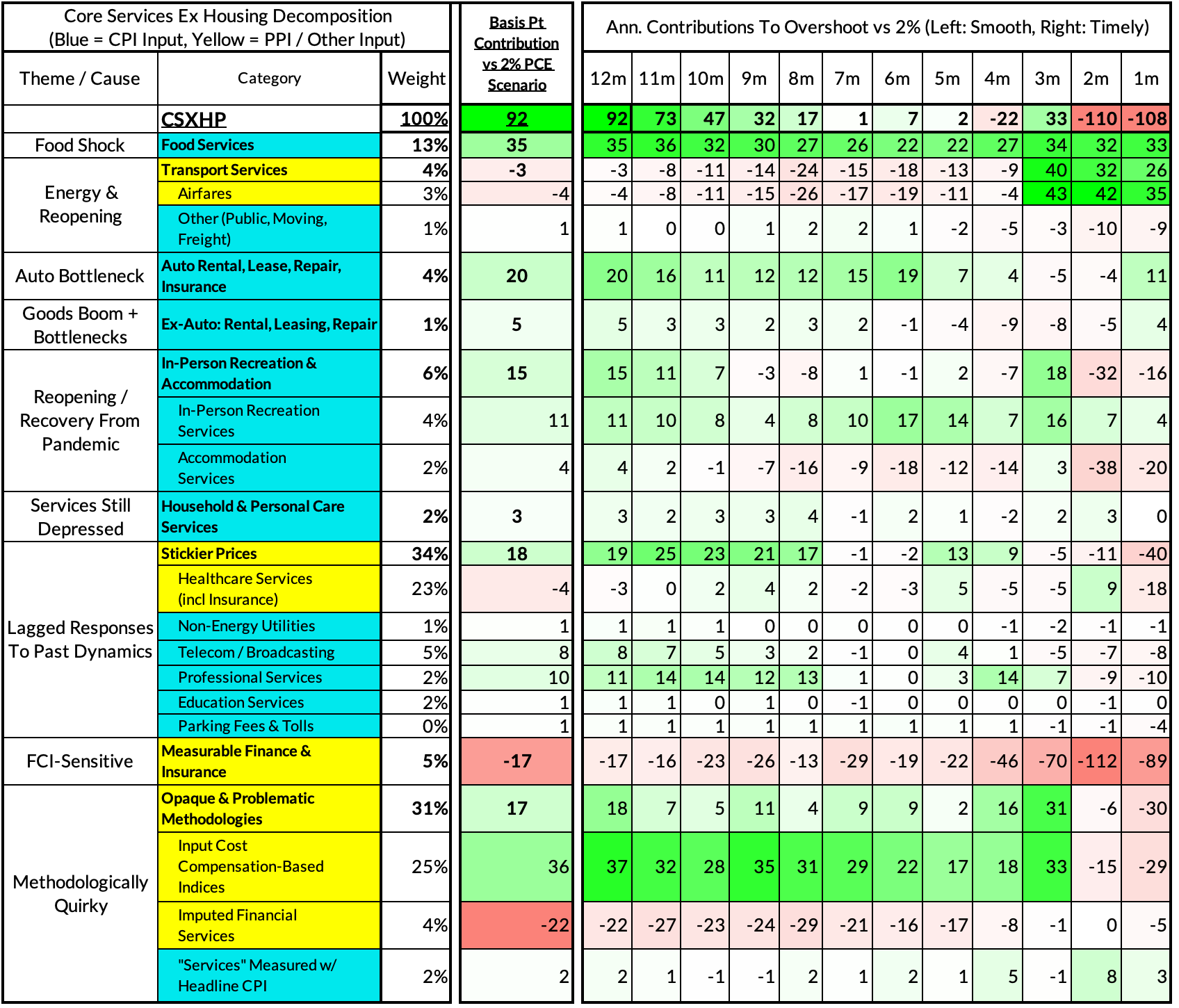

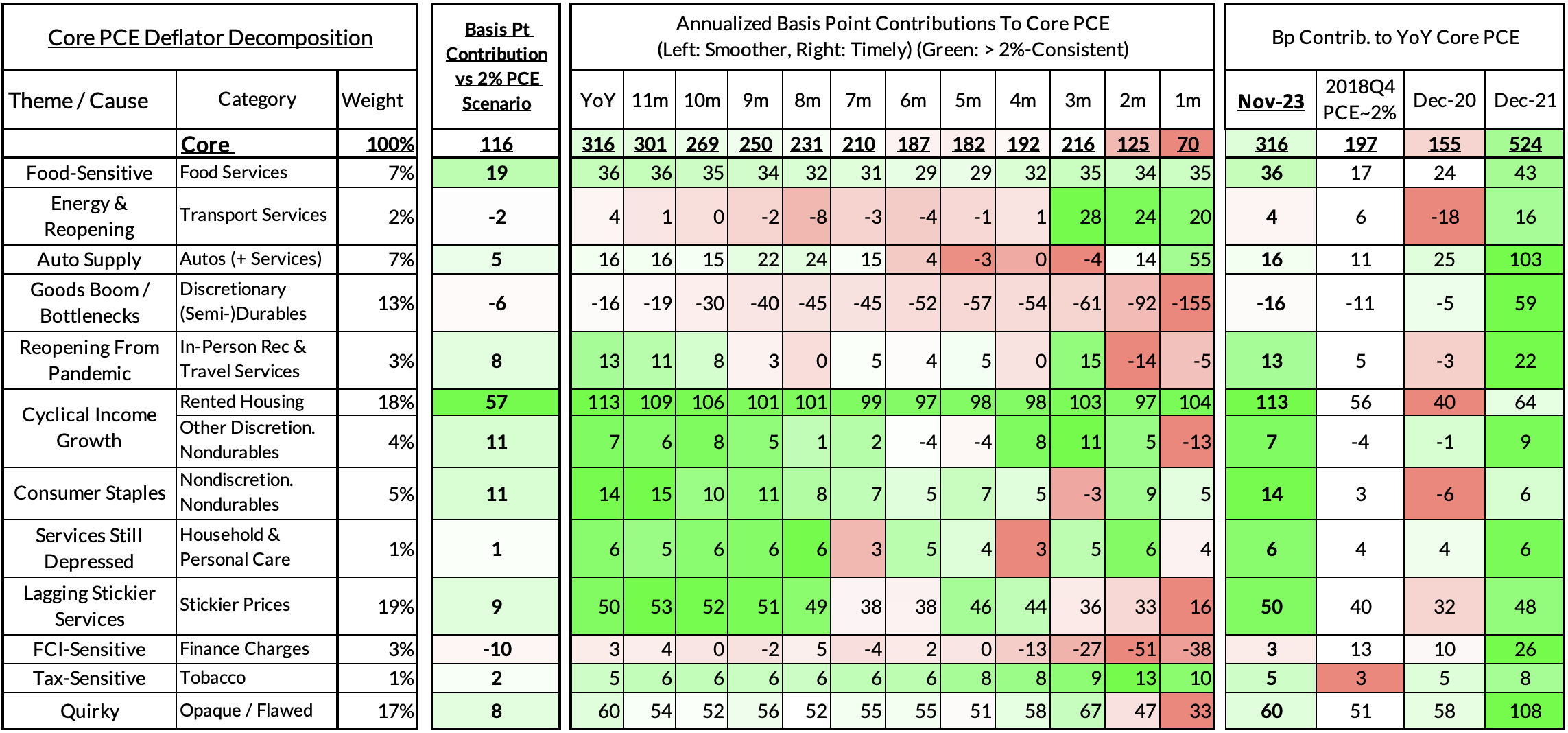

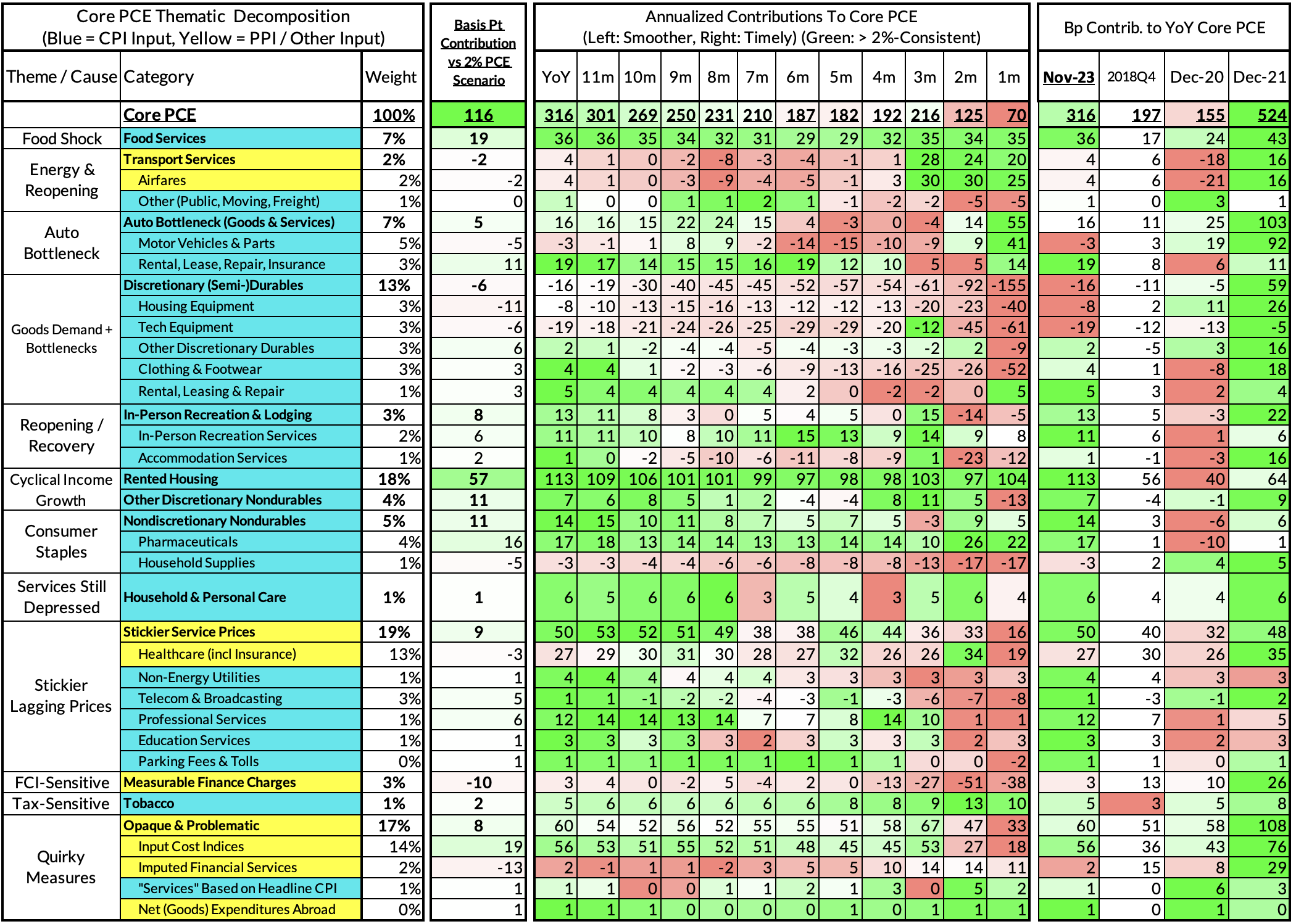

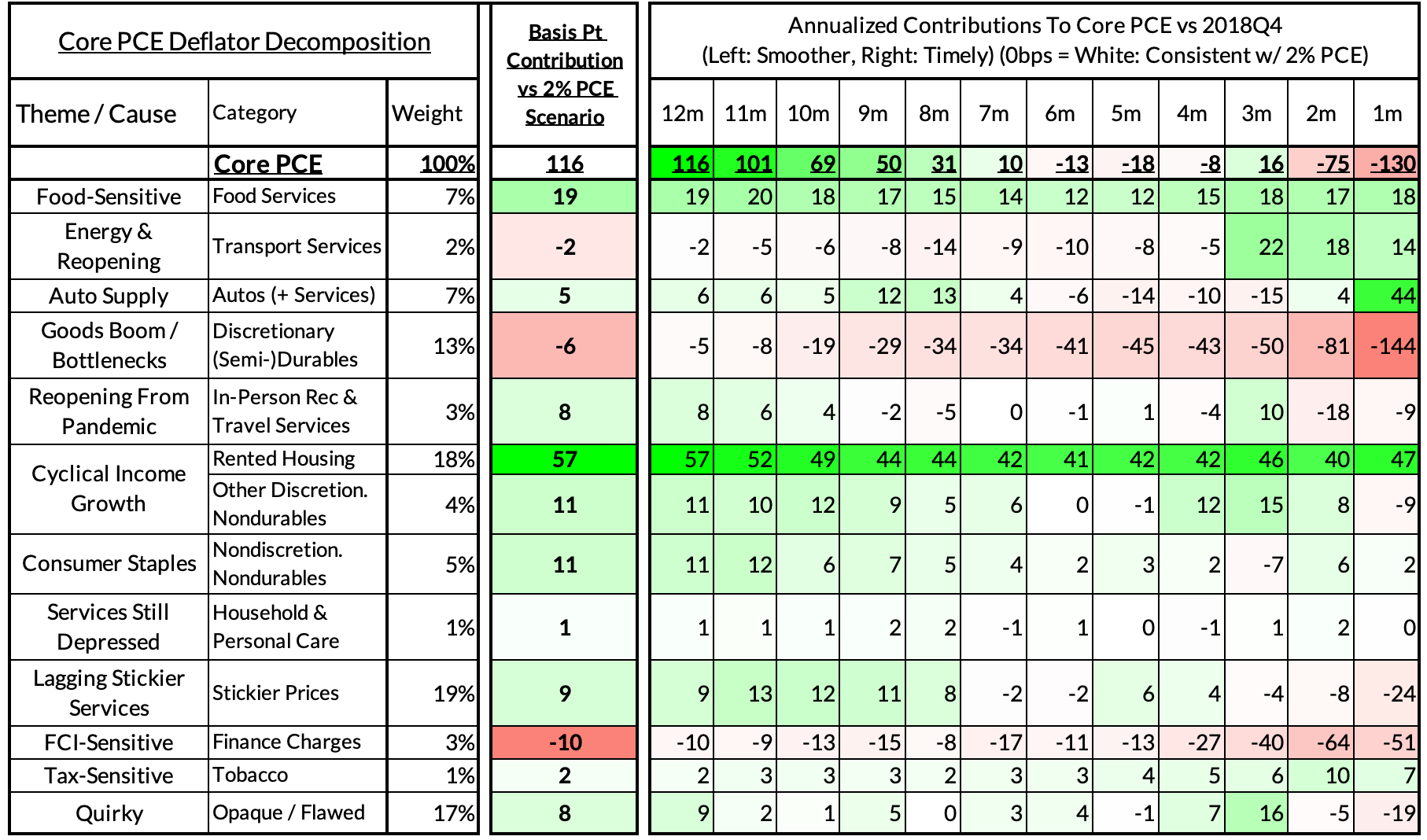

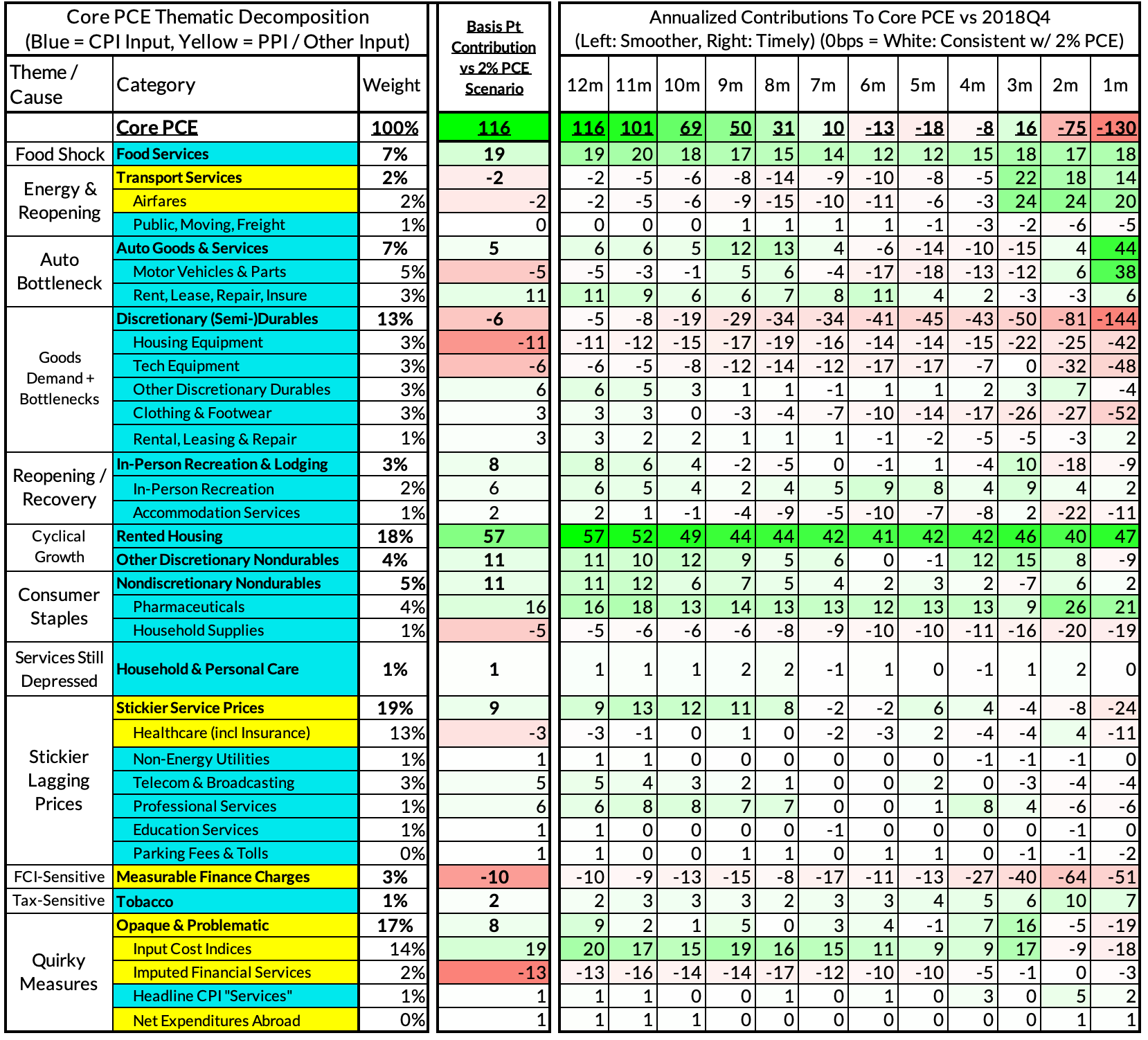

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release. Reach out to us if you would like to become a Premium Donor to support and access all of our research content.

Summary

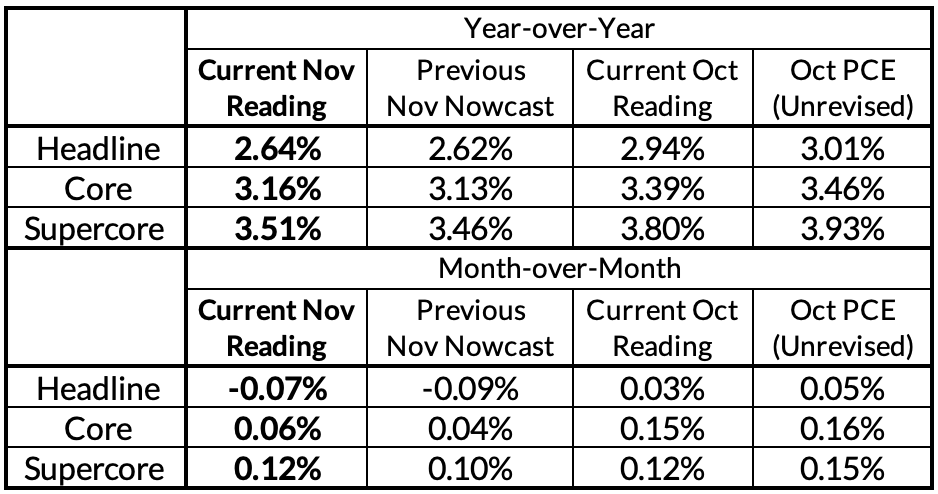

Our monthly nowcasts were marginally too low (1.5-3bps for m/m and y/y Core PCE). All things considered, we do not see major issues to reconcile between what we nowcasted and how things panned out. Nor do we see grounds for radically revising our views of inflation or the Fed's reaction function to the inflation data. Today's data is very close to what the Fed was seeing at the December FOMC meeting. Powell demonstrated high cognizance of the nuances of PCE inflation dynamics that were known on the day PPI was released.

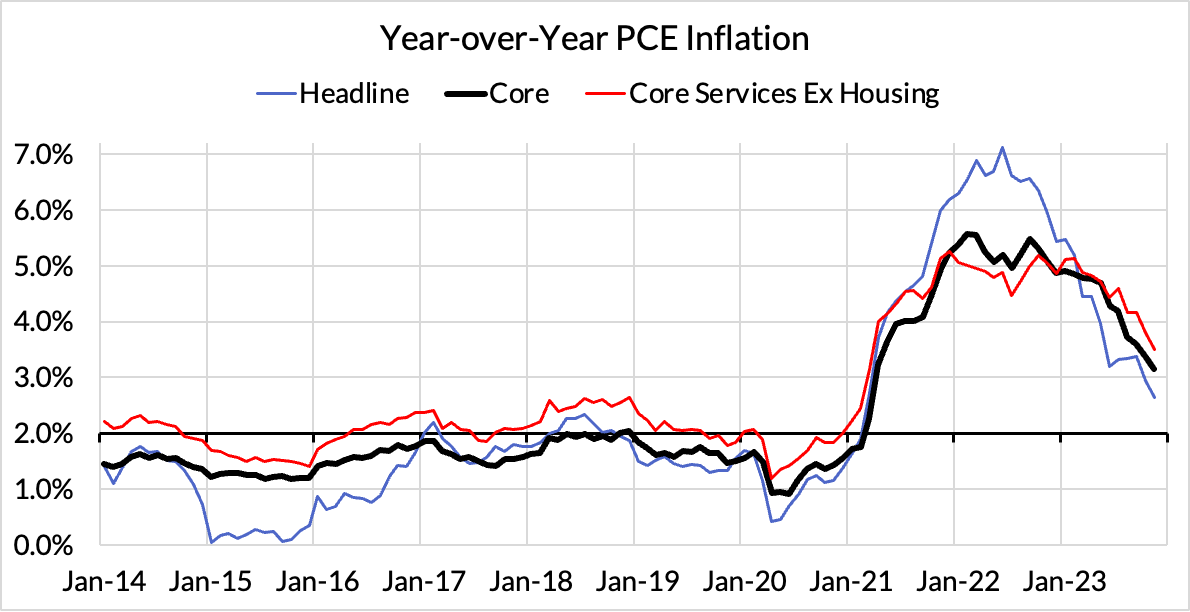

We expect to see encouraging core inflation dynamics in the coming months as used car price deflation starts to feed back into CPI releases and rent price deceleration re-emerge, but there are upside risks. Q1 in the past two years has shown conditional residual seasonality: firms lagging on price increases push through bigger price increases at the turn of the calendar year. There's reason to believe the lag is not so pronounced this time around, in which case Q1 might be hotter than adjacent quarters but meaningfully slower than 2022Q1 and 2023Q1.

Our expectation is for the Fed to begin normalization interest rate cuts at the March FOMC meeting, and for Fedspeak to reflect this intention after the January CPI/PPI releases. Risks are firmly tilted towards the Fed only beginning cuts in May than to beginning normalization in January. So long as the Fed continues on the path of interest rate normalization, the precise timing between March and May should not be particularly important. Of course, if we saw more concerning labor market dynamics or financial market deterioration, then the case for cutting in January would strengthen more dramatically.

For the Detail-Oriented: Core PCE Heatmaps

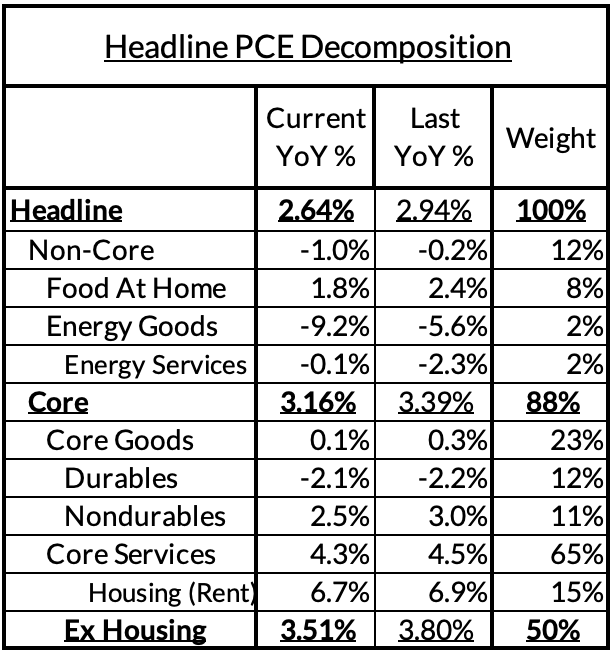

Right now Core PCE (PCE less food products and energy) is running at a 3.16% year-over-year pace as of November, 116 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth), which caused market rents to surge in 2021. Rent is contributing 57 basis points to the 116 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (automobile bottlenecks are likely to explain only 5 basis points now, while food inputs likely added 19 basis points to the overshoot)

- Some more demand-driven (in-person recreation and travel services likely added 8 basis points to the overshoot)

- So with demand- and supply-side drivers (consumer staples and discretionary goods likely added 16 basis points).

- Some oddball segments have offsetting effects (measured financial service charges now likely subtracted 10 basis points, while contributions from input cost indices and imputed financial services likely added 6 basis points to Core PCE vs 2%-consistent outcomes).

The final two heat maps below gives you a sense of the overshoot on shorter annualized run-rates. November monthly annualized core PCE yielded a 130 basis point undershoot vs 2% target inflation (0.7% annualized).

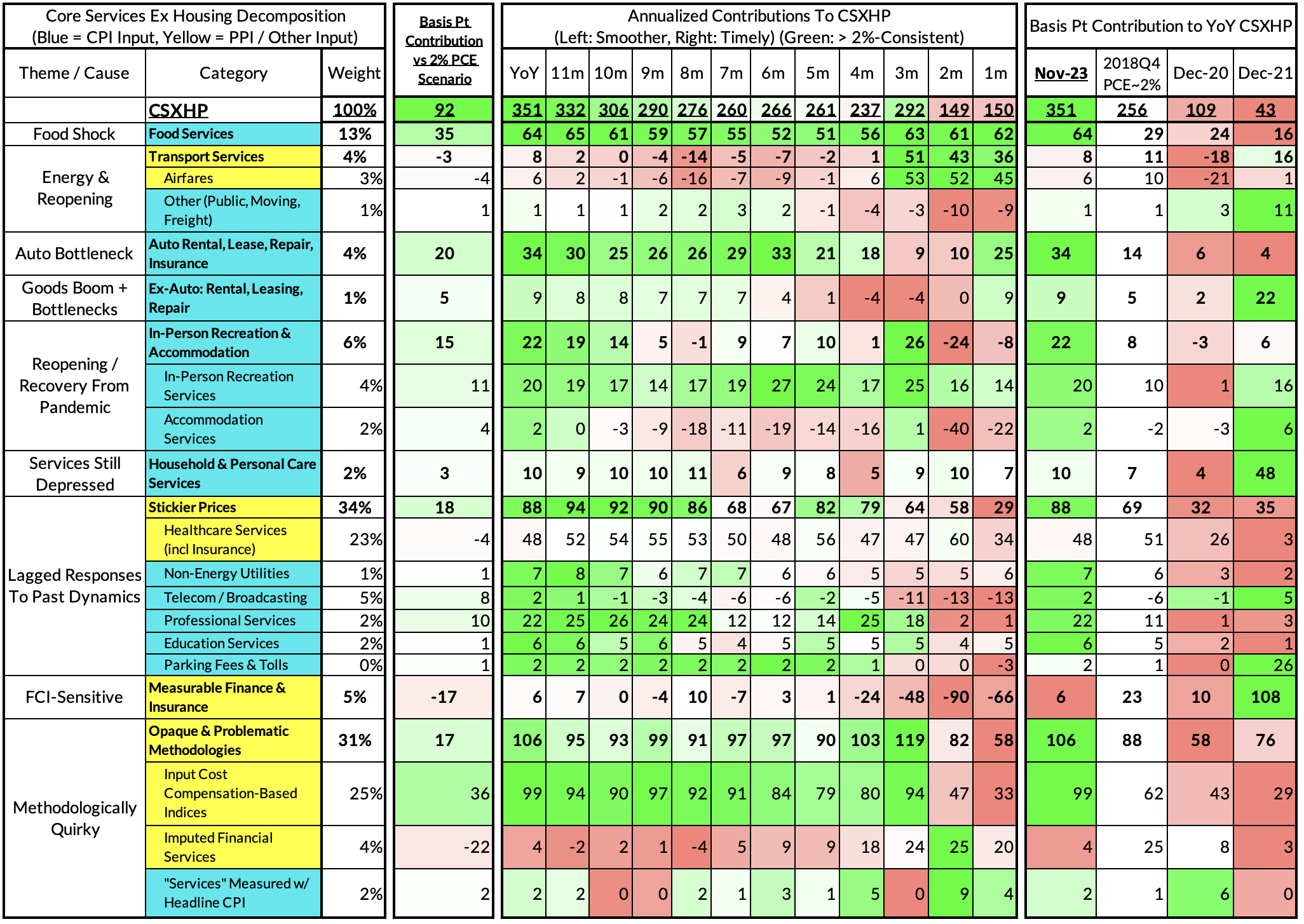

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The November growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 3.51% year-over-year, a 92 basis point overshoot versus the 2.59% run rate that coincided with ~2% headline and core PCE.

November monthly supercore ran at a 1.50% annualized rate, a 108 basis point undershoot of what would be consistent with 2% headline and core PCE.