Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

This is a truncated version of the preview initially made available to our exclusive distribution this past Friday. Please reach out to us if you would like to access the full preview when it is first made available. If you'd like to start a 90-day free trial of our exclusive content, you can do so using this link. If you have any questions or would like to see samples of our past content, feel free to get in touch with us.

Summary

- We (rightly) forecasted February upside based on January upside but for those same reasons, the residual seasonality upside effect should begin to dissipate in March and further in Q2. The upside surprise in January across goods and services foretold further upside in February, primarily because so much of the CPI surveys' measurement of price changes follows a bimonthly process. We are now through that "residual seasonality hump" tied to "New Year, New Prices." We should see more signs of disinflation resuming and broadening in March relative to January & February and more visibly as we enter Q2.

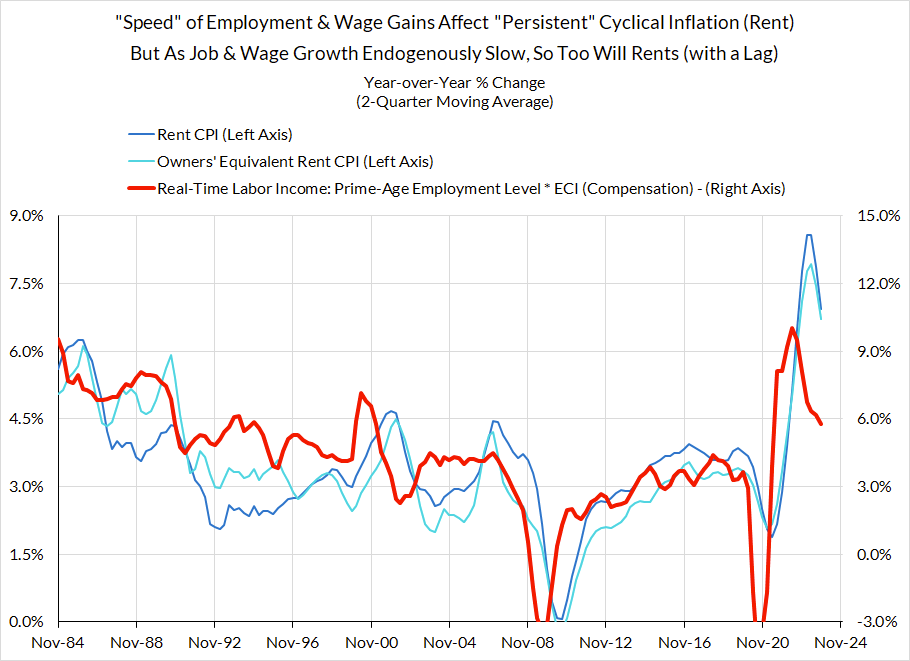

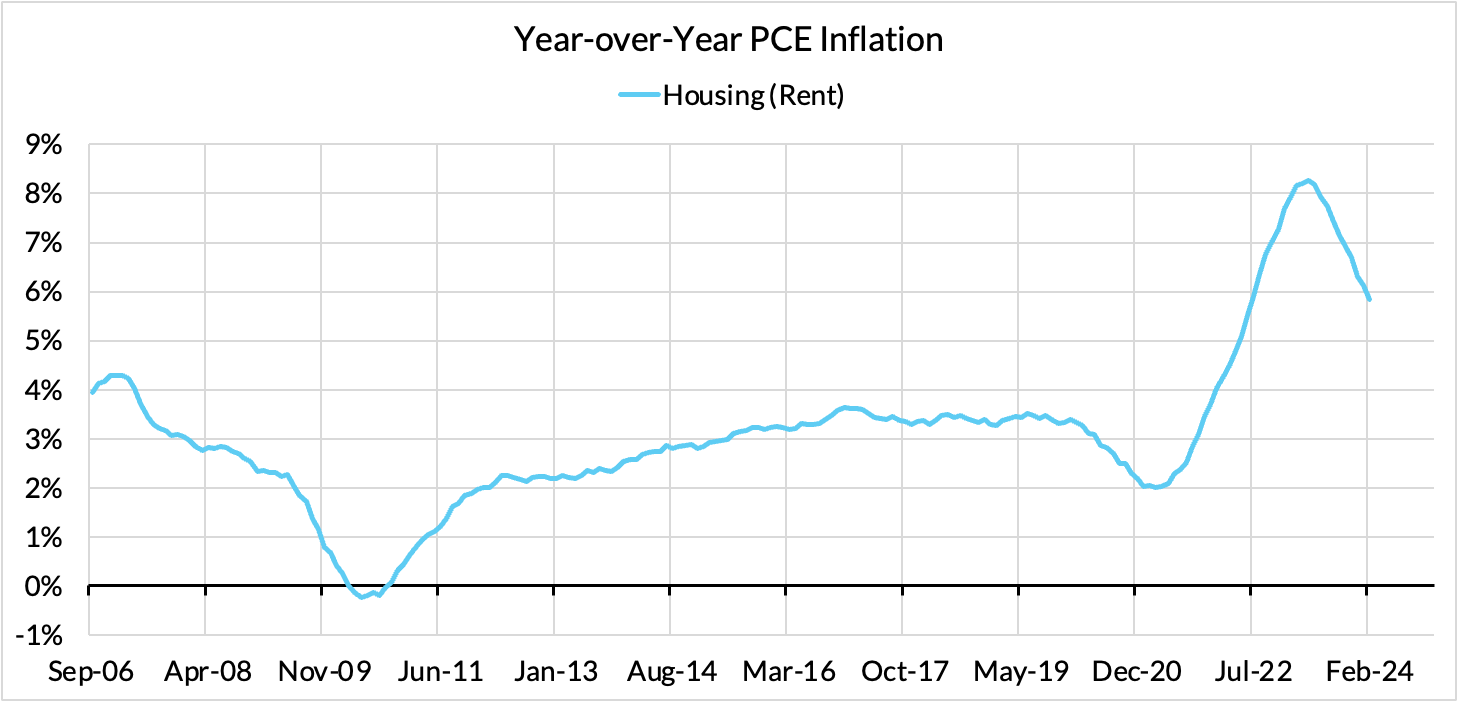

- Owners' equivalent rent dynamics are primed for deceleration soon but March is probably too soon. Notoriously named "Superusergate," there was much speculation about a structural shift upward in OER inflation in 2024 as a result of single family detached units receiving higher weight. We were skeptical that this was a major driver of January OER upside relative to rent of primary residence and February data largely strengthened our skepticism (largely inverting January's OER-rent divergence). We see more signs that the revised seasonal factors are likely to induce more local volatility in relative readings between rent and OER. We are getting close to a more discernible leg of rent and OER disinflation but given the seasonal factors, it may take another month or two for it to fully come to fruition. If we saw OER correct in a manner similar to rent of primary residence, the case for a preemptive May interest rate cut might resurrect itself in a 'shoot-the-moon' scenario, firmly against the current balance of risks. Such a scenario would have to be coupled with broad Core PCE disinflation (<0.13%) and favorable downside revisions to past Core PCE readings.

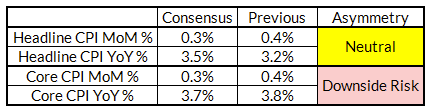

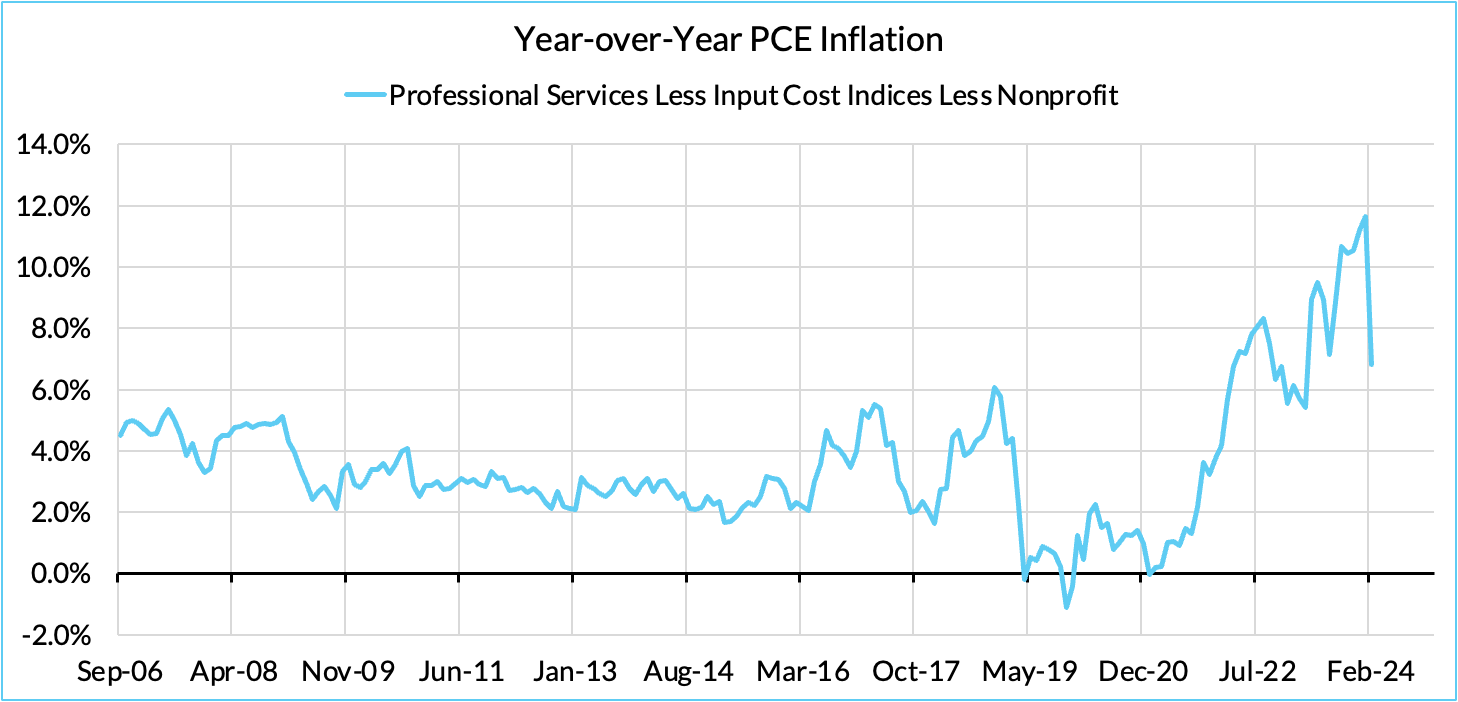

- The Core CPI-PCE "wedge" should remain similarly high in March as it was in February. Our Core CPI forecast is on the border between a 0.2% and 0.3% (0.25% unrounded), but with healthcare services, airfares and vehicle insurance likely to diverge between CPI and PCE, we expect the wedge to be 7-9 basis points. As a result, our baseline forecast for March Core PCE is 18 basis points. That should be enough to further strengthen the case for a June interest rate cut but not sufficient for putting a May interest rate cut in play. Should we see Core PCE run hotter than 0.24%, the Fed would feel far more skittish about pursuing an interest rate reduction in June (at least not without further confirmation of disinflation in the April and May data releases).

Forecast Details

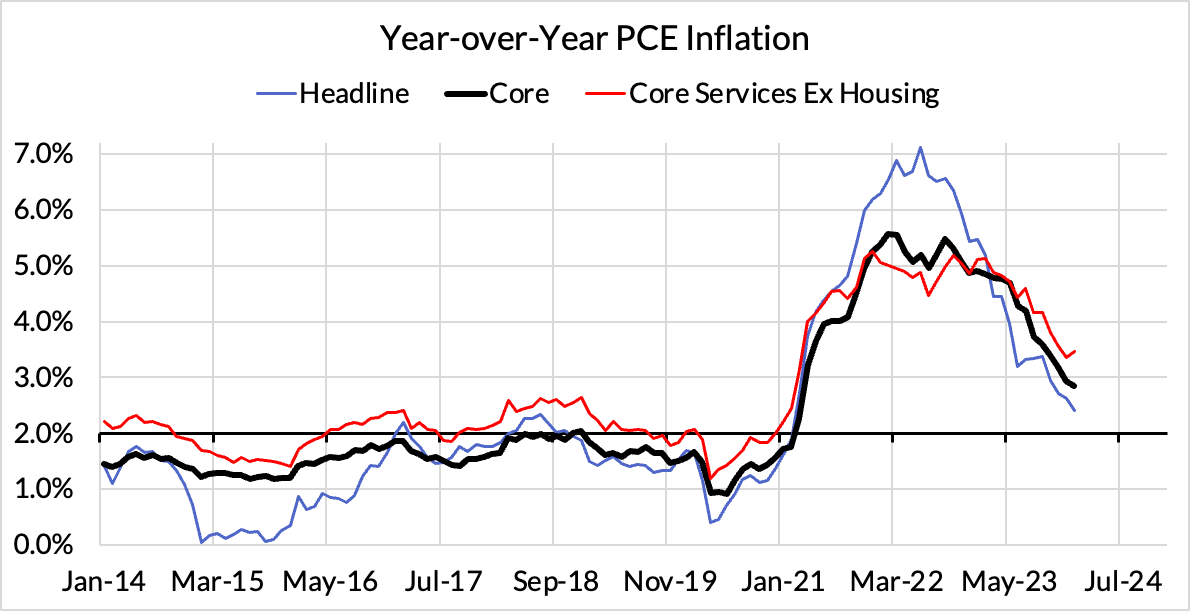

- If the residual seasonality thesis is right, it should soon be time for more local optimism. CPI sampling tends to follow a bimonthly process for estimating price changes. That means "new year, new prices" likely foretells strength across January and February but dissipating upside over subsequent months. Now that we are past January & February, inflation readings should be getting more favorable. Given the presence of residual seasonality of uncertain magnitude, year-over-year readings for PCE inflation gauges are a more robust yardstick.

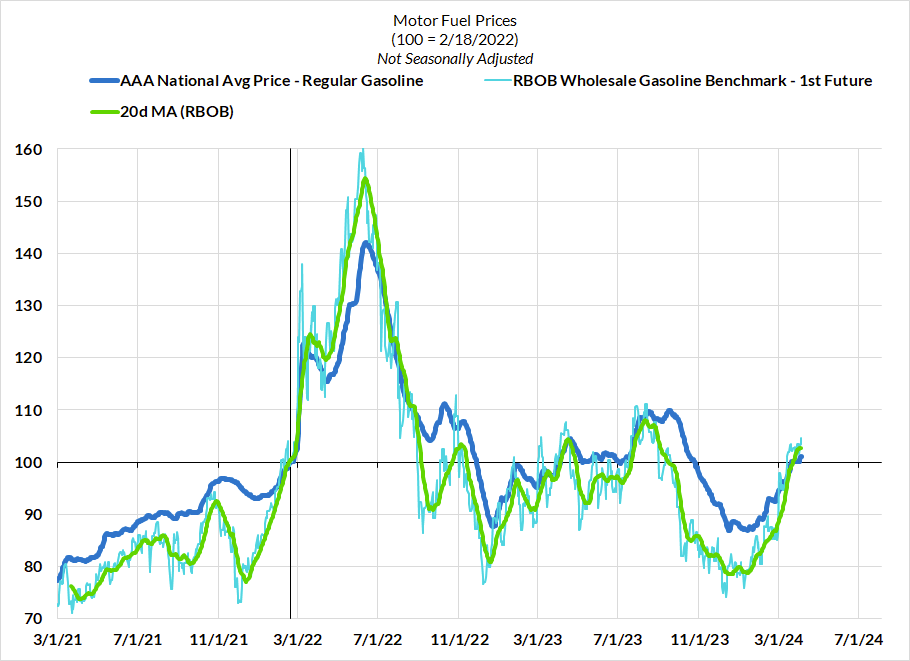

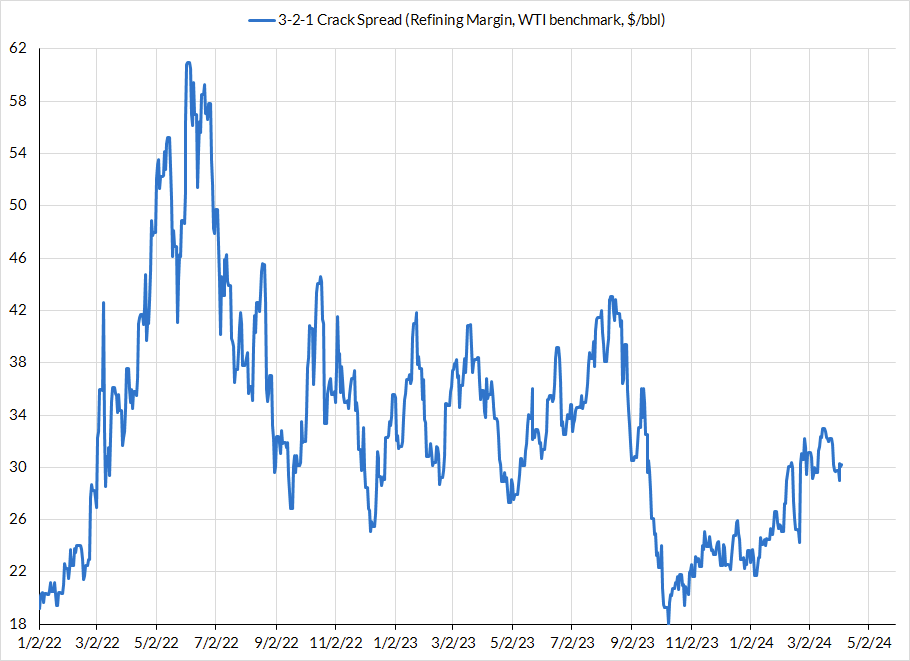

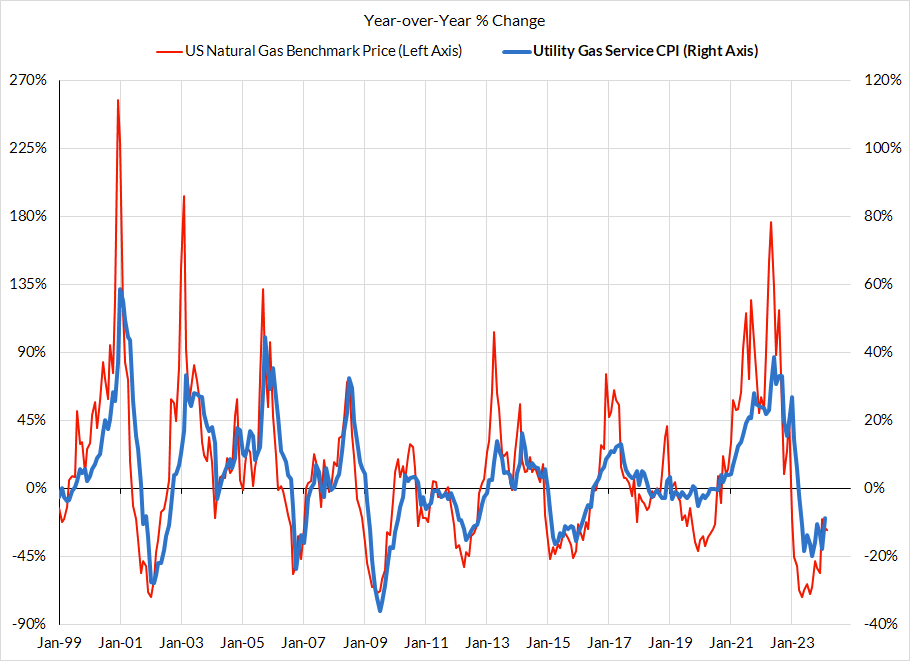

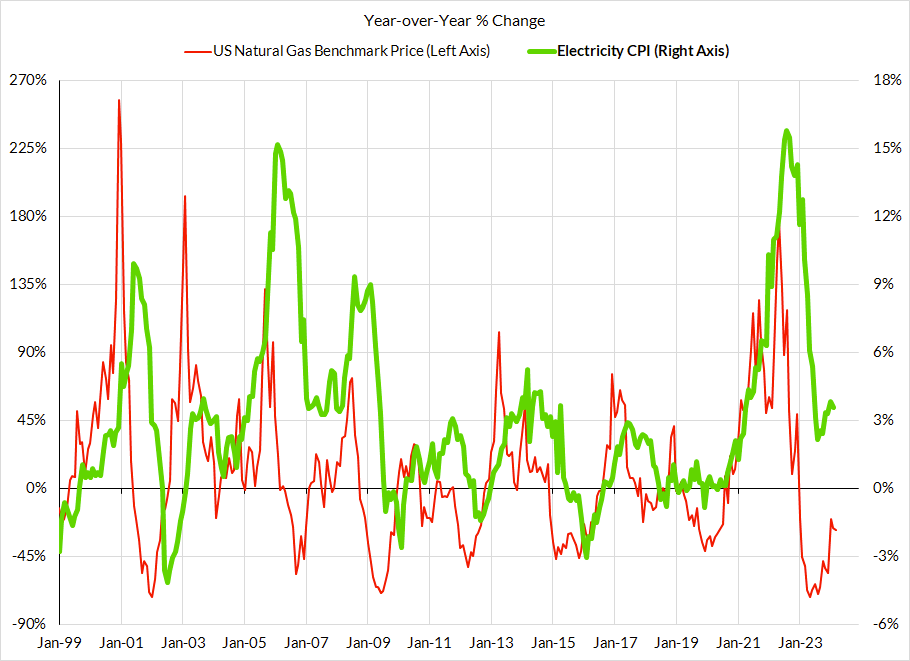

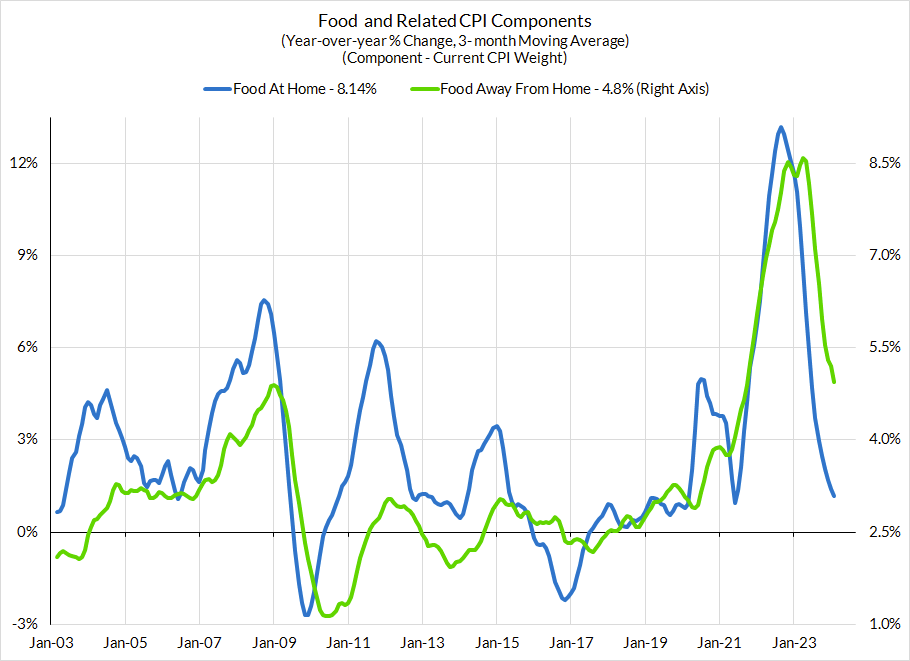

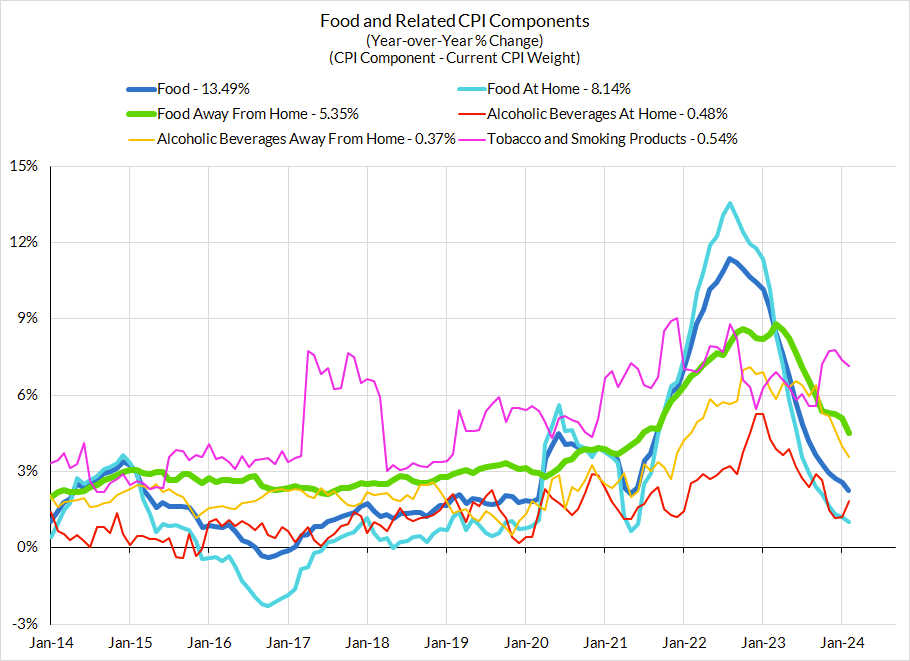

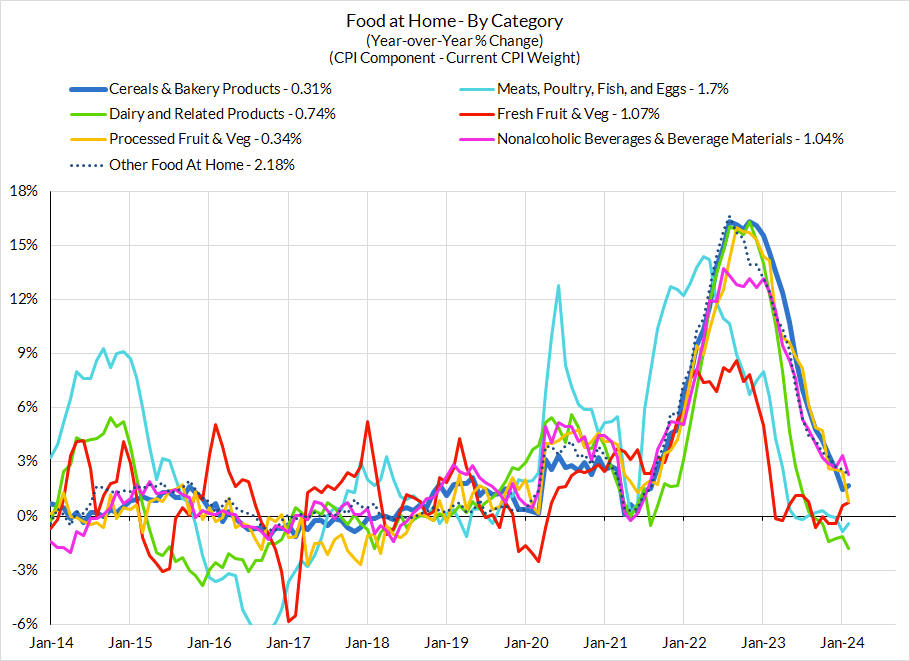

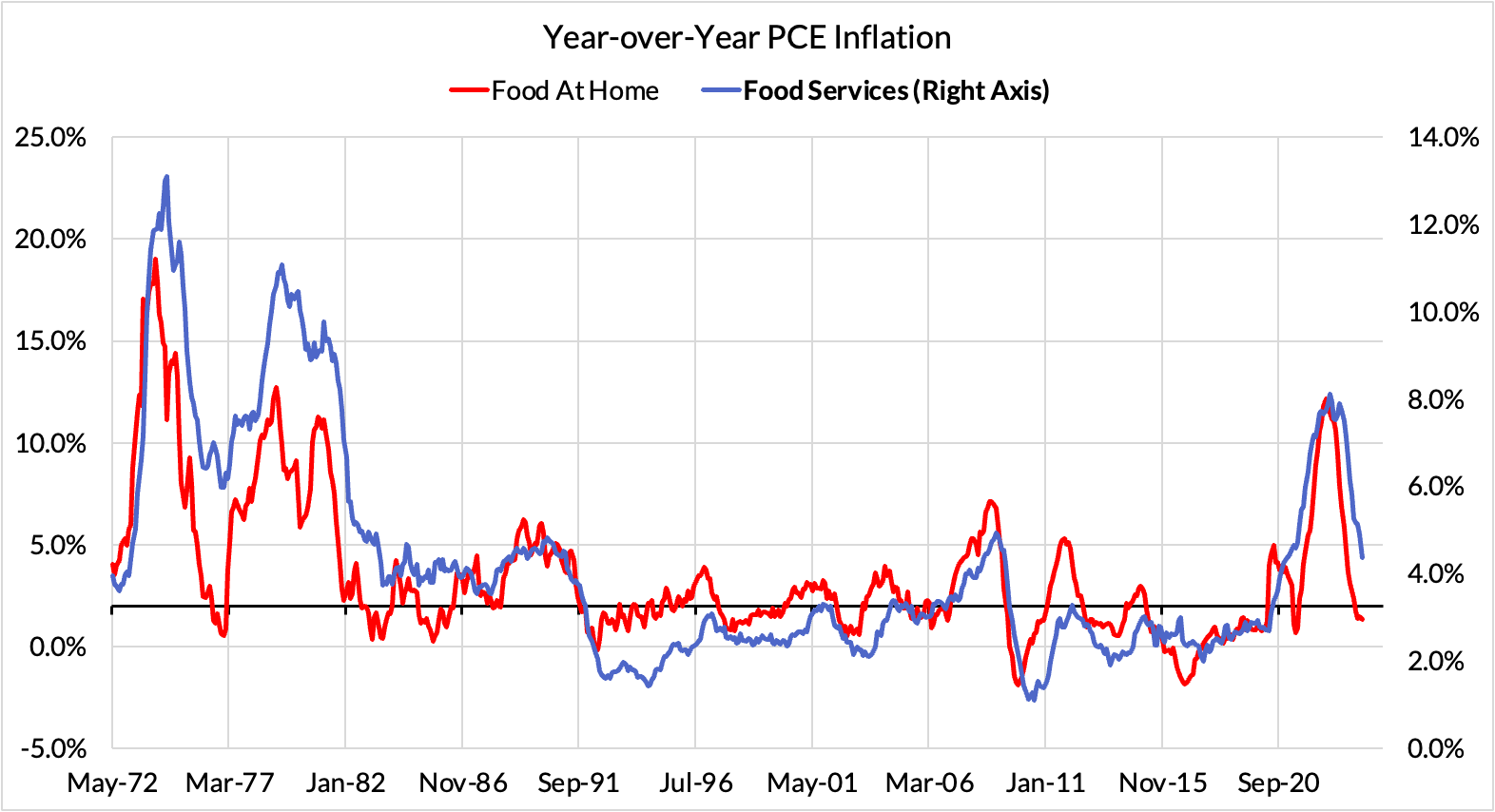

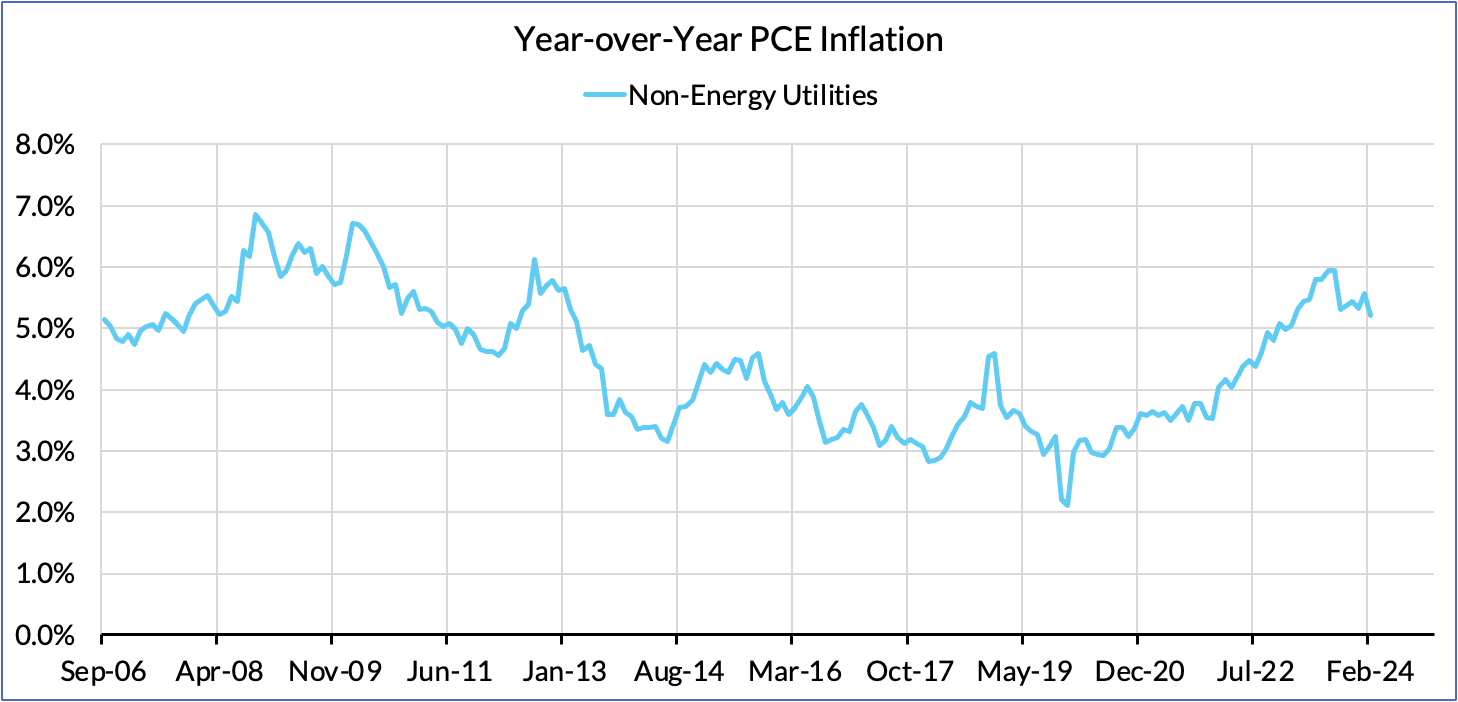

- Headline / non-core inflation has some two-sided risks: Gasoline prices are back on the rise and will rise further in April too, but there are some dynamics that should be more disinflationary...it's just a question of timing. Falling natural gas prices should feed into lower utility gas service and electricity prices. Food and food services should continue to benefit with a longer lag from stable diesel prices over thee course of 2023 (we saw a whiff of genuine softness in food service pricing in the latest CPI release). We currently expect Headline CPI to run at 0.27% m/m (on the softer side within the consensus range of forecasts).

- What to make of rent and OER? We are cautious about timing and respectful of seasonal factors but deceleration is the trend. We suspected that the BLS' explanation for the divergence visible in the January data between "rent of primary residence" and "owners' equivalent rent" does not have substantial forward-looking value and that appears increasingly correct given what we learned from the February data. Our best guess is that the divergences are underratedly aggravated by revised seasonal factors and some additional noise. With that in mind, we have baked in marginal deceleration in March but do not expect a chunky leg of disinflation to necessarily materialize imminently (but the odds of it materializing within the next three CPI releases seems high).

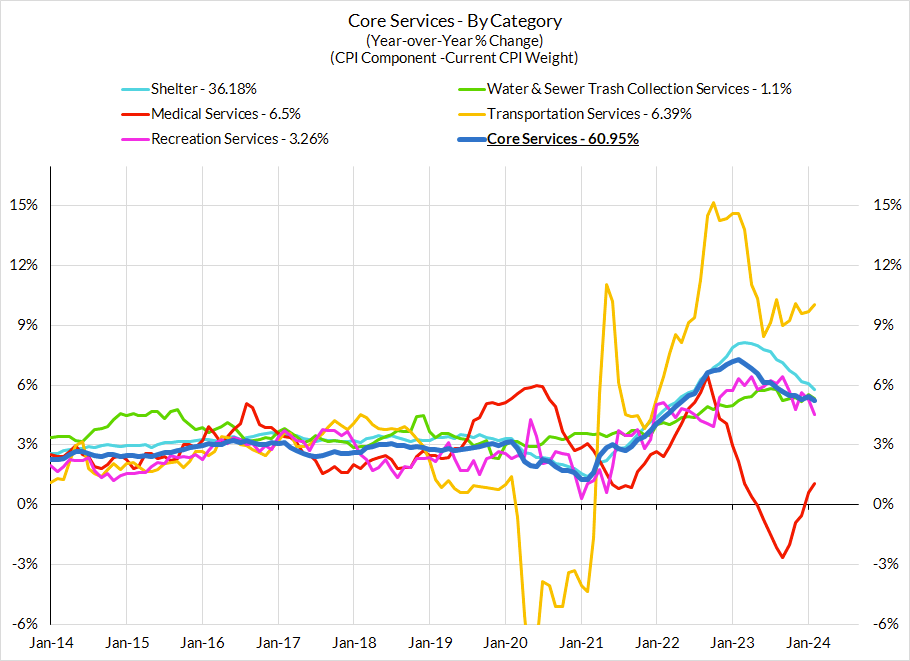

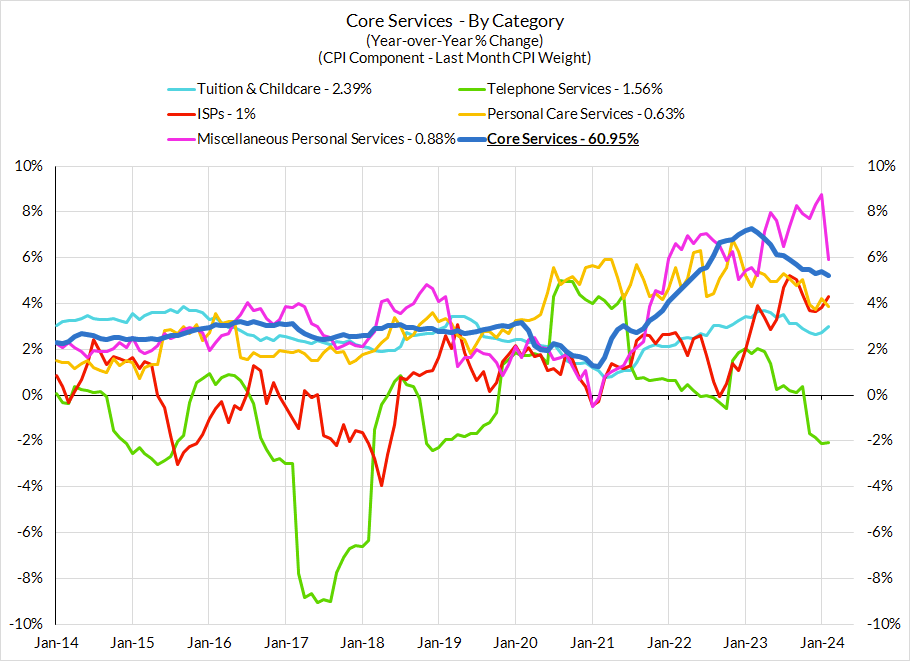

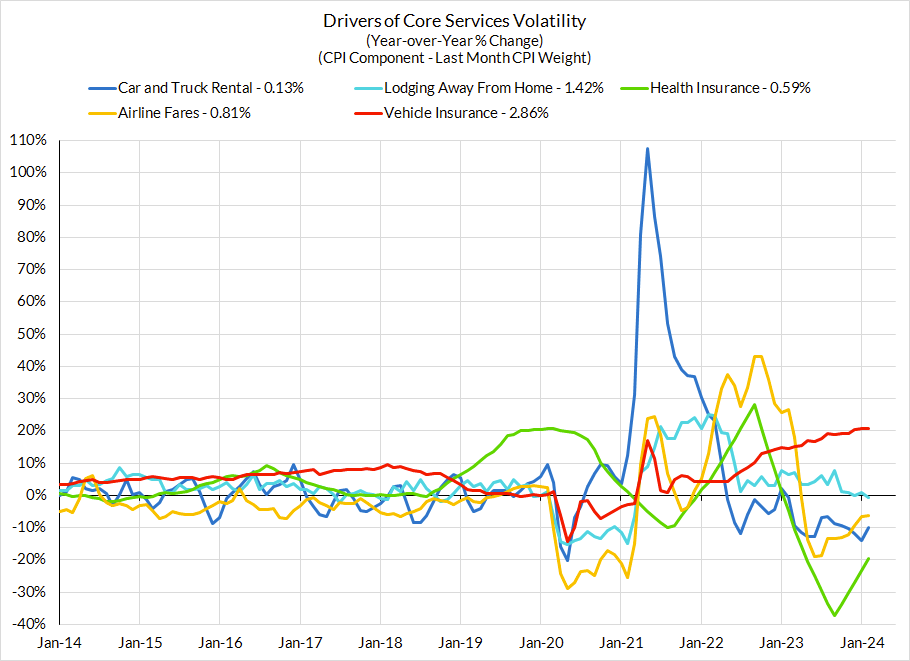

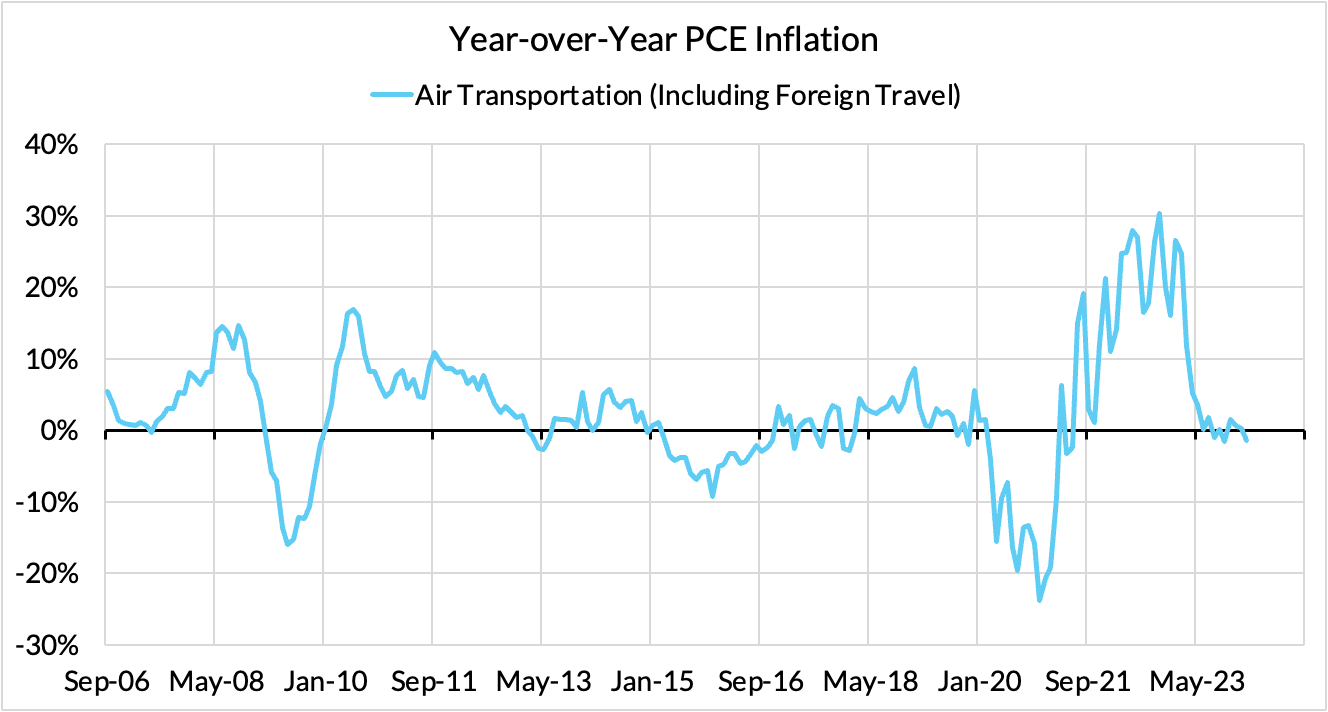

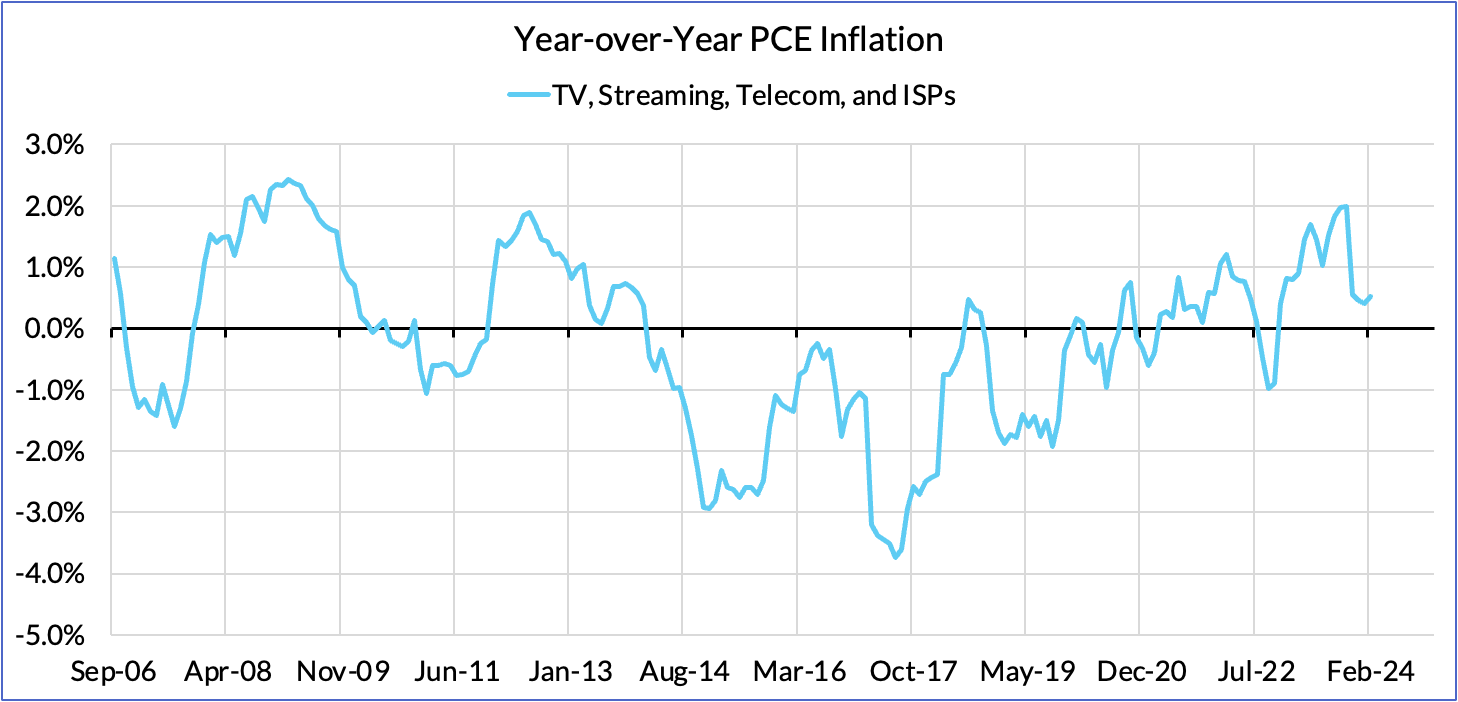

- Wedge dynamics favor Core PCE disinflation soon: Vehicle insurance PCE is far more muted than its CPI cognate. Airfare PPIs have substantially outperformed Airfare CPI (even after accounting for structural biases); some PPI underperformance relative to CPI seems likely in the coming months, though we expect some of the convergence to come through higher airfare CPI too. We are also growing more optimistic about food services disinflation.

- The risks to the Fed are a delay in the timeline for interest rate reductions. June remains our base case for the first interest rate reduction but July and September are far more likely than May. It would take a heroic alignment of circumstances to put May back in play; not impossible (need March PCE downside + downside revisions) but quite unlikely at this stage.

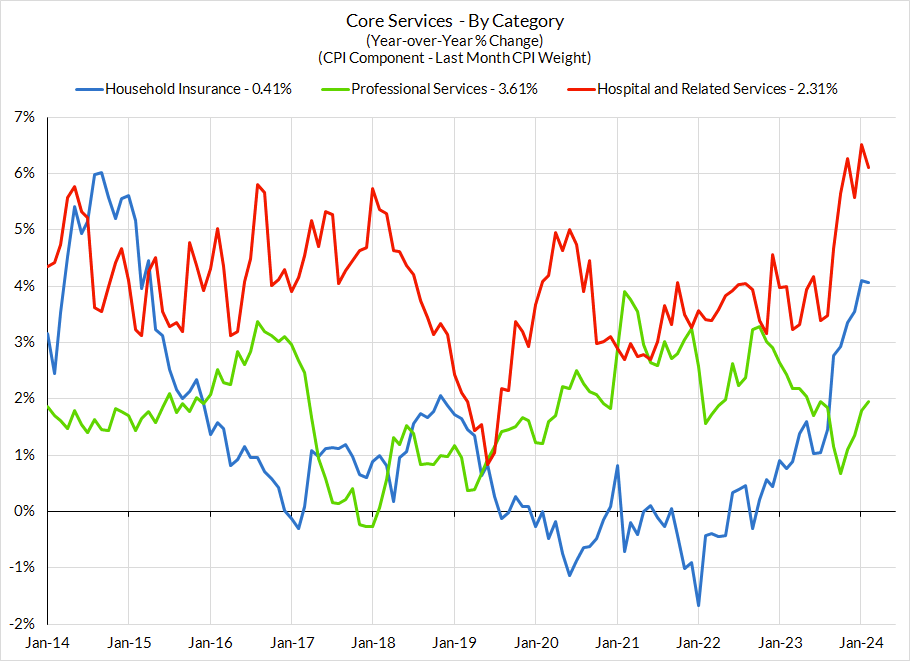

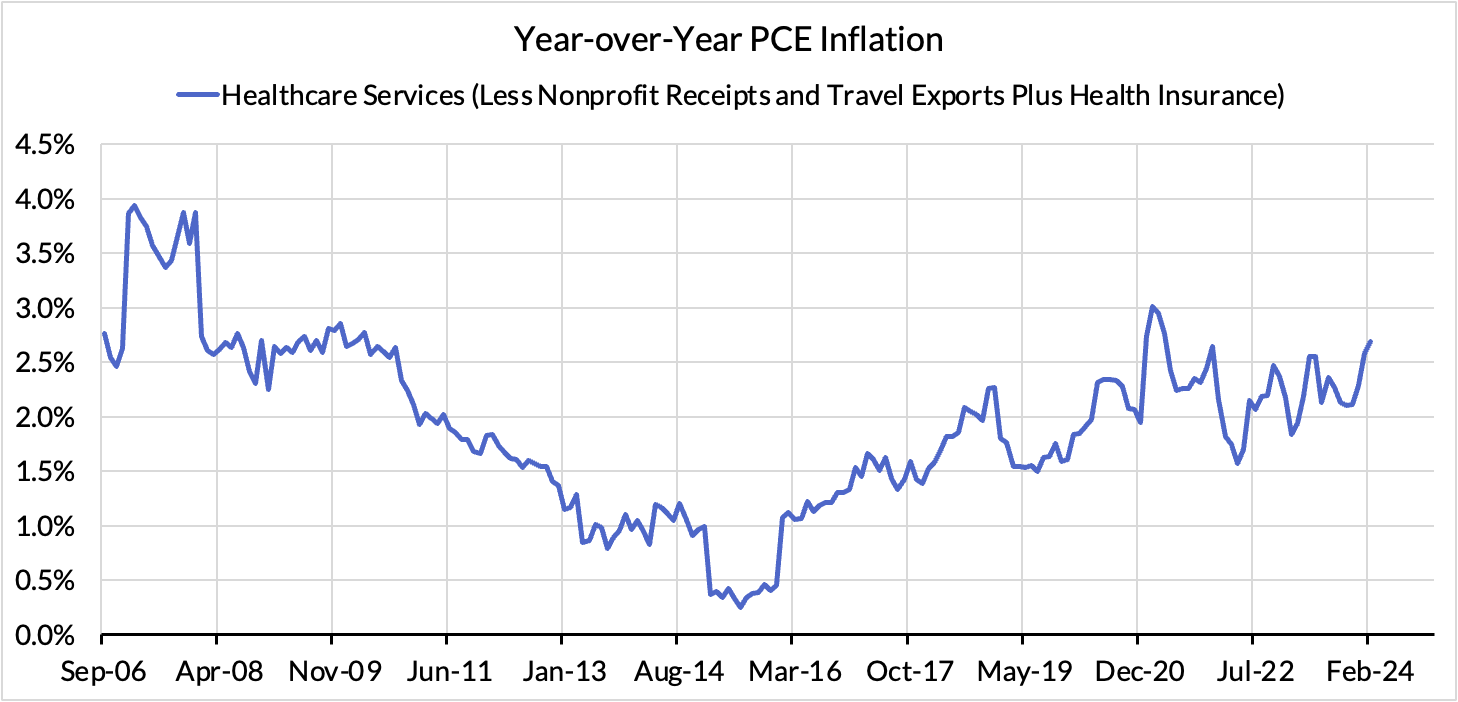

- The 2025 healthcare services PPI/PCE inflation outlook is improving thanks to tighter Medicare Advantage policy: Recent healthcare policy developments suggest that Medicare Advantage will be paying out at a slower pace to insurers (and for insurers to ultimately pay out to providers) in 2025. We see this dynamic as worth a 10 basis point reduction in Core PCE in 2025Q4 year-over-year readings, relative to our baseline. We have factored in direct bargaining effects, adjusted for nonprofit provider distributions, and anticipated some spillover private payer effects. This dynamic will be of specific relevance to Core PCE but not to Core CPI (healthcare policy and government cost control measures have a less relevant effect on healthcare services CPI relative to PPI/PCE). While highly incremental, this still enhances the likelihood of a soft landing over the coming 12-18 months.

CPI Charts

Non-Core CPI Components

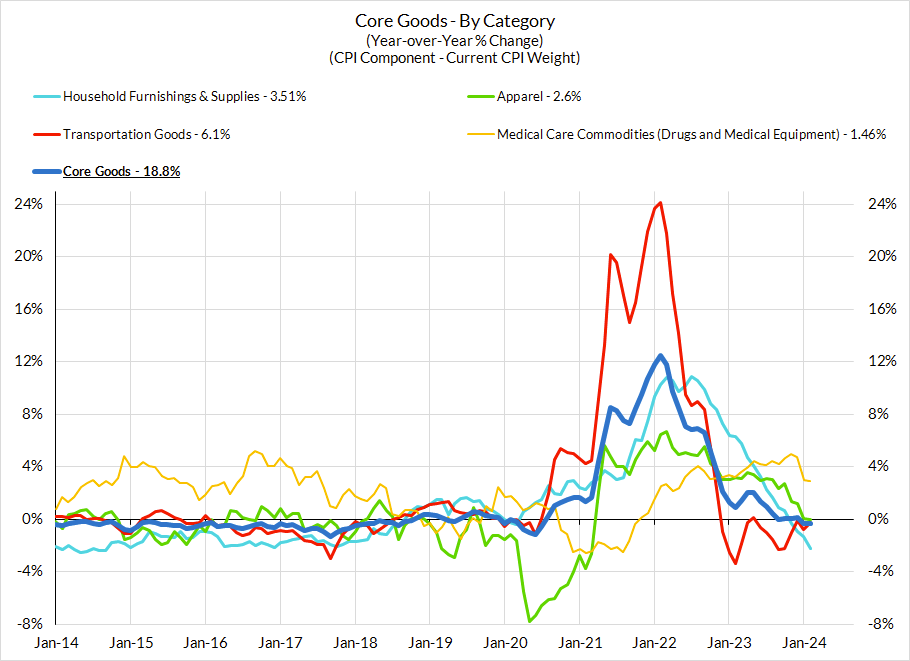

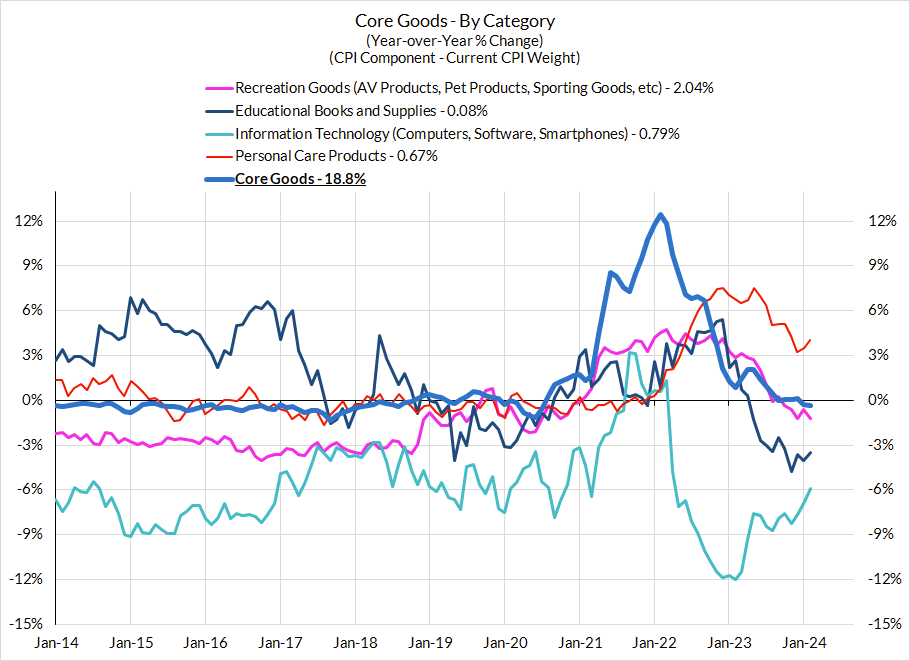

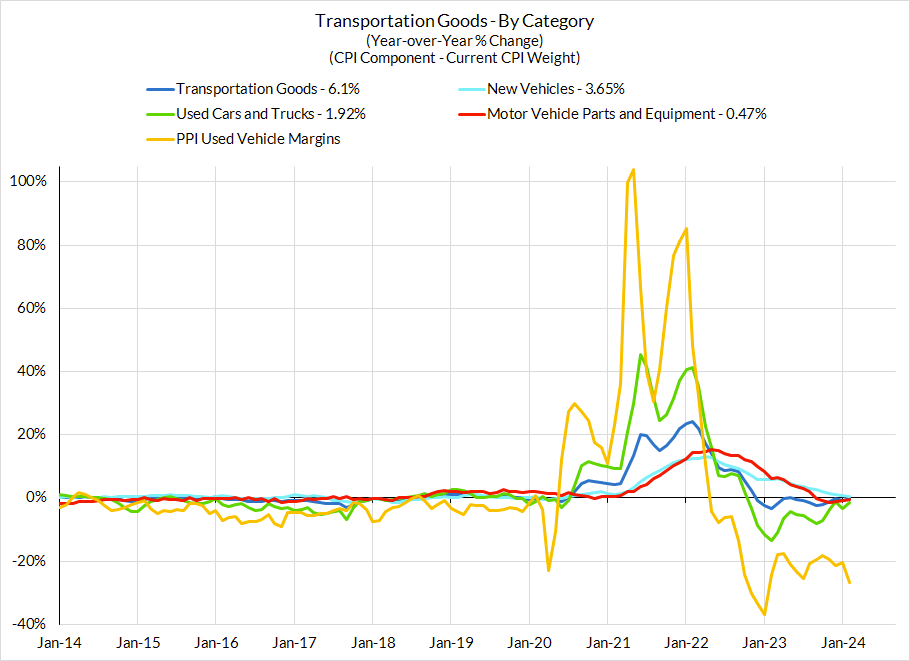

Core Goods CPI Components

Core Services CPI Components (Not All Feed Into Core PCE)

From Last PCE Recap

PCE Charts

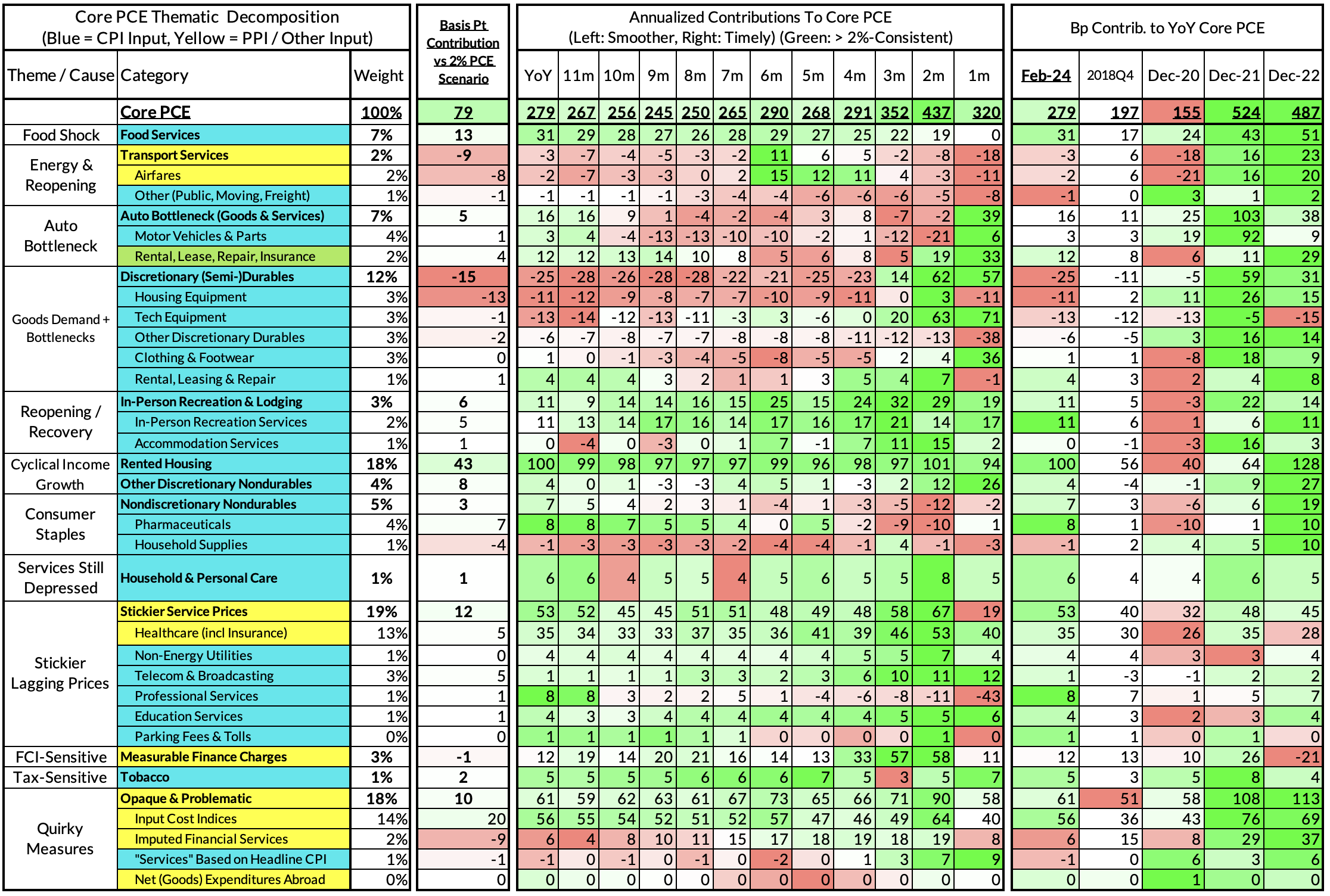

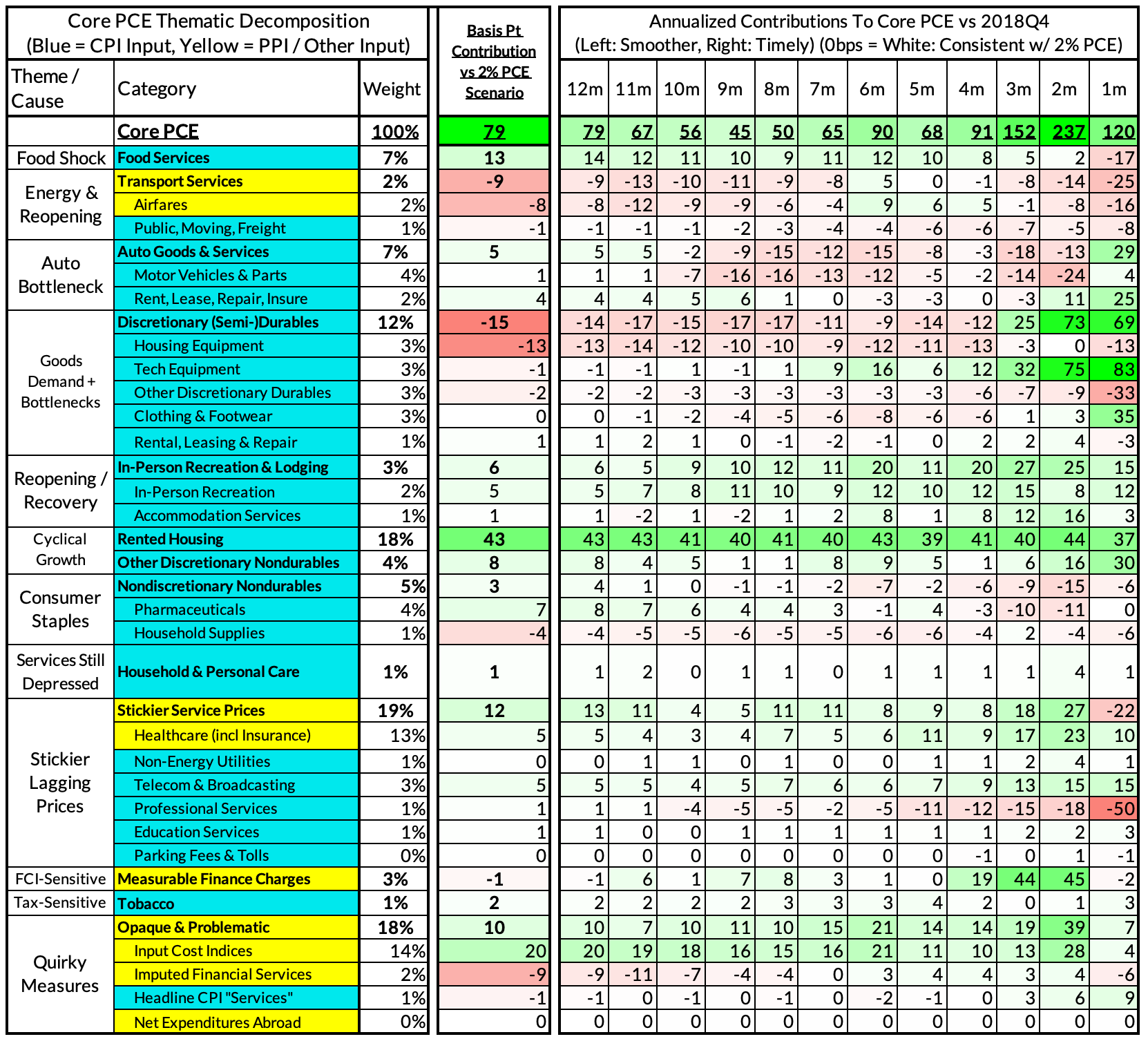

For the Detail-Oriented: Core PCE Heatmaps

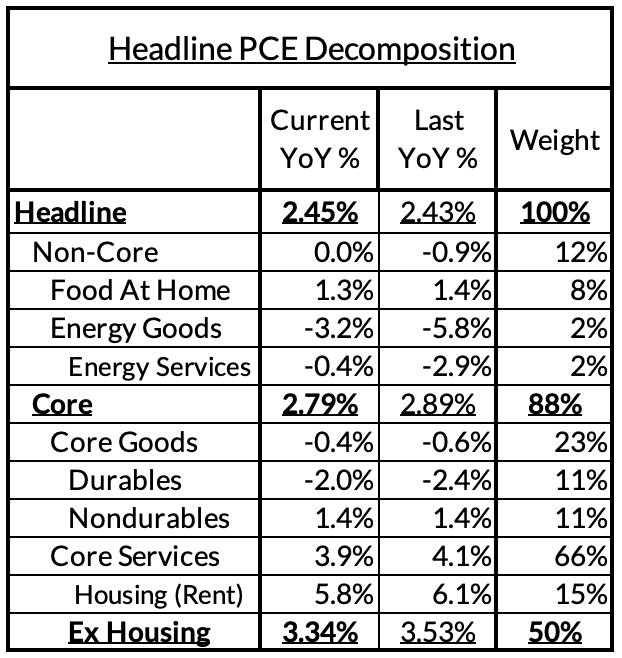

Core PCE (PCE less food products and energy) ran at a 2.79% year-over-year pace as of February, 79 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 43 basis points to the 79 basis point core PCE overshoot.

There are other contributors to the overshoot:

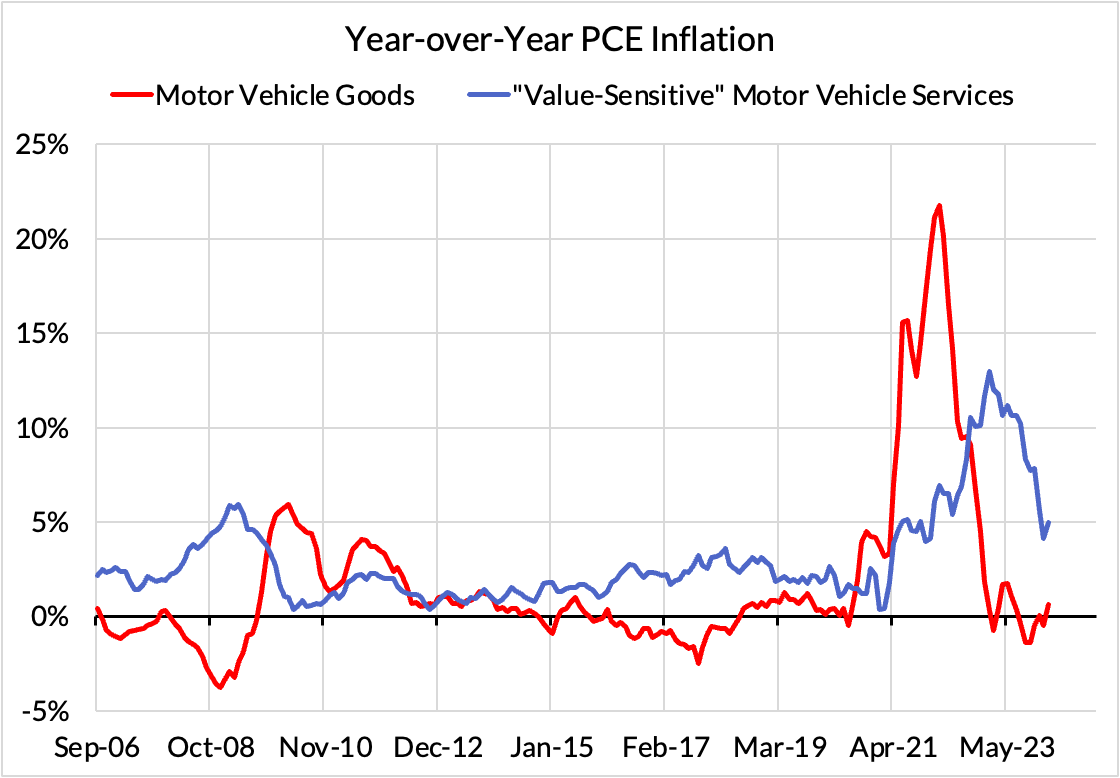

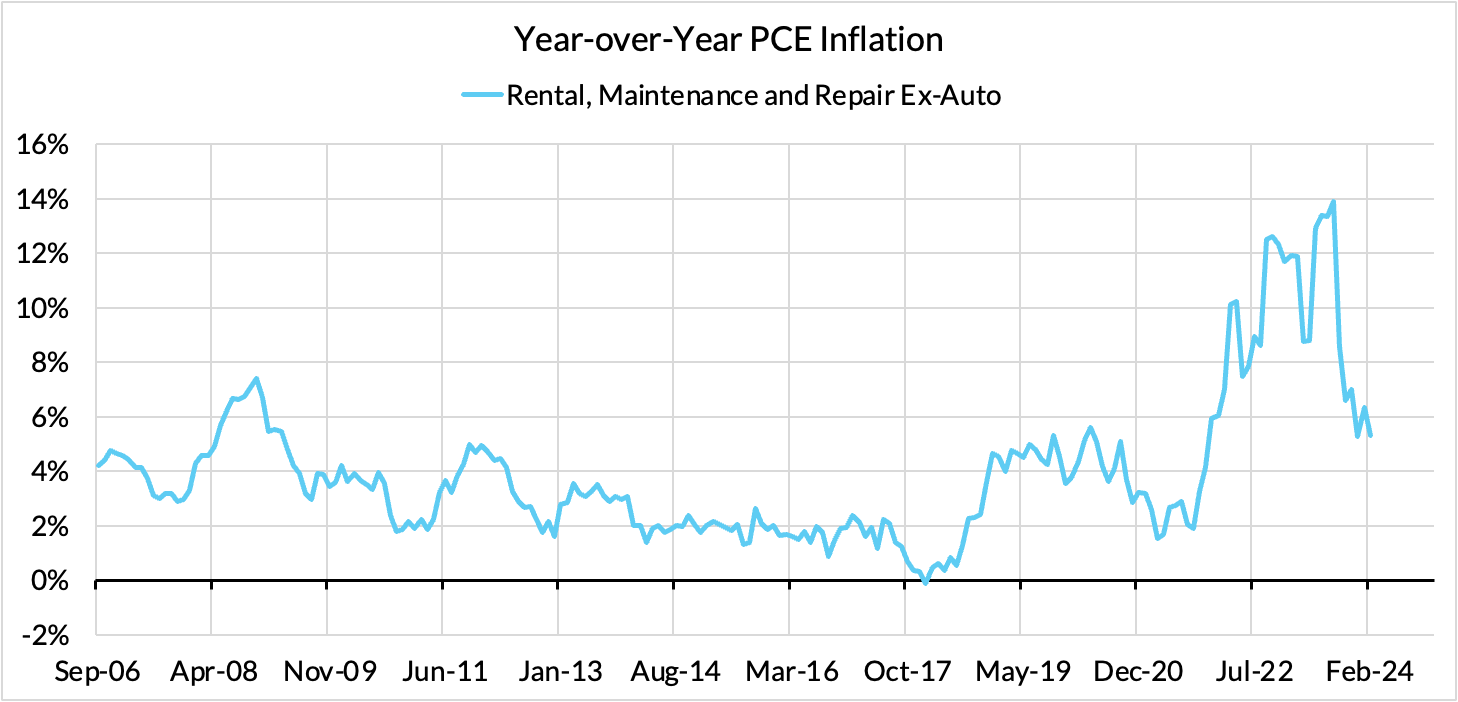

- Some more supply-driven (food inputs likely added 14 basis points to the overshoot, motor vehicle bottleneck effects added 4 basis points)

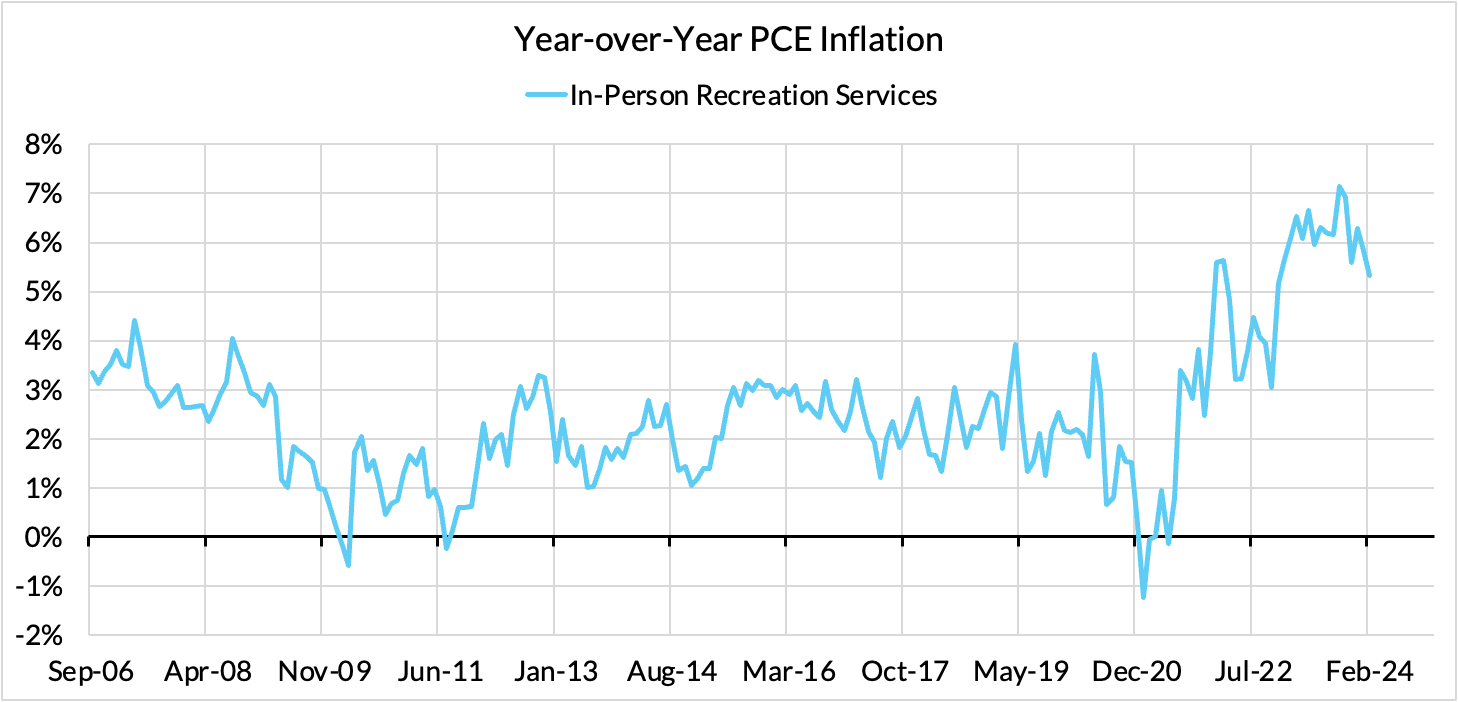

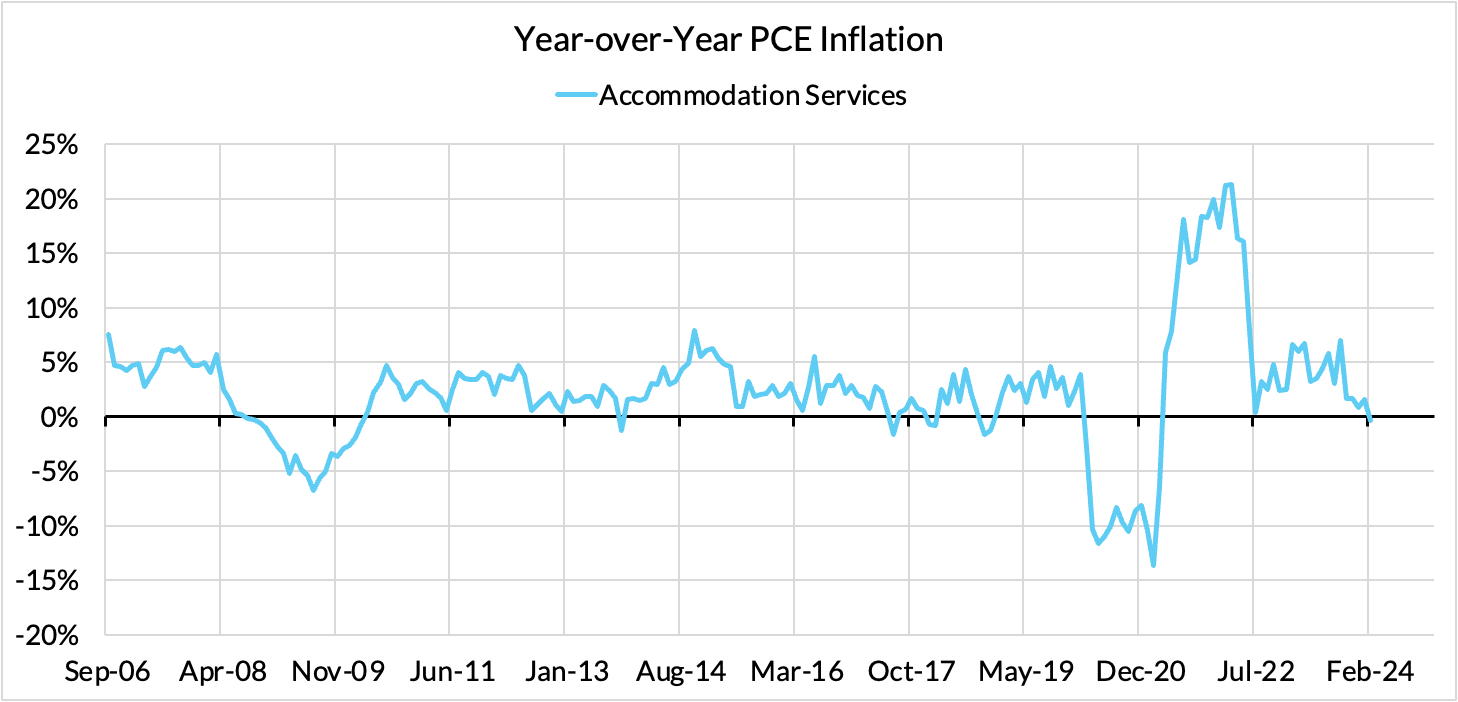

- Some more demand-driven (in-person recreation and travel services likely added 6 basis points to the overshoot)

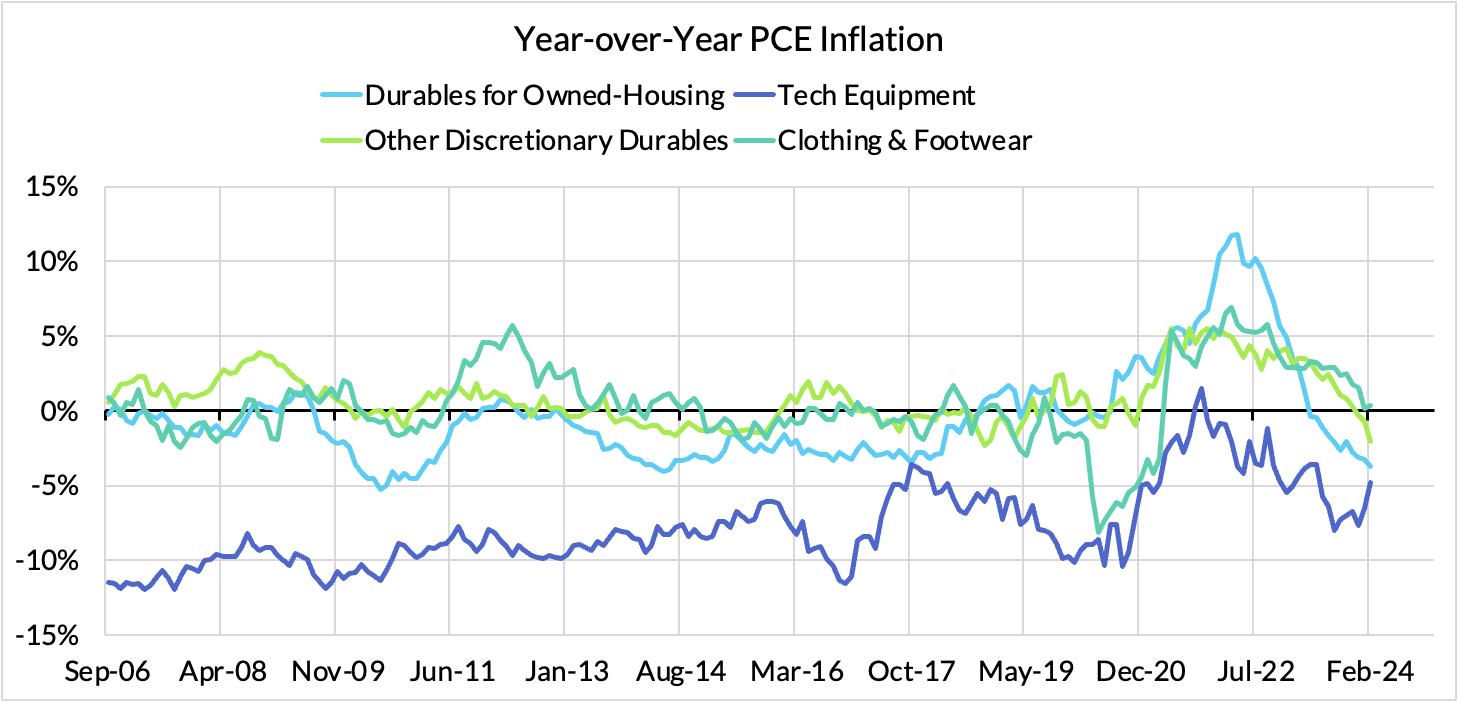

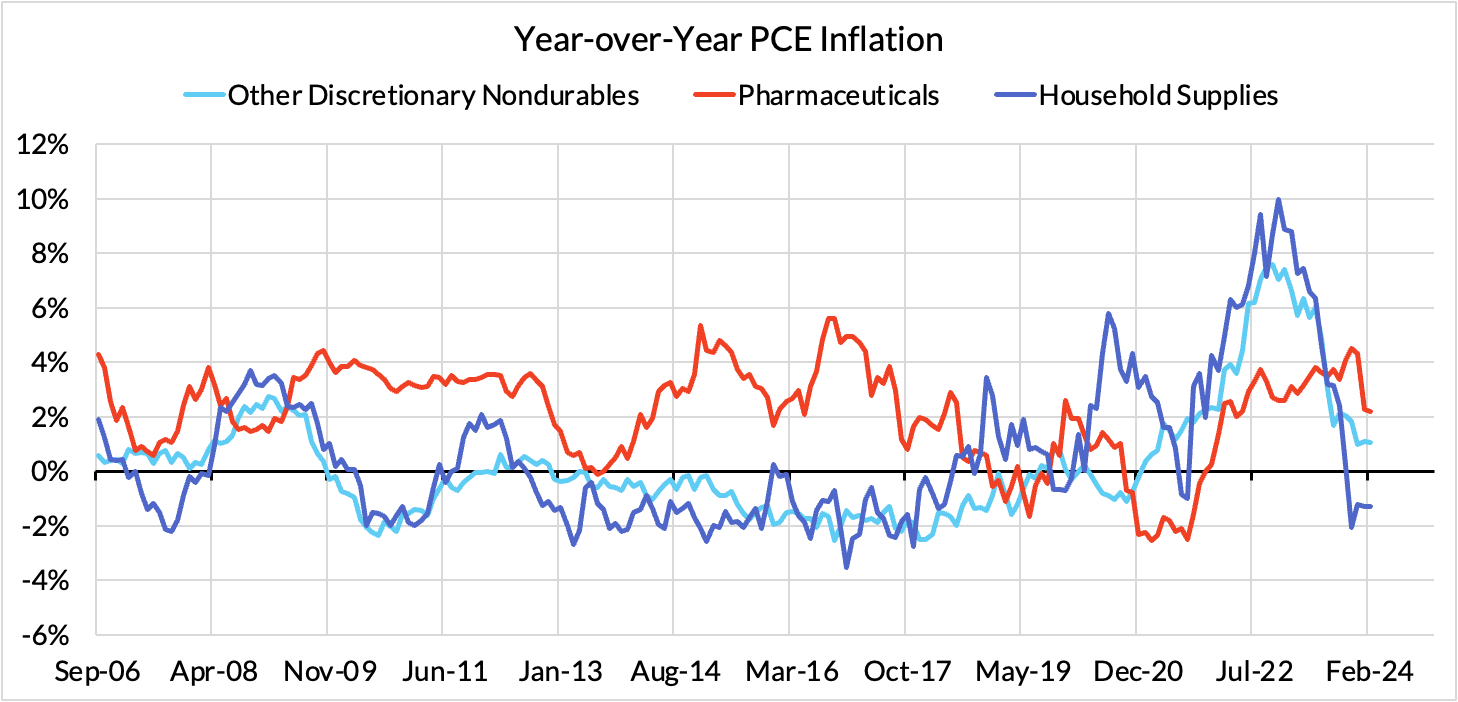

- Some with demand- and supply-side drivers (core nondurable goods are adding 11 basis points).

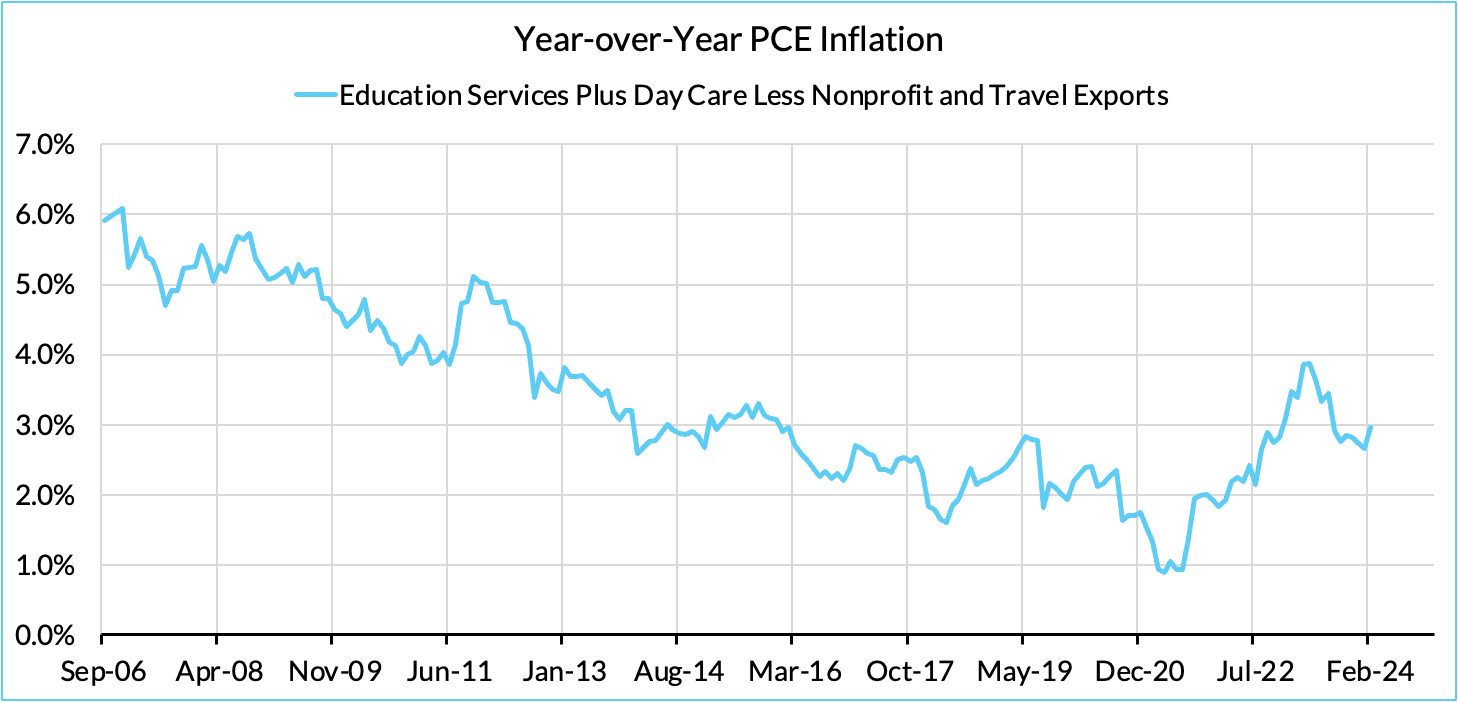

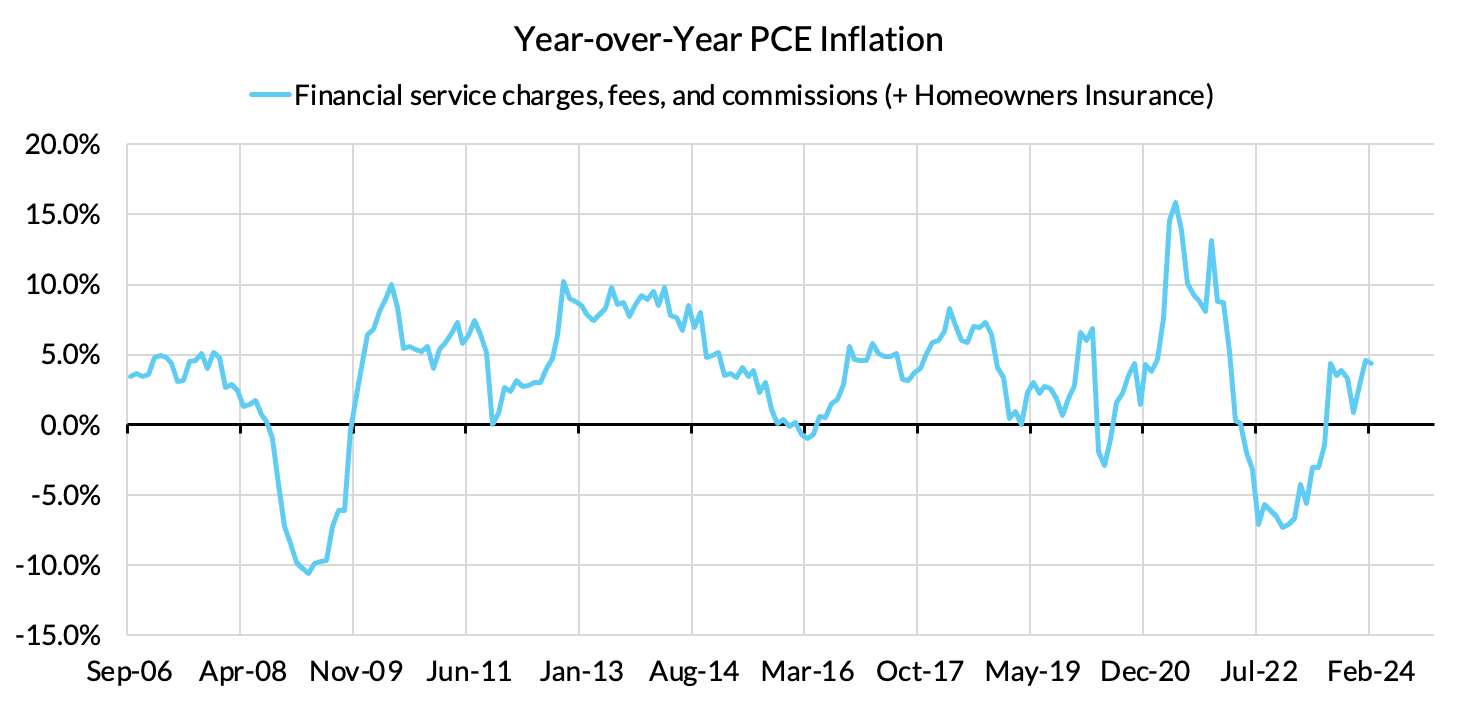

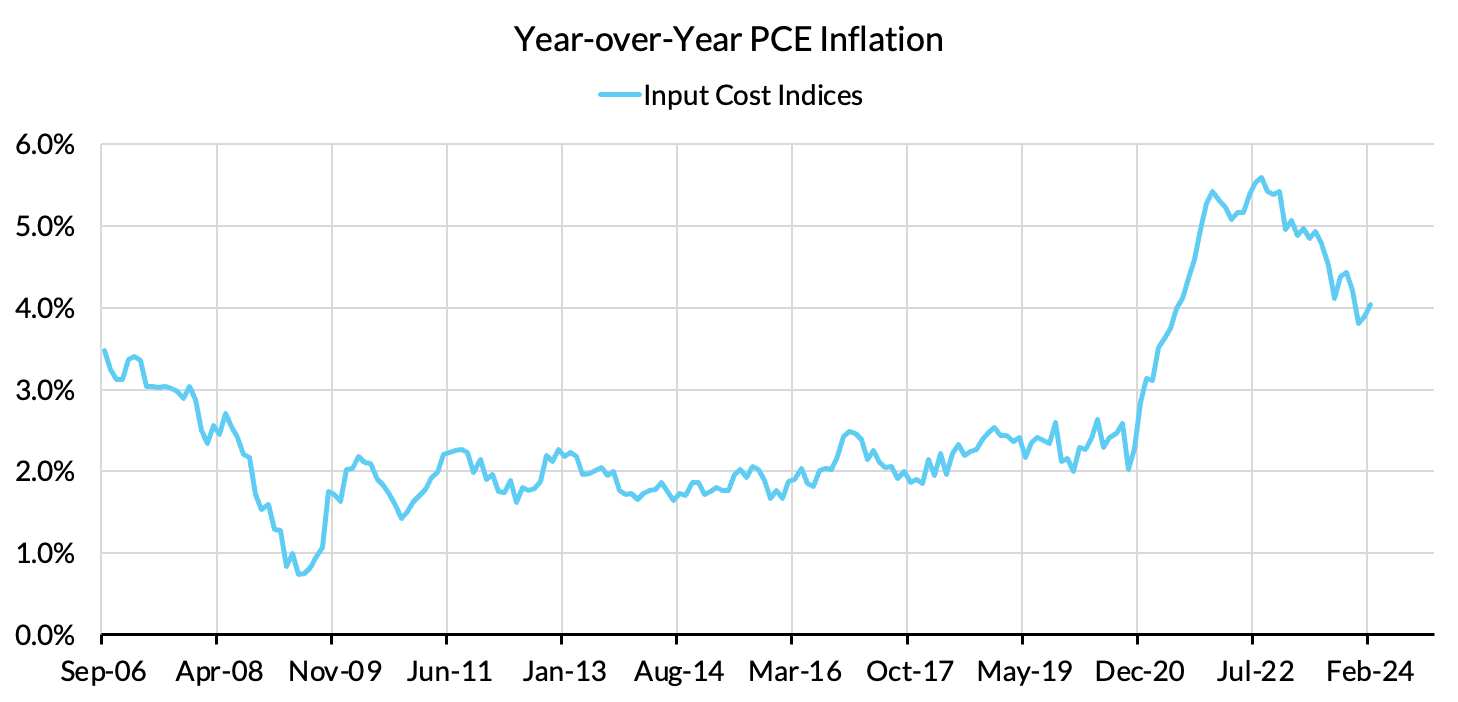

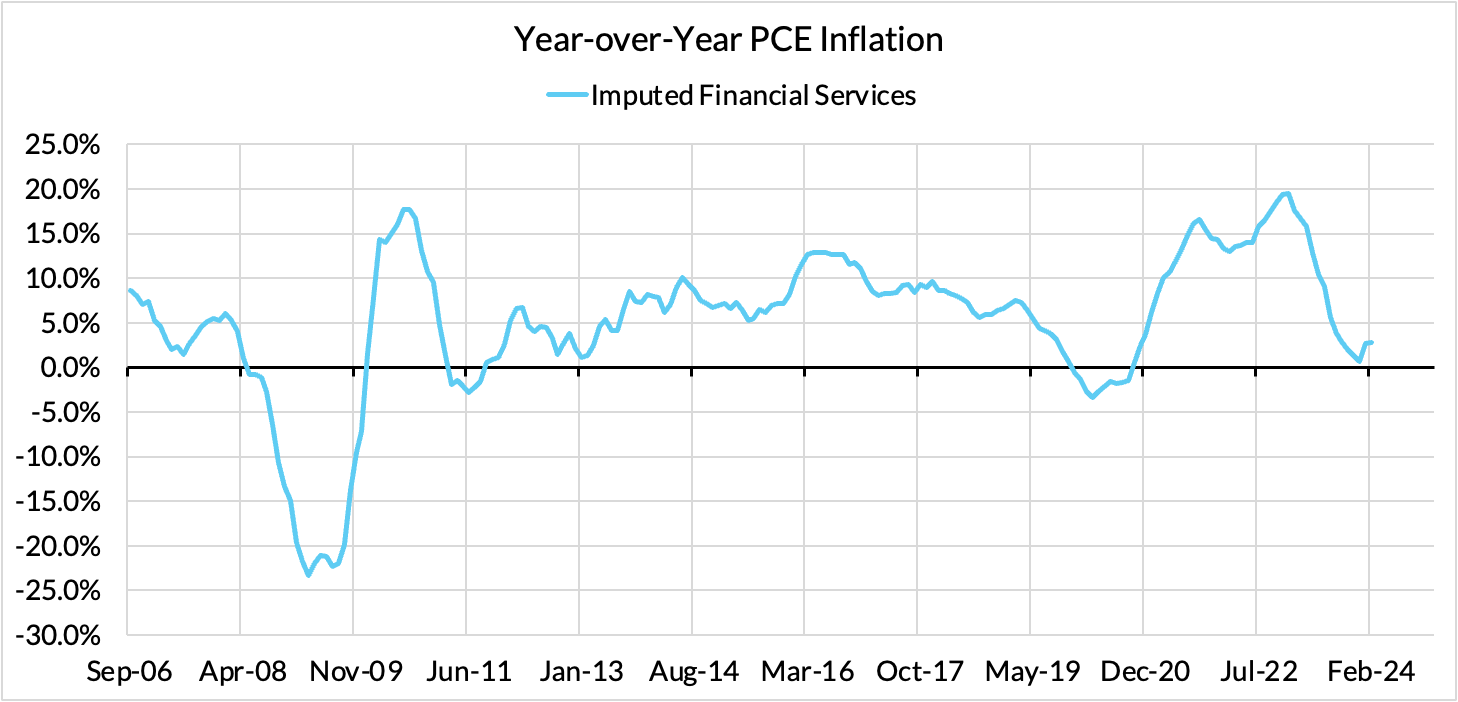

- Some oddball segments have offsetting effects (measured financial service charges are subtracting 1 basis point, while contributions from input cost indices and imputed financial services likely adding 11 basis points to Core PCE vs 2%-consistent outcomes).

The subsequent heatmap below gives you a sense of the overshoot on shorter annualized run-rates. February monthly annualized core PCE yielded a 120 basis point overshoot vs 2% target inflation (3.20% annualized).

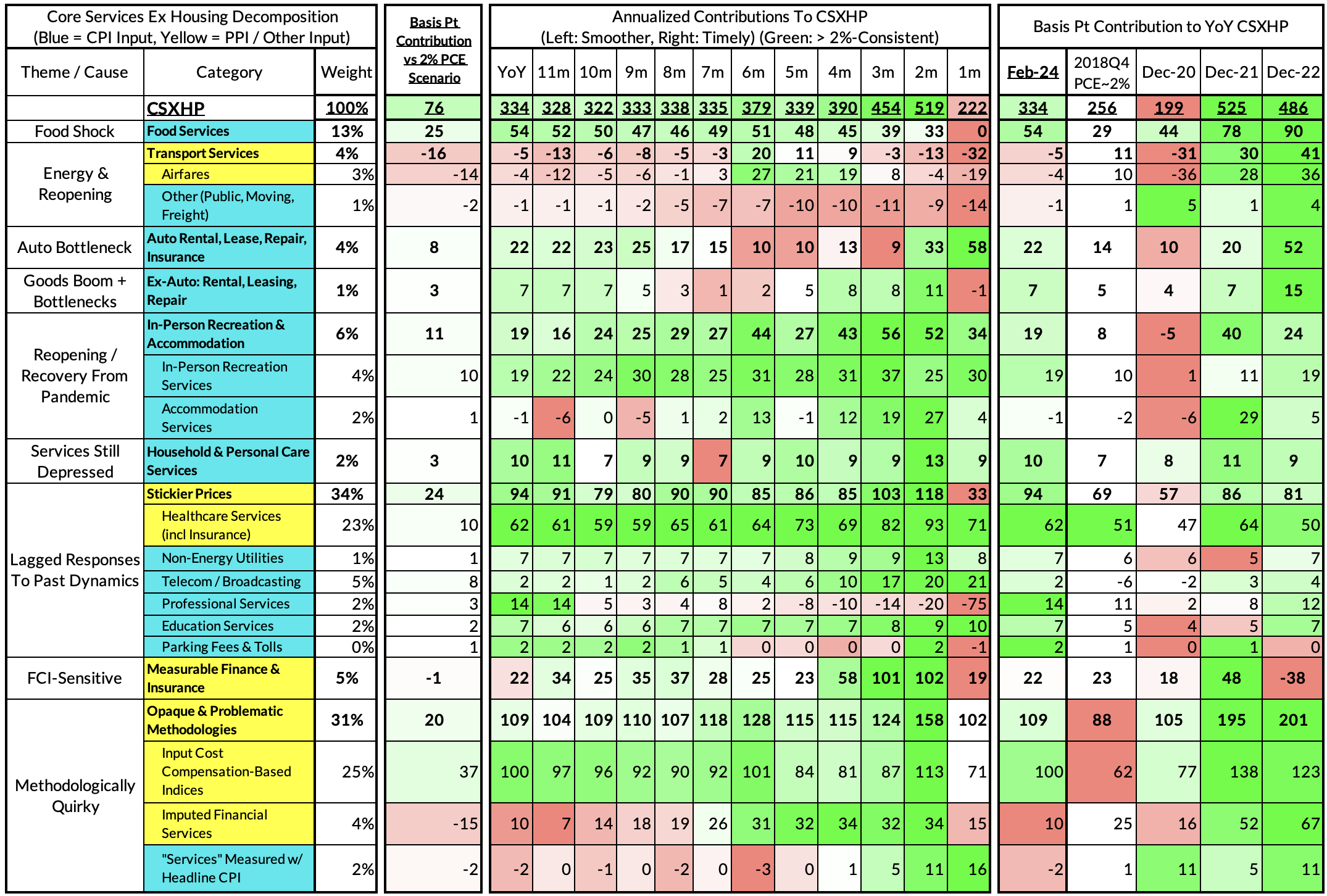

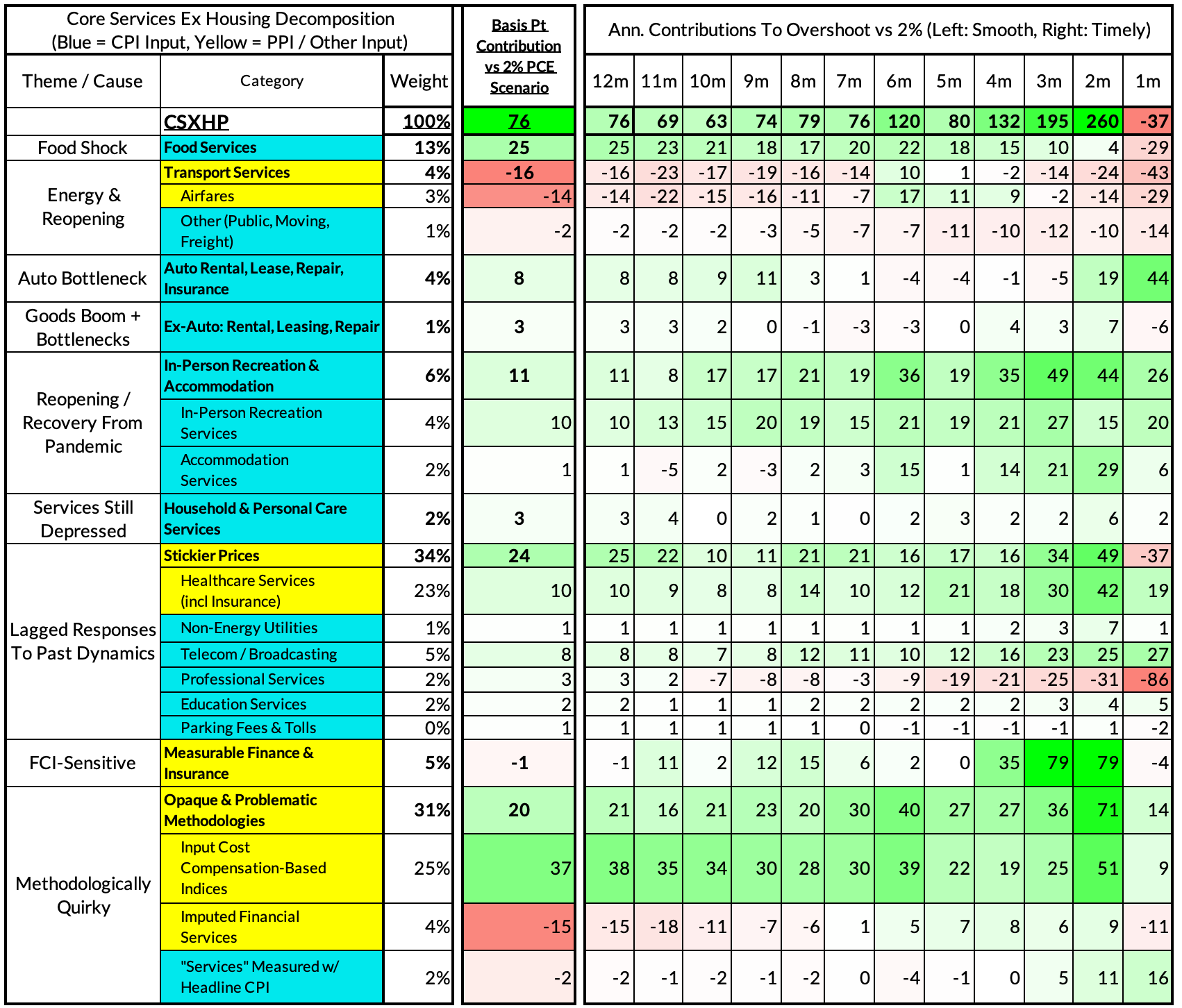

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

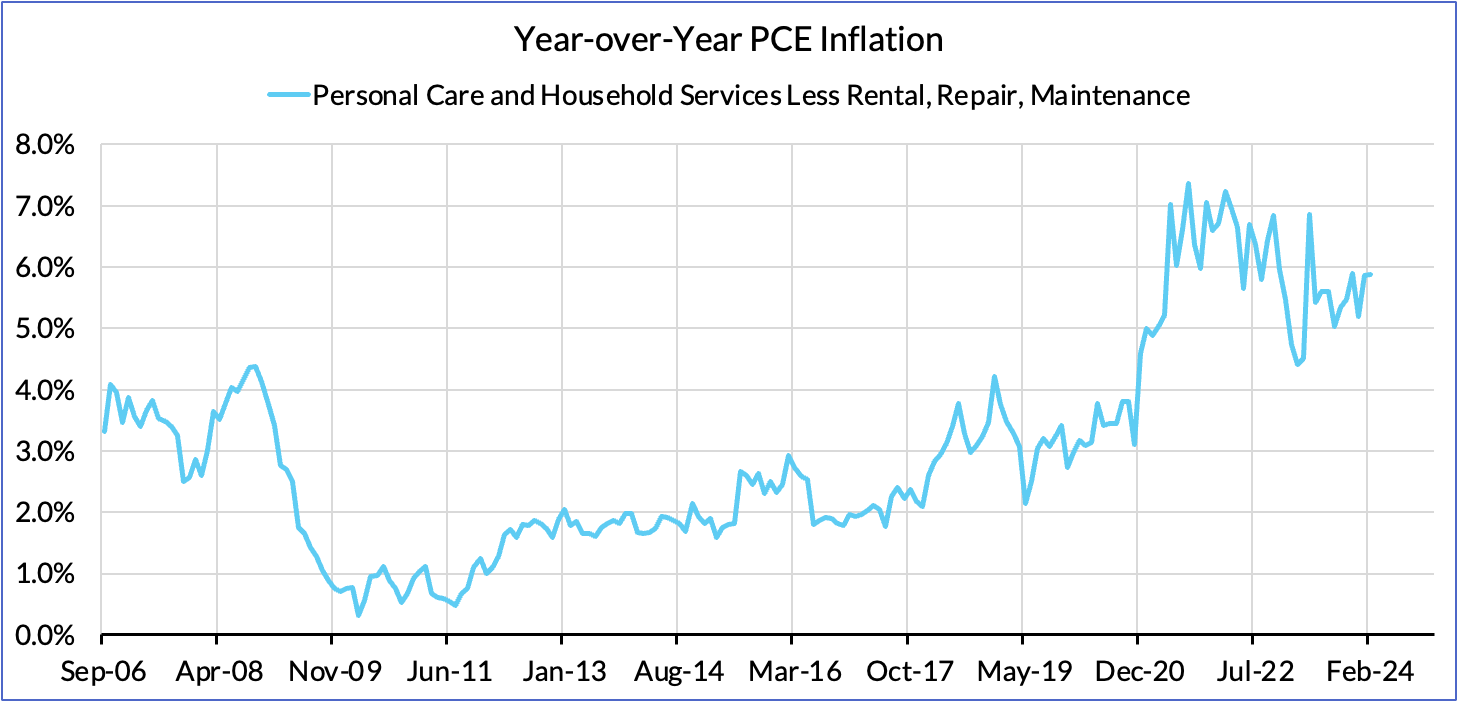

The February growth rate in "Core Services Ex Housing" ('supercore') PCE ran at a 3.34% year-over-year, a 76 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and core PCE.

February monthly supercore ran at a 2.22% annualized rate, a 37 basis point undershoot of what would be consistent with 2% headline and core PCE.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?

- 7/9/23: June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting Clearer But Not Soon Enough To Forestall a July Hike

- 8/8/23: July Inflation Preview: Used Car Downside Can Hasten Path To 2% Core PCE Outcomes

- 9/12/23: August Inflation Preview: CPI Risks Growing More Balanced Even As PCE Risks Tilt More To The Downside

- 10/10/23: September (Pre-PPI) Inflation Preview: The Wedge Will Matter Again...Pulling Up CPI and Pushing Down PCE

- 11/13/23: October Inflation Preview: A Data Release That Can Dictate The Future of The Hiking (& Easing?) Cycles

- 12/11/23: November Inflation Preview: Headline Downside But Can Core PCE Keep A March "Normalization Cut" In Play?

- 1/10/24: December Inflation Preview: How Much More Disinflation Can Be "Banked" Before Q1 Begins?

- 2/9/24: January Inflation Preview: High Stakes Data Releases With Fat Tails On Both Sides

- 3/9/24: February Inflation Preview: Jan-Feb Residual Seasonality Poised To Stoke Upside & Headfake The Fed