If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

Note 1/28/24: This post has been updated to correct the color-coding on the change in PCE price inflation table.

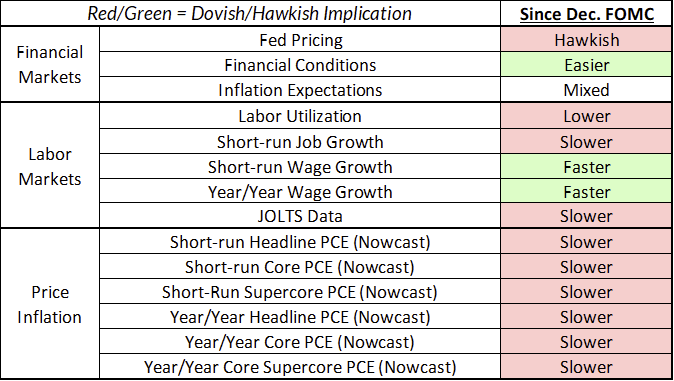

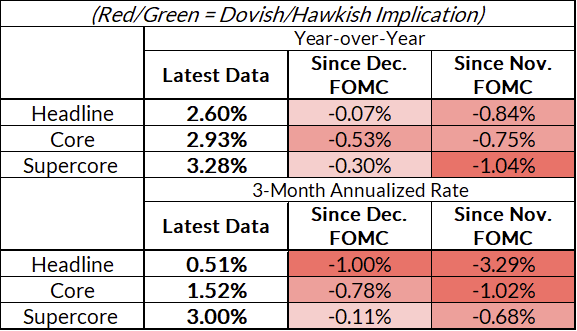

How Has The Data Evolved Since Last FOMC?

What to look for:

- A Hold: Fedspeak has been mostly noncommittal for the past few weeks, with no member endorsing a rate cut at this meeting. While there have been obvious developments that encourage rate cuts (inflation falling, labor market risk rising), FOMC members are waiting to see how much of both of those trends will stick before moving. They are uncertain as to how much of the inflation cooldown or the recent fall in employment is due to quirky seasonal adjustment, whether or not goods disinflation will continue, and how long it will take for rental inflation to follow the new-lease rent indices. Waller has expressed an aversion towards reversal of policy—in his view, the worst outcome would be to cut and then have to hike. In addition to another round of inflation and jobs data, February will also bring revisions to the seasonal factors in CPI (which flow through to PCE) as well as an update to the December employer survey data (which suffered from an unusually low response rate in the first release).

- Optionality: We expect Powell’s press conference to be similar to how the other members have been talking before this meeting: assert that they are attune to the risks on both sides of the mandate, acknowledge the progress, but maintain optionality in saying that they are still looking to see if the progress will stick. This includes the option to go in March.

The Developments That Matter:

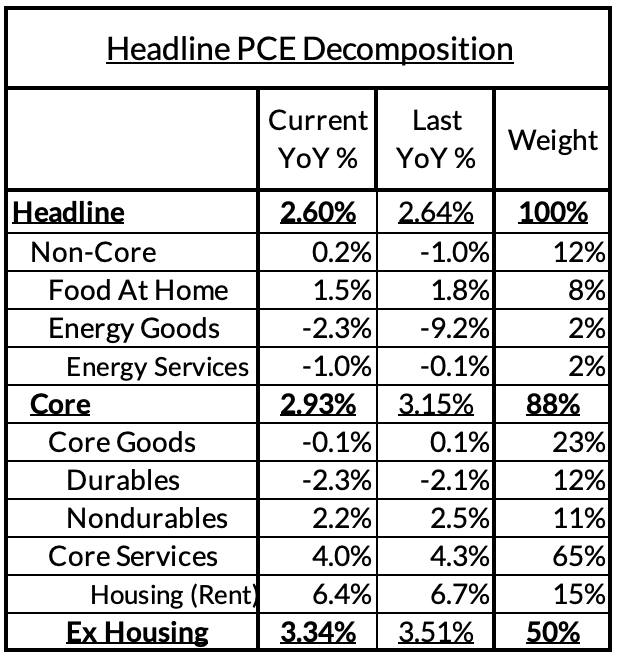

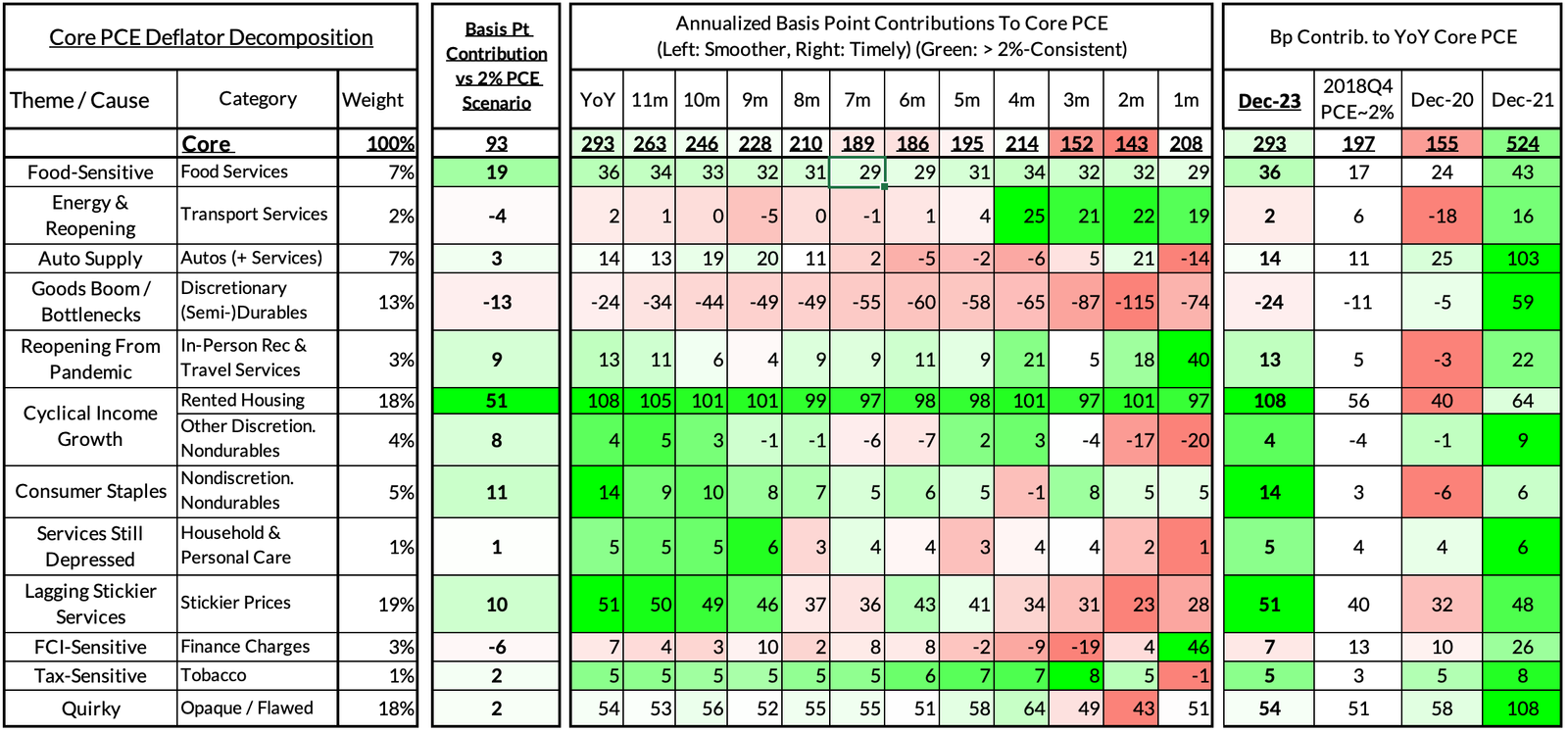

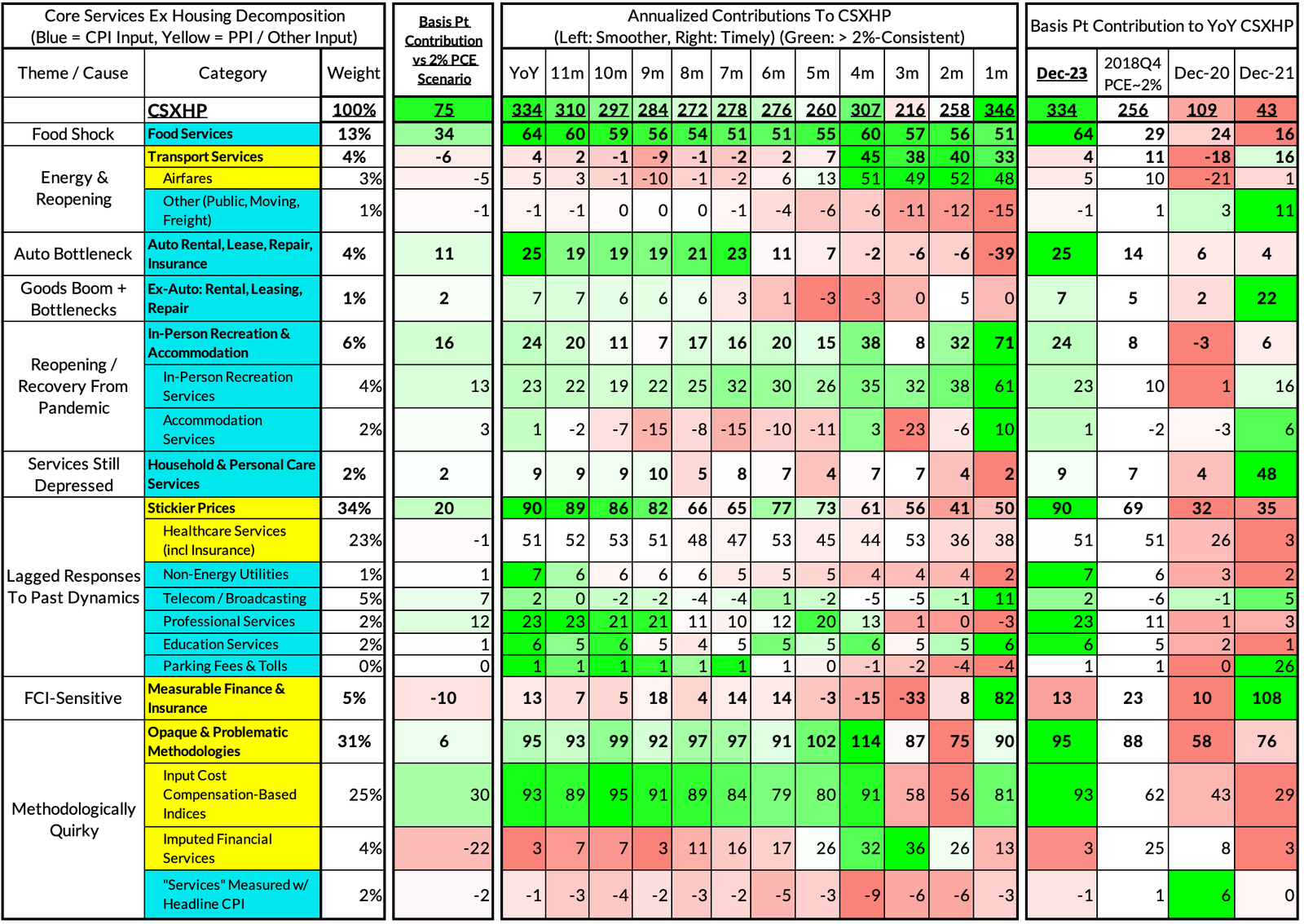

- Inflation continues to fall. Over the last three months, core PCE prices have grown at an average annualized rate of 1.5%. The quarterly growth rates for both Q3 and Q4 2023 were 2.0%—exactly the Fed’s target. While core services ex-housing inflation was warmer in December than in October and November, much of this is attributable to changes in financial services charges that are essentially driven by stock market movements, and inflation in this category is substantially lower on a year-on-year basis.

- Labor Market Risks are Elevated: The household survey for December was cause for worry. While unemployment is still low, the prime-age employment rate is now 0.5 percentage points off its high earlier this year. While there are not any signs of layoffs—which would be the biggest red flag—there are signs of a hiring slowdown in the household survey data as well as the JOLTS data. The hiring rate is now at 2014-2015 levels. However, these could be due to strange seasonality issues (the prime-age employment rate also fell in late 2022 before rebounding to new highs), but the data from December is cause for concern from a risk preemption point of view.

- Good News on Growth: Real GDP grew at a rate of 3.3% in Q4 2023, with a Q4/Q4 growth rate of 3.1%. That latter number is significantly above the prediction from the December 2023 Summary of Economic Projections (2.6%) and far above the prediction from December 2022 (0.5%). This GDP growth has happened even while hours growth has been slowing, indicating that the Q4 productivity number will likely be impressive.

- Lots of new data is around the corner: Just two days after the FOMC meeting, we’ll get another round of labor market data; the next week will bring revisions to the CPI seasonal factors, and the week after that will bring January CPI and PPI. The next jobs report will be informative not only about January, but about December as well. The December jobs report saw a strong establishment survey report with 216,000 jobs added, but the response rate was under 50%, its lowest in over 30 years.

What we’re thinking

- Given the timing of the data releases, maintaining optionality is good: At this moment, there is a lot of uncertainty not only around the inflation and labor market outlook but around how much of recent data trends are real. The timing of the pivot coinciding with the most seasonally weird part of the calendar unfortunately means the Fed is operating with an unusually low amount of clarity. To that end, Fed officials keeping quiet about the timing and extent of rate cuts (while not closing the door on March) is prudent.

- If the labor market slowdown sticks and inflation looks fine in February, be ready to go in March: By March, the Fed will have a majority of Q1 inflation data, new seasonal factors for CPI, and another two months of labor market data (plus a clearer look at December). If the labor market slowdown is still apparent after that and inflation continues to remain low, March would be a very good time to begin cutting in order to preempt labor market risks.

- Our productivity optimism is being validated: We won’t get the productivity number until next week but the combination of slowing hours and strong real GDP growth indicates that the productivity number will impress once again. For the Fed, this should shade down concerns about hot wage growth, especially since there is still room for wage growth to catch-up.

The Fed continues to drag the supply-side: While the overall real gdp number was strong, residential fixed investment is still weak and real private research and development investment growth has been negative for two quarters in a row. The Fed needs to account for its effects on the supply-side and how they might pose inflationary threats down the road.

Our PCE decompositions for December 2023: