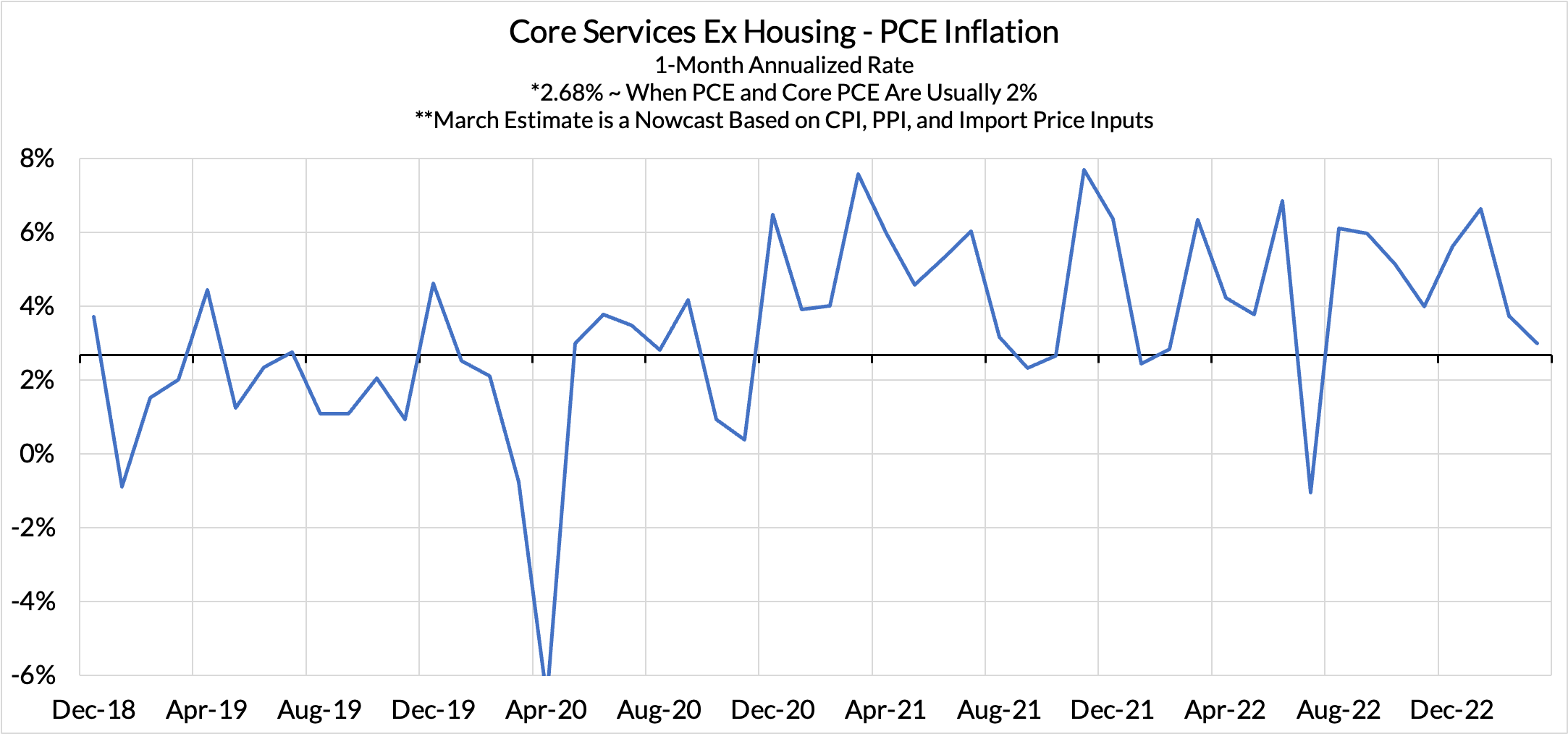

Summary: If we focus on the domestic labor that contributes to "Core Services Ex Housing PCE" output, we see that wage growth is no longer looking so hot. Labor cost pressures on "Core Services Ex Housing" PCE inflation are diminishing. Within the Fed's preferred framing of inflation dynamics, this wage deceleration dynamic should firmly diminish the case for further rate hikes to tame inflation. As it stands now, the Fed still has yet to appropriately acknowledge this labor cost dynamic.

Discussion

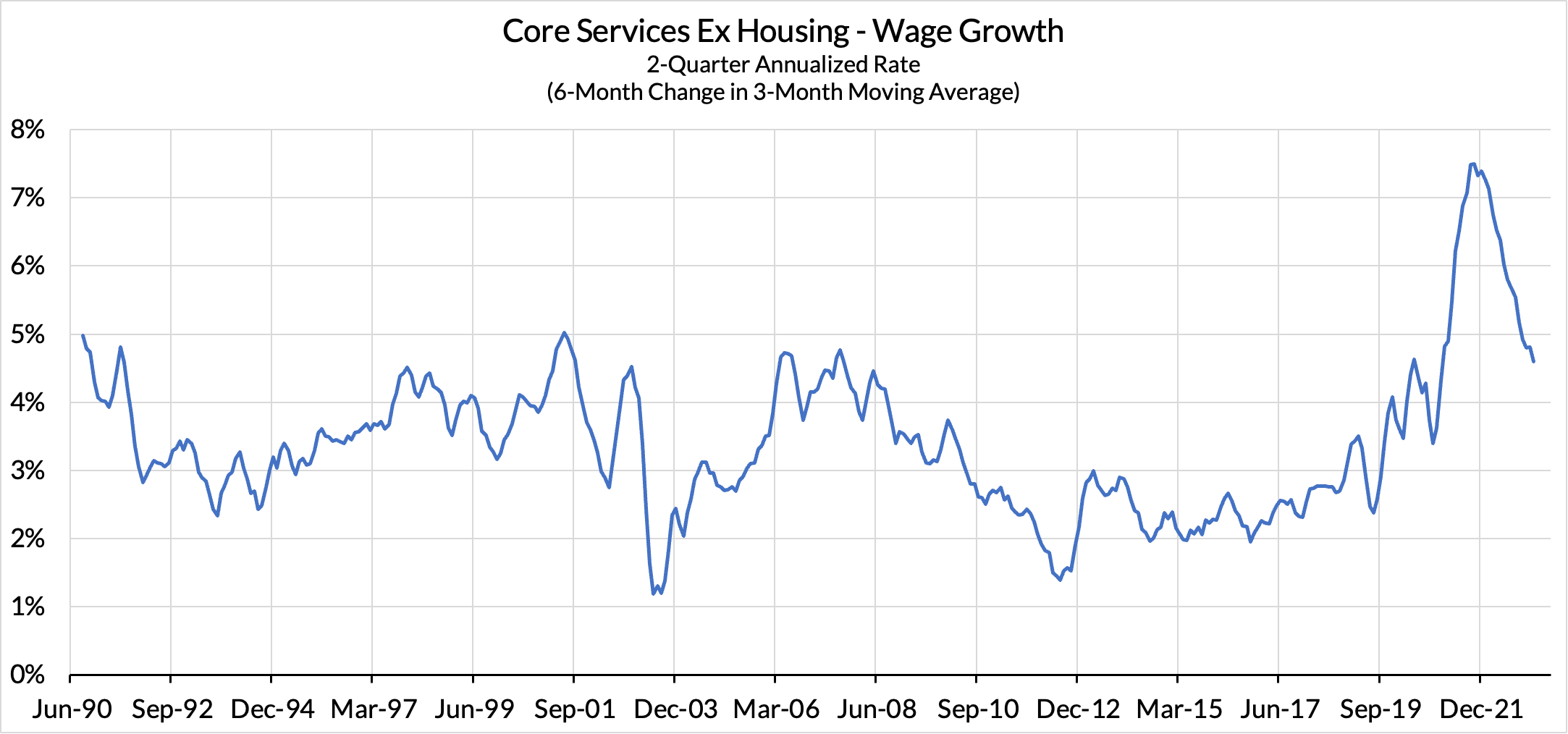

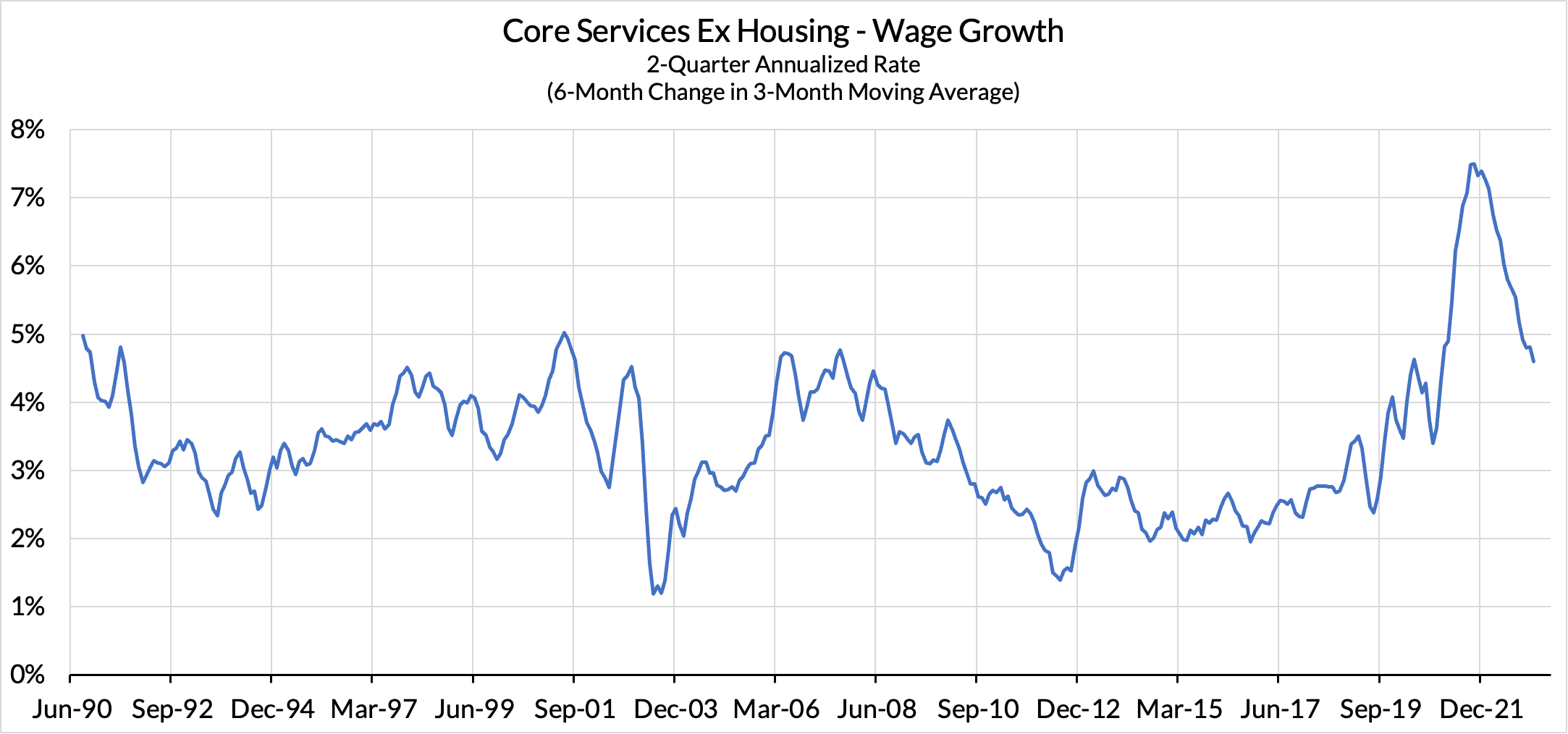

If you read Preston Mui's labor market recap after the March jobs report, you will have noticed that Preston replicated CEA economist Ernie Tedeschi's measure of "Core Services Ex Housing" (CSXH) wage growth. The measure is continuing to show material deceleration. This measure re-weights industry-level wage data according to each industry's contribution to consumed consumed CSXH output. Ernie's own analysis shows that among wage measures that forecast CSXH PCE inflation out-of-sample, this measure of wages is superior. Average hourly earnings, the Employment Cost Index, and the Atlanta Fed Wage Growth Tracker are all inferior in terms of forecasting relevance.

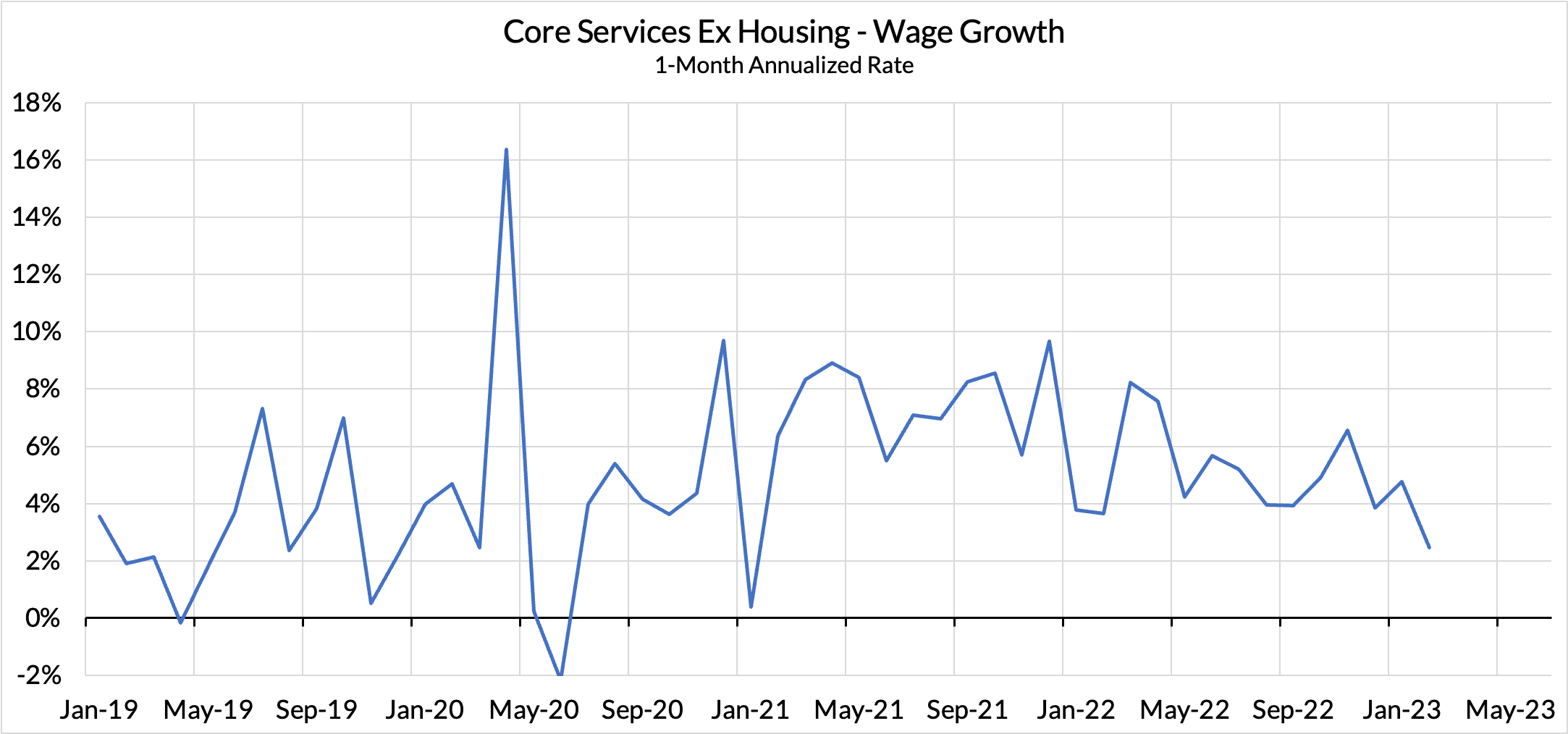

The data is showing two clear facts: (1) labor cost pressures surged around the reopening process subsequent to the pandemic but also (2) have been decelerating for over a year now. Smoothed near-term growth rates show that CSXH wage growth is now running at the same growth rate as it did 2006-07 and 2000-01.

More strikingly, the near-term data has reflected more deceleration than what is captured in the above "smoothed" measure.

If the Fed believes that its policies work on inflation primarily through the labor market (we agree there), and the labor market's pressure on non-housing services inflation is dissipating, the Fed's case for weakening the labor market further should also diminish.

To be clear, we do not adhere to the Fed's claim that "Core Services Ex Housing" PCE inflation is caused by wage dynamics. But to the extent the Fed intends to be internally consistent and reckon with the most robust interpretation of their own claims, the case for a strong "wage-cost-push" dynamic is diminishing.

For ourselves, if we saw enough risk of job growth and wage growth breaching our threshold "floor" growth rate, that would be enough case for the Fed to pivot away from tightening financial conditions. A Fed framework oriented around labor income and labor income growth outcomes is far more robust than one centered around consumer price inflation outcomes, which are more attenuated from Fed policy and subject to a wider set of proximate non-monetary causes.