This is the final chapter of “The Dream of the 90's is Alive in 2024: How Policy Can Revive Productivity Growth,” a new research report from Employ America. "The Dream of the 90's" examines the macroeconomic conditions that led to strong growth in the late-1990s and what policies can revive that productivity growth today.

Part I: The Three Drivers of Productivity Growth

Part II: Clear Eyes, Full Employment, Can't Lose

Part III: Boom Goes the Fixed Investment

Part IV: Gas in My Tank Feels Like Money in the Bank

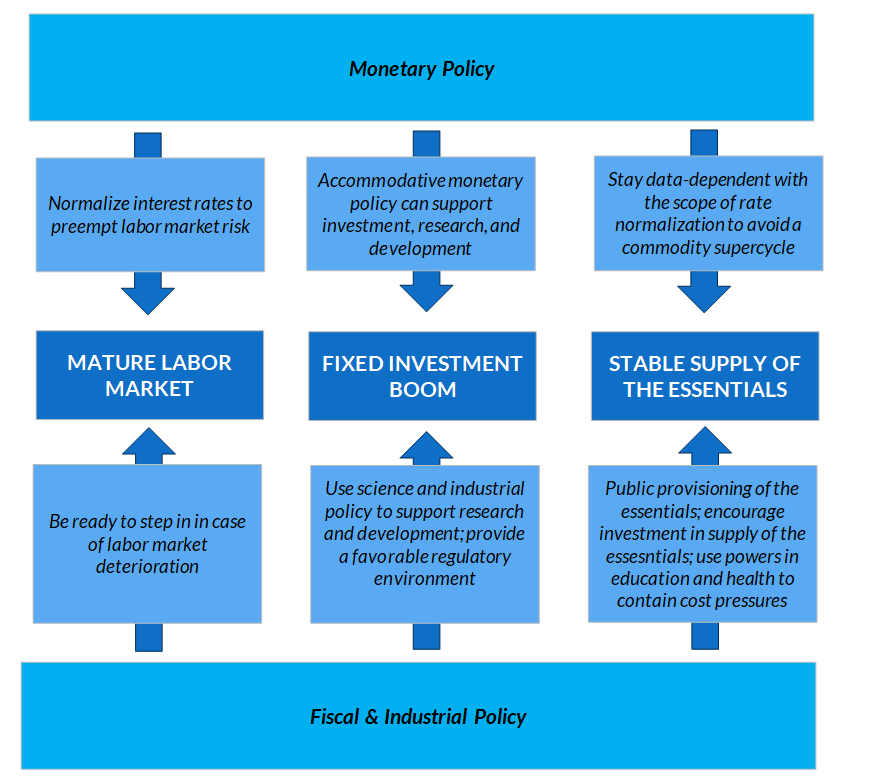

So far, we have established how full employment, a fixed investment boom, and a secure supply-side provided the conditions necessary for the 1990s productivity boom. We have also shown that we have many of the policy tools necessary for securing productivity growth again today. These conditions can and ought to be reinforced using the fiscal and monetary levers appropriate to each driver.

Keep the Labor Market Gains and Let it Mature

The biggest risk to a mature labor market today is a labor market recession. To protect this mature labor market, and the productivity gains it brings about, the Fed must be willing to preempt risks to unemployment and ensure workers have the opportunity to grow into their new jobs. Although the Fed cares about getting wage growth down to levels they consider “sustainable” with low inflation, they should remain attentive to overall labor income growth, especially if employment gains slow. Labor markets look tight today, but we know that when they start to break down, problems can quickly snowball.

To hold onto the hard-won labor market strength of the past four years, the Fed must be willing to normalize interest rates with the preemption of labor market risks in view. In “Three Motivations for Interest Rate Normalization: A Playbook for Fed Policy in 2024,” Skanda Amarnath and I made the argument that the Fed should adopt a strategy of front-loading rate cuts in 2024 for precisely this reason.

Encourage Investment and Innovation

In the 2020s, the economy is at a crossroads with respect to investment. Like the 1980s and 1990s, we’ve experienced a full recovery in employment. How policy acts to support investment from here will do a lot to determine whether the investment picture looks more like the 1980s or the 1990s. So what can policy do?

Macroeconomically, expected demand is a critical variable for policy; to secure an investment boom, policy should make sure demand remains adequate. Quick actions by both monetary and fiscal policymakers ensured a quick recovery by supporting demand and helped us avoid another stagnation trap. The Fed’s embrace of the soft landing as a real possibility has provided further optimism about the investment outlook. However, the Fed has also been consistent in its identification of “below-trend growth” as a necessary step to return to 2% inflation. Maintaining consumer demand by ensuring a baseline growth rate of labor income should be a priority. Without this, we risk declines in expected demand that invalidate the investment decisions of firms, and which may even reverse an incipient investment boom.

The second key to a fixed investment boom is to make sure the market avoids the tight financial conditions that straitjacketed fixed investment in the 1980s. As we argued in Three Motivations for Interest Rate Normalization: A Playbook for Fed Policy in 2024, the Federal Reserve cannot take the recent supply-side expansion for granted. We believe it must consider the investment consequences of monetary policy on investment, particularly investment in productivity-improving research and development. The Fed does not need to add productivity as a third mandate to its mission, but they should be aware that slowing investment today may exacerbate medium-term inflation risks, as argued by Fornaro and Wolf (2023).

Anticipation of the U.S. Federal Reserve holding off on interest-rate changes will encourage more companies to spend on capital investments again

Survey Respondent, December 2023 Manufacturing ISM Report On Business

The last piece of the puzzle is an accommodative fiscal and regulatory environment. A unique dynamic in the investment outlook today is the tremendous fiscal support for investment, thanks to IRA and CHIPS. Despite tight monetary policy, this fiscal support is buoying fixed investment (a combination of tight monetary policy and fiscal support for investment is in fact one policy mix suggested by Fornaro and Wolf (2023)). Maintaining a balance between these factors is critical to ensuring that a fixed investment boom can proceed.

For an example of how policy can help support investment in research and development, consider our series on next-gen geothermal energy, Hot Rocks. In that series, we argue that programs such as the Loan Program Office at the Department of Energy, which provides subsidized loans for high-risk investment, could help directly target the financing barriers to investment in the current high-interest rate environment. Other policy innovations like changing the accounting rules to better allow for equity investments by the federal government could also help. To return to the topic of semiconductors, smart and targeted science policy is useful but not sufficient to maintain a robust supply; sometimes industrial policy is needed as well. Finally, providing an appropriately supportive regulatory environment will be important across many sectors, from easing permitting reform for power transmission sites to easing zoning laws for multifamily housing projects.

A Resilient Supply-side is a Stable Supply-side

Of the three core productivity drivers, a secure supply of essentials is the most complex but the most powerful, especially from a policy perspective. Both monetary and fiscal policymakers should take what actions they can to ensure that supply of these essentials does not “lock up”. While the 1990s benefited from the luck of relatively calm oil prices and a foreign financial crisis, luck is not a strategy. Overall, the biggest lesson from the last few years is simply that we cannot take orderly supply chains for granted. As our own Alex Williams has argued, industrial policy should be undertaken with a macroprudential view to help stabilize inflation.

A stable supply of the essentials is an even more complex goal in the context of the energy transition. Successfully translating energy production from fossil fuels and into cleaner sources will require substantial fixed investment. The Fed will need to ensure that the monetary policy environment remains sufficiently conducive to fixed investment by ensuring robust consumer demand and favorable financial conditions. On the other hand, excessive monetary easing may result in adverse supply-side developments; as Skanda Amarnath and I argued in our piece on Fed normalization, a depreciating dollar could stoke commodity demand and a commodity supercycle. The appropriate amount of monetary easing will depend on the relevant transmission mechanisms.

The bluntness of monetary policy as a tool means there will remain important problem areas for fiscal policy to target. Building out a decarbonized electrical grid will require securing the minerals critical to green technologies. We have long been proponents of the Department of Energy using long-term fixed price contracts to stabilize the price and supply of oil. Fortunately, the Biden Administration has taken up the approach we advocated for and has made significant steps towards using these powers. They can go further by applying similar strategies to govern the supply of critical materials such as lithium. Regulatory policy should also be reformed to reduce barriers to development where appropriate (see our piece on policy interventions to promote geothermal energy for an example).

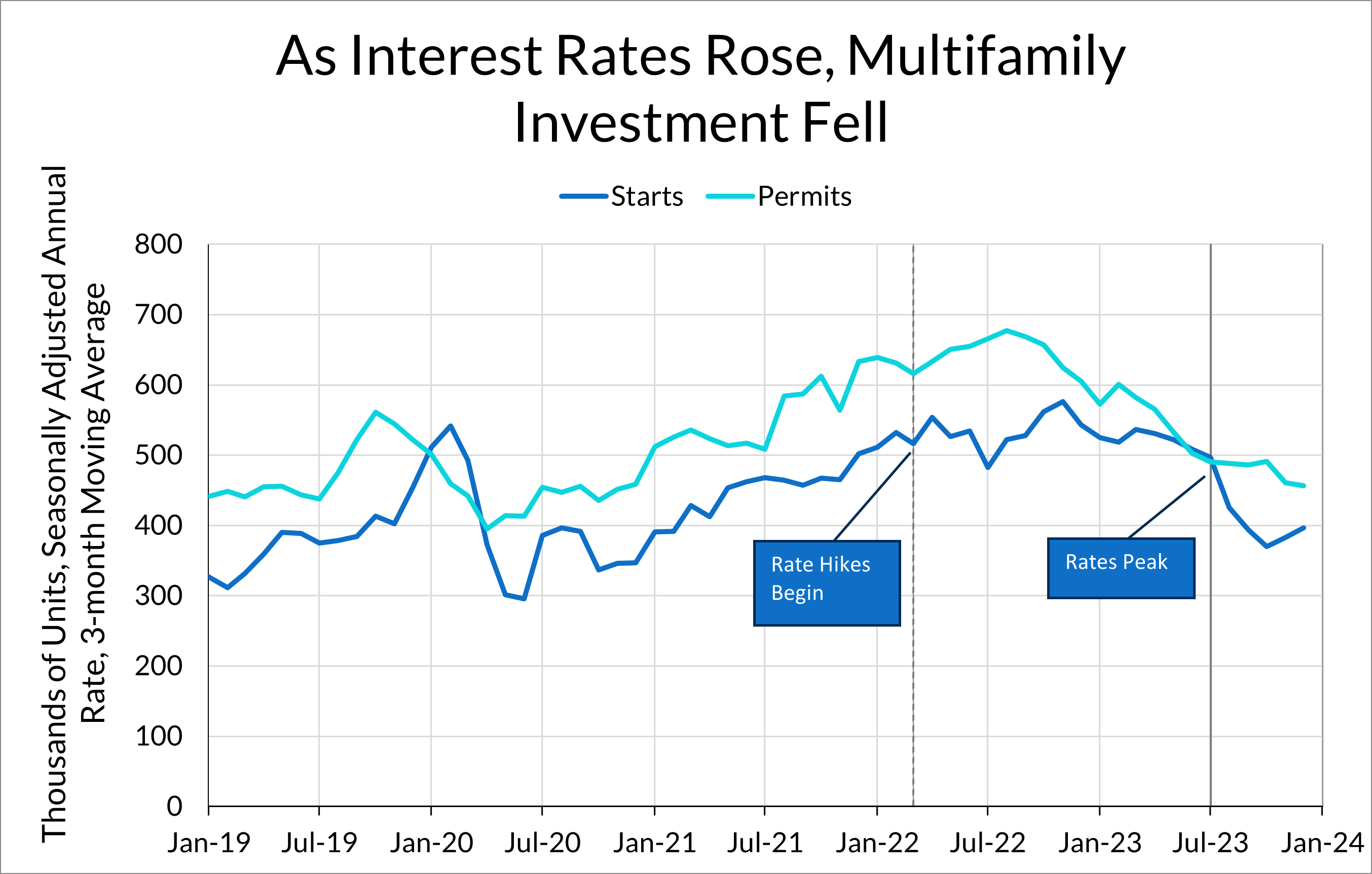

Housing is just as – maybe more – sensitive to financial conditions and regulatory policy as green energy projects. As the Fed raised rates in 2022, new multifamily housing permits and starts have fallen substantially, which bodes poorly for the supply of rental housing in the future. As Mortenson Construction Chairman David Mortenson told Neel Kashkari recently, the current rate environment is holding back construction:

Kashkari: We know the single-family home building slowed down a lot in response to monetary policy but it seemed like there was still a boom of multi-family in this region… are there more yet to come or are those on hold pending the rate environment?

Mortenson: I think they’re more interest rate sensitive, just like the single-family home. We’ve got a number of pieces of land that we’re trying to do multifamily on answer need rates to come down another 100 basis points before we think they’re viable.

January 12, 2024 Regional Economic Conditions Conference at the Minneapolis Federal Reserve

There are roles for a wide range of policy improvements here. Besides encouraging housing development by relaxing zoning regulations and barriers to development, local governments can boost housing supply by finding ways to directly provide public housing options, as with the case with Montgomery County.

Finally, the federal government should take care to contain cost increases in sectors where it has significant sway over pricing. Thankfully, medical services inflation has remained relatively low, due to aggressive cost-saving measures in Medicare; we should continue this by implementing site-neutral payments in Medicare to constrain costs in hospital services. Elsewhere, the Department of Education should use its leverage from financial aid to encourage higher education institutions to limit tuition increases.

Productivity Is More Than Just Luck

Declining to make these straightforward policy moves means abandoning strong growth, a more resilient economy, and a better deal for workers without receiving anything in return. The 1990s productivity boom was born out of the confluence of a mature labor market, a fixed investment boom, and a period of strong supply. There is much that policy—monetary, fiscal, and regulatory—can do to support these dynamics.

The pandemic recovery has left us at a crossroads in the 2020s. We’ve experienced a full and rapid recovery in employment, but monetary policy must be prudent in ensuring that wage growth and labor income growth remain robust enough to maintain demand and allow workers a chance to settle into their new jobs. Fiscal policy is doing much to encourage fixed investment, but tight financing conditions are holding back investment, especially in research and development. Encouraging fixed investment will be necessary to ensure that a steady supply of the essentials—especially energy and housing—remain available.

Whether or not we see another boom in productivity is a question of policy, not a question of fate. With the appropriate policy supports, these productivity drivers—a mature labor market, a fixed investment boom, and a stable supply of the essentials—may bring about a period of sustained economic growth and robust productivity growth.