Today’s hot PCE print keeps a June hike plausibly in play though it still seems like a hold is the better baseline view. This week saw another big round of Fedspeak — though we are still notably waiting on updates from Esther George. Kashkari, Barkin, Bostic, Daly, Bullard, Logan, Waller, Collins and Mester all either delivered prepared remarks or interviews during the week, with Kashkari doing the most, at three appearances.

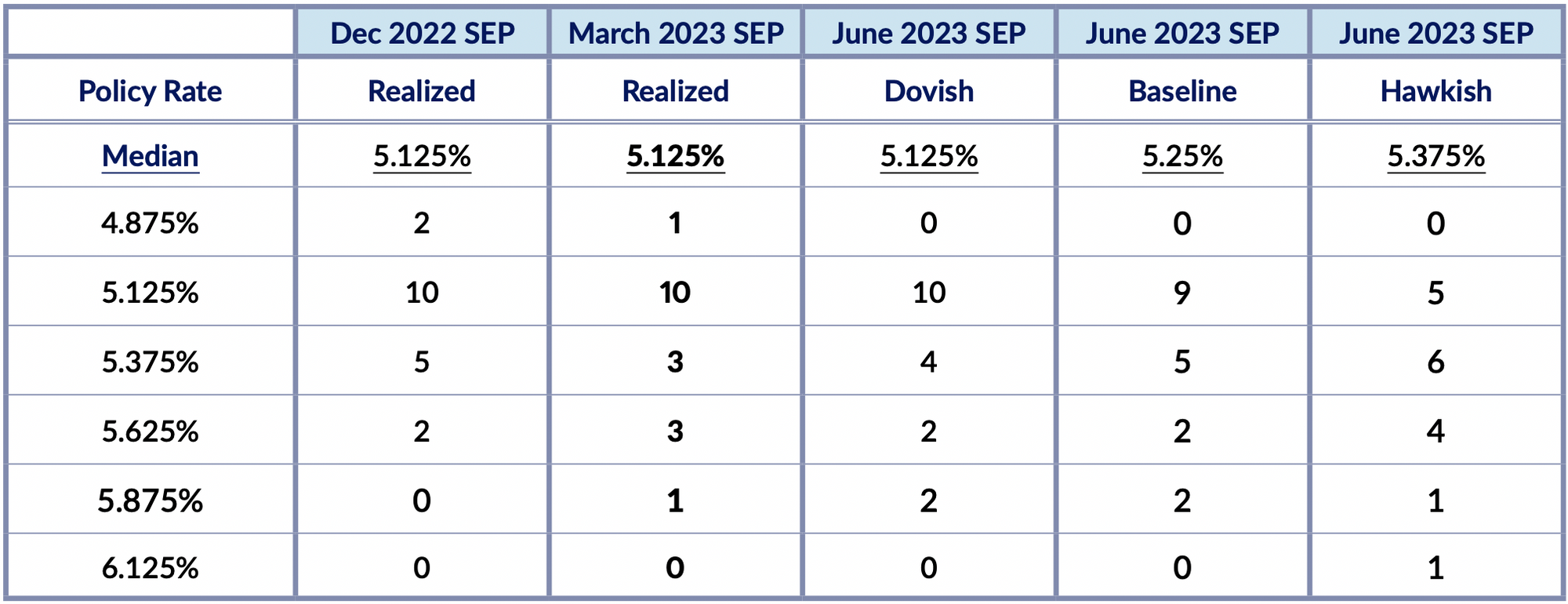

Much of the commentary has been focused on the need to remain data-dependent, while Bostic announced a preference to skip the next meeting’s hike and Bullard explicitly firmed up his 2023 SEP dot at 5.625%. Waller’s speech in particular is worth reading. In all, we continue to expect a split between committee members satisfied with current rates and a collection of more hawkish committee members who would like the rate to move one, two, or even three hikes further north.

Summary Table

The full version of this Fedspeak Monitor is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.