This is the second chapter of “The Dream of the 90's is Alive in 2024: How Policy Can Revive Productivity Growth,” a new research report from Employ America. "The Dream of the 90's" examines the macroeconomic conditions that led to strong growth in the late-1990s and what policies can revive that productivity growth today. The first chapter is here. Subsequent chapters will be published over the coming days.

Previous Chapters

Part I: The Three Drivers of Productivity Growth

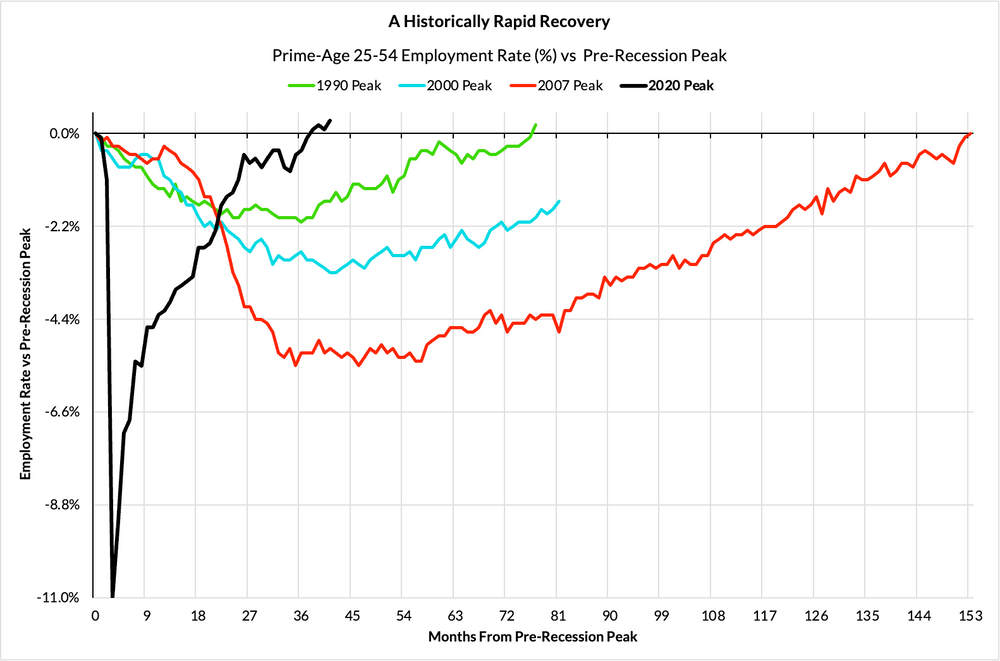

For decades, “jobless recovery” has been a watchword in the aftermath of each recession. It took well over a decade for the labor market to recover from the Great Financial Crisis, and that was after a solidly incomplete recovery from the 2000s dot com bust. This has meant the economy has rarely had the chance to reap the productivity benefits from a mature labor market near full employment. But in the 1990s—and today—we saw a fully-recovered labor market.

Until the post-pandemic recovery, the last time the US labor market fully healed from a recession was the 1990s. Although the current recovery has moved faster than the 1990s recovery, the employment gains seen then were far stronger than those of the post-2000 and post-GFC recoveries. By the summer of 1998, prime-age employment nearly recovered to its pre-recession peak of 80.2%, about three and a half years after its worst reading.

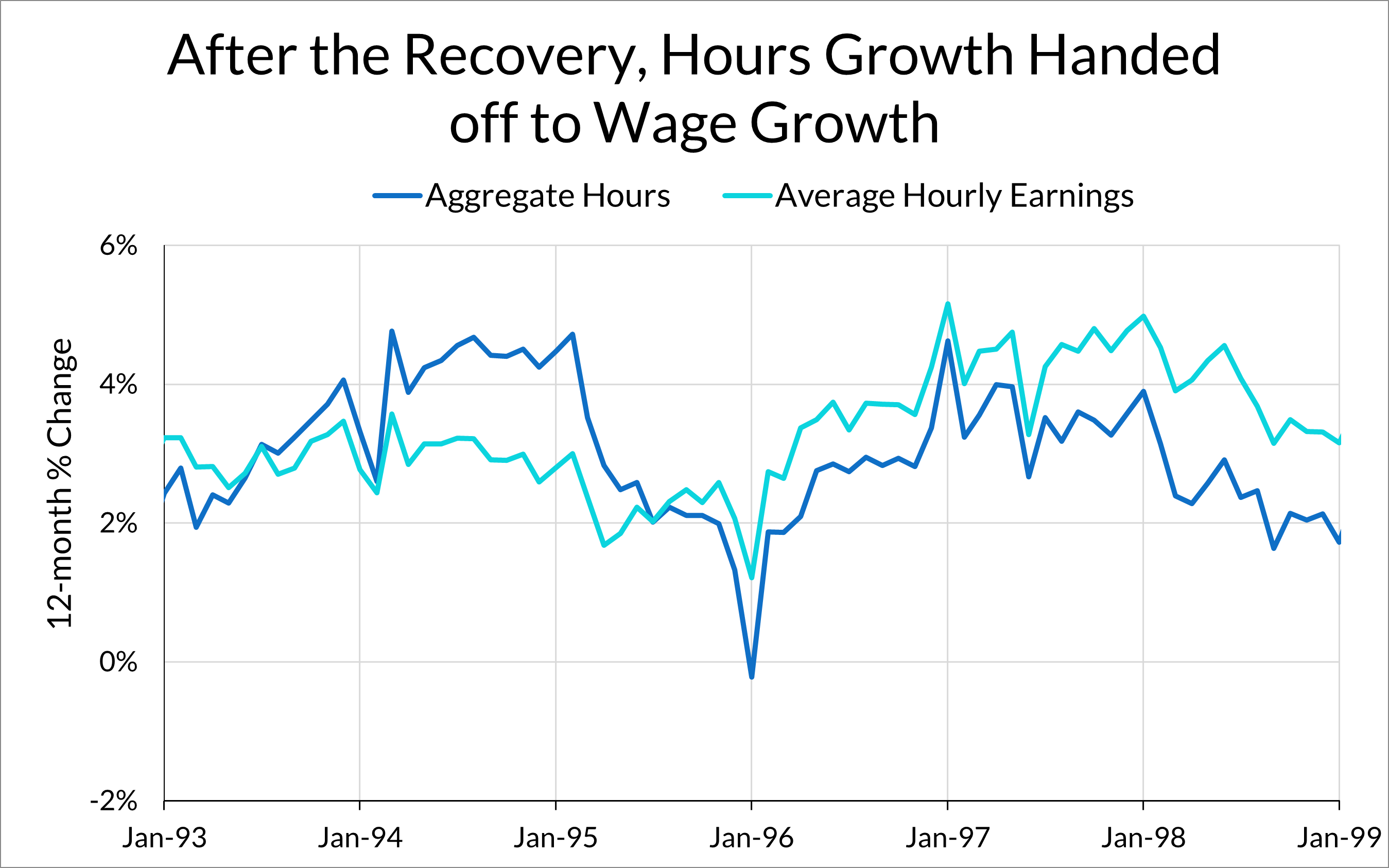

After recovering, the labor market progress kept going. Prime-age employment eventually reached a peak of 81.9% in 2000. The unemployment rate, which had averaged 5.6% in 1995, gradually fell to an average of 4.0% in 2000. While this continued labor market expansion was never an explicit goal of the Fed—members saw low unemployment as inherently inflationary—they still let it happen. Rather than preempt inflation, the Fed waited for inflation to arise, effectively adopting a stance of policy “forbearance” (Blinder and Yellen, 2001) during the late-1990s expansion. This helped support the tight labor market: as the labor market matured, the source of labor income growth shifted from primarily employment growth into wage growth.

The Good That Mature Labor Markets Do

Mature labor markets contribute to productivity growth in several ways. The first is through iterative and improved matching by workers towards higher productivity jobs. When workers change jobs, they generally move up the productivity ladder towards higher-paying jobs. This dynamic also varies in intensity with the business cycle; when labor markets are tighter, higher-wage firms hire more workers from non-employment and from lower-wage firms (Haltiwanger, et. al, 2024). In addition, as Skanda Amarnath explains in depth, it is worth accounting for “time-to-train” effects when thinking through the timeline on which to expect contributions to productivity growth. It takes time for workers to get settled into their jobs and train up before they can make their full contribution to overall output. The faster the recovery, the sooner these time-to-train effects wear off.

Mature labor markets recursively support productivity growth by supporting steady labor income growth. As employees move to higher-paying and higher-productivity jobs, employment growth hands off to wage growth, keeping total labor income growth steady. This labor income growth makes it possible for consumer spending to continue growing.

Businesses expand their investment plans when they see and expect continued consumer spending growth. This consumer spending growth means increased revenue, which justifies investments in productivity-enhancing capital goods.. As many economists and policymakers have argued, inadequate demand slows growth in output and productivity by eroding workers’ skills and curtailing investment in capital and innovation.

Benigno and Fornaro (2018) call this situation a “stagnation trap,” and argue that:

...aggregate demand is one of the key determinants of business investment spending and productivity growth. For example, companies have little appetite for investing in new technologies during a recession, because they anticipate that the profits derived from this investment will be low. As a result, future productivity growth falls and the economy’s potential output drops. Through this channel, temporary recessions can have persistent adverse consequences for long-run output.”

Benigno and Fornaro (2019)

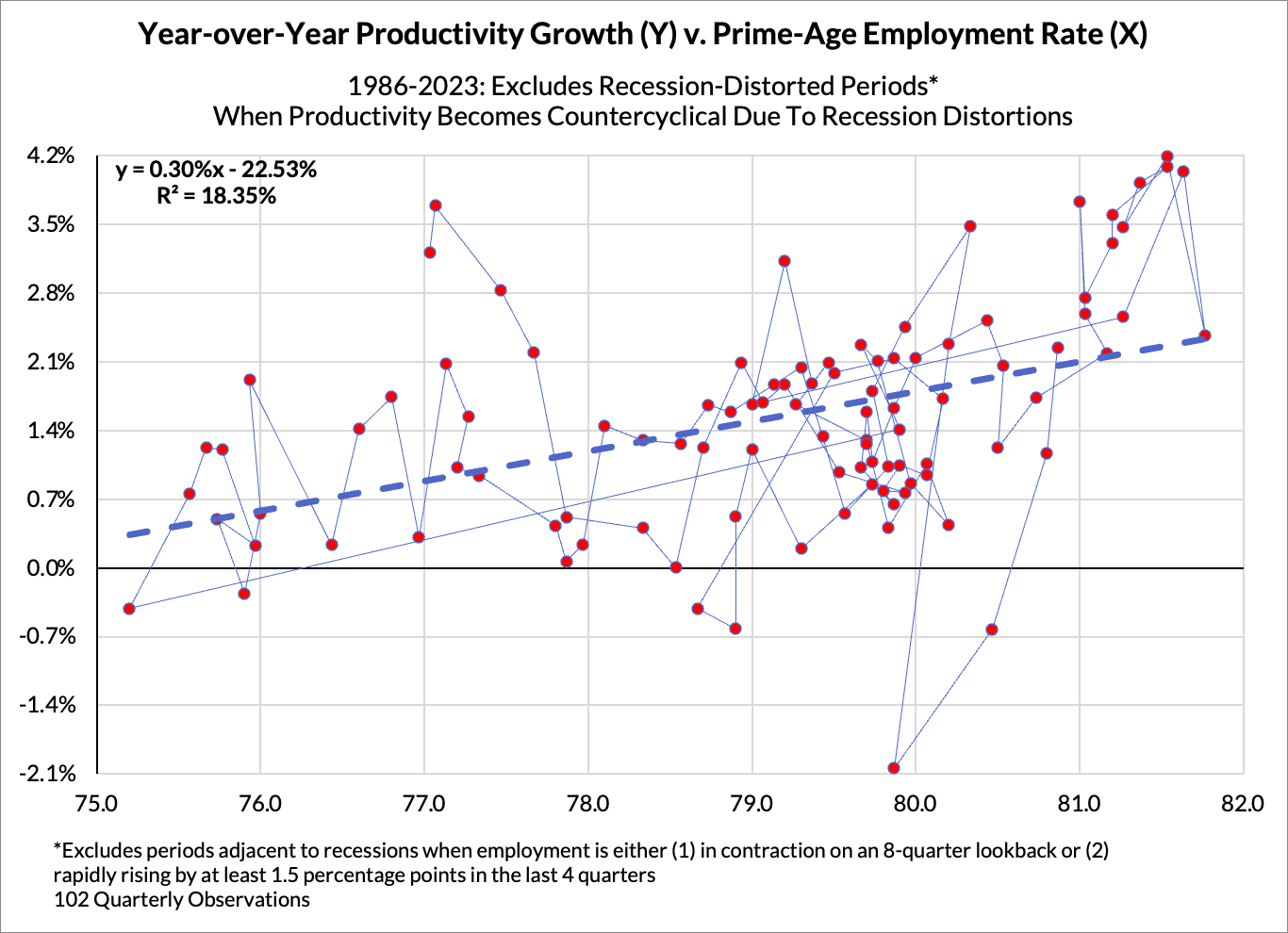

The empirical data on productivity and employment provides some cautious support for the idea that full employment supports productivity. As we mentioned before, productivity is a tricky metric to really understand. When employment goes down quickly, and output takes longer to go down, measured productivity increases quickly and mechanically. During times of rapid changes in employment, such as during recessions or in early parts of recoveries, labor productivity growth is also inadvertently driven by the disproportionate firing or hiring of lower-wage workers. When this dynamic is in play, measured labor productivity growth increases during recessions and falls in the early innings of labor market recovery. Outside those periods, growth in labor productivity correlates positively to the level of employment.

While the 1980s and 1990s saw complete labor market recoveries, the recessions in 2000 and 2007 were not followed by full recoveries. Thanks to the swift and supportive monetary and fiscal policy response to the pandemic, we have seen a complete recovery in the labor market. Prime-age employment rates have reached, then surpassed, the highs of the 2010s (although recent months have seen some give-back in that recovery). As in the 1990s, today’s economy has the full employment leg of the productivity stool.

However, continued labor market strength is not a guarantee. Employment rates have fallen from their post-pandemic peaks as job gains and hiring have slowed down. When the labor market breaks, it generally does so rapidly, so prevention is the best medicine here. Securing continued labor market strength will require a Federal Reserve willing to normalize interest rates with an eye towards preempting downside labor market risks.