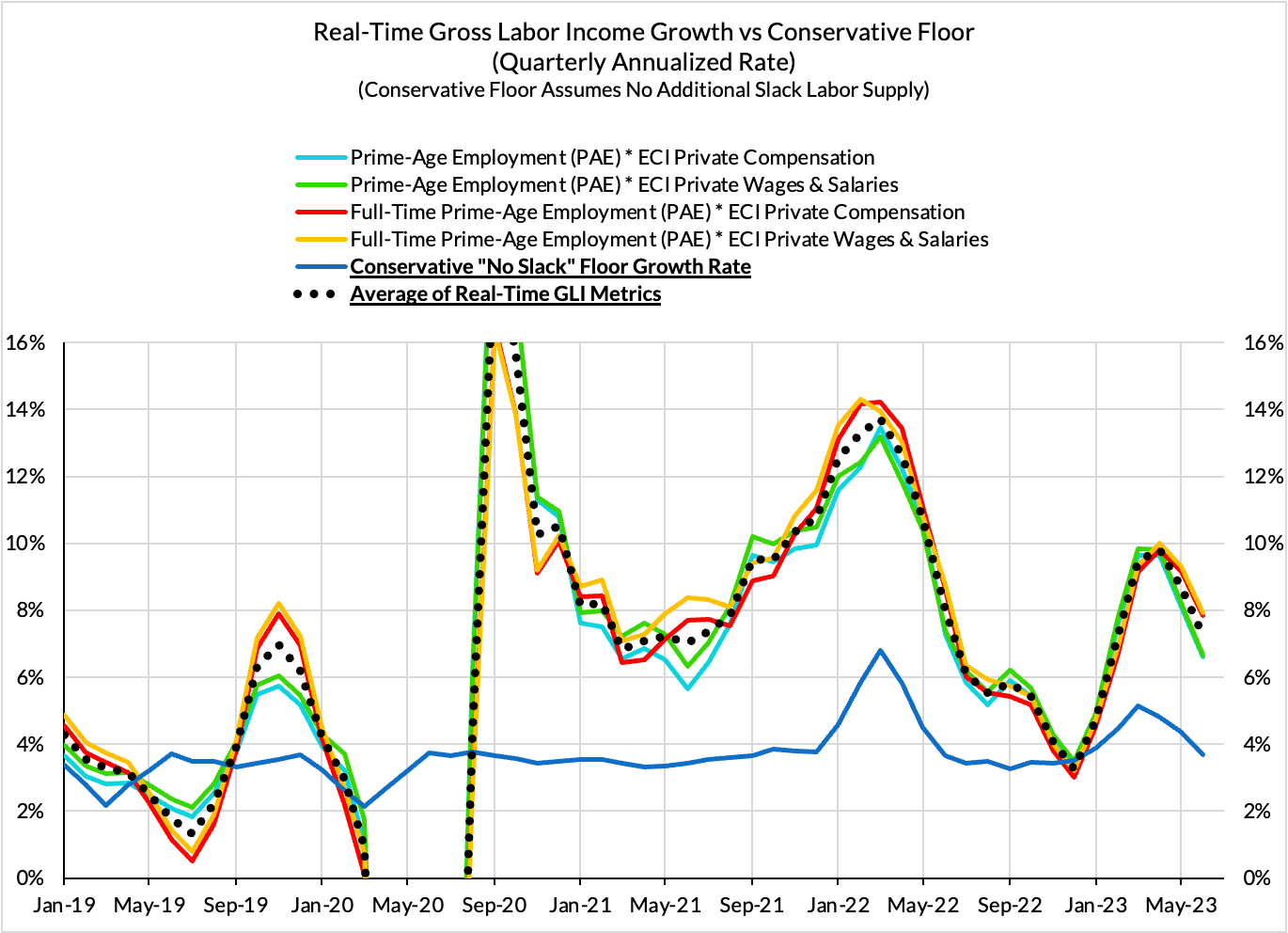

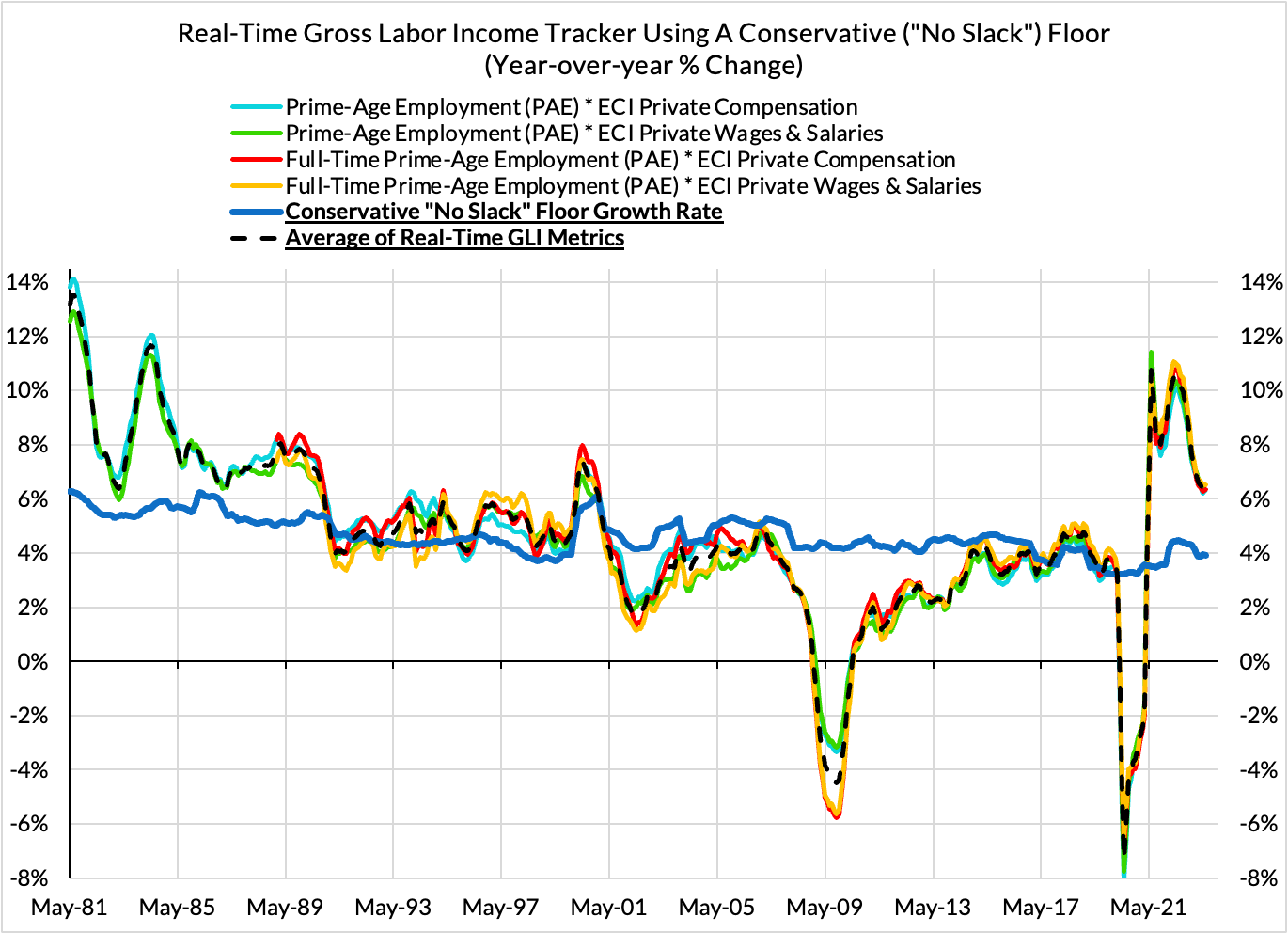

- Cautiously Optimistic About Supply: Nominal indicators can normalize even as real economic indicators show acceleration. That implies that current growth is not necessarily inflationary, and could even prove productivity enhancing.

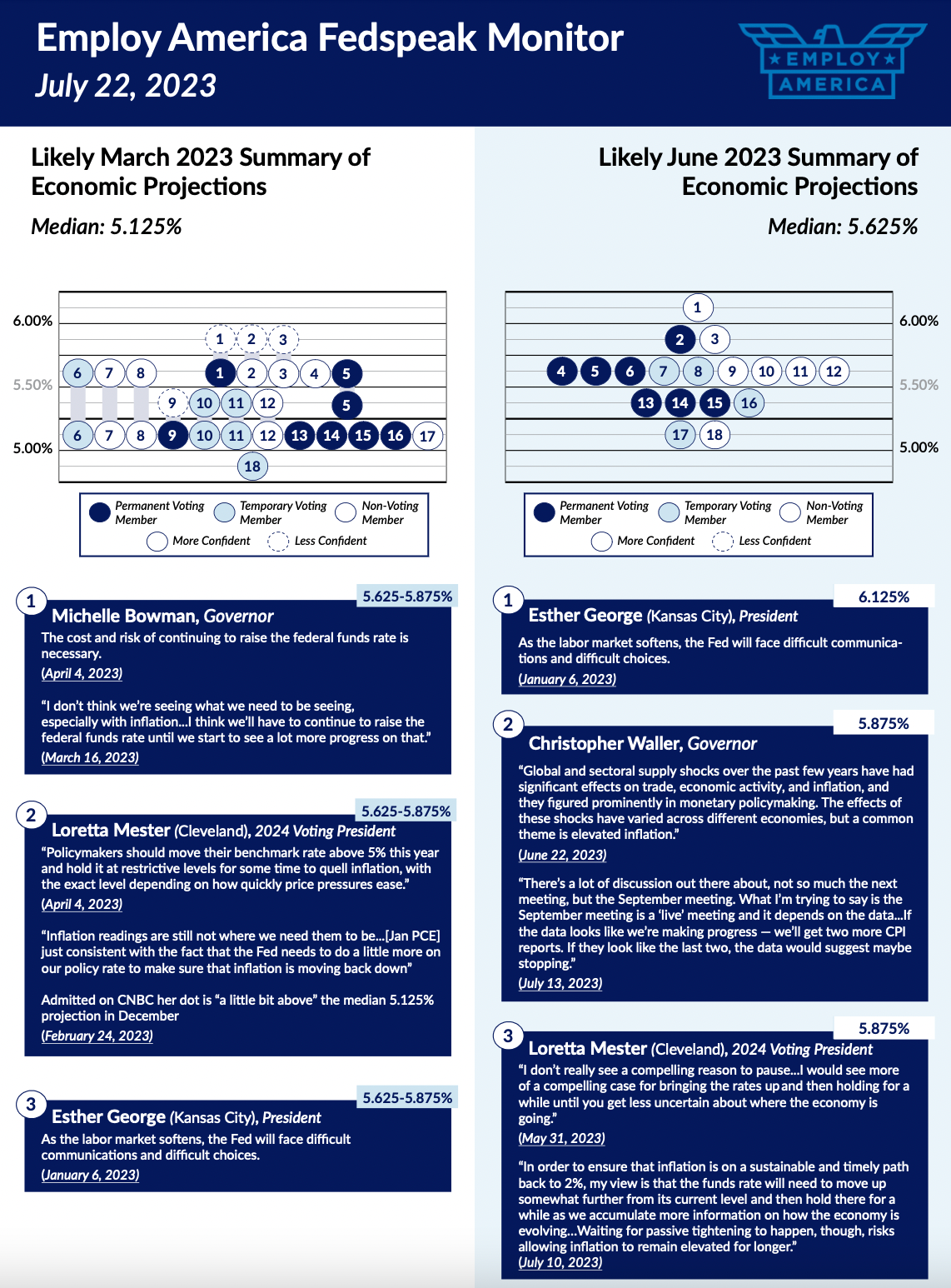

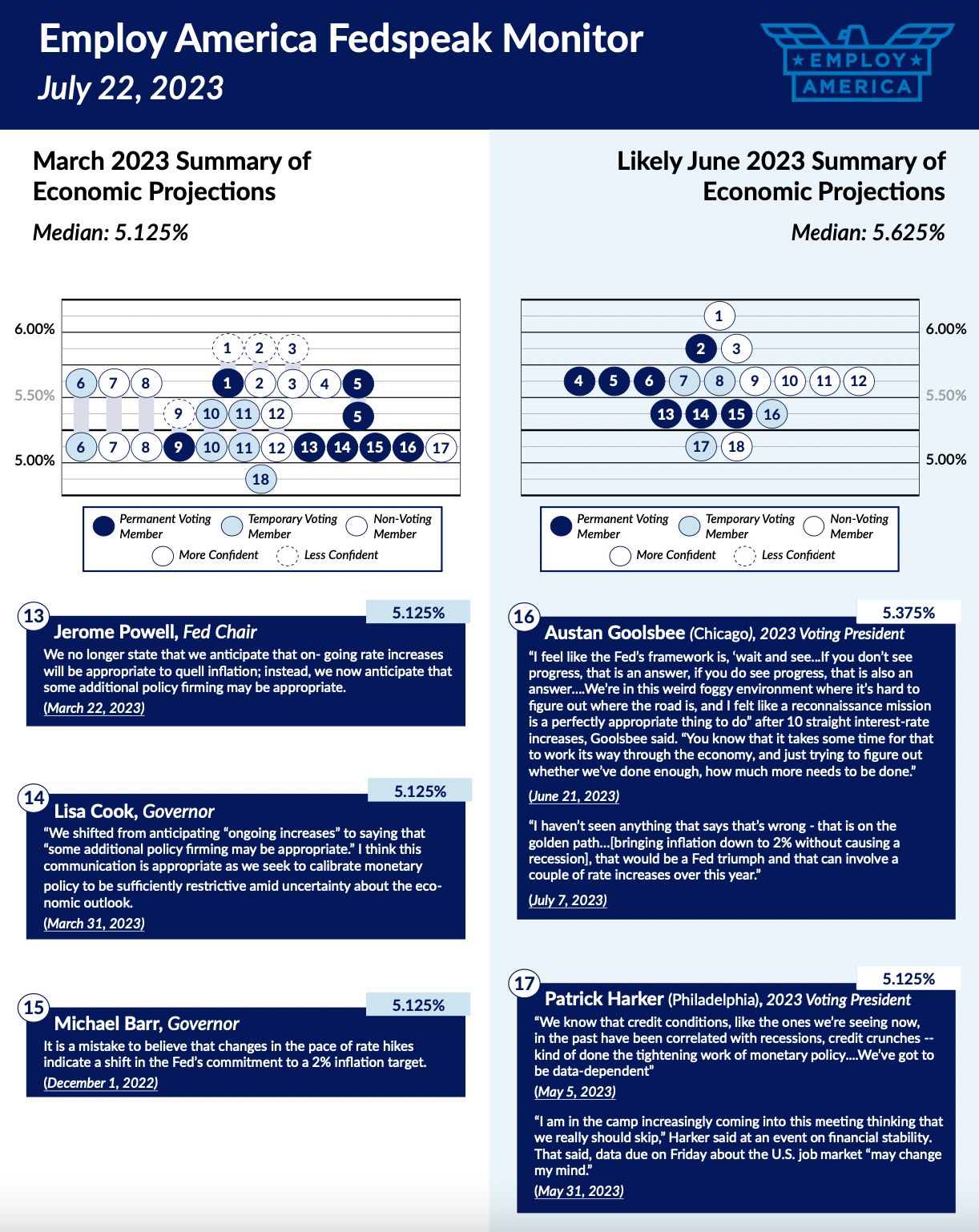

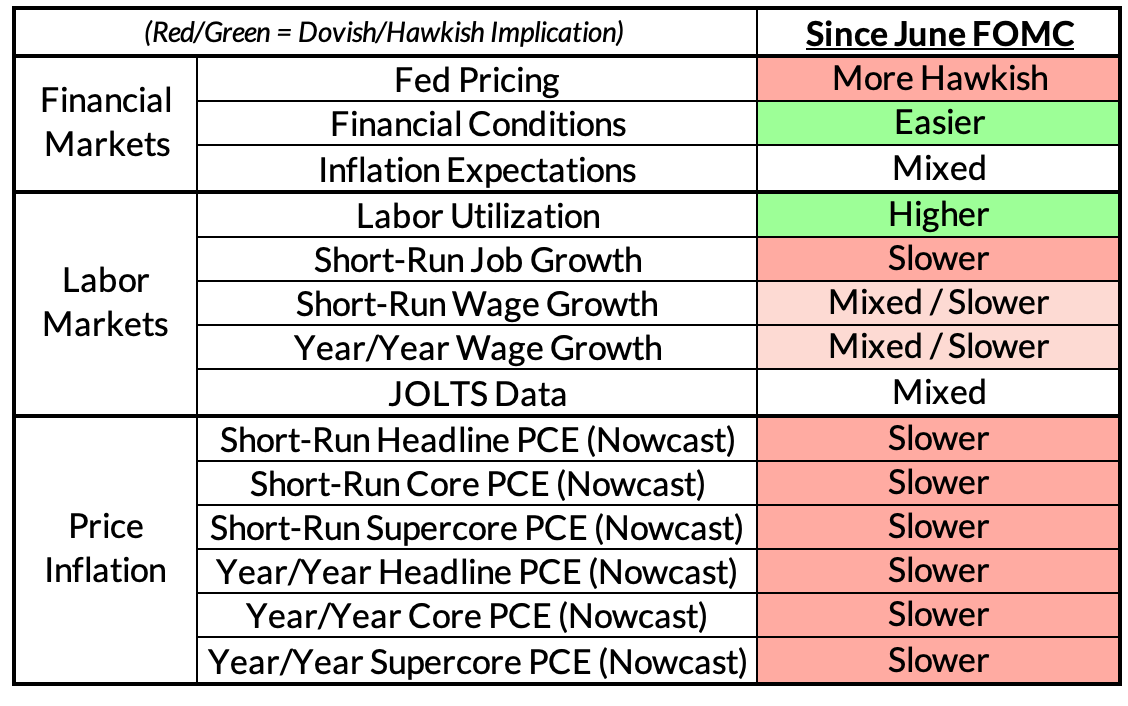

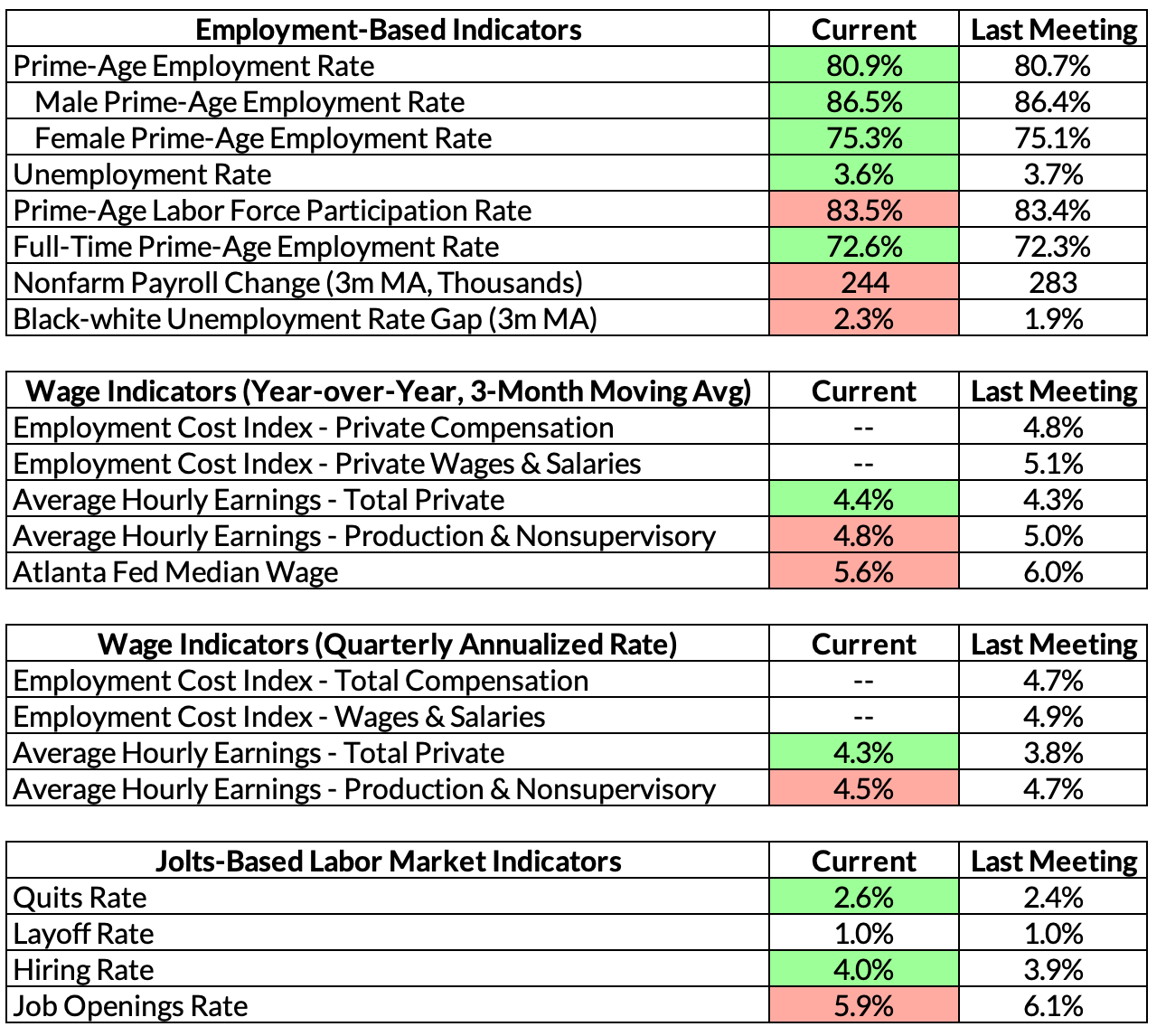

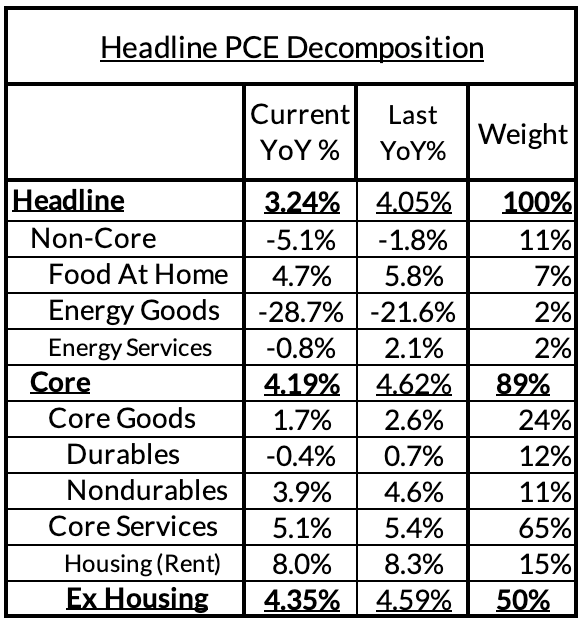

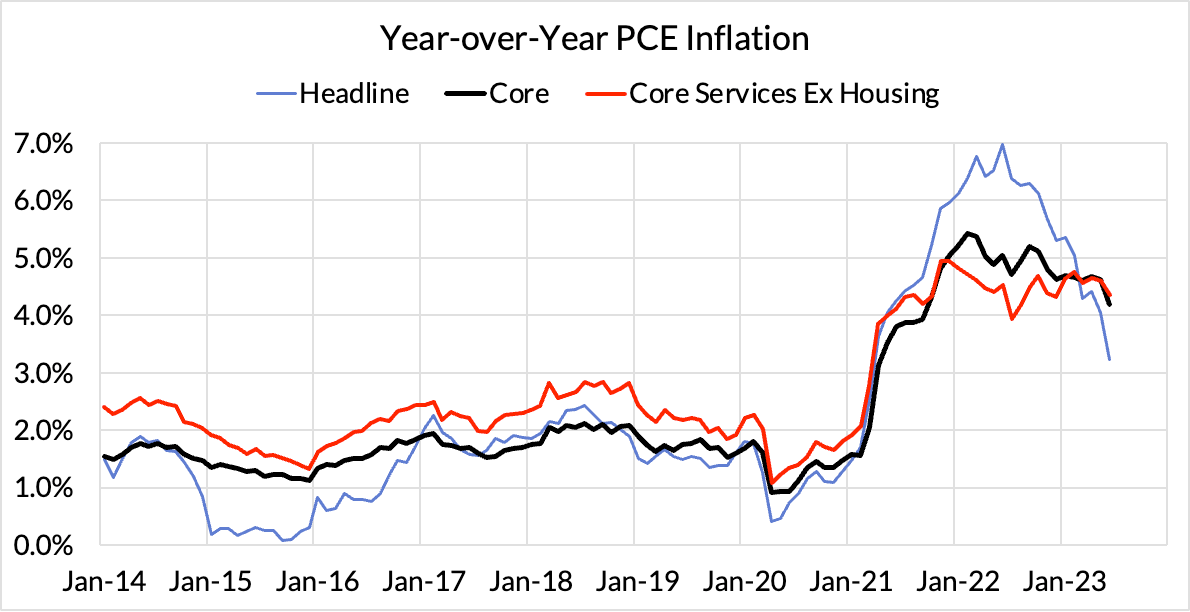

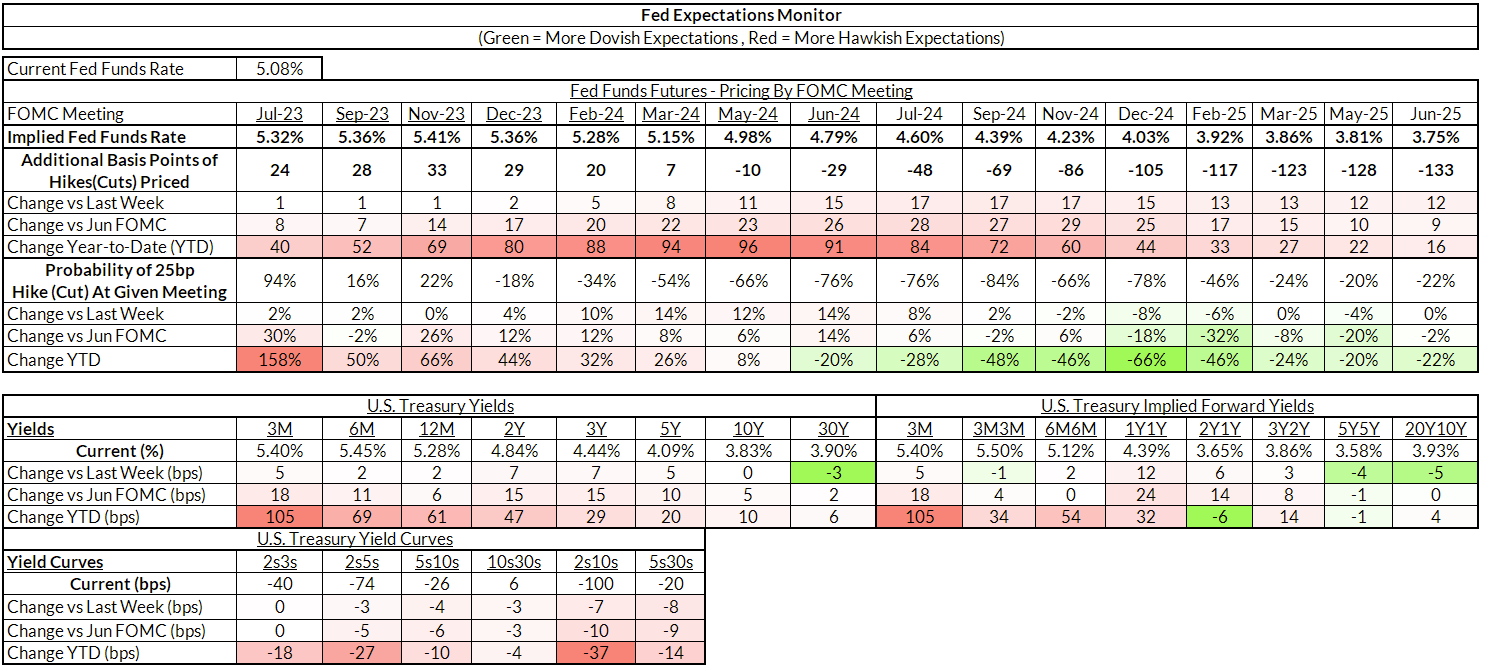

- Dogma is likely to beat data-dependence in July: We didn’t learn much between the June and July FOMC meetings but the only major data surprise was the soft CPI and PPI data. PCE inflation is now better positioned to undershoot the June FOMC projections for 2023 inflation. And yet the Fed is shifting from a pause in June to yet another hike. The dogmatic desire among hawks for another hike in July has won the day.

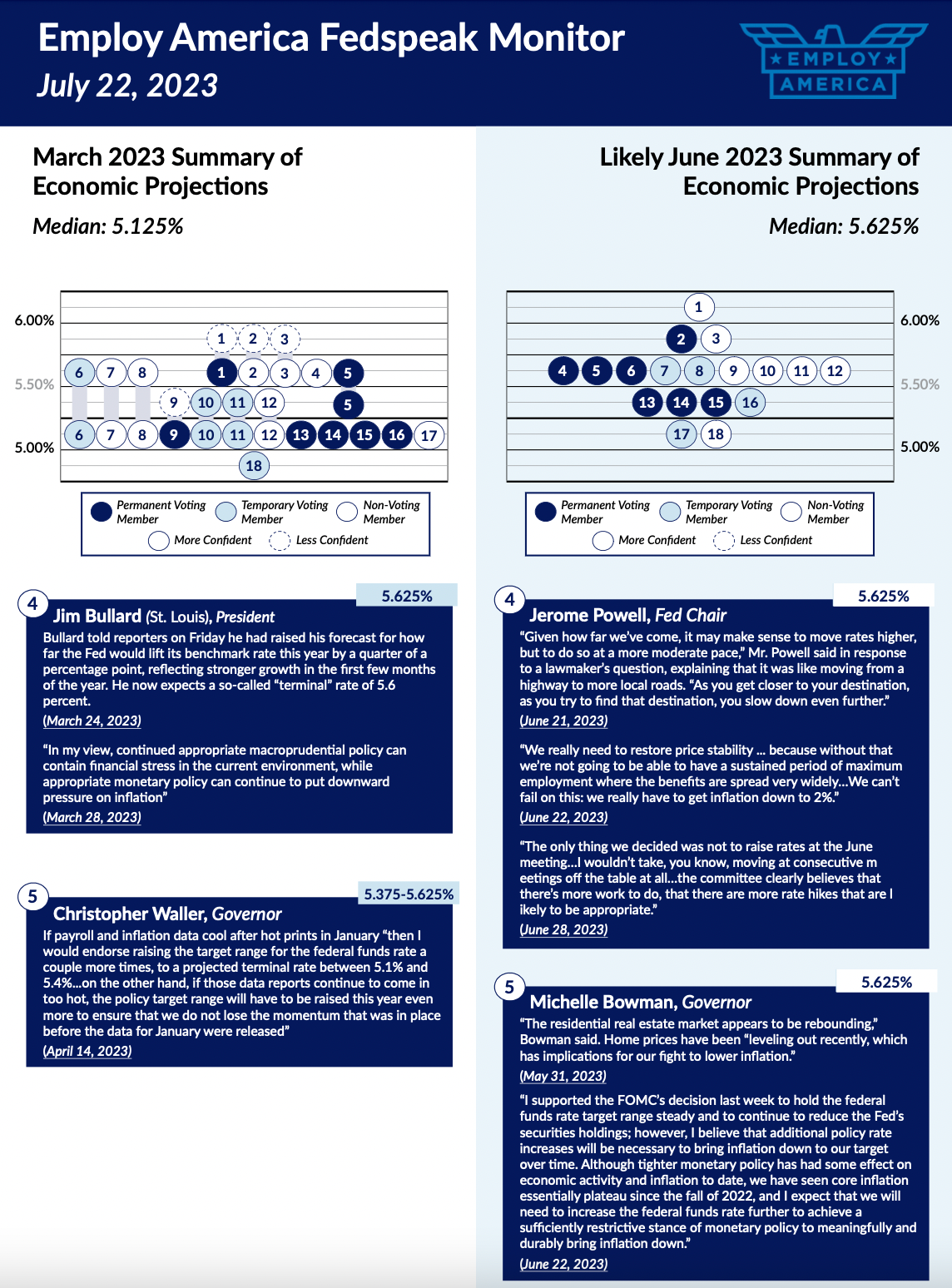

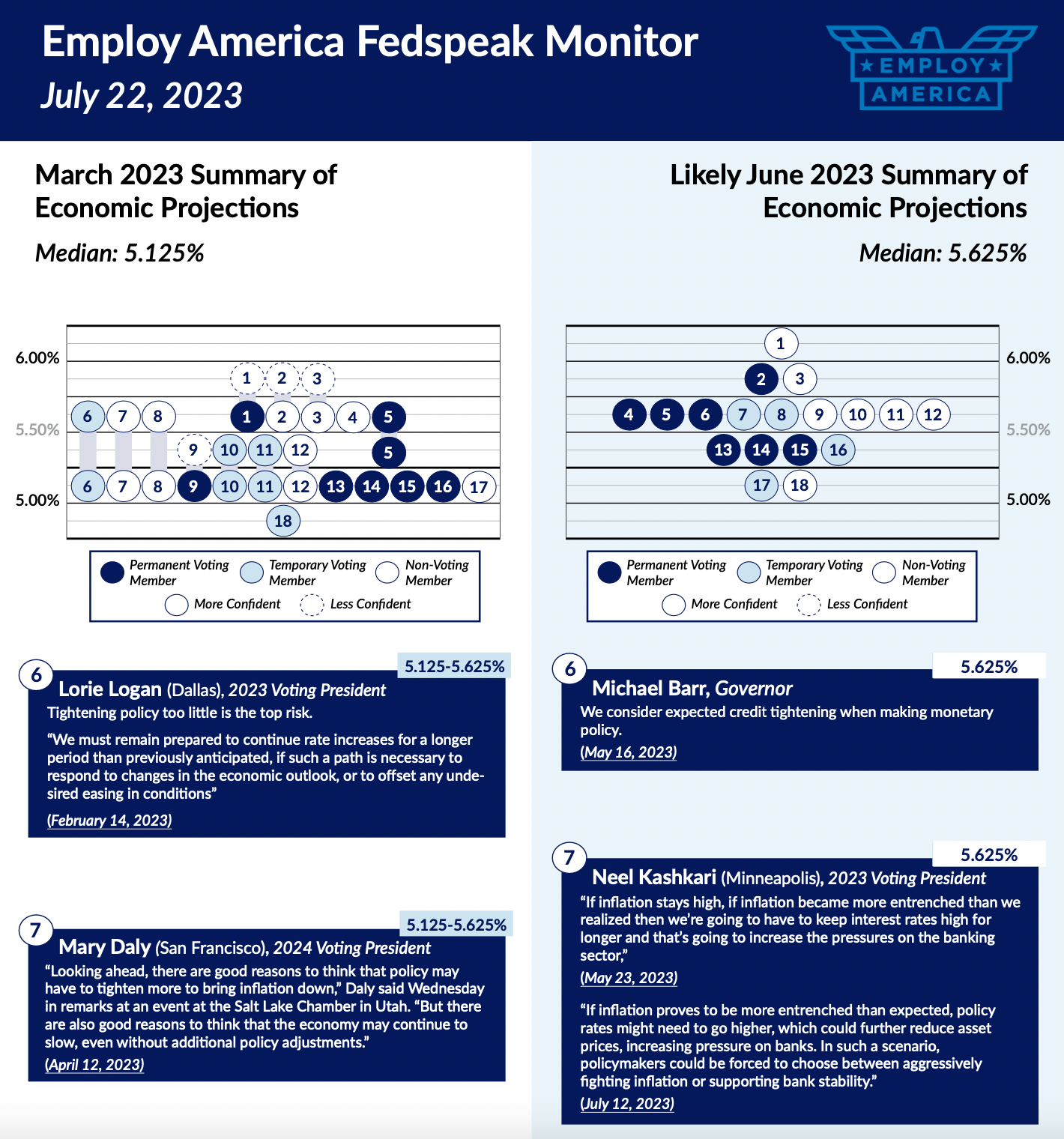

- July should be the last hike: The hawks are still throwing a bit of a tantrum, feeling burned by the pause in June and eager to keep a September hike live. Nevertheless, even Chris Waller now admits that if July and August inflation show similar softness to June, he will be more inclined back away from additional hikes. Given how little data we have received since the May FOMC meeting and the growing evidence of lagged dynamics (from Rent CPI to SVB), we would have thought it wiser to wait-and-watch until the September meeting. A hike in July probably won’t be fatal but it also seems hard to defend on the basis of “data-dependence.”

What To Expect

- A 25bp Hike. Markets are pricing it, the Fedspeak continued to push for it, it’s going to happen. The question is what it means for September and November, as reflected in the FOMC statement and the July Fed press conference.

- Ambiguity About The Next Meeting. This meeting’s hike makes the rate path in the following meeting’s SEP more important – Powell will likely try to keep optionality in this meeting, at the request of FOMC hawks. Nevertheless, the data is clearly showing that wages and prices have a capacity to decelerate even with the labor market looking strong. Such developments, should they persist, will make a September hike a heavy lift.

- Little Reaction. This is unlikely to be a meeting that coincides with fireworks in financial conditions — unless Chair Powell makes some truly unexpected moves. It’s really the next two inflation prints that will count. Should they come in soft and disinflation gather momentum as we project, the Fed will no longer be hiking this year.

What We Think The Fed Should Do

- Follow The Data. Very little data that we’ve received over the intermeeting period has been game-changing, outside of June CPI and PPI showing broader disinflationary pressures. Arguably, we haven’t even seen game-changing data since the May meeting. The only reason the hawks are arguing for a hike in July is that recession has not materialized. Job growth slowed, predictably. Lower tier wage data is decelerating marginally. But the most important bit of information is that inflation is slowing across a few key themes now. A summer holiday from hikes would have been more consistent with a data-dependent approach. The Q2 Employment Cost Index, two more inflation prints, and Q2 GDP all occur after the July FOMC meeting (and before the September FOMC meeting). Such a "holiday" would have given the Fed a chance to seriously gauge the scope for disinflationary momentum without (1) delivering gratuitous hikes and (2) foreclosing optionality for additional hikes later this year if justified. All of this said,

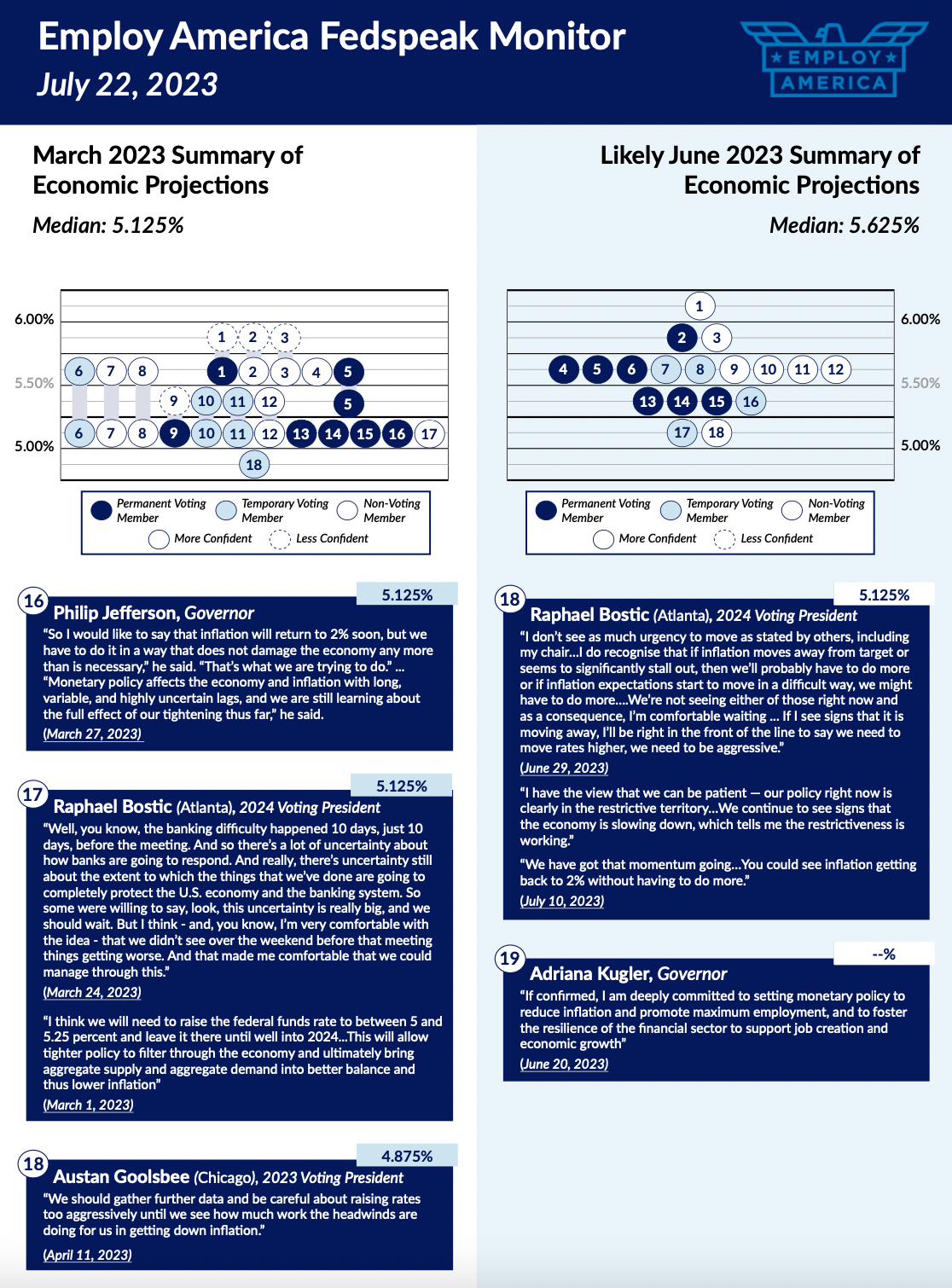

- Either You Believe in Lags Or You Don’t: 2024 is coming faster than you’d think and if inflation slows, there will be a clear a tension associated with the Fed’s renewed push for hikes. Raphael Bostic might seem dovish today, but the heart of his viewpoint is about lags: he is less inclined to be hyper-reactive to spot core inflation, whether elevated now or more underwhelming next year. The Lorie Logan and Chris Waller view seems to be hyper reactive to elevated core inflation today, but it remains to be seen whether the hawks will be willing to cut in the face of falling spot core inflation. The more that high core inflation automatically motivates additional hikes (as will be the case in July), the lower the threshold should be for removing restrictive policy in the face of core inflation progress (as might be the case in 2024).

- Consider The Full Implications of a Supply Recovery. Real economic growth in the United States is looking resilient and accelerating in real (inflation-adjusted) terms. This is going to draw out the usual hawkish arguments about growth being too strong to keep inflation in check. But if you look more closely, the drivers of economic growth are more supply driven. Fixed investment is now poised to outperform, not consumption. Real economic output growth is accelerating, even as nominal expenditure growth is largely decelerating across major consumption and some labor income segments. We foresee a heightened debate about whether the neutral interest rate (“r-star”) is rising and making policy structurally less tight, or whether there is a supply-side productivity recovery that the Fed should not gratuitously undermine.

- Remain in risk management mode: The world can still change quickly. Rates are high and while the financial system seems fine for now, it only takes one news event (and one major private balance sheet) to change things. Financial entities that (1) still rely on leverage and (2) do not have to directly mark-to-market can temporarily hide and insulate themselves from the effects of higher interest rates. We don't see imminent recession risk in 2023 and have been early to note the resiliency of growth, all of which should diminish recession probabilities from where they likely stood twelve months ago (close to 50% by our models). But so long as interest rates are this historically high and the Fed remains dissatisfied with the inflation outlook, one-year-forward recession risks are still higher than the unconditional 16-20% probability.

- Soft landing still requires a prudent Fed: As Chicago Fed president Austan Goolsbee has noted, the goal should be to avoid landing the plane nose-down. Nominal spending and income growth are both decelerating, and supply-healing should gradually feed through to inflation releases over the coming months and quarters. If the Fed is not intent on crashing the economy for the sake of their reputations on inflation, the likelihood of a soft landing increases. The Fed will deserve some justified credit for avoiding such an adverse scenario.

One Goofy Idea

Why Can't "Credibility" Arguments Apply To The Supply-Side? Is This All Convenient Post-Hoc Justification? As disinflation proceeds, commentators are looking for a cause to thank, perhaps to conveniently justify past policy prescriptions. Although we have yet to see identifiable causal passthrough from interest rates to labor markets to demand to measured inflation, many have been quick to cite the Fed’s hikes as the cause of today’s disinflation. It seems curious that many of these same people explicitly framed the Fed's hikes as working only insofar as they drove recessionary unemployment increases in the process. Since the data don’t quite line up this way, the explanation has largely rested on the Fed’s credibility contributing to well-anchored inflation expectations.

The thing is, there is as much evidence for that story as there is for a story where supply-side fiscal credibility following the passage of CHIPS, IIJA and the IRA led markets to expect stabilization in fixed investment. One can make cheeky arguments for these legislative acts anchoring long-term inflation through stabilizing the trajectory of fixed investment and the supply side. These arguments have about as much as evidence going for them as "Fed credibility" arguments. Expectational arguments are ultimately arguments about expecting "something"; there has to be some underlying non-expectational mechanism that rational agents are front-running and amplifying.

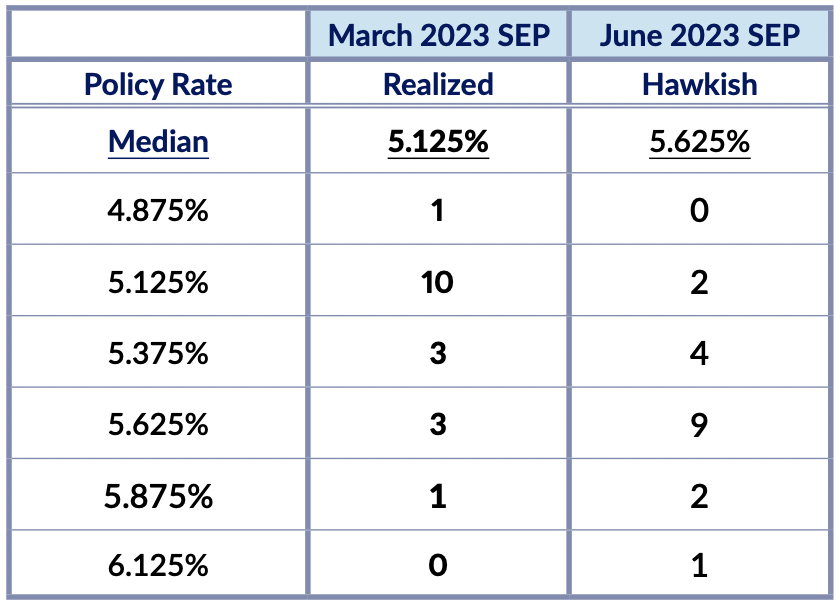

Summary Table