This preview was published three days ago for our Premium Donor distribution. Consider subscribing if you would like to support our public research and advocacy work, and receive early access to our data release previews.

Summary:

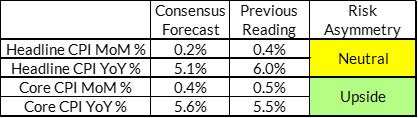

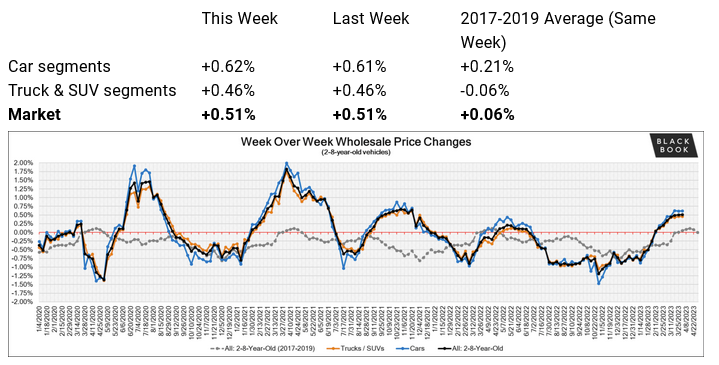

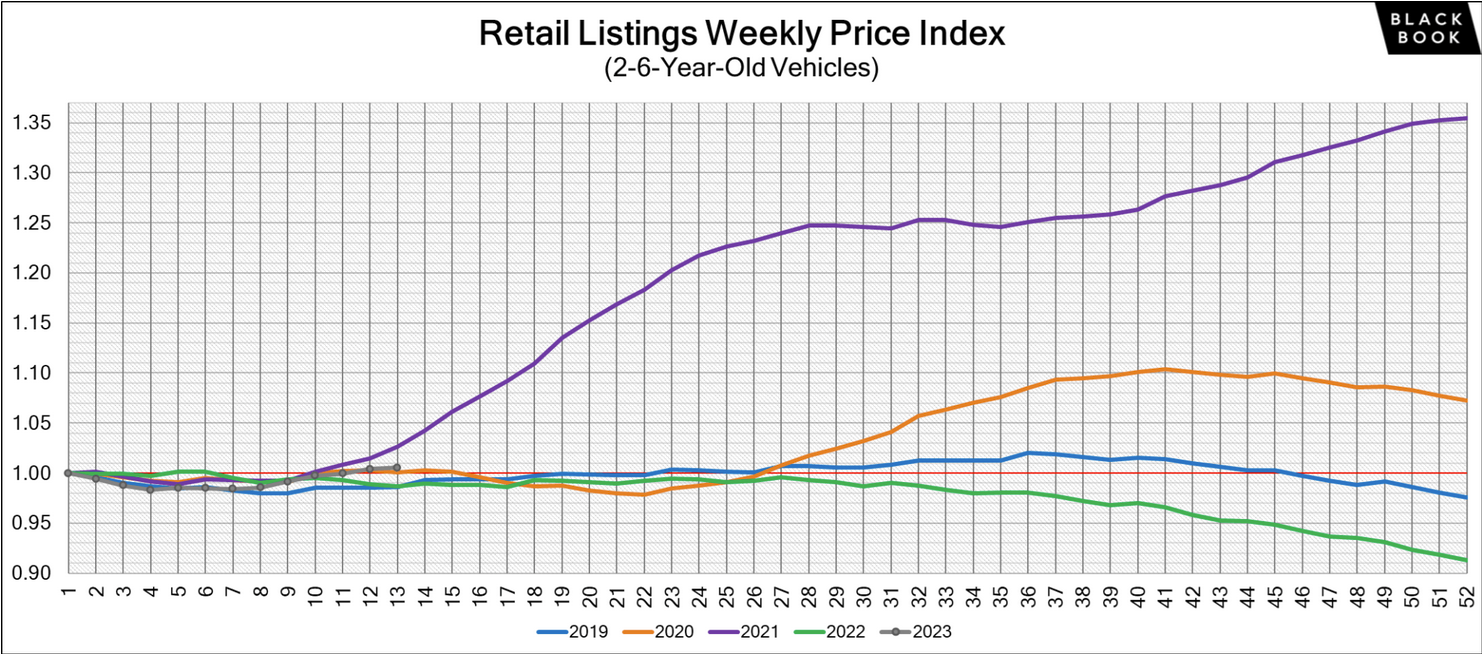

The risks for March and Q1 core inflation have remained asymmetrically tilted to the upside relative to consensus forecasts, and have arguably moved further to the upside. Wholesale automobile prices have been sharply rising throughout the 2023 calendar year. It may only be a matter of time before it filters into the CPI, both goods (new and used vehicles, parts) and value-sensitive services (rental, leasing, repair, insurance). This will likely push the Fed to cement a 25bp hike in May and start signaling the need for further hikes in June and potentially July. Headline inflation risks remain more balanced because of declining benchmark natural gas prices and the potential for deceleration in food prices.

Key Dynamics Within Baseline (Upside) View:

Our upside inflation view is likely to push the Fed to consider additional hikes beyond 5.125% terminal rate projection (as per the March edition of the FOMC's Summary of Economic Projections).

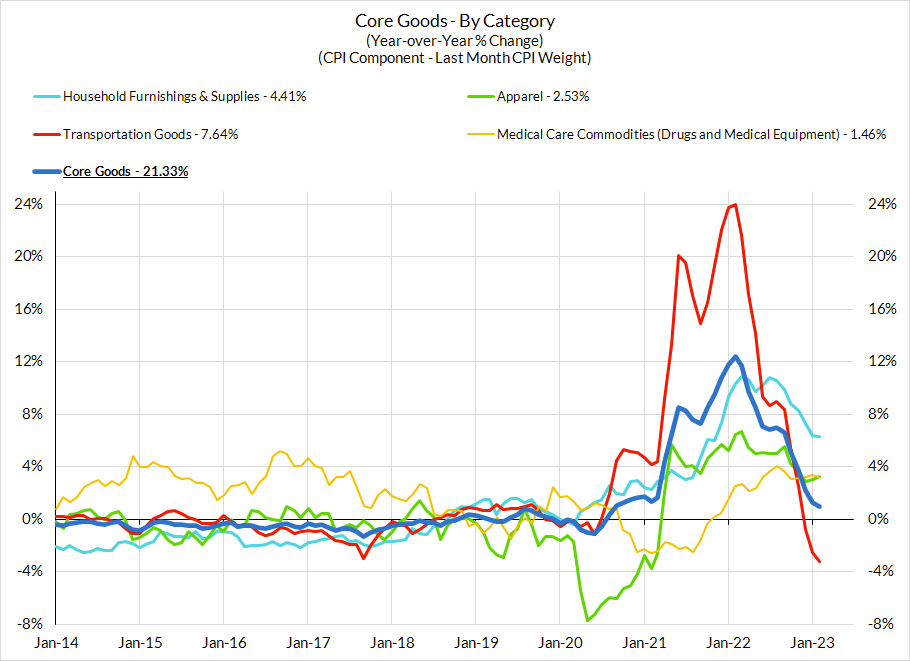

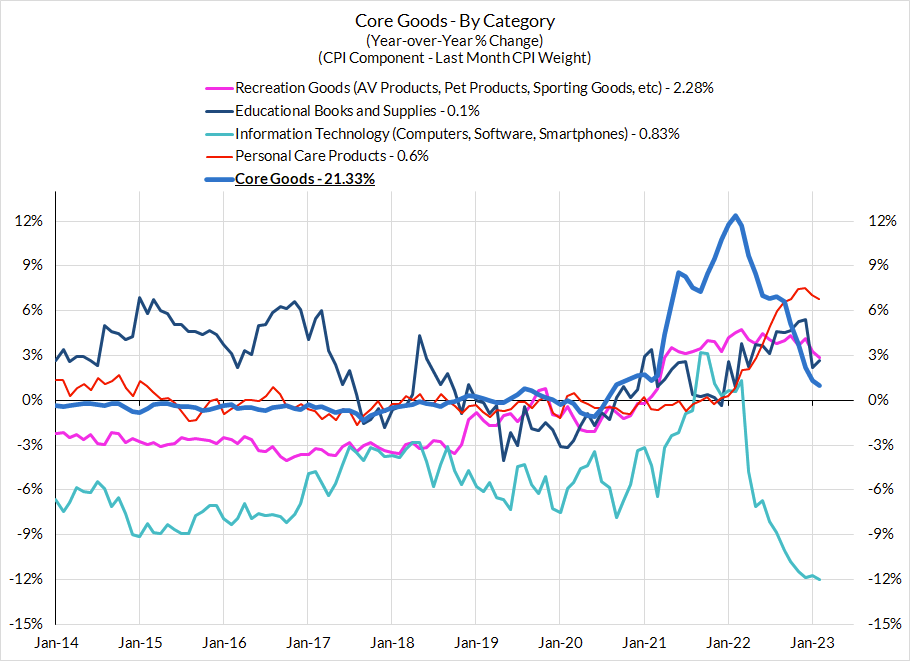

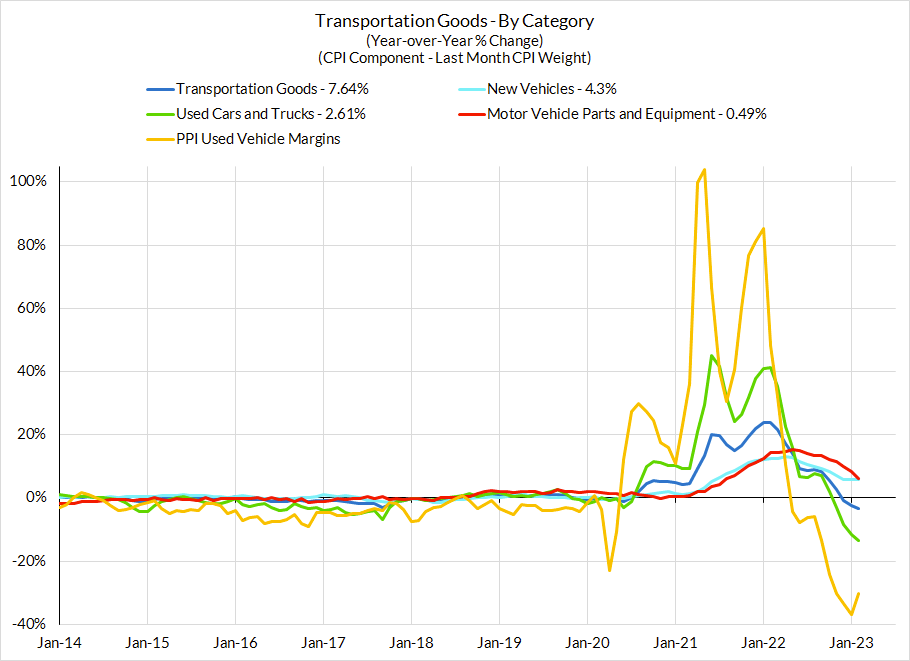

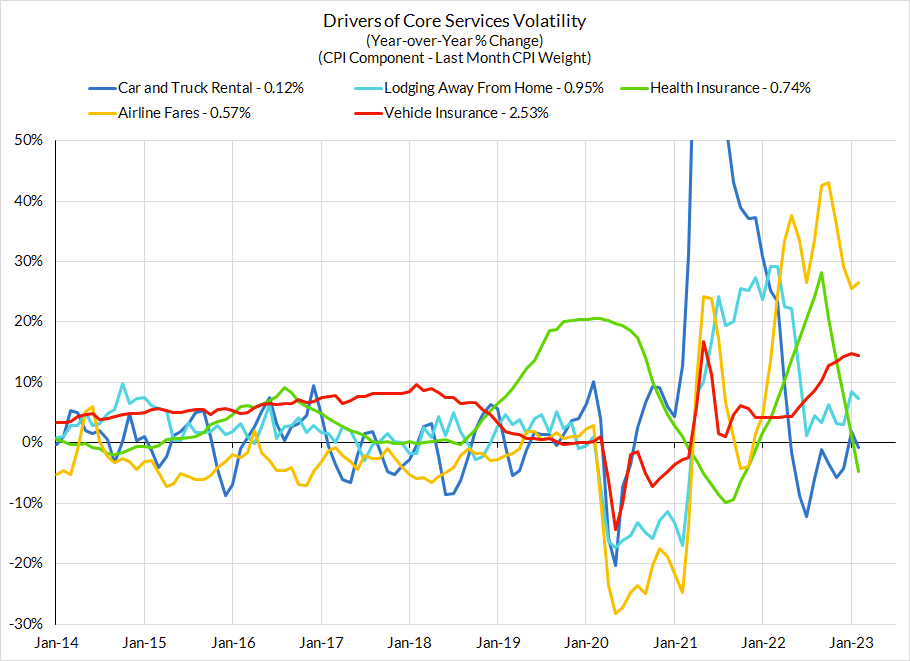

- The Fed is behind the curve on automobile price dynamics: The Fed seems pleased to cite the decline in goods prices over the past few months but most of that decline can be attributed to a sharp decline in used cars CPI. But wholesale used cars prices have been sharply rising in 2023. The lack of a proper supply recovery has left the market vulnerable to outsized price spikes in the face of marginal changes in demand. Retail prices are beginning to show passthrough effects from wholesale prices (albeit less than 1:1). It seems only a matter of time (likely in the March-to-May CPI releases) for it to start showing up in the CPI data. Adding insult to injury, higher automobile prices also affect service prices the Fed presumes to be more labor market-driven: the price of renting, leasing, repairing, and insuring a car have all shown sensitivity to auto prices. So long as the Fed shows a limited understanding of what's going on, an upside surprise to automobile prices is still likely to motivate hawkish Fed policy. The March FOMC projections and the general tenor of Fedspeak reflect an excessively upbeat/sanguine view of goods price dynamics.

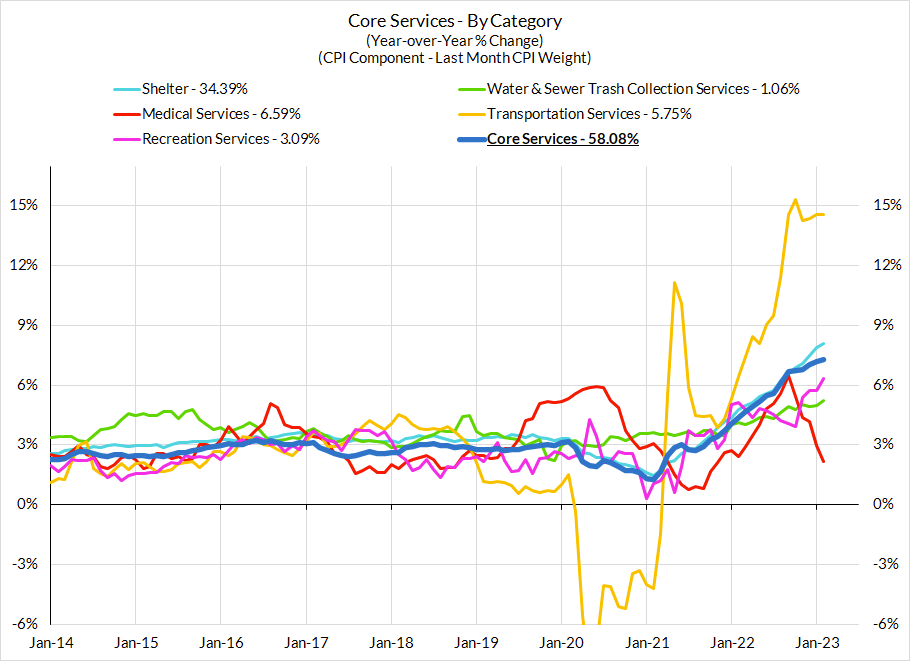

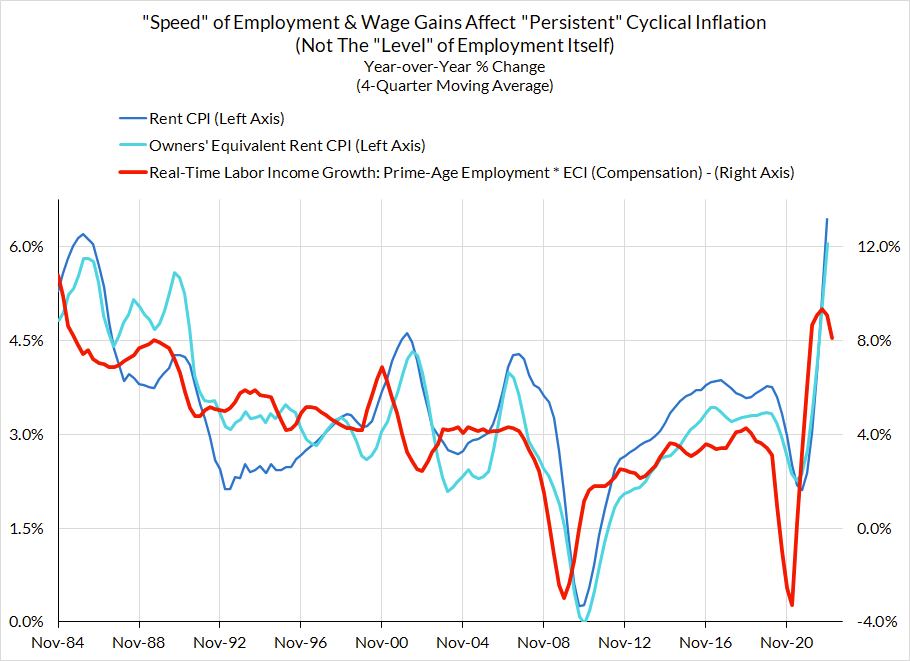

- The Fed is likely presuming that rent disinflation begins too soon: We still have yet to see rent CPI show the same disinflating trend that is visible in market rent measures, and the risks here are tilted to a longer lag than what the Fed or the forecasting consensus presumes.

Downside Inflation Scenario:

It seems unlikely that news from a single inflation release will cause the Fed to back off its intent to bring the Federal Funds Rate up to at least 5%. Still, a soft inflation release might increase the scope for the Fed to stop at 5.125%, rather than pushing for further interest rate increases.

- Are there other goods prices that can offset the upside from automobile prices? Automobile prices have lower direct weight on CPI as a result of revised weights. It's possible we see offsetting dynamics emerge, but none of them seem as identifiable, especially with still ongoing Q1 calendar revisions posing upside risks. The most likely suspects: furniture & furnishings, apparel, recreation goods, and possibly medical care commodities (automobiles & information processing equipment are the main goods categories that have driven downside thus far).

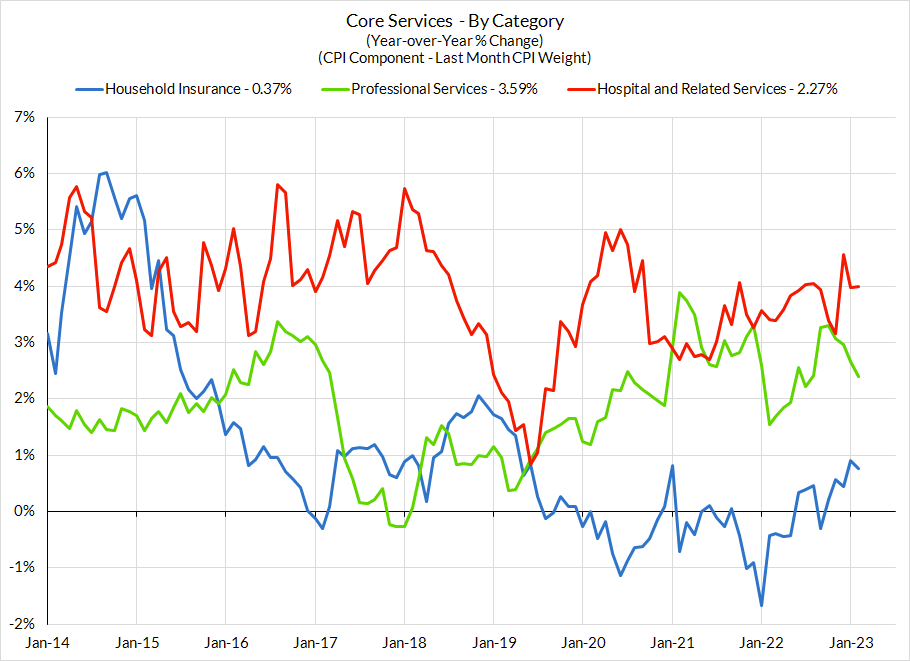

- Can stickier services show more relief sooner? It's still Q1. Many service price revisions tend to lag broader inflation dynamics, only being revised at the turn of the calendar year; it's why we expected upside from January through to March. Within services, food services might begin to decelerate as a result of grocery store price deceleration, but that process is likely to be slower moving. Cyclical in-person and reopening-sensitive services have more scope for slowing down in the coming months but in a downside scenario, these dynamics might materialize sooner than we expect in our baseline scenario. And finally, it's possible that rent inflation decelerates faster than we anticipate and closer to the Fed's more optimistic projections.

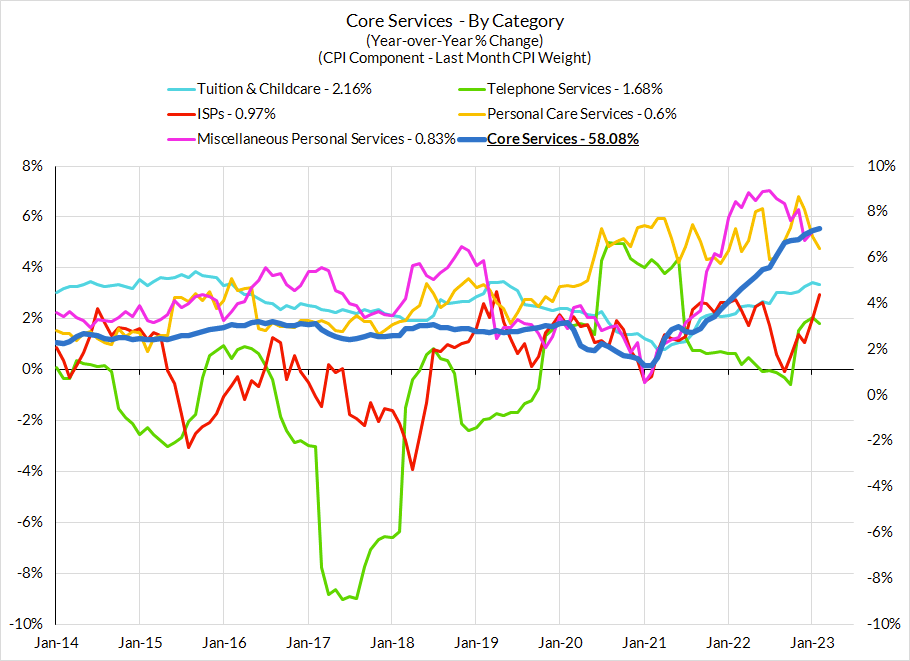

- Dark Spaces of Core Services Ex Housing PCE: It's possible we begin to see slower wage growth feed into some of the "dark spaces" of PCE: imputed financial services and input-cost compensation-based indices. Higher deposit rates and slower wage growth would be the two major drivers here. More discussion in our February PCE Recap.

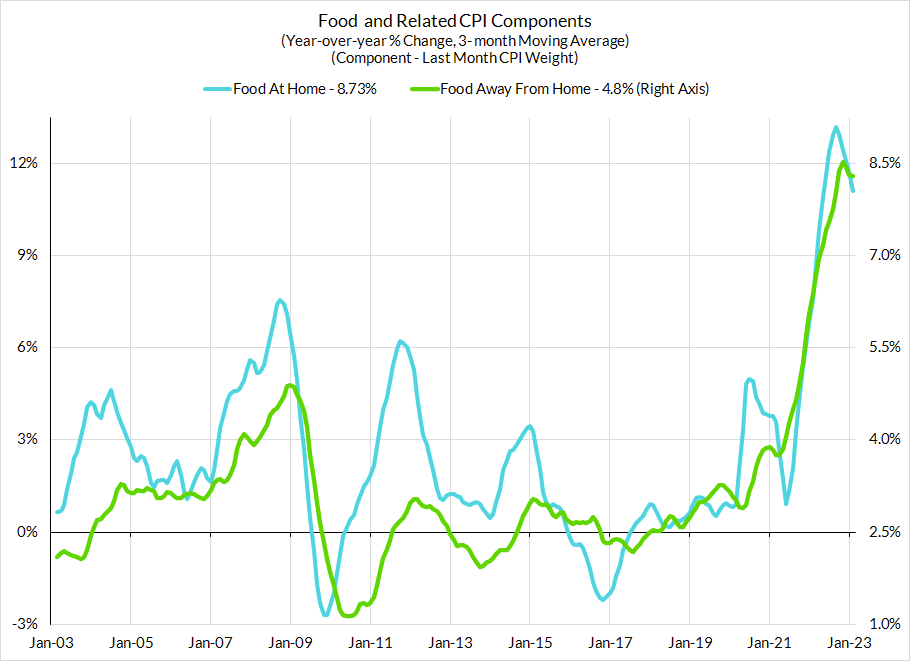

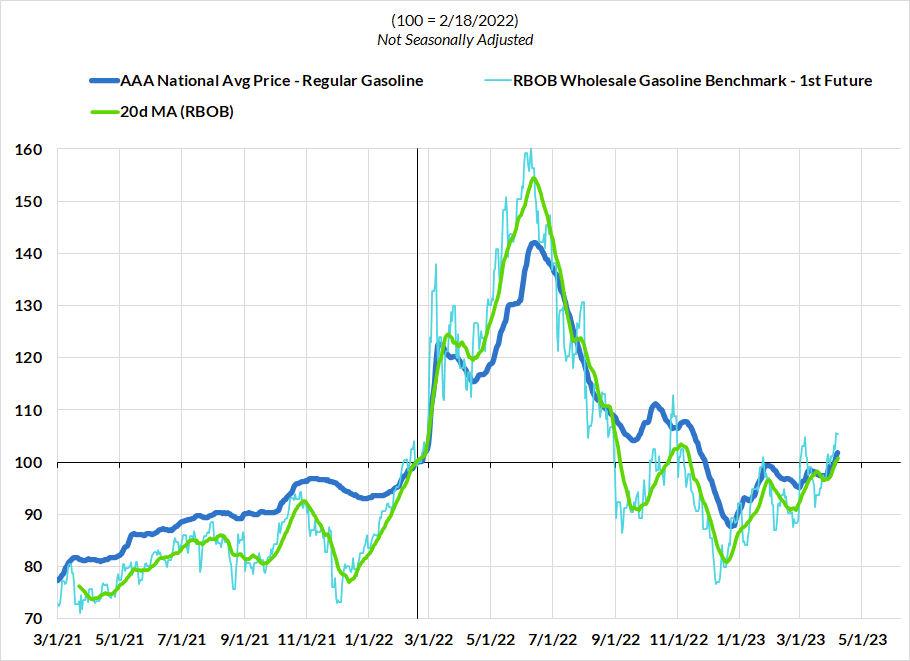

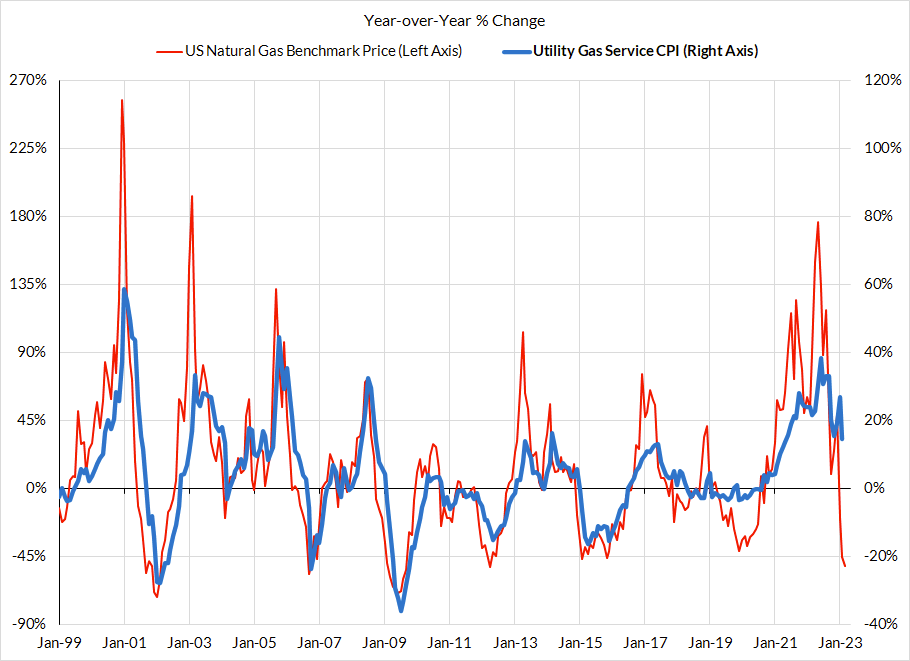

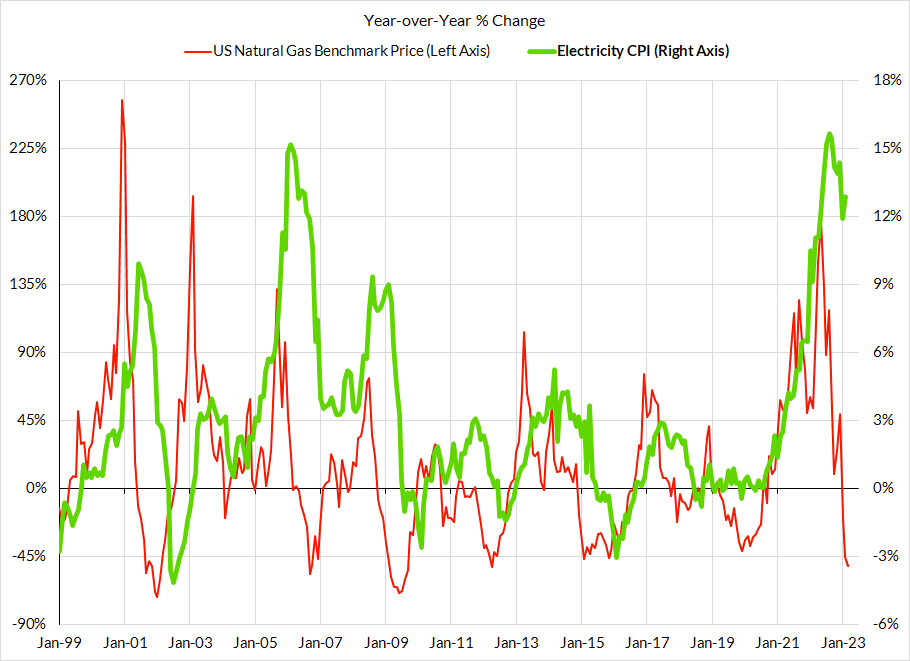

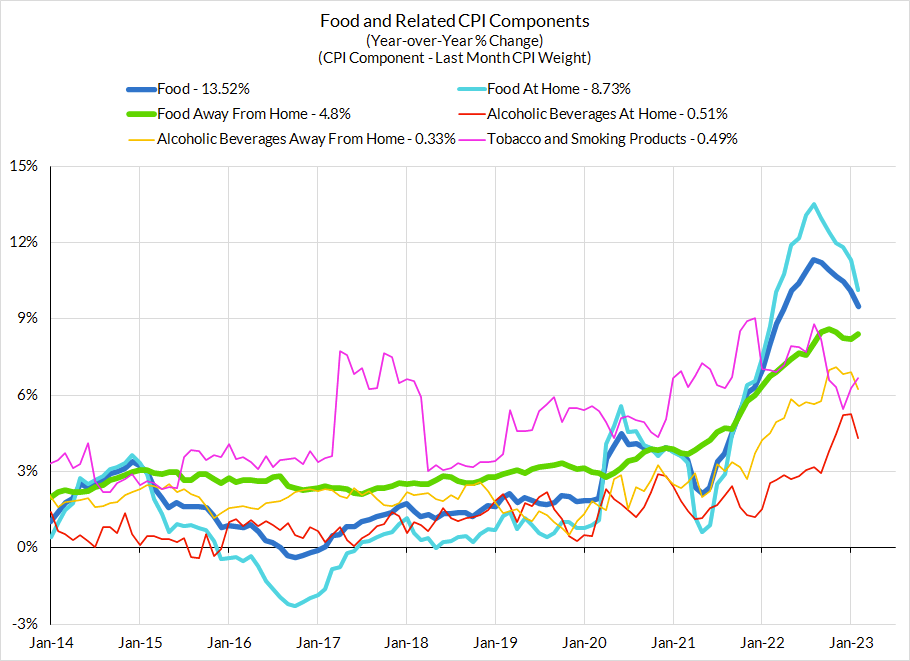

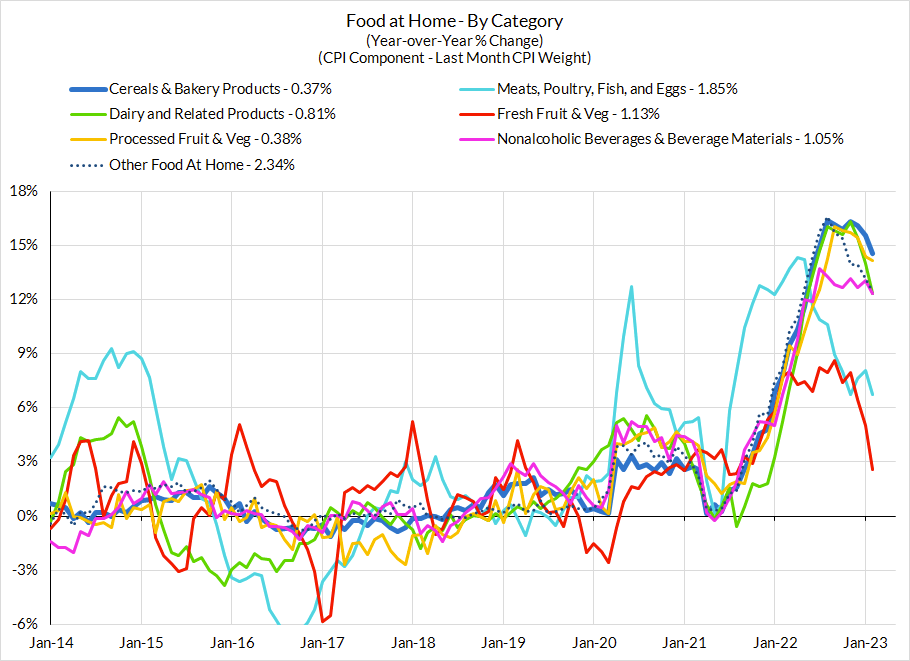

- Non-core dynamics: The non-core segments of inflation offer more mixed signals. Natural gas price declines are likely to slow down energy services inflation (utility gas service more immediately, electricity prices with more of a lag). While the OPEC cut will pull up motor fuel prices, it will only be of relevance in April (and should not be blown out of proportion). Food prices have shown greater scope for deceleration in the last few months, and with the help of improving supply chains, should continue to do so.

New Potential Supply Shocks:

- The big upside risk to food prices is likely to stem from the risk of flooding in California (from snowmelt), but this is a dynamic to flag for Q2 and Q3 food prices, not March. If it did materialize, we would expect it to affect not just grocery store prices, but restaurant prices that count towards Core PCE and Core Services Ex Housing PCE.

Final note:

The Fed's narratives are aging poorly: The Fed's grasp of goods price dynamics is far too sanguine, while their confidence that services inflation is caused by the labor market is also liable to aging poorly. Right now there are growing signs that wages are decelerating, but goods prices and services prices may not provide the kind of relief that the Fed assumes. In our framework, a sufficient slowdown in expected labor income growth should be enough cause for a pause. The Fed seems to hold itself excessively responsible for delivering 2% inflation, even if it has more proximate effects on the labor market and the proximate causes for inflation lie elsewhere.

CPI Charts

Non-Core CPI Components

Core CPI Components

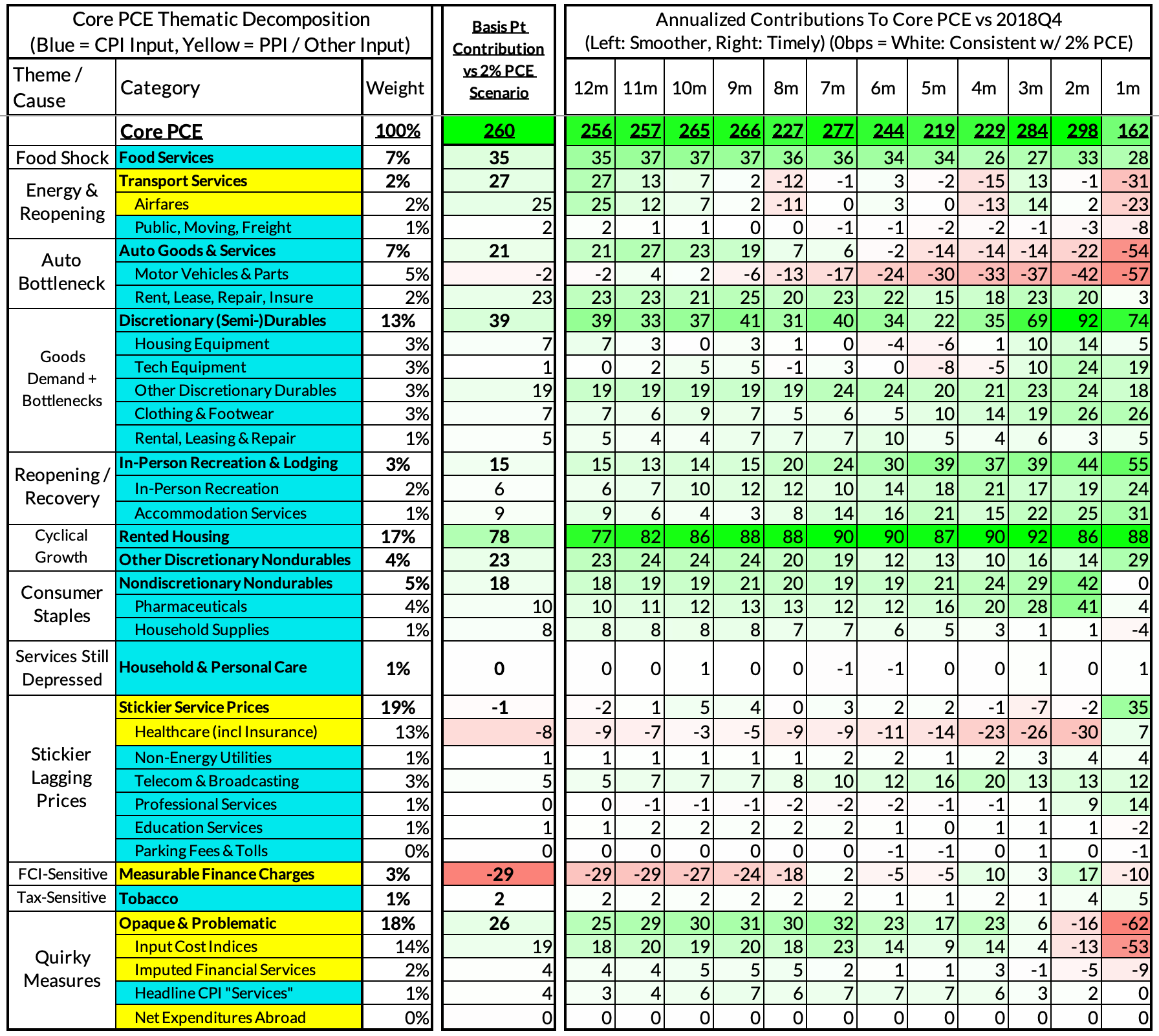

For the Detail-Oriented: Core PCE Heatmaps

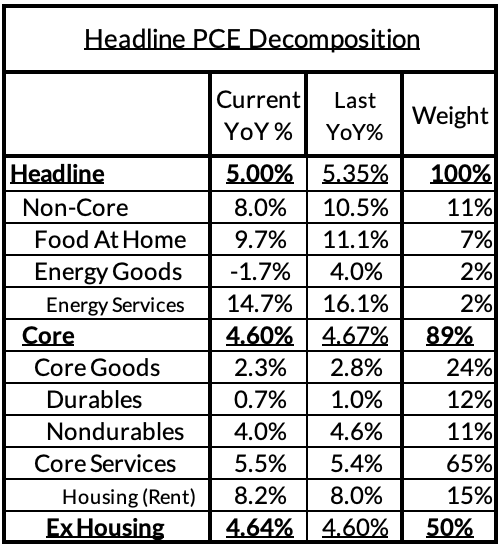

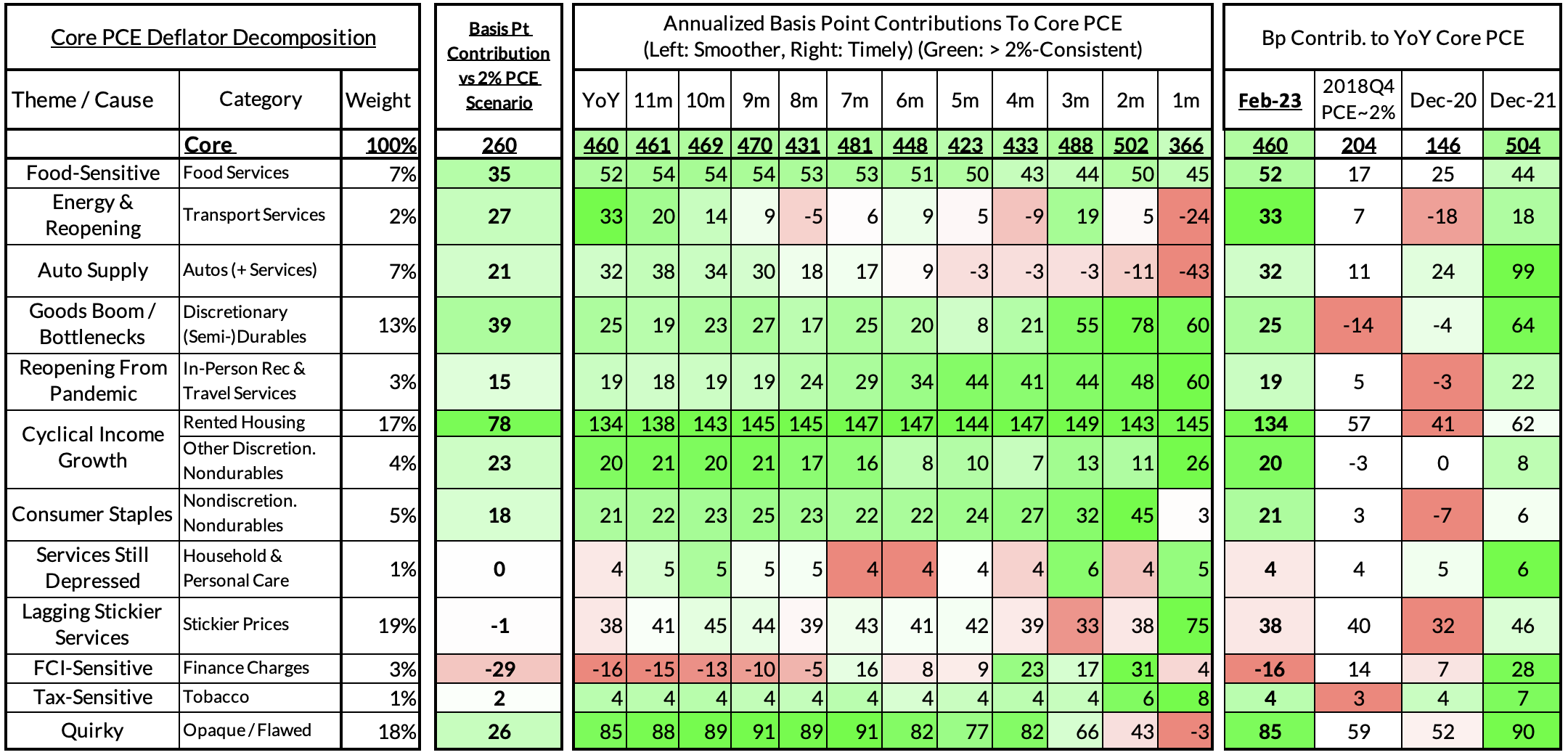

Right now Core PCE (PCE less food products and energy) is running at 4.60%, 260 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22

There are other contributors to the overshoot, some more supply-driven (automobile bottlenecks likely explain 21 basis points, while food inputs likely added 35 basis points to the overshoot) and some more demand-driven (in-person recreation and travel services adding 15 basis points to the overshoot), and some reflect both (airfares are both reopening-sensitive and energy-sensitive, adding 27 basis points to the overshoot).

The final heatmap gives you a sense of the overshoot on shorter annualized run-rates. February's monthly core PCE yielded a 162 basis point overshoot vs 2% target inflation (3.62% annualized).

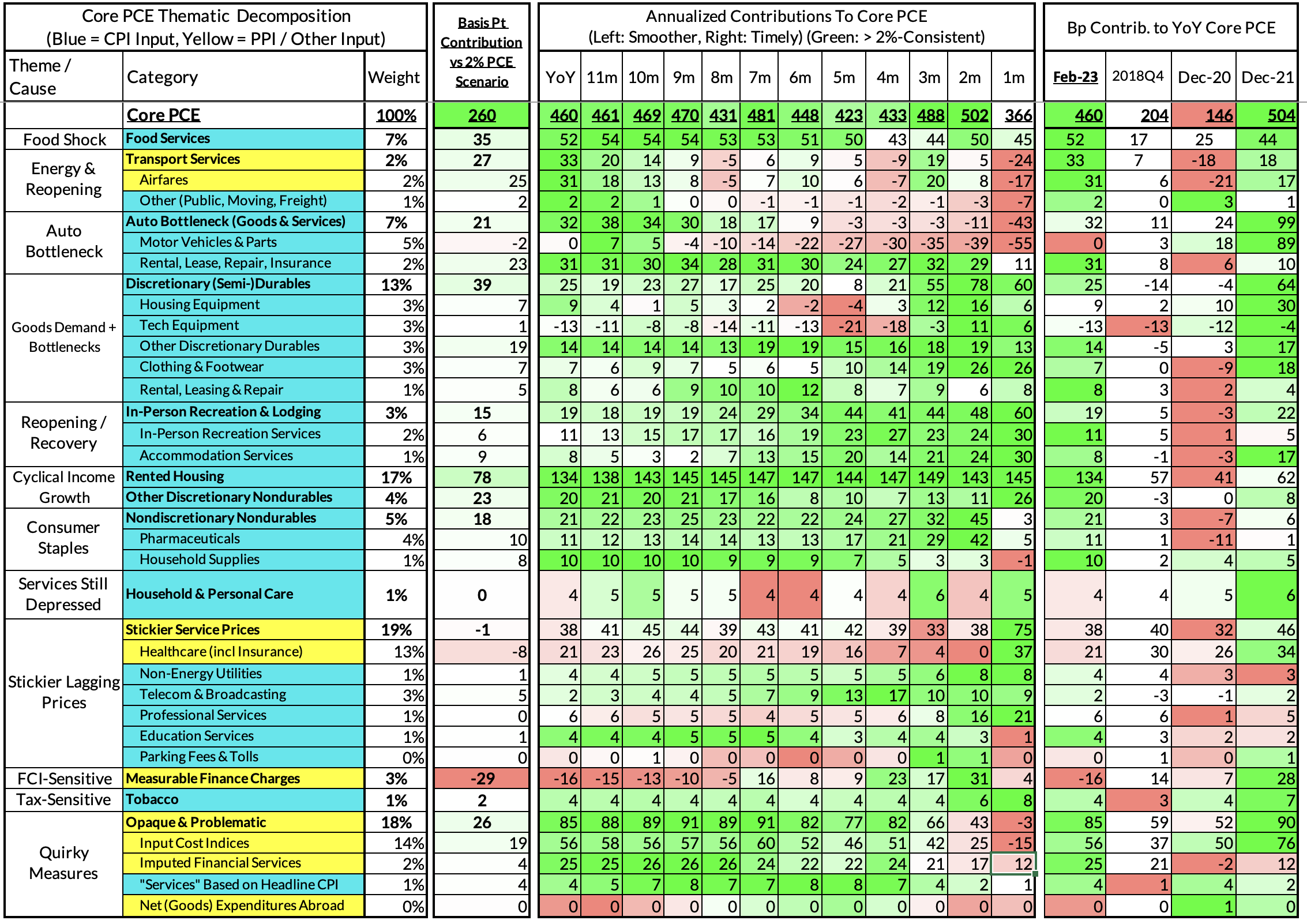

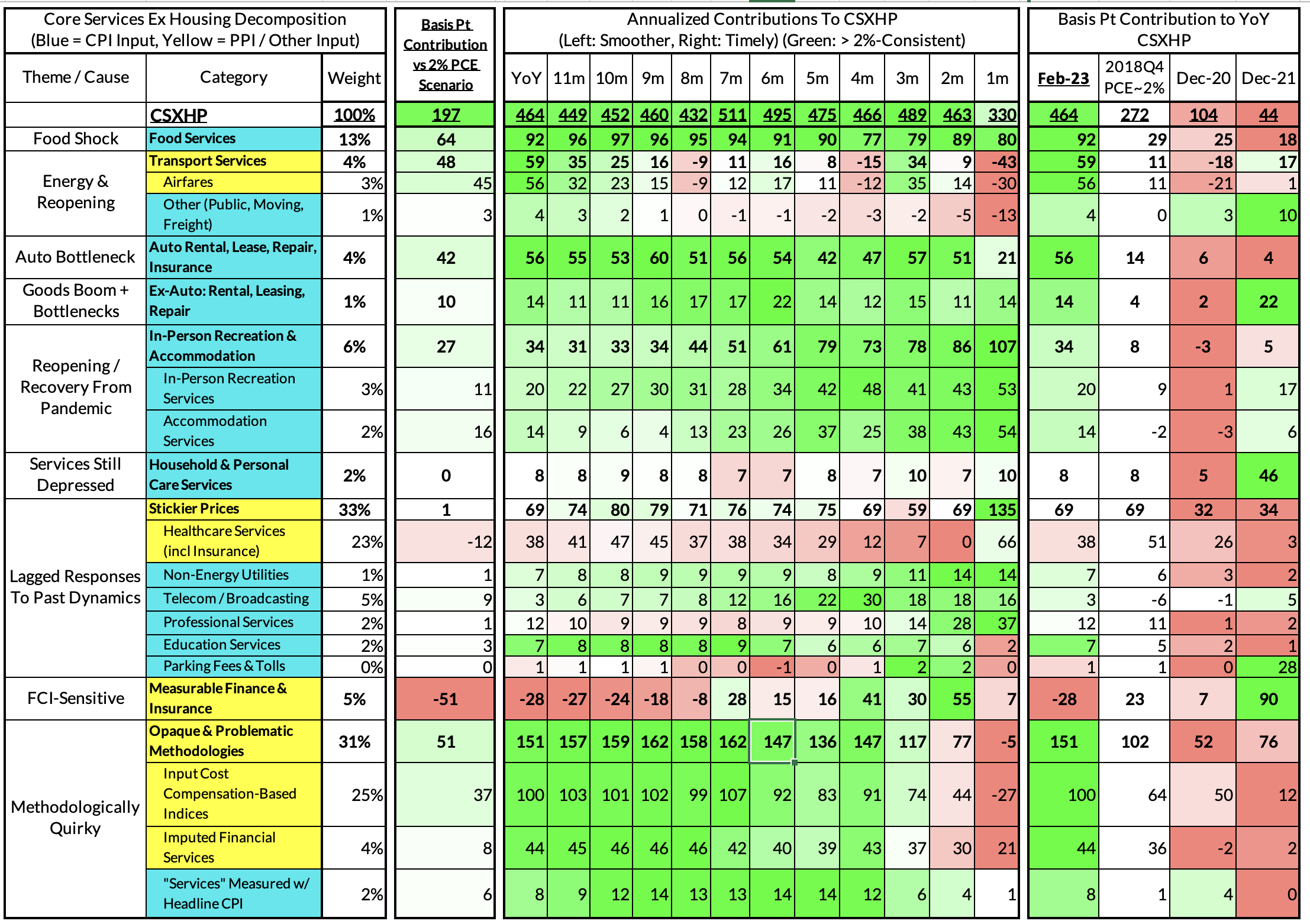

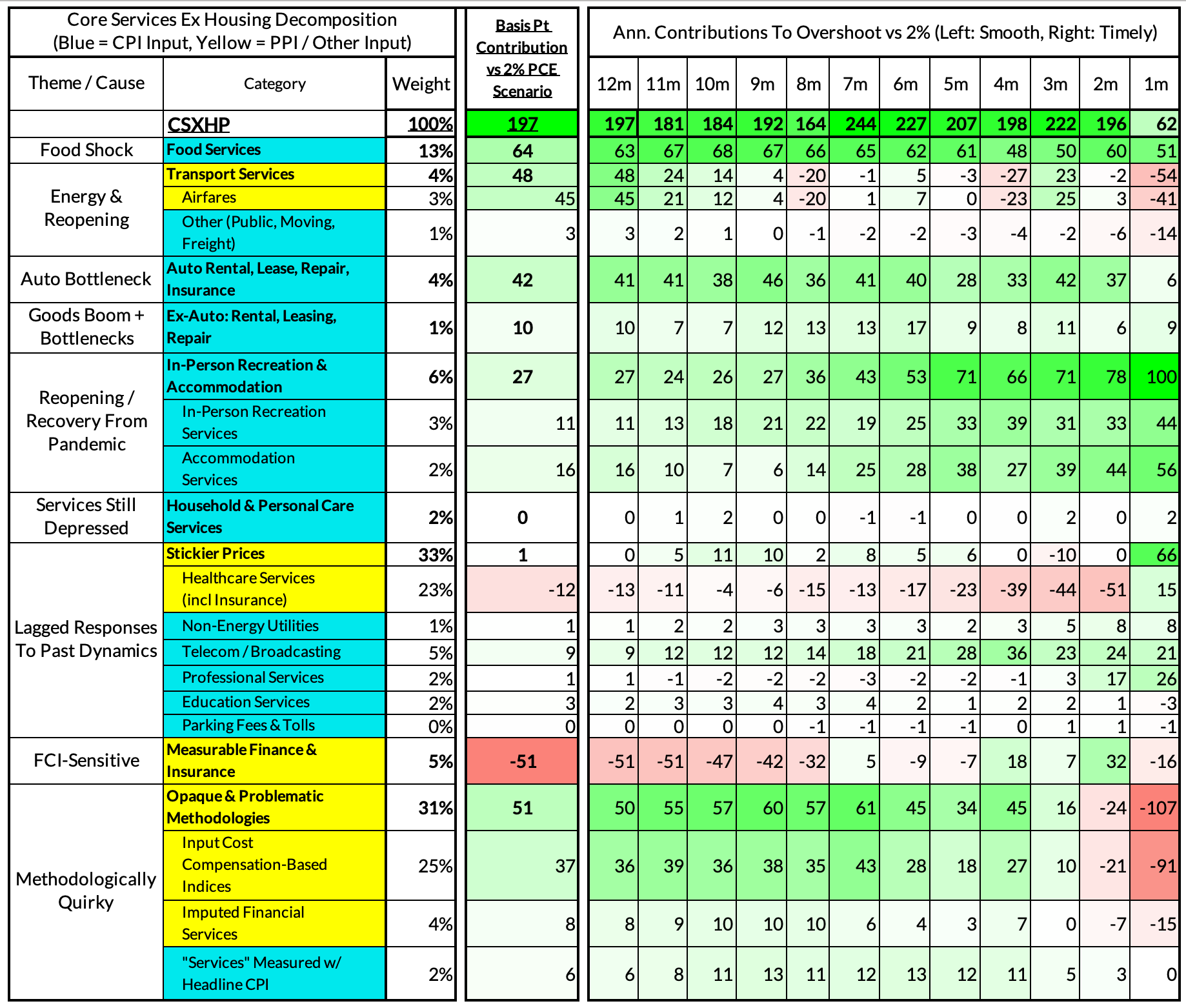

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

February's growth rate in "Core Services Ex Housing PCE" is on track to run at 4.64%, a 197 basis point overshoot versus the 2.72% run rate in this aggregate that coincided with 2% headline and core PCE.

We would call special attention to what we're seeing in the "Methodologically Quirky" categories we have flagged in the bottom rows. They are softening up quite a bit in recent months and could put downward pressure as slower wages, higher deposit rates, and food and energy price deceleration take further root.

Past Inflation Previews and Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages