This preview was originally released this past Sunday to Premium Donors. If you would like to get the first look at this kind of content, please feel free to reach out to us here or start a 30-day free trial today

Sections:

- Summary

- Key Dynamics Within Baseline View

- What's it going to take to get back to 2% Core PCE? A Roadmap

- CPI Charts

- From Our PCE Recap (For Those Who Missed It)

- Past Inflation Previews & Commentary

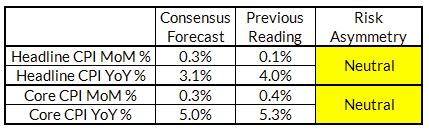

Summary: The risks for June (CPI) are finally looking more balanced after three previous months of lurking upside risk. We can see meaningful upside and downside scenarios here. From July through September, we are likely to flag downside risk to Core CPI and to a lesser extent Headline CPI.

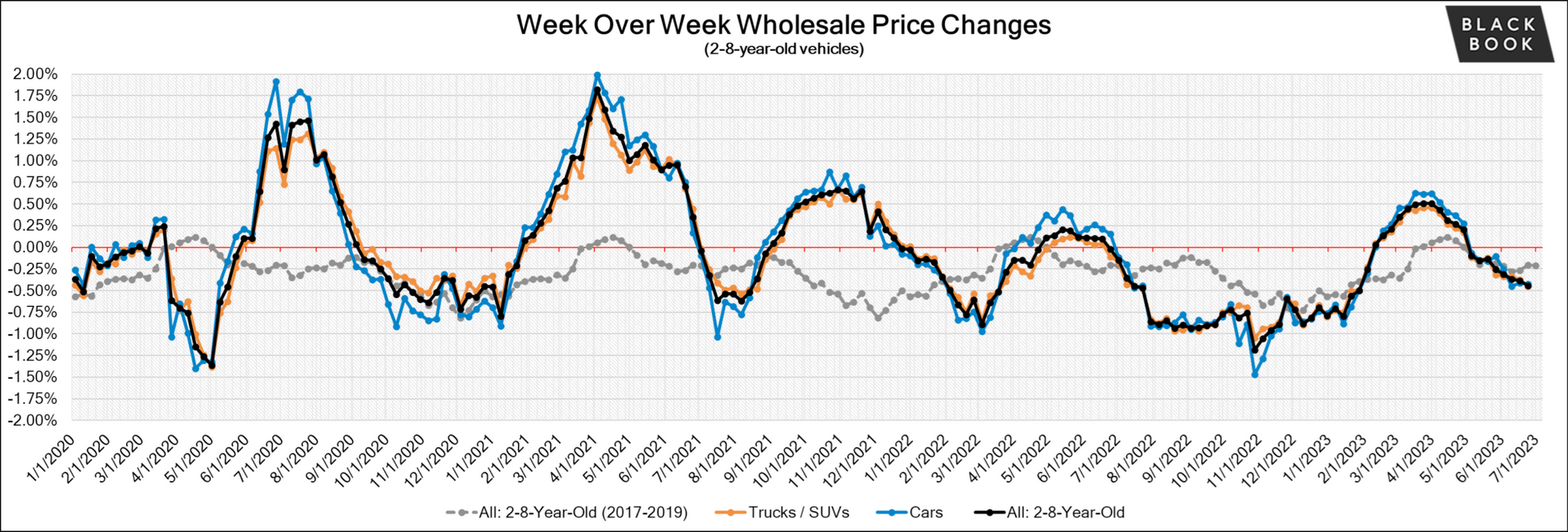

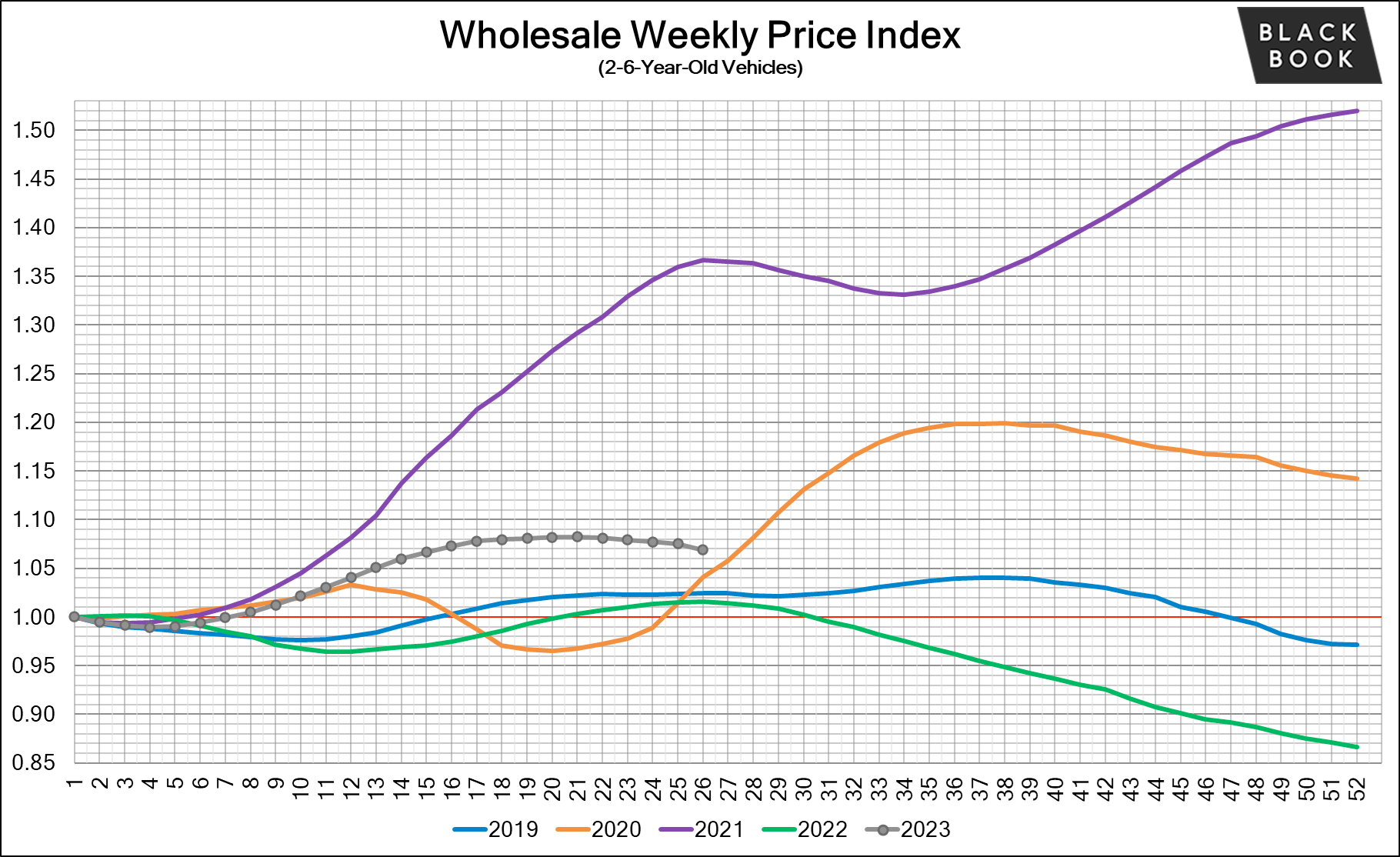

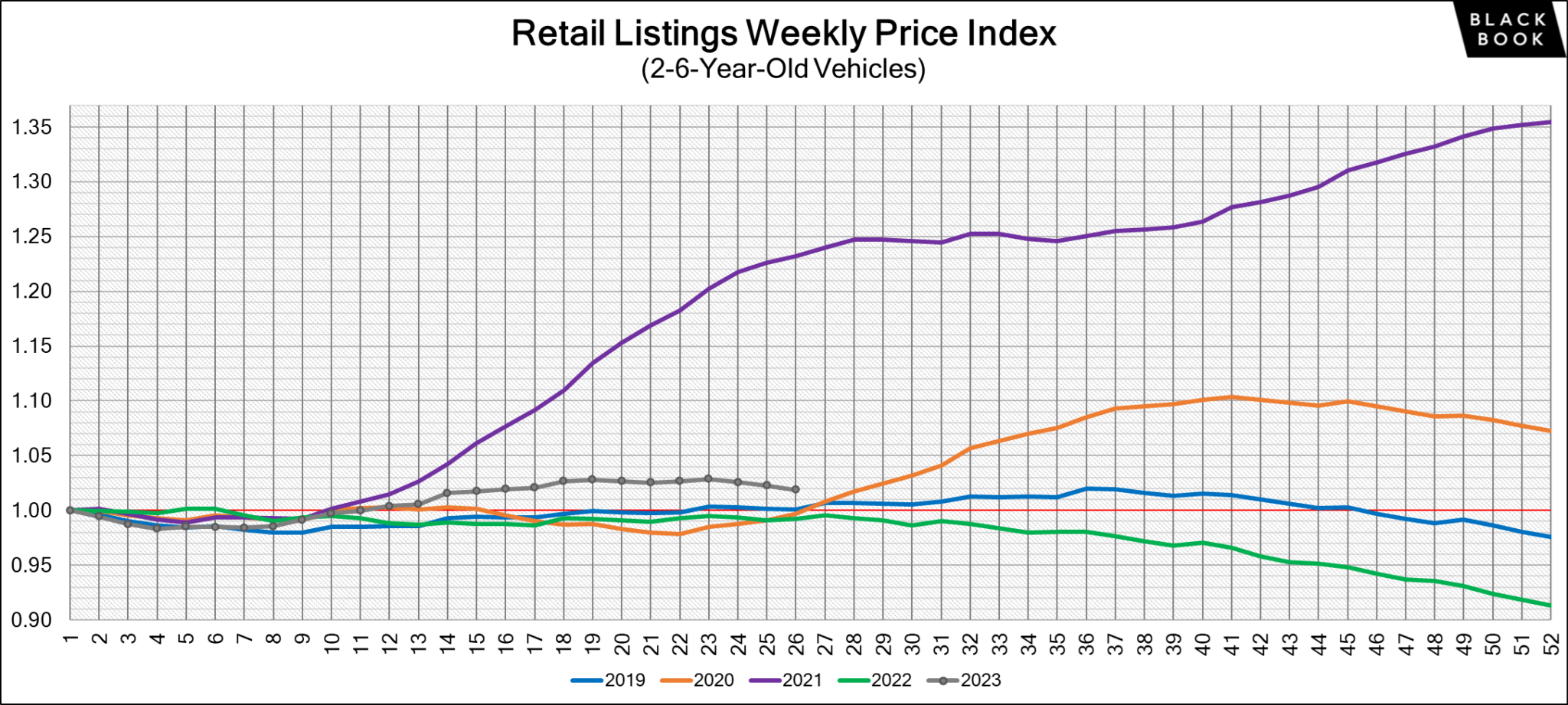

- Used cars and rent: Used cars and rent disinflation brings down our base-case for core CPI to 0.29% m/m, in line with the forecasting consensus (0.3% m/m). There are pathways to upside and downside surprises such that the risks are balanced. In terms of Fed policy and market asymmetry, a downside surprise (0.24% m/m or lower) seems more important and impactful.

- Not Yet Primetime For Downside: The two reasons we are not ready to flag downside risk in June CPI: 1) used cars CPI can lag private measures of wholesale and retail used cars quite variably around these inflection points, and 2) some of the service CPI disinflation last two months might be a little too fast too soon (some good breaks that might foretell a bad break this month).

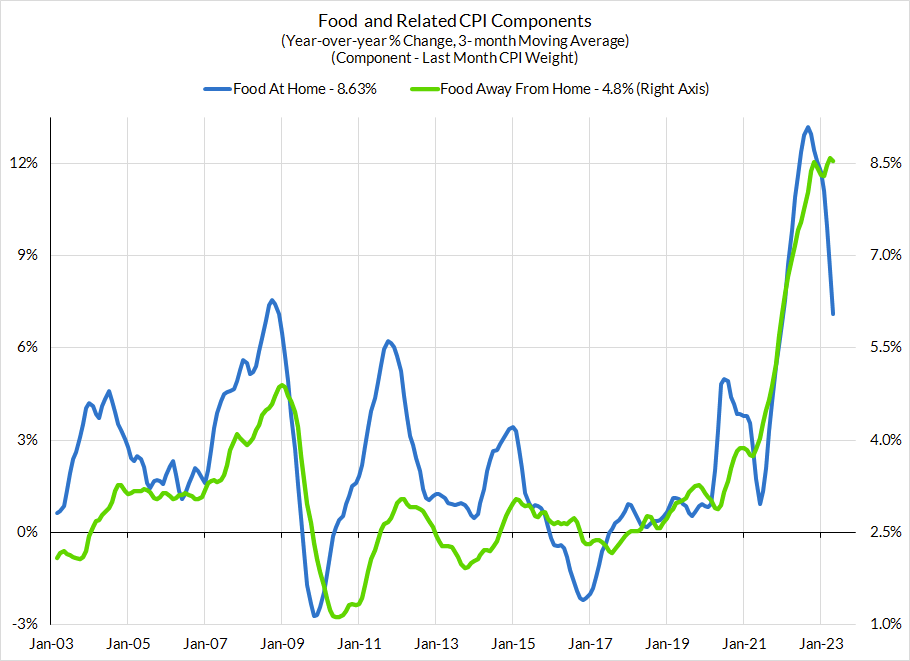

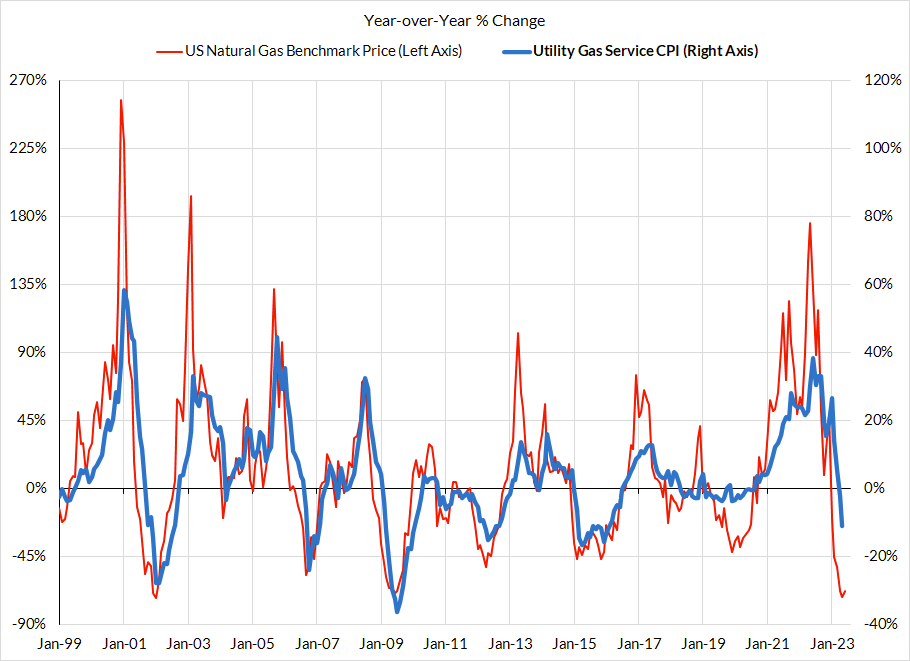

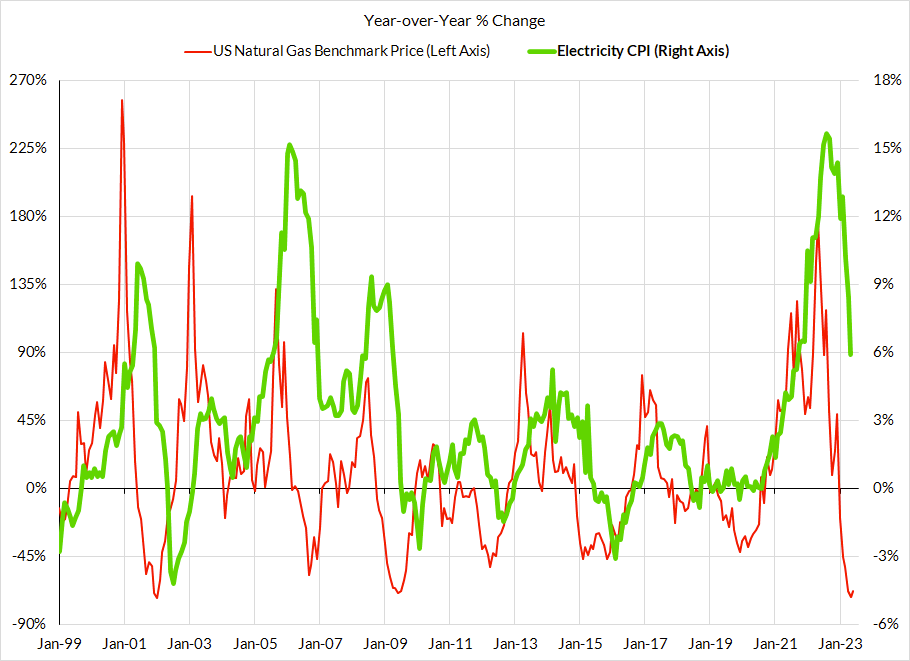

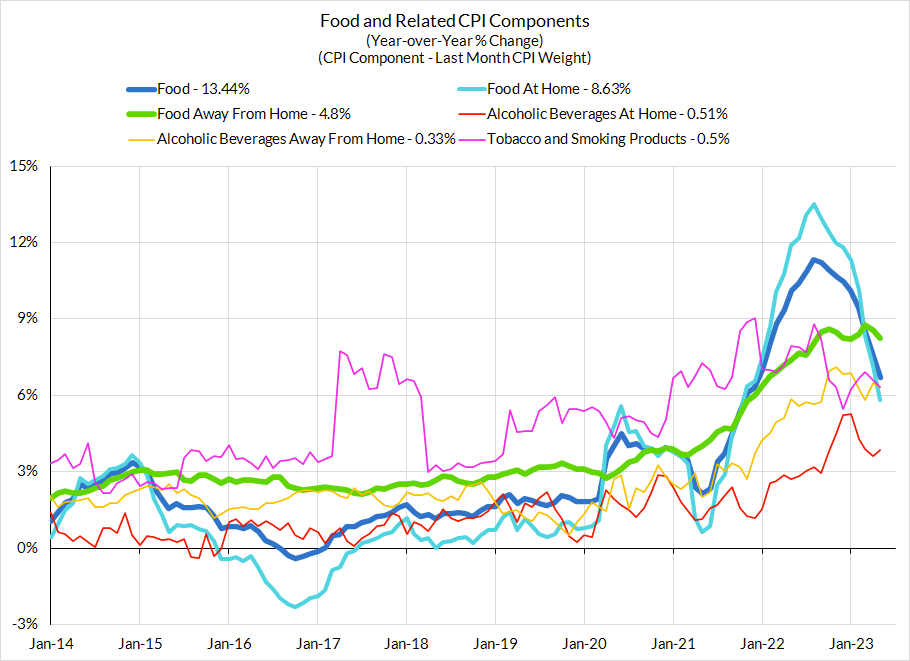

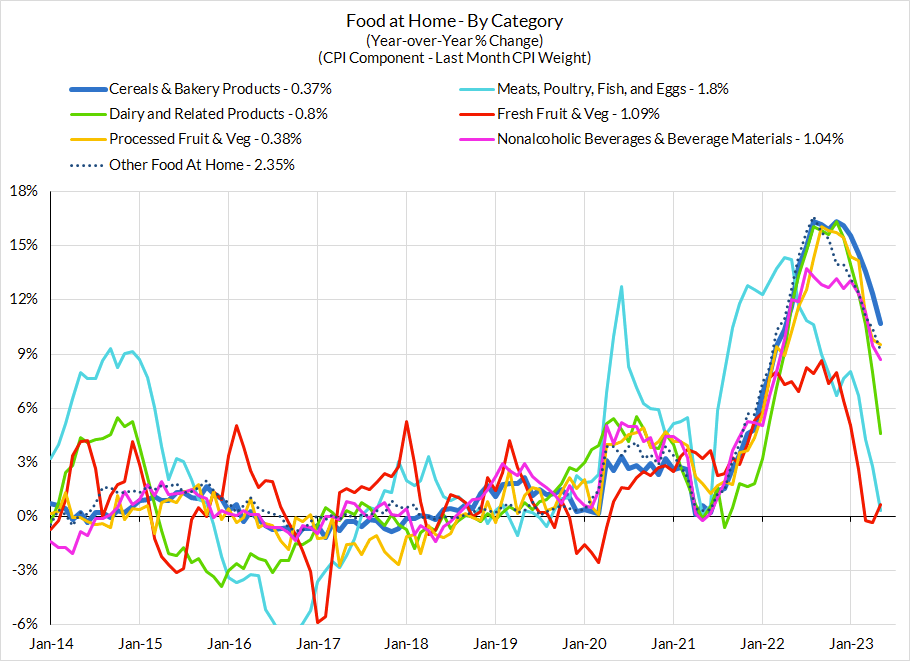

- Headline Inflation Dynamics: Disinflation in food prices and lower benchmark natural gas prices could still bring further downside risk to headline CPI than what the forecasting consensus implicitly pencils in, but that discrepancy is smaller now than in past months where we've rightly flagged this issue. And food services CPI doesn't count to core CPI but it does matter a lot to core and core services ex housing PCE.

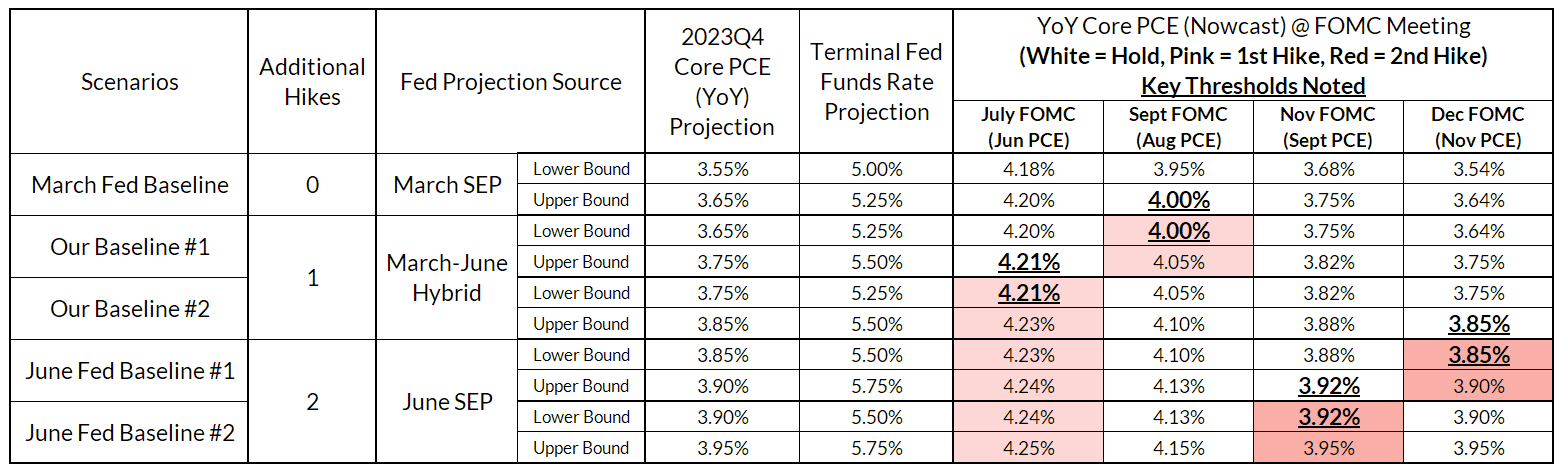

- Shoot The Moon July Hold Scenario: Everyone (including ourselves) sees a July hike as a strong base case but there is a scenario where weak core CPI leads to a July hold. What else has to go right: 1) PPI inputs to PCE also look soft, such that core PCE in June is on track to be 0.20% m/m (4.20% y/y) or lower, 2) an FOMC official within the middle of the committee notes "we can still hike twice this year without hiking in July," and 3) regional banks reporting earnings in the FOMC blackout period look concerning. This is a scenario in which markets may move away from pricing July as a lock, and Fed doves and centrists might see the benefits of additional optionality.

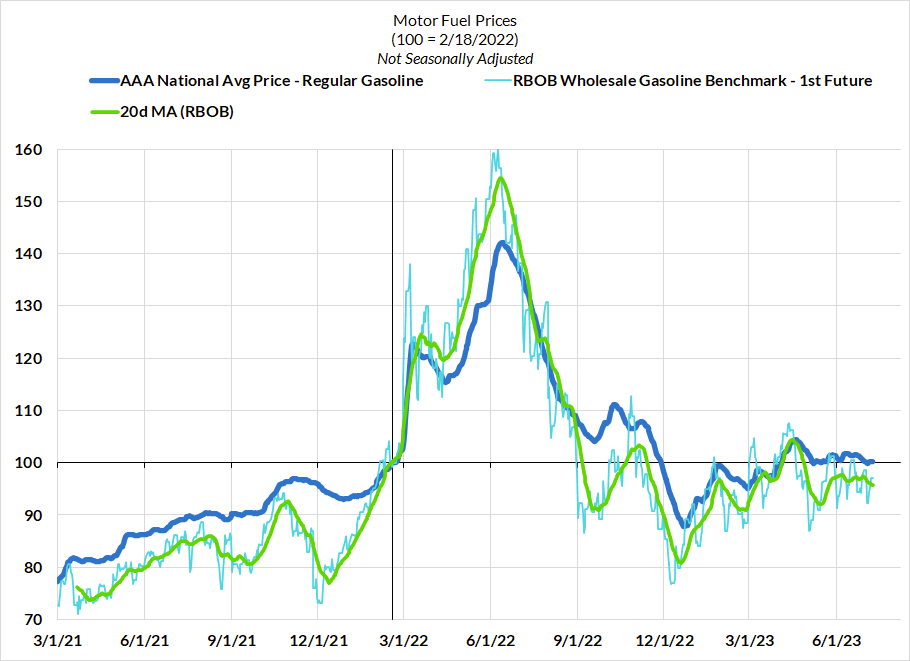

- Q3 Optimism: If dynamics play out as we expect, we will grow more optimistic about the prospect for disinflation in Q3, specifically because the used car impulse will be firmly behind us and some downside dynamics related to market rents, motor vehicles, energy, and food impulses have a better chance of pushing into core inflation.

Key Dynamics Within Baseline View

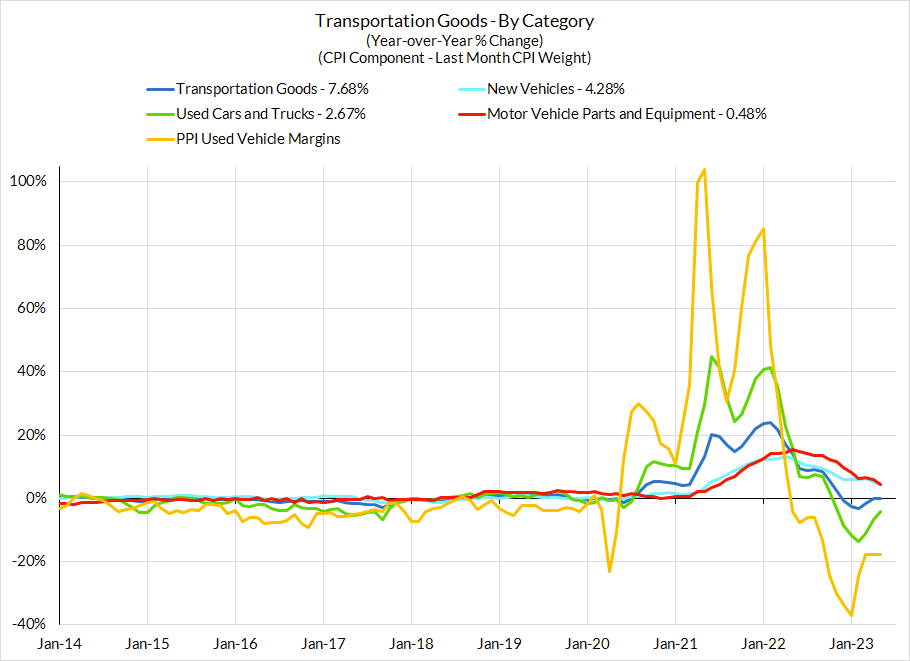

Rent inflation should take another leg down in the next three months, just as it did three months ago. Wholesale and used car prices are starting to deflate but probably not soon enough to meaningfully deflate used cars CPI (which could still increase by ~1%).

What's it going to take to get back to 2% Core PCE? A Roadmap

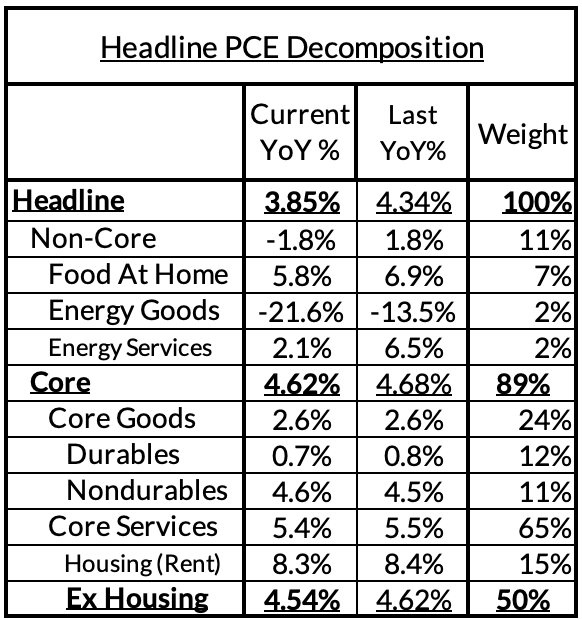

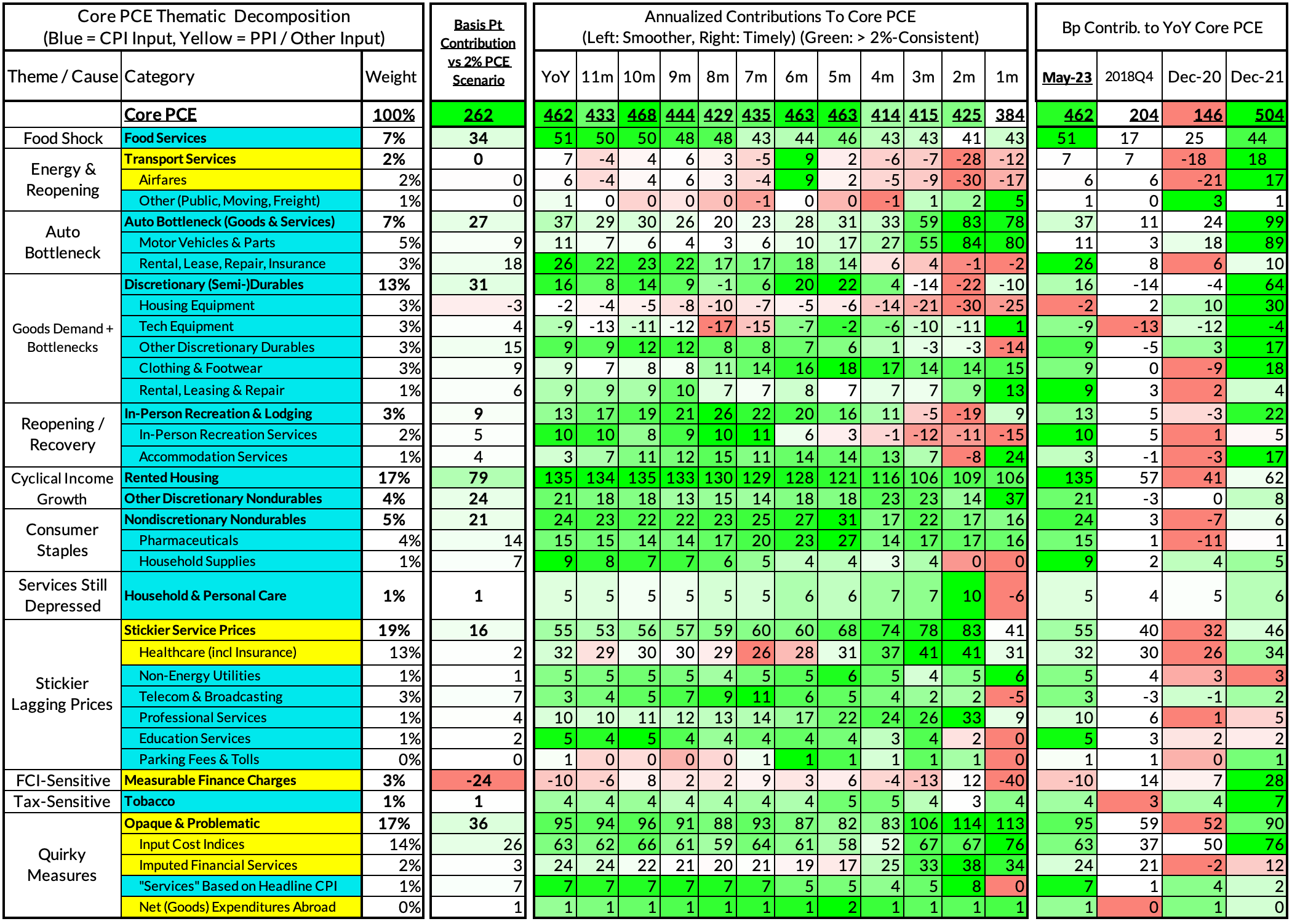

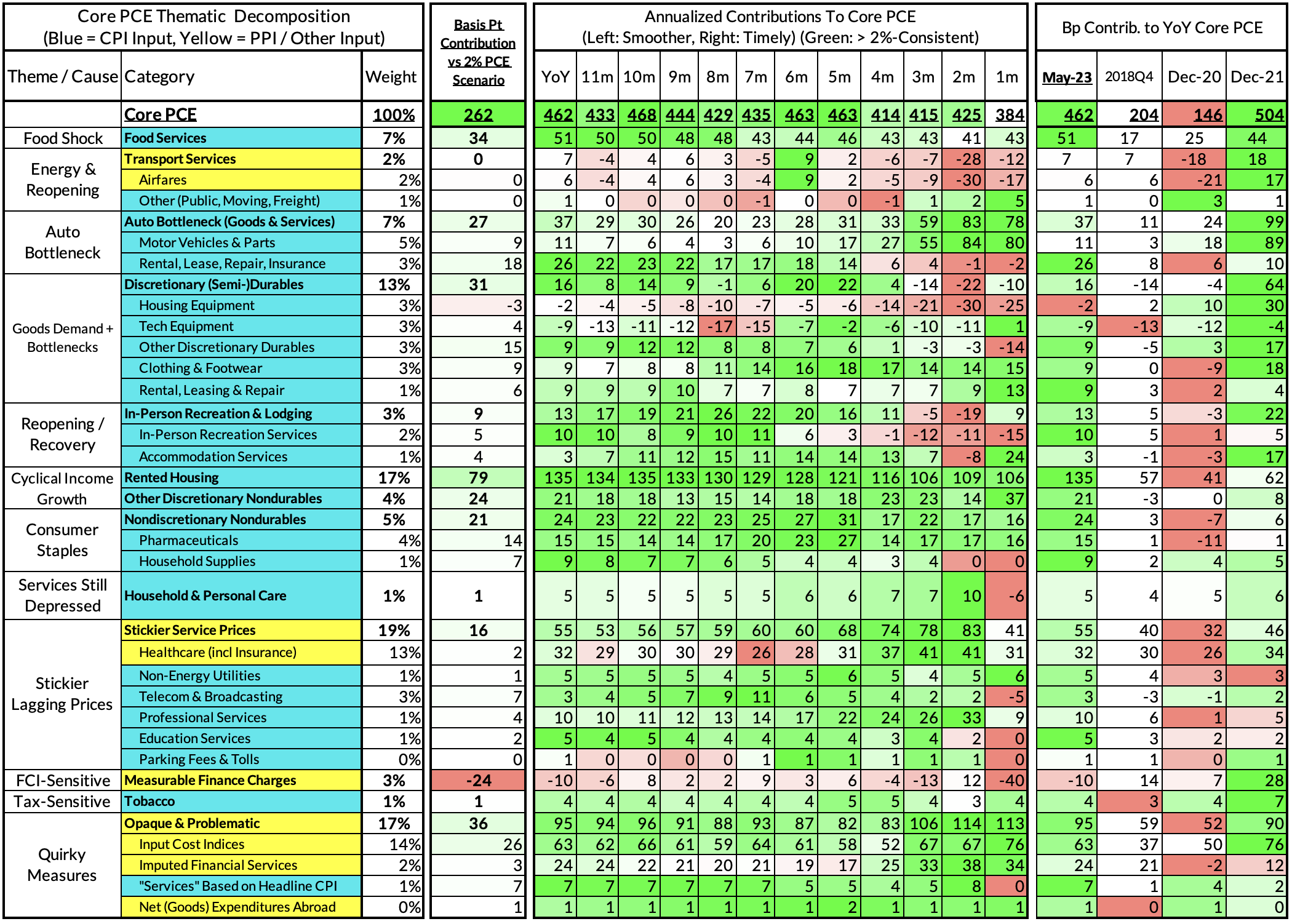

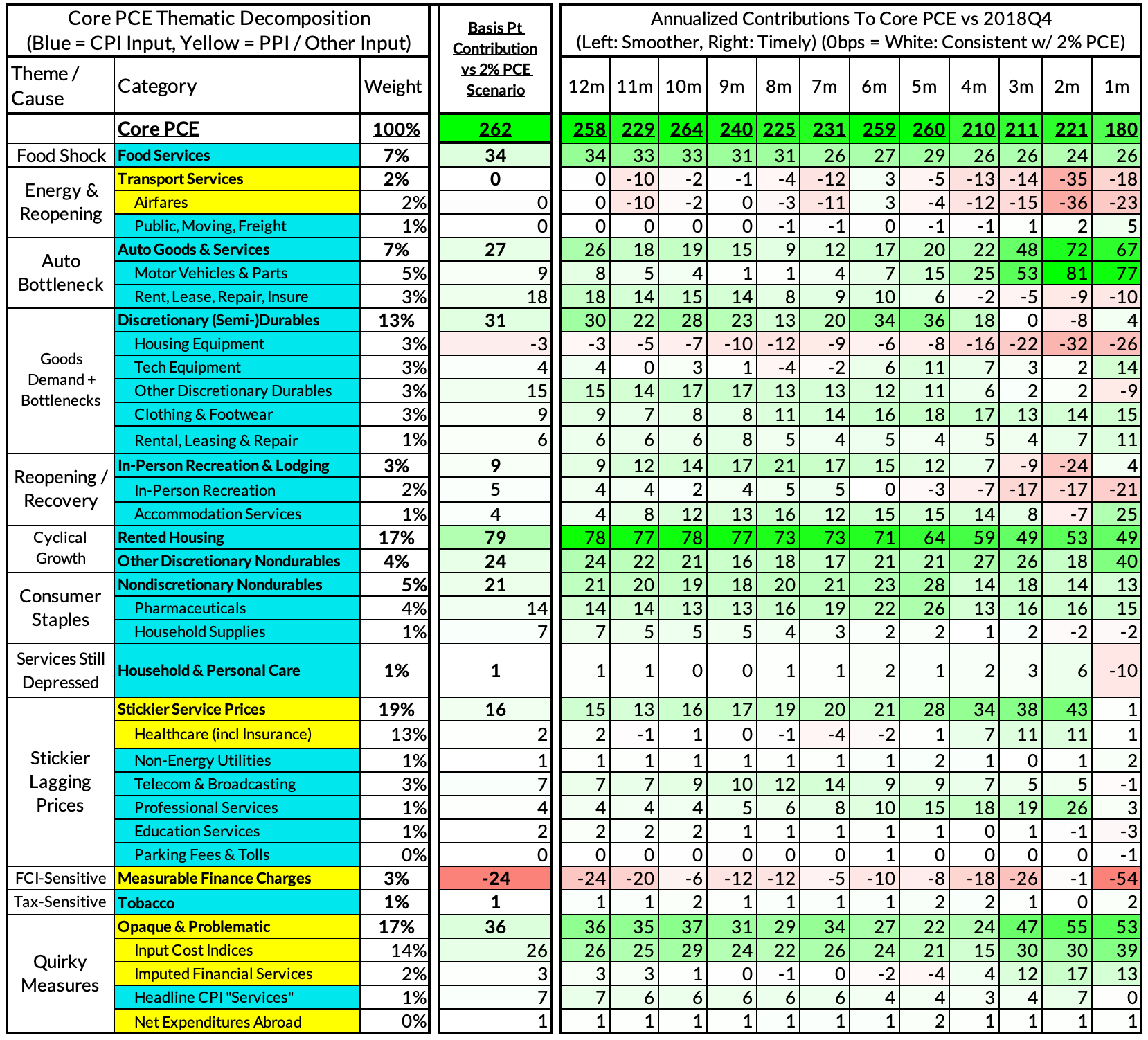

There's 262 basis points of core inflation overshoot that needs to be worked off for the Fed to hit its goals. Let's start from most important to least, with the note that a realistic 2% PCE scenario likely requires some of the categories below to not merely "stop overshooting" but to also "begin undershooting" what's consistent with 2% Core PCE.

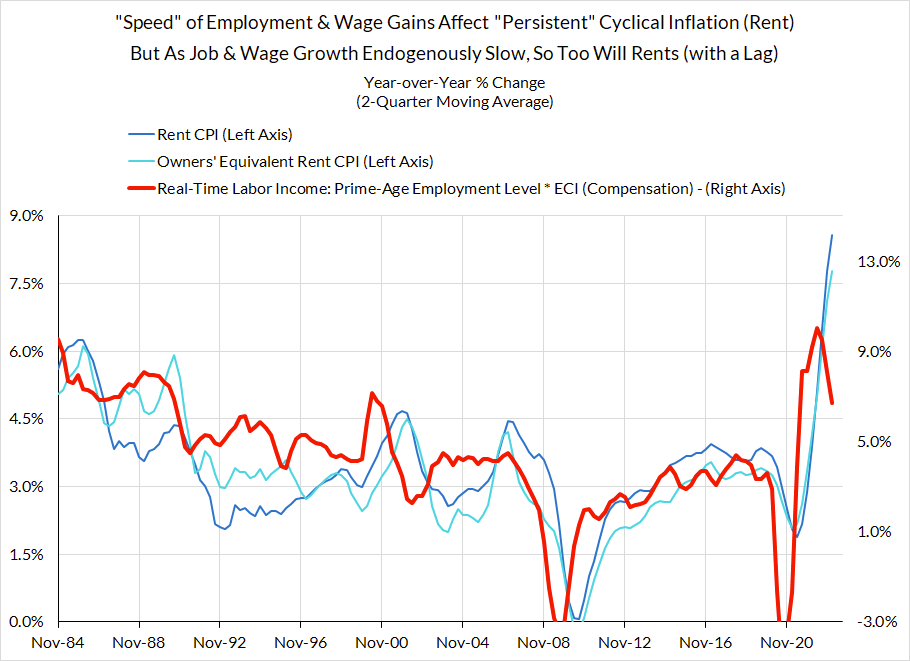

- Rent & OER (79bps out of 262): By now everyone should know that the CPI measures lag by about 12-18 months relative to market rent measures, which had been disinflating and even deflating by some measures. Think of rent and OER as a long moving average of what the market rent data is signaling, and add on some lags to boot. The CPI housing survey likely will not show any deflation even if market rent deflation is the norm for 6-9 months. But it's currently on track to get rent & OER down to a pre-pandemic pace of inflation by June 2024, and arguably lower later in 2024.

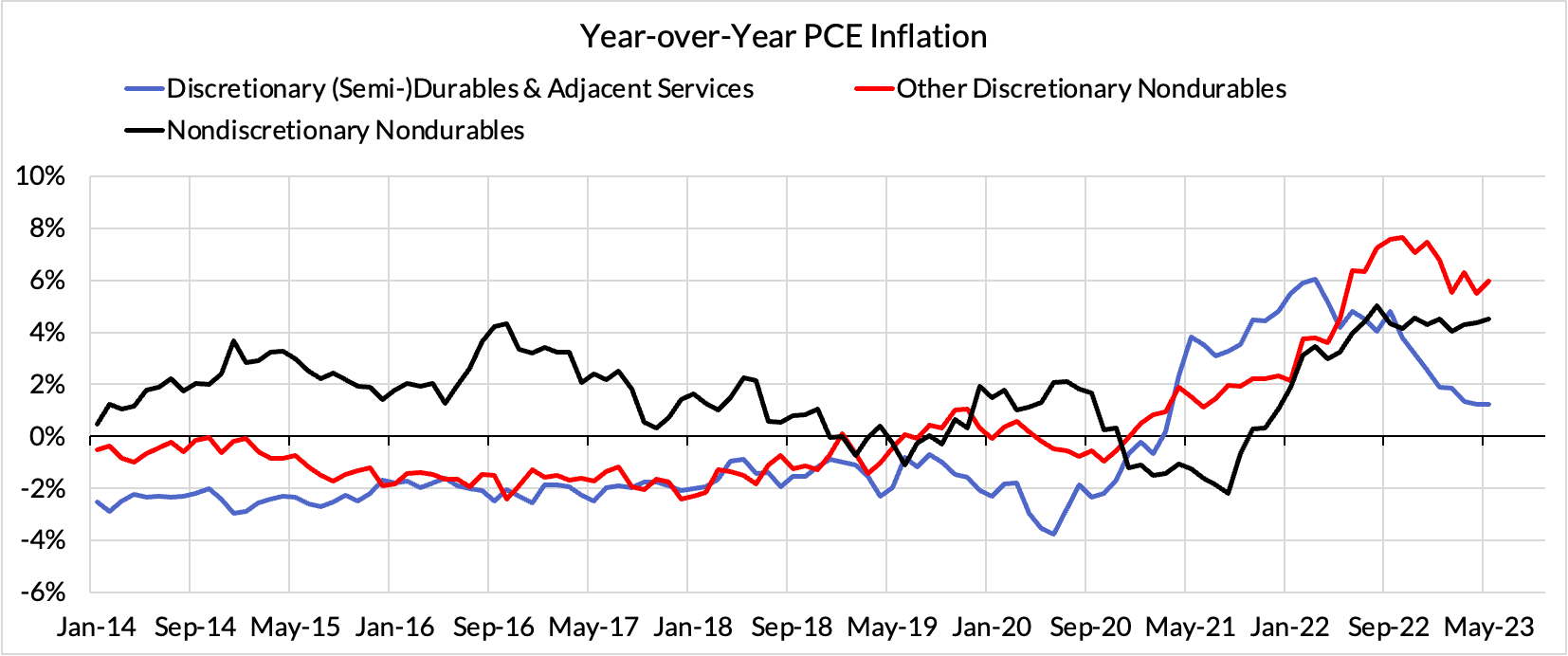

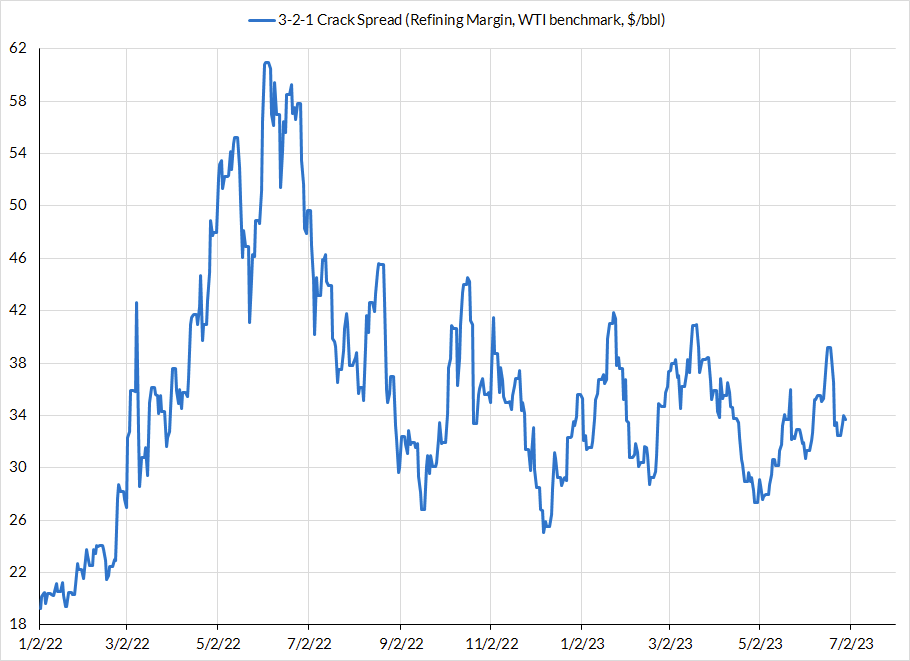

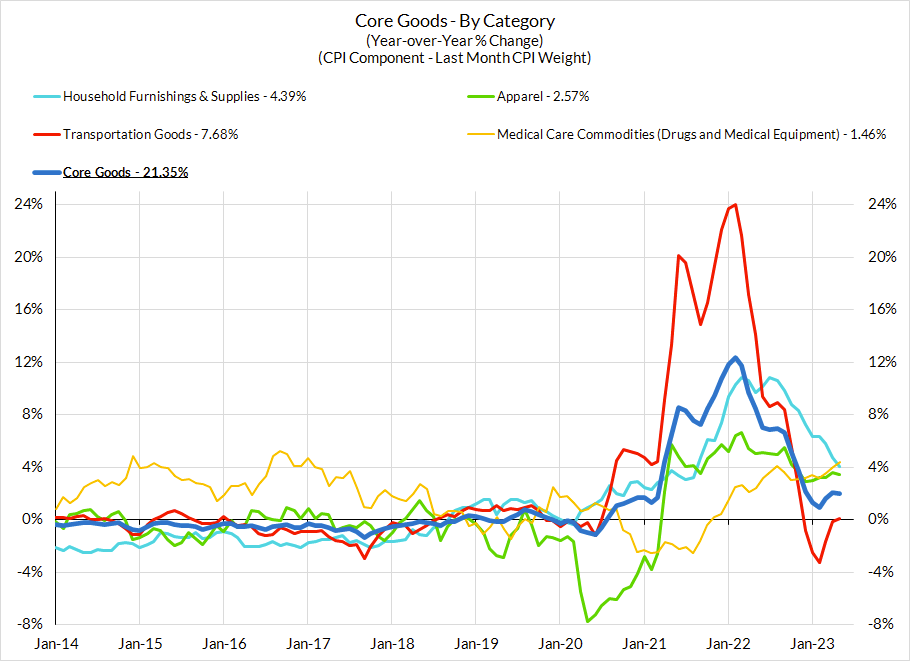

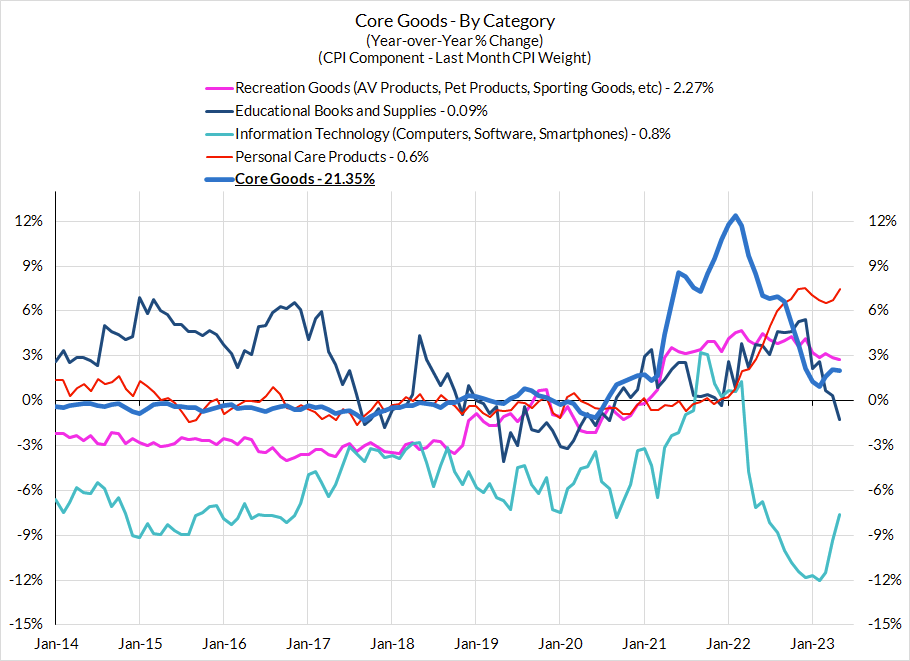

- Goods Deflation Ex Autos (76bps out of 262): Only in the past couple of months have we seen a broadening of goods deflation into discretionary durables (ex autos) and consumer staples. Elevated goods demand has been substantially destroyed in the past 12 months and cost shocks through the price of transportation, diesel, and chemicals are likely only now in a position to help ease the inflation path here. This process is likely to proceed slowly but last two months suggest we're on the path to 2%-consistent PCE readings here. Discretionary nondurables are the lone area in the goods complex where there is less sign of progress; it is still responsible for 24bps of the 260bp core PCE overshoot. We are not so sure all of the overshoot here will normalize in 12-15 months but a substantial subset still should.

- Food & Energy Passthrough To Core Services (34bps out of 262): While most think about food service prices as a direct byproduct of wages in the sector (which have also decelerated rapidly), restaurant pricing tends to track grocery store pricing more closely, with the appropriate lag. We have seen food services prices decelerate in the past few months, with a lag to decelerating food prices. Food prices were decelerating largely as demand destruction kicked in (real food consumption flattened, same for food services) and cost structures stabilized (diesel an important input for transporting food). Likewise, labor shortages are likely less relevant to passenger airfares than the local stabilization of jet fuel prices, should it prove sustained. We are optimistic that these components can steadily disinflate further as food supply chains and commodity price cost drivers normalize.

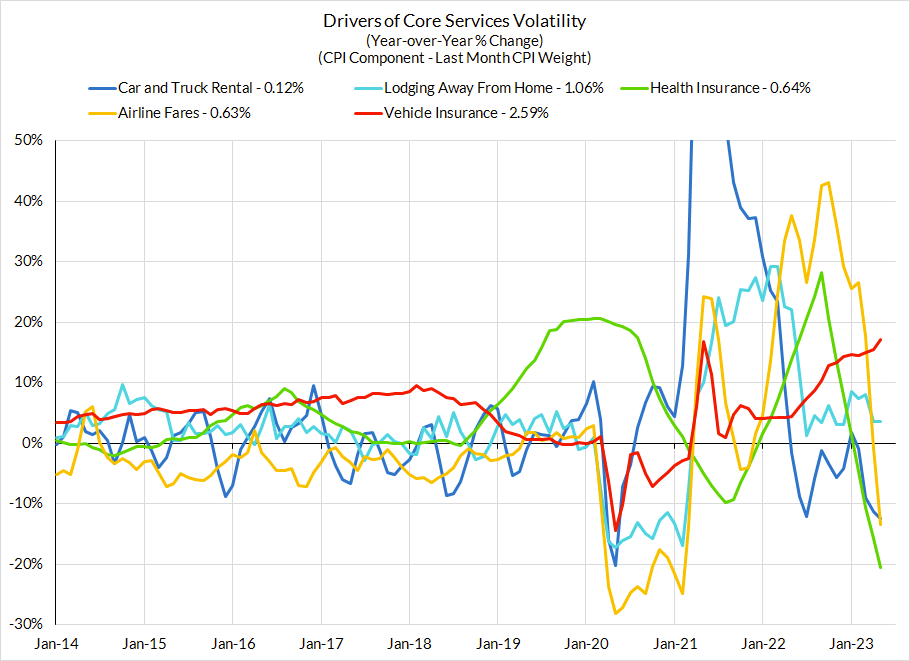

- Auto Supply Recovery (27 out of 262): We've been dealing with depressed motor vehicle production for over 2.5 years and only in the last few months have we seen accelerated production near pre-pandemic levels. This has implications that extend beyond new and used vehicle prices, which should begin another spell of deflation in Q3. It should also cool a range of services prices that have run hot in PCE: vehicle rental, leasing, repair, and insurance. Those service prices tend to move with a lag relative to auto values but should be more of a tailwind in 2024, at least when looked at in totality. We are optimistic that the basket of prices sensitive to auto values will be a substantial driver of disinflation in the next 12-15 months.

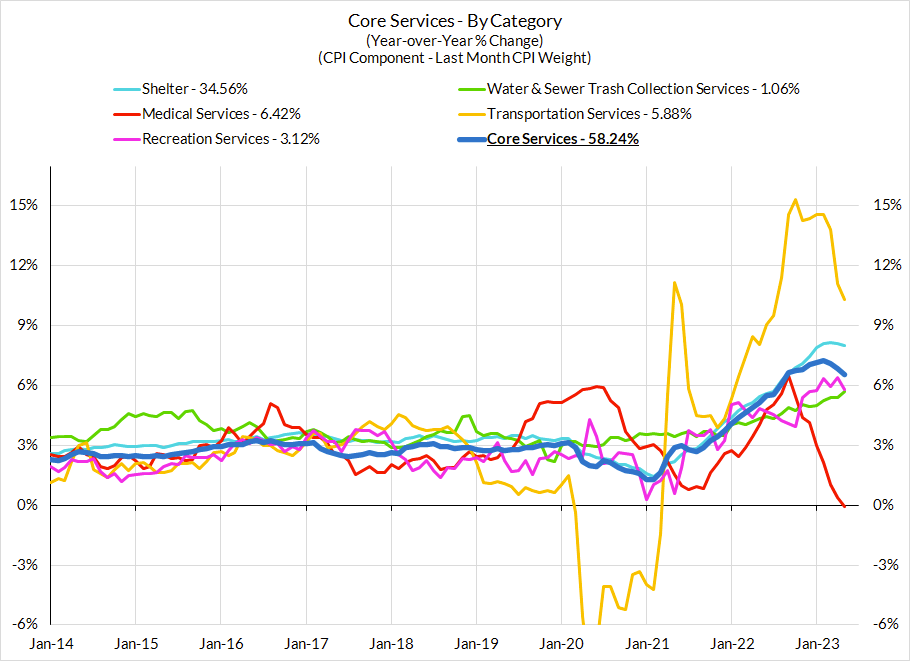

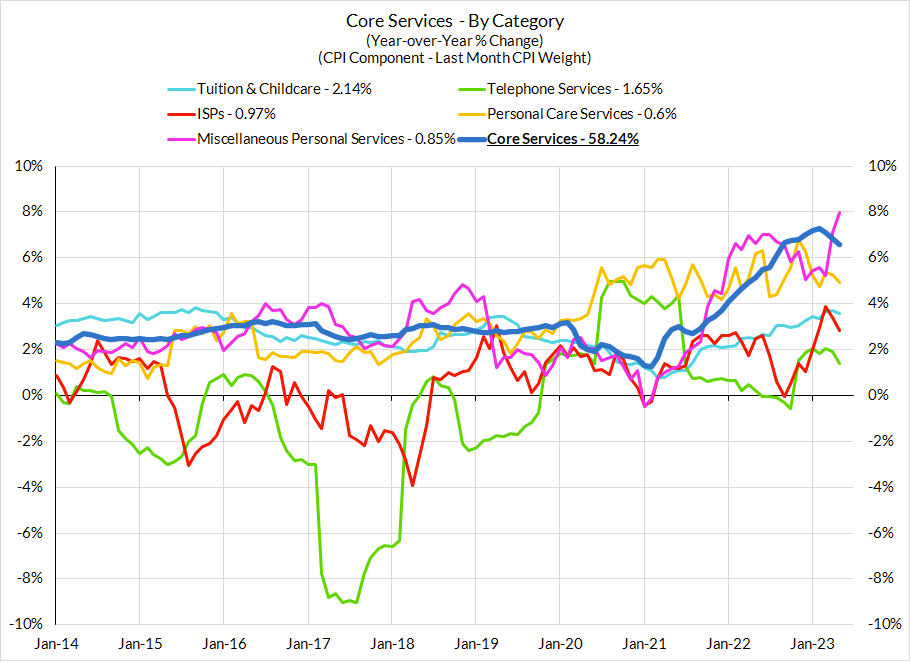

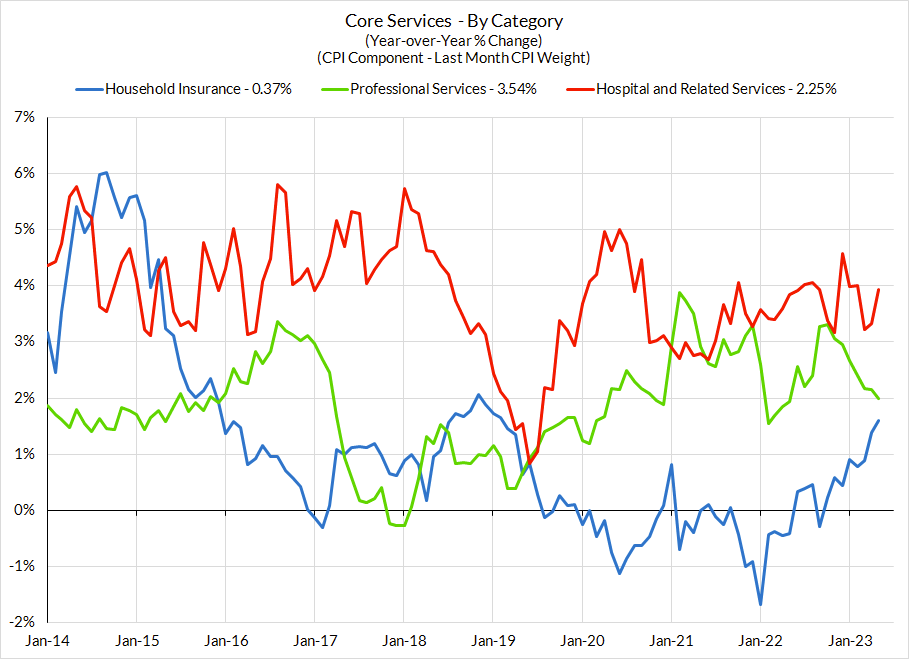

- Stickier Service Prices (16bps out of 262): Healthcare service demand roared back in 2022 as procedures put off during the pandemic rushed back. Moreover, private payers were willing to stomach steep price increases from providers in at the turn of the calendar year (2023Q1). It remains to be seen what 2024Q1 will mean both for public and private payers of medical services. But most of the overshoot here is outside healthcare and is largely a function of elevated headline inflation dynamics in 2022. As headline inflation cools more rapidly this year, the 2024Q1 annual-reset effect for telecom and professional services should be lower too.

- Idiosyncratic Price Effects (12bps out of 262): Input cost indices have been a substantial contributor to the inflation overshoot. These indices are basically wage data plus some PPIs, both of which should suggest further disinflation ahead. But they need to be counterweighed by the role asset prices and rate hikes play in measurable finance charges; asset price deflation lowered these measures and asset price increases now suggest a stronger outlook. We are left expecting modest disinflation and high uncertainty here.

- In-Person Service Prices (9bps out of 262): Until recently, this was a major driver of the inflation overshoot but saw some chunky bits of deflation through recreation services and lodging. Revenge services demand tied to reopening appears to be cooling in nominal and real terms after a strong 2022. We expect more normalization here but with further bumps in the road given the volatility of price changes of late.

CPI Charts

Non-Core CPI Components

Core Goods CPI Components

Core Services CPI Components (Not All Are Feed Into Core PCE)

From Our PCE Recap (For Those Who Missed It)

For the Detail-Oriented: Core PCE Heatmaps

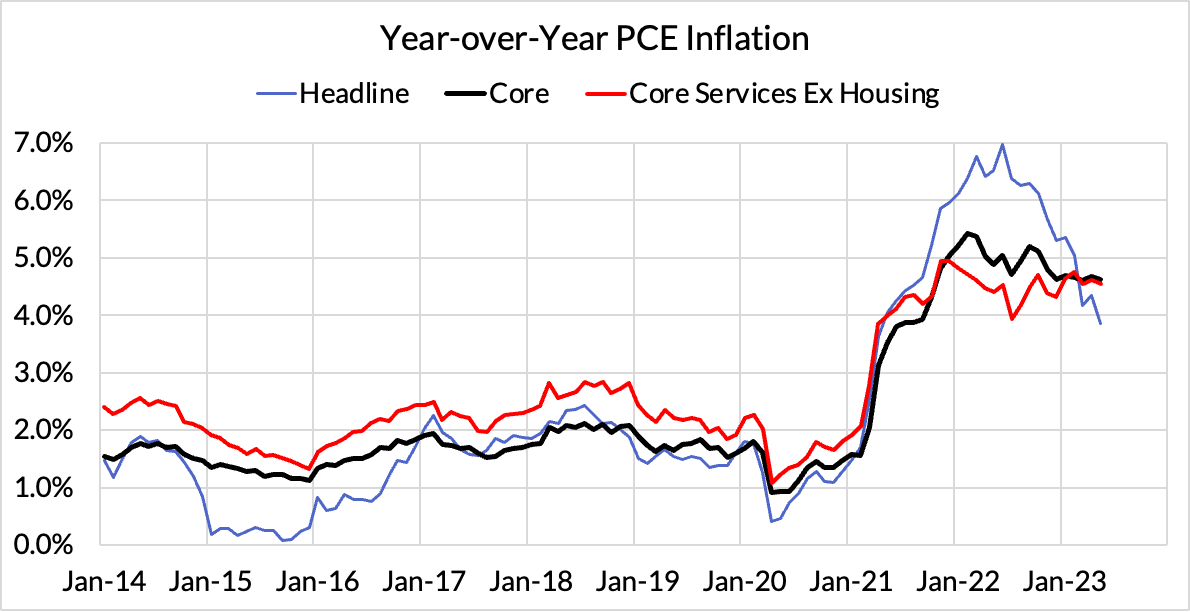

Right now Core PCE (PCE less food products and energy) is running at 4.62% as of May, 262 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 79 basis points to the 262 basis point core PCE overshoot.

There are other contributors to the overshoot, some more supply-driven (automobile bottlenecks likely explain 27 basis points, while food inputs likely added 34 basis points to the overshoot), some more demand-driven (in-person recreation and travel services adding 9 basis points to the overshoot, consumer staples and discretionary nondurables adding 45 basis points).

The final heatmap here gives you a sense of the overshoot on shorter annualized run-rates. April monthly annualized core PCE yielded a 180 basis point overshoot vs 2% target inflation (3.80% annualized).

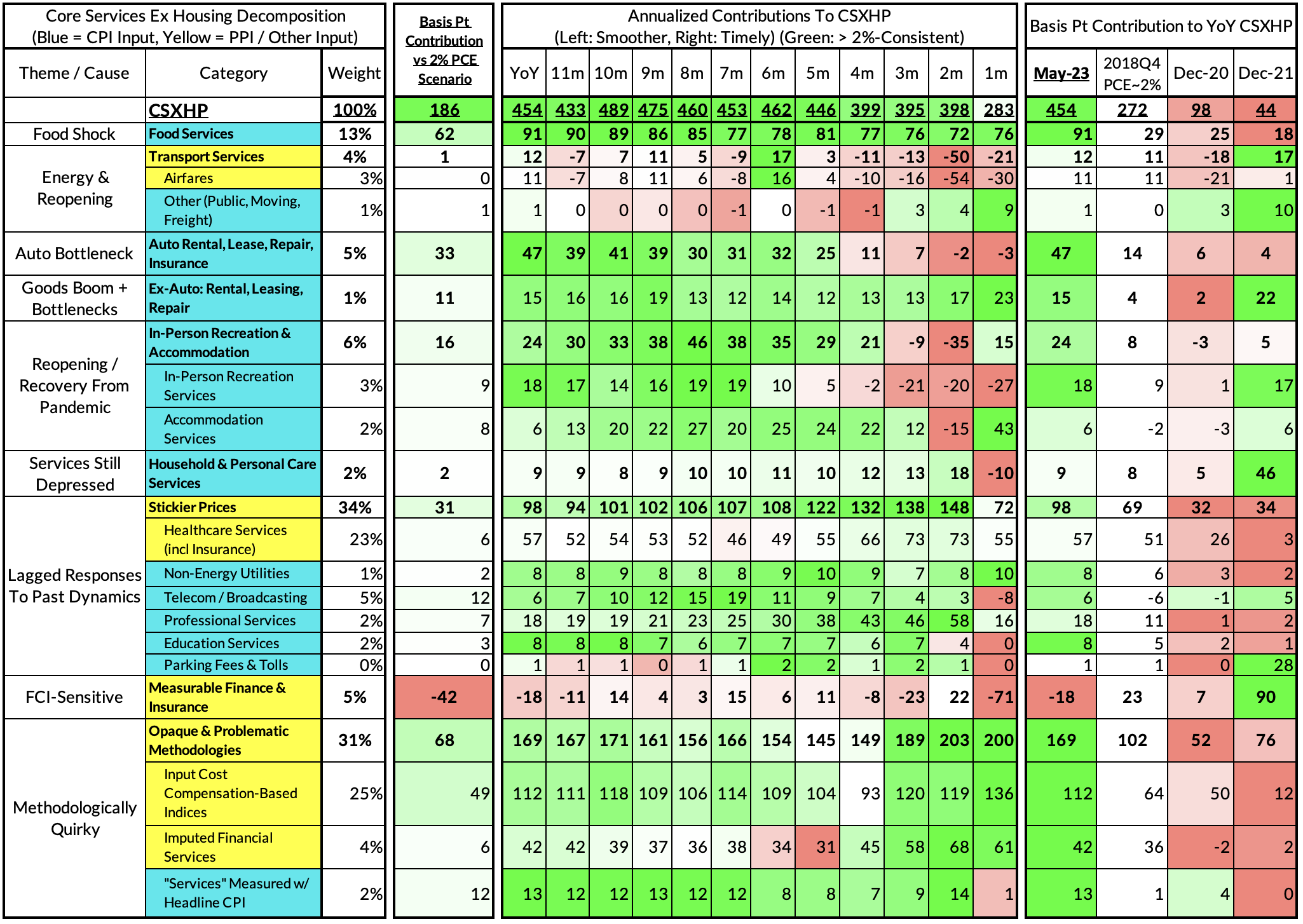

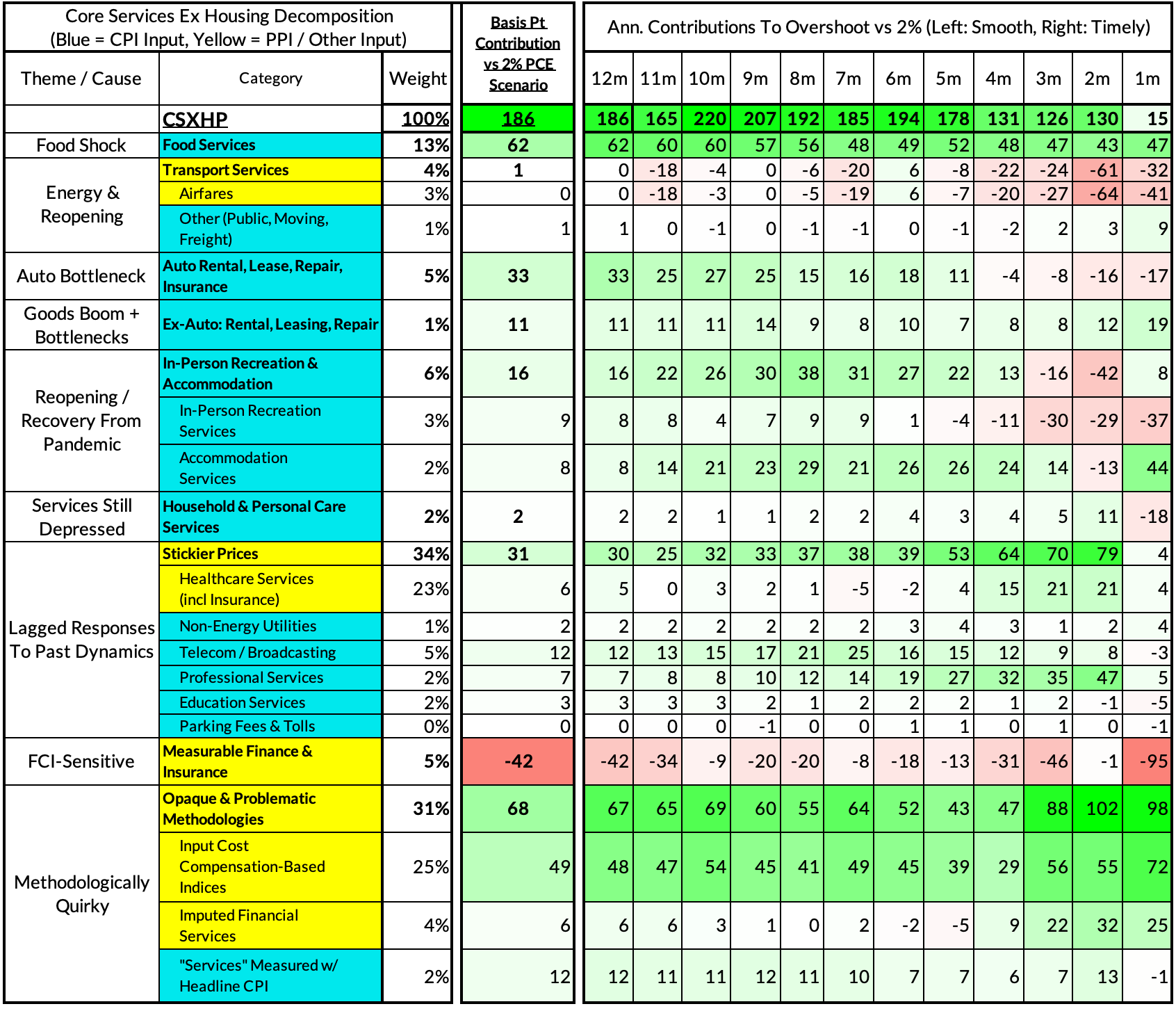

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The May growth rate in "Core Services Ex Housing PCE" ran at 4.54% year-over-year, a 186 basis point overshoot versus the 2.68% run rate that coincided with ~2% headline and core PCE in 2018Q4.

April monthly CSXHP ran at a 2.83% monthly annualized rate, a mere 15 basis point overshoot of what would be consistent with 2% headline and core PCE. This

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?