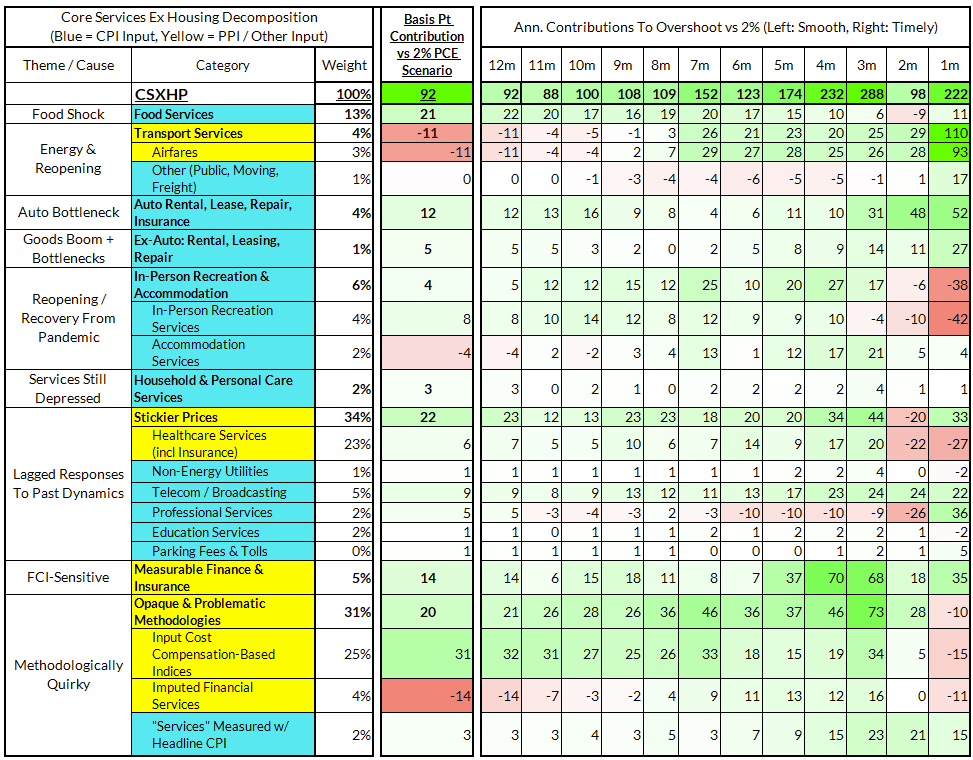

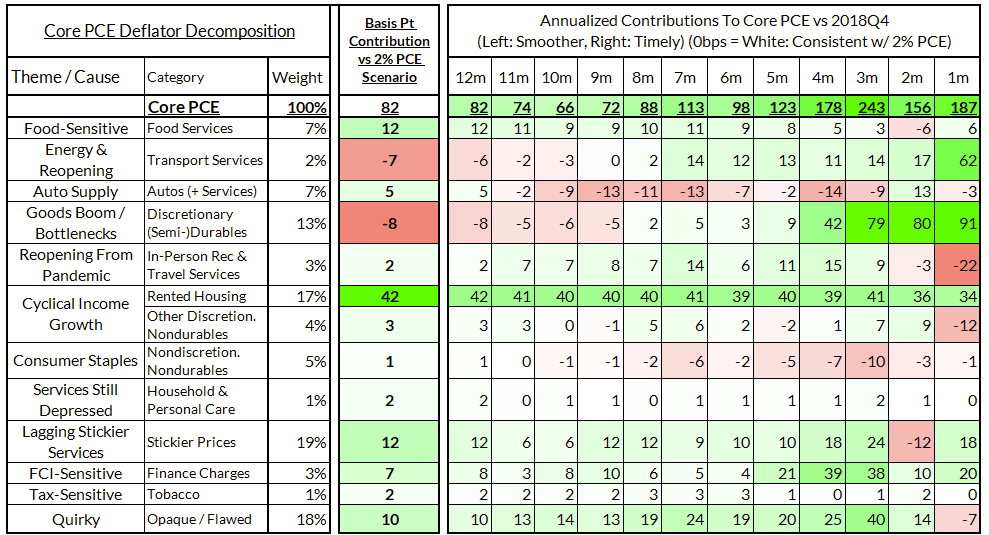

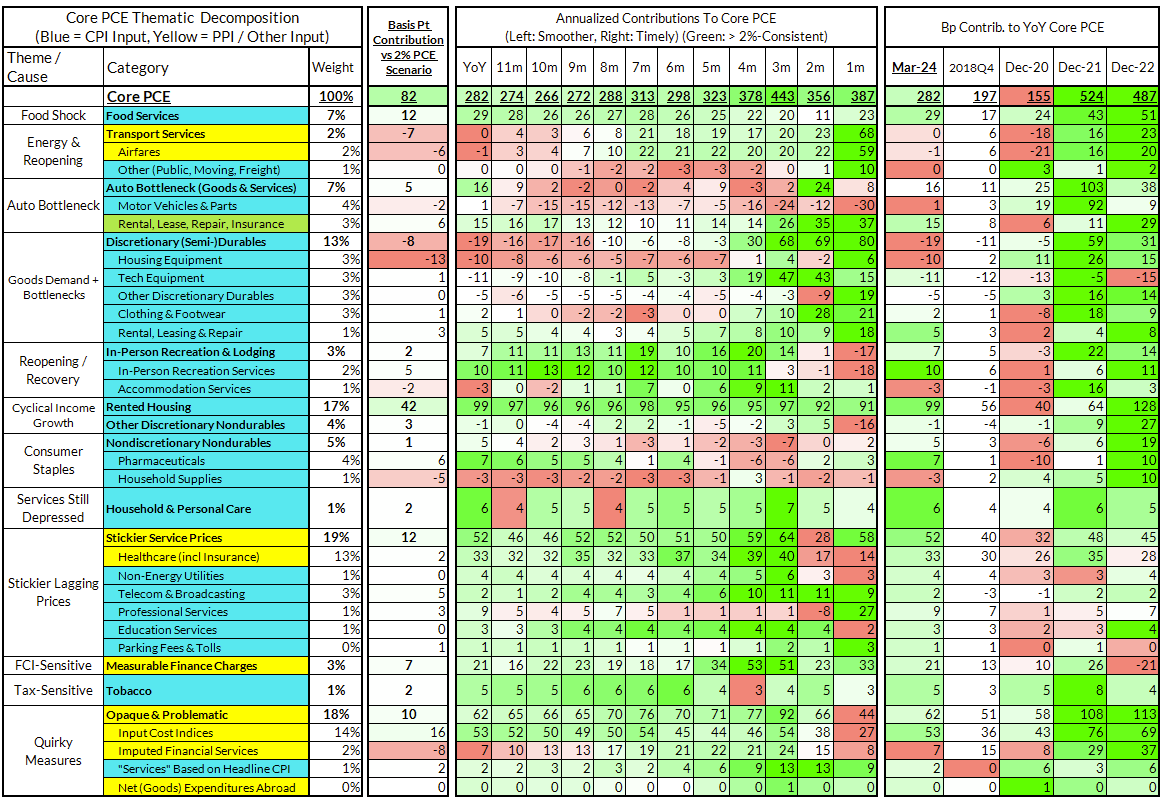

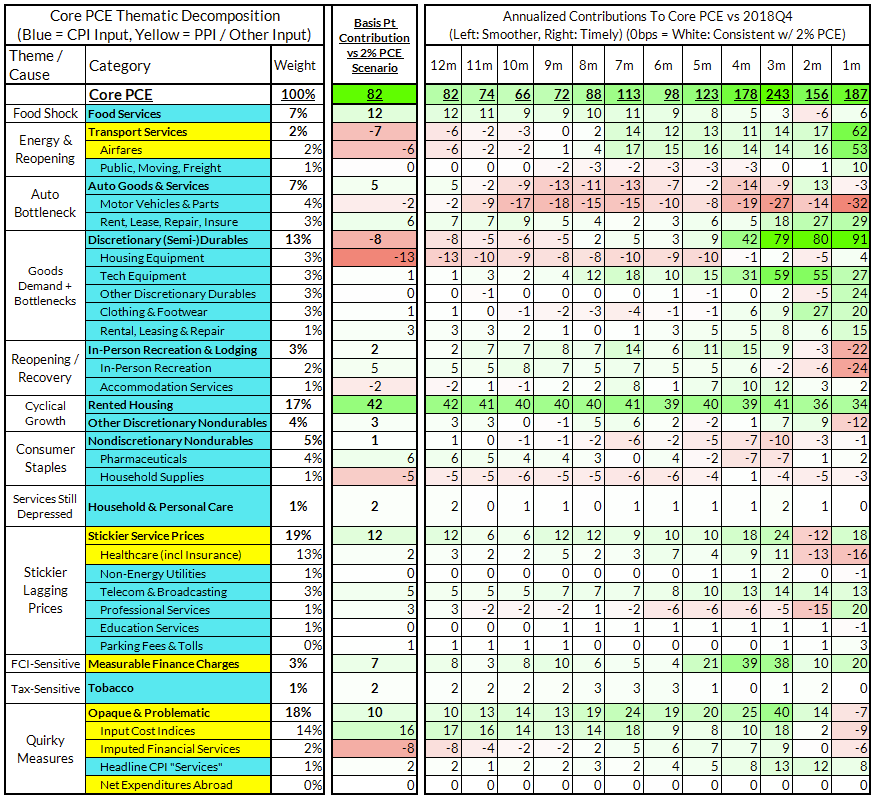

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

If you'd like to start a 90-day free trial of our exclusive content, you can do so using this link. If you have any questions or would like to see samples of our past content, feel free to get in touch with us.

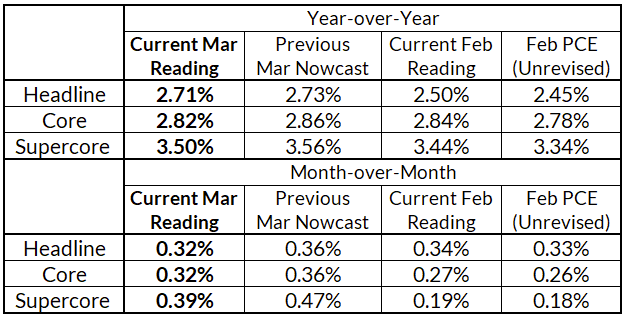

Summary: Final Readings For PCE

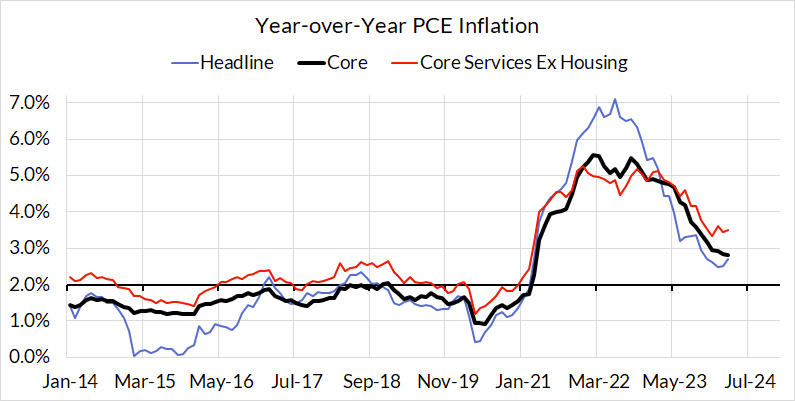

Q1 was filled with a series of upside inflation surprises. While we warned from the outset that Q1 was fat-tailed in the distribution of possible inflationary outcomes, the strength of inflation certainly surprised us and surely surprised the Fed as well. It does not mean that the disinflationary process has come to an end, and in fact, year-over-year readings are still meaningfully lower than where they were 6-12 months ago, but Q1 was a meaningful bump in the road.

Today we mostly learned that the inflation upside in Q1, after accounting for revisions, was concentrated in January and that March Core PCE readings were actually marginally more benign than what we were nowcasting. Perhaps most encouragingly, in the monthly estimates, here are still signs of further disinflation in BEA indices for input costs and imputed financial service prices, boding well for further supercore disinflation later this year. That said, the deviations are ultimately marginal and do not change our baseline view: the first interest rate reduction is most likely to transpire in September.

We are still optimistic on the prospects for further disinflation this year.

- It's hard to point to fundamental demand or supply-side drivers of inflation in Q1, that too in a manner that is worth extrapolating to future quarters. The upside residual seasonality effect was strong, and stronger than we anticipated, but it's hard to come up with good reasons for extrapolating from Q1 goods price inflation, which looks to involve mostly a reversal of the strongly deflationary readings from the previous quarter. We still expect to see some parts of goods pricing show more deflation over the course of this year (apparel, motor vehicles and parts). The absence of an "undershoot" of 2%-consistent goods price inflation readings means that services inflation readings will have to show more reduction to reach 2% in the aggregate.

- The good news is that the inertial parts of services inflation have continued to show more signs of deceleration: rent/OER disinflation is slow but continuing, food services disinflation is still in train, and healthcare services is softening up helpfully. A normalized labor market, food and energy price stability, and fiscal policy are supportive of further progress in those respective trends. Unfortunately, these stickier trends were largely masked in Q1 by volatile price movements in financial service prices and airfares. Motor vehicle services also popped in Q1 but we would expect to see more sustained signs of disinflation here so long as motor vehicle prices do not see another major upward spike.

For the Detail-Oriented: Core PCE Heatmaps

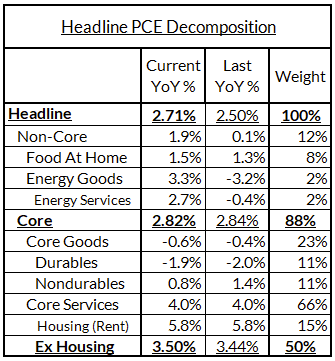

Core PCE (PCE less food products and energy) ran at a 2.82% year-over-year pace as of March, 82 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 42 basis points to the 86 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (food inputs likely added 12 basis points to the overshoot, motor vehicle bottlenecks adding 5 basis points)

- Some more demand-driven (in-person recreation and travel services likely added 2 basis points to the overshoot)

- Some oddball segments have aggravating effects (measured financial service charges now likely adding 7 basis points, while contributions from input cost indices and imputed financial services likely adding 8 basis points to Core PCE vs 2%-consistent outcomes).

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. March monthly annualized core PCE yielded a 187 basis point overshoot vs 2% target inflation (3.87% annualized).

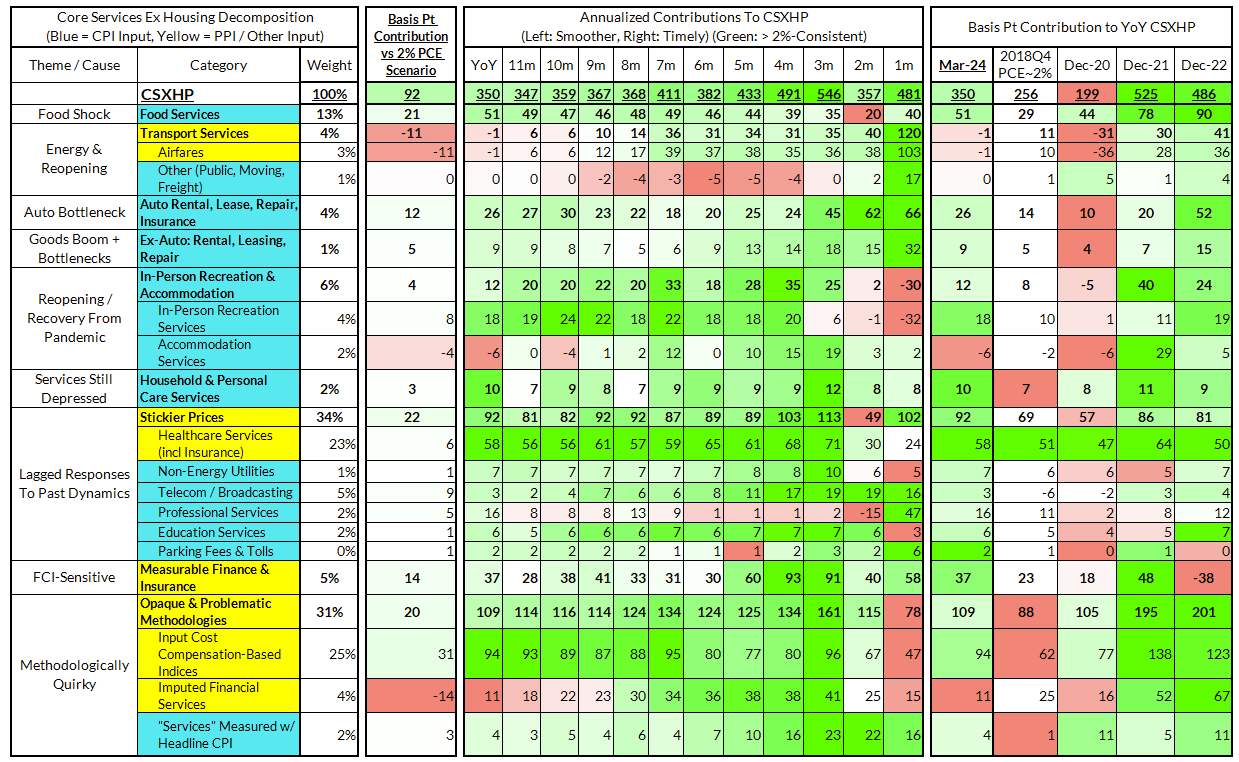

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The March growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 3.50% year-over-year, a 92 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

March monthly supercore ran ata 4.81% annualized rate, a 222 basis point annualized overshoot of what would be consistent with 2% headline and core PCE.