We had a flurry of Fedspeak this week, with more than half the Committee making speeches or taking interviews. Few explicitly solidified their intention to pause, but some — like Neel Kashkari — did explicitly discount the likelihood of a pause. Bostic and Goolsbee are both on record preferring a pause at the next meeting. Others, like Jefferson and arguably Powell himself, gave softer gestures through highlighting the level of the Fed Funds rate, the speed of tightening, and the potential for lags. This contingent may opt for a “compromise” stance that holds in June while still signaling another hike on the cards for later this year.

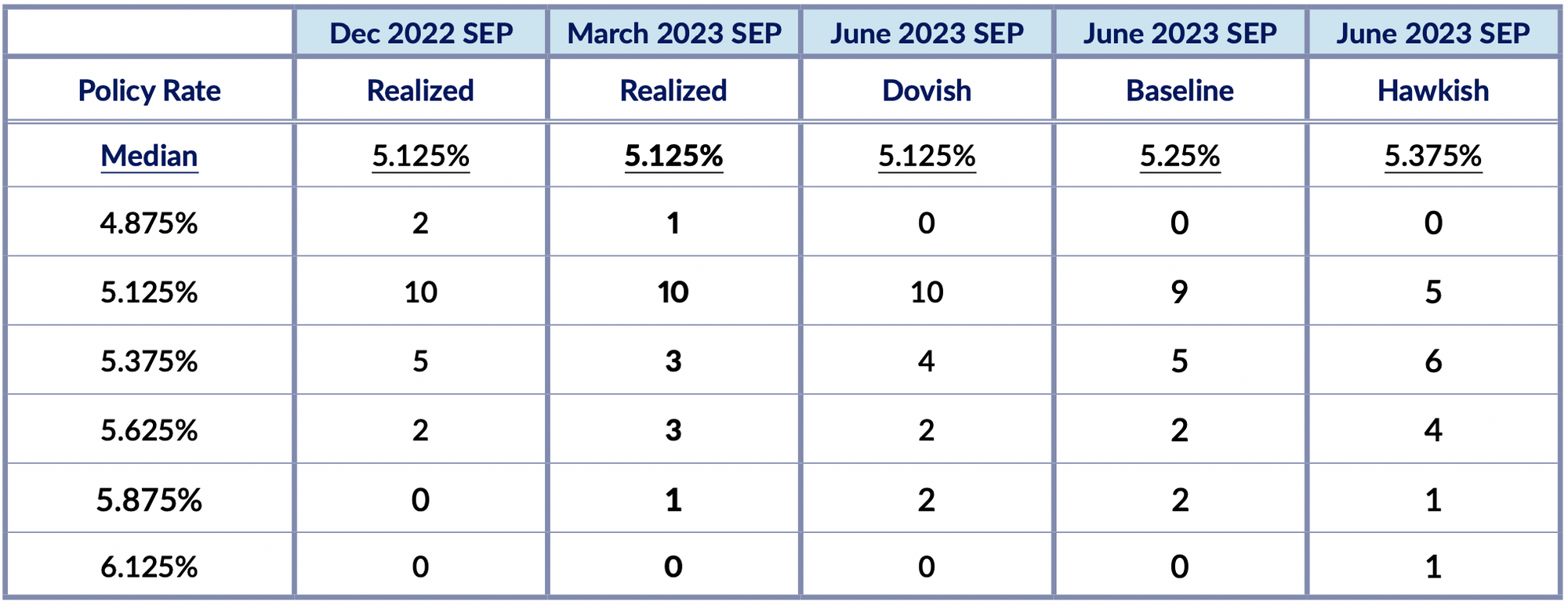

With this in mind, we present three scenarios for the next Summary of Economic Projections. We see a substantial contingent satisfied with the current interest rate, and expect that another substantial contingent will prioritize upside optionality going forward. The “compromise” will likely involve a June hold but a higher terminal 2023 dot vs March SEP, at least by half a hike. Powell will likely be uncomfortable signaling the end of hikes if the committee chooses to hold in June.

Summary Table

The full version of this Fedspeak Monitor is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.