This preview was originally released this past Friday to Premium Donors. If you would like to get the first look at this kind of content, you can start a free 30-day trial or reach out to us here for more information.

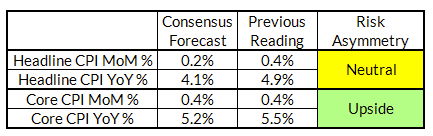

Summary: The risks for May (CPI) are still tangibly to the upside, but developments from April CPI do shade favorably relative to what was the baseline headed into the April CPI preview.

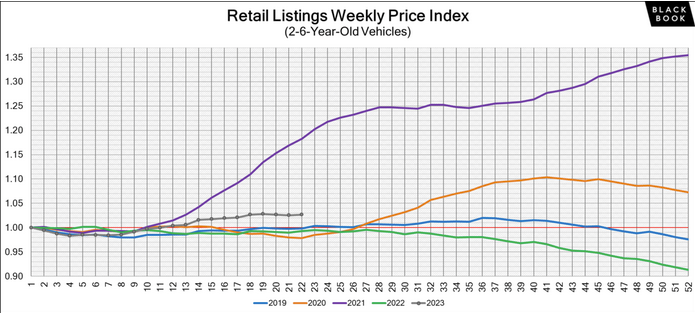

- Used cars still singlehandedly pushes the base-case for core CPI to a high 0.4% (0.44%), and makes an upside surprise more likely than a downside surprise for core inflation.

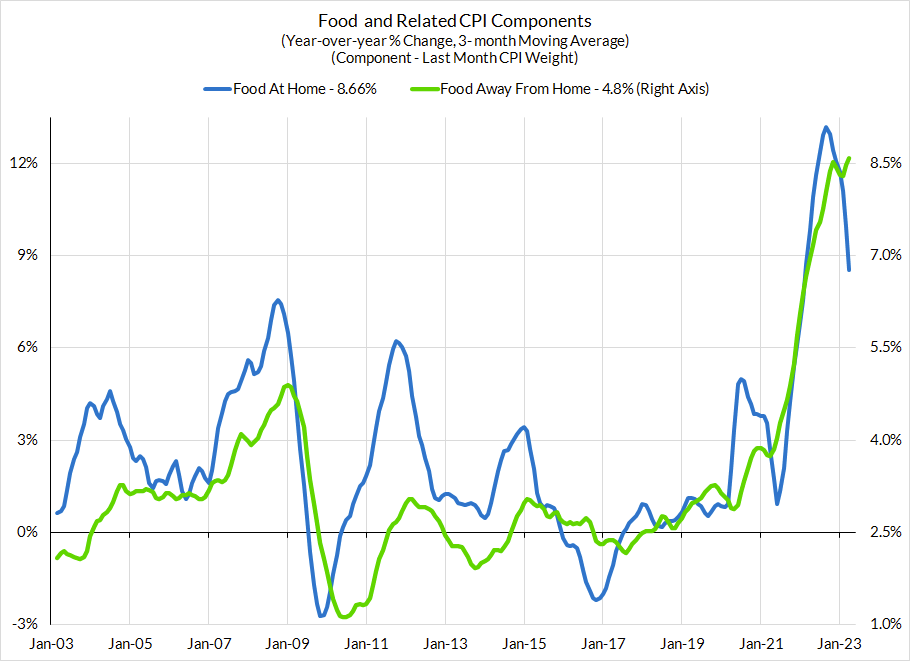

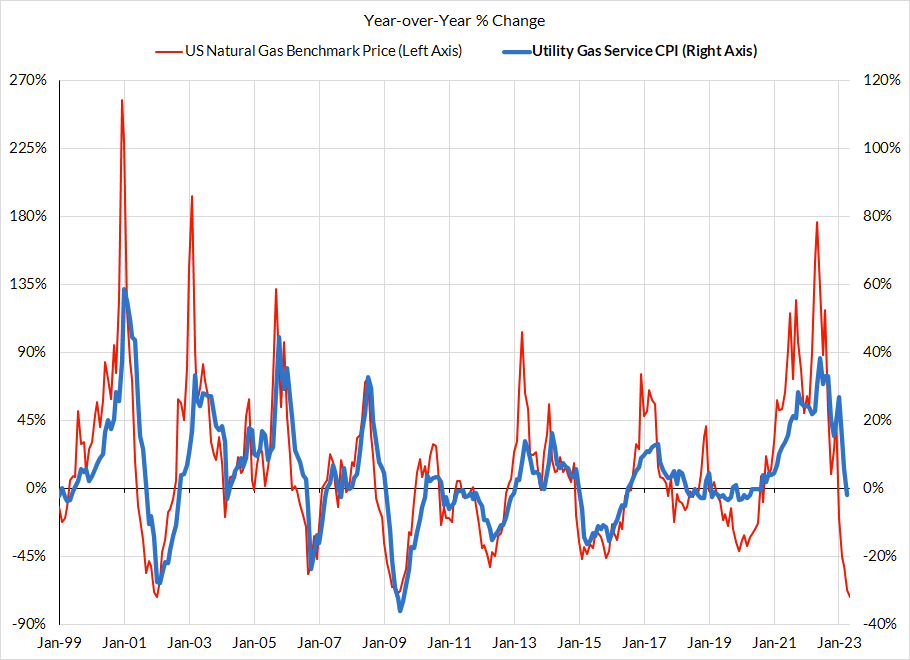

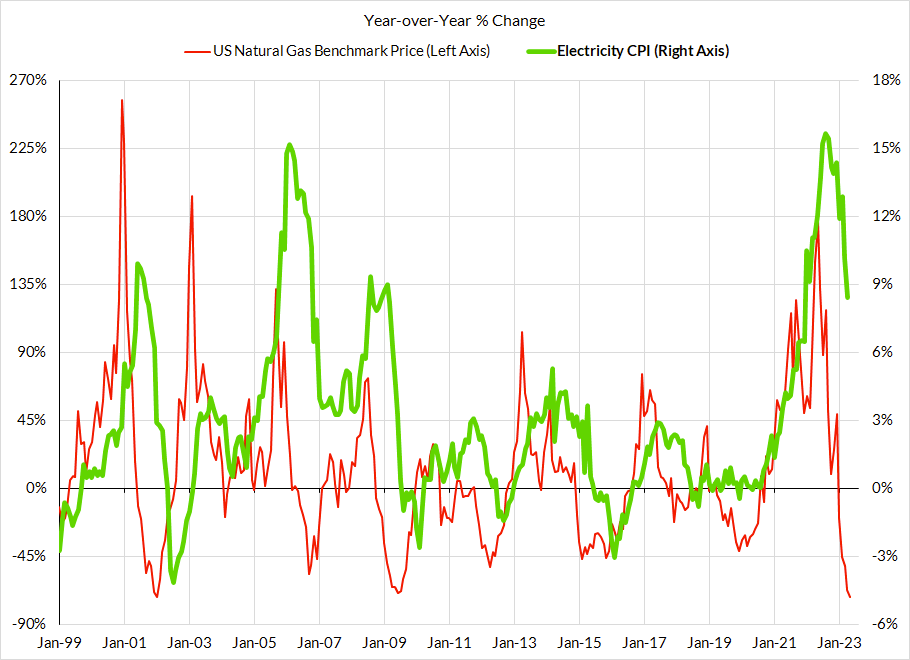

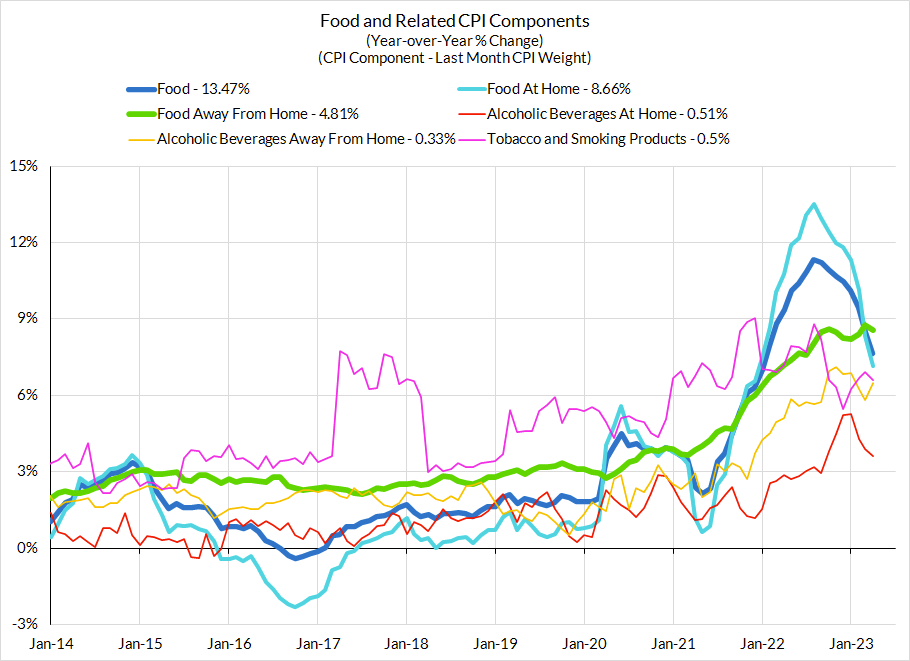

- Disinflation in food prices and lower benchmark natural gas prices could still bring further downside risk to headline CPI than what the forecasting consensus implicitly pencils in.

- While we don't think a strong CPI print will force the Fed to hike in June, it remains an outstanding risk. Our baseline expectation is for a June "hold" and a July "hike."

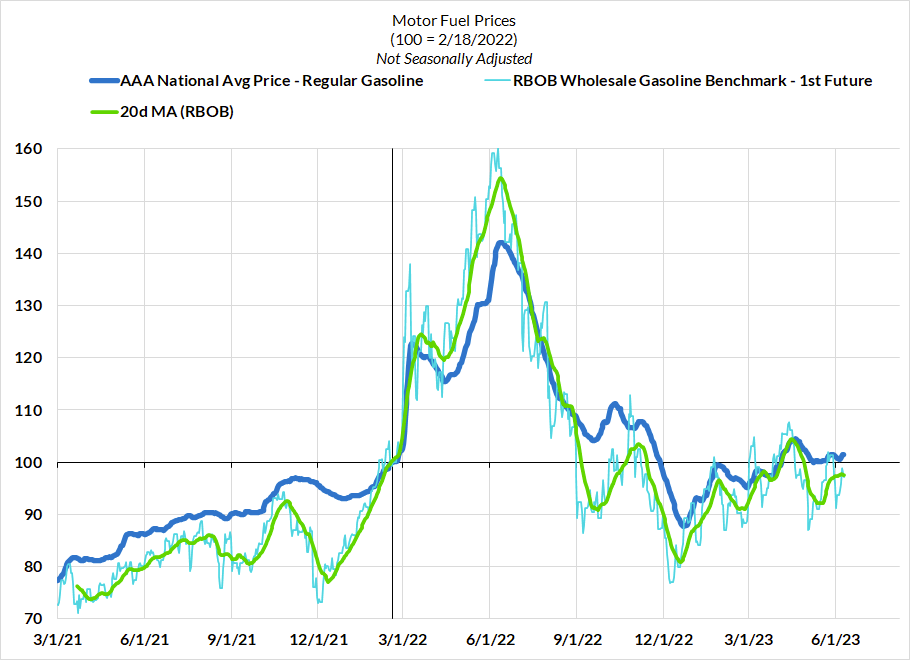

- If dynamics play out as we expect, we will grow more optimistic about the prospect for disinflation in Q3, specifically because the used car impulse will be firmly behind us and some downside dynamics related to market rents, motor vehicles, energy, and food impulses have a better chance of pushing into core inflation.

Key Dynamics Within Baseline (Upside) View:

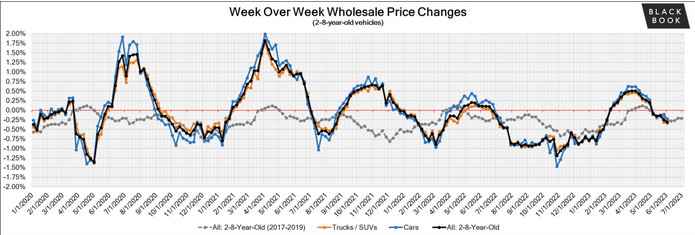

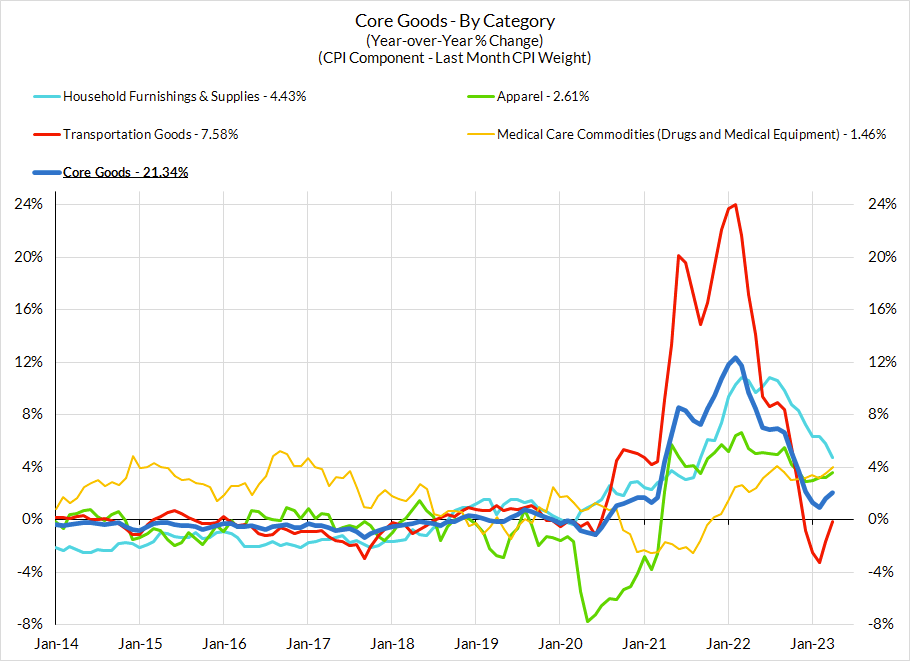

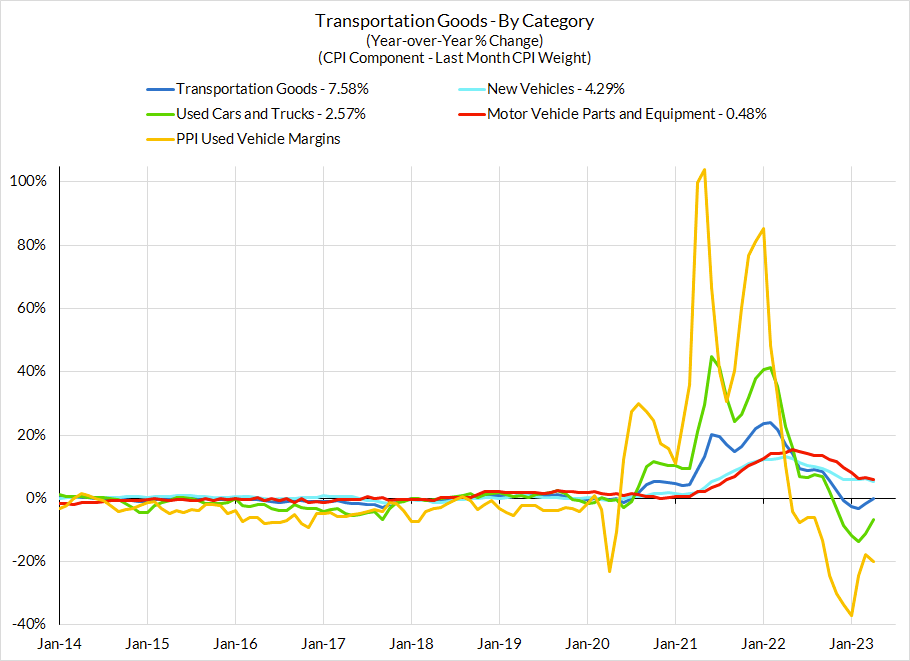

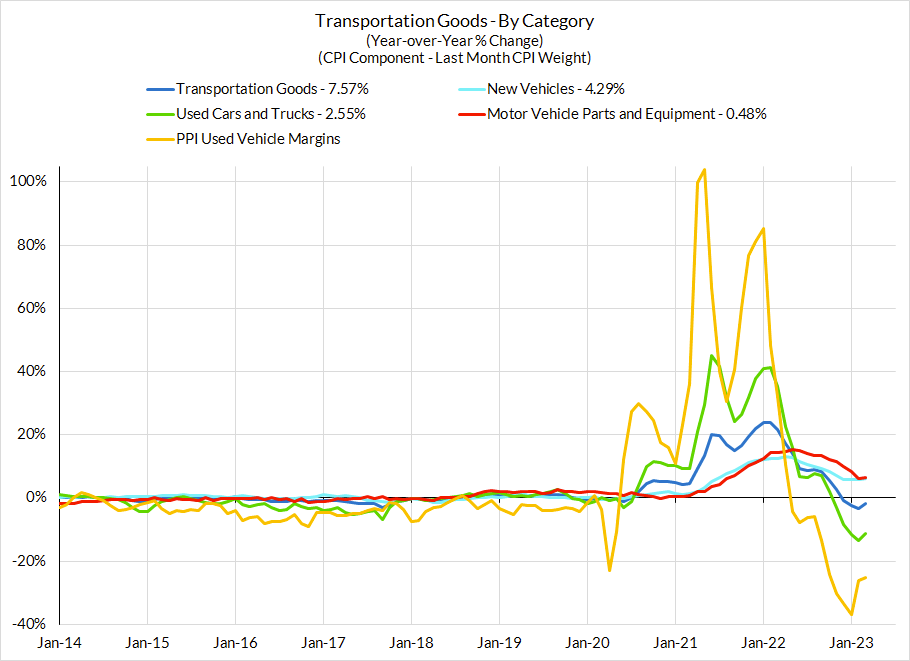

- Motor vehicles: Used cars still singlehandedly pushes the base-case for core CPI to a high 0.4% (0.44%). Due to structurally tight supply and the advent of tax refund season, demand simply swamped supply for 2-3 months, and appears to be feeding into CPI with a 1-2 month lag. The good news is that we could potentially be through this dynamic by the end of May (retail pricing would suggest as much), so long as upside does in fact play out as predicted. We are seeing more signs that the structurally tight supply picture may begin to dissipate: motor vehicle assemblies have jumped in the last two months. If assemblies can stay elevated through the remainder of the year, we expect a sustained disinflationary impulse across motor vehicle goods and services to feed through over the next 12-15 months.

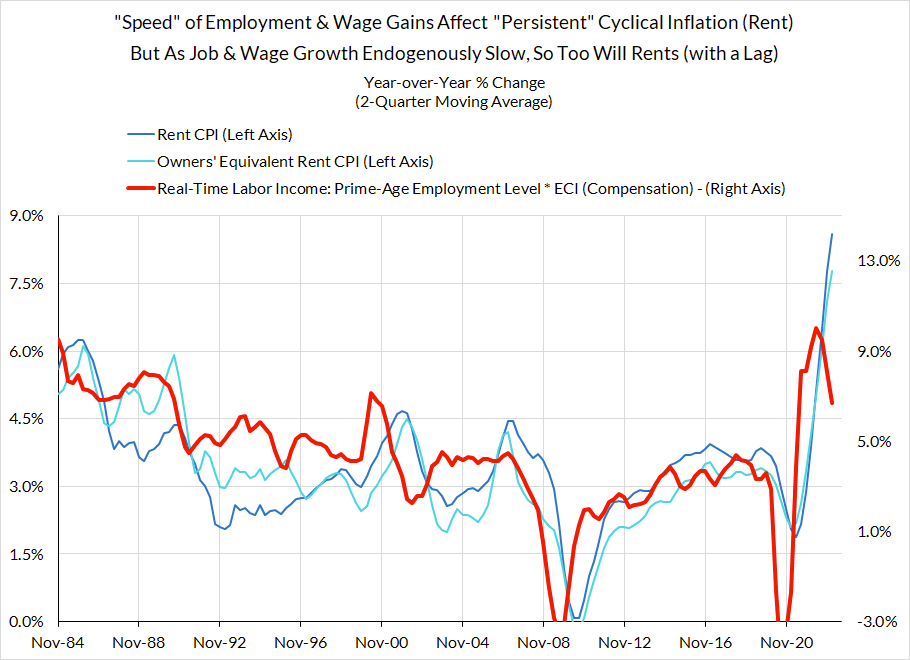

- Rent & OER: Rent disinflation is still at risk of proceeding marginally slower than consensus, but we were encouraged after last month's readings. Expect a similar growth rate to the last two months.

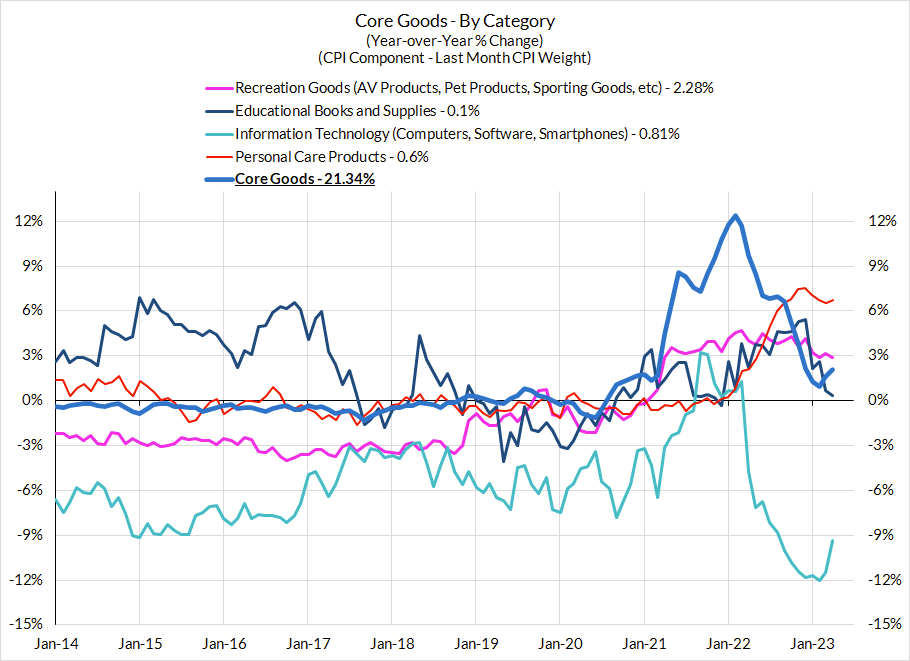

- The end of "annual resets"? April did show some evidence that after moving past the Q1 window, "annual reset" upside risk has diminished. Stickier CPI components that feed into PCE, especially within "Core Services Ex Housing PCE" and consumer staple goods, showed signs of abating.

- Broader goods disinflation? We are also beginning to see more broadening of core goods inflation into the furnishings, furniture, and appliances categories. This was a powerful offset to used cars upside in April and likely will not be as powerful an offset in May.

- The CPI services that matter? CPI inputs to "Core Services Ex Housing PCE" were actually stellar in April and may not look quite so stellar in May. That said, the non-CPI sources of upside should show more signs of mean-reversion outside of healthcare services.

- Food prices matter for core inflation: The category to continue watching on CPI day is not in core CPI: food services. Food services are a big chunk of Core PCE and Core Services Ex Housing PCE. Most importantly, food service prices tend to respond with a lag to grocery store "food at home" prices, which have been disinflating substantially.

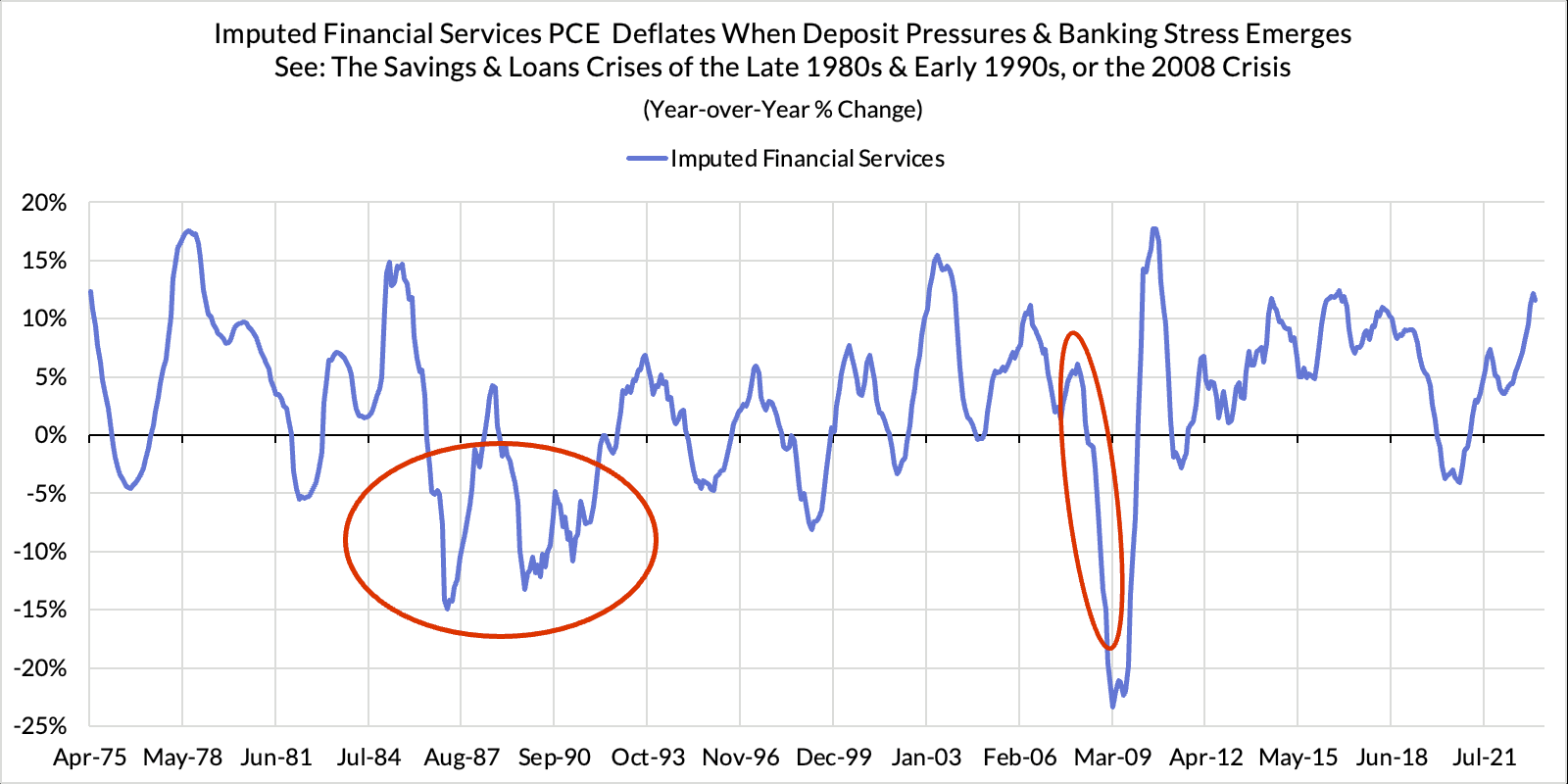

- Any reversion in the inflationary dark spaces of PCE? We tried not to pencil in excessive downside from input cost indices or imputed financial services despite their fundamental drivers signaling such dynamics. Instead the nowcast was caught offsides by upside, particularly in imputed financial services. We would be surprised to see a similar move again, but are still trying investigating the source of upside in April.

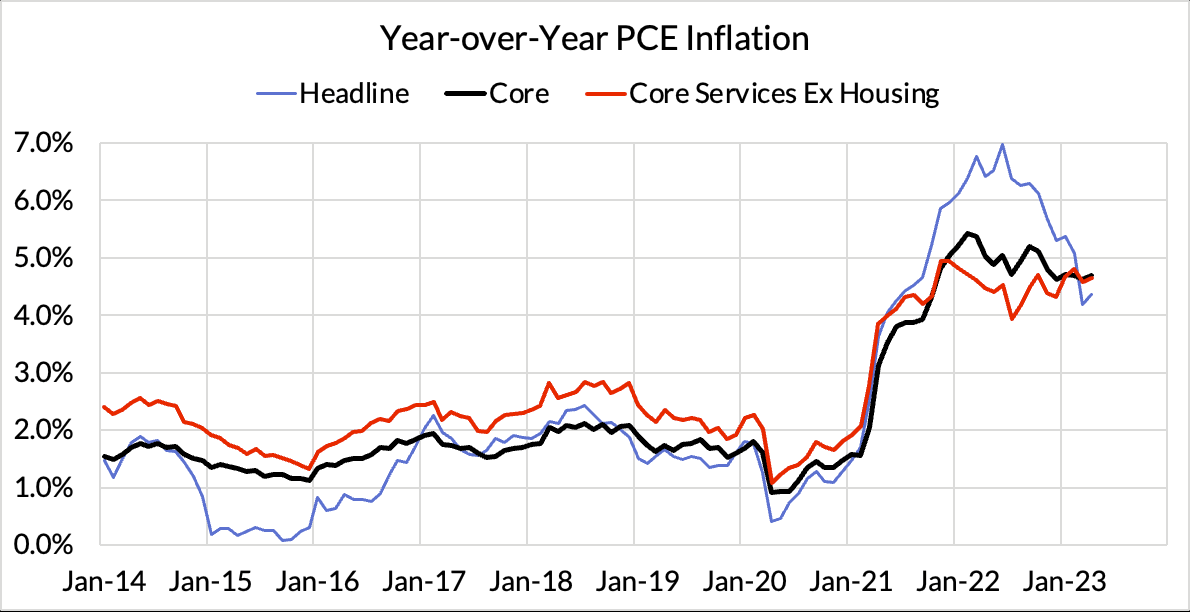

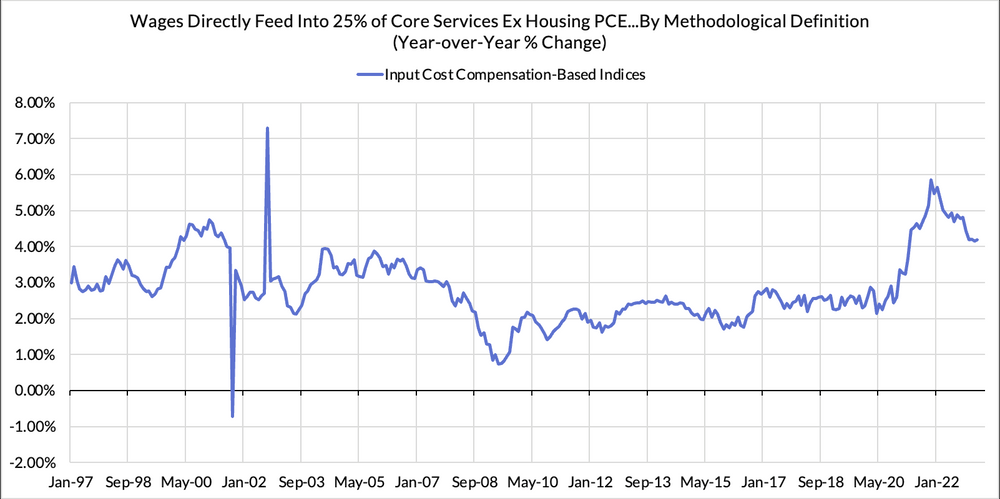

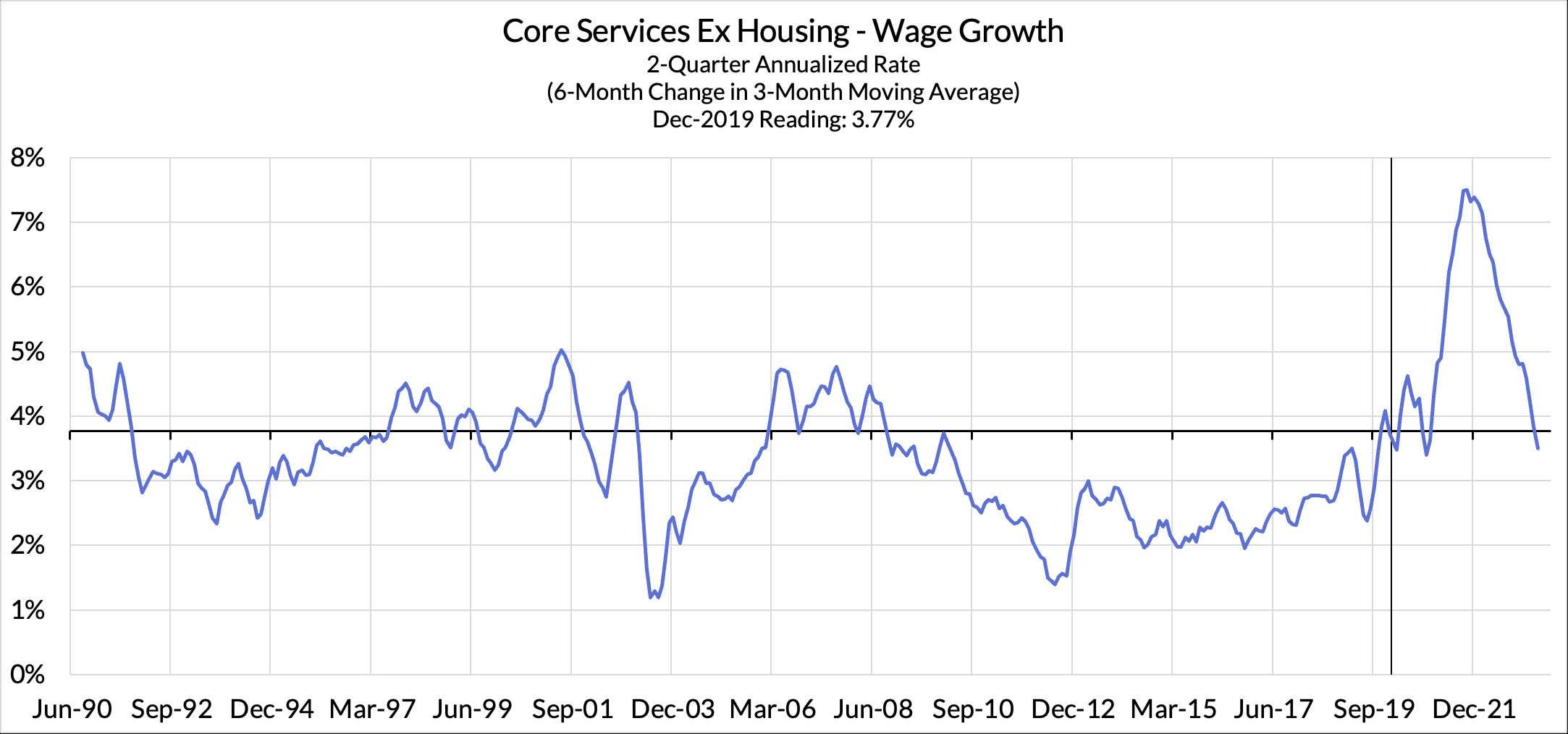

Final Note: The Fed's story about "Core Services Ex Housing PCE" being "wage-driven inflation" doesn't seem to be cashing out, at least not as of yet. Based on the BEA's own Input-Output tables, the wages that should be of greatest relevance to this aggregate have substantially disinflated.

CPI Charts

Non-Core CPI Components

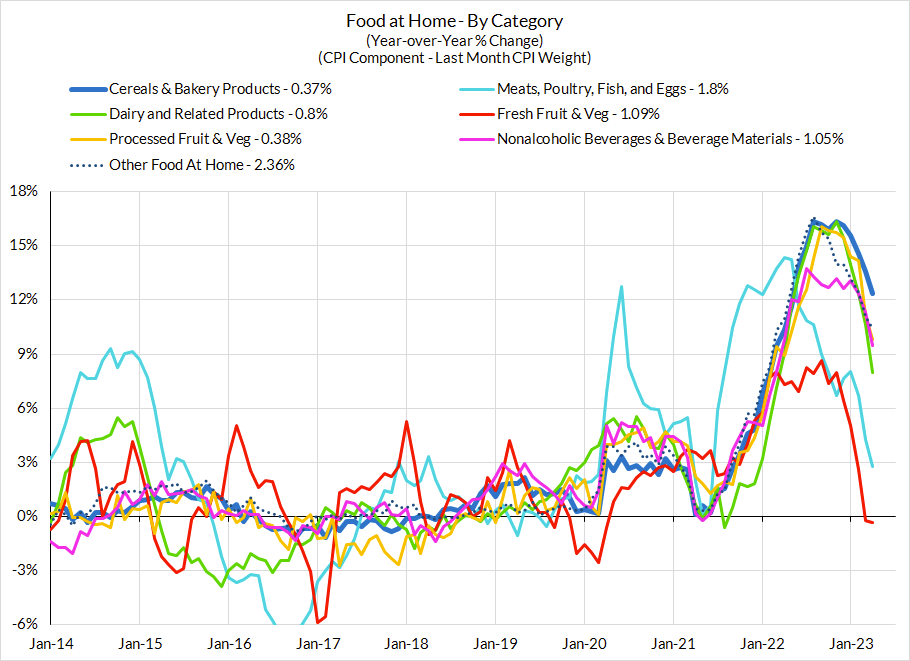

Core Goods CPI Components

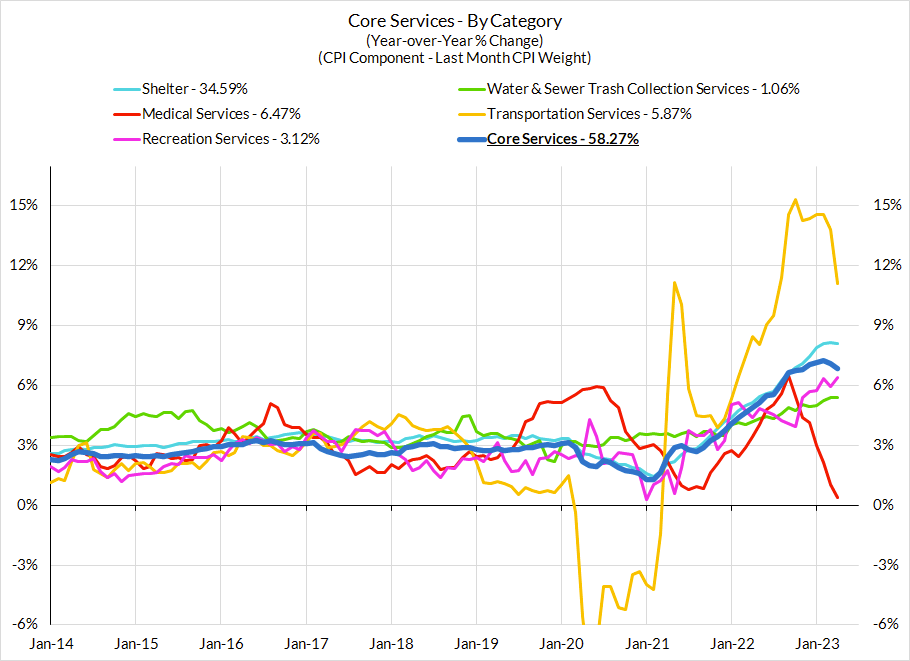

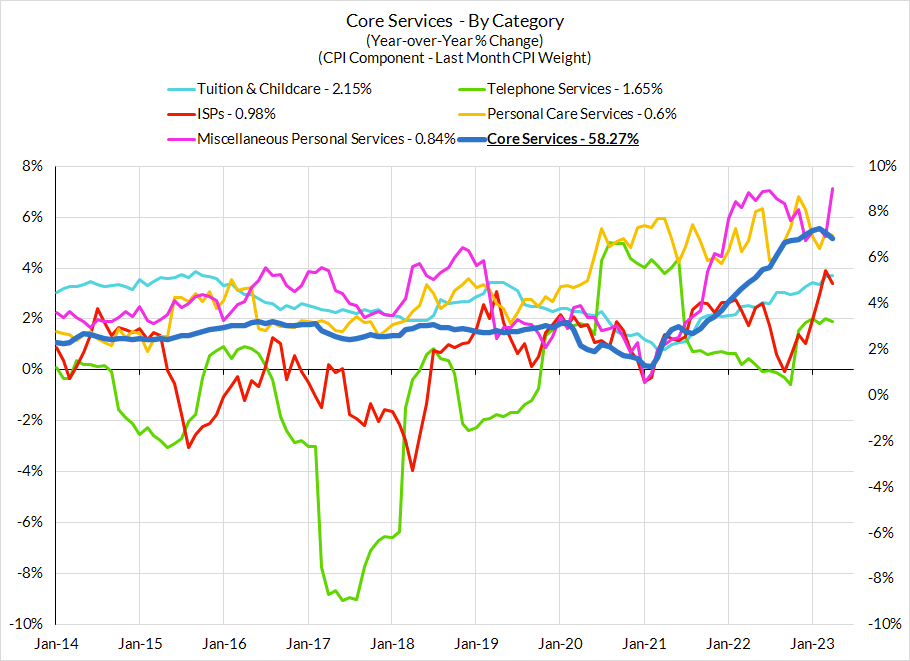

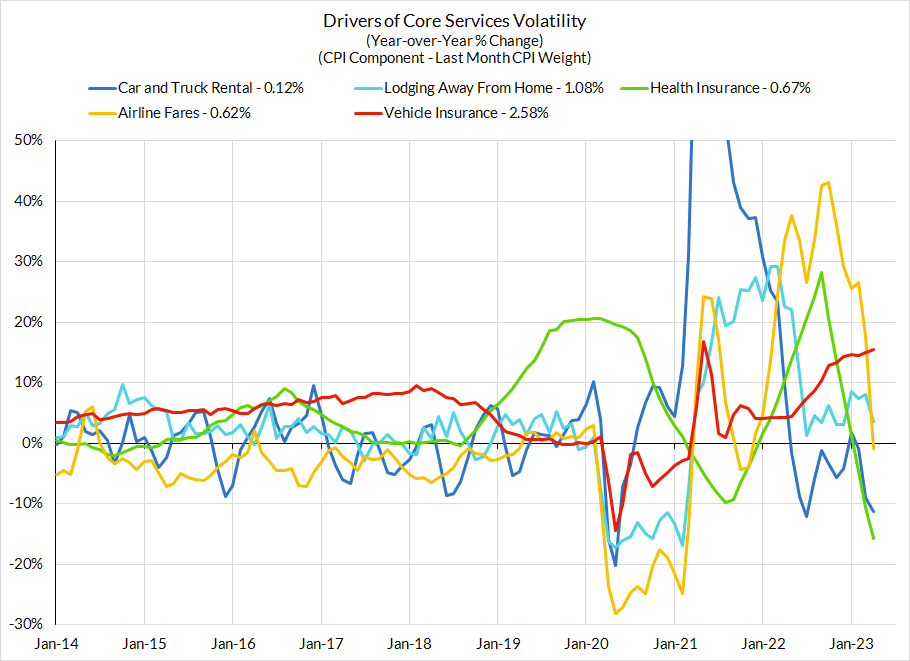

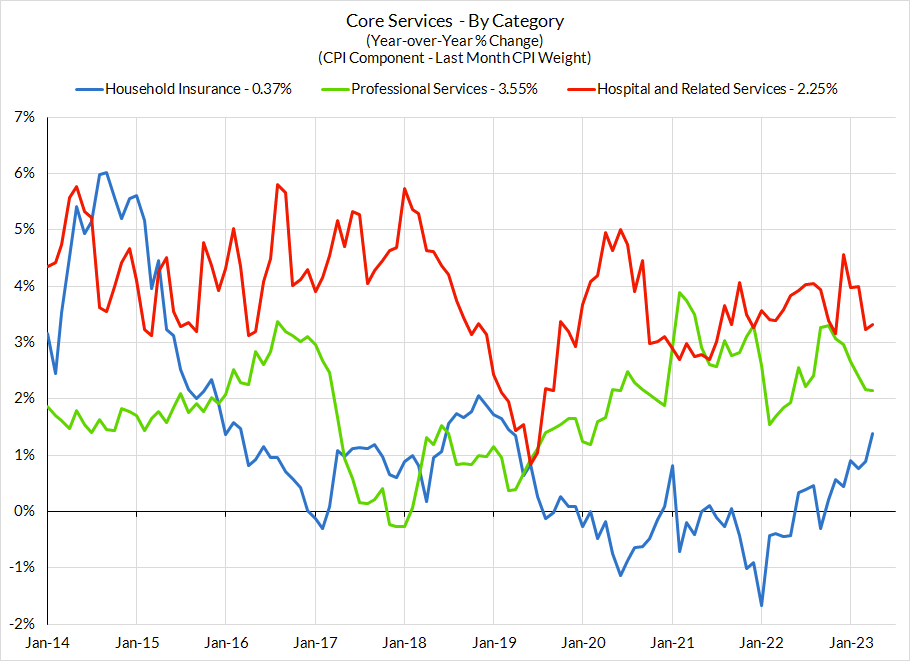

Core Services CPI Components (Not All Relevant to Core PCE)

From Our PCE Recap (For Those Who Missed It):

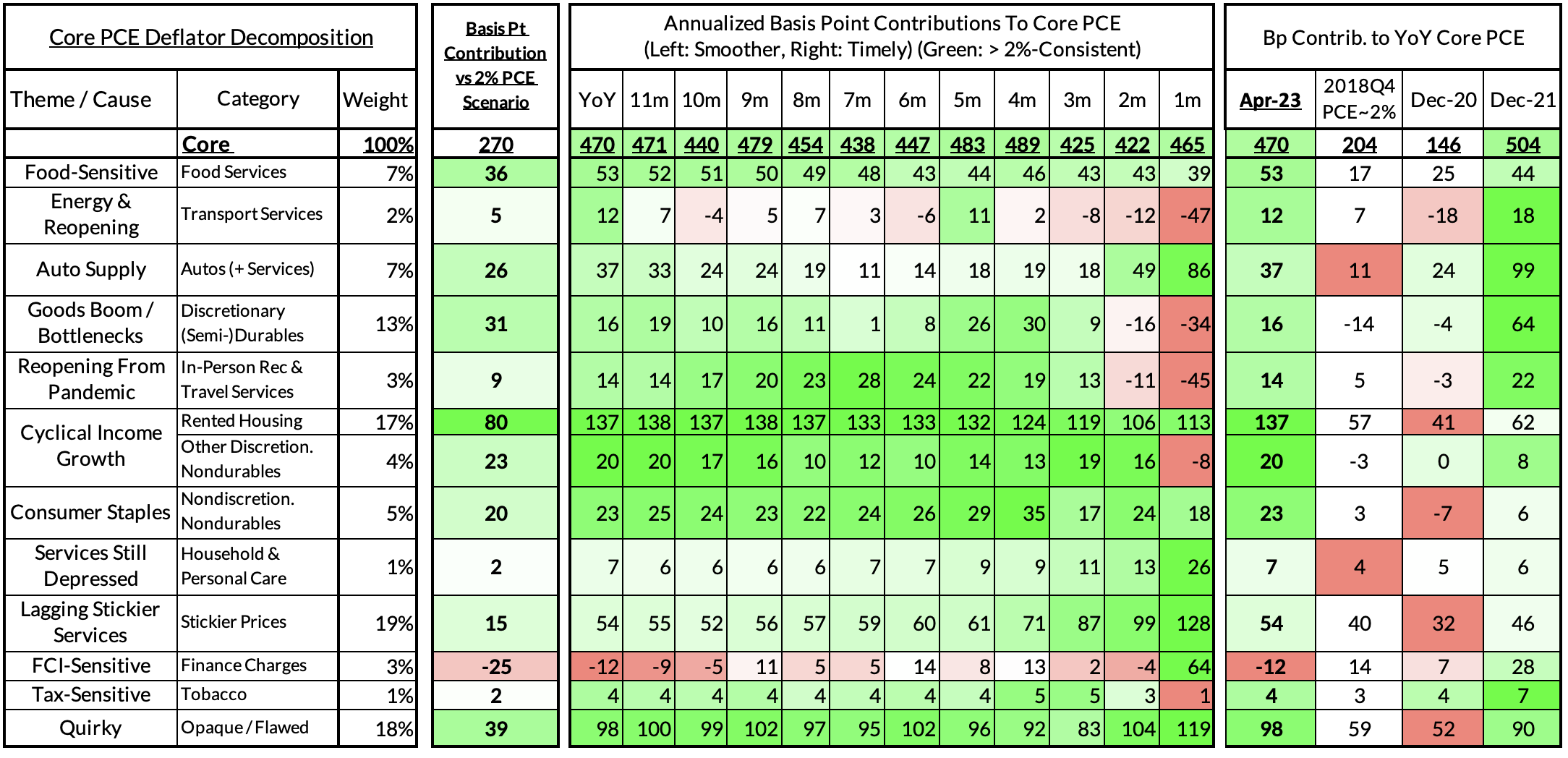

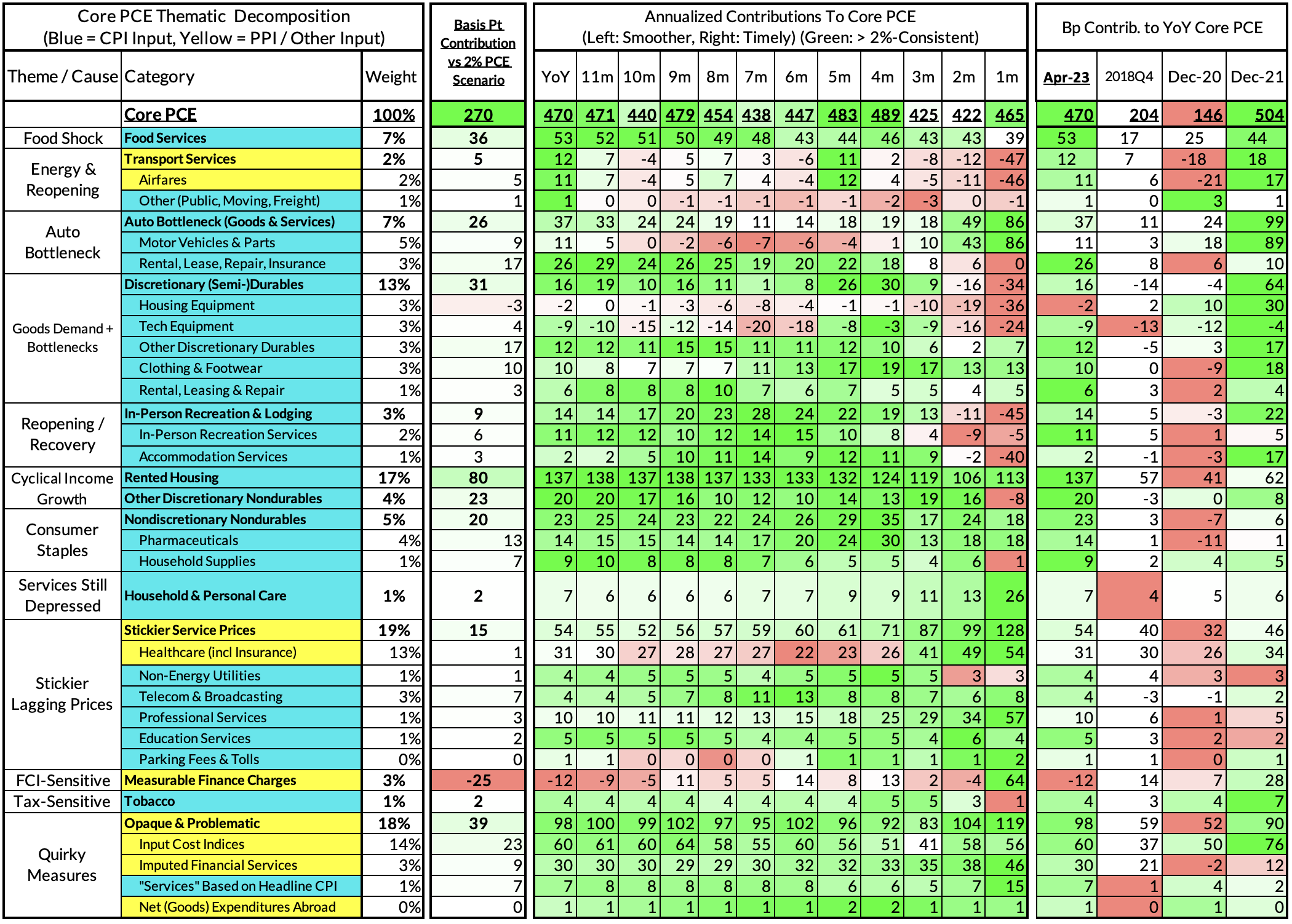

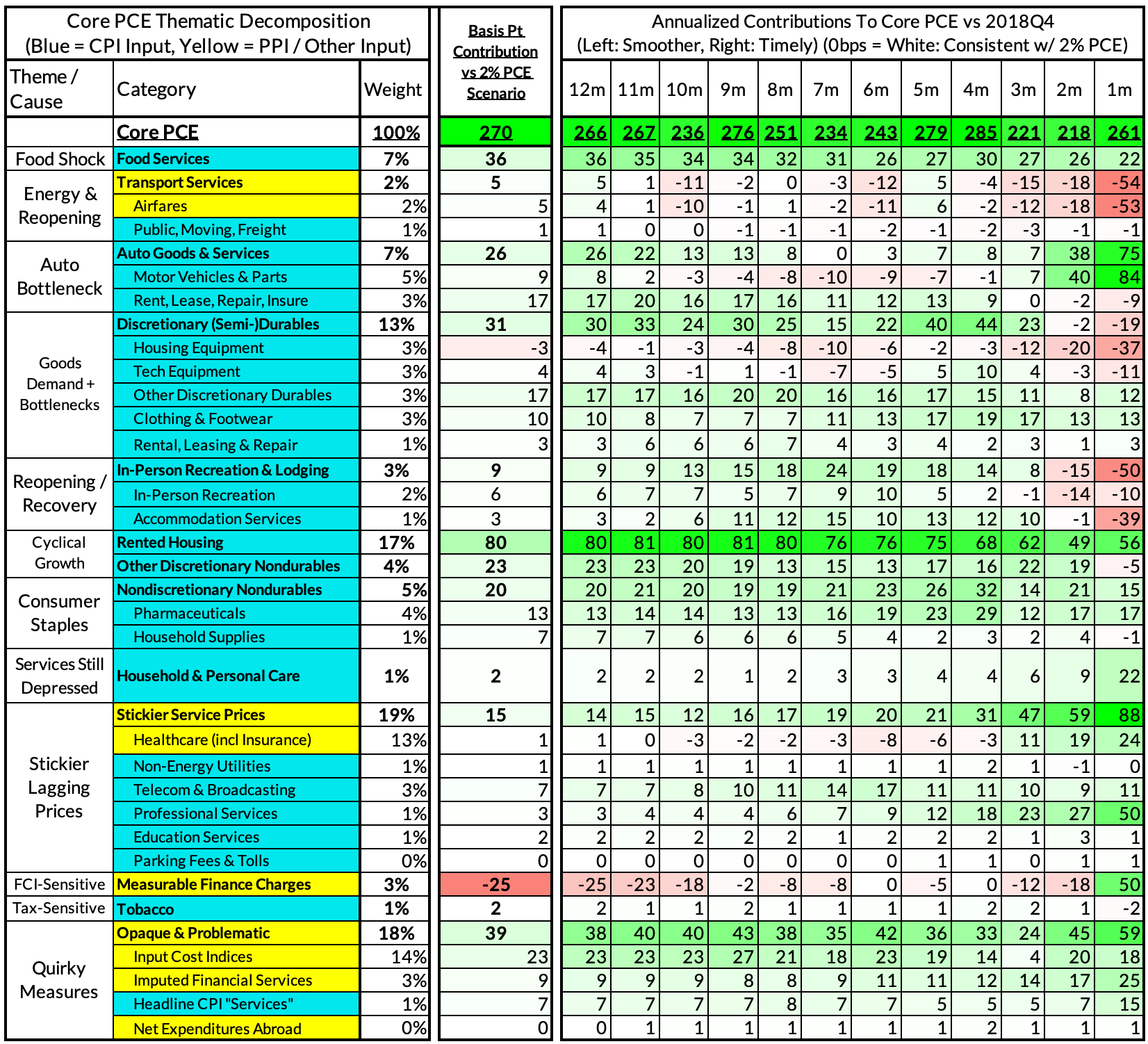

For the Detail-Oriented: Core PCE Heatmaps

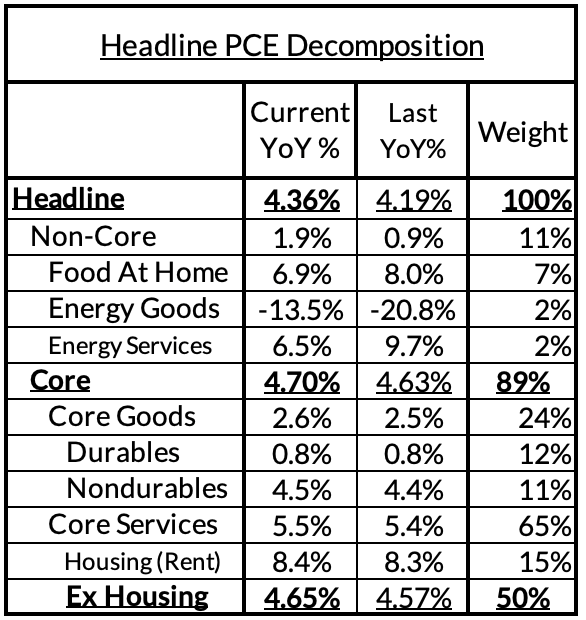

Right now Core PCE (PCE less food products and energy) is running at 4.70% as of April, 270 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 80 basis points to the 270 basis point core PCE overshoot.

There are other contributors to the overshoot, some more supply-driven (automobile bottlenecks likely explain 26 basis points, while food inputs likely added 36 basis points to the overshoot) and some more demand-driven (in-person recreation and travel services adding 9 basis points to the overshoot, consumer staples and discretionary nondurables adding 43 basis points), and some reflect both (transportation services is both reopening-sensitive and energy-sensitive, now back to a 5bp contribution).

The final heatmap gives you a sense of the overshoot on shorter annualized run-rates. April monthly annualized core PCE yielded a 261 basis point overshoot vs 2% target inflation (4.61% annualized).

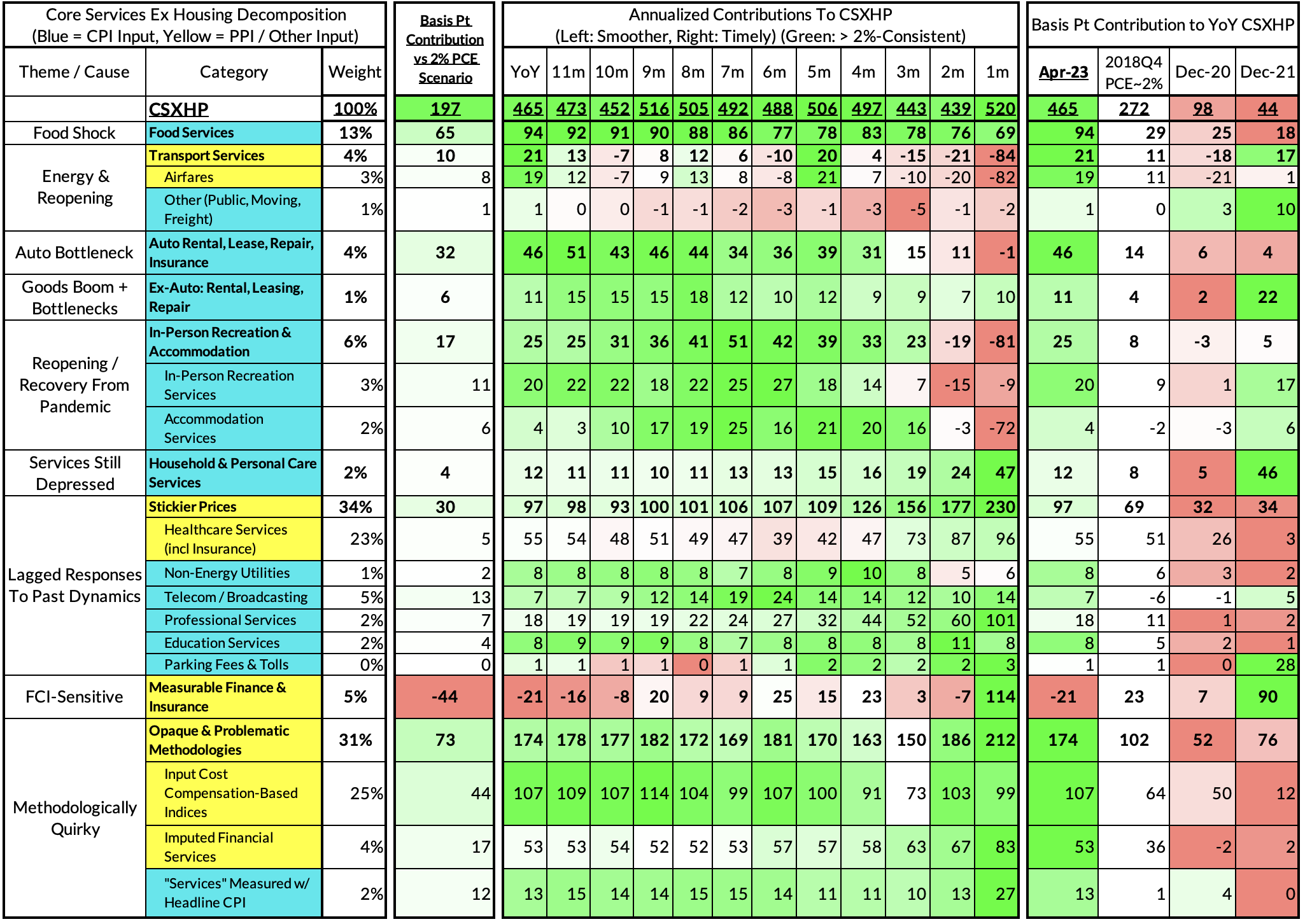

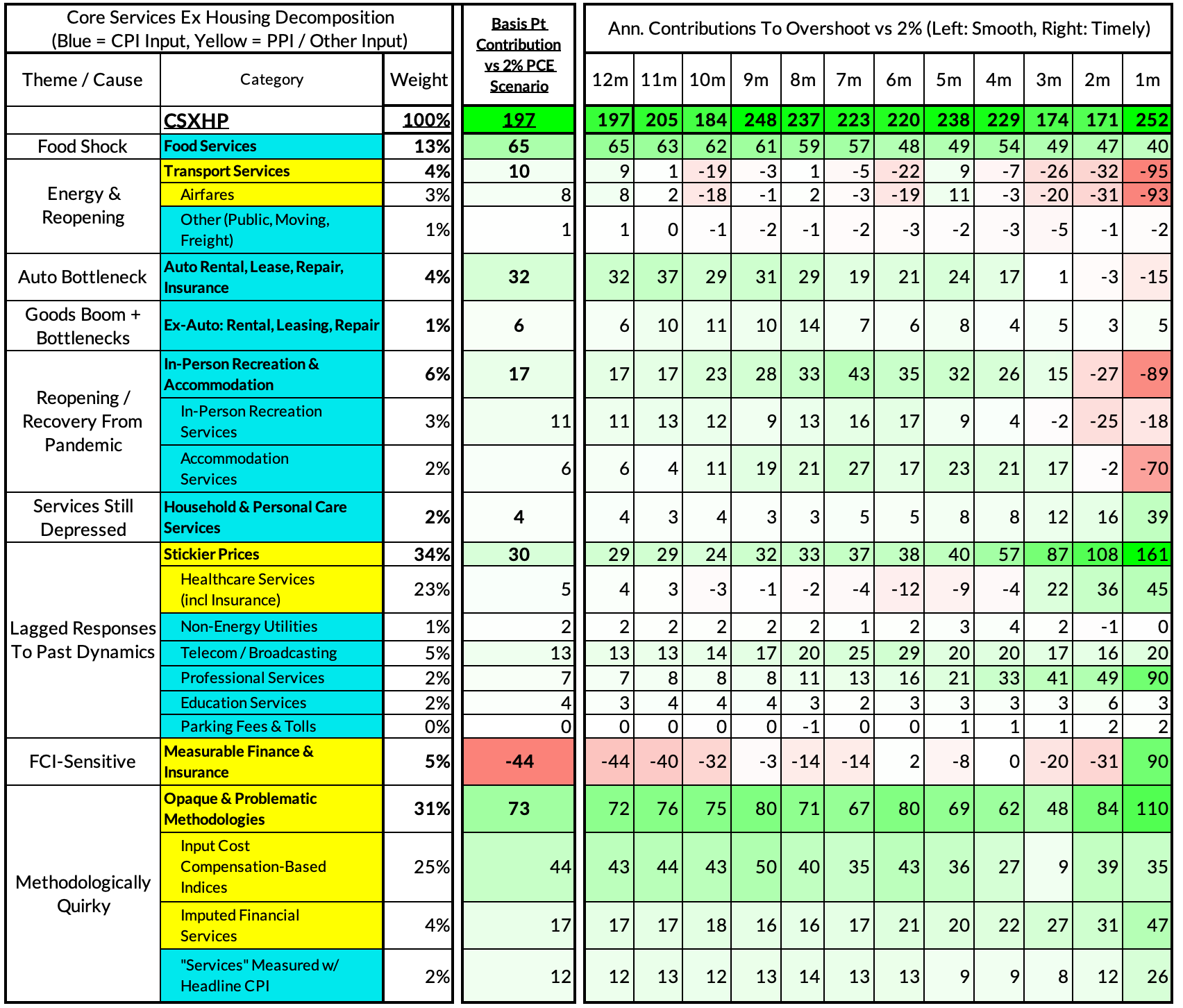

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The April growth rate in "Core Services Ex Housing PCE" ran at 4.65% year-over-year, a 197 basis point overshoot versus the 2.68% run rate that coincided with ~2% headline and core PCE in 2018Q4.

April monthly CSXHP ran at a 5.20% monthly annualized rate, a 252 basis point overshoot of what would be consistent with 2% headline and core PCE. Our cautionary notes about how this number can swing around were worth heeding htis month.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?