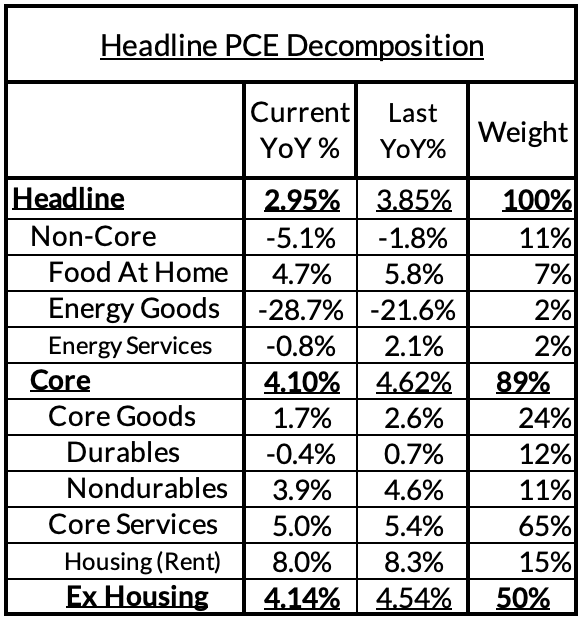

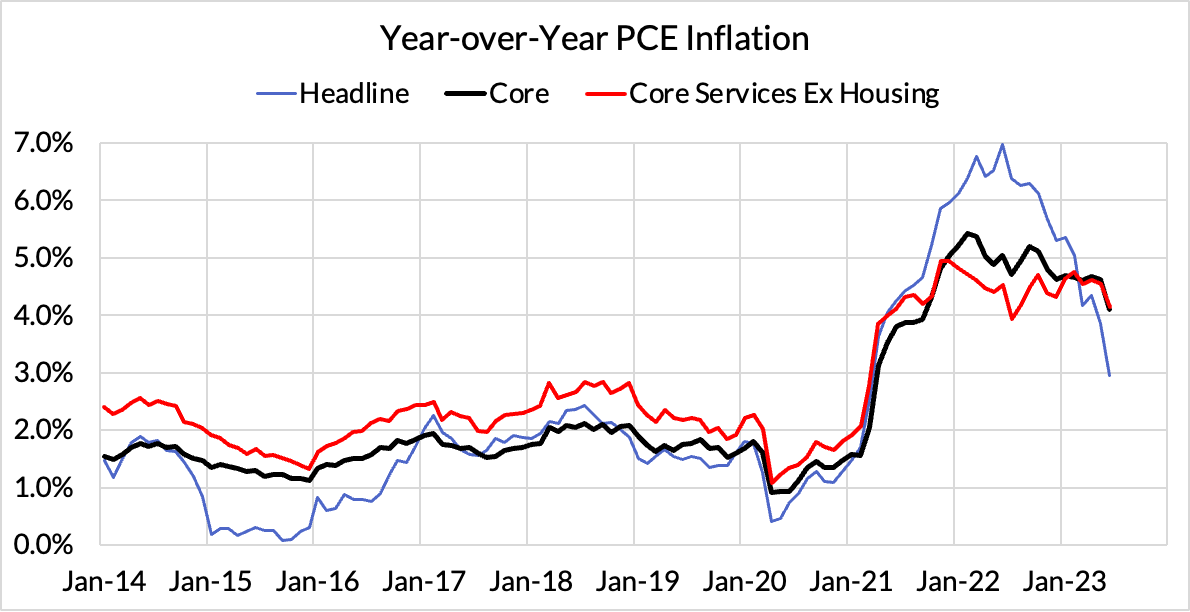

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

Summary: As we've noted now for the previous two CPI recaps, the details continued to look encouraging and signal a deeper inflection point in the inflation data. The key inputs to PCE (note: NOT airfares) are showing deceleration and these inputs tend to have forward-looking signal. We will see tomorrow what news June PPI + revisions bring; it's very possible the Fed's internal nowcasts for June Core PCE at the July FOMC meeting signal what we are tracking: that Core PCE is set to underperform FOMC members' projections in both June and March. Core Services Ex Housing PCE could show even sharper deceleration in June than it did in May (though best to wait for PPI before getting too far ahead of ourselves). Today's information puts far less pressure on the Fed to deliver a second additional hike after July. And if PPI inputs to PCE come in very weak tomorrow, a July hike will look more like hawkish dogma than data-dependence.

The full version of this Corecast installment is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.