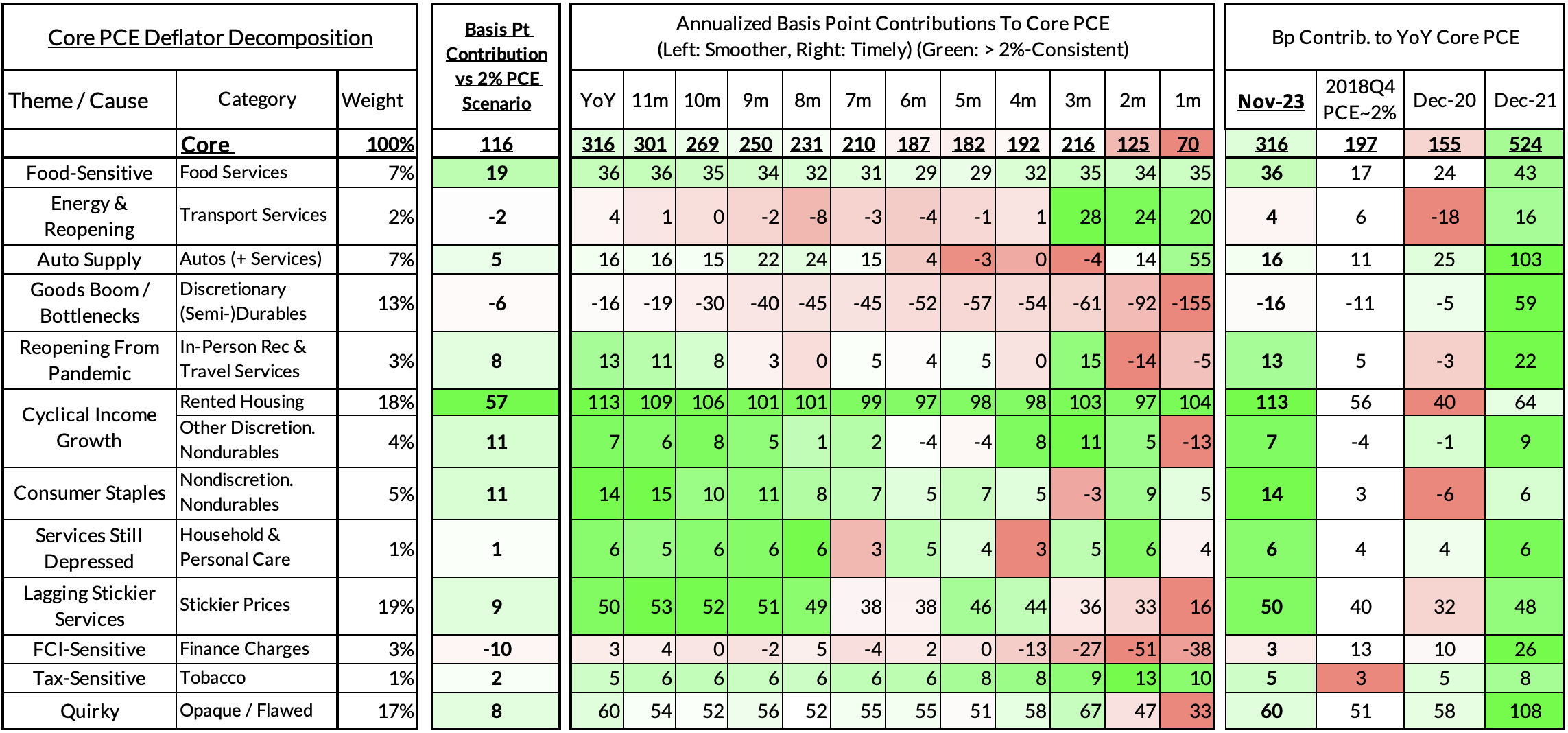

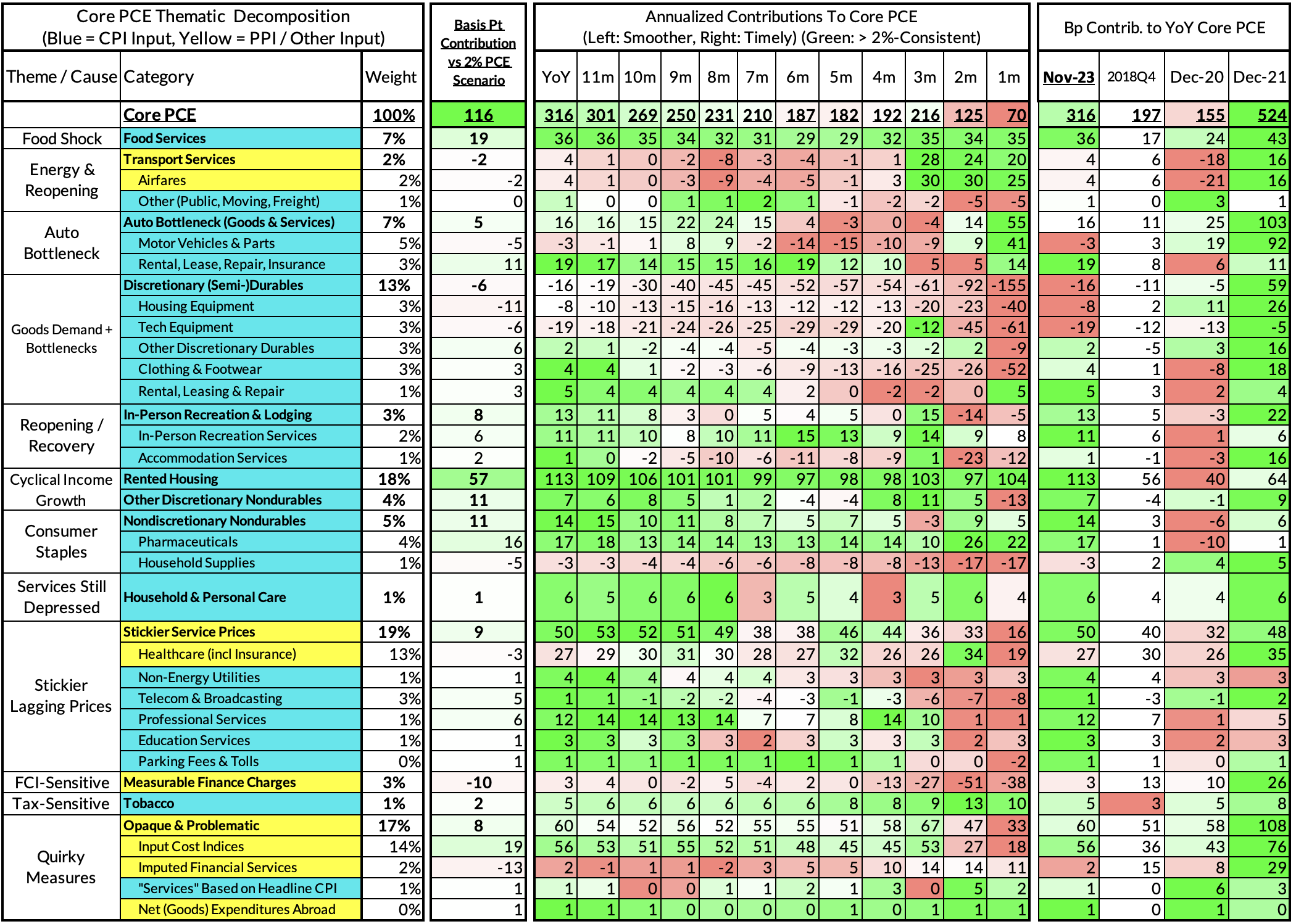

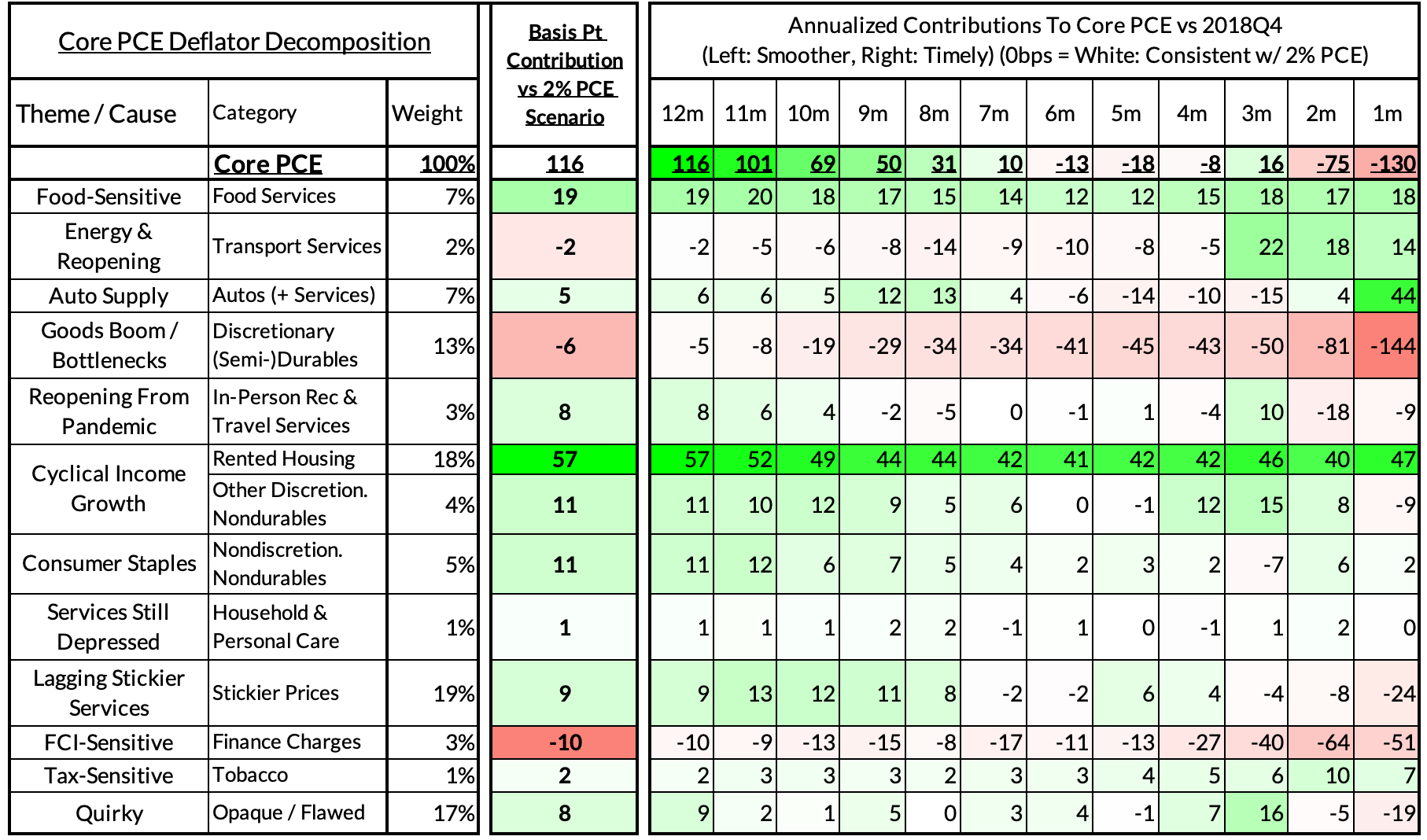

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

This is a truncated version of the preview initially made available to our exclusive distribution on Monday. Please reach out to us if you would like to access the full preview when it is first made available.

Summary

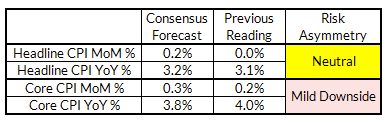

- Headline CPI is poised to grow in line with consensus (0.23% vs 0.2%), while risks are mildly tilted to the downside now vs consensus (0.24% vs 0.3%).

- Our forecast is in line with consensus for Core CPI (0.23%) with a slightly more diminished "wedge" to Core PCE (5-8 basis points).

- There's a very good chance that Core PCE falls below 3.00% on a year-over-year basis, requiring only a 0.24% month-over-month gain in December. Core PCE growing less than 0.20% month-over-month would bring Core PCE to 2.9% on a rounded year-over-year basis. Reaching these milestones will increase the leeway for the Fed to potentially talk about cuts in 2024, but for most FOMC members, the proof will be in the January pudding. It is more useful to think of this release as a chance to "bank in" more disinflation ahead of the first quarter, which has proven to be the most volatile and upside-laden quarter for inflation over the past two calendar years.

Forecast Details

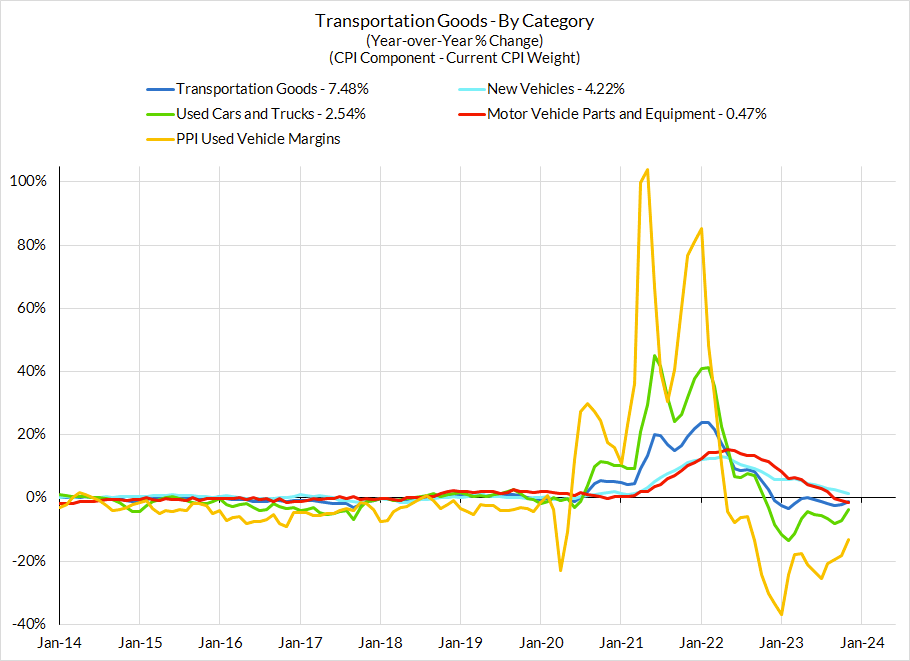

- This core inflation release is notable for the lack of obvious thematic drivers. While motor vehicle deflation should be arriving very soon, it likely will not arrive substantially by December. Goods deflation in the last two months has been especially broad and not tied to a particular theme. Our core CPI forecast is for 0.24% increase, very mildly below consensus. Relative to November, we expect marginally less goods deflation in December. The easiest path to CPI upside and downside surprises revolves around goods prices (in both directions). We expect rent deceleration to come with bumps but ultimately materialize incrementally (risks two-sided relative to our forecast).

- Core PCE already materially underperformed Core CPI last month, for reasons we largely flagged but even more strikingly than we anticipated. We suspect Core PCE cannot underperform Core CPI so much in this upcoming set of releases. While airfares PPI/PCE should more meaningfully underperform in December, healthcare and financial services will cut the other way.

Key Dynamics Within Baseline View (Close Commentary To November Preview; Views Little Changed)

- Brace for residual seasonality in Q1: Q1 in 2022 and 2023 brought with it a wave of annual upside resets to prices. Prices surged, likely as firms who lagged on pricing used the new calendar year and the conclusion of the holiday season to catch-up to competitors' pricing and preserve their margin in the face of big cost-push shocks. This type of "conditional residual seasonality" is likely less prevalent in 2024Q1 and could benefit from another wave of used cars deflation falling at an ideal time, but our baseline view still bakes in some local price acceleration from December to January and February. 2024Q1 should be less inflationary than 2023Q1 or 2022Q1 but nevertheless the most inflationary quarter of 2024. December represents a last chance before the potential Q1 storm to "bank in" facially encouraging disinflationary news.

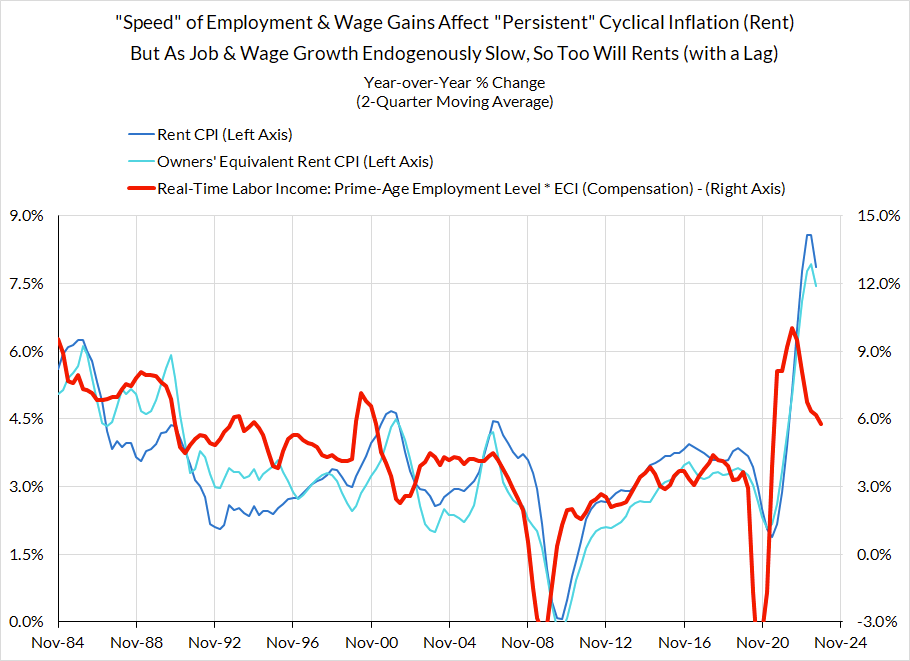

- The most important driver of core inflation will be the trajectory of rent and owners' equivalent rent (OER). Market rents have continued to slow and arguably deflate on some measures. These outcomes should, with some diminished sensitivity and a longer lag, feed into CPI and PCE outcomes. As it currently stands, the last 3-6 months of core PCE overshoot vs the Fed's 2% target would disappear if rent and OER CPI were replaced with real-time market-rent measures. Over the course of 2024, core PCE should slow purely because of slowing rent and OER inflation

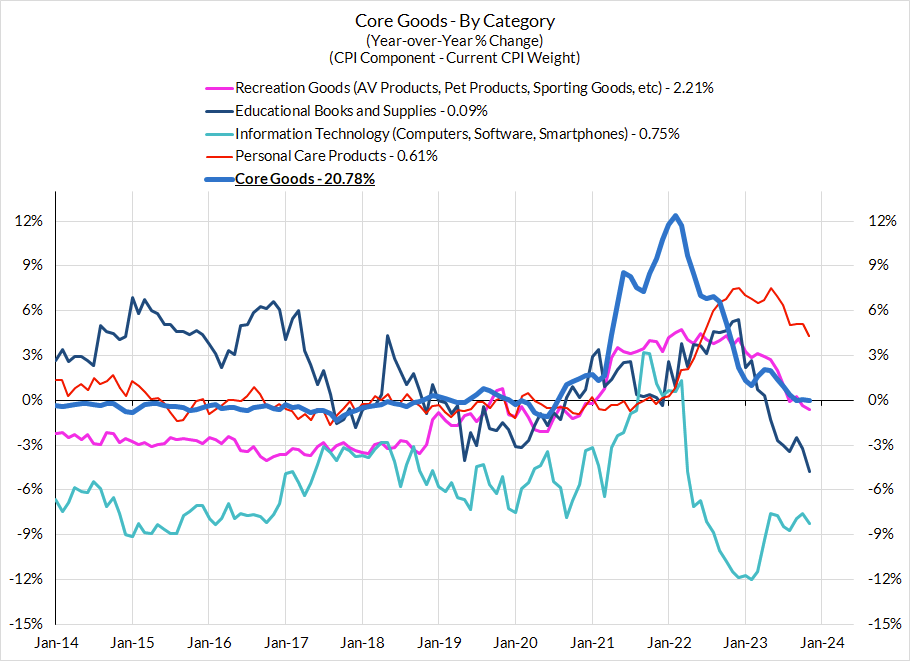

- Core goods deflation should continue, but expect it to be a shallow but persistent contributor to the disinflationary process. Price levels for a number of key core goods categories are still elevated and thus have room for sustained underperformance in a manner that supports achievement of the Fed's 2% target. The pace of this deceleration might be dismissed as transitory, but we see good evidence and reason to believe that price transmission from key cost and supply chain shocks will be asymmetric. While prices rocketed higher as these shocks first hit, they will likely deflate at a slower pace (rockets vs feathers) over a more elongated timeline. For December, we are expecting flat vehicle prices, but there will be a new deflationary impulse beginning fairly soon.

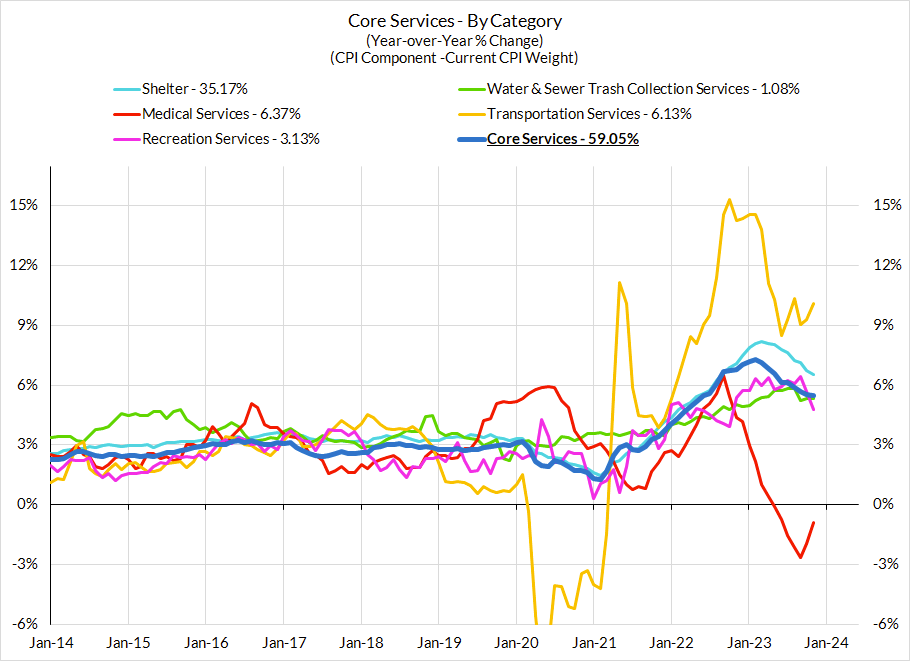

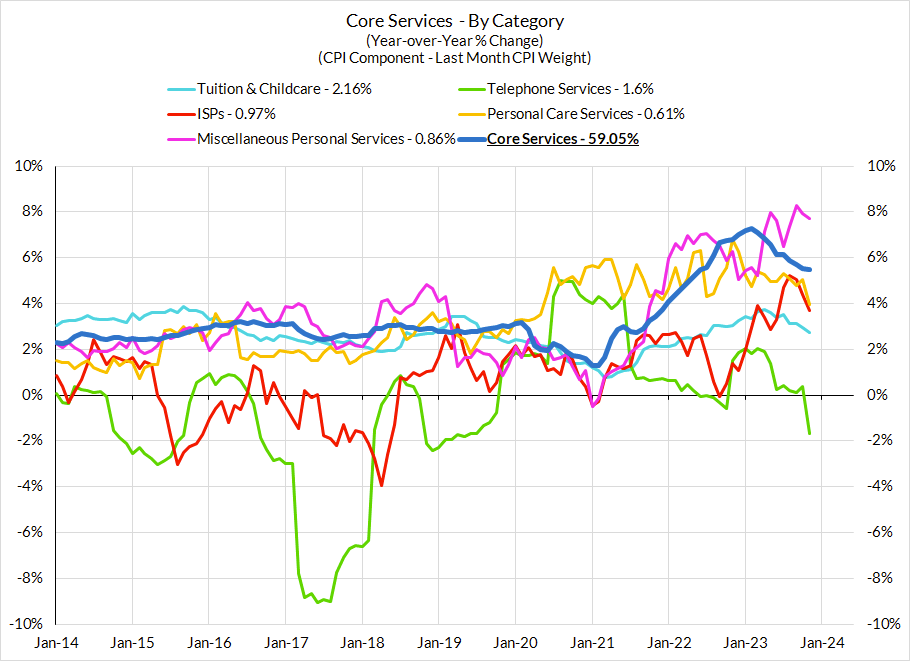

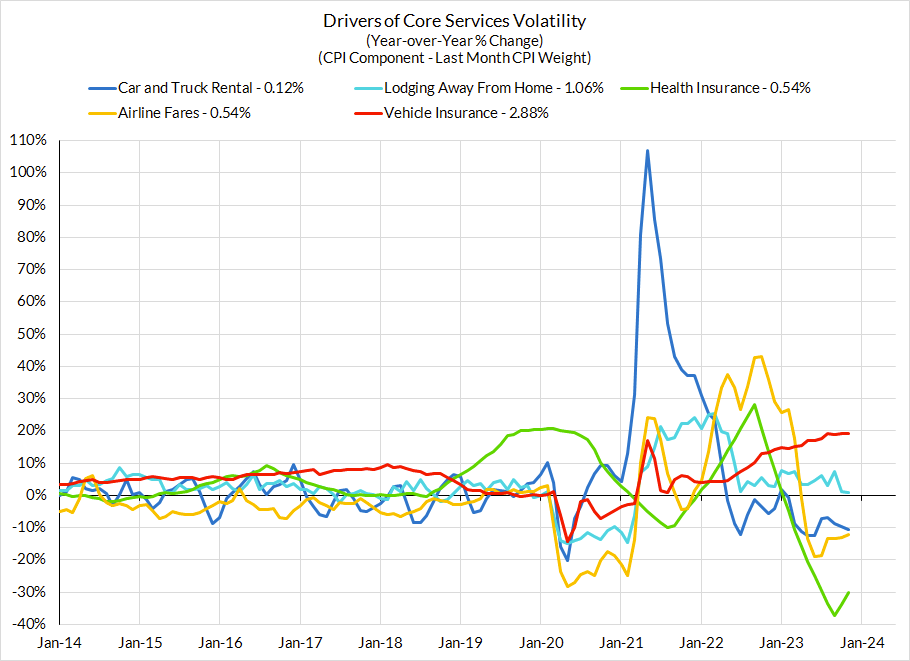

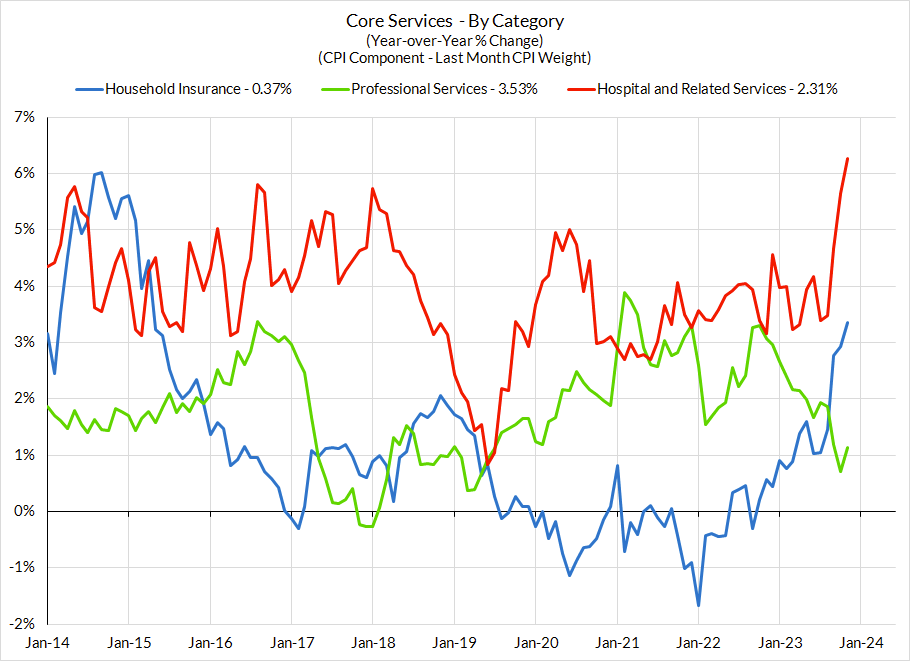

- Core services disinflation will ultimately materialize but the road will be bumpy and noisy between CPI and PCE: Some volatile prices are likely to flare higher in December, specifically financial services PPI due to rising equity prices. We expect to see some airfare CPI upside in December, but some disinflation within the PPI measures.

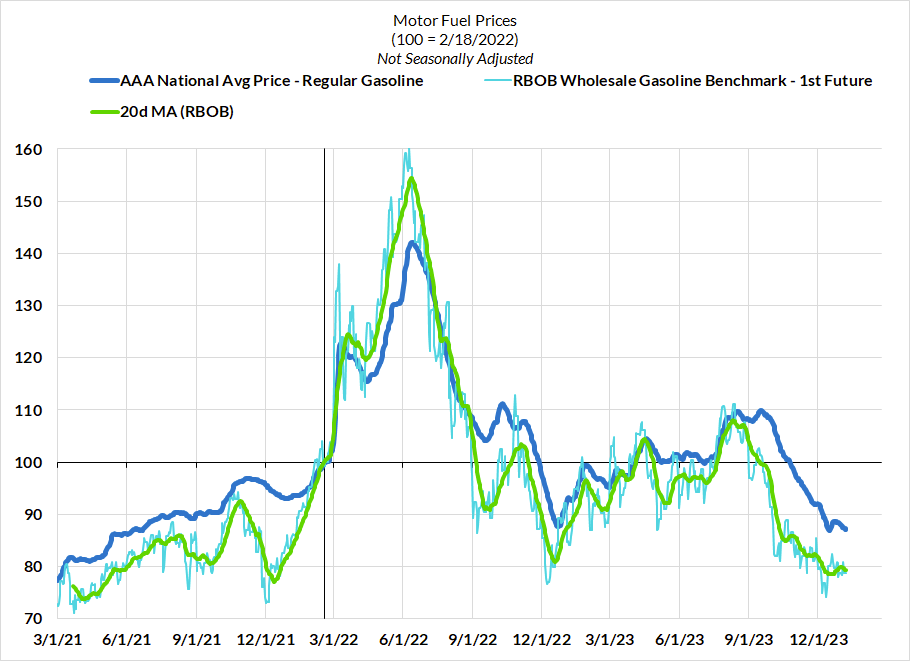

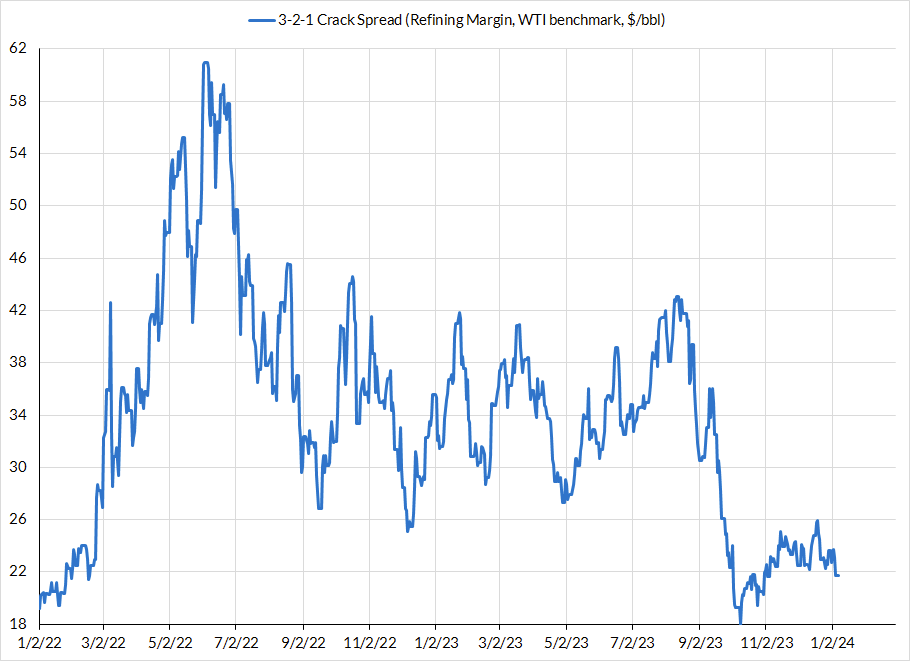

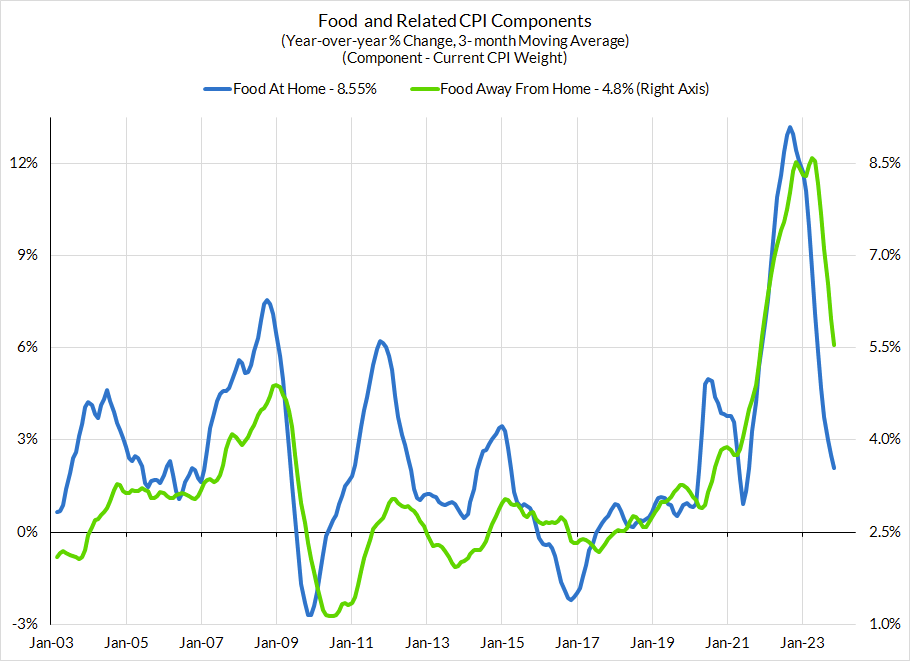

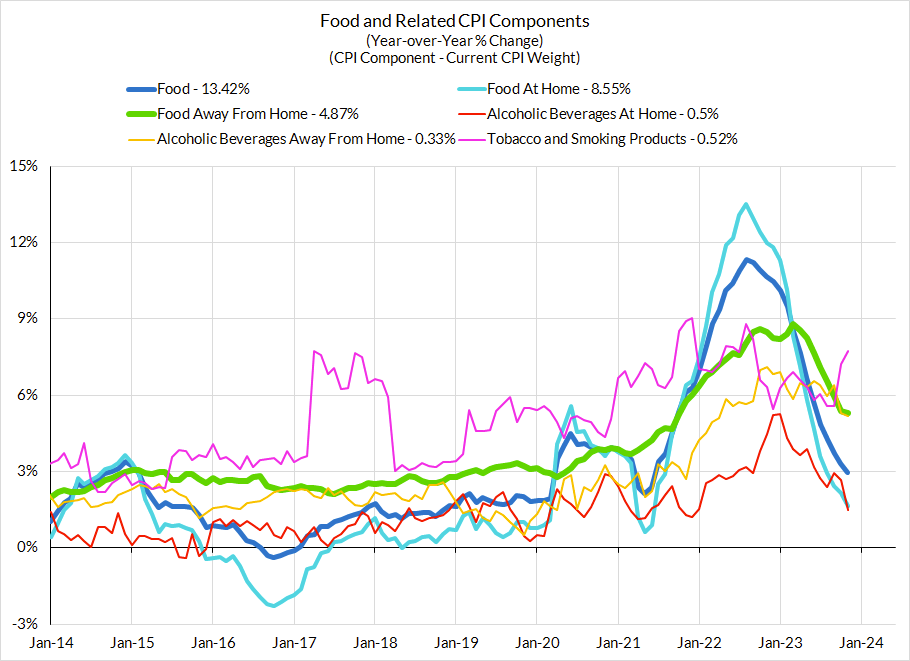

- Commodity price passthrough on the downside: Over the next six months, we expect to see more encouraging signs from lower commodity prices. Two key mechanisms: diesel->food at home -> food services and jet fuel -> airfares. Energy prices likely matter to a number of core nondurable goods too.

CPI Charts

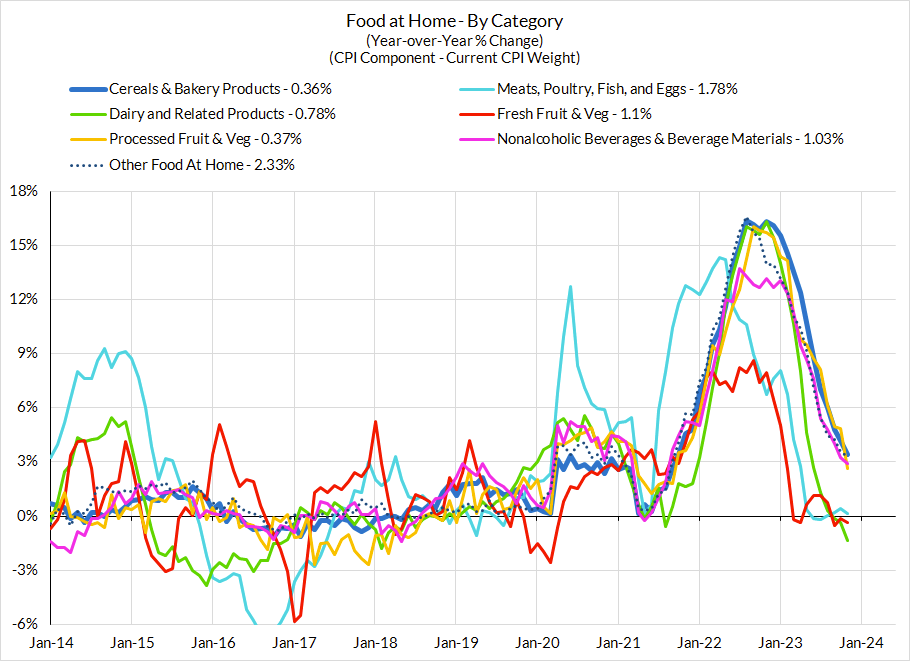

Non-Core CPI Components

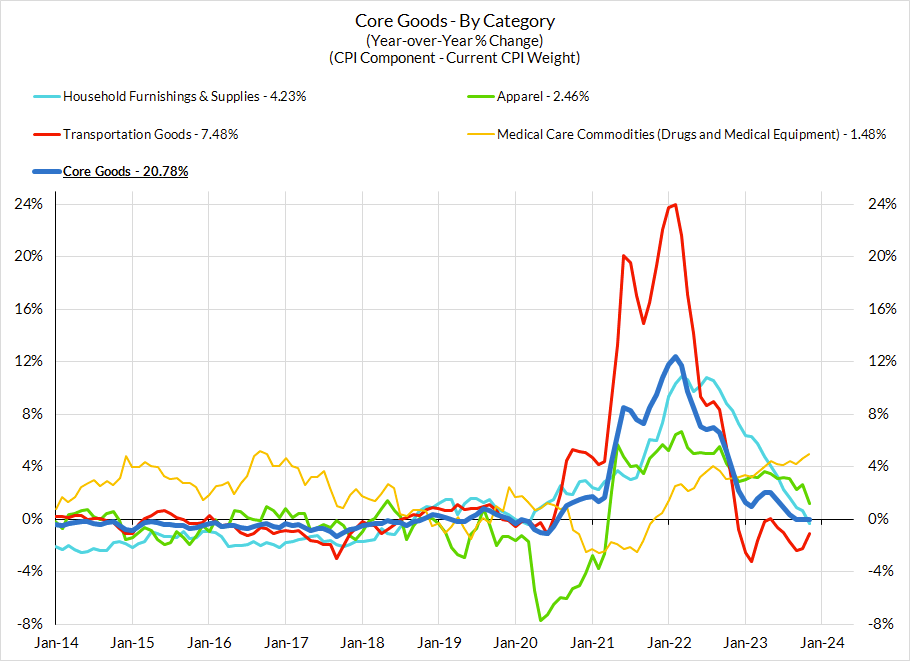

Core Goods CPI Components

Core Services CPI Components (Not All Feed Into Core PCE)

From Our PCE Recap (For Those Who Missed It)

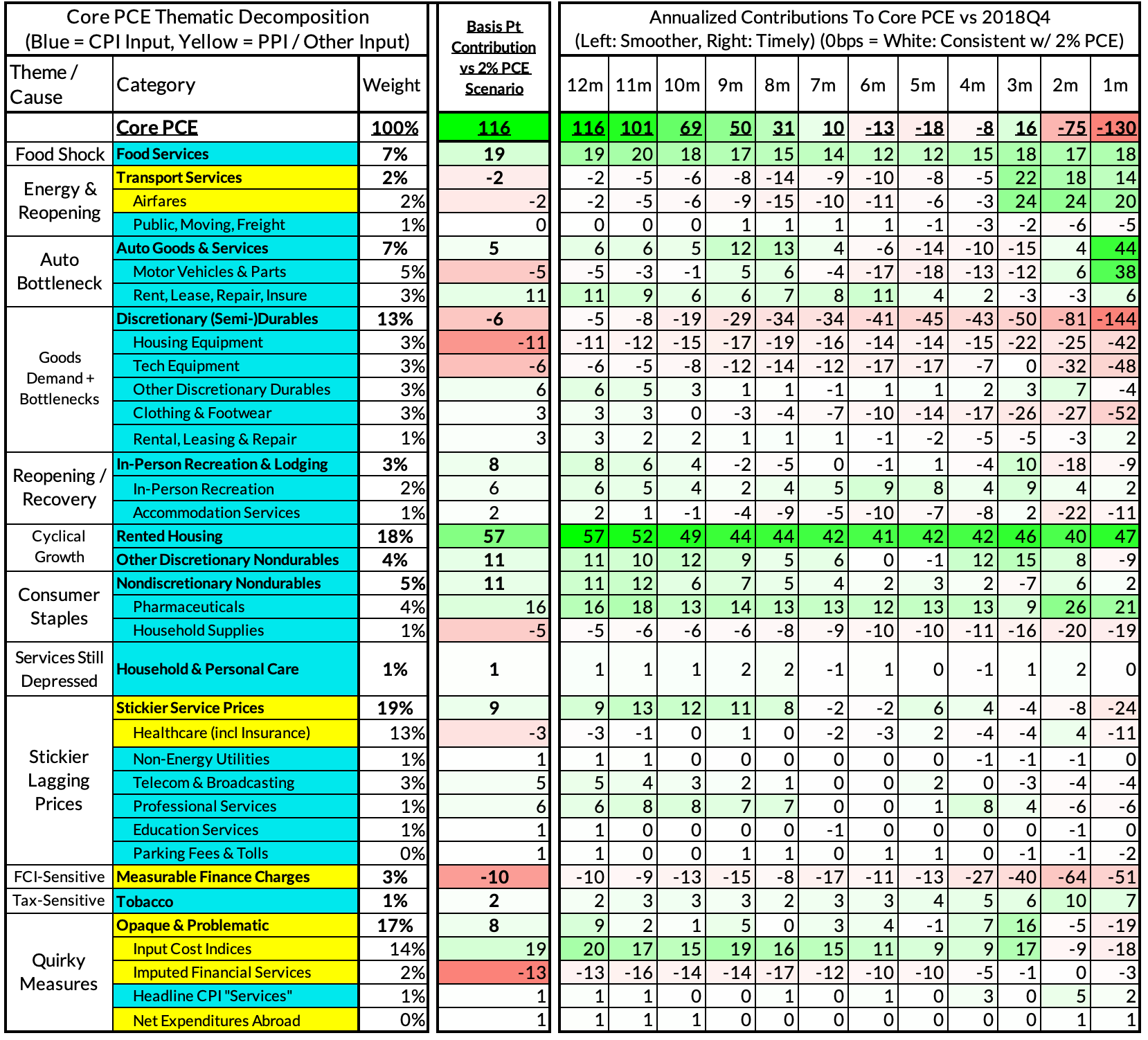

For the Detail-Oriented: Core PCE Heatmaps

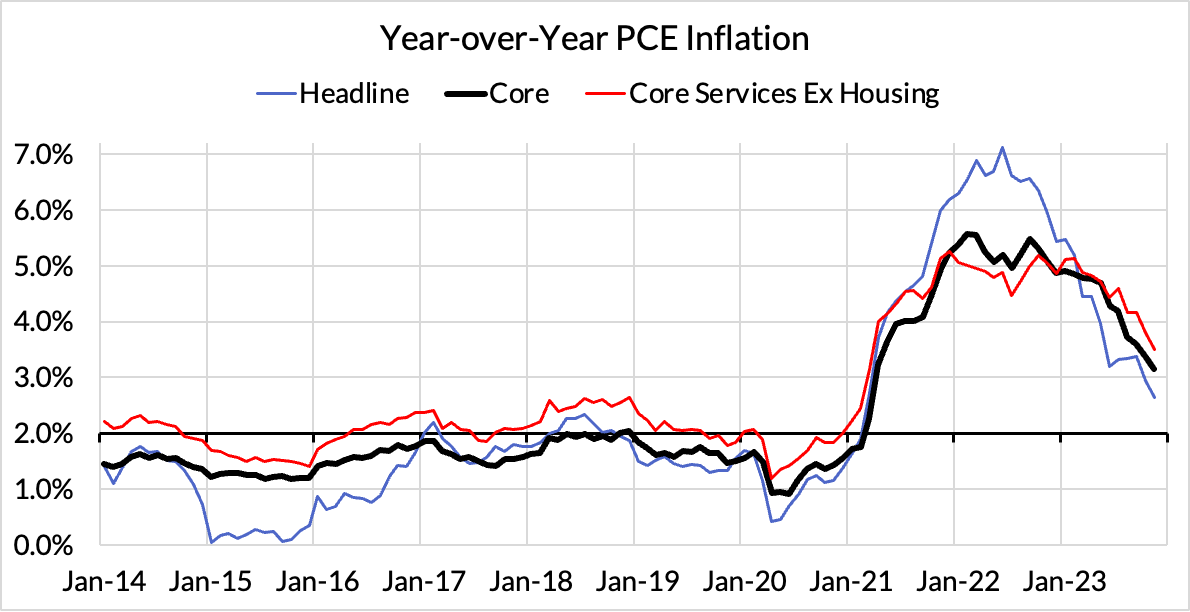

Right now Core PCE (PCE less food products and energy) is running at a 3.16% year-over-year pace as of November, 116 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth), which caused market rents to surge in 2021. Rent is contributing 57 basis points to the 116 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (automobile bottlenecks are likely to explain only 5 basis points now, while food inputs likely added 19 basis points to the overshoot)

- Some more demand-driven (in-person recreation and travel services likely added 8 basis points to the overshoot)

- So with demand- and supply-side drivers (consumer staples and discretionary goods likely added 16 basis points).

- Some oddball segments have offsetting effects (measured financial service charges now likely subtracted 10 basis points, while contributions from input cost indices and imputed financial services likely added 6 basis points to Core PCE vs 2%-consistent outcomes).

The final two heat maps below gives you a sense of the overshoot on shorter annualized run-rates. November monthly annualized core PCE yielded a 130 basis point undershoot vs 2% target inflation (0.7% annualized).

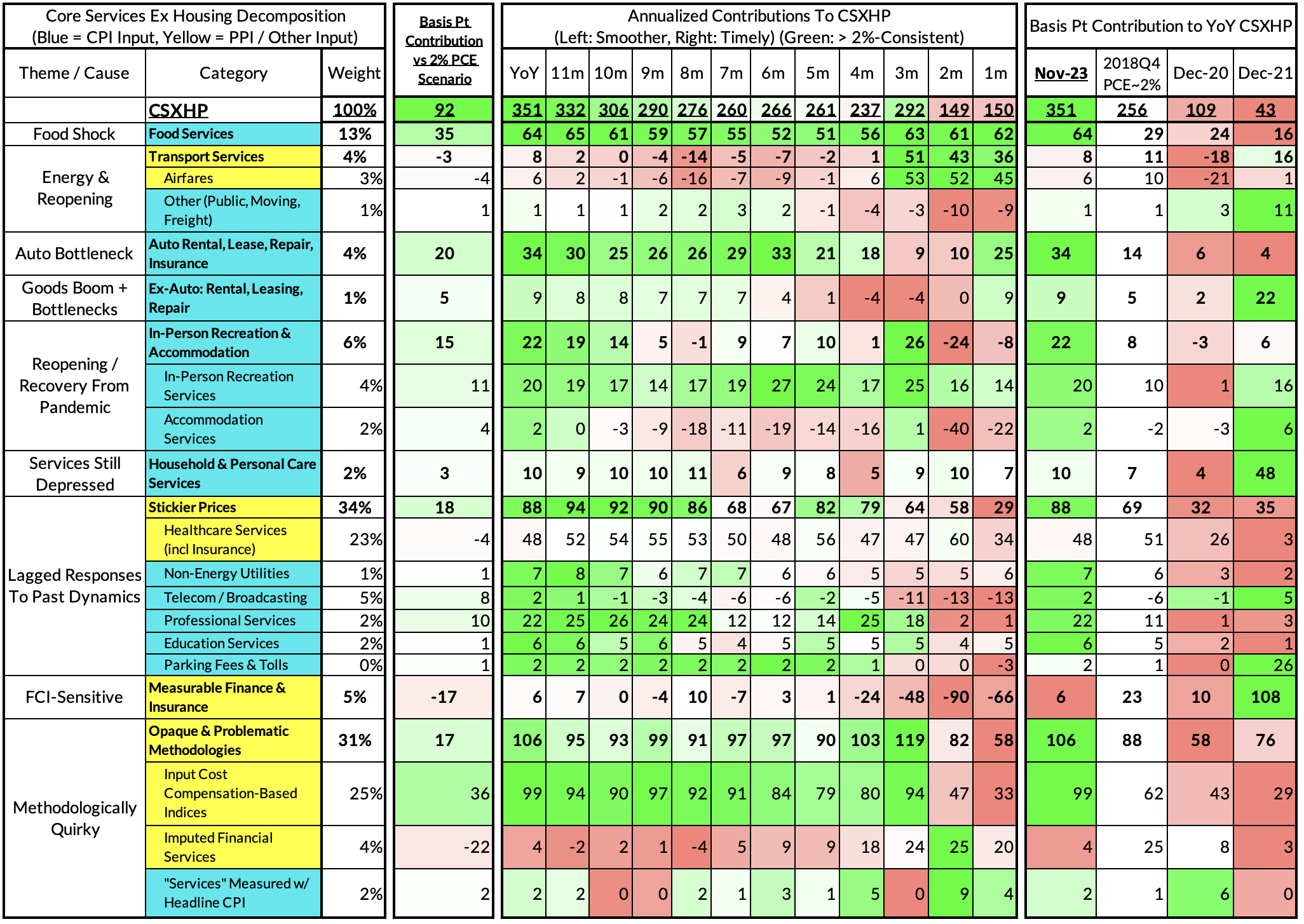

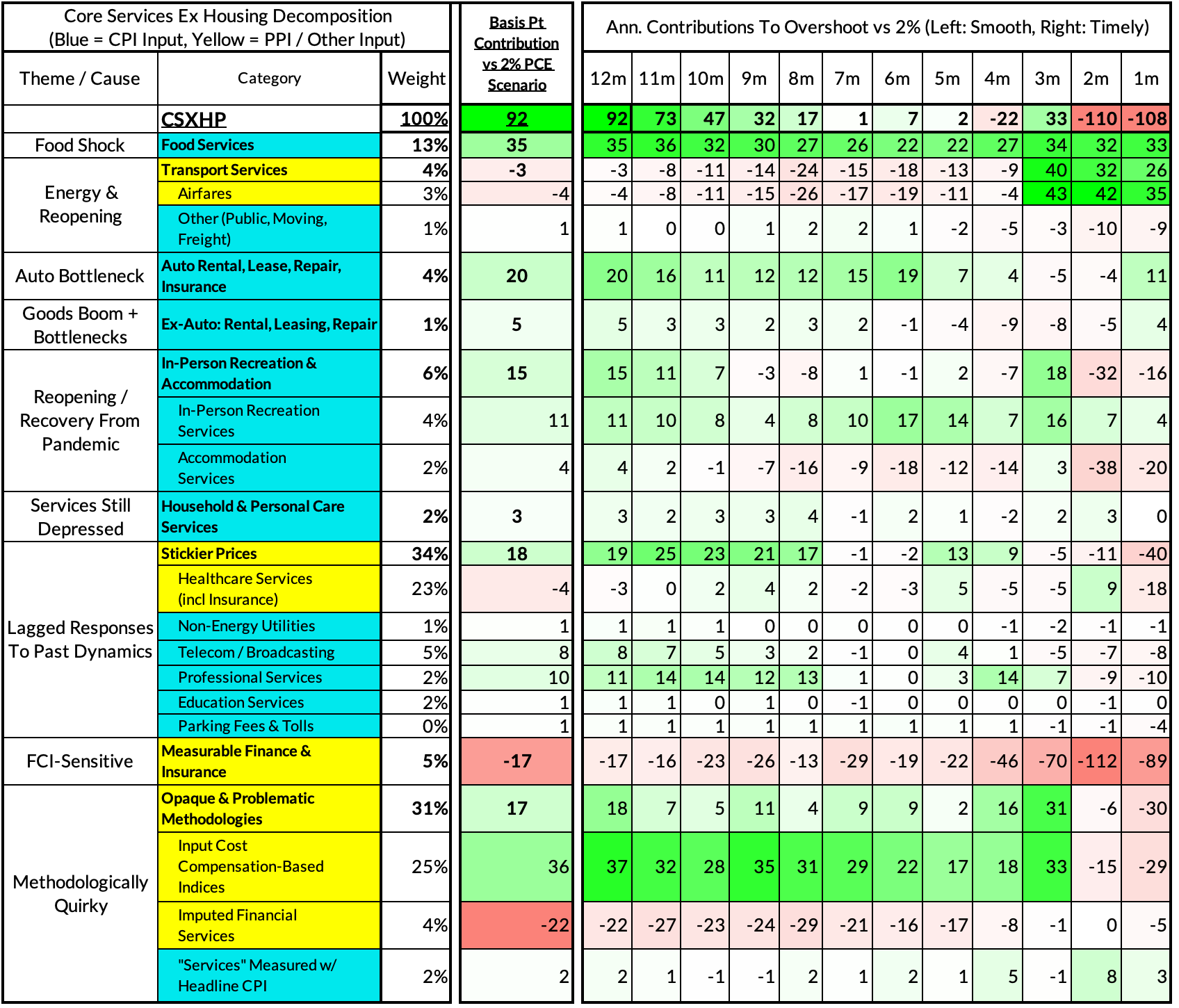

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The November growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 3.51% year-over-year, a 92 basis point overshoot versus the 2.59% run rate that coincided with ~2% headline and core PCE.

November monthly supercore ran at a 1.50% annualized rate, a 108 basis point undershoot of what would be consistent with 2% headline and core PCE.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?

- 7/9/23: June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting Clearer But Not Soon Enough To Forestall a July Hike

- 8/8/23: July Inflation Preview: Used Car Downside Can Hasten Path To 2% Core PCE Outcomes

- 9/12/23: August Inflation Preview: CPI Risks Growing More Balanced Even As PCE Risks Tilt More To The Downside

- 10/10/23: September (Pre-PPI) Inflation Preview: The Wedge Will Matter Again...Pulling Up CPI and Pushing Down PCE

- 11/13/23: October Inflation Preview: A Data Release That Can Dictate The Future of The Hiking (& Easing?) Cycles

- 12/11/23: November Inflation Preview: Headline Downside But Can Core PCE Keep A March "Normalization Cut" In Play?