What to Expect:

- The Fed will step down from their breakneck pace of 75 basis point hikes to a still very brisk 50 basis point pace of hikes.

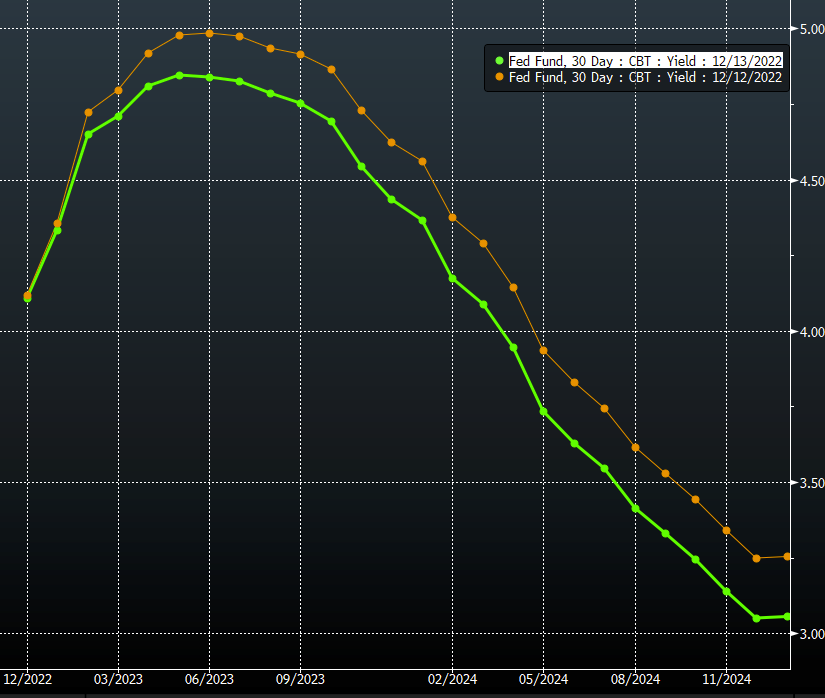

- FOMC members are likely to signal that the peak Fed Funds Rate will be above 5%, likely in the target range of 5-5.25%.

- FOMC members are likely to project even harsher increases in the unemployment rate in 2023 as part of their projections for the economy under 'optimal policy.' They were already projecting a 0.9% increase in the unemployment rate (to 4.4%) at the September FOMC meeting. They are now likely to project an unemployment rate close to in 2023. Typically such increases in the unemployment rate foretell further increases in unemployment in 2024 (in the absence of a subsequent policy intervention). We view this to be the most problematic aspect of the Fed's policy actions thus far. Recessionary employment declines impose direct, unequal, long-term welfare costs on ordinary Americans. The Fed could instead aim for a slower pace of job growth and wage growth, which likely will prove to be consistent with decelerating consumption and prices.

The Dynamics That Matter:

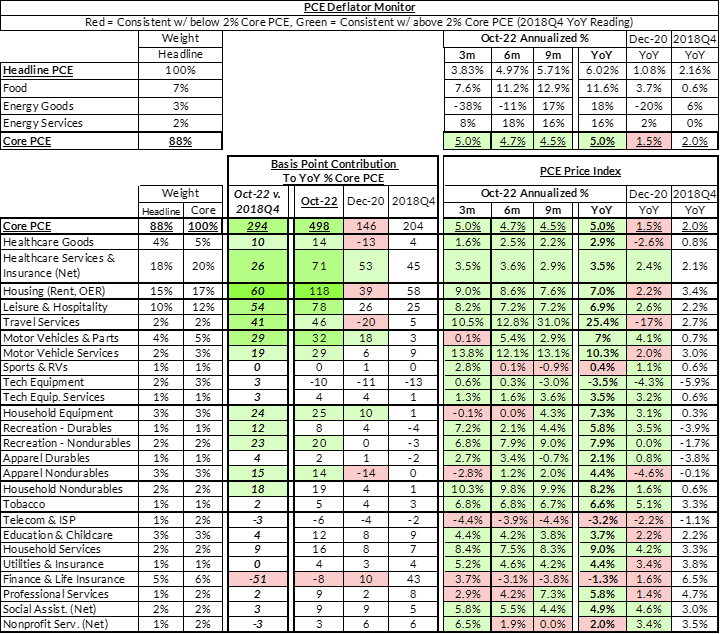

- We are now seeing potential for accumulating disinflationary momentum in October and November, but only after two surprisingly strong inflation prints for August and September. Market-implied inflation expectations have substantially corrected to levels consistent with 2% PCE inflation. This correction is also likely not due to a rise in liquidity risk premiums associated with pricing such fixed income products (riskier assets generally performed well over this period).

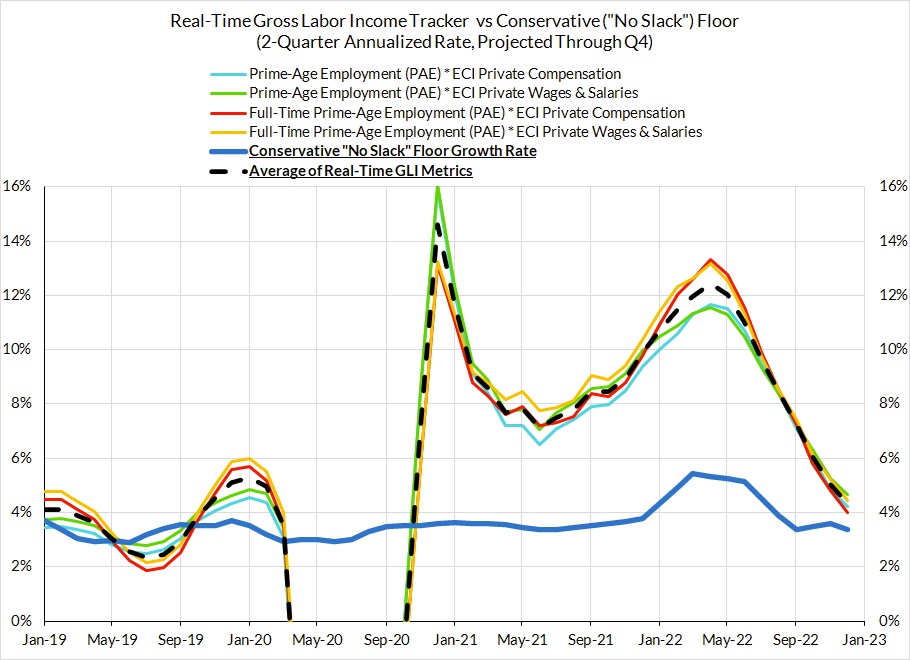

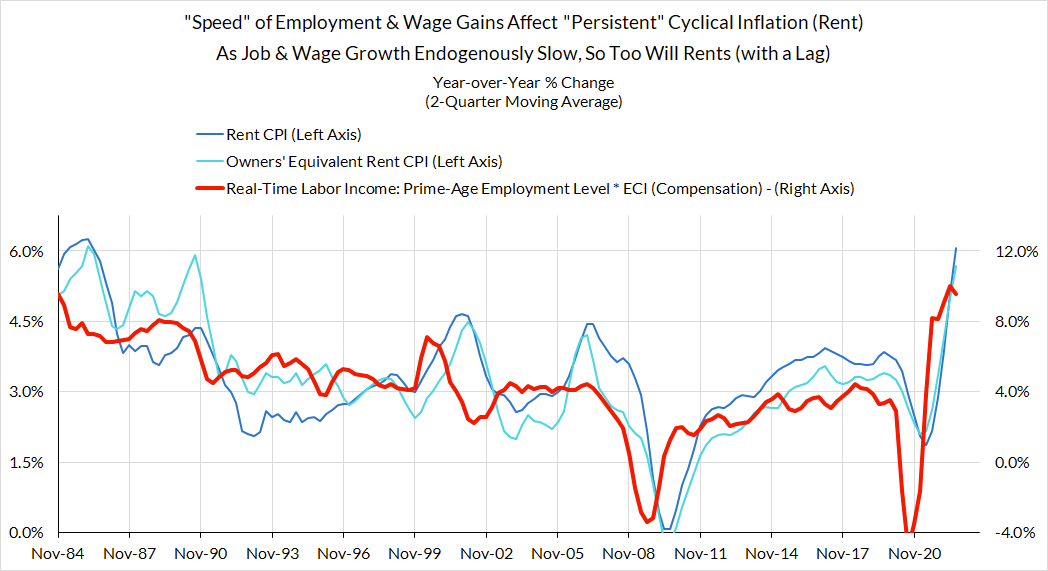

- The labor market looks fine on the surface, but there is growing scope for damage as realized tightening of financial conditions still take effect. The establishment survey's stellar nonfarm payroll prints are likely to be revised down sharply over time given the Philly Fed's calculations. If cumulative job growth is more consistent with the shallower trajectory in the household survey, that is all the more reason to take our "real-time gross labor income tracker" seriously. Measures of job growth and wage growth robust to revision issues show gross-labor income substantially decelerating, even while still running at an acceptable and respectable growth rate.

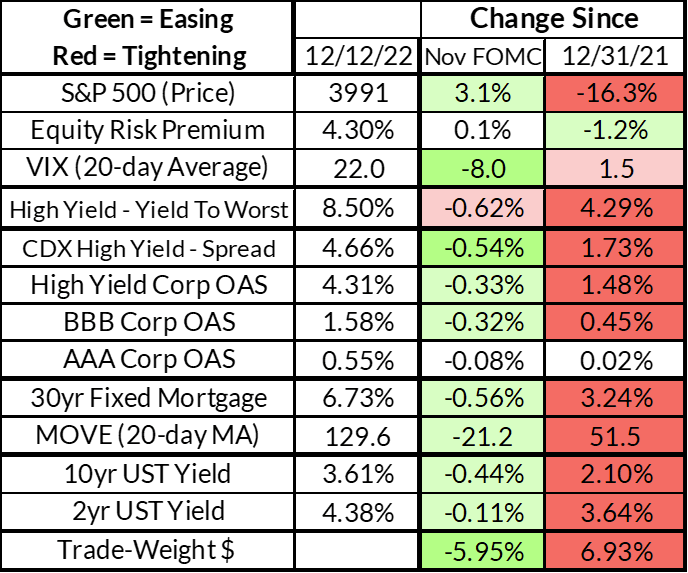

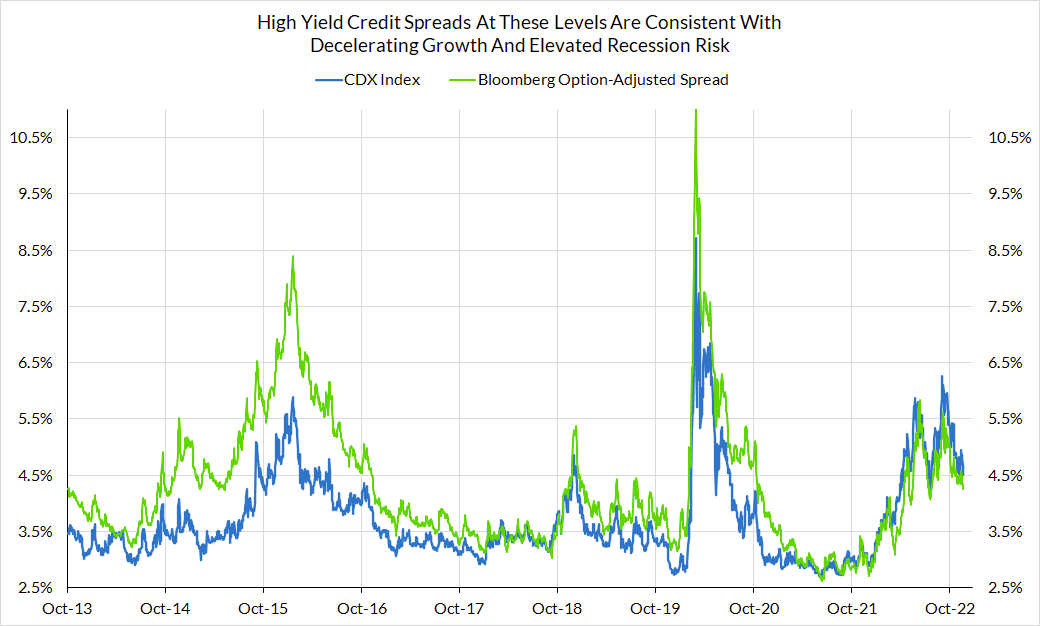

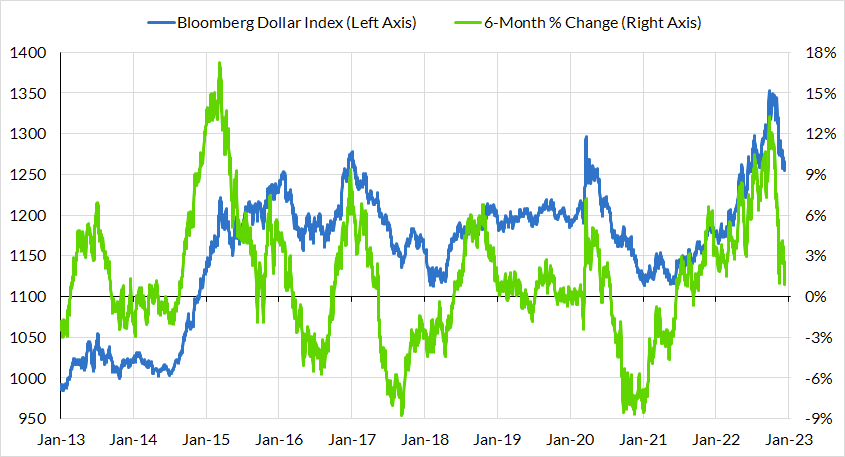

- Financial conditions have marginally eased in the inter-meeting period. Nevertheless, given the accumulation of tightening over just the past year, lagged effects from realized tightening are likely to decelerate the labor market further.

What We Think The Fed Should Do:

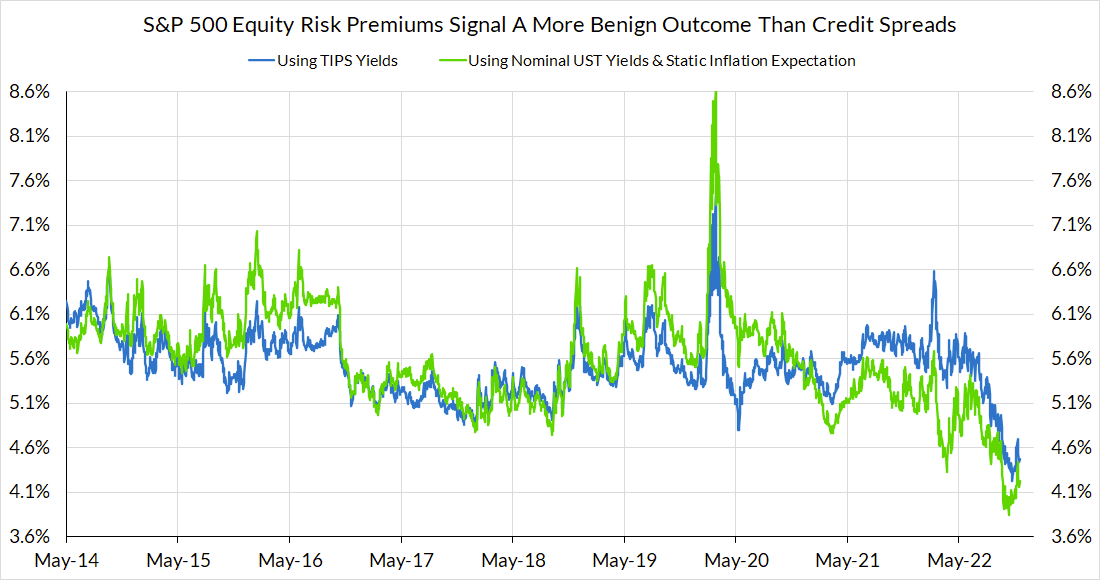

The risks to the outlook are increasingly balanced. Interest rate hikes should not serve to tighten financial conditions beyond what financial markets have already priced into the macroeconomic outlook. The best way to reconcile the Fed's dual mandate is to prioritize keeping a sufficient trajectory of gross labor income growth (job growth and wage growth). If the forecasted trajectory for gross labor income is sufficient AND inflation is likely to exceed its target over the forecasted horizon, additional tightening actions are justified. However, there is now a growing symmetry between the probability of insufficient gross labor income growth and excessive inflation. If risks are already balanced under the current outlook (informed by financial conditions), the Fed should avoid rocking the boat more than what markets have already priced in.

- Gross labor income growth is decelerating and now the Fed's actions should reflect greater downside risk to the income growth outlook. The household survey—despite its month to month volatility—offers a read of labor market health not distorted by rapid revisions. We have seen prime-age employment rates—as measured by the survey—decline over the past three months and flatline on a six month basis. Wage trends embedded in ECI data (and best forecasted by the quits rate) signal additional deceleration.

- The probability of above-2% core and headline PCE inflation in 2023 still remains elevated, but has diminished in the past two months. Inflation swaps are pricing in a 2.55% CPI inflation over the next 12 months, roughly consistent with 2% PCE inflation. We still need to see more disinflationary momentum in the realized inflation data but we can't have a meaningful trend without first seeing 2 months of progress.

- Given that the risk of excess inflation is diminishing while the rrisk of insufficient gross labor income growth is growing, the Fed should not be seeking to tighten or ease financial conditions drastically. Financial conditions are how monetary policy matters to the real economy. They reflect the broader set of asset prices and interest rates that give the Fed's policy tools all of their traction in addressing employment and inflation. The Fed's interest rate hikes are a factor—but not the only factor—affecting financial conditions. What matters to financial conditions from here are the surprises the Fed delivers relative to its expected path.

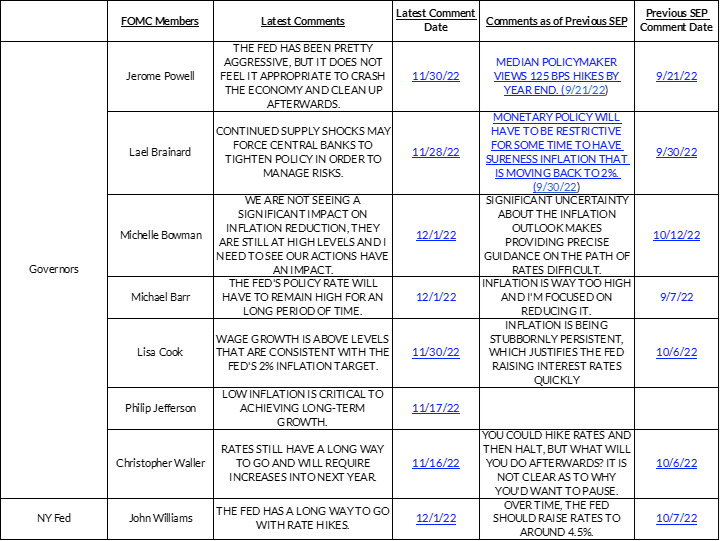

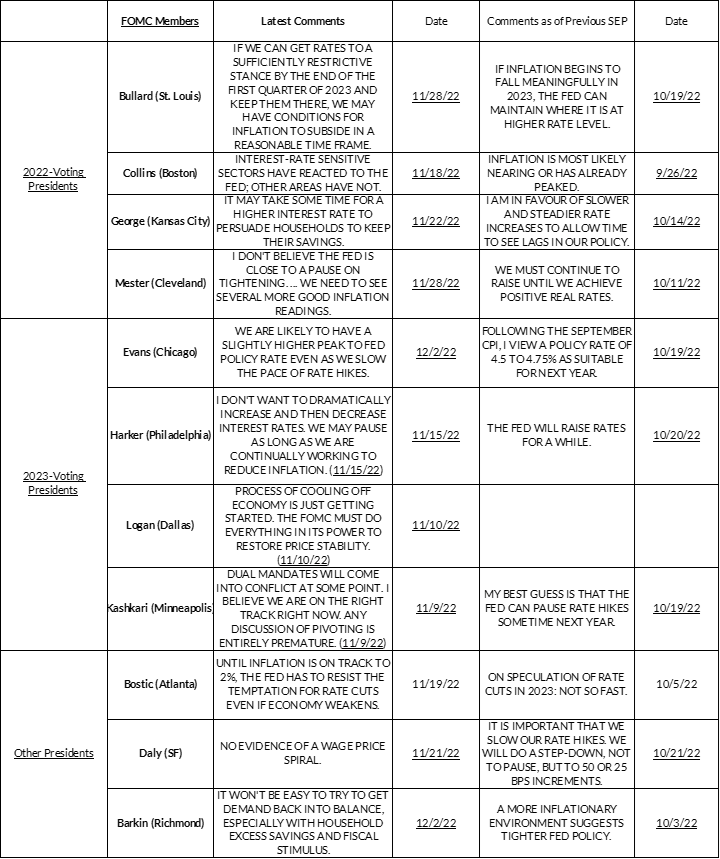

Latest Fedspeak

Macroeconomic Dynamics

Financial Market Pricing