Summary

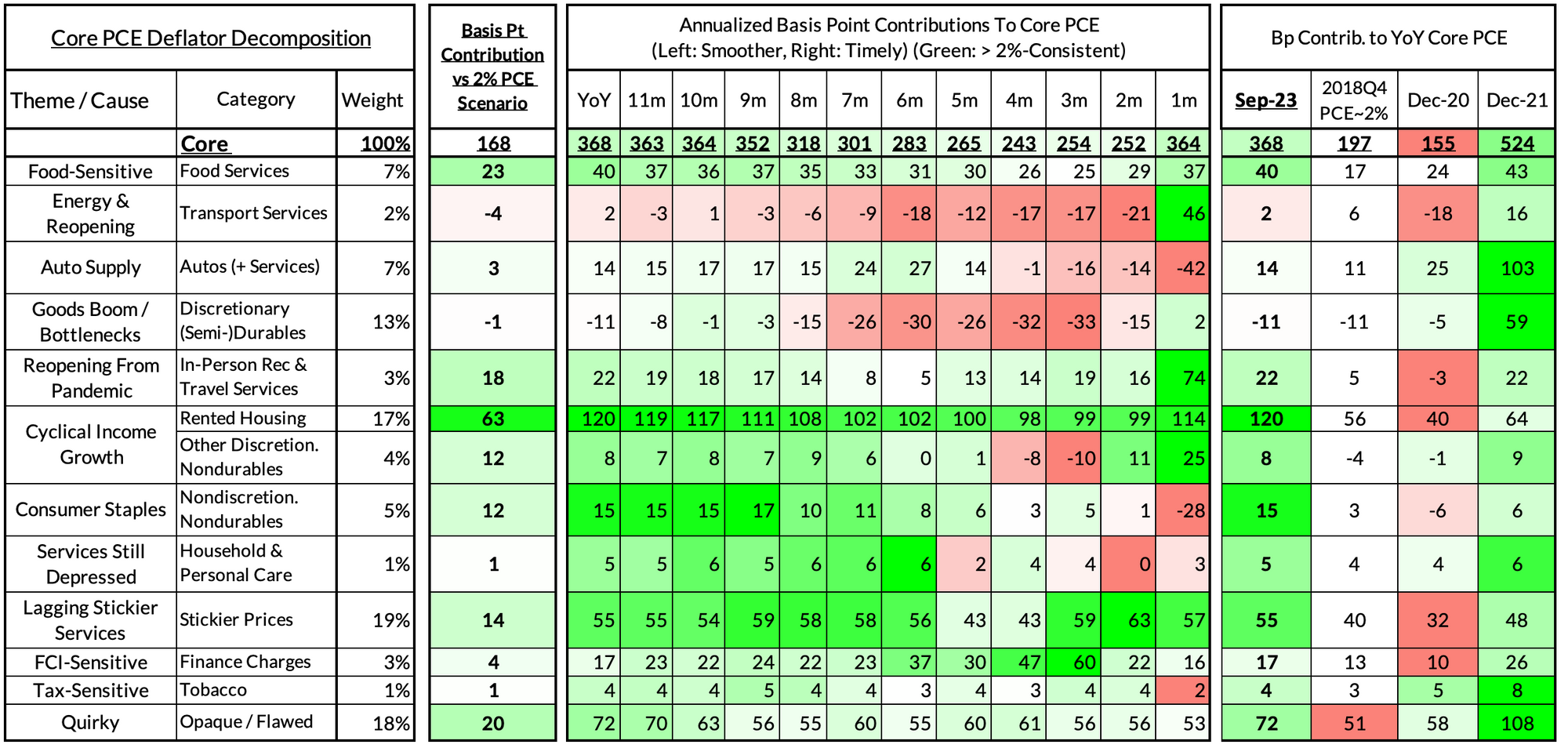

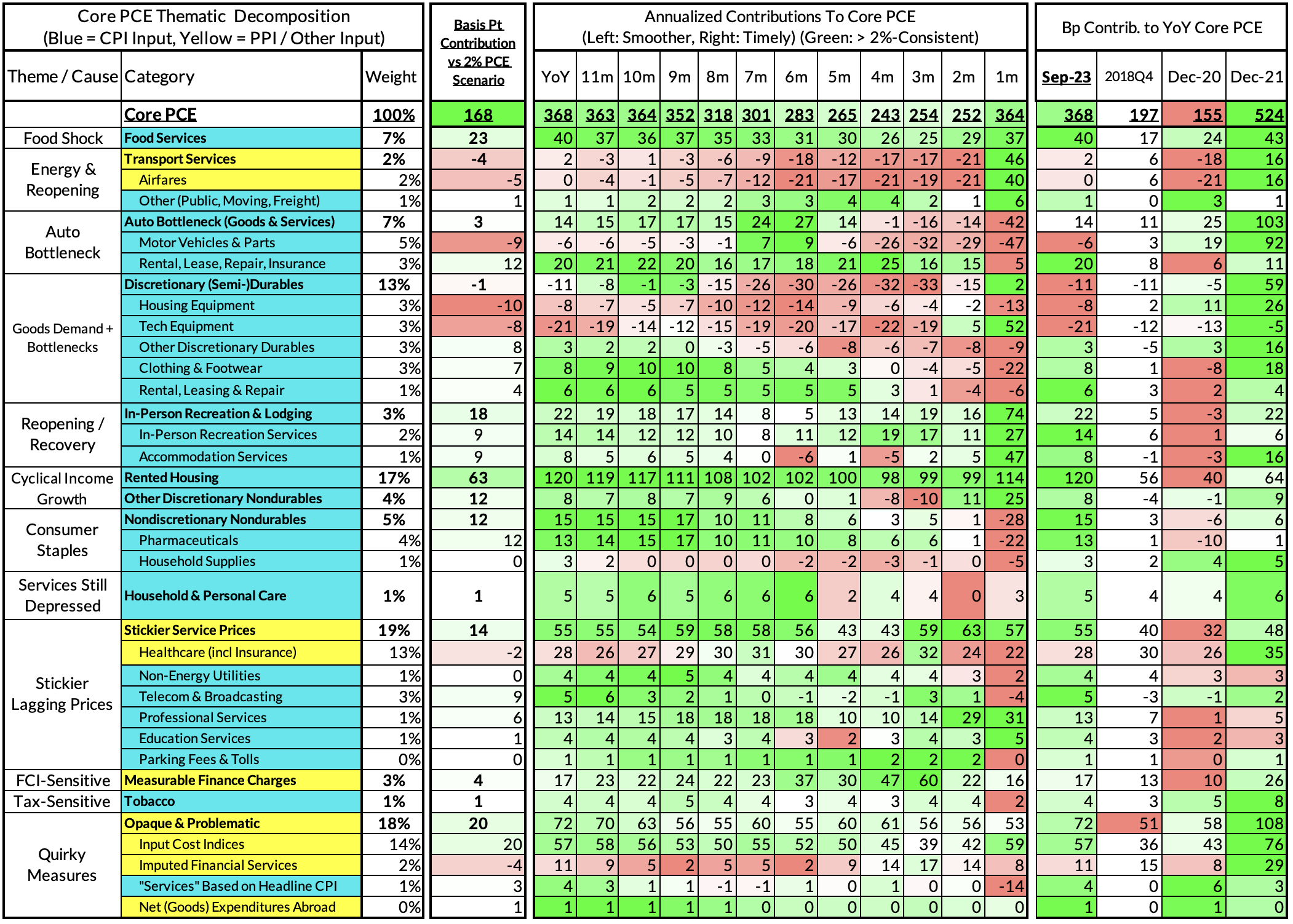

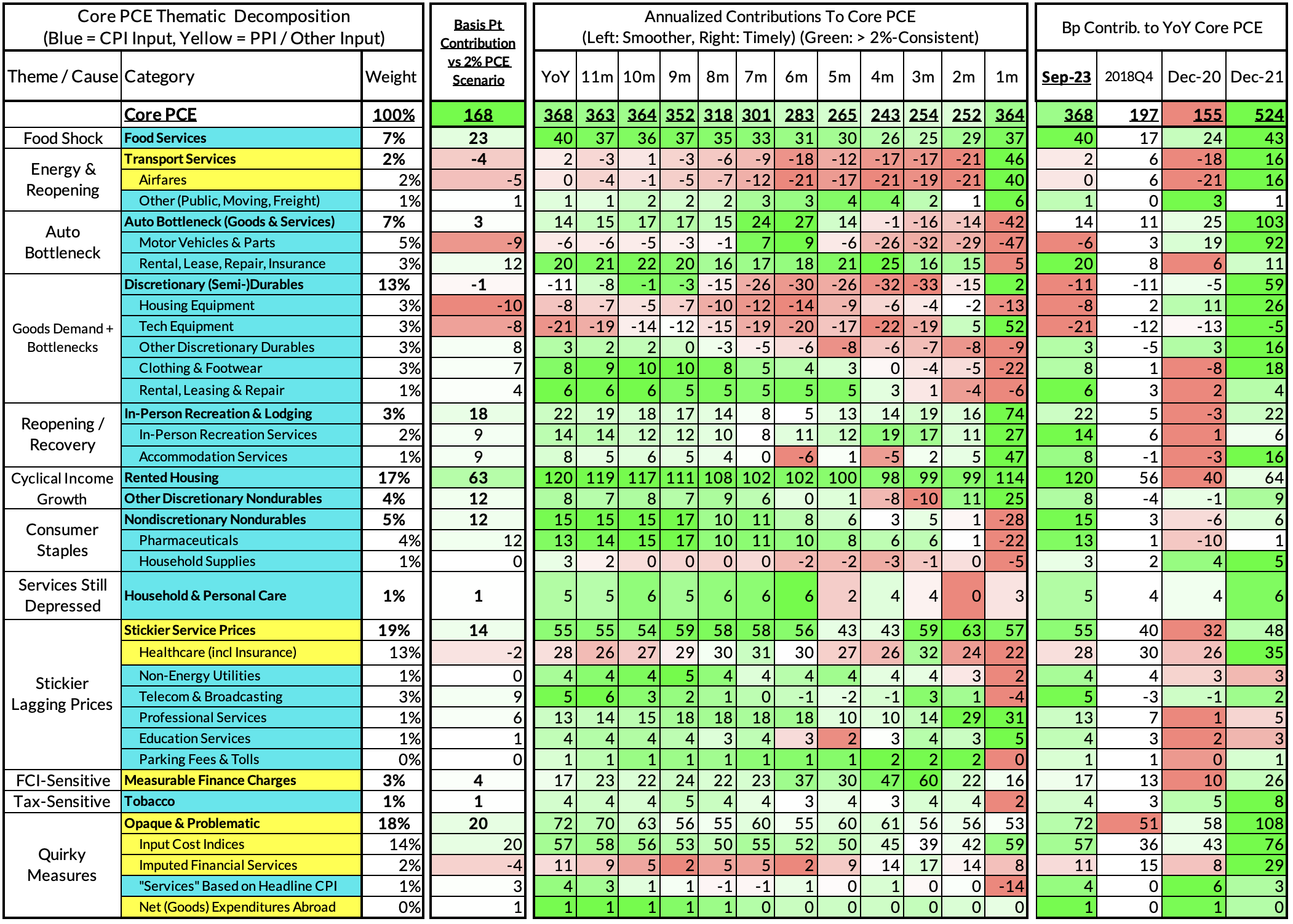

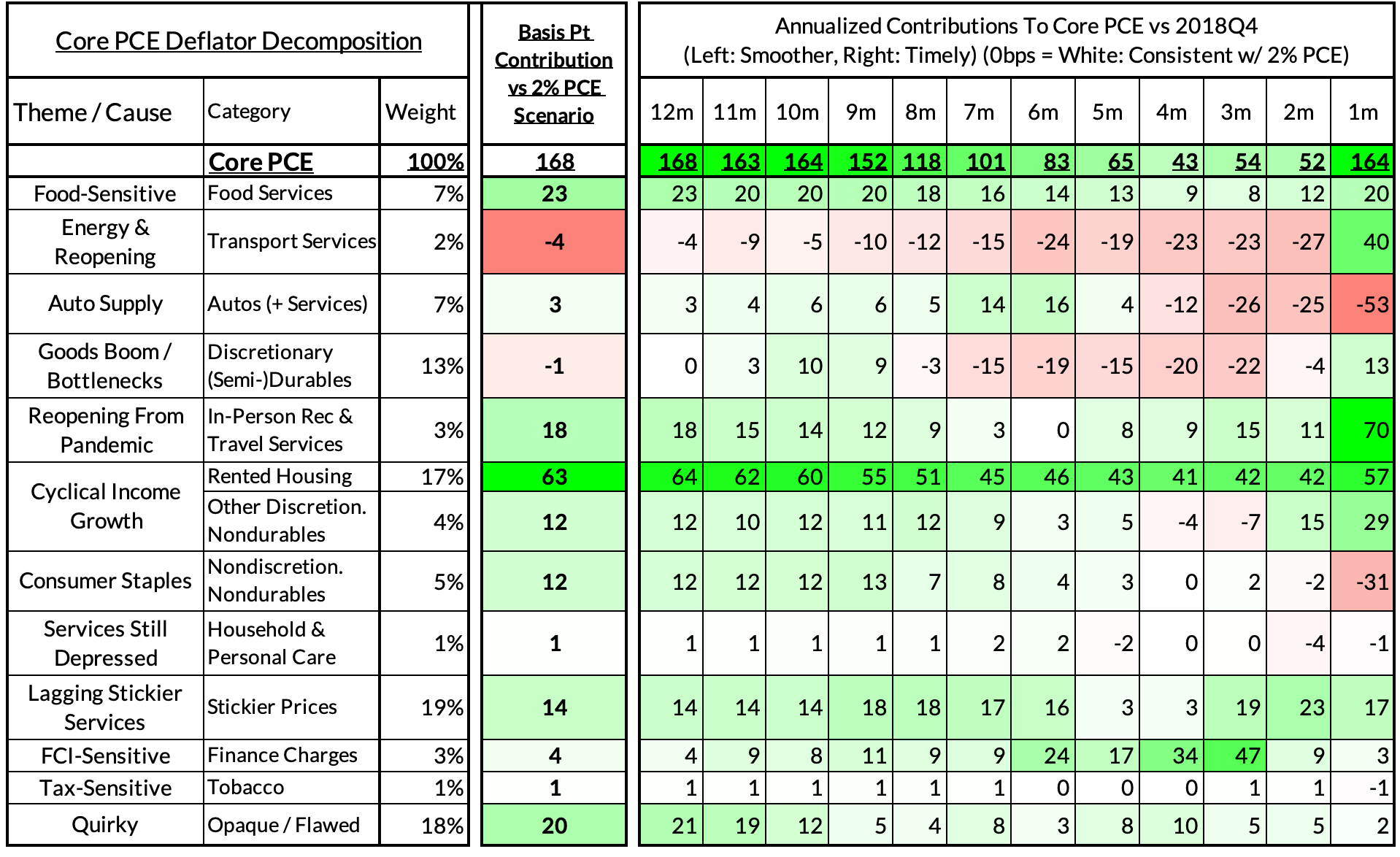

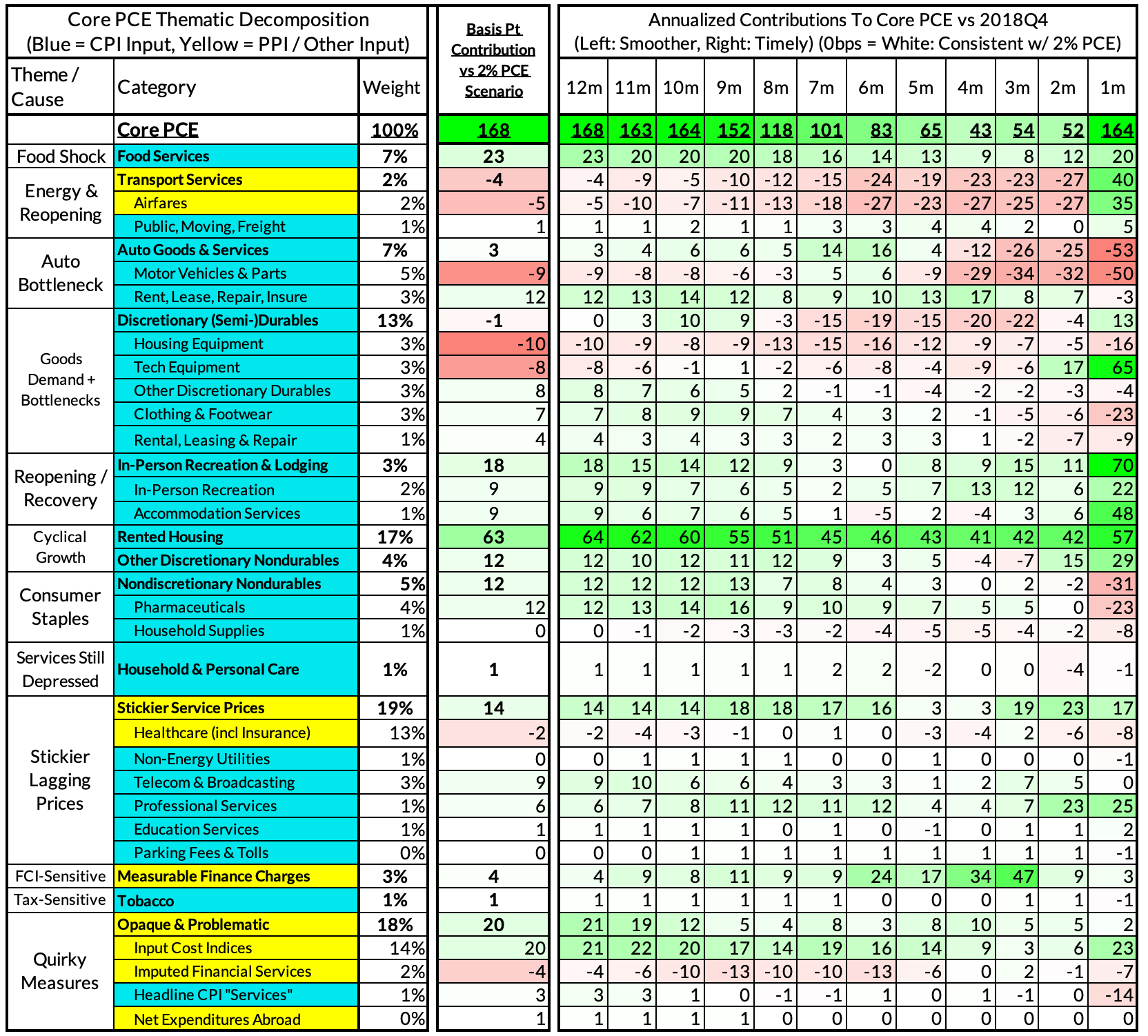

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

Summary

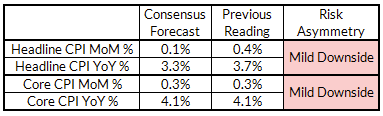

It's not a strong view on our part, but we see marginal asymmetry towards a downside surprise in CPI in October, though our baseline forecast is consistent with consensus. The asymmetry is driven by ongoing core disinflation and some reversal in outlier strength among core services components. It is also contingent on an Owners' Equivalent Rent forecast for October that does not extrapolate much from September's mini-spike; should we see a further spike in October, it would suggest a slower path for rent deceleration than currently modeled.

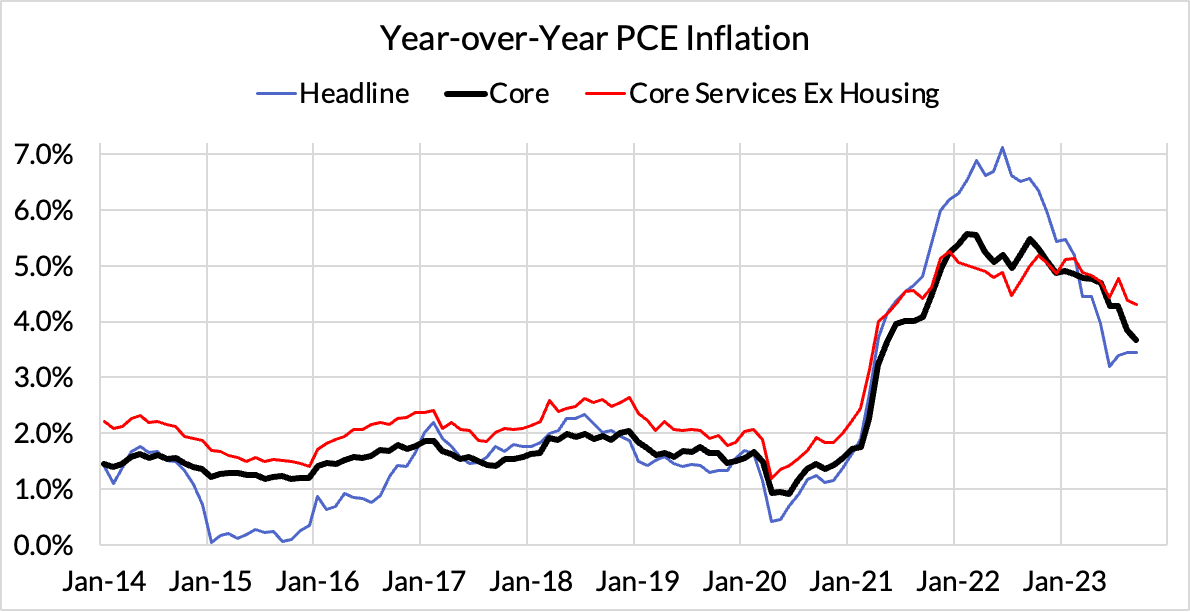

We are headed into a set of potentially pivotal data releases ahead of the December meeting. Should these inflation data points signal ongoing strength, a December or January hike may still live on (though the latest employment report suggests diminished odds of such a hike). Should we see signs of PCE inflation softening relative to consensus expectation, the prospect for any more hikes should conclude and questions about a potential easing cycle in 2024 grow more frontloaded. Core PCE should also be soft enough to hold off an additional hike, but the Fed will be patient in how it responds to the data.

Key Dynamics Within Baseline View

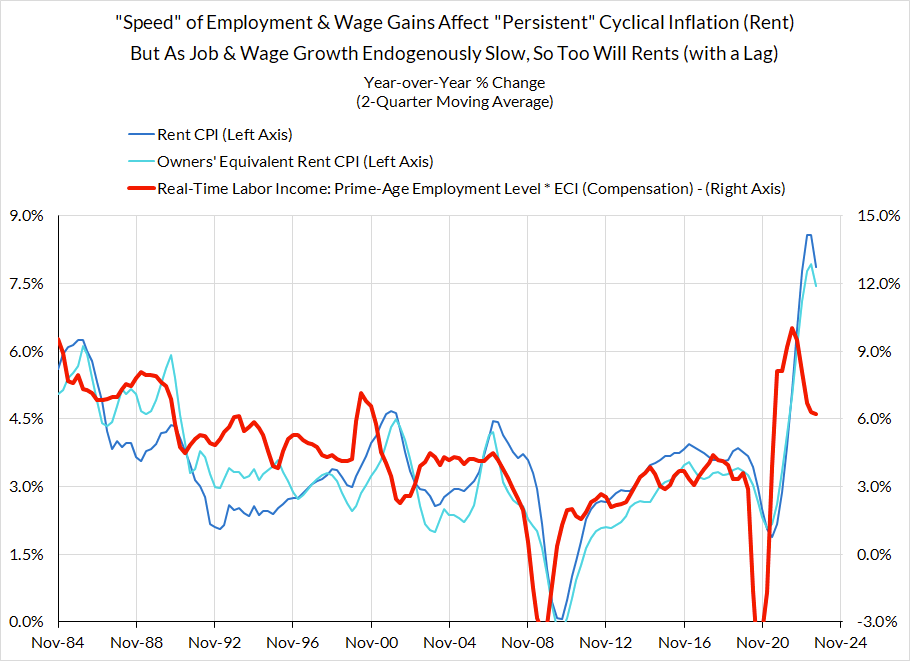

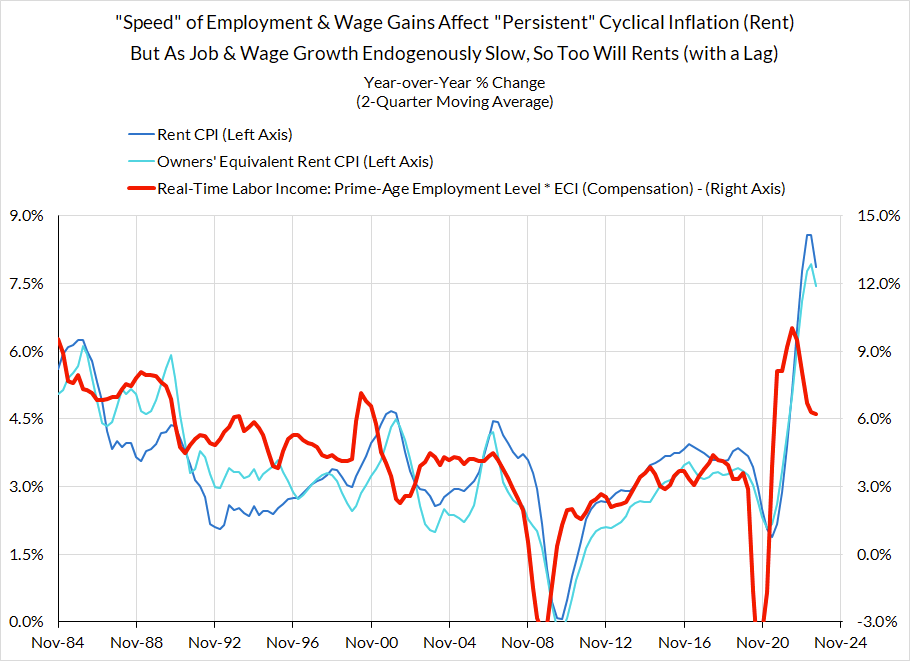

1) Was the September OER mini-spike a signal or noise? Hard-wired in our current CPI forecasts is a more benign interpretation of last month's owners' equivalent rent dynamic. September's mini-spike might be a sign of further strength in the coming months but we are not anticipating a material "re-acceleration." The path of market-rents clearly signals further deceleration in the coming 12-18 months but the precise translation to rent and OER CPI is subject to long-and-variable lags of their own. The Fed is likely to keep putting some emphasis on the "Supercore" measure of PCE to avoid excess sensitivity to this dynamic.

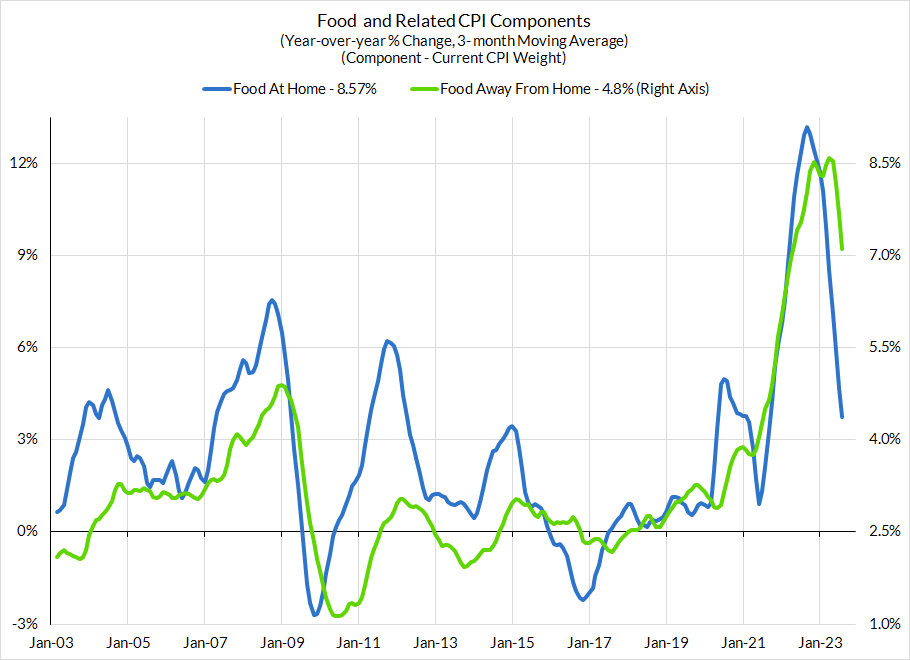

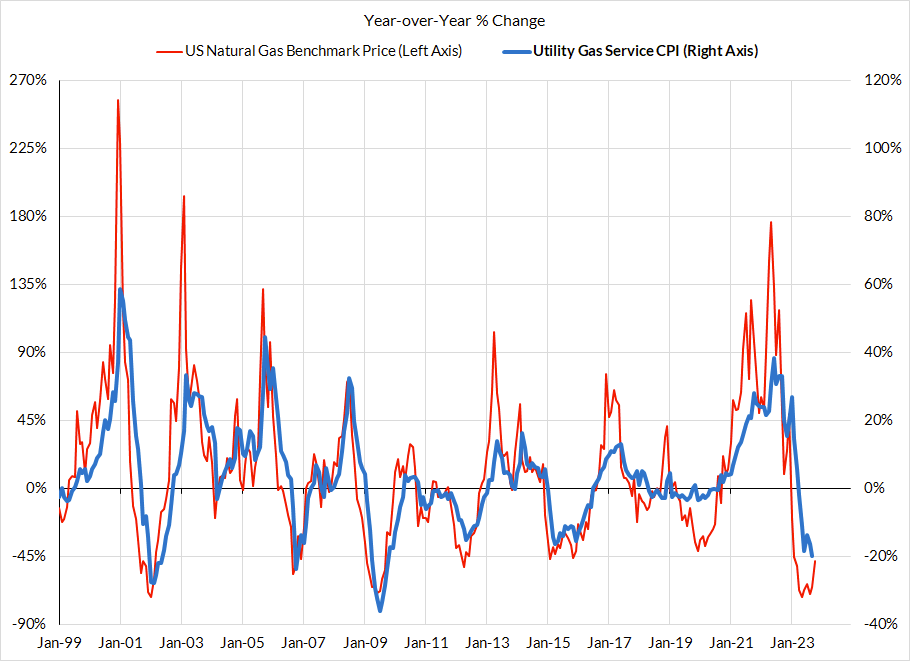

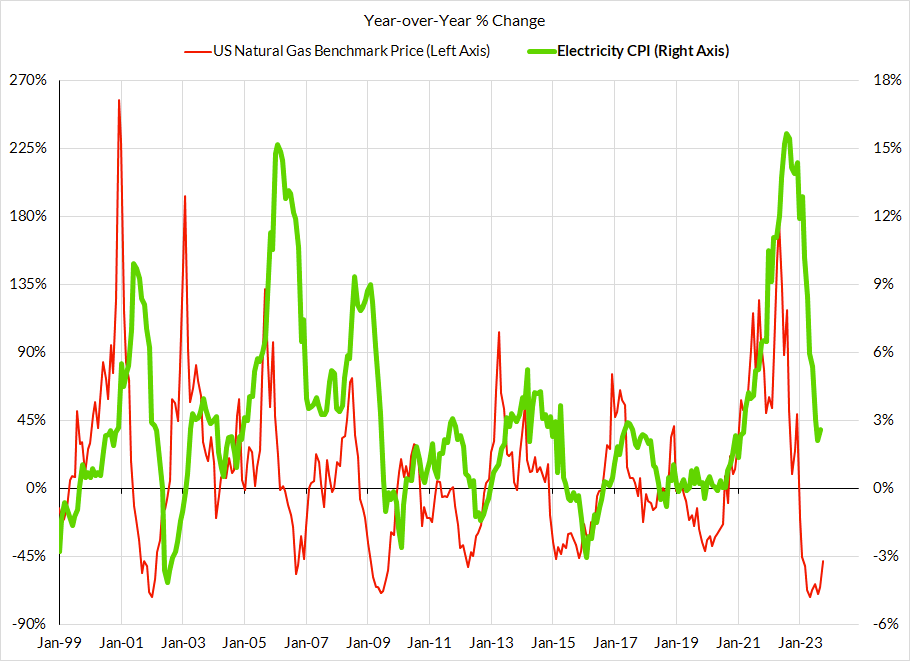

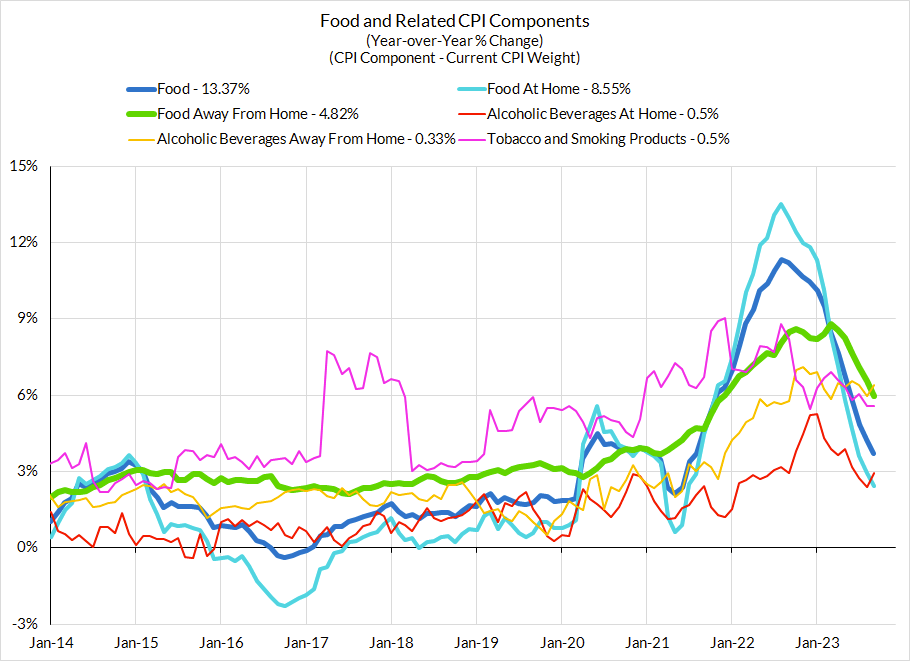

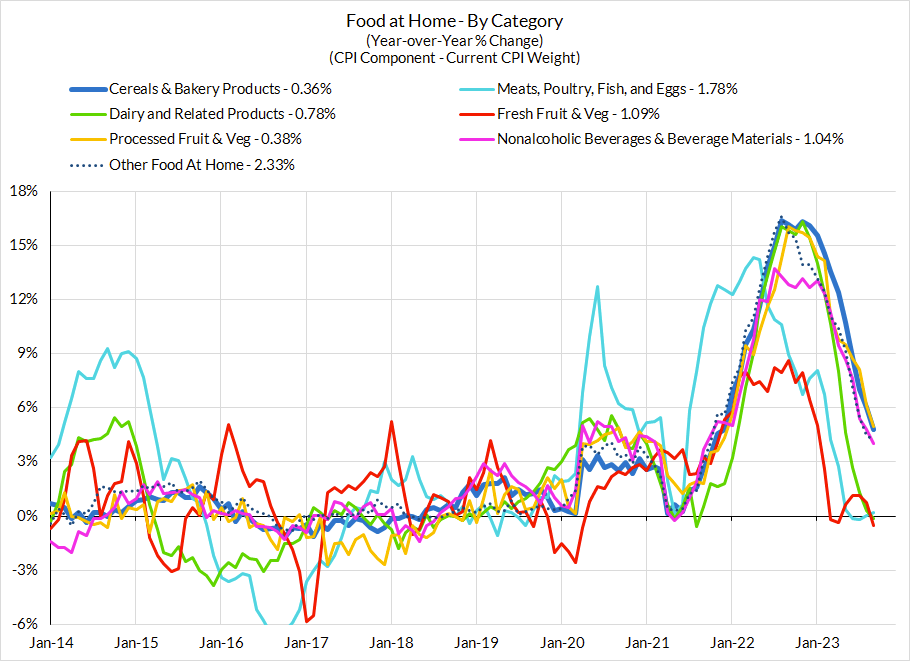

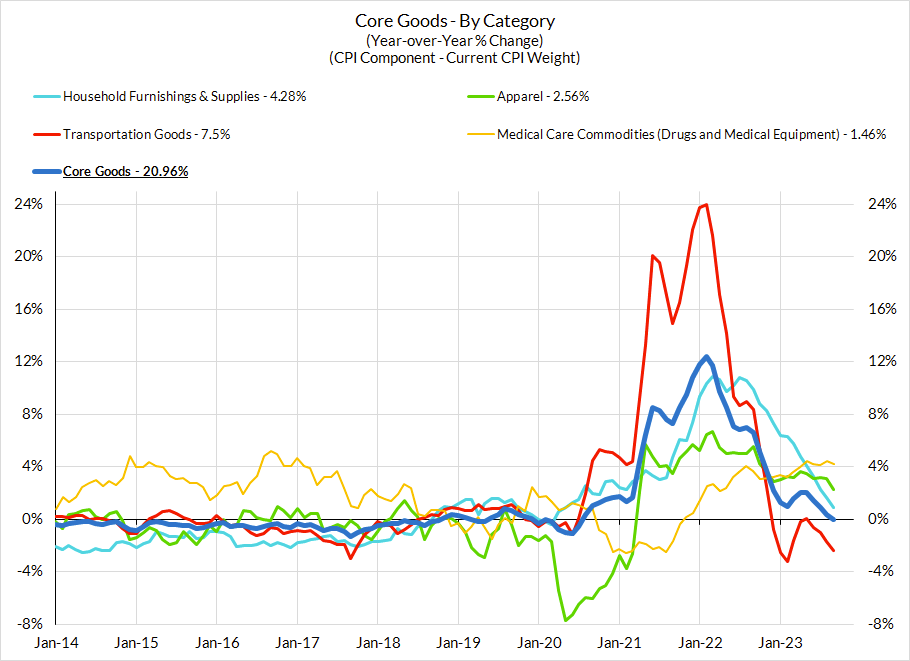

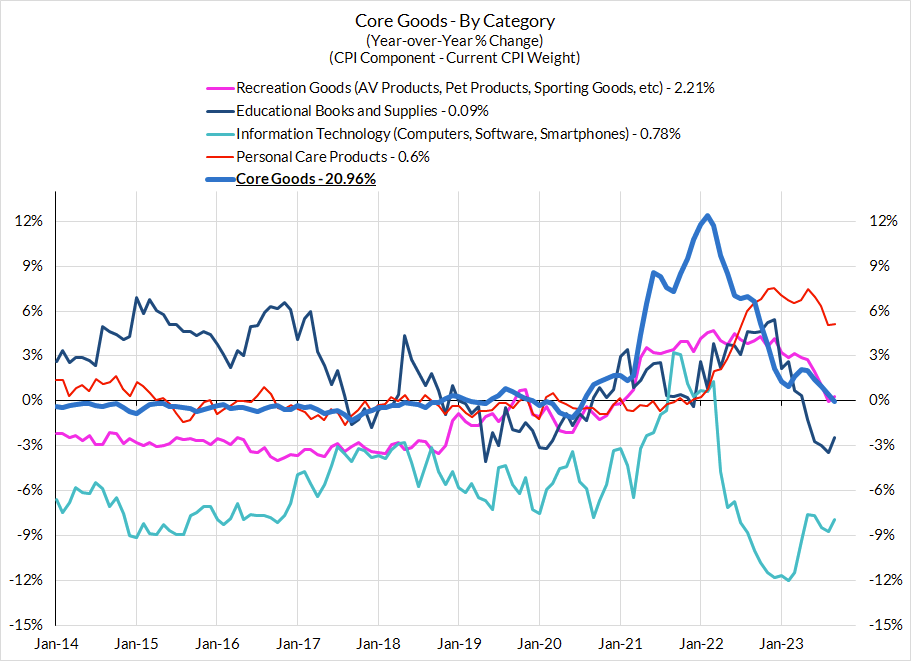

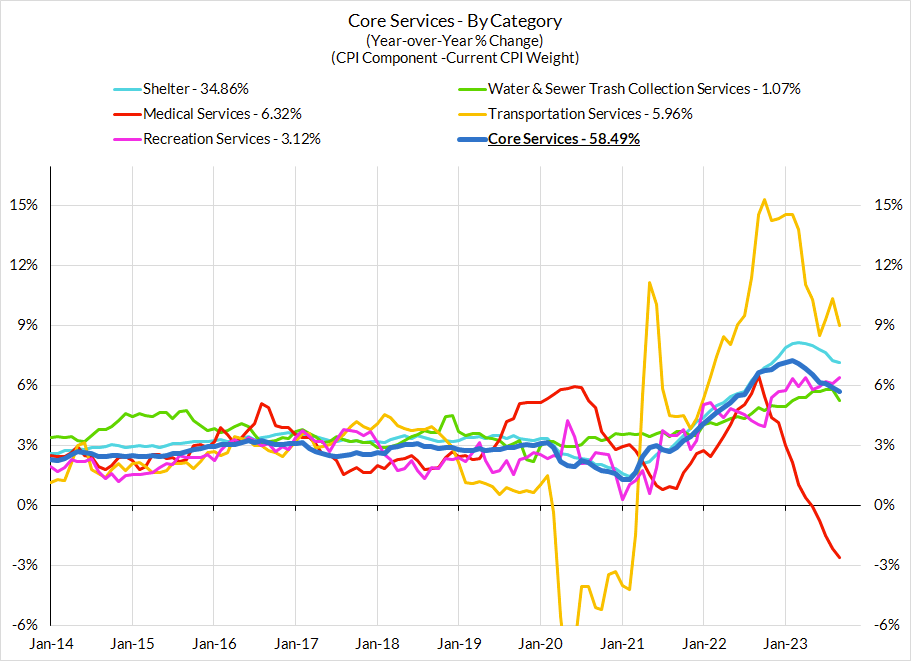

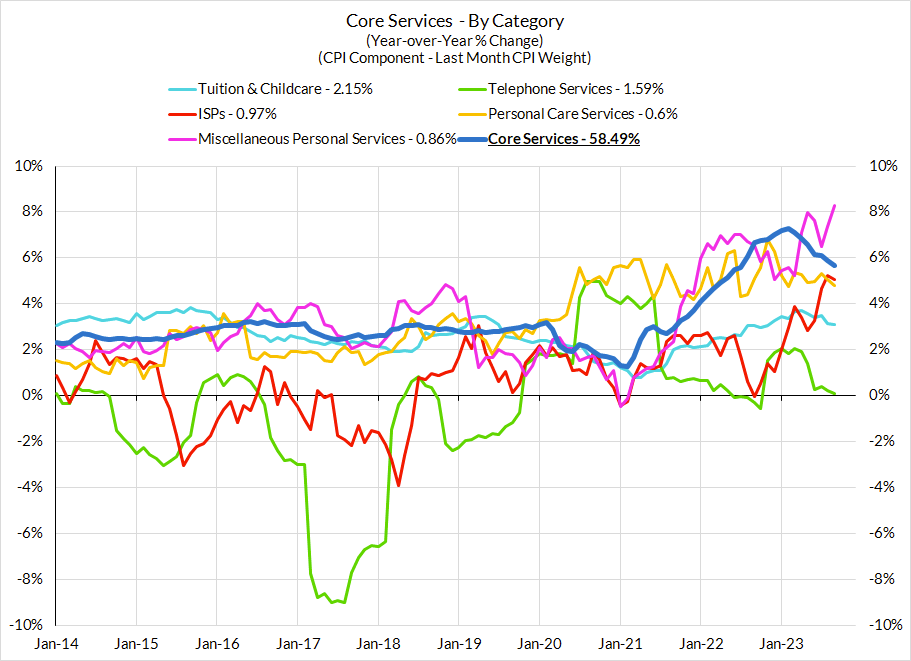

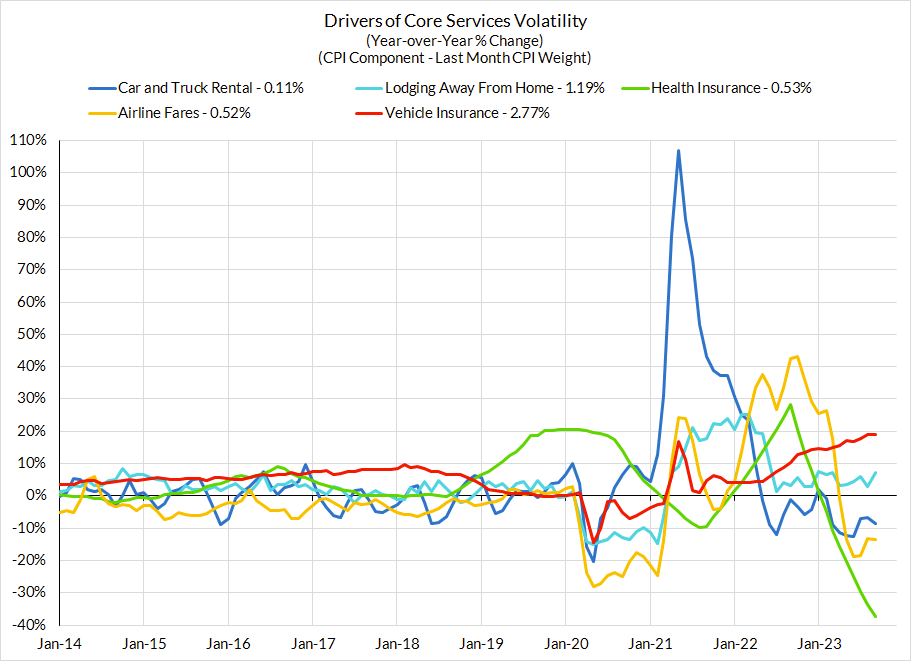

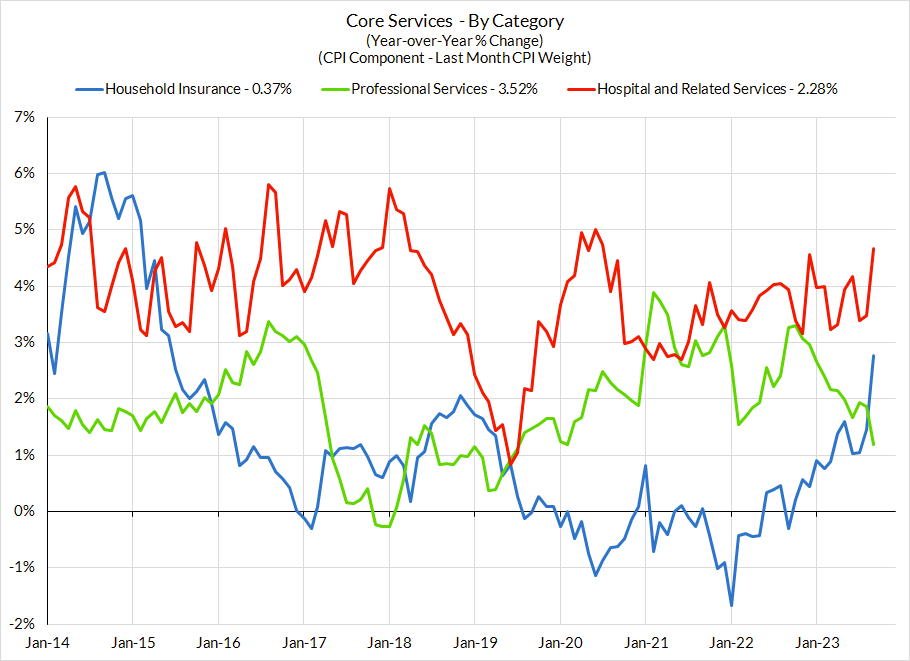

2) Headline and core inflation both have some downside risks: We see more evidence that core goods deflation should continue, stability—if not downside—in commodity price dynamics relevant to non-core inflation and energy-sensitive services. Core services CPI was boosted in recent month by strong airfares, a surprise increase in owners' equivalent rent, a residual seasonality bump in the price of lodging, and a sharp rise in legal service prices. These effects should fade in the coming months and make it easier to achieve a downside core CPI surprise for the time being. With each passing month, medical services CPI will be boosted due to a quirk in the methodology for measuring health insurance, but this has no bearing on Core PCE and should thus have no bearing on Fed policy.

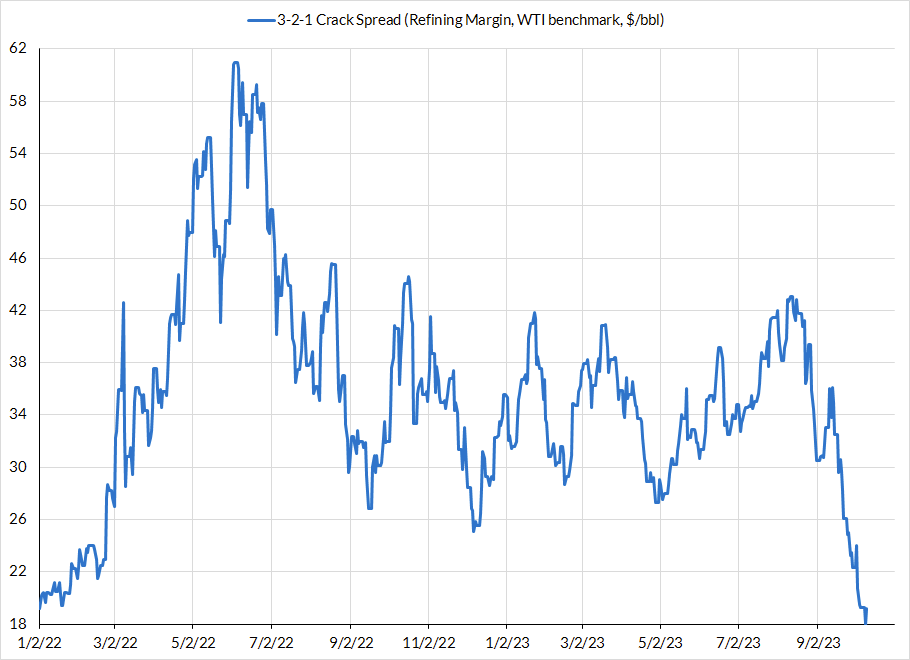

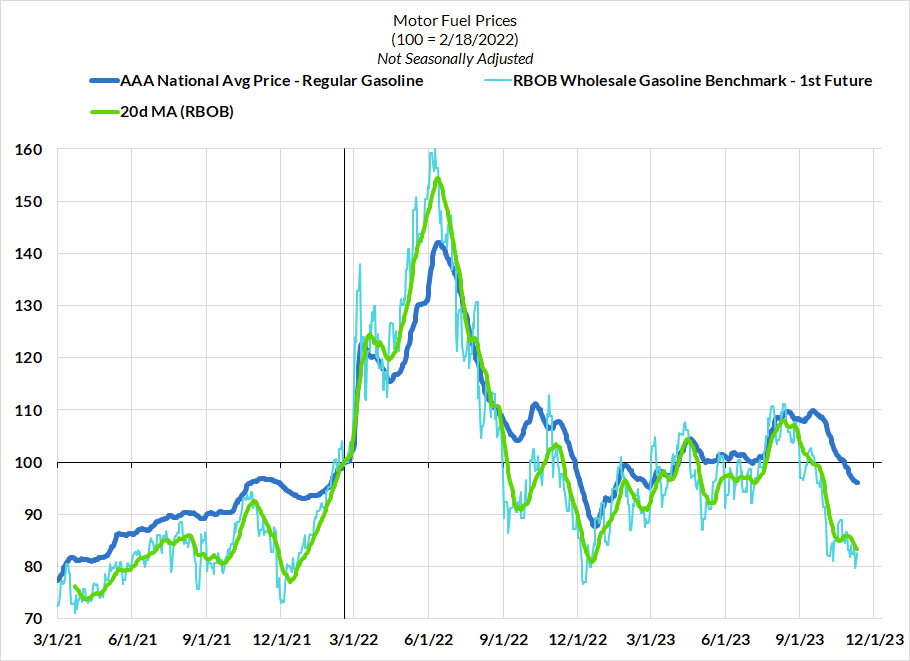

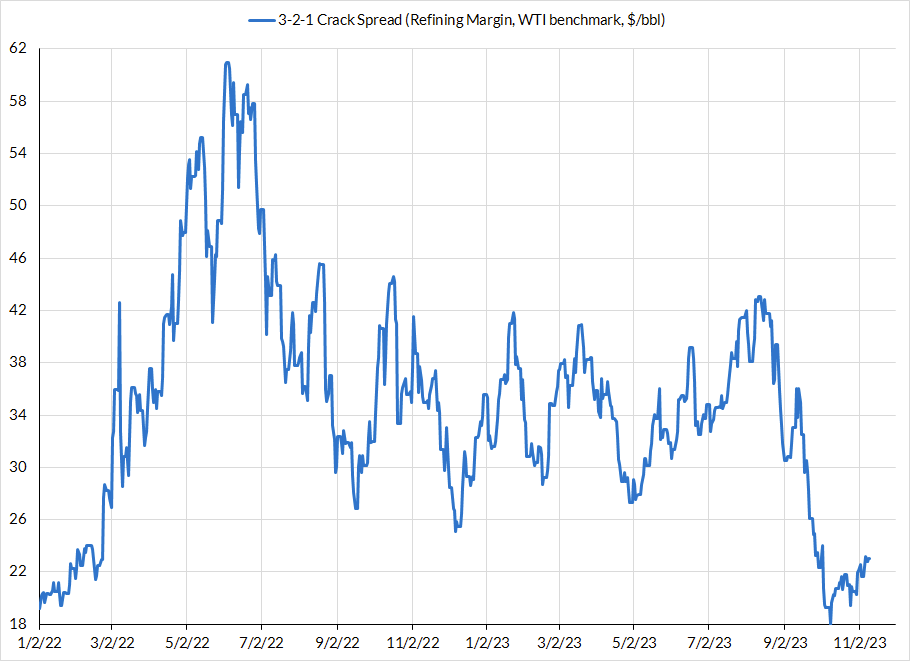

3. More disinflationary benefits from stable oil and refined product prices. Even in seasonally adjusted terms, we will see a meaningful decline in motor fuel prices, but we should also see some benefit to food, food services, and airfares inflation over the coming months. Crude oil prices are lower and so are the spreads between crude oil and final refined product prices. These tailwinds won't last forever, but they are welcome developments given the previous surge in crude oil and refined product prices 3 months ago.

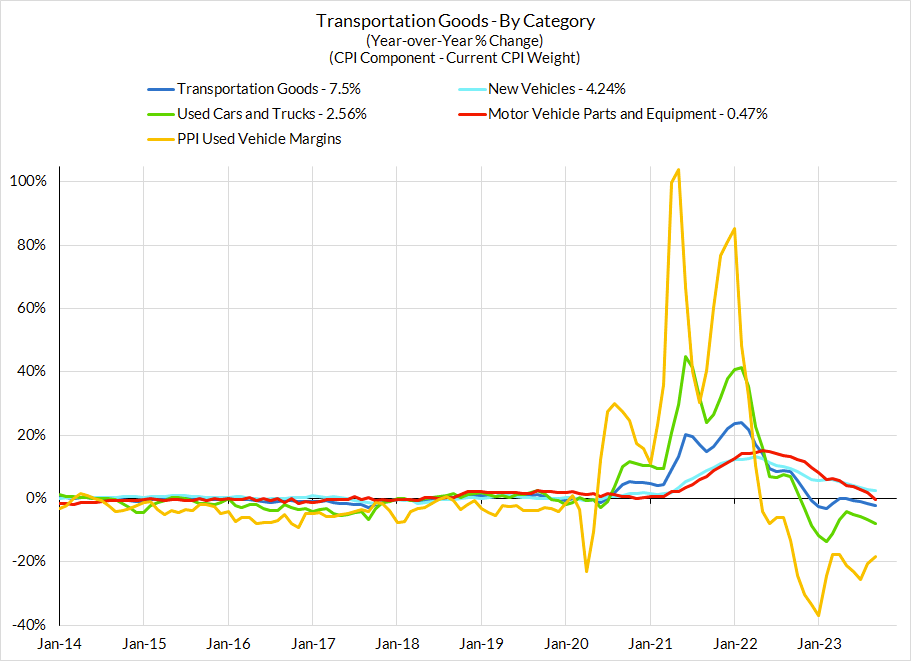

4. Used car deflation is ongoing: We do not expect an outsized decline in October but the trends in Used Car prices suggest that (1) the UAW strike had very limited effects on the motor vehicle supply chain and (2) the weekly trends in wholesale used car prices are deflationary. The disinflationary progress here might be chunky and there is downside risk over the next few months. Overall, the price levels here are still sufficiently elevated to suggest that downside is forthcoming.

5. Don't forget the wedge. The wedge between Core CPI and Core PCE was not a particularly big deal in September, but could still prove to be a big deal over the coming months. Airfares are likely to not show much divergence, but food services disinflation and upcoming health insurance CPI acceleration will imply hotter Core CPI readings (all else equal) relative to still cooling Core PCE readings. Other categories unique to CPI, like vehicle insurance, are likely to continue showing strength. Ultimately, the Fed should and likely will stick to PCE as its gauge, even if CPI drives news headlines and bigger market reactions. As we detailed in a previous inflation preview, there are multiple sources of divergence between Core/Supercore CPI & PCE, including (1) airfares, (2) healthcare services, (3) food services, (4) financial services, and (5) wage-based input cost indices.

CPI Charts

Non-Core CPI Components

Core Goods CPI Components

Core Services CPI Components (Not All Feed Into Core PCE)

From Our PCE Recap (For Those Who Missed It)

For the Detail-Oriented: Core PCE Heatmaps

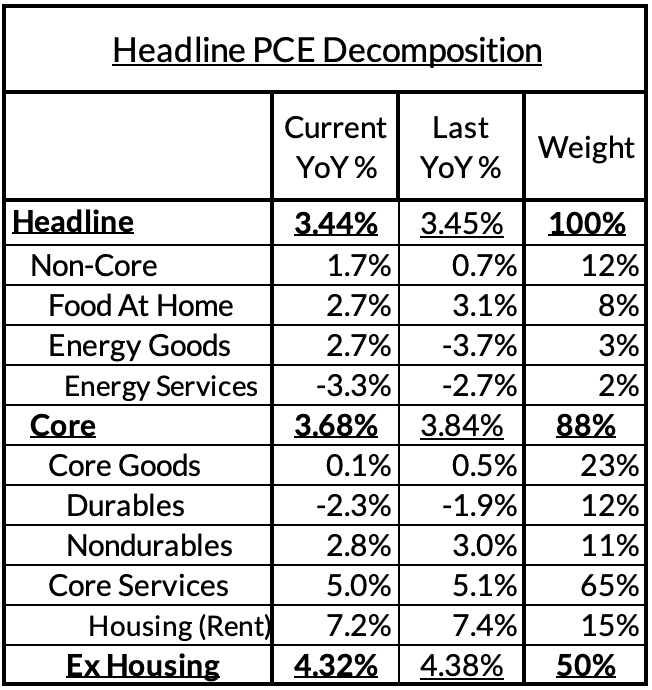

Right now Core PCE (PCE less food products and energy) is running at a 3.68% year-over-year pace as of September, 168 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth), which caused market rents to surge in 2021. Rent is contributing 63 basis points to the 168 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (automobile bottlenecks are likely to explain 3 basis points now, while food inputs likely added 23 basis points to the overshoot)

- Some more demand-driven (in-person recreation and travel services likely added 18 basis points to the overshoot)

- So with demand- and supply-side drivers (consumer staples and discretionary goods likely added 23 basis points).

- Some oddball segments have offsetting effects (measured financial service charges now likely adding 4 basis points, while contributions from input cost indices and imputed financial services likely added 16 basis points to Core PCE vs 2%-consistent outcomes).

The final two heat maps below gives you a sense of the overshoot on shorter annualized run-rates. September monthly annualized core PCE yielded a 164 basis point overshoot vs 2% target inflation (3.64% annualized).

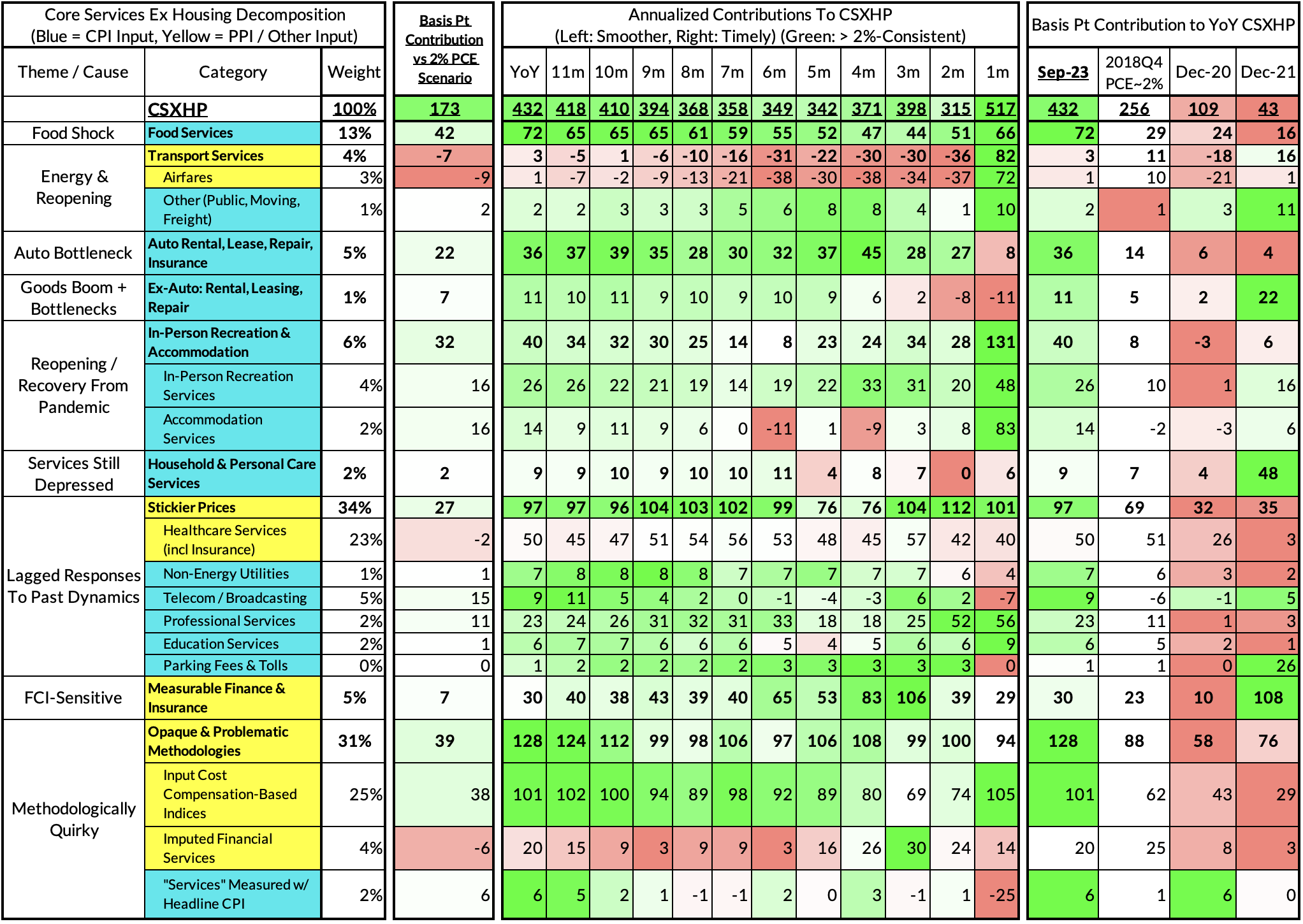

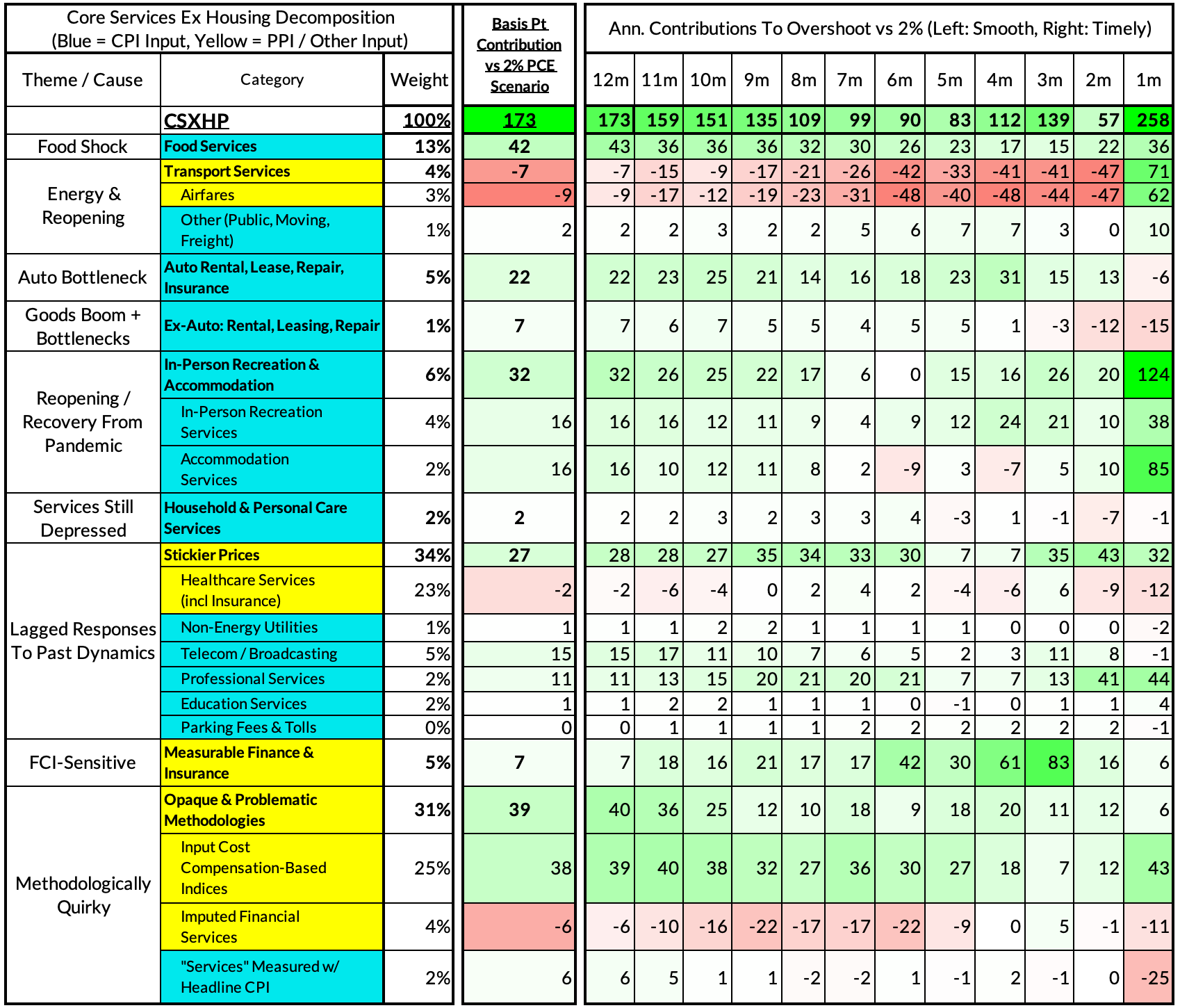

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The September growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 4.32% year-over-year, a 173 basis point overshoot versus the 2.56% run rate that coincided with ~2% headline and core PCE.

September monthly supercore ran at a 5.17% annualized rate, a 258 basis point overshoot of what would be consistent with 2% headline and core PCE.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?

- 7/9/23: June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting Clearer But Not Soon Enough To Forestall a July Hike

- 8/8/23: July Inflation Preview: Used Car Downside Can Hasten Path To 2% Core PCE Outcomes

- 9/12/23: August Inflation Preview: CPI Risks Growing More Balanced Even As PCE Risks Tilt More To The Downside

- 10/10/23: September (Pre-PPI) Inflation Preview: The Wedge Will Matter Again...Pulling Up CPI and Pushing Down PCE