Market rents are decelerating, which means CPI-measured rents – and with them, core and headline CPI – should ultimately decelerate as well, with a lag. But is this deceleration due to the Fed’s actions? Or is it because job growth is slowing down endogenously, as many have been expecting over this past year? Or perhaps other one-time effects – pandemic-driven migration or demand for additional floorspace, say – are ending with the pandemic?

Getting this answer right is key for assessing how the Fed should assess the balance of risks between inflation and the labor market going forward. Measured rents are a major factor in both core and headline CPI, so the stakes here are high.

It may be surprising to hear, but the balance of evidence today suggests that the recent deceleration in market rents has little to do with Fed policy overall. Although purchasing demand for new single family homes may be drying up as Fed rate hikes increase mortgage rates, those channels have little impact on instantaneous market rents.

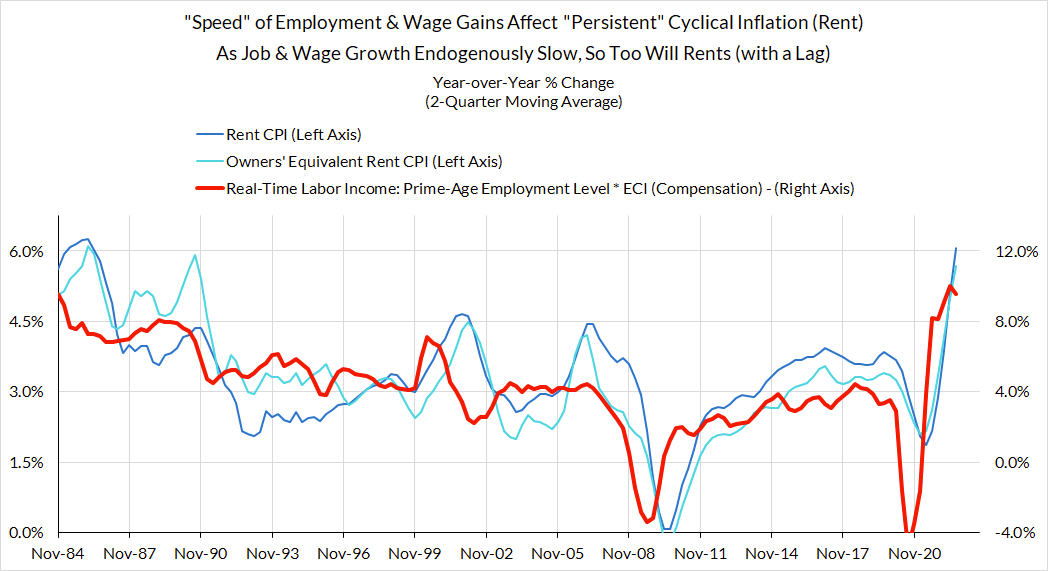

What we do know is that when the economy is adding a lot of jobs, rents usually rise. The economy has steadily added fewer jobs each month as the recovery to pre-pandemic labor market conditions concludes. It’s no more surprising to see rental prices slow down as the labor market downshifts to a more normal speed than it is to see rents jump during times of historically strong job growth (as was the case through much of 2021 and early 2022).

Some of these price increases can be attributed to one-time migration effects as well. Many moved to less dense and lower-cost areas over the pandemic, helping push up both house prices and rents in those areas by more than prices and rents fell in the areas they left. Rents, like many other things, are often priced on the margin.

Importantly, market rents began to slow down before the Fed’s hawkish policies had any identifiable impact on the labor market. Many of the Fed’s most prominent and hawkish critics feel they need to see a higher unemployment rate for inflation to come down, particularly in services like rent. The reality looks a bit different. It might be possible to construct an expectations-based explanation here – maybe landlords just have that good of a model of Fed policy – but this feels farfetched (besides, if landlords were that good, they should be working for hedge funds instead). That we see the deceleration continue at about the same pace after hikes begin certainly suggests the process is not directly dependent on rate hikes.

On a more structural level, it is not clear that there is a transmission channel from the Fed to slower rental price growth other than the labor market. Increasing borrowing costs and decreasing household wealth – two of the most commonly cited Fed policy mechanisms – don’t quite make it to rental prices.

Rent is an “operational” expenditure for households. Unless things have gotten particularly dire, most households fund the rental of housing services with labor income, not credit or from an existing stock of household wealth. That we are seeing rents come down without the labor market weakening strongly suggests that whatever labor market impacts rate hikes have had, they have yet to substantially worsen the job market. Without that, no policy transmission.

Some, though, have argued that since the entirety of rental happened during the pandemic era, rate hikes should have started sooner. The lag between market rents and CPI rents is an indication to them that the Fed is and has been behind the curve.

However, if the slowdown we are observing is not due to Fed policy, it is hard to understand how hiking earlier would have allowed us to curtail inflation without sacrificing the millions of Americans who found jobs in that period. If the hikes were strong enough to slow employment growth then, it would have meant that the Fed was actively leaning against the labor market recovery at the time and aimed to promote higher long-term unemployment as a necessary result.

Market rents peaked around the middle of 2021, long before prime-age employment recovered from its pandemic losses in mid-2022. Just because the labor market recovery is now largely complete does not mean that it was always going to have been successful, no matter the policy mix.

Had the Fed raised rates sooner, job growth would have had to stall earlier if the goal was to avoid the bulk of the demand-pull effect on rents. But that would have risked lock-in at lower employment levels, as in the extended recovery from the 2001 and 2008 recessions.

If what we care about is the ability of everyday workers to afford housing, higher long-term unemployment is a deeply unequal and immoral way of achieving this outcome.

It is extremely interesting that we are seeing the stickiest, most-lagged and longest-lived component of inflation decelerating during a period of high labor utilization and nominal wage growth. If there are, as some would like us to believe, “always direct tradeoffs between inflation and strong labor markets,” this situation is hard to explain. We are seeing that prices – even prices principally sensitive to the rate of job growth – can decelerate while the labor market continues to strengthen and wages rise. In truth, it suggests that we can get to 2%-consistent rent inflation while employment continues to grow. No need for the kinds of recessionary hits to employment some prominent economists are looking to engineer.

If inflation phenomena can largely correct on their own (without triggering the feared “wage-price spiral”) while labor market effects remain persistent, it makes more sense to focus energy, priority, and policy space on preserving high employment and avoiding steep employment declines.

The situation with CPI rents does suggest that the Fed should be careful about hitting the brakes any harder. Macroeconomic trends and financial conditions already indicate that the labor market is slowing down. They may not need the Fed to hit the brakes any harder. Allowing the recovery to run its course – rather than continuing to hike until we see a recession – may accomplish the Fed’s anti-inflationary goals just as well as continued hikes would, but without risking economic growth and employment.

Trying to demonstrate seriousness about inflation by pushing for recessionary labor markets may succeed in worsening employment outcomes, but it is not clear it will slow inflation much faster. Prices can decelerate while jobs still grow. Dismissing that fact in order to appear a more Hardened Realist is cheap, but the costs to workers of doing so may prove expensive.