One popular narrative thread throughout the post-pandemic labor market was the “Great Resignation.” During the recovery, workers have been quitting their jobs at rates never seen before in the data. Many explanations have been proffered for this phenomenon, such as changing life priorities, workers reevaluating what they want out of a job, or a wave of early retirements.

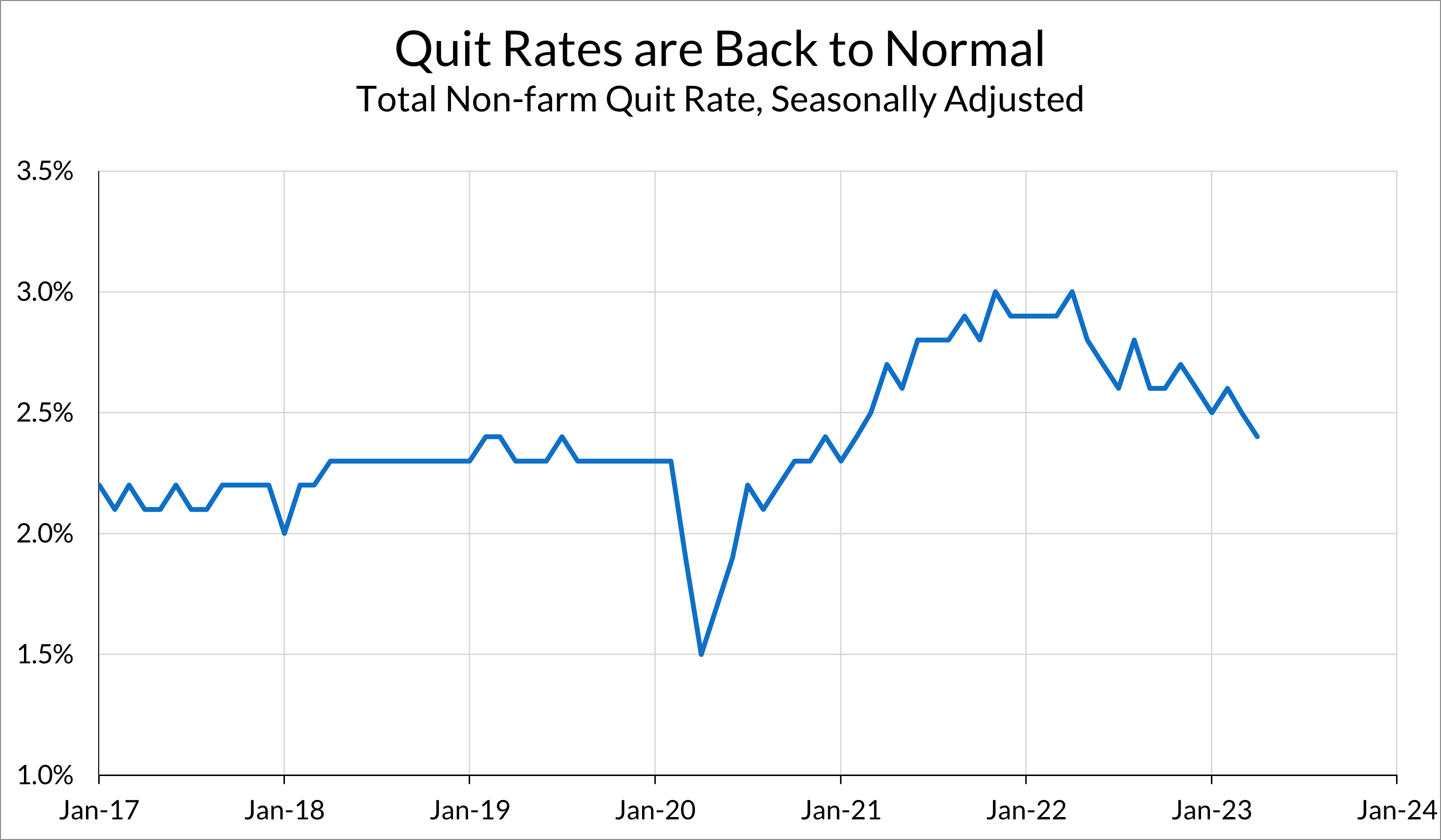

Ultimately, high quit rates are a sign that the labor market is good for workers. Higher quit rates mean that workers are more likely to leave their current jobs for better jobs, or feel more confident in their ability to find a job while unemployed. Here at Employ America, we consider the quit rate to be a superior measure of the health of the labor market compared to metrics such as job openings, since quits are a more definitionally consistent and measurable metric of economic activity.

The post-pandemic surge in job-hopping and quitting has essentially normalized. The quit rate averaged 2.7% in 2021, compared to 2.3% in 2019. Since then, the quit rate has remained historically elevated while gradually returning to pre-pandemic levels. In the last JOLTS release, the quit rate fell to 2.4%, well within the range of quit rates in 2019. The Fed should take this as a sign that the labor market has loosened significantly over the past year, and that further Fed action comes with increased downside labor market risks now that we’re back to pre-pandemic levels of turnover.

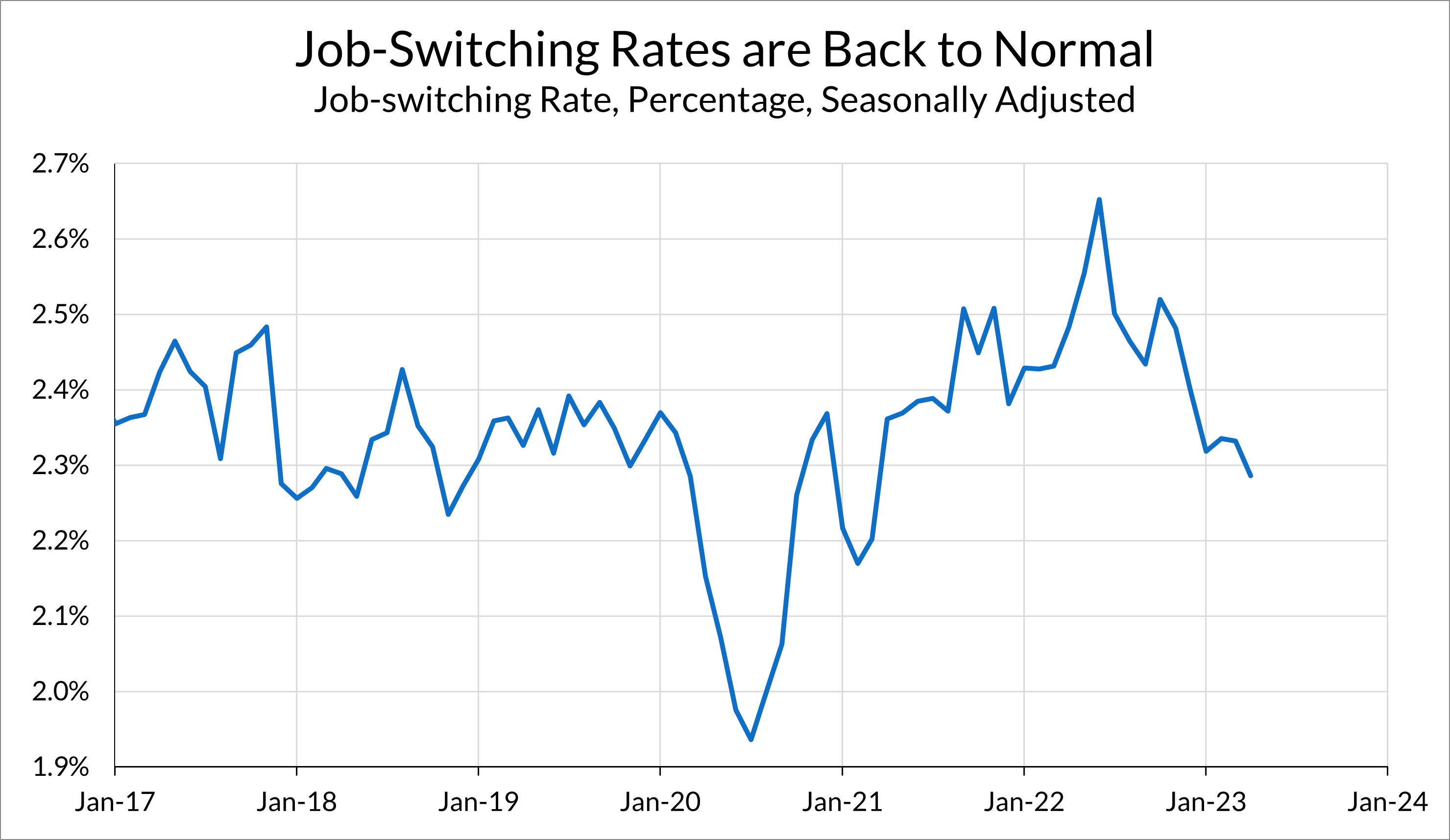

Another piece of evidence for renormalization comes from the household survey, which asks workers if they are working for the same employer as the previous month, or a different employer. The rate that workers report moving to new employers is back to normal after having been elevated during the pandemic recovery.

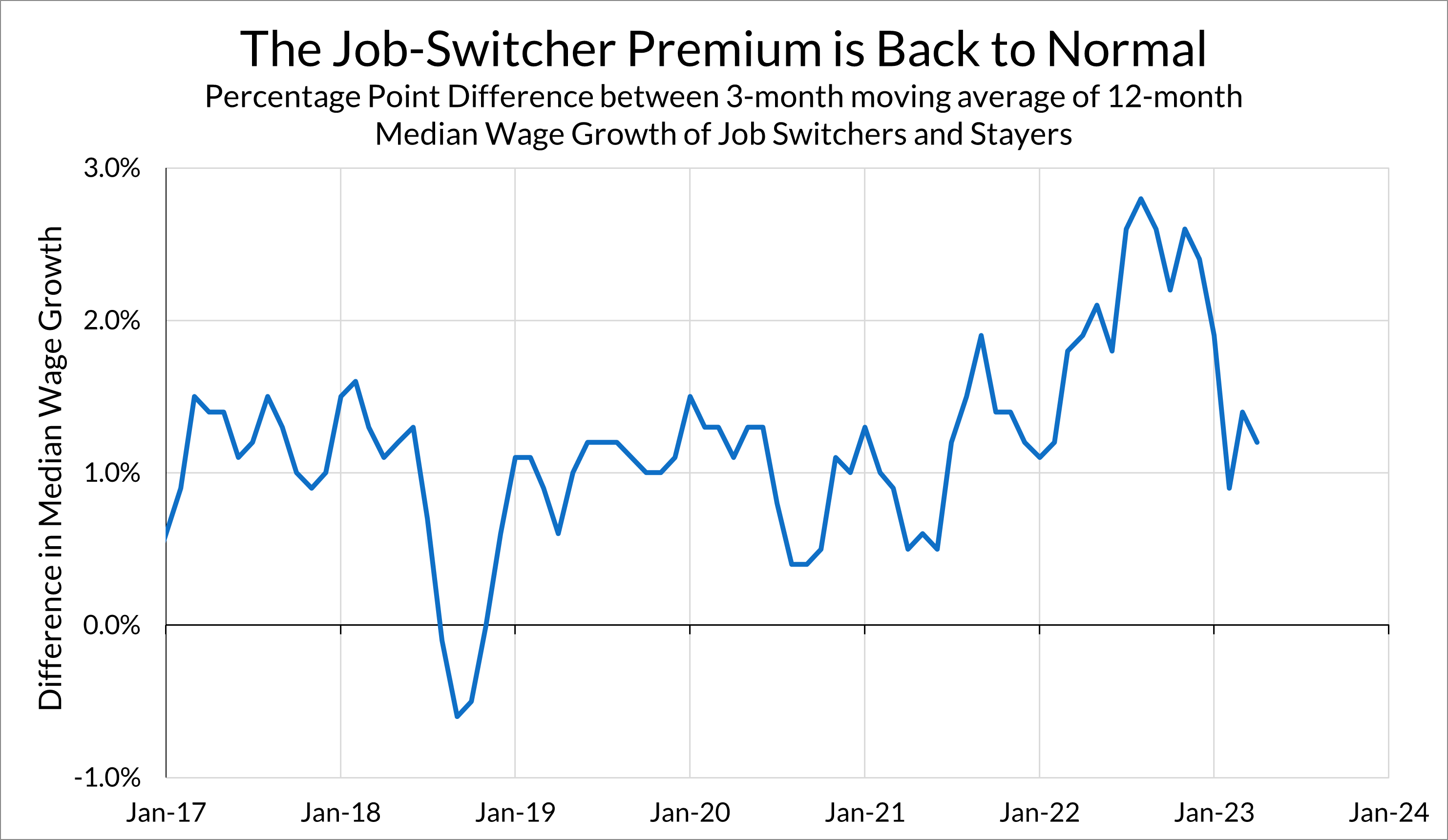

Not only has the rate of job-switching normalized; the return to job-switching has also normalized. The job-switcher “wage growth premium”—the difference in wage growth between job switchers and job stayers—has also fallen from its previously elevated levels to pre-pandemic levels.

As I wrote last week in our May 2023 labor market recap, a lot of the labor market data is pointing to renormalization. When it comes to the phenomenon of workers leaving their jobs in search of better jobs, it looks like the labor market has indeed renormalized. Despite this, the Fed, misguided by its overreliance on the vacancy-to-unemployed ratio, has continued to characterize the labor market as requiring significant cooling due to “excess demand.” As I wrote in March, now that quits and job openings are telling different stories about where the labor market is, the Fed needs to choose wisely to avoid pushing the labor market into recession.