Summary

Amidst all of the understandable concern with inflation and recession risks, the evidence continues to foretell a welcome inflection point on the horizon—a rare procyclical upturn in productivity growth.

We continue to see signs that a maturing labor market—in which employment rates fully recover from recessionary damage and subsequently rise at a steadier pace—proves consistent with higher rates of productivity growth.

Tight labor markets should not be viewed as a universal panacea to the challenge of low productivity growth, but by accelerating the timeline for potential workers to be hired and trained to productive capacity, business cycle policies can facilitate an important form of human capital deepening.

This piece represents the first of two that discusses the potential role of strong labor market outcomes in supporting higher productivity growth. Here we first discuss the measurement challenges that frame our approach to analyzing productivity, and lay out our view for why achieving stronger productivity growth is nevertheless desirable. We then lay out four key facts that inform our understanding of why full employment and productivity goals can be mutually reinforcing:

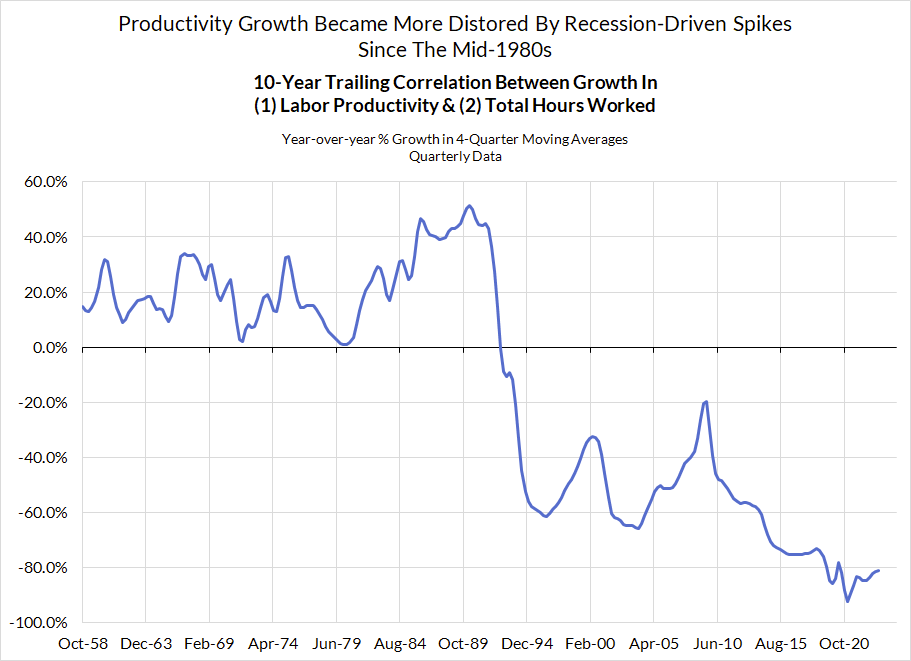

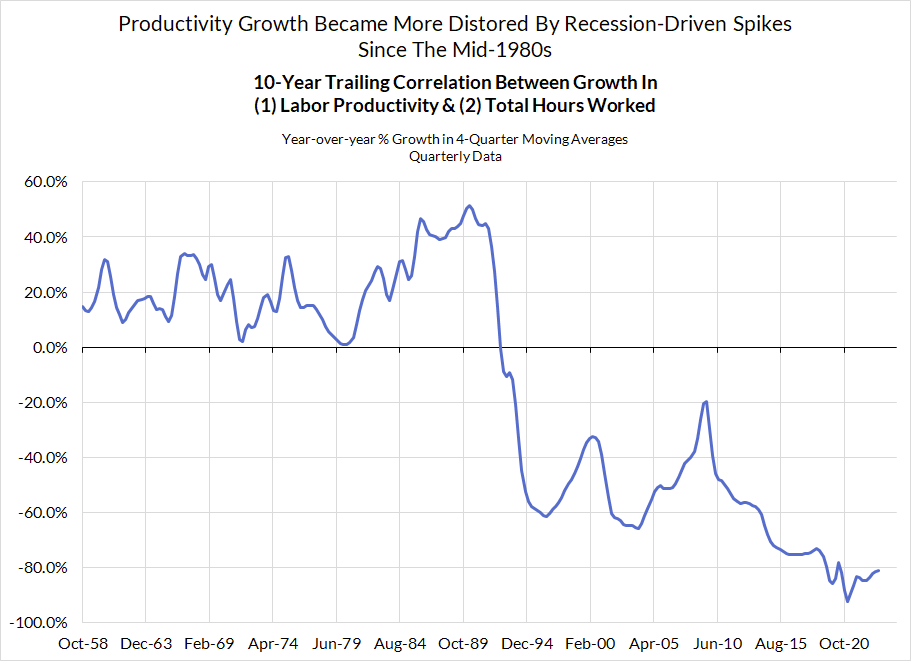

- Since the mid-1980s, productivity growth has become countercyclical relative to labor market dynamics, due to recession-induced distortions.

- Productivity performance over the past few decades has been weaker than previous decades.

- Past productivity trends do not predict future productivity growth.

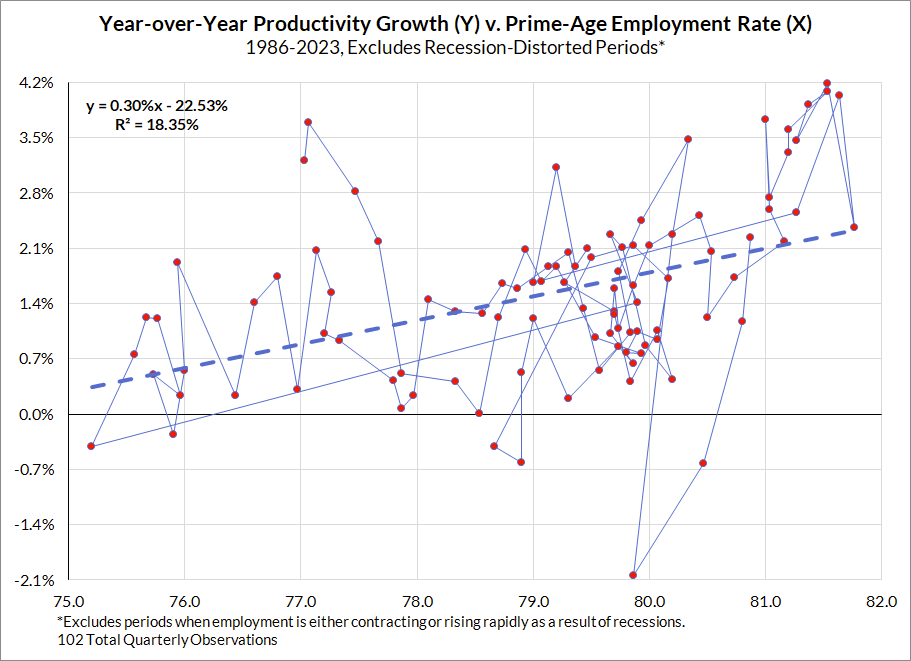

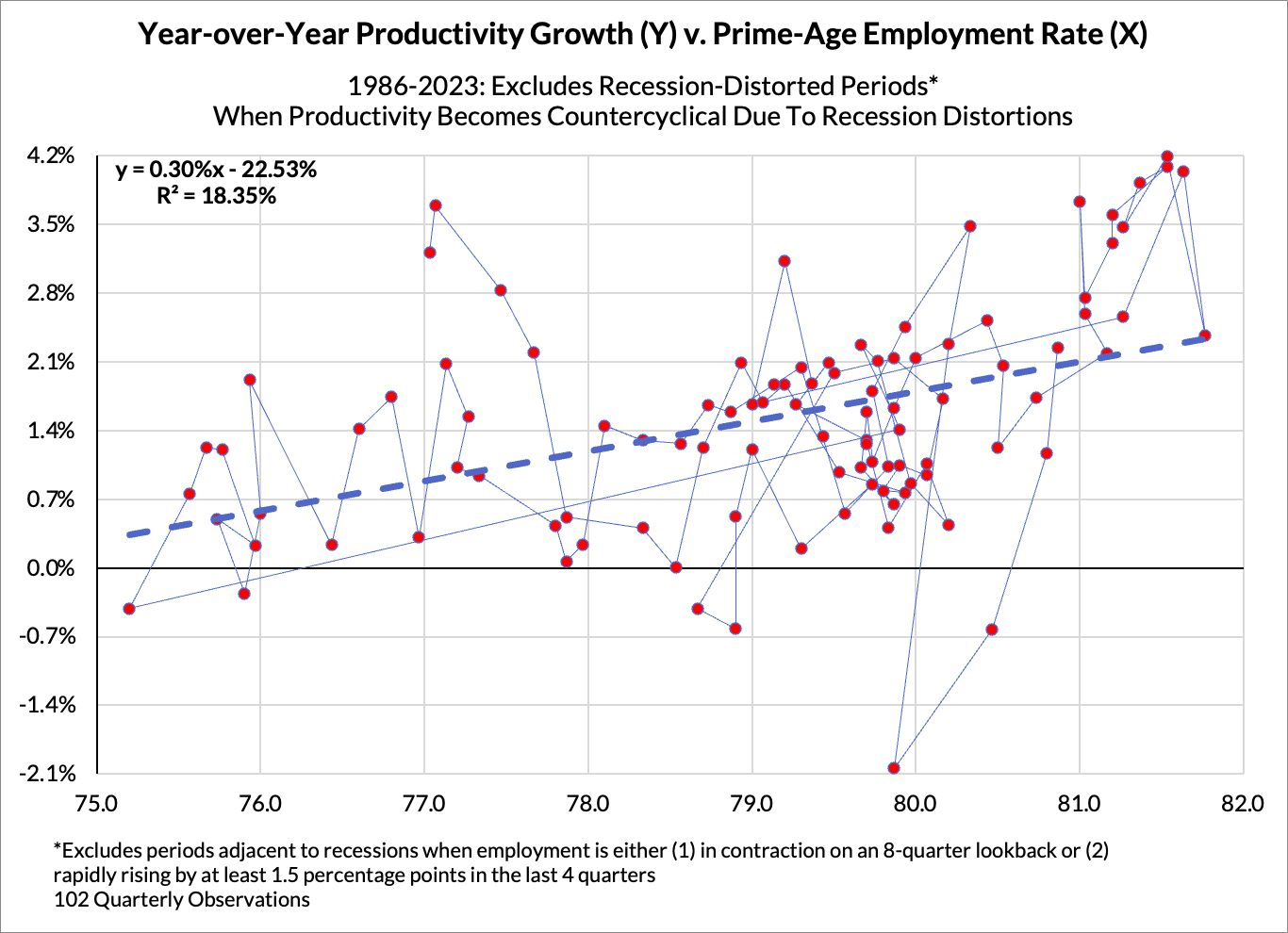

- Excluding periods when employment rates are either (1) contracting or (2) rapidly recovering, productivity growth relates positively with employment rates.

In our subsequent post, we will take a comprehensive approach to explaining why the latter half of the 1990s expansion saw a productivity boom that proved elusive within all other business cycle expansions in recent decades. We see reasons to believe that similar conditions can realistically emerge in the coming years, but it will require avoiding policy mistakes, and some good luck to avoid adverse shocks.

Productivity Growth, As Measured and As Conceptualized

Deconstructing Productivity Measurement

Productivity estimates are not robust, and all estimates of productivity should be treated with serious caution. Economists are sometimes keen to lecture others about the importance of productivity growth, only to show far less command of the measurement mechanics and limitations. All macroeconomic data are rife with imperfections, but productivity estimates amplify these imperfections. Worse yet, theories of productivity growth can reflect an allergy to evidence-driven approaches. The macroeconomic data available to us are imperfect, but this series of posts on productivity seeks to understand the macroeconomic data as it is observed. We try to limit reliance on residuals, proxies of proxies, and unfalsifiable priors.

Our series of posts on productivity will focus on nonfarm output per hour ("labor productivity") estimates. Such estimates are constructed from estimates of output and hours worked. Statistical agencies derive granular inflation-adjusted output estimates from micro-level observations of nominal expenditure and prices for goods and services of similar specificity. They also collect separate data measuring total hours worked at the business establishment level. Unfortunately, labor productivity is not observed with microdata at the firm-, establishment-, or production-process-level. Instead, labor productivity estimates are a mere ratio of two independent aggregates, real inflation-adjusted output and total hours worked.

Reliance on independent, highly aggregated estimates makes productivity estimation especially vulnerable to error propagation. There are already plenty of issues with how we measure real GDP. How should prices capture quality improvement, "free" ad-supported digital services, and in-house software development that lacks a directly observed market transaction? On top of this, hours worked estimates are not necessarily aligned to the best-observed segments of GDP. If hired workers disproportionately contribute to under-estimated segments of real output, productivity growth will be further underestimated as a result.

Nonfarm output per hour (labor productivity) estimates differ from measures of "total factor" or "multi-factor" productivity (TFP), which economists more frequently cite and emphasize. TFP growth estimates are intended to reflect the outperformance of real output growth left unexplained by the growth of labor inputs (hours worked) and fixed capital inputs. In addition to the challenges of measuring investment output (for reasons stated earlier), the rate of depreciation to the existing "aggregate capital stock" is difficult to monitor over time and is subject to numerous assumptions of varying stability and validity. All of the measurement and error propagation issues that plague labor productivity estimates are only further multiplied when estimating TFP.

Why Higher (Measured) Productivity Growth Is Still Worthwhile

In light of the measurement challenges discussed, one might question the merit of aiming for higher (measured) productivity growth. Given that workers' compensation can substantially deviate from their marginal product of labor, misinterpretation and overemphasis of productivity data can be highly problematic. Fed officials interpret wage growth as inherently inflationary if it locally outperforms what realized trends in productivity growth otherwise suggest.

A more charitable view exists for understanding the merit of productivity growth, even if less conventionally stated. All else equal, higher productivity growth reduces the potential inflationary implications of growing economic activity.

In the aggregate, there is a robust relationship between the growth rate of total labor income and the growth rate of nominal consumer spending. The growth in dollars spent is reliably proportional to the dollars of total paycheck income all Americans cumulatively earn.

The dollars spent on consumer spending do not automatically translate to inflation-adjusted consumption. Especially when gasoline prices are rising, higher nominal consumer spending—both on motor fuel and in the aggregate—tends to reflect the less desirable reality of higher consumer price inflation, not more real consumption. Nominal and real consumer spending growth are usually correlated, but when supply constraints for critical items bind acutely, higher nominal consumer spending growth tends to reflect a more inflationary outcome as a result.

Higher growth in measured economic activity also does not have to be inflationary if the additional output (and spending) growth is primarily driven by capital expenditures. While higher consumer spending can "push up" the prices of consumer goods and services of relevance to cost of living concerns, stronger fixed investment spending can exert demand-side pressure on a substantially distinct set of inputs from what is relevant to consumption.

All of these nuances grow more salient at a time when strong economic growth might be wielded as justification for keeping interest rates—and by extension recession risk—elevated. While there is a loose relationship between GDP growth and inflation, it is an overstatement to say that high GDP growth is always and everywhere inflationary. As the first three quarters of 2023 have demonstrated, accelerating GDP growth can still be consistent with decelerating prices and hours worked if supply-side improvement emerges.

Key Facts About Productivity Growth In Recent Decades

Fact #1: Since the mid-1980s, productivity growth has become countercyclical relative to labor market dynamics, due to recession-induced distortions.

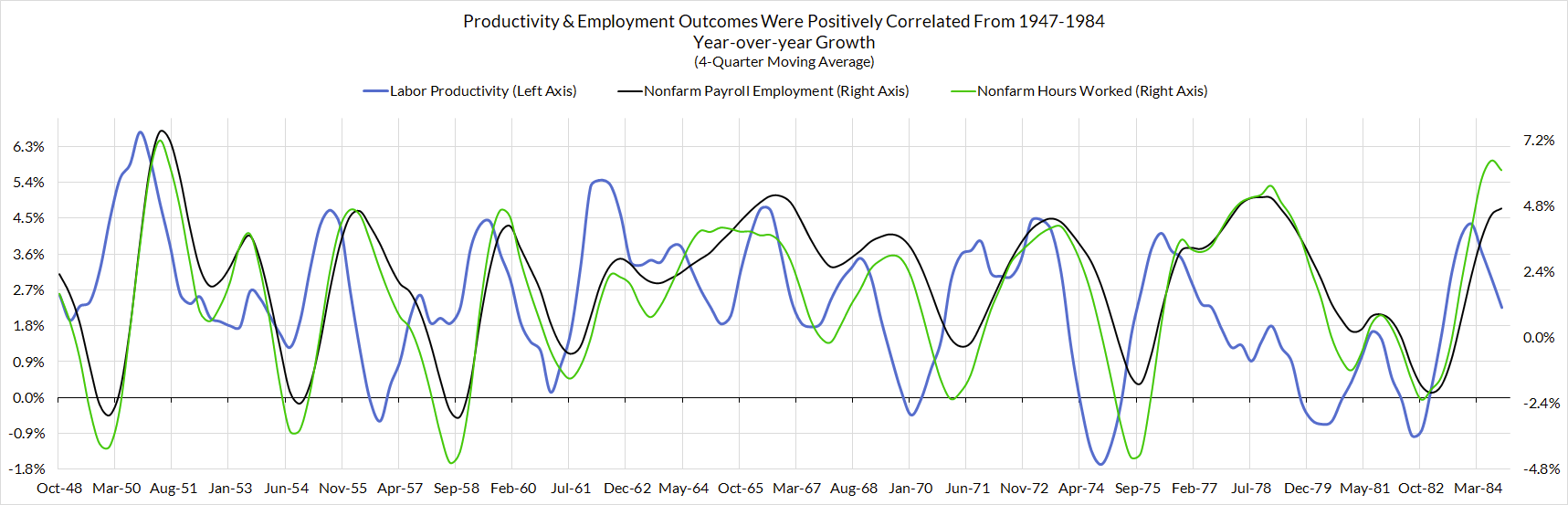

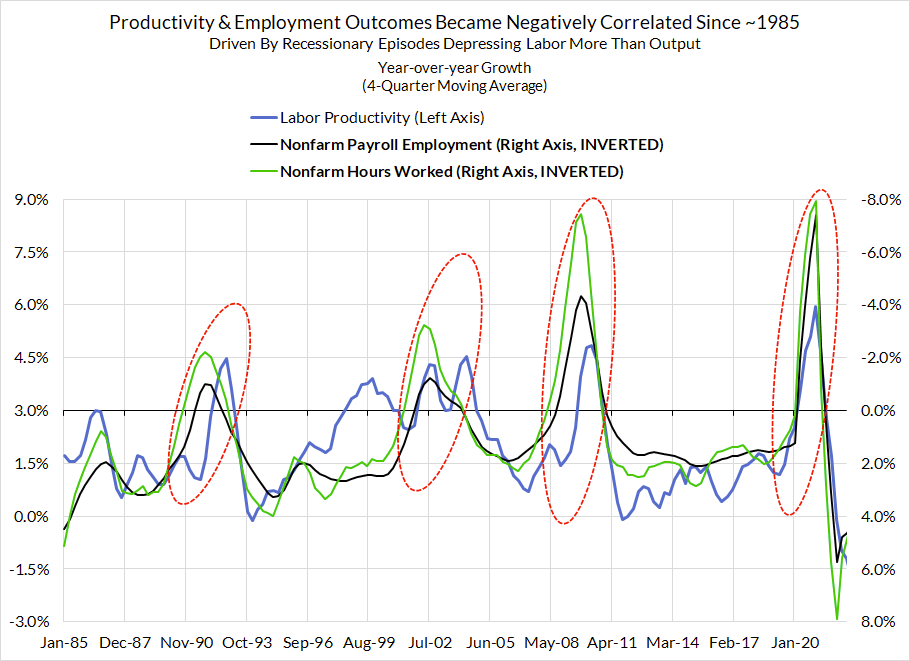

Prior to the last four decades, productivity growth and job growth were not in tension. With a few notable exceptions, 1947-1984 was a period in which productivity growth generally went hand-in-hand with a thriving labor market, and recessions rarely looked good for either. If productivity was growing strongly, it was usually a sign of a growing economy in which employment was also growing, or else poised to grow strongly. If productivity was weakening, it was a sign of weakening real output and final sales, which would have downstream effects on firms’ ability to hang on to workers.

In the subsequent four decades, we have seen a decoupling. Recessions can inflict historic and persistent damage on both real output and the labor market, but the immediate impact on the productivity data is a massive boost. In each of the past four recessions, real output has outperformed, even as labor was culled at historic scale. Make no mistake, real output still contracted in each of these recessionary episodes, but far less so than the observed impact on the labor market. Productivity growth thus became increasingly countercyclical, and especially so in comparison to the labor market.

It may be tempting to some to view the newfound countercyclicality as a natural process of productive capitalism, one in which unproductive labor must be shed (possibly to be retrained and reallocated to other sectors that can make better use of available labor). But the longer track record reveals that recessionary productivity gains are "empty-calorie" productivity gains. In each of the relevant episodes, the productivity gains from shedding labor ultimately reverted as employment began to recover. The productivity spikes of 1991-92, 2001-03, 2009-2010, and 2020 all gave way to productivity busts once the labor market began healing. In the episodes where employment rates finally caught up to pre-recessionary levels, recessionary productivity gains ultimately reverted back to their pre-recession trend. The longer it took for the labor market to heal—prime-age employment took over 12 years to return to its 2007 peak—the longer the observed drag on productivity growth.

Time-To-Train Effects: A Longer Lag Between Labor Decisions And Output Outcomes

We see a reasonably robust explanation for countercyclical productivity growth: there are growing time lags between labor turnover decisions and their effect on real output. Just as it can take time to train a recently unemployed worker to the point that their full productive contributions materialize and mature, a hired worker's productive contributions to output can also live on for a longer duration of time than their employment tenure.

Just as there is “Time-To-Build” between an investment decision and the final formation of new capital, there is also “Time-To-Train” between the decision to hire a worker and the full maturation of their productive contributions. The "Time-To-Train" might be longer when workers were recently unemployed due to a recession. These lags between labor decisions and output outcomes may have grown as the US labor market shifted away from simpler forms of manufacturing into a more complex set of products and economic activities.

The lagged impact of hiring and unemployment on output thus helps to explain (1) why productivity tends to be sluggish when job growth is strong as a result of recovering from more depressed employment levels and (2) why productivity temporarily spikes when employment rates are precipitously falling. Taken together, the countercyclicality of productivity becomes far less mysterious.

Fact #2: Productivity performance over the past few decades has been weaker than previous decades

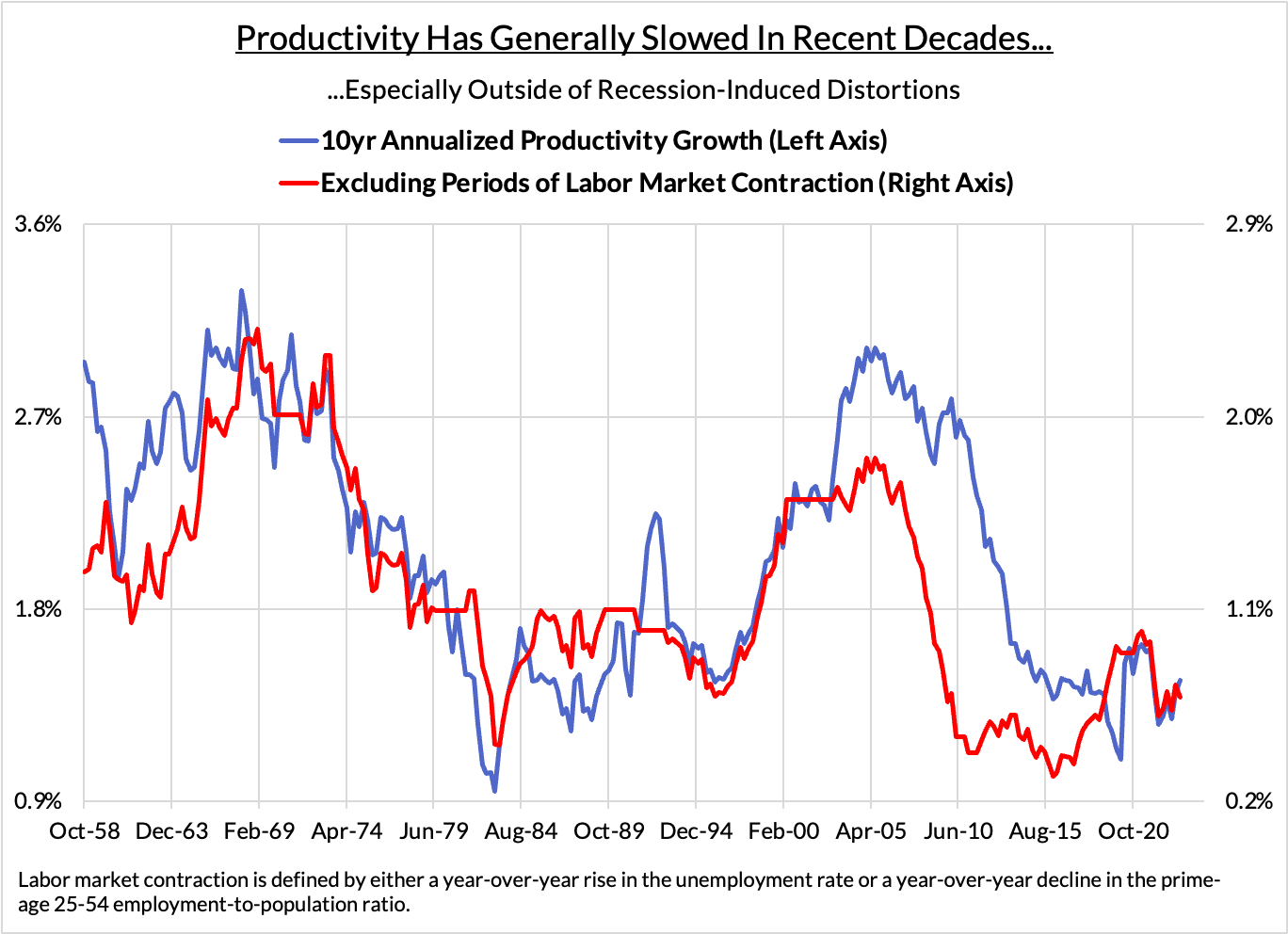

Despite a heightened focus in the United States on efficiency and economic growth around the 1970s and 1980s, the last four decades have generally seen poorer rates of productivity and economic growth outcomes. While views about the importance of low unemployment and low inflation have clearly shifted over the decades, views about the importance of economic growth and efficiency have remained more robust and arguably grown stronger over this period. The strong preference for higher productivity growth is fundamentally at odds with the weaker pace of gains in this period.

On a 10-year rolling basis, annual productivity growth consistently averaged around 2.5%-3% on a 10-year rolling basis through the first three decades of the post-war period. Aside from the late 1990s economic boom, productivity growth has not proven to be as strong in the absence of recession. The strongest extended period of productivity growth in recent decades involved two sustained periods of declining employment, first from 2000 to 2003 and later from 2007 to 2010.

Fact #3: Past productivity trends do not predict future productivity growth

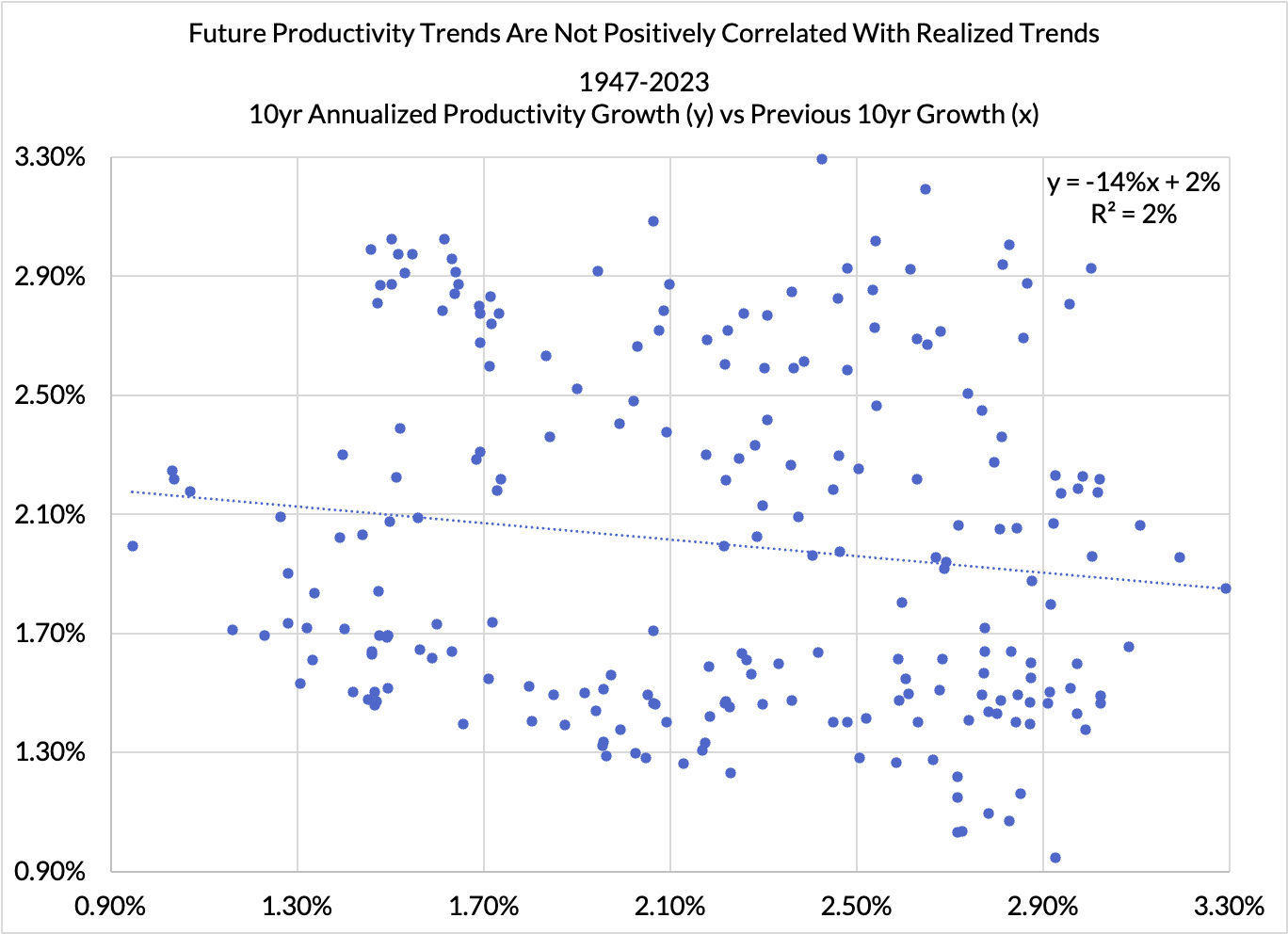

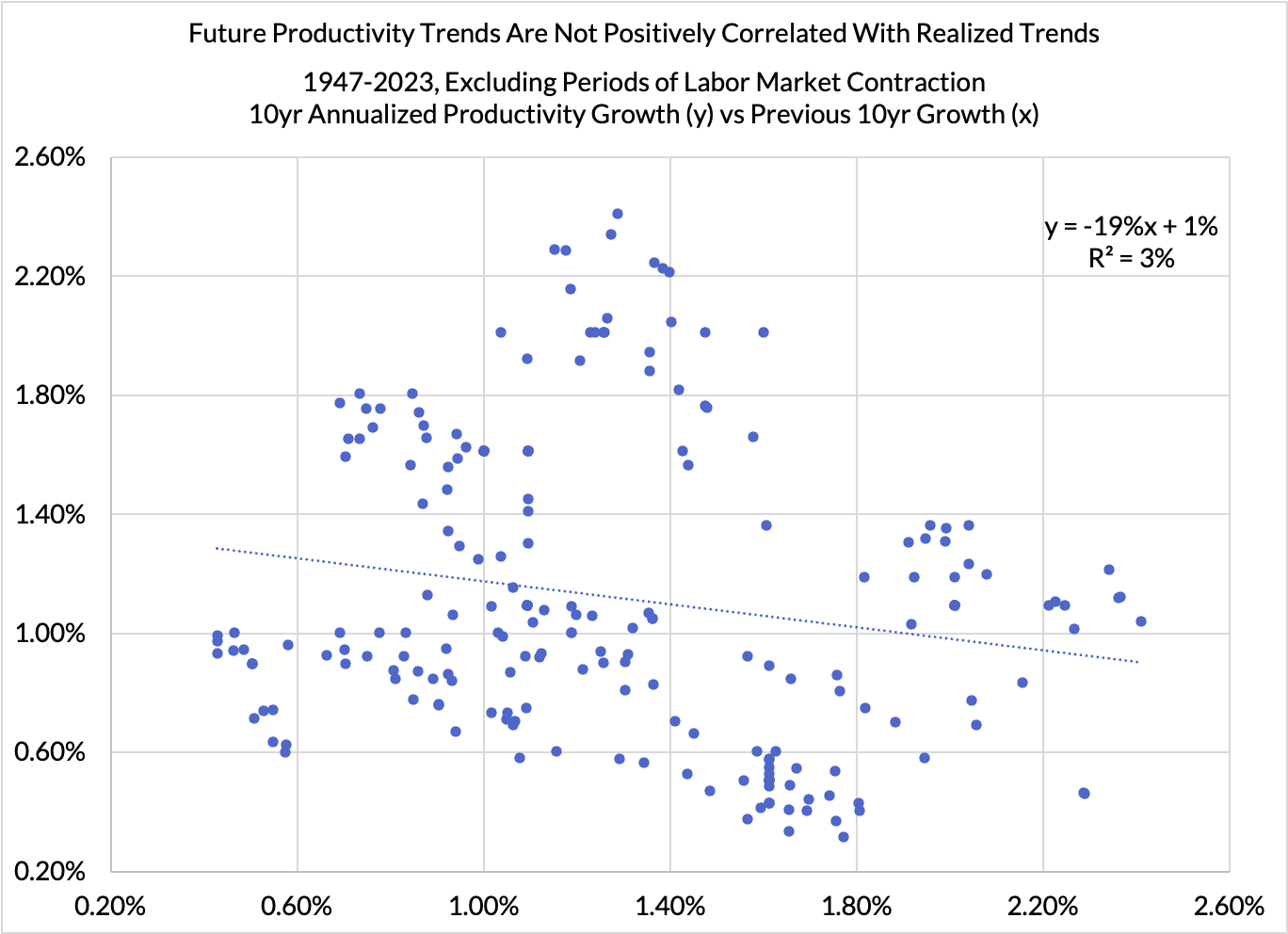

The recently realized "trend" in productivity growth is not encouraging, but there is a silver lining: realized trends are poor predictors of future trends in labor productivity growth.

The last 5, 10, and 15 years of productivity growth have been underwhelming, but a lot has also happened to suggest that the past need not continue into the present and future. The past 15 years include a historic financial crisis, a historically sustained rise in unemployment, a historically sluggish labor market recovery, and a whole host of unique shocks tied to the pandemic and the Russian invasion of Ukraine. Some of these dynamics will rhyme, but none will perfectly repeat.

This alone provides good reason not to fear elevated rates of wage growth. Even if the relationship between wage growth and productivity is presumed to be important and meaningful, future wage growth should be compared against future productivity growth, not its 10-year trailing average. If productivity growth improves on a forward-looking basis, higher wage growth should not impose the same inflationary tensions that are currently feared. At the very least, the productivity data does not give a good basis for merely extrapolating from past trends.

Fact #4: Excluding periods when employment rates are either (1) contracting or (2) rapidly recovering, productivity growth relates positively with employment rates

As discussed earlier, productivity growth in recessions reflects "empty calorie gains" that revert as the labor market begins to recover. If the employment recovery proceeds more swiftly, recessionary productivity gains also revert. But if we exclude periods distorted by these dynamics, a more interesting pattern begins to emerge: higher (prime-age) employment rates have generally coincided with higher rates of productivity growth.

Since the time that productivity became countercyclical in the mid-1980s, and after excluding observations clearly distorted by recessionary dynamics, the underlying relationship between employment and productivity growth is a positive one. So long as prime-age employment rates are neither contracting nor rapidly surging as a result of recessions, full employment appears to positively correlate with productivity growth outcomes. Prime-age employment rates that are even just 1% higher translate to an additional 0.3% of labor productivity growth in expansions. Compounding the gains of 0.3% productivity growth over time adds up to sizable potential for welfare improvement.

There is an intuitive reason why this correlation might hold, and in a manner consistent with previous facts. The sooner workers are hired back and trained up, the sooner they might be able to accelerate their contributions to real output.

These correlations and univariate regressions have to be treated with the utmost caution for many reasons, including small sample size and autocorrelation issues. Nevertheless, they do suggest something potentially compelling about the role of countercyclical macroeconomic policy in shaping productivity growth over the longer run. If it is the case that high employment rates and steady labor takeup are the ultimate sweet spot for achieving sustained periods of higher productivity growth, policymakers have strong reason to prioritize the rapid re-attainment of high employment rates following recessions (and subsequently transitioning to a steadier growth trajectory). Allowing depressed employment rates to fester risks long-term economic harm.

Concluding Thoughts

To the best of our ability to contextualize the data, full employment is a potential asset to superior productivity outcomes. After accounting for recession-induced distortions that cause productivity to spike and then revert, we see how complete recoveries from recessions can subsequently set the stage for incrementally higher productivity growth. Allowing employment rates to fester at low levels can elongate the timeline by which the potential workforce acquires the requisite skills, knowledge, and experience to contribute to future output. The sooner the labor market matures back to higher and more productive employment rates, the sooner that real output contributions from past hiring can accumulate, even as job growth likely normalizes to a steadier pace.

Our subsequent post continues in this empirical vein, but with a more episodic focus over the past few decades. We see three key data-driven reasons why productivity outperformed in the late 1990s without the presence of a recession. Learning the right policy lessons from that period could be critical for ensuring that higher productivity outcomes sustain over a more extended period and across business cycle expansions.