If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

Latest Fedspeak and Our December 2023 Dot Projections

Our Scenarios for the Dot Plot

How Has The Data Evolved Since Last FOMC?

What to look for:

- A Hold: The Fed will leave its target range for the Federal Funds Rate at 5.25%-5.50%. Fed officials have been trying to talk tough about the potential need for further rate hikes, but it’s clear any hikes are conditional on higher inflation. Since the last meeting, we’ve gotten another month of inflation data showing that we are still on the golden path of disinflation. We will get another round of CPI and PPI data on Tuesday and Wednesday.

- Continued tough talk: The cooling inflation puts the Fed in an awkward position where they would like to avoid talking about the prospect of 2024 cuts, but the inflation trajectory makes that avoidance look less and less tenable. Core PCE inflation is currently running at a 3.45% year-on-year basis, already undershooting the end-of-2024 projections from the last four SEPs. Recent Fedspeak has most committee members uninterested in talking about rate cuts, but every new soft inflation print makes that approach less credible and less consistent with their previous policy.

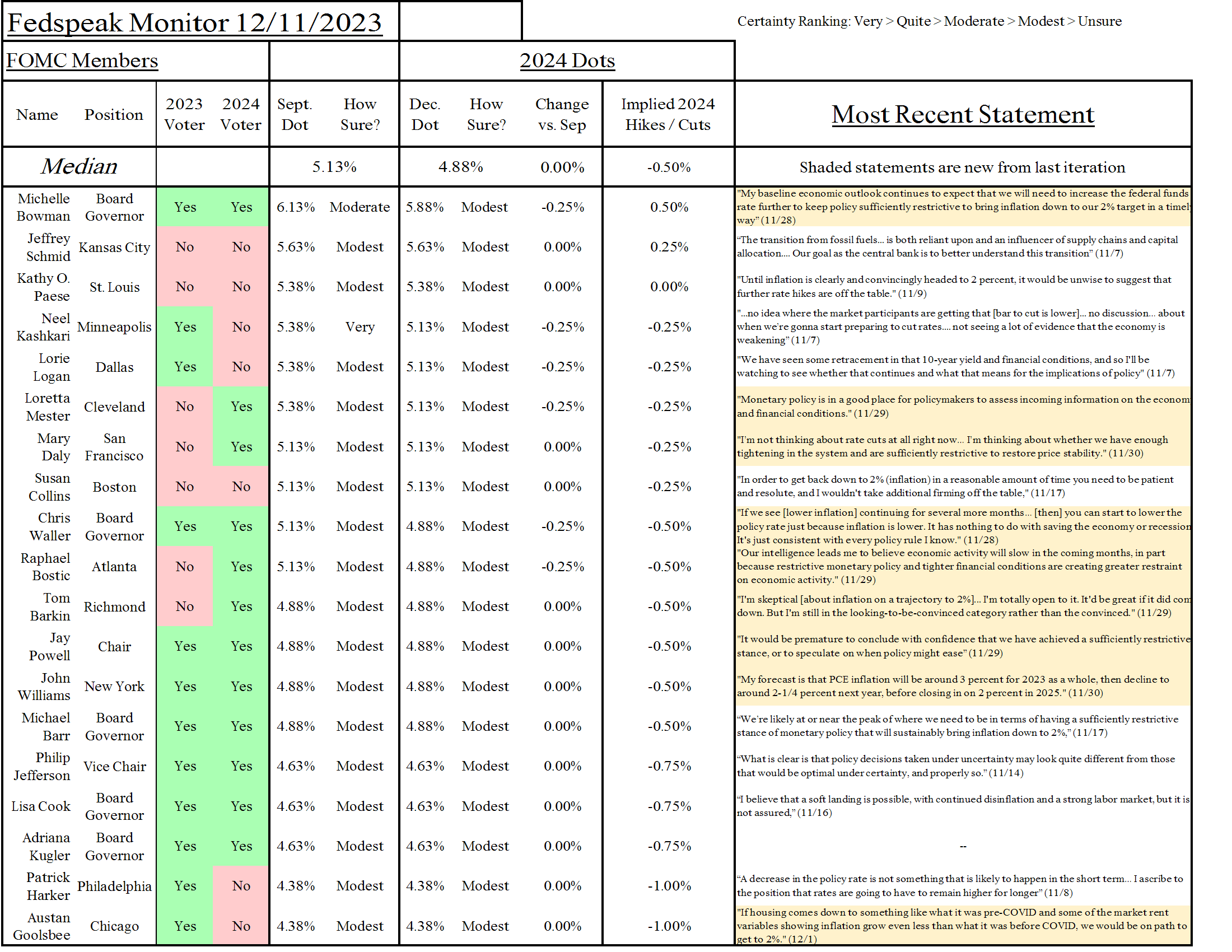

- Any signs of 2024 easing? Right now, the question is when and by how much the Fed will cut in 2024. We think Powell will resist talking about this at the press conference, saying they’re taking things “meeting by meeting,” but they will have to release a new Summary of Economic Projections this week. This may be our first view into what the committee is thinking about rate cuts, beyond recent statements from Waller, Bostic and Williams.

- The balance of risks likely tends towards the hawkish side given recent Fedspeak, but cool last-minute CPI and PPI prints could throw the risks to the dovish side. Much of the committee seems set on refraining from talking about the prospect of cuts until they’re convinced that inflation is well on its way back to 2%. We expect the tightening bias to remain in the statement language, given recent Fedspeak.

- Not much movement in the other projections. Real GDP growth and unemployment projections will probably not move very much, given that recent developments there have been consistent with the previous projection. The committee’s ability to keep talking about maintaining policy at this level requires them to still maintain a similar projection of inflation; we do not expect the inflation projections to change much either. Even though we have the median 2024 dot dropping to 4.875%, note that the median dot in September was barely 5.125%, with 9 of 19 members at 4.875% or under. Given their recent comments, we’re penciling in Bostic and Waller at 4.875%, enough to move the median.

The Developments That Matter:

- Core PCE is Undershooting the September FOMC projection. The latest Core PCE 12-month growth rate came in at just under 3.7%, which was the end-of-year projection for core PCE at the September FOMC meeting. High inflation prints over the next two months could spur the Fed to hike, but so far inflation is cooperating more than was expected even a few months ago. The committee will have a good sense of November’s PCE inflation by Wednesday morning, as they’ll have CPI and PPI data.

- Continued Robust Labor Market with Softening Wage Growth: The latest unemployment release gave some relief from fears of elevated unemployment risk, with an unemployment rate of 3.7% (the unemployment rate at the previous meeting was 3.8%). From a longer point of view, wage growth still appears to be on a downwards trend and defying predictions based on the unemployment rate. Quarterly annualized wage growth is running at 3.75%, just a tad higher than what Powell thinks is consistent with 2% inflation.

- Where do they think the balance of risks is?: Taken together, the question for what the Fed will say about 2024 is: where do they think the balance of risks is? Risks on both the inflation and unemployment front are lower than at the previous meeting. While we think the disinflation news is news enough that they should be willing to talk about preempting unemployment risks, the good news on unemployment will probably make the committee feel like they have more room to talk tough and delay signals about 2024 cuts.

What we’re thinking

Last week, we released a research report: Three Motivations for Interest Rate Normalization: A Playbook for Fed Policy in 2024. This is our view of where Fed policy should go in 2024. Give the whole thing a read, but a summary is:

- Preemption of unemployment and financial stability risks implies that cuts should be front-loaded. Unemployment goes up like a rocket and down like a feather, and financial crises can hit before the Fed receives any warning. The recent disinflation means the balance of risks has shifted away from inflation (relative to where they were earlier this year). This gives the Fed room to cut and preempt unemployment risks. The most justified time to pursue a larger 50 basis point “normalization cut” is at the outset, to move swiftly away from objectively restrictive policy settings.

- Consistency on inflation implies following inflation down as well as up. When the Fed was hiking, the rate trajectory was consistently revised upwards when inflation surprised to the upside. The Fed now finds itself in the opposite position: inflation has consistently surprised to the downside for the first few months, and is under the end-of-2024 projections in the last 4 SEPs. Policy legibility implies the Fed should respond by following inflation down. A Taylor-like rule generally implies 150 bps of cuts for every 100 bps of disinflation (an average of a cut a meeting if inflation returns to 2% over the next 4-5 quarters). We recognize these kinds of cuts would only transpire with a lag (and under our own preferred framework would too), but so long as the responses are proportional and well-communicated, such a lagged approach can suffice.

- The Fed’s effect on the supply side implies data flexibility. Powell talks about the supply side as a given, but recent research has stressed the importance of the Fed’s effects on investment in innovation. Further tanking investment in research and development, multifamily housing, and energy projects could rebound against the Fed’s on the inflation front beyond 2024; there may be a trade-off here. The Fed should take a broad view of its effects on the economy beyond inflation and unemployment and react accordingly.

Our PCE decompositions for October 2023: